Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Now that French Prime Minister Francois Bayrou has officially resigned after losing a no-confidence vote a day earlier, all eyes are on the person who could succeed him. Macron said he would tap a new premier in the coming days.

Now that French Prime Minister Francois Bayrou has officially resigned after losing a no-confidence vote a day earlier, all eyes are on the person who could succeed him. Macron said he would tap a new premier in the coming days.

We have a list of the leading contenders, which includes the 39-year old current defense minister Sebastien Lecornu. Socialist party leader Olivier Faure, former prime minister Bernard Cazeneuve and even central bank governor Francois Villeroy de Galhau are also among the potential successors.

The problem will be finding someone who can find common ground in the polarized National Assembly — and who has the wherewithal to undertake deeply unpopular budget cuts to avert a debt crisis. Investors are unnerved, with France’s borrowing costs converging with Italy’s for the first time in the euro zone’s history.

Marine Le Pen’s far-right National Rally has been among opposition parties calling for a new legislative ballot, something that Macron appears to have ruled out. “For us, it’s a snap election or nothing,” as National Rally President Jordan Bardella summed it up on RTL radio.

Some have also called for Macron’s resignation, but he has steadfastly rejected quitting before the end of his term in 2027. After the downfall of the fourth prime minister in two years though, it’s hard not to see this as the swan song for the Macron era.

Israel conducted a military strike against senior Hamas leaders in the Qatari capital of Doha, escalating an already tense standoff between the country and Arab nations over the war in Gaza. Several blasts were heard in the Qatari city. Qatar is a key mediator between Israel and the Palestinian group that’s designated as a terrorist organization by the US and European Union.

Israel also ordered Gaza City’s one million residents to leave in advance of a major military offensive, with top officials vowing devastation unless Iran-backed Hamas surrenders. Global outrage has grown since Israel announced last month that it would take over the city, home to half the enclave’s population, with longtime European allies threatening to cut trade ties and planning to back Palestinian statehood at the United Nations in two weeks.

France and Germany are urging the European Union to target major Russian oil companies such as Lukoil or Litasco as part of the bloc’s next package of sanctions, according to a document seen by Bloomberg. The EU is currently discussing the content of its 19th package of sanctions, which includes proposed measures to target Russian banks and the country’s energy trade.

Norwegian Prime Minister Jonas Gahr Store is starting talks to form a new Labor government after his center-left bloc won a slim majority in the national legislature. Store — who stemmed 16 years of consecutive decline in Labor support — said he would seek agreements with left-leaning parties, but also broader cooperation across the political spectrum on topics like support for Ukraine and defense.

Egypt is lifting a decades-old rental cap that had allowed millions to pay below-market prices. Rents on affected properties stand to soar as much as 20 times in upscale areas while for lower-income areas the increase would be 10-fold. Contracts on previously rent-controlled housing will be nullified after a seven-year grace period. The government has vowed to build low-income housing to help with the transition.

Banca Monte dei Paschi di Siena has secured a majority stake in Mediobanca, cementing a once-unthinkable €16 billion takeover that’s set to reshape Italian finance. The deal is set to create Italy’s third-largest lender by assets, in line with Italian Prime Minister Giorgia Meloni’s push to establish a new large bank that can rival Intesa Sanpaolo and UniCredit.

Ethiopia inaugurated Africa’s biggest hydroelectric dam, which will power homes and industries across East Africa while deepening a years-long dispute with Egypt and Sudan over the Nile’s flow. Africa’s second-most populous nation expects the dam to address chronic energy shortages and to sustain its manufacturing sector.

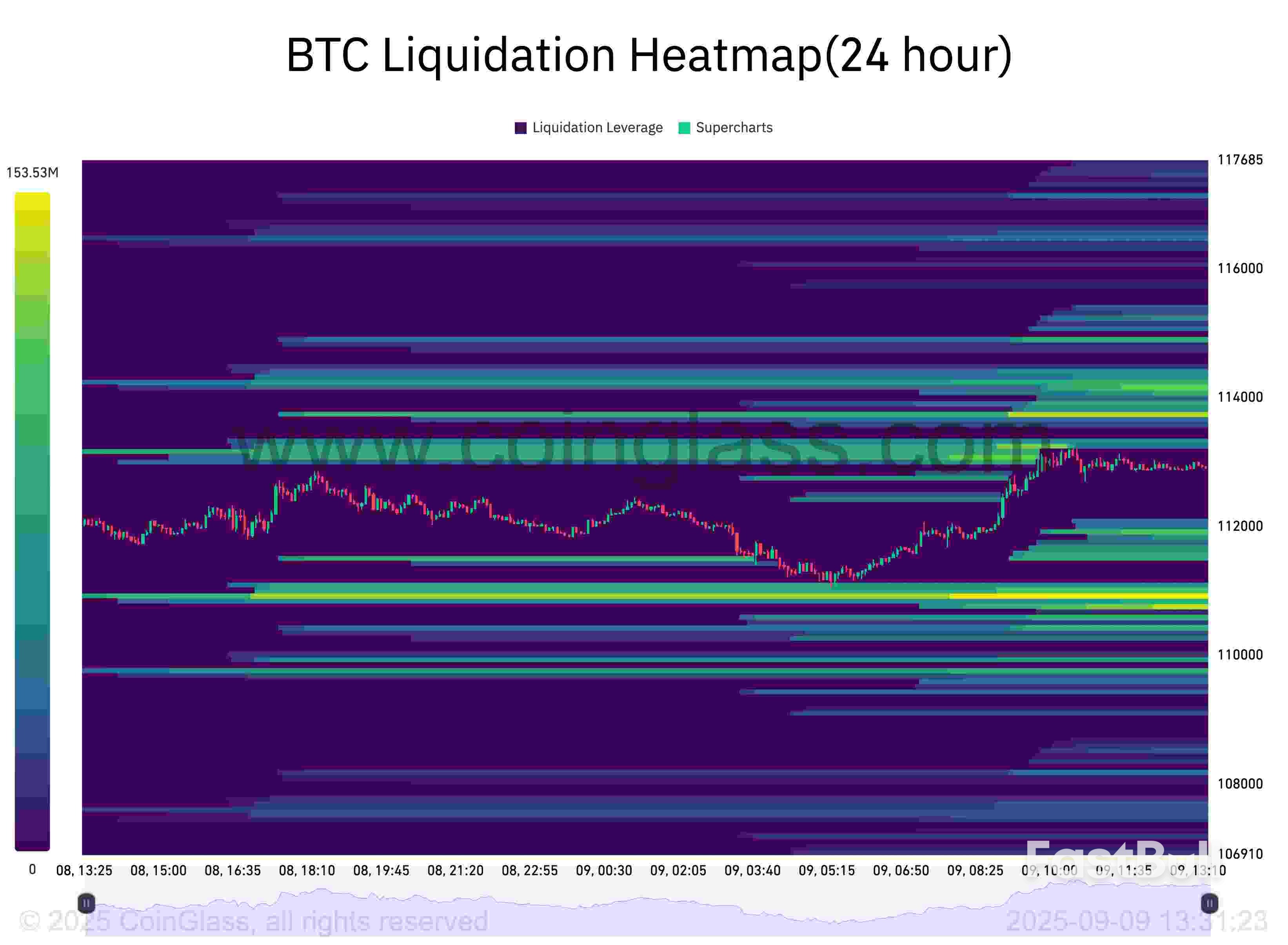

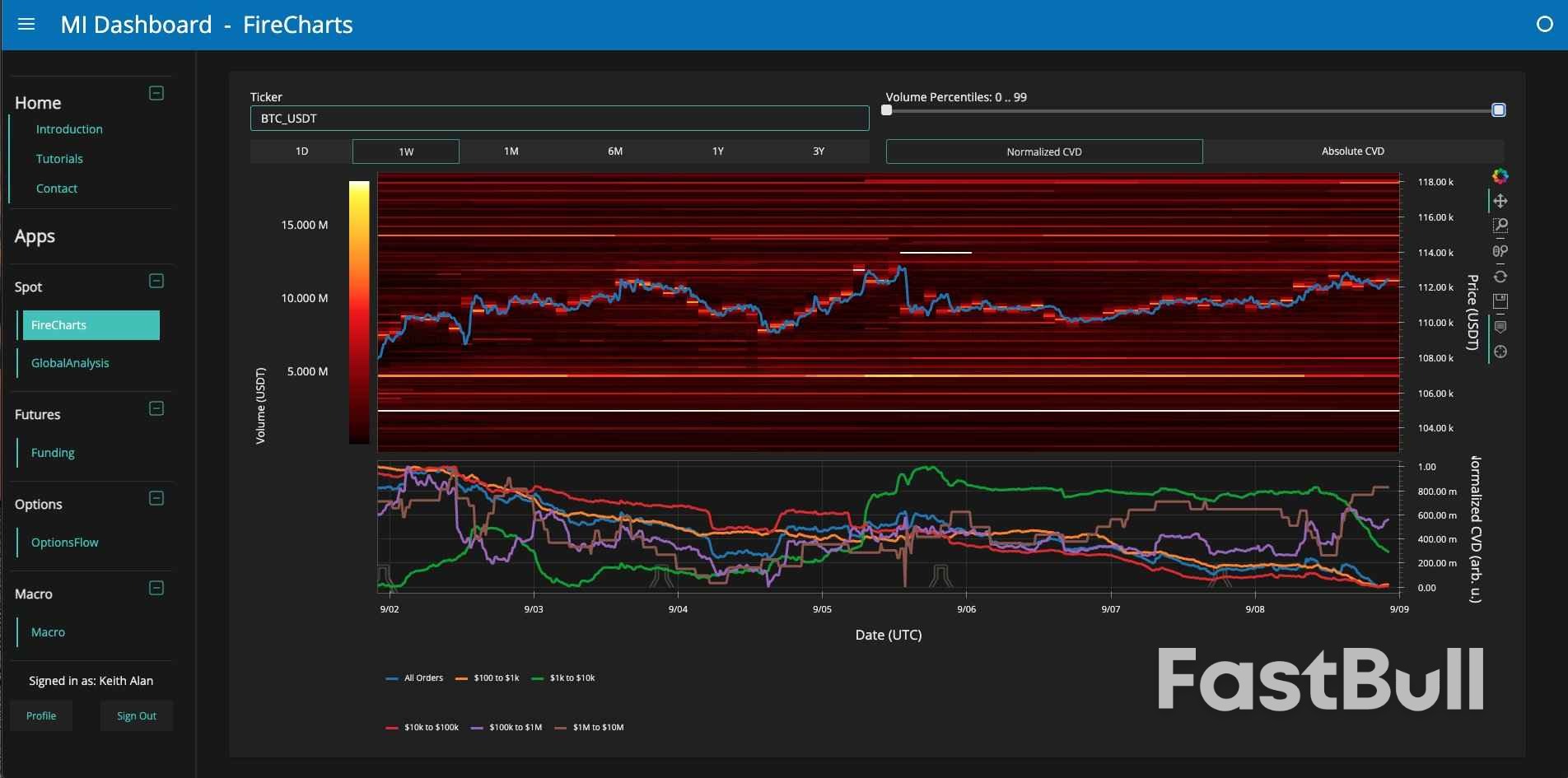

As of September 8, 2025, Bitcoin (BTC) trades near $110K after weaker U.S. jobs data dragged Treasury yields and the dollar lower factors that usually support crypto markets. Yet analyst Plan C warns that a Q4 halving isn’t automatic; historical trends show mixed outcomes, so seasonality alone is not a reliable signal.

In this bitcoin price prediction, confirmation remains the focus: defend $110K–$112K and then reclaim $117K–$118K with volume, and the door to higher moves opens; lose that floor and the setup leans toward chop or deeper retracement. In that case, many traders look to rotate into altcoins offering better upside, with fresh breakout patterns and cleaner risk–reward.

The big question is: will the next big leg come from BTC dominance, or is rotation into alternatives the smarter play right now?

The macro environment for bitcoin just brightened: the latest U.S. jobs report showed slower hiring, a rising unemployment rate, and negative revisions. This sent Treasury yields lower, pushed the dollar index down about 0.70%, and lifted expectations for a September Federal Reserve rate cut.

Easier policy usually helps BTC by weakening the dollar and reducing funding costs, which cuts downside risk even if Q4 enthusiasm fades. As one strategist noted, “labor-market weakness gives the Fed room to cut.” A dovish Fed can stabilize Bitcoin, but traders still want confirmation on the chart before leaning bullish.

Sources: U.S. BLS Employment Situation, Aug 2025, Reuters Instant View, Reuters Dollar Reaction, Reuters Fed Cut Expectations.

Sources: BLS Employment Situation — Aug 2025, Reuters: Instant View, Reuters: Dollar falls sharply after jobs data, Reuters: Investors look for more aggressive US rate cuts.

BTC is currently consolidating inside a $110K–$112K support band after its sharp retrace, with repeated wicks suggesting dip-buying even while momentum stays muted.

If buyers protect this range and a strong daily close holds inside or above the zone, or if BTC clears $117K–$118K on convincing volume, then $117K–$118K becomes the first upside target with scope for higher gains if momentum builds further.

But if the range fails on a decisive close, the door opens to $108K–$106K, with potential liquidity grabs into $103K–$101K. In short, this zone remains critical: it offers a tactical entry for medium-term bulls, but confirmation beats trying to catch a falling knife.

With the bitcoin price still stuck near $110K and no clear breakout yet, an altcoin rotation strategy can improve risk–reward. The idea: move part of a position from sideways BTC into coins showing stronger setups, visible catalysts (launches, protocol upgrades, adoption), and breakout potential, while still anchoring with Bitcoin. One candidate drawing attention right now is Pepeto, does it fit the criteria?

Pepeto (PEPETO) is positioned as a promising rotation choice. Its token powers PepetoSwap, a zero-fee exchange with no listing charges, designed to make token launches and trading cheaper while routing incentives through PEPETO. Alongside, it supports a cross-chain bridge enabling users to move assets and liquidity across networks within the app, broadening reach and deepening order flow.

Staking currently offers around 231% APY, attracting early adopters and helping to lock liquidity so markets remain stable post-listing. Momentum is strong: the presale has raised more than $6.6M already, with only a small allocation left, priced at $0.000000152 at the current stage and set to climb as each round fills.

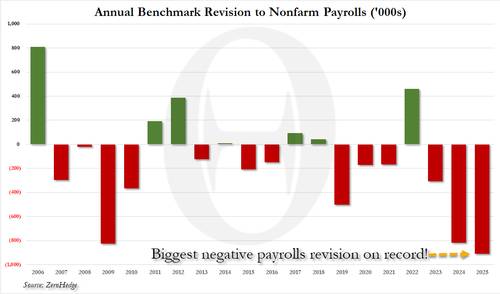

Two weeks ago, before both Bloomberg and Reuters, we told our subscribers to "brace for another huge negative payrolls revision"...

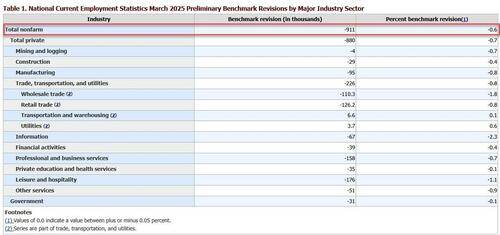

... and just like one year ago when we did exactly the same, we were spot on: moments ago the BLS reported that as part of its preliminary annual benchmark revisions, a record 911K payrolls for the period April 2024-March 2025 would be revised away.

Some more from the full press release:

The preliminary estimate of the Current Employment Statistics (CES) national benchmark revision to total nonfarm employment for March 2025 is -911,000 (-0.6 percent), the U.S. Bureau of Labor Statistics reported today. The annual benchmark revisions over the last 10 years have an absolute average of 0.2 percent of total nonfarm employment. In accordance with usual practice, the final benchmark revision will be issued in February 2026 with the publication of the January 2026 Employment Situation news release.

Each year, CES employment estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW). These counts are derived primarily from state unemployment insurance (UI) tax records that nearly all employers are required to file with state workforce agencies.

What is more remarkable about today's print is that after last year's stunning 818K negative revision, which was the second biggest since the global financial crisis (and which we also warned ahead of time was coming), virtually nobody expected this year's number to be higher. It was not only higher, but it was the biggest negative revision on record!

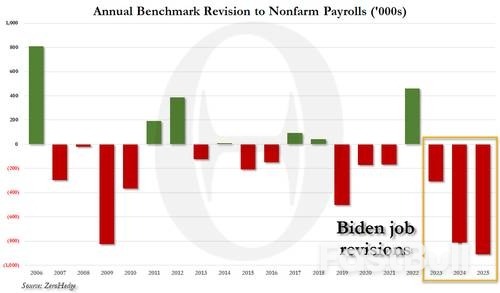

No wonder the WSJ now reports that "White House Prepares Report Critical of Statistics Agency" in what is a clear effort at kitchen-sinking all the ugly, fake jobs numbers that were "created" by the Biden admin, and saddled Trump with relentless negative revisions. Expect 1-2 more months of painful job prints, and then another powerful rally higher into the 2026 midterms under a new BLS commissioner as all of Biden's fake baggage is expunged.

So what does it all mean? Couple things and we will follow up with a more extended analysis but here is the punchline:

Just as remarkable: 2 million jobs from the last 3 years of the Biden admin have now been revised away.

One thing that will never be revised away, however, is the trillions in debt accumulated over his period, and which we now learn encumbered future generations of Americans with massive amounts of debt only to create far fewer jobs than initially reported.

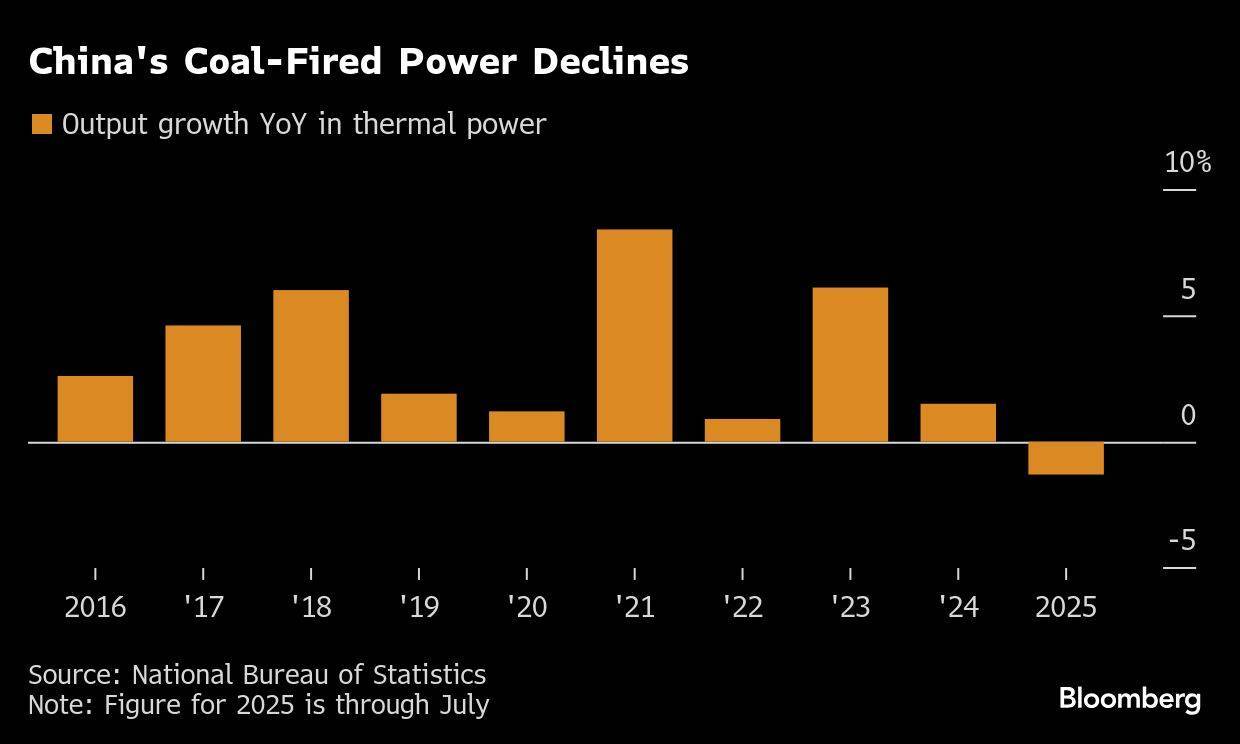

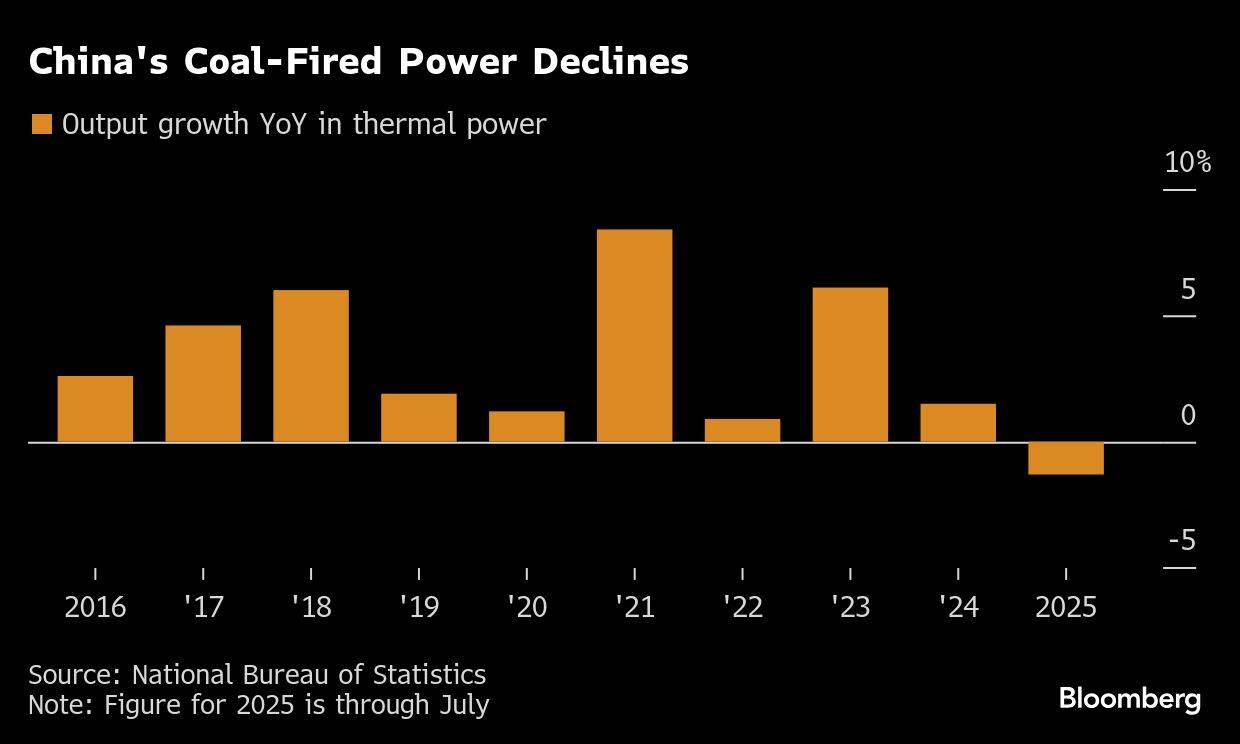

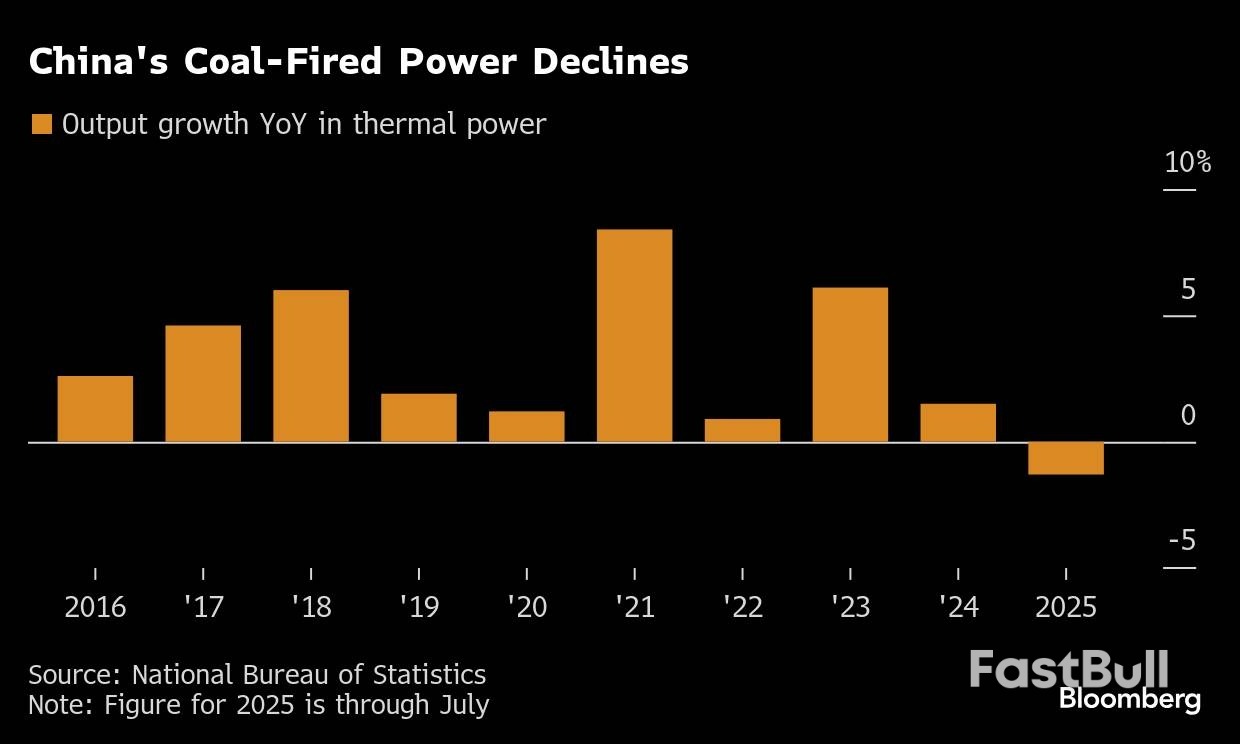

The stage may be set for the world’s use of fossil fuels to begin dropping in about five years time, thanks to China’s rapid adoption of renewables and its increasing reliance on electricity, clean energy think tank Ember said in a report on Tuesday.The researchers identified how fossil fuel consumption could be pressured into long-term decline, via the scale and pace of China’s own green transition, and its dominant role exporting clean energy to other countries. In 2023, one-quarter of emerging countries had leapfrogged the US in terms of the electrification of their economies, helped by the availability of cheap Chinese clean-tech, according to Ember.

A domestic milestone was reached in the first half of this year, when China’s solar and wind generation more than met demand growth for power, cutting fossil fuel usage by 2%, the researchers said. It follows a massive investment in clean energy, which totaled $625 billion last year or almost a third of the world’s total.“China’s surge in renewables and whole-economy electrification is rapidly reshaping energy choices for the rest of the world, creating the conditions for a decline in global fossil fuel use,” Ember said. If current trends hold, “it’s likely that the world’s fossil fuel demand will be in structural decline by 2030.”

Cutting fossil fuel use is necessary to reducing carbon emissions and avoiding the worst consequences of a hotter planet. But the path to net zero has been complicated by various factors, from indifference and even hostility to the energy transition in some countries like the US, to concerns over the costs of its implementation in others. That has put a huge onus on the world’s biggest polluter to effectively ride to the rescue.China has been responsible for most of the global growth in fossil fuel use for a decade, Ember said. In its reading, as that demand fades “the implications for governments basing their economic growth plans on exporting coal, oil and gas are plain to see,” it said.

Moreover, China is disproving the notion that green goals and economic growth are at odds, according to the report. Instead, it’s taken a path that has allowed the two to reinforce each other and create “self-sustaining momentum.”

Key points:

Ethiopia officially inaugurates Africa's largest hydroelectric dam on Tuesday, a project that will provide energy to millions of Ethiopians while deepening a rift with downstream Egypt that has unsettled the region.Ethiopia, the continent's second most populous nation with a population of 120 million, sees the $5 billion Grand Ethiopian Renaissance Dam (GERD) on a tributary of the River Nile as central to its ambitions for economic development.Begun in 2011, the dam's power generation should eventually rise to 5,150 MW from the 750 MW that its two active turbines are already producing.Prime Minister Abiy Ahmed has said Ethiopia will use the energy to improve Ethiopians' access to electricity while also exporting surplus power to the region.

Ethiopia's downstream neighbours, however, have watched the project advance with dread.Egypt, which built its own Aswan High Dam on the Nile in the 1960s, fears the GERD could restrict its water supply during periods of drought, and could lead to the construction of other upstream dams.It has bitterly opposed the dam from the start, arguing that it violates water treaties dating to the British colonial era and poses an existential threat.Egypt, with a population of about 108 million, depends on the Nile for about 90% of its fresh water.

Egypt would continue to closely monitor developments on the Blue Nile and "exercise its right to take all the appropriate measures to defend and protect the interests of the Egyptian people", Egyptian Foreign Ministry spokesperson Tamim Khallaf told Reuters on Monday.Sudan has joined Egypt's calls for legally binding agreements on the dam's filling and operation, but could also benefit from better flood management and access to cheap energy.Cairo's position received support from U.S. President Donald Trump during his first term. Trump said it was a dangerous situation and that Cairo could end up "blowing up that dam", but his administration failed to secure a deal on the project, over which years of talks produced no agreement.

Insisting that the project's development is a sovereign right, Ethiopia has pressed ahead. In 2020, it began filling the reservoir in phases while arguing that the dam would not significantly harm downstream countries."The Renaissance Dam is not a threat, but a shared opportunity," Abiy told parliament in July. "The energy and development it will generate stand to uplift not just Ethiopia."Independent research shows that so far, no major disruptions to downstream flow have been recorded — partly due to favourable rainfall and cautious filling of the reservoir during wet seasons over a five-year period.

In Ethiopia, which has faced years ofinternal armed conflict, largely along ethnic lines, the GERD has proven a source of national unity, said Magnus Taylor from the International Crisis Group think tank."The idea that Ethiopia should be able to build a dam on its own territory... and shouldn't be pushed around by Egypt is broadly something that most Ethiopians would get behind," he said.Ethiopia's central bank provided 91% of the project's funding, while 9% was financed by Ethiopians through bond sales and gifts, without any foreign assistance, local media has reported.

The dam's reservoir has flooded an area larger than Greater London, which the government says will provide a steady water supply for hydropower and irrigation downstream while limiting floods and drought.Rural Ethiopians, however, may have to wait a little longer to benefit from the extra power: only around half of them are connected to the national grid.While relations with Egypt over the dam have deteriorated in the last year, they can still get worse, said Matt Bryden from think tank Sahan Research.

Landlocked Ethiopia's plan to gain access to the sea via its old adversaries Eritrea or Somalia has seen Egypt throw its weight behind Asmara and Mogadishu.The idea of strategic rival Egypt dictating not only Nile water usage but access to the Red Sea, is clearly unacceptable to Addis Ababa, Bryden said.

Israel launched an audacious attack on Hamas leaders in Qatar on Tuesday, expanding its military actions that have ranged across the Middle East to include the Gulf Arab state where the Palestinian Islamist group has long had its political base.

Qatar, which has acted as a mediator alongside Egypt in talks on a ceasefire in the almost two-year-old war in Gaza, condemned the action as "cowardly" and called it a flagrant violation of international law.

Two Hamas sources told Reuters that Hamas officials in the ceasefire negotiating team survived the attack.

Israeli officials told Reuters the strike was aimed at top Hamas leaders including Khalil al-Hayya, its exiled Gaza chief and top negotiator.

Several blasts were heard in Qatar's Doha, Reuters witnesses said. Plumes of black smoke were billowing from the city's Legtifya petrol station. Next door to the petrol station is a small residential compound that has been guarded by Qatar’s emiri guard 24 hours a day since the beginning of the Gaza conflict.

Ambulances and at least 15 police and unmarked government cars thronged the streets around the blast site an hour after the strike.

Israel has killed several top Hamas leaders since the Palestinian militant group attacked Israel in October 2023, killing 1,200 people and taking 251 hostage, according to Israeli tallies.

Israel has also launched airstrikes and other military action in Lebanon, Syria, Iran and Yemen in the course of the Gaza conflict.

In Lebanon, it attacked the heavily armed Iran-backed group Hezbollah and in Yemen it launched air strikes on the Iran-aligned Houthi group. Both groups have launched strikes on Israel during the Gaza conflict.

An Israeli official confirmed to Reuters that Israel had carried out an attack on Hamas leaders in Qatar. Qatar's Al Jazeera television, citing a Hamas source, said the attack was aimed at Hamas Gaza ceasefire negotiators.

The assault is likely to deal a serious, if not fatal blow to efforts to reach a ceasefire, especially since it took place in the Gulf Arab country Qatar, which has hosted several rounds of talks.

Reporting by Andrew Mills in Doha, Jana Choukeir in Dubai and Steven Scheer and Maayan Lubell in Jerusalem, Writing by Michael Georgy, Editing by William Maclean

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up