Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Cctv - China And ASEAN Countries Agree To Strengthen Dialogue For Maintaining Peace And Stability In South China Sea

Kazakhstan's Gold Reserves Rose To 10.96 Million Ounces (approximately 340.89 Tons) In December

Financial Times: British Ministers Say Labour's Housing Construction Plans Will Depress House Prices

[Chinese Ambassador To The US: People-to-People Exchanges Help China And The US Build A New Way Of Coexisting In The New Era] On The 28th Local Time, Chinese Ambassador To The US Xie Feng Said At An Event In Philadelphia That People-to-people Exchanges Should Serve As A Bridge, A Medium, And A Mirror To Help China And The US Build A New Way Of Coexisting In The New Era. Xie Feng Attended The 2026 "Happy Chinese New Year" Concert And "Hello! China" Tourism Promotion Event Jointly Organized By The China National Tourist Office In New York And The Philadelphia Orchestra. In His Speech, He Said That China And The US Are Currently Exploring A New Way Of Coexisting In The New Era, A Long And Arduous Task That Requires Both Sides To Continuously Strengthen The Bonds Of People-to-people Exchanges And Inject A Continuous Stream Of Positive Energy Into China-US Relations

White House Official - President Trump Not Indicating USA Would Decertify Canadian Built Airplanes In Operation

The White House Announced That President Trump Will Attend A Policy Meeting At 2 P.m. ET On Friday (3 A.m. Beijing Time The Following Day) And Sign An Executive Order At 11 A.m. ET On Friday (midnight Saturday Beijing Time)

According To The Japan Exchange Website, From 10:21:49 To 10:31:59 Beijing Time On January 30, 2026, The Osaka Exchange Activated Its Circuit Breaker Mechanism For Platinum Futures, Temporarily Suspending Trading. This Was Due To A Sharp Drop In Global Platinum Prices, With The Decline Reaching The 10% Limit Set By The Previous Day. The Circuit Breaker Mechanism Is A Measure Taken By Exchanges To Cope With Severe Market Volatility, Aiming To Temporarily Restrict Or Suspend Trading To Encourage Investors To Remain Calm. This Was The First Time The Circuit Breaker Mechanism For Platinum Futures Had Been Activated Since December 30, 2025, Starting At 10:21 AM Beijing Time And Lasting For 10 Minutes

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

BOK Governor Rhee is "puzzled" by the won's "unreasonable" depreciation, warning of inflation risks.

Bank of Korea (BOK) Governor Rhee Chang-yong has voiced significant concern over the Korean won's recent depreciation, stating that its fall has gone far beyond a reasonable level and could pose a risk to inflation.

Speaking at a Goldman Sachs conference in Hong Kong, Rhee admitted he was "really puzzled" by the currency's performance over the last two months. "Compared with the dollar index, we started to decouple in October and November," he noted, highlighting a divergence that has worried policymakers.

For months, the Korean won hovered near the key psychological level of 1,450 per U.S. dollar. Late last month, it weakened further, touching the 1,480 level amid broad dollar strength, geopolitical risks, and significant overseas securities investments by local investors.

In response, South Korean authorities issued strong verbal warnings and implemented a series of policy measures. These actions helped the currency regain some ground, pushing it back above the 1,430 won level.

Governor Rhee attributed the won's sharp decline to a phenomenon he described as "scarcity in plenty." He explained that while robust exports were bringing a strong inflow of dollars into the country, market participants were surprisingly reluctant to sell them in the spot market.

This hesitation has created an artificial shortage of dollars, putting downward pressure on the won despite healthy fundamentals.

A major factor, according to Rhee, is the overseas investment activity of the National Pension Service (NPS). He pointed out that the scale of the NPS's foreign investments has become very large relative to the size of South Korea's foreign exchange (FX) market.

This has effectively reinforced market expectations that the won will continue to weaken, encouraging even more overseas investment from individuals. Rhee was critical of the fund's strategy, stating, "The NPS' current FX hedging target is zero percent, and in my personal view as an economist, that does not make sense. The hedging ratio needs to be raised."

The governor did welcome a recent decision by the NPS to cut its overseas investment plan by half this year, a move expected to reduce dollar demand by at least US$20 billion. He confirmed that discussions are ongoing with the government and the pension fund to establish a new framework for managing its FX exposure.

The BOK is closely watching the exchange rate's effect on prices. Rhee warned that if the won remains in the 1,470-1,480 range for an extended period, the central bank may need to revise its inflation forecast upward. For now, inflation is projected to remain around 2% this year.

On the broader economy, Rhee identified several key growth drivers for the year, including:

• Exports of semiconductors, with strong momentum in chips related to artificial intelligence (AI)

• Defense products

• Automobiles

• Ships

Prime Minister Narendra Modi's upcoming budget is set to tackle India's most pressing economic challenges: creating jobs for millions of new workers while shielding the nation from global uncertainty and trade tensions. An analysis of economist expectations reveals a strategic focus on bolstering employment and stimulating growth.

According to a Bloomberg News survey of 29 economists, Finance Minister Nirmala Sitharaman is expected to prioritize measures that support job creation and drive economic expansion. Key policy levers will likely include increased spending on infrastructure like roads, ports, and railways, along with new export incentive schemes and reforms to the import-duty structure.

This government-led push is a direct response to a shaky global economic environment and lagging private investment. With the private sector's share of new investment hitting a decade low in the year ending March 2024, the government has stepped in to fill the gap. To sustain demand and protect incomes, it boosted its own capital spending by 30% during that period.

Even as it ramps up spending, the ruling party is expected to maintain its commitment to fiscal discipline. While new social programs may be announced in five states to secure popular support, the broader goal is to rein in debt and reduce the budget deficit.

Economists project Sitharaman will target a budget deficit of 4.2% of gross domestic product for the fiscal year starting in April, down from 4.4% in the current year. This aligns with a roadmap established in last year's budget to lower federal debt to around 50% of GDP by 2030-31.

Analysts at BofA note this framework allows for a gradual reduction in the deficit, which helps manage the high debt-servicing costs that accumulated during the COVID-19 pandemic. However, the current debt level remains a concern. The International Monetary Fund estimates India's general government debt rose to 81.29% of GDP by March 2024, up from 69% in 2015, largely due to pandemic-era borrowing.

Several critical figures will define the government's economic strategy and its potential for success.

Economic Growth and Revenue Targets

Economists forecast India's economy will grow between 6.5% and 7% in the next fiscal year, with inflation hovering near the central bank's 4% target. This implies a nominal GDP growth of 9.5% to 10.5%—a crucial assumption for projecting government revenue. The recently released Economic Survey offers a similar projection, pegging growth between 6.8% and 7.2%.

On the revenue side, the government faces significant challenges. Last year's tax cuts on goods, services, and personal income, designed to offset a 50% tariff shock from the U.S., have constrained revenue. The budget is expected to target net tax collections of 28.3 trillion rupees ($308 billion), supplemented by 500 billion rupees from disinvestment.

To meet existing targets, corporate and income tax collections must rise by 11.7% and 43% respectively in the final four months of the fiscal year, according to Radhika Rao at DBS Bank Ltd. The government is also counting on dividends from the Reserve Bank of India (RBI) and other financial institutions, with transfers expected to reach about 3.2 trillion rupees.

Capital Expenditure and Defense Spending

Capital expenditure (capex) will remain a central pillar of the budget. The government is likely to allocate approximately 12.04 trillion rupees for capex, equivalent to nearly 3% of GDP. However, some economists warn that the capacity to expand and execute massive infrastructure projects may be approaching a saturation point.

Defense-related capital spending is also projected to increase significantly, rising to 2.3 trillion rupees from 1.8 trillion rupees last year, reflecting heightened border tensions following the conflict with Pakistan in May.

Record Borrowing and Market Implications

To fund its spending plans while pursuing fiscal consolidation, the government is expected to engage in record bond borrowing. Economists anticipate gross market borrowing of 16.5 trillion rupees, with net borrowing at 11.6 trillion rupees.

This heavy borrowing schedule could pressure the RBI to support the market through secondary bond purchases, according to Citigroup Inc. economists. Market participants surveyed expect the 10-year government bond yield to settle around 6.7% by the end of December 2026.

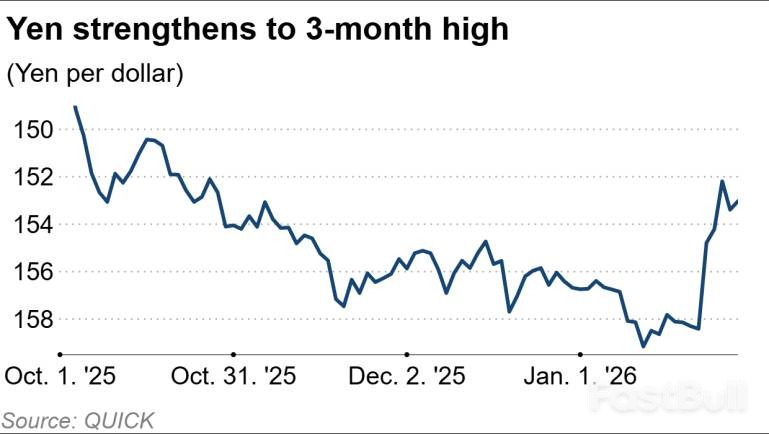

Speculation of a coordinated U.S.-Japan currency intervention has sent the yen soaring against the dollar, but market analysts remain uncertain if the rally has enough momentum to push past the 150 mark, especially with a lower house election scheduled for February 8.

In under a week, the yen staged a dramatic comeback, strengthening over 4% from 159 to 152 against the dollar and reaching a three-month high. On Friday morning, the currency was trading in the 152 to 153 range.

This sharp reversal follows a period of weakness for the yen, which intensified after Sanae Takaichi became prime minister in October. Her expansionary fiscal policy and a recent call for a snap election, combined with the Bank of Japan's monetary policy outlook, had created significant selling pressure on the currency.

The yen's rapid ascent began as traders grew alert to a potential intervention. The speculation was fueled by reports of a "rate check" conducted by the New York Federal Reserve and pointed comments from Japanese authorities. A rate check, where monetary officials inquire about foreign exchange price quotes from banks, is often seen as a prelude to direct market intervention.

"We will take appropriate action as necessary in close cooperation with U.S. authorities," Japanese Finance Minister Satsuki Katayama stated on Tuesday.

Although official data has not confirmed an actual intervention, the mere possibility has been enough to shift market sentiment.

"Governments don't always need to pull the trigger to move markets," explained Stefan Angrick, head of Japan and frontier market economics at Moody's Analytics. "The credible threat of coordinated action can be enough to move exchange rates, especially when Japan and the U.S. act together."

Despite the market's reaction, official U.S. comments have been mixed. President Donald Trump said he was comfortable with the dollar's value, telling reporters, "The dollar is doing great."

Further dampening intervention speculation, U.S. Treasury Secretary Scott Bessent said on Wednesday that Washington was "absolutely not" intervening to support the yen.

Toru Suehiro, chief economist at Daiwa Securities, noted that while Trump seemed to downplay the dollar's fall, he also signaled he would not want it to decline further, hoping the currency will "seek its own level." Suehiro interprets this to mean a weaker dollar is not yet a major issue for the U.S. administration.

"He deems a further depreciation as undesirable," Suehiro said. "I expect for statements supporting the dollar to gradually come out and there will likely be no actual intervention to buy the yen and sell the dollar."

While some analysts expect the yen could temporarily rise beyond the 150 threshold, few predict a sustained strengthening trend, particularly if Prime Minister Takaichi solidifies her power in the upcoming election.

A report from BofA analysts highlighted that short-term accounts have been selling the yen, partly over concerns about Japan's fiscal health. They noted, "Systematic accounts are notably long USD/JPY, with potential unwind triggers estimated around 153.3-155.1."

However, the report also emphasized that the major investment flows out of Japan over the past decade are "more structural." These include:

• Outbound foreign direct investment

• Public pension fund rotation into foreign securities

• Household purchases of foreign assets

These flows are considered "less cyclical or speculative" and would likely not be reversed by a currency intervention.

David Rolley, co-head of global fixed income at Loomis Sayles, forecasts that the yen will remain range-bound. "I don't expect it to go back to 158 but I'm not sure if it can break 150 either," he commented. Rolley added that a break below 148, a level where the yen traded for months last year, "would be a different world" and could signal a "yen bull market," but "that's not where we are yet."

Looking ahead, political uncertainty could weigh on the yen. Michael Wan, senior currency analyst at MUFG Bank, said that in the near term, "the yen could see some modest underperformance given the uncertainty on the policy direction and outcomes of the upcoming snap election."

However, Wan also stressed that a joint intervention would be a significant development. "I think we will probably not revisit the sharp yen selling pressures we saw over the past two months," he said.

For a fundamental, medium-term shift away from yen selling, Wan argues that Japan must address its negative real interest rates and clarify "the pace of BOJ rate hikes, beyond U.S. rates and the U.S. dollar."

Analysts at Goldman Sachs, led by strategist George Cole, echoed this sentiment. They warned that if intervention is preferred over tighter monetary or fiscal policy, any relief for the yen and Japanese government bonds (JGBs) "may be short-lived." With JGB yields already soaring to multi-decade highs, Goldman Sachs concluded that fiscal restraint is likely the "fastest policy route to boost both JGBs and JPY durably."

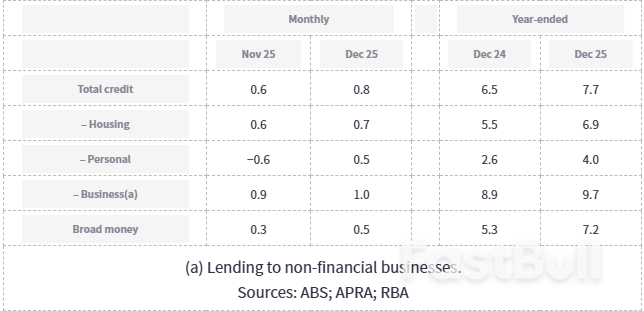

The table below presents a summary of the latest financial aggregates statistics.

All growth rates for the financial aggregates are seasonally adjusted, and adjusted for theeffects of breaks in the series. Data for the levels of financial aggregates are notadjusted for series breaks, and growth rates should not be calculated from data on thelevels of credit.

Historical levels and growth rates for the financial aggregates have been revised owing tothe resubmission of data by some financial intermediaries, the re-estimation of seasonalfactors and the incorporation of securitisation data. The RBA credit aggregates measurecredit provided by financial institutions operating domestically. They do not capturecross-border or non-intermediated lending.

Since the July 2019 release, the financial aggregates have incorporated an improvedconceptual framework and a new data collection. This is referred to as the Economic andFinancial Statistics (EFS) collection. For more information, seeUpdates to Australia's FinancialAggregates and the July 2019 Financial Aggregates.

Since the March 2023 release, series that exclude lending to warehouse trusts in business credit were added tothe financial aggregates. More information is available in theChange Notice published 21 April 2023.

U.S. President Donald Trump issued a stark warning to the United Kingdom on Thursday, labeling its new business overtures to China as "very dangerous." The comments came as London and Beijing take significant steps to repair their strained relationship and forge a new long-term strategic partnership.

The diplomatic push is highlighted by Prime Minister Keir Starmer's four-day visit to China, the first by a British leader in eight years. Starmer, accompanied by a delegation of nearly 60 business executives, is aiming to reset bilateral ties and unlock new economic opportunities.

The meeting between Prime Minister Starmer and Chinese President Xi Jinping has already produced several key agreements designed to boost economic ties. According to Downing Street, the new measures include:

• Tariff Reduction: China has agreed to cut its import tariffs on British whisky in half, from 10% down to 5%.

• Visa-Free Travel: British nationals will be granted visa-free travel to China for stays of up to 30 days.

• Major Investment: British pharmaceutical giant AstraZeneca announced it will invest $15 billion in China through 2030.

When asked about Starmer's efforts, Trump told Reuters, "it's very dangerous for them to do that."

The U.K.'s diplomatic strategy mirrors a similar move by Canada, which signed its own trade agreement with China earlier this month. The visit by Canadian Prime Minister Mark Carney signaled Ottawa's intent to diversify its trade partners amid ongoing friction with Washington.

Trump directed an even stronger warning toward Canada, stating it was "even more dangerous for Canada to get into business with China." He added, "Canada is not doing well... You can't look at China as the answer."

In a sharp reversal of his previous stance, Trump has threatened to impose a 100% tariff on Canadian goods if Ottawa proceeds with the China trade deal.

"President Xi is a friend of mine, I know him very well," Trump said, before adding an unusual warning. "The first thing they're going to do is say you're not allowed to play ice hockey anymore. Canada's not going to like that."

Oil prices are on track for their most significant monthly surge in years, driven by escalating tensions in the Middle East over a potential U.S. conflict with Iran that could threaten global energy supplies.

While both major benchmarks saw a slight pullback on Friday, their monthly performance remains exceptionally strong. Brent crude futures dipped 21 cents to $70.50 a barrel, and the more active April contract fell 37 cents to $69.22. U.S. West Texas Intermediate (WTI) crude saw a 39-cent drop to $65.03 per barrel.

Despite the minor decline, both benchmarks are poised to break a five-month losing streak.

• Brent crude is set for a monthly gain of over 16%, its largest jump since January 2022.

• WTI crude is on pace to rise more than 14% in January, marking its biggest monthly increase since July 2023.

The primary driver behind the price surge is the heightened risk of conflict between the United States and Iran. U.S. President Donald Trump on Wednesday called for Iran to negotiate on its nuclear program or risk a military strike, prompting a sharp response from Tehran.

This standoff has injected a significant "risk premium" into oil prices. According to IG market analyst Tony Sycamore, traders are now pricing in the possibility of major disruptions to Iranian oil exports or a shutdown of shipping through the vital Strait of Hormuz.

Adding to the tension, the Trump administration is reportedly holding separate talks in Washington this week with senior defense and intelligence officials from Israel and Saudi Arabia to discuss Iran. While U.S. officials state that President Trump is still reviewing his options, the military buildup in the region has put the market on high alert.

Despite the heated rhetoric, some analysts believe a full-scale disruption to Iran's oil infrastructure is unlikely. Analysts at JPMorgan, led by Natasha Kaneva, noted that "elevated inflation and this year's mid-term elections" in the U.S. make a prolonged conflict undesirable.

Their analysis suggests that if military action does occur, it would likely be "targeted, avoiding Iran's oil production and export infrastructure." This view is shared by Citi, which estimates a 70% probability that the U.S. and Israel will opt for more restrained actions against Iran in the near term, such as limited strikes and oil tanker seizures.

Beyond the Middle East, a series of unrelated supply disruptions have further tightened the global oil market, collectively removing an estimated 1.5 million barrels per day (bpd) in January, according to JPMorgan.

Key supply challenges include:

• Kazakhstan: The massive Tengiz oilfield is slowly restarting production after electrical fires impacted 7.2 million barrels of output. It is expected to take a week to return to full capacity.

• United States: An Arctic weather wave is projected to reduce crude and condensate output by 340,000 bpd this month.

• Russia: Bad weather has hampered the country's oil exports.

• Venezuela: The nation was forced to cut production after U.S. forces ousted President Nicolas Maduro.

However, the situation in Venezuela is evolving. The new interim government approved a major reform of its oil law on Thursday, while the Trump administration eased some sanctions on the country's oil industry. These moves are designed to encourage investment and could eventually lead to an increase in Venezuela's oil and gas output.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up