Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The OPEC+ producer group is expected to accelerate supply hikes later this year, possibly leading to a surplus in the fourth quarter that could place some downward pressure on oil prices, according to analysts at HSBC.

The OPEC+ producer group is expected to accelerate supply hikes later this year, possibly leading to a surplus in the fourth quarter that could place some downward pressure on oil prices, according to analysts at HSBC.

Since April, the Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, has either made or announced output upticks totalling some 1.37 million barrels per day, or 62% of the 2.2 million of the total amount of supply it plans to put back into the market.

Strategists have suggested that these countries, which include producers like Saudi Arabia and Russia, are attempting to recapture some market share during a time of broader economic uncertainty stemming from global trade tensions and an ongoing transition to greener fuel sources.

At its May meeting, OPEC+ confirmed that it will raise its quota by 411,000 bpd for July, roughly equivalent to three monthly output increases and the same as May and June, the HSBC analysts said in a note to clients on Friday.

Meanwhile, recent data from the Energy Information Administration showed that global crude production is tipped to expand by 840,000 barrels per day this year and by 680,000 bpd in 2026.

Against this backdrop, the HSBC analysts led by Kim Fustier predicted that OPEC+ will pump up supply by 411,000 and 274,000 bpd in August and September, respectively -- a move the brokerage said would compress "five increases into two months".

Traditionally strong demand in the summer travel season is expected to absorb the impact of the OPEC+ output increases, the HSBC analysts said. But they flagged that the hikes "should tip the market into a bigger fourth quarter surplus than previously forecasted".

"Deteriorating fundamentals after summer raise downside risks to oil prices and our $65 per barrel assumption from fourth quarter onwards," the analysts added.

On Friday, oil prices were choppy as traders eyed concerns over slowing growth and weakening demand, but were still on track for the first positive week in three amid growing expectations that global supplies will be tighter than initially expected this year.

At 06:43 ET, Brent futures rose 0.1% to $65.41 a barrel, and U.S. West Texas Intermediate crude futures increased by 0.1% to $63.41 per barrel.

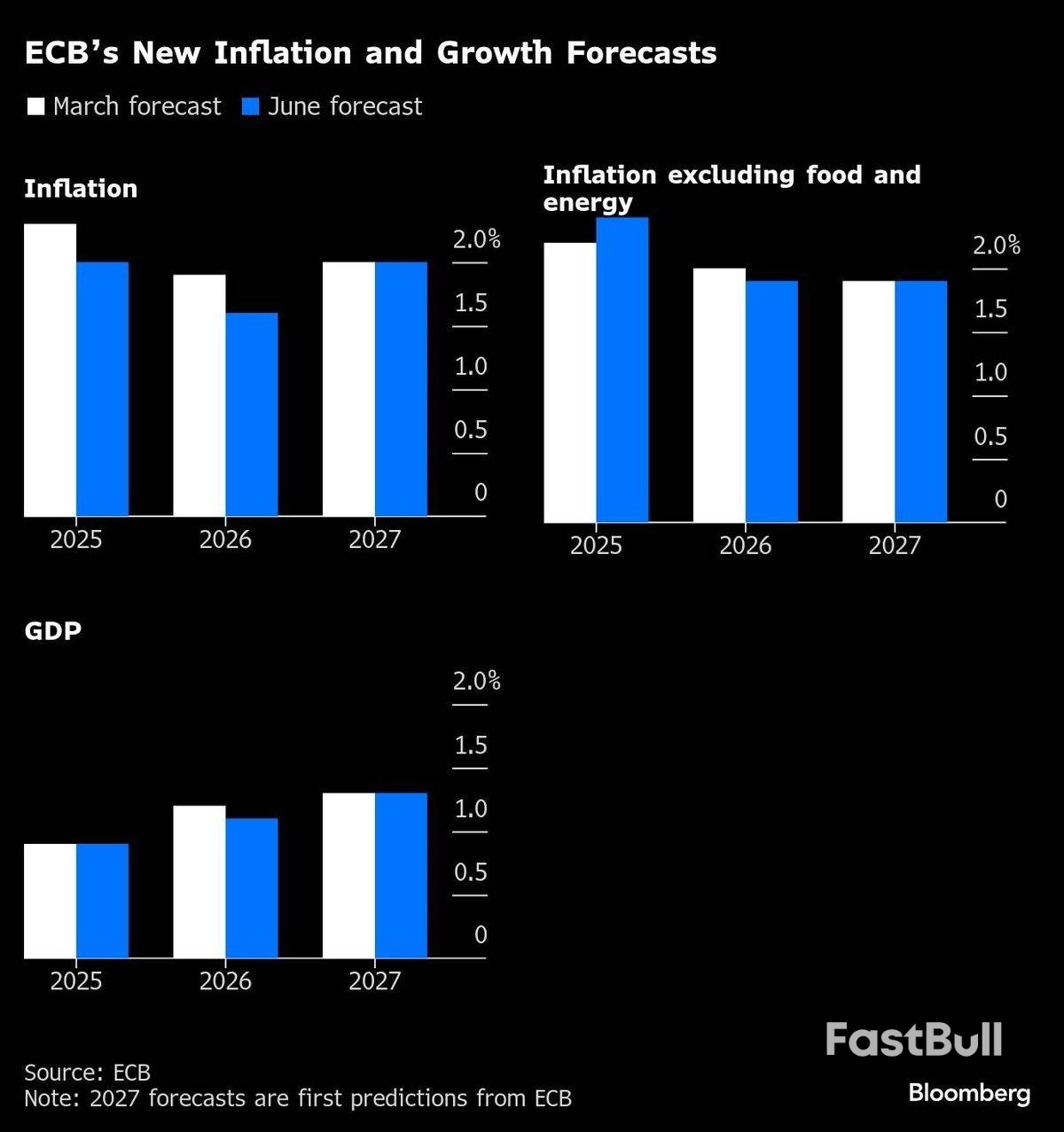

The European Central Bank (ECB) should take a break from lowering interest rates to give officials a chance to assess recent shocks, particularly from trade, according to Governing Council member Yannis Stournaras.

“Now the best thing is wait and see,” the Greek central bank chief told Bloomberg Television. “It’s nearly done but with such uncertainty worldwide you can never say it’s done.”

The comments echo President Christine Lagarde on Thursday after the ECB reduced its deposit rate for an eighth time, to 2%. That move left policymakers “in a good position to navigate the uncertain conditions that will be coming up”, she said.

Officials envisage a pause when they next set policy in July, with some possibly even seeing the campaign as finished, according to people familiar with the matter.

Stournaras said another decrease in borrowing costs would need the eurozone’s 20-nation economy to weaken beyond what’s currently envisaged, stranding inflation below the 2% target — a scenario he doesn’t see happening.

“The bar for another rate cut is high, in July and beyond,” he said in a separate Bloomberg interview in London. “It would need big downward surprises to cut again — so, much weaker growth or much stronger disinflation. But we keep all options open as uncertainty is high and there are many known and unknown unknowns.”

Inflation eased more than expected in May, to 1.9%. New ECB projections published on Thursday foresee prices rising by just 1.6% in 2026 before hitting 2% in 2027.

“I’m not worried about a temporary undershooting of inflation, and at the moment I don’t see a risk of ending up in a too-low inflation scenario as pre-pandemic,” Stournaras said. “If there’s a reversal in US tariff policy and a more careful fiscal policy in the US, the strength of the euro may quickly reverse.”

At the same time, the economy has proved resilient with a stronger-than-anticipated performance at the start of the year that was revised higher still on Friday, to a quarterly advance of 0.6%. It’s yet to feel the full force of US tariffs, however. The ECB expects expansion of 0.9% this year and 1.1% next.

“If the economy continues as we have forecast, I think we’ll stay at 2%,” Stournaras said. “If the economy weakens, we might go below. If the economy strengths, we might change course.”

He advocated a “smooth, steady-hand policy,” without cutting rates too much and too fast, only to have to raise them quickly later.

Stournaras said views among the Governing Council aren’t too far apart, with this week’s decision almost unanimous.

“The difference between what you’d call dovish and hawkish is not that big,” he said. “We have converged.”

The season’s rising mercury now brings a familiar pattern: Europe and Asia step up their competition to secure cargoes of liquefied natural gas.

So far this year, despite a bigger need to fill depleted inventories and forecasts for scorching weather, Europe appears to be winning the supply it needs. Prices, while still higher than last year, have been trading in a narrow range for a month now.

With Russian gas largely lost, Europe needs about €7 billion ($8 billion) of additional LNG imports from April to October, according to Bloomberg Intelligence. Currently, shipments to the continent are higher than usual for this time of year, ship-tracking data compiled by Bloomberg show.

By contrast, China’s imports have been sluggish over four consecutive months, primarily because of weaker economic activity, tariff tensions with the US and rising domestic alternatives.

In addition, two tankers bound for India this month diverted to Europe mid-journey because of ample inventories and cooler-than-expected weather in the south Asian nation.

“Asia Pacific LNG demand is shaping up to be muted,” Aldo Spanjer, head of energy strategy at BNP Paribas SA, said in a note this week. “Europe will be able to attract enough LNG this summer to start Winter-25 with a relatively comfortable stock level.”

Imports by northwest Europe and Italy could be roughly one-third higher than last year, which would translate to continued healthy injections into storage, according to BloombergNEF.

Strong power generation from renewables will help cushion the stress from growing demand, while global supplies of the super-chilled fuel will top up when Shell Plc’s LNG Canada project starts exporting as soon as late June.

So far, so good for Europe, but competition could get worse in July and August, the hottest months in the Northern Hemisphere. Gas-hungry Egypt is about to demonstrate greater appetite for LNG in the coming weeks.

That means some cargoes initially meant for Europe may be diverted, potentially leading to higher prices and slower stockpiling.

Where does a giant refinery in Nigeria, Africa’s largest oil producer, go to source the raw materials it needs to make fuels for 228 million people? Try crude fields around Midland in West Texas, about 6,500 miles away. This year, the Dangote refinery bought a third of its crude from the US, mostly West Texas Intermediate-Midland, ship tracking compiled by Bloomberg shows. The proportion has been almost double what it was last year.

The London Metal Exchange has compelled Mercuria Energy Group Ltd. to lend out its huge position in aluminum to other traders to reduce risks to the market, according to people familiar with the matter.

The US is using its dominance of a niche petroleum gas — ethane — as a bargaining chip in its trade war with China.

Nippon Steel Corp. and United States Steel Corp. are on pace to finalize their $14.1 billion combination with Trump administration before a June 18 deadline, according to people familiar with the matter.

Silver extended gains to 13-year highs while platinum reached its highest level since early 2022, signaling growing investor appetite for the precious metals used in key industries.

Stonepeak Partners is in exclusive talks for a buyout of Yinson Holdings Bhd. that may value the Malaysian energy infrastructure company at as much as 9 billion ringgit ($2.1 billion), according to people with knowledge of the matter.

Industrial decarbonization initiatives are the latest to take a hit in the US as the Trump administration rolls back climate-related funding. The cement and chemicals industries were the largest beneficiaries of the $6 billion allocated last year by the Department of Energy’s Industrial Demonstrations Program. These sectors have now seen the largest cuts, with the government withdrawing about 90% of the grants, according to BNEF.

A warming planet, complex geopolitics and fierce competition are putting companies’ operations under increasing scrutiny. The Bloomberg Sustainable Business Summit returns to London on June 26 to explore ways to bolster resilience and mitigate risk.

JPMorgan Chase (JPM -0.99%) is a sprawling financial services titan. This mega-bank has produced a total return of 208% in the past five years. It's difficult for anyone to complain about that type of gain.

As of this writing, shares of JPMorgan Chase trade just 5% off of their all-time high. Investors might have their eyes on the business if they're looking to gain more exposure to the industry in their portfolio, but where will this top bank stock be in five years?

JPMorgan's impressive stock performance in the past five years has been driven, unsurprisingly, by strong financial gains. In 2024, the company reported revenue of $178 billion, which was 54% higher than in 2019. What's more, diluted earnings per share soared 84% during that time.

The momentum has continued into 2025, despite recent economic challenges. In Q1, total deposits were up 2% year over year, providing low-cost funding to power loan growth. Net interest income rose 1%, with non-interest income jumping 17%.

This doesn't mean there aren't risks to be mindful of. Since banks in general are so exposed to the economy and credit cycle, a potential cause for concern is the chance of a recession happening. Even CEO Jamie Dimon isn't exactly the most optimistic. On the Q1 2025 earnings call, he agreed with JPMorgan's chief U.S. economist, putting the chance of a recession at 50-50.

As of March 31, JPMorgan Chase had a whopping $2.5 trillion in total assets on the balance sheet. What's more, it carries a massive market cap of $736 billion. And in the last 12 months, it raked in $181 billion in net revenue. This is a truly colossal organization.

This business is the clear leader in the financial services sector, with its hands in numerous different areas. Not only does JPMorgan have a significant presence in capital markets and investment banking activities, but it's also a strong player in asset and wealth management, as well as in consumer banking. This diversity presents a favorable setup. Weakness in one area can be more than offset by robustness in another.

Investors can rest assured knowing that this company won't be disrupted anytime soon, if ever. It has built up durable competitive advantages that support its staying power.

There are cost advantages that stem from the company's huge scale. It's able to leverage expenses and investments in many areas, such as technology and marketing efforts.

Then there are switching costs, both for corporate customers and individual consumers. Because JPMorgan Chase can essentially offer any financial product or service its customers need, the more ingrained it becomes, the harder it is for customers to leave.

It also helps to have industry veteran Jamie Dimon at the helm, who many agree is one of the best CEOs. He successfully navigated the Great Recession, making JPMorgan an even better bank.

The stock has done remarkably well in the past. And given the factors just mentioned, investors are probably wondering why they don't own JPMorgan Chase.

Despite a positive view of the company, I don't believe future returns will resemble the past. The main reason why comes down to valuation. Shares trade at a steep price-to-earnings ratio of 13, which is above the trailing five- and 10-year averages.

Investors familiar with the banking industry might be more inclined to look at the price-to-book ratio. As of this writing, this metric stands at 2.2, near the highest it has been in the past 20 years. Consequently, I wouldn't be surprised if this stock lags the broader market between now and 2030.

Britain's financial regulator is to remove a ban on consumers buying crypto exchange-traded notes (ETNs), ditching its previous position of wanting to keep them out of the hands of retail investors.

The Financial Conduct Authority said on Friday that allowing retail investors to buy ETNs would support growth and competitiveness, in the latest sign that the UK is shifting its approach to crypto as the government seeks to grow the economy and support a digital assets industry.

Last year the FCA had approved the launch of crypto ETNs for professional traders but banned retail investors from access, calling the products "ill-suited" because of "the harm they pose".

"We want to rebalance our approach to risk and lifting the ban would allow people to make the choice on whether such a high-risk investment is right for them given they could lose all their money," David Geale, executive director of payments and digital assets at the FCA, said in a statement on Friday. The proposal will now go out for consultation.

Britain in April published draft laws for bringing cryptocurrencies under compulsory regulation for the first time, aligning it with the United States' approach, rather than the European Union, which has built rules tailored to the industry.

To be sold to individual consumers, the ETNs will need to be traded on an FCA-approved investment exchange, the regulator said.

A ban on retail investors trading cryptoasset derivatives would remain, the watchdog added.

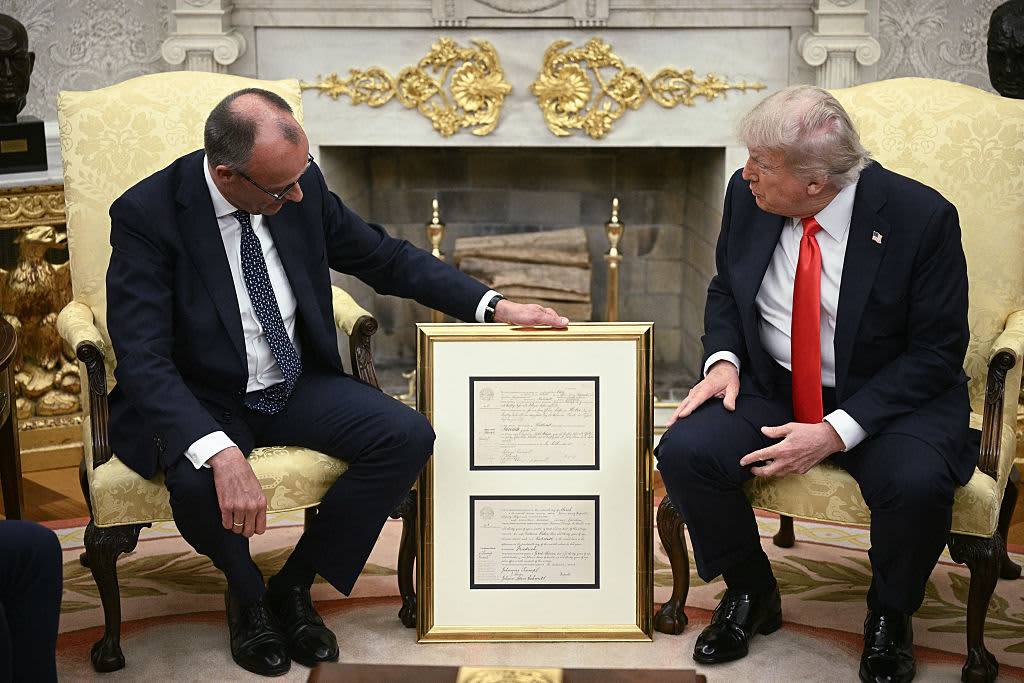

German Chancellor Friedrich Merz's meeting with U.S. President Donald Trump was dramatically overshadowed by the U.S. leader's spat with Elon Musk. But it was still seen as a win for Merz.

"Being sidelined is not necessarily always a bad thing," Carsten Brzeski, global head of macro at ING, told CNBC on Friday. "In fact, it might have even helped Merz as the Musk distraction was also deviating attention away from more controversial topics.

It was a high-stakes trip for Merz, who is just a few weeks into his chancellorship, especially given the treatment other leaders have gotten from Trump in the Oval Office in recent months.

As such, Merz is unlikely to be disappointed about the outcome — especially given the potential downsides.

"Having avoided an escalation in the Oval Office is already an achievement these days," Brzeski added.

Merz arrived in D.C. with a full agenda that ranged from strengthening relations between the U.S. and Germany, to tariffs — which could significantly impact key German industries — as well as U.S. support for Ukraine in its war with Russia and higher NATO defense spending.

While we don't know what was discussed behind closed doors, Merz was seemingly able to address most of these points with Trump, political strategist Julius van de Laar told CNBC's "Squawk Box Europe" on Friday.

"I think what Friedrich Merz got across is that he hopes that the U.S. president will continue to support Ukraine," he said, noting that the issue had gathered momentum recently given several significant attacks. Merz was able to pick up on this, and draw links to the anniversary of D-Day a day after their meeting.

"And he said the United States played a great role in ... freeing Europe from the Nazi regime back then, and so he's hoping that Donald Trump will ... say we're going to get engaged again and help Europe become free of dictatorship," van de Laar said.

Merz making this point was important in the context of highlighting the U.S-German relationship, according to Jackson Janes, senior resident fellow at the German Marshall Fund. Speaking to CNBC's "Squawk Box Europe," he also pointed out that Trump was gifted his grandfather's birth certificate by Merz, "making the point 'you have a relationship with Germany in your own family.'"

German Chancellor Friedrich Merz presents US President Donald Trump with what Merz said was the birth certificate of Trump's grandfather, who was born in 1869, during a bilateral meeting in the Oval Office of the White House in Washington, DC, on June 5, 2025.

Janes also noted that Merz highlighting Germany's plans for higher defense spending would have marked a positive note in the discussion.

Germany recently changed its fiscal rules to allow for higher defense spending, and Merz's government seems to be making it a priority. The chancellor has promised a financial push to boost the German military, and the country's foreign minister has suggested support for Trump's proposal that NATO members spend 5% of their gross domestic product on defense.

Meanwhile, the sensitive topic of Germany's far-right party, the Alternative fuer Deutschland, was seemingly avoided. Officials in the Trump administration have in recent weeks come out in support of the party after German intelligence services classified it as a "proven right-wing extremist organization."

This led to clapbacks from German politicians, with Merz himself warning the U.S. not to get involved. The classification of the AfD is currently on hold amid a legal challenge.

All in all, Merz's visit to D.C. was seen as "a home run or a hole in one," van de Laar said.

ING's Brzeski also suggested that the trip laid good foundations between the leaders. "There seems to be some common grounds between Trump and Merz, which could be the seeds for a more constructive relationship," he said.

Merz even appeared to get some compliments from Trump, with the president commending him for his English skills and saying that while "difficult," the German leader was a "very good man to deal with."

Following the meeting, Merz appeared satisfied, saying in a social media post that the atmosphere was "really good," and that the two have much in common. "I am coming back with the feeling that we can speak on the phone any time," he said, according to a CNBC translation.

But even an in-person reunion might not be too far off: a Trump trip to Berlin is already being planned, Merz told German media.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up