Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Kevin Warsh favored for Fed Chair, signaling Trump's pro-growth policy shift by 2026.

A potential leadership change at the Federal Reserve is taking shape, with former Fed Governor Kevin Warsh flagged as a likely candidate for the top job. U.S. Treasury Secretary Scott Bessent has indicated Warsh is a leading contender, with President Trump expected to announce a decision in January 2026.

The potential shift is driven by a clear agenda for a more pro-growth Federal Reserve. Scott Bessent has been a key figure in developing the shortlist for the next Fed Chair, advocating for a policy direction that mirrors the Alan Greenspan era of the 1990s.

Bessent has emphasized the central bank's role in fostering economic expansion, stating, "At a certain point, the Federal Reserve must also do its part to spur investment." This vision aims to create an environment conducive to greater fiscal activity.

While Kevin Warsh is a notable candidate, the selection process includes interviews with other contenders such as Kevin Hassett and Rick Rieder. Bessent has stressed the importance of integrity and a strict adherence to the Fed's dual mandate for any nominee. The final decision by President Trump is expected to signal a significant change in the course of U.S. monetary policy.

Markets are already reacting to the prospect of new leadership. U.S. Treasuries dropped following Bessent's remarks concerning current Fed Chair Jerome Powell, signaling that investors are bracing for potential shifts in economic strategy.

The financial implications of this pro-growth stance could be substantial, with a focus on prioritizing investment that may involve rate cuts starting in 2026. This comes as Powell's term faces scrutiny amid an ongoing Department of Justice investigation.

A potential chairmanship for Warsh is seen as ushering in a more flexible and open-minded policy framework, reminiscent of strategies employed during past technology booms. The administration's focus remains on ensuring transparency and addressing structural issues within the Federal Reserve to better align with its economic objectives.

The Trump administration has escalated its conflict with the Federal Reserve by opening a criminal investigation into Chairman Jerome Powell, a move that evokes the high-inflation 1970s when political pressure compromised central banks.

Economists are drawing stark comparisons. In 2019, Turkish President Recep Tayyip Erdoğan fired his central bank governor for refusing to cut interest rates. The economic fallout was severe, with the lira collapsing and inflation spiraling out of control. Even then, the governor was never accused of a crime.

In the United States, however, Fed Chair Jay Powell is now the subject of a federal investigation concerning a $2.5 billion renovation of the central bank's headquarters.

In a move that shattered decades of protocol, Powell responded directly to the pressure. He released a short video on the Fed's website, stating the investigation was a pretext engineered by the Trump administration to force deep cuts to interest rates.

Markets have so far remained steady, with stocks and bond yields showing little reaction. Investors appear to be betting that the Fed will successfully resist the political pressure. Still, economists view the situation as alarming. The White House and the Federal Reserve have historically served as pillars of global economic stability; now, they are in open conflict.

"It was leading by example," said Klaas Knot, former head of the Dutch central bank, reflecting on America's historical support for market-based institutions. "They have apparently chosen to set an entirely different example."

The timing of the escalation is critical. President Trump is promoting his economic agenda in Davos while the Supreme Court hears a case involving Lisa Cook, a Fed governor he attempted to fire over allegations of mortgage fraud, which she denies.

The clash between Trump and Powell has been building for years. After appointing Powell, the president quickly turned on him when the Fed began raising rates. The attacks have grown more intense during Trump's second term.

Trump has publicly called Powell a "stubborn mule" and a "numbskull," stating he would "love to fire" the chairman for not cutting interest rates to 1 percent. The White House has since zeroed in on the Fed's building project, which is reportedly $700 million over budget and is now the focus of the Department of Justice probe.

For months, Powell remained silent, even as the administration tried to remove Lisa Cook from the board. His decision to release a video statement marked a definitive shift in strategy.

The move triggered a reaction on Capitol Hill, with senators Thom Tillis, Lisa Murkowski, and John Kennedy all voicing support for Powell. On Wall Street, prominent figures like Jamie Dimon and Christine Lagarde reiterated the importance of central bank independence.

Glenn Hubbard, who chaired the Council of Economic Advisers under George W. Bush, commended Powell's handling of the situation. "He clarified what had happened," Hubbard said. "He didn't editorialize." Hubbard also joined every living former Fed chair in signing a letter that condemned the investigation.

Cracks have also appeared within the administration. Treasury Secretary Scott Bessent publicly supported a review of the Fed but was reported to have privately urged Trump to drop the investigation. Treasury officials later insisted there was "zero daylight" between Bessent's position and the president's. Hubbard described the episode as an "own goal of epic proportions."

The investigation has made it more difficult for Trump to reshape the Federal Reserve. Powell's term as chair is set to end in four months, but he is entitled to remain on the board until January 2028. Allies suggest that Powell is now reconsidering an early departure, a move that would have allowed Trump to appoint another ally to the board.

Gaining Senate approval for a new nominee presents another major hurdle. Senator Tillis has threatened to block any nomination until the probe is dropped. A prolonged delay could result in Powell remaining as chair.

The controversy has also damaged the standing of Kevin Hassett, a close Trump ally who initially supported the probe before backtracking, saying, "I expect that there's nothing to see here." While other potential candidates like Kevin Warsh, Chris Waller, and Rick Rieder have remained quiet, Stephen Miran was confirmed to the Fed board last year.

James Egelhof of BNP Paribas stated that the Fed is expected to adhere to its established policy framework. Nevertheless, some investment funds are hedging their bets. Pimco, a firm managing $2.2 trillion, is actively reducing its exposure to the U.S. dollar.

Experts warn of the long-term consequences. Paul Diggle noted the risk of "creeping politicisation," while Adam Posen observed that foreign governments are now developing strategies "not dependent on the US."

Even if the case against Powell fails, economists fear the damage to the institution may linger. Lael Brainard warned that the investigation could have a chilling effect, making officials hesitant to speak freely. "Everybody is nervous," she said, "that they too could be the subject of a criminal investigation."

President Donald Trump is exploring an executive action to cap credit card interest rates at 10%, a move being considered amid congressional gridlock. The proposal is a central piece of a broader affordability agenda aimed at addressing housing costs and consumer debt.

The administration’s plan also includes measures to block institutional investors from buying single-family homes and a proposal to allow savers to use 401(k) funds for home down payments. Trump has stated that further details on these initiatives will be revealed during his speech at the World Economic Forum in Davos next week.

Discussions are actively underway. National Economic Council Director Kevin Hassett confirmed on Fox Business that the White House is in talks with major banks, stating, "They think that the president's on to something."

The administration is moving quickly, with Trump calling for a one-year, 10% cap on credit card rates to be implemented by a January 20 deadline. His team has also been meeting with homebuilders to discuss housing affordability.

The pressure intensified after Press Secretary Karoline Leavitt framed the initiative as a "demand" from the president, saying companies are expected to lower rates by the deadline.

Alongside the credit card cap, officials are also reviewing a potential ban on stock buybacks by publicly traded homebuilders, an idea first floated by Bill Pulte, head of the Federal Housing Finance Agency. While discussions continue, White House officials have confirmed that no final decisions have been made.

The potential rate cap dominated earnings calls at major financial institutions this week, with executives from JPMorgan Chase, Citigroup, and Bank of America all raising concerns about the plan's feasibility and impact. A common theme was the lack of detail available to measure the potential effects on their businesses.

Key concerns from industry leaders include:

• Economic Slowdown: Citigroup Chief Financial Officer Mark Mason warned that a government-mandated cap could slow overall economic activity.

• Reduced Credit Access: Bank of America Chief Executive Officer Brian Moynihan suggested that if banks are forced to cap rates, they may pull back on lending, limiting access to credit for consumers.

Bank trade groups echoed these worries. Rob Nichols, head of the American Bankers Association, highlighted the fundamental risk of unsecured loans. "We're talking about unsecured lending," he said, "so it's not like an auto loan or a mortgage loan where there's something you can take back."

As financial firms planned their responses, lobbyists worked to understand how Trump could legally implement such an order. According to one lobbyist involved in the talks, using the interstate commerce clause to override state usury limits is one option being discussed.

Consumer advocates are divided on the proposal. Some have warned that a 10% cap might be too low, potentially causing banks to stop lending to lower-income borrowers altogether.

However, others support the idea of a reasonable limit. Adam Rust of the Consumer Federation of America pointed to federal credit unions, which already operate under rate caps. "It's about finding a reasonable rate that doesn't undermine the ability of consumers who are struggling to get by," he said.

As an alternative to a mandate, Kevin Hassett also floated the idea that banks could voluntarily launch new "Trump cards" with lower rates. Following this theme, the company Bilt rolled out three new credit cards this week with rates capped at 10%, though the limit only applies to new purchases and lasts for one year.

The United States has imposed a 25% tariff on certain advanced computing chips, a move that South Korea's trade minister said will have a limited initial impact on the country's semiconductor companies.

The new measures, announced by President Donald Trump, follow a nine-month national security investigation under the Trade Expansion Act of 1962.

According to Trade Minister Yeo Han-koo, the first phase of the tariffs specifically targets high-end artificial intelligence chips from companies like Nvidia and AMD.

"Since the memory chips that South Korean companies mainly export are currently excluded, the immediate impact is expected to be limited," Yeo stated.

However, he cautioned that it was "not yet time to be reassured," highlighting uncertainty over how a potential second phase of tariffs could expand. Yeo confirmed the government will continue to work with the industry to protect the interests of South Korean firms.

The 25% tariff applies to a narrow range of high-performance semiconductors and devices containing them. Among the products explicitly named are Nvidia's H200 AI processor and AMD's MI325X chip.

The White House specified that the tariffs would not apply to chips and related devices imported for:

• U.S. data centers

• Startups

• Non-data center consumer applications

• Non-data center civil industrial applications

• U.S. public sector applications

The action is part of a wider U.S. strategy to incentivize domestic semiconductor manufacturing and reduce reliance on chip producers in regions like Taiwan. According to a White House fact sheet, the United States may impose broader tariffs on semiconductors in the future to further this goal.

The potential for escalating measures was underscored by U.S. Commerce Secretary Howard Lutnick. Speaking at a groundbreaking ceremony for Micron's new plant in New York, Lutnick warned that South Korean and Taiwanese chipmakers not investing in the U.S. could face tariffs as high as 100% unless they commit to increasing production on American soil.

As Thailand heads towards a pivotal election next month, the ruling Bhumjaithai Party is campaigning on a platform to resolve the border conflict with Cambodia and crack down on the country's role as a transit point for human trafficking victims.

The conservative party, which assumed power in September, is positioning itself as the primary defender of Thai sovereignty following clashes with Cambodia that erupted for five days last July and again in December.

Foreign Minister Sihasak Phuangketkeow, the party's second prime ministerial candidate after incumbent leader Anutin Charnvirakul, stated that if re-elected on February 8, Bhumjaithai will maintain its firm stance on protecting Thailand's territorial integrity. Simultaneously, the party aims to restore diplomatic ties to reopen borders and resume trade.

Anutin has leveraged a wartime leader image by aligning closely with the Thai military, a strategy that has doubled his party's popularity since border tensions flared last May. This hardline position resonates strongly with conservative and rural voters, especially in the seven northeastern border provinces, boosting the party's campaign with nationalist sentiment.

"We are determined to protect our sovereignty, our territorial integrity," Sihasak said in an interview. "I'm hoping that we will be able to put the conflict behind us soon, build up confidence and trust and move forward with our relationship."

Sihasak emphasized that any progress is contingent on the December 27 ceasefire holding. Key conditions for normalizing relations include:

• The withdrawal of heavy weapons from border areas.

• Cooperation on landmine removal.

• Joint crackdowns on scam operations.

"This is still a very delicate period where we have to avoid all acts of provocation," he cautioned.

The foreign minister dismissed recent comments from Cambodian minister Keo Remy, who suggested Bhumjaithai's re-election would trigger a third border clash and advised Thais to vote for other parties. Sihasak labeled the remarks "verbal provocation" and interference in domestic affairs.

Bhumjaithai's rise came after the previous Pheu Thai government, led by Paetongtarn Shinawatra, was ousted. A leaked phone call involving a former Cambodian leader led to her court-ordered dismissal for ethical violations. While Pheu Thai claims it can also resolve the conflict, public trust has weakened due to the Shinawatra family's close personal ties with Cambodia's ruling Hun dynasty before the border dispute.

Meanwhile, the progressive People's Party, which has never held power, advocates for a peaceful solution but remains untested in handling territorial conflicts. Its anti-establishment stance contrasts sharply with a period of high public adoration for the armed forces.

Thailand has framed the deadly conflict not just as a territorial dispute but also as a war on the transnational criminal operations that have taken root in Cambodia. The Thai air force has targeted several sites in the neighboring country, identifying them as abandoned casinos repurposed for military or drone activities.

Internally, Sihasak acknowledged that Thailand must address its role as a regional transit hub for victims lured into working for scam centers.

"If we are going to try to lead the regional and international efforts to combat scams, we have to look at ourselves and put our house in order," he stated. "You have to crack down on those involved, otherwise it's not going to be possible."

The conflict has also drawn international economic pressure. In July, US President Donald Trump threatened to freeze trade deals with both Thailand and Cambodia if the fighting did not stop. After a ceasefire was reached, the US imposed a 19% tariff on goods from both nations.

Sihasak said a re-elected Bhumjaithai government would seek to lower these export tariffs in upcoming negotiations with US officials. He also plans to task Thai ambassadors worldwide with finding new export markets and attracting foreign direct investment to counter growing protectionism.

"We're facing more protectionism, more unilateralism, especially what we see coming from the US," he said.

Furthermore, the party aims to rebuild investor confidence. Thailand's stock market has experienced net outflows of foreign funds for three consecutive years since 2023, a period marked by political turmoil and two regime changes.

"If we have a stable government, we have consistent policies, I think we could reverse the trend," Sihasak concluded. "Thailand is still an attractive place to invest."

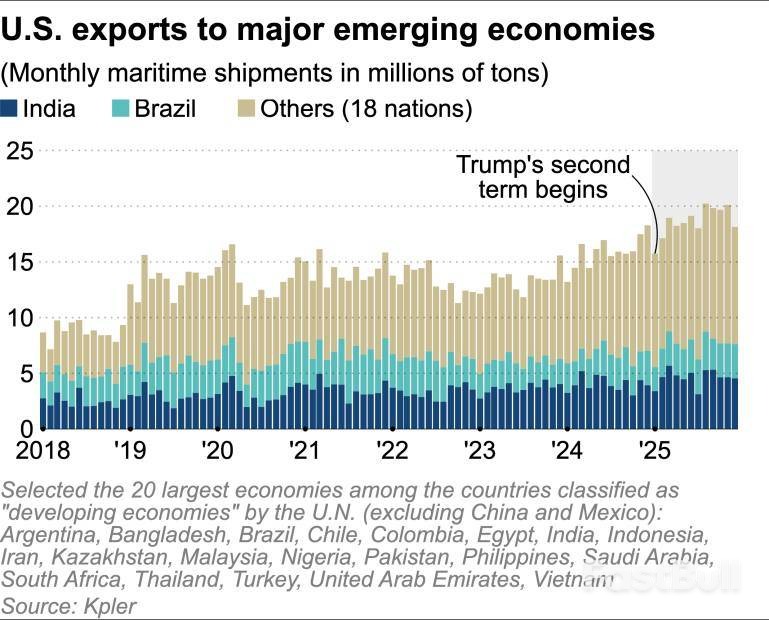

U.S. maritime exports to key emerging markets, excluding China, jumped 17% last year, highlighting how President Donald Trump's trade policies are actively reshaping global supply chains.

An analysis of Kpler trade data reveals that U.S. shipments to 20 major emerging economies, including India, Brazil, and Vietnam, grew from 190 million metric tons in 2024 to 223 million tons in 2025. This surge, particularly in agricultural goods, has helped offset a steep decline in exports to China.

"We can see a significant increase in imports following trade talks with the U.S." in some countries, noted Ishan Bhanu, lead agricultural commodities analyst at Kpler.

Several Asian nations recorded sudden and dramatic increases in U.S. commodity imports after securing more favorable trade terms with Washington.

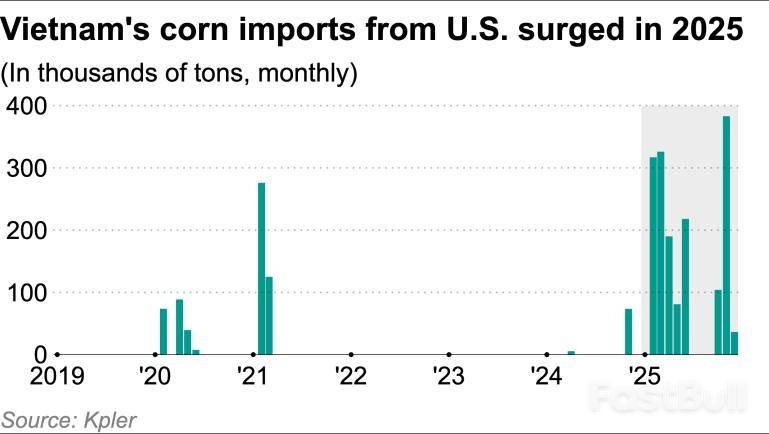

Vietnam's Corn Market Transformed

Vietnam provides a stark example of this trend. In 2025, the country's corn imports from the U.S. skyrocketed 21 times compared to the previous year, reaching approximately 1.7 million tons. This shift followed a trade negotiation last June where the U.S. agreed to lower its tariff rates from 46% to 20% in exchange for Vietnam purchasing $2 billion in American farm products.

By November, Vietnam's monthly corn imports from the U.S. hit a record 383,000 tons. "A very interesting phenomenon," Bhanu told Nikkei Asia. "Vietnam has always taken a lot of South American corn, and [in 2025] it has taken a lot of U.S. corn."

Pakistan and Bangladesh Follow Suit

Similar dynamics played out in other textile-exporting nations. U.S. soybean shipments to Pakistan surged from just 60,000 tons in 2024 to 1.23 million tons in 2025. The boom followed a July trade agreement where the U.S. cut import tariffs on Pakistan's textile sector from roughly 29% to 19%, boosting its competitiveness against rivals like India.

Bangladesh also shifted its procurement strategy. Historically a major buyer of Russian, Canadian, and Ukrainian wheat, Bangladesh began purchasing large volumes from the U.S. after securing reduced American tariffs on its own exports. "Now they're buying a lot from the U.S., even at higher prices than other countries," Bhanu explained.

Across the globe, Nigeria also became a major buyer of U.S. grains, with wheat imports climbing from 0.53 million tons in 2024 to 1.48 million tons in 2025. Driven by these new agreements and other factors like a delayed Russian harvest, total U.S. wheat exports to the 20 emerging nations rose 16% to 21.57 million tons.

The trade deals prompted many nations to purchase U.S. commodities even when they were more expensive on the open market. In early January, U.S. soybeans were priced at $418 per ton, higher than Brazilian soybeans at $407 per ton.

"Emerging markets continued buying U.S. products, mindful of trade negotiation terms and relations with Washington," said Bhanu.

While Brazilian soybeans were cheaper due to a bumper crop, the political calculus favored U.S. suppliers. In the corn market, a smaller price gap between U.S. and other sources gave American exporters a competitive edge. "Tariff negotiations prompted emerging markets to change their sourcing strategies," confirmed Hideki Hattori of Nippn, a major Japanese flour milling company.

The export boom wasn't limited to agriculture. U.S. natural resource shipments also expanded, with crude oil exports to the 20 emerging economies climbing 58% in 2025 to 36 million tons, or about 760,000 barrels per day.

India became a key buyer as it sought to improve relations with Washington. The country faced a 50% U.S. tariff on its exports as a penalty for purchasing Russian oil, which President Trump claimed was "fueling a war machine." In response, Indian refiner Reliance Industries announced it would halt Russian crude imports at its Jamnagar complex.

Kpler data shows India's crude imports from Russia fell 29% year-on-year in December, while its imports from the U.S. soared 4.9 times to 330,000 barrels per day.

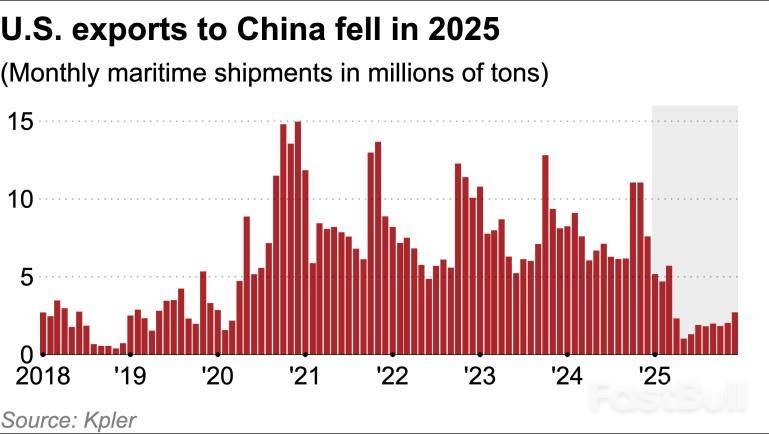

While U.S. exports to these new markets grew, they failed to compensate for a massive drop in trade with China. U.S. exports to China plummeted 65% in 2025, falling from 93 million tons to 32 million tons. The 33-million-ton increase in shipments to the 20 other nations did not fully offset this decline.

The collapse in the China trade was driven largely by a near-complete halt in soybean transactions, which previously accounted for 30% of U.S. exports to the country, after May 2025.

The "America First" trade policy may also create economic headwinds. A study by the Auckland University of Technology projected that the Trump tariffs would reduce the U.S. economic growth rate by 0.36 percentage points in 2025. The growth rates of Thailand and Brazil were also expected to decline by 0.44 and 0.19 points, respectively.

As the second Trump administration enters its second year, emerging economies are navigating a new geopolitical landscape. "Southeast Asian countries cannot afford to be too confrontational toward the U.S.," said Tricia Yeoh, an associate professor at the University of Nottingham Malaysia. "They are particularly adept at creating good impressions."

However, she added that Washington's aggressive tariff policies and hardline stances are creating "a growing impression among Southeast Asia and other emerging countries that the U.S. is no longer adhering to the rules-based international order."

U.S. President Donald Trump on Friday suggested he might impose tariffs on countries that do not support U.S. control over Greenland, escalating his administration's rhetoric even as a bipartisan congressional delegation was in Copenhagen working to ease tensions with Denmark.

For months, Trump has publicly insisted that the U.S. should acquire Greenland, a semi-autonomous territory of NATO ally Denmark. Earlier in the week, he declared that anything less than the Arctic island falling under U.S. control would be "unacceptable."

During a White House event on rural health care, Trump revealed a new potential strategy, recounting how he had previously threatened European allies with tariffs on pharmaceuticals.

"I may do that for Greenland too," Trump stated. "I may put a tariff on countries if they don't go along with Greenland, because we need Greenland for national security. So I may do that."

This was the first time the president mentioned using tariffs to force the issue. The White House has consistently justified its pursuit of Greenland by claiming China and Russia have designs on the territory, which holds vast untapped reserves of critical minerals. The administration has also not ruled out the possibility of taking the territory by force.

The tariff threat follows a recent meeting in Washington where the foreign ministers of Denmark and Greenland met with U.S. Vice President JD Vance and Secretary of State Marco Rubio. While the talks resulted in an agreement to form a working group, they failed to resolve fundamental disagreements, with Denmark and the White House later offering conflicting views on the group's purpose.

In sharp contrast to the White House's confrontational tone, a delegation of U.S. senators and House members met with Danish and Greenlandic lawmakers in Copenhagen, including Danish Prime Minister Mette Frederiksen.

The delegation's leader, Senator Chris Coons, a Delaware Democrat, thanked their hosts for "225 years of being a good and trusted ally and partner," adding that they had a "strong and robust dialogue about how we extend that into the future."

Senator Lisa Murkowski, an Alaska Republican, stressed that the visit was meant to nurture a decades-long relationship. "Greenland needs to be viewed as our ally, not as an asset, and I think that's what you're hearing with this delegation," she told reporters.

European leaders maintain that any decision regarding Greenland's status is a matter for Denmark and Greenland alone. In response to the growing pressure, Denmark announced this week it was increasing its military presence in Greenland in cooperation with its allies.

Greenlandic and Danish officials have been direct in their criticism of the U.S. administration's stance.

"We have heard so many lies, to be honest and so much exaggeration on the threats towards Greenland," said Aaja Chemnitz, a Greenlandic politician and member of the Danish parliament who participated in the meetings. "And mostly, I would say the threats that we're seeing right now [are] from the U.S. side."

Greenland's prime minister, Jens-Frederik Nielsen, made his government's position clear on Tuesday. "If we have to choose between the United States and Denmark here and now, we choose Denmark. We choose NATO. We choose the Kingdom of Denmark. We choose the EU."

Back in the U.S., some lawmakers are working to counter the president's agenda. Senator Murkowski, alongside New Hampshire Democrat Senator Jeanne Shaheen, has introduced bipartisan legislation to prohibit the use of Defense or State Department funds to annex or take control of Greenland or any other NATO member's sovereign territory without consent.

Murkowski also noted the lack of public support for the idea. "When you ask the American people whether or not they think it is a good idea for the United States to acquire Greenland, the vast majority, some 75%, will say, we do not think that that is a good idea," she said.

The dispute is also raising deep concerns among the region's Indigenous population. Sara Olsvig, chair of the Inuit Circumpolar Council, which represents 180,000 Inuit across Alaska, Canada, Greenland, and Russia, said the White House's persistent statements offer "a clear picture of how the U.S. administration views the people of Greenland, how the U.S. administration views Indigenous peoples, and peoples that are few in numbers."

Speaking from Nuuk, Greenland, Olsvig told The Associated Press that the core issue is "how one of the biggest powers in the world views other peoples that are less powerful than them. And that really is concerning." She added that the Indigenous Inuit of Greenland do not want to be colonized again.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up