Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)--

F: --

P: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Dec)

U.S. Cleveland Fed CPI MoM (Dec)--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Imports (CNH) (Dec)

China, Mainland Imports (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)--

F: --

P: --

U.S. EIA/WTI Crude 1-Year Average Price Forecast (Jan)

U.S. EIA/WTI Crude 1-Year Average Price Forecast (Jan)--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. Yield--

F: --

P: --

Argentina 12-Month CPI (Dec)

Argentina 12-Month CPI (Dec)--

F: --

P: --

Argentina National CPI YoY (Dec)

Argentina National CPI YoY (Dec)--

F: --

P: --

. How are you today

. How are you today

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan eyes a ¥500 trillion sovereign wealth fund, pooling vast public assets for new revenue despite governance and loss risks.

A coalition of Japanese lawmakers is pushing a proposal to create a massive sovereign wealth fund, aiming to consolidate roughly ¥500 trillion ($3.2 trillion) in public financial assets to generate new revenue for the nation. The initiative seeks to address Japan's chronic budget deficits by actively managing these assets to fund key policy goals.

The core idea is to bring Japan's foreign exchange reserves, pension assets, and exchange-traded funds held by the Bank of Japan under the management of skilled investment professionals in a single entity. Proponents estimate that even a modest 1% annual return could generate ¥5 trillion.

This new income could be used to eliminate the consumption tax on essential goods like food or to cut annual social insurance premiums for working households by approximately ¥70,000.

The Komeito party, formerly part of the ruling coalition with the Liberal Democratic Party (LDP), is spearheading this effort. An alliance of lawmakers backing the fund is expected to form in the coming weeks, drawing members from the LDP, the main opposition Constitutional Democratic Party, and the Democratic Party for the People. A former finance minister is also reportedly among its supporters.

Komeito's immediate goal is to pass foundational legislation for the sovereign wealth fund during the parliamentary session that convenes this month.

The concept of a Japanese sovereign wealth fund isn't new. The LDP explored the idea with a project team back in 2008, but the initiative lost momentum after the global financial crisis.

This time, the proposal is fueled by the successful transformation of the Government Pension Investment Fund (GPIF), one of the world's largest institutional investors. In 2014, the LDP-Komeito government approved a strategic shift for the GPIF, diversifying its portfolio from a heavy concentration in Japanese bonds toward higher-risk domestic and foreign stocks.

The results have been significant. By the end of fiscal 2024, the GPIF's assets under management had grown to about ¥250 trillion, an increase of roughly 80% from fiscal 2014. Komeito hopes to apply the lessons and expertise gained from the GPIF's success to this new, larger fund.

A significant portion of the proposed fund's capital would be sourced from the government's foreign exchange fund special account. This account, managed by the Finance Ministry to stabilize the exchange rate and fund market interventions, held ¥187 trillion in assets as of the end of March 2025.

Currently, these assets are believed to be heavily invested in U.S. Treasurys. The new proposal would diversify these holdings into a broader range of assets, mirroring the strategy that proved successful for the GPIF.

Despite its potential benefits, establishing such a fund presents several challenges.

• Governance Conflicts: Fund managers would need to make investment decisions based on profitability, free from political pressure or influence.

• Managing Losses: Since the fund's capital would not be derived from budget surpluses, any investment losses would directly reduce the government's assets. This would require establishing clear rules to manage such scenarios.

• Legislative Changes: If management of the fund were outsourced to private-sector professionals, new legislation would be required.

• Alternative Priorities: A key counterargument is that Japan should prioritize using its available capital to pay down its substantial public debt rather than investing it in financial markets.

The UK's Conservative Party is drawing a clear line against its right-wing rival, Reform UK, over the future of the Office for Budget Responsibility (OBR).

Mel Stride, the Conservative Treasury spokesman, has stated that while the party is open to overhauling the OBR, its continued existence is "non-negotiable." This stance directly opposes calls from Reform UK leader Nigel Farage, who has suggested the fiscal watchdog should be scrapped entirely.

Stride warned that eliminating the OBR would trigger a market backlash, likely leading to "a premium on our borrowing costs." Farage, however, stated earlier this month that he is giving "serious thought" to whether the UK would be "better off without the OBR."

The independent forecaster has become a center of controversy since Chancellor Rachel Reeves's November budget. The OBR's decision to downgrade the UK's growth outlook at the time forced the Labour chancellor to raise taxes to stay within her own fiscal rules.

This move fueled criticism from populists on both the right and left, who argue that the OBR is effectively making tax and spending decisions instead of the elected government. The situation intensified following an unprecedented leak of budget details nearly an hour before Reeves's speech, followed days later by the resignation of OBR chair Richard Hughes.

In a planned speech at the Institute for Government, Stride is expected to frame the OBR as a pillar of economic credibility for markets, taxpayers, and businesses.

He plans to directly challenge Farage's motives, arguing it's "not hard to see why a politician like Nigel Farage might want to get rid of the OBR when he fought the last election on a manifesto which made £140 billion ($190 billion) of fantasy unfunded commitments."

Labour has also attacked Farage for "fiscal recklessness," describing his proposal to ditch the OBR as "Liz Truss on steroids." The comparison invokes the market chaos that followed former Prime Minister Liz Truss's 2022 mini-budget, which sidelined the OBR. Farage has since said he would prioritize cutting public spending and waste before implementing tax reductions.

While defending the OBR's existence, the Conservatives are also signaling a desire for change. Stride accused Chancellor Reeves of "sidelining the OBR" by cutting its assessments of fiscal rules from twice a year to just once.

He indicated that a Conservative government would explore reforms to the institution, including "innovative approaches" not yet tried in the UK.

"There will be some aspects that might benefit from reform," Stride is expected to say. "For example, is the economic modeling sufficiently flexible to capture the dynamic impacts of policy. We will look carefully at the way in which the OBR works."

Germany is spearheading a diplomatic effort to resolve rising tensions with the United States over Greenland, proposing a new NATO mission to address security in the Arctic. The move aims to de-escalate a dispute sparked by U.S. President Donald Trump's repeated threats to take control of the vast island.

German Foreign Minister Johann Wadephul expressed optimism about reaching a compromise following a meeting with U.S. Secretary of State Marco Rubio in Washington on Monday. Wadephul voiced hope that the U.S. would participate in the proposed NATO mission, which is intended to bolster Greenland's security.

"NATO is currently starting to work on concrete plans which will be discussed with our US partners," Wadephul told reporters. "There's the readiness to do this on all sides within the NATO framework. Germany will also try to contribute to this."

The U.S. State Department has not issued an official statement on the proposal, leaving Washington's reaction to the German initiative unclear. The plan focuses on Arctic security and is designed to mend relations with the U.S. over the strategic territory, which belongs to NATO member Denmark.

The diplomatic friction follows President Trump's inflammatory comments about taking over the island, including by military force, which has angered European leaders. While his administration has explored business deals to increase the U.S. footprint in Greenland, Trump has publicly justified a takeover by pointing to the growing military presence of Russia and China in the Arctic region.

On Sunday, the president reaffirmed his position, telling reporters aboard Air Force One, "If we don't take Greenland, Russia or China will take Greenland and I'm not going to let that happen." He insisted the U.S. will get the island "one way or another."

The controversy has become a significant stress point for the NATO alliance. Danish Prime Minister Mette Frederiksen warned that a U.S. move on Greenland would destroy the transatlantic partnership, prompting fresh criticism from Trump toward other NATO members.

The issue is now being formally addressed within the alliance. "We are indeed discussing Greenland within NATO," German Chancellor Friedrich Merz confirmed during a visit to India. "We share the American concerns that this part of Denmark needs to be better protected."

Further diplomatic talks are scheduled. Danish Foreign Minister Lars Lokke Rasmussen and his Greenlandic counterpart, Vivian Motzfeldt, are set to meet with Secretary Rubio on Wednesday.

Following his meeting in Washington, Wadephul's diplomatic tour continued to New York for a scheduled meeting with United Nations Secretary-General Antonio Guterres. During his discussion with Rubio, Wadephul also addressed the ongoing negotiations between the U.S., Europe, and Ukraine regarding an agreement to end Russia's war of aggression, stating Germany's willingness to support a military mission as part of a security guarantee.

New Zealand's business confidence surged in the fourth quarter, reaching its highest point since March 2014 as lower interest rates begin to stimulate the economy.

A quarterly survey from the New Zealand Institute of Economic Research (NZIER) revealed that a net 48% of firms expect general business conditions to improve. This marks a significant jump in optimism from the 18% recorded in the previous quarter.

According to NZIER Principal Economist Christina Leung, the data indicates that the central bank's interest rate cuts are finally having their intended effect, helping the nation's economic recovery gain momentum.

The dramatic improvement in sentiment was not isolated to one area. "The lift in sentiment was widespread across all sectors and regions," Leung stated.

Key metrics from the survey underscore this growing optimism:

• Seasonally Adjusted Confidence: On an adjusted basis, a net 39% of businesses anticipated better conditions, up from 17% in the prior period.

• Capacity Utilization: The measure of capacity utilization also increased, rising to 89.8% from 89.1%.

This data follows a period of economic sluggishness, where New Zealand's economy contracted in three of the last six quarters before returning to growth in the third quarter. Economists and policymakers now broadly forecast that economic growth will accelerate over the next year.

Despite the strong rebound in activity and confidence, the NZIER survey suggests that inflation pressures remain contained for now.

However, the report also points to emerging challenges. Leung noted that labor shortages are beginning to appear in specific parts of the economy, including the services, manufacturing, and building sectors.

The combination of recovering demand and contained inflation has direct implications for the Reserve Bank of New Zealand. To support the flagging economy, the central bank has cut its official cash rate (OCR) by 275 basis points since August 2024.

A more buoyant economy reduces the need for further stimulus and could prompt the central bank to raise the cash rate earlier than its current forecasts suggest.

Reflecting this outlook, NZIER projects that the monetary policy cycle has reached its turning point.

"With demand starting to recover but inflation remaining contained, we expect no further OCR cuts," Leung said. "We forecast the OCR to trough at 2.25% until the Reserve Bank of New Zealand commences increasing the OCR in the second half of 2026."

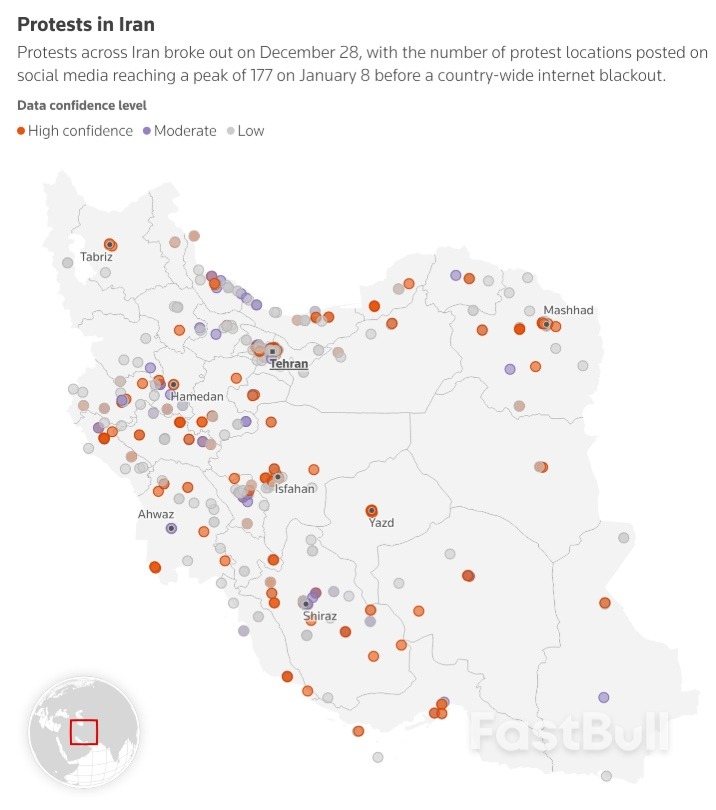

Iran's Islamic Republic is facing a historic internal crisis. After a year of major setbacks to its regional power, the regime is now battling a wave of anti-government demonstrations that have swept the country since late December 2025. Sparked by a catastrophic currency collapse, the protests have morphed into a revolutionary movement.

Across Iran, thousands have taken to the streets, defying a brutal state crackdown to denounce the country's leadership, destroy symbols of the regime, and attack its infrastructure. A battle for Iran's future is underway, and while the odds are steep for the protesters, the government's grip on power appears more fragile than ever.

Tehran's response to the uprising has been severe. The government has imposed an internet blackout, issued defiant rhetoric, and unleashed a bloody assault on demonstrators. Yet, the protests continue.

The regime holds a significant advantage with its vast surveillance and security apparatus, driven by an existential will to survive. Credible reports indicate that while the country was cut off from the world, more than 10,000 people were detained and 6,000 were killed, with the true figures likely much higher.

As the crisis intensified, U.S. President Donald Trump pledged on social media to intervene on behalf of the Iranian people, stating that Washington was "locked and loaded" to "rescue" them. While the administration is weighing its options, direct military action carries substantial risks with little guarantee of providing immediate relief to Iran's population.

However, inaction is not the only alternative. A more effective strategy would involve a global effort to isolate the Islamic Republic and provide meaningful support to the revolution. Key actions should include:

• Efforts to restore internet access for the Iranian people.

• Tighter sanctions to pressure the regime.

• The closure of Iranian embassies and expulsion of its officials.

• Building capacity for human rights documentation and opposition training.

Even if the regime temporarily quells the protests through mass violence, its long-term stability is in serious doubt. Iran's leadership has no viable solution for the economic hardships that have repeatedly fueled unrest, nor can it reclaim its once-dominant position in the region.

Internally, the regime is already on the verge of a precarious leadership transition. Supreme Leader Ayatollah Ali Khamenei is 86 years old and receding from public life. A clear successor is absent, a problem compounded by the unexpected death of President Ebrahim Raisi in a May 2024 helicopter crash and the aging of the original revolutionary generation.

After four decades of building an expansive network across the Middle East, Tehran has recently suffered immense setbacks. Its proxy militias are a shadow of their former strength, and its transnational reach was severely disrupted by the fall of Bashar al-Assad's regime in Syria. Furthermore, repeated Israeli and American attacks have decimated Iran's nuclear program and air defenses.

At home, years of unrest have steadily eroded the regime's authority. Each protest movement has deepened popular resistance, making it harder for the government to impose its will. The most visible sign of this is the widespread public defiance of compulsory hijab laws, a direct legacy of the 2022-2023 "Women, Life, Freedom" movement that followed the death of Mahsa Amini.

The current crisis is the culmination of years of systemic decay. For a long time, the regime's playbook for survival seemed effective, but its inability to reform has made a fundamental transformation necessary. The trajectory has pointed not toward a sudden collapse but toward a slow, steady deterioration of the state's control over its economy, politics, and society.

This long-brewing instability has shifted the political imagination of the Iranian people. They are no longer just asking who will be the next leader within the existing system; they are beginning to question what will replace the system itself.

The prospect of meaningful change in Iran has often swung between the unthinkable and the inevitable. Today, the pendulum is swinging decisively toward change. The Iranian people have launched their revolution. With a concerted, American-led effort to apply unprecedented pressure on the regime while supporting the opposition, they can succeed.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up