Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)A:--

F: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)A:--

F: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)A:--

F: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)A:--

F: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)A:--

F: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)A:--

F: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)A:--

F: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)A:--

F: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)A:--

F: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)A:--

F: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)A:--

F: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

Japan PPI MoM (Dec)

Japan PPI MoM (Dec)--

F: --

P: --

Australia Consumer Inflation Expectations (Jan)

Australia Consumer Inflation Expectations (Jan)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Dec)

U.K. 3-Month RICS House Price Balance (Dec)--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest Rate--

F: --

P: --

Saudi Arabia CPI YoY (Dec)

Saudi Arabia CPI YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Nov)

U.K. Services Index MoM (SA) (Nov)--

F: --

P: --

U.K. Services Index YoY (Nov)

U.K. Services Index YoY (Nov)--

F: --

P: --

U.K. Manufacturing Output MoM (Nov)

U.K. Manufacturing Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance (Nov)

U.K. Trade Balance (Nov)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Nov)

U.K. Monthly GDP 3M/3M Change (Nov)--

F: --

P: --

U.K. GDP MoM (Nov)

U.K. GDP MoM (Nov)--

F: --

P: --

U.K. Industrial Output MoM (Nov)

U.K. Industrial Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Nov)

U.K. Trade Balance Non-EU (SA) (Nov)--

F: --

P: --

U.K. Trade Balance (SA) (Nov)

U.K. Trade Balance (SA) (Nov)--

F: --

P: --

U.K. Manufacturing Output YoY (Nov)

U.K. Manufacturing Output YoY (Nov)--

F: --

P: --

U.K. Construction Output MoM (SA) (Nov)

U.K. Construction Output MoM (SA) (Nov)--

F: --

P: --

U.K. Industrial Output YoY (Nov)

U.K. Industrial Output YoY (Nov)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output YoY (Nov)

U.K. Construction Output YoY (Nov)--

F: --

P: --

U.K. GDP YoY (SA) (Nov)

U.K. GDP YoY (SA) (Nov)--

F: --

P: --

U.K. Trade Balance EU (SA) (Nov)

U.K. Trade Balance EU (SA) (Nov)--

F: --

P: --

France HICP Final MoM (Dec)

France HICP Final MoM (Dec)--

F: --

P: --

Germany Annual GDP Growth

Germany Annual GDP Growth--

F: --

Italy Industrial Output YoY (SA) (Nov)

Italy Industrial Output YoY (SA) (Nov)--

F: --

P: --

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Germany's Klingbeil warns Europe must assert economic power, fearing "pawn" status as the transatlantic alliance dissolves.

German Finance Minister Lars Klingbeil has issued a stark warning: Europe must adopt a more assertive economic posture or risk becoming a "pawn of the major powers" in a turbulent global landscape.

Speaking at a DIW Institute event in Berlin, Klingbeil argued that the foundational U.S.-led transatlantic alliance, which has long underpinned European prosperity, is fundamentally breaking apart. He noted that the increasing use of trade policy as a weapon is placing an "extreme burden" on Germany's export-dependent economy.

Klingbeil, a co-leader of the Social Democrats and deputy to Chancellor Friedrich Merz, emphasized that Europe can no longer afford to be "naive and blind" about its relationship with the United States. His conviction was strengthened during a recent visit to Washington.

"I believe... that the transatlantic alliance is undergoing a far more profound transformation than we have been willing to admit," he stated. "The transatlantic relationship as we have known it is dissolving."

While he described a recent dinner conversation with U.S. Treasury Secretary Scott Bessent as positive, the overall message was one of urgent realism. To navigate this "new world," Klingbeil insisted the EU "must not shy away from tougher, more far-reaching measures where we are under pressure."

Klingbeil pointed to existing EU levies on Chinese-made vehicles and steel as examples of the necessary assertiveness Europe must embrace. He stressed that international competitors are actively undermining the continent's economic strength.

"Our competition is not sleeping; it is deliberately attacking our competitiveness," he said. "And that is why I say: We must assert ourselves more strongly than before."

This strategic reevaluation has become a top priority for the ruling coalition of Merz's conservatives and Klingbeil's SPD, which came to office in May. The government has been forced to reassess its ties with major trading partners, including the U.S. and China, as they adopt increasingly protectionist policies.

The urgency of this geopolitical shift is underscored by Germany's own economic challenges. The federal statistics office is set to release its first estimate for 2025 GDP, with economists forecasting meager annual growth of just 0.2%.

This would mark the first expansion since 2022, following two years of contraction. GDP is projected to grow by approximately 1% this year, as government stimulus measures begin to take hold.

To counter the slowdown, Klingbeil highlighted his government's aggressive domestic strategy. "We have launched the largest investment offensive in our country's history," he explained. "With €500 billion for infrastructure and at least as much again for defense, we're providing a strong government stimulus."

These efforts, which also include a package of corporate tax incentives, are part of the government's push to revive Europe's largest economy amid unprecedented global challenges.

A change in leadership could unlock a dramatic resurgence in Venezuela's oil industry, with a new forecast predicting crude output could surge by roughly 50% over the next decade. According to industry consultant Enverus, this would mark a significant return for the Caribbean nation, home to some of the world's largest crude reserves, to the global energy market.

Enverus, one of the oil industry's premier forecasting firms, projects that production could reach approximately 1.5 million barrels a day by 2035. This analysis is among the first to model a post-Maduro oil landscape for Venezuela.

The potential for growth is substantial. If political stability and investment conditions improve, Enverus outlines a high-case scenario where Venezuela's total output could climb to 3 million barrels a day by 2035.

A comeback of this scale faces significant hurdles. Venezuela's recent output has fluctuated near 1 million barrels per day, far below its 1970s peak of almost 4 million barrels. Reviving the industry would require companies to rebuild or replace abandoned rigs, repair leaky pipelines, and restore fire-ravaged equipment.

Beyond infrastructure, oil executives are seeking clear legal frameworks, guarantees for their investments, and security for their employees before committing capital.

President Donald Trump has called on US oil companies to channel at least $100 billion into reviving Venezuela's energy sector. Following a White House meeting with nearly 20 industry representatives, it's clear that while the opportunity is recognized, major players are proceeding with caution.

Exxon Mobil Corp. Chief Executive Darren Woods told Trump that the South American country is currently "uninvestable," a sentiment that echoes warnings from other industry leaders. However, Woods also expressed confidence that the Trump administration could deliver the legal and regulatory reforms needed for any future investment.

For now, Exxon's arch-rival, Chevron Corp., remains the only major international oil company with active operations in Venezuela.

While producers deliberate, oil traders and US refiners are already positioning themselves for access to Venezuelan crude. Trump has said Venezuela will relinquish as much as 50 million barrels of its oil for the US to sell, and trading houses Trafigura Group and Vitol Group are preparing to move the crude. The sudden availability of 50 million barrels would represent one of the largest unexpected supply flows in years.

Short-Term Glut vs. Long-Term Deficit

Despite the potential influx, Enverus expects the added barrels will not greatly impact the price of Brent, the global crude benchmark. The market is already grappling with a forecast glut for this year, which is expected to transition into supply shortfalls later in the decade.

"Even with accelerated sanctions relief, we still see 1–2 million barrels per day of global oversupply in the first half of 2026 and limited incremental volumes from Venezuela," said Al Salazar, head of macro research at Enverus.

The long-term outlook is different. "Long-term global oil balances are projected to face a deficit of 2 million barrels per day by 2035, creating space for Venezuela's incremental supply without materially impacting prices," Enverus concluded.

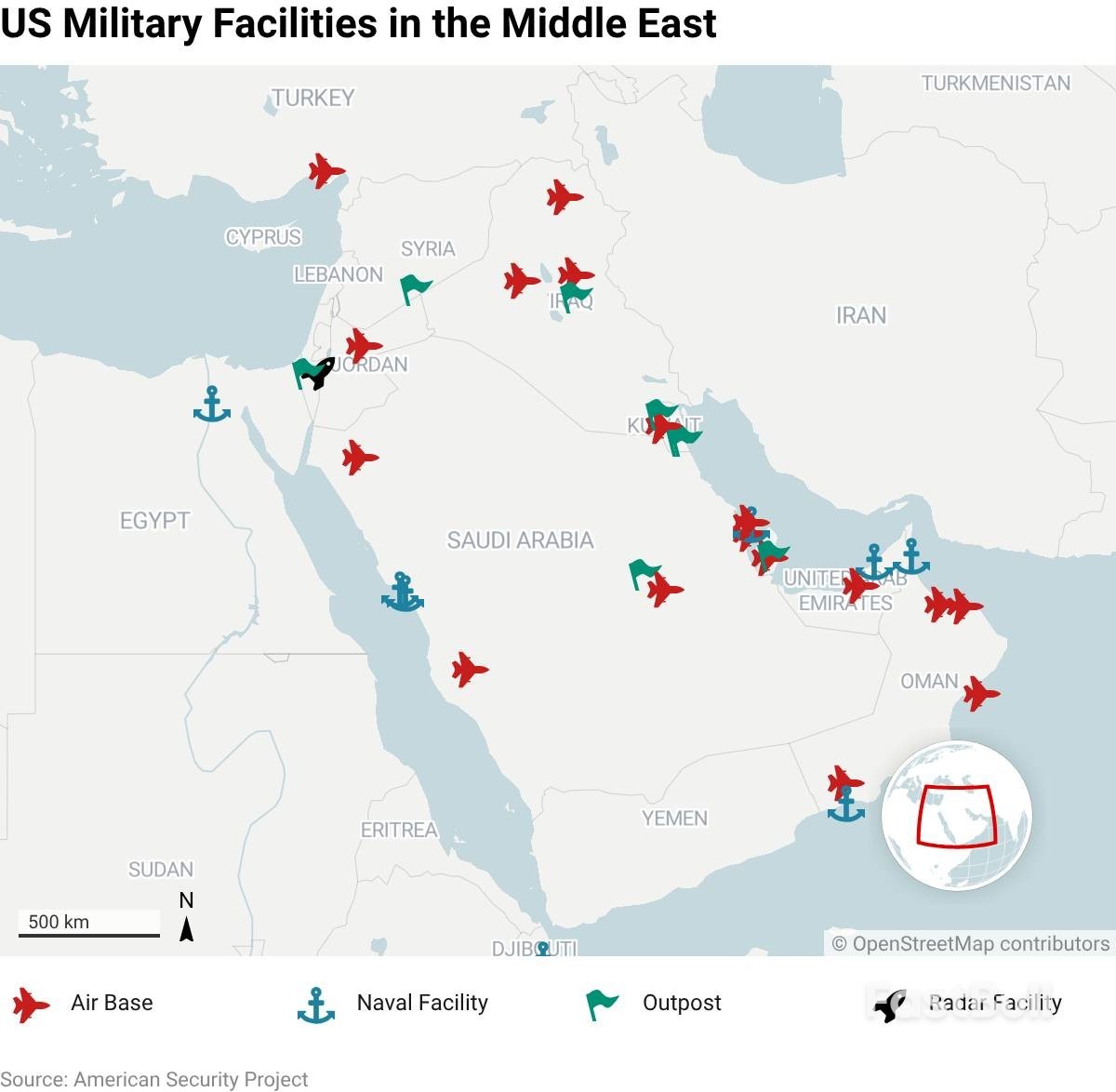

A U.S. official said Wednesday that the United States is withdrawing some personnel from bases in the Middle East. This comes after a senior Iranian official said that Tehran had warned its neighbors that Iran would also strike U.S. bases if Washington launches an attack.

Iran’s leadership is struggling to quell the worst domestic unrest in the history of the Islamic Republic, as Tehran tries to block repeated threats from US President Donald Trump to intervene on behalf of anti-government protesters.

An unnamed U.S. official said that, out of caution, the U.S. is withdrawing some personnel from key bases in the region, given the escalating tensions.

Three diplomats said some personnel have been advised to leave the region’s main U.S. air base in Qatar, although there are no immediate signs of a large-scale troop evacuation, as happened hours before last year’s Iranian missile attack.

Trump has repeatedly threatened to intervene in the situation in Iran in support of protesters. In Iran, authorities have reportedly cracked down on protests against clerical rule, resulting in thousands of deaths.

Iran and its Western adversaries have described the unrest as the most violent since the 1979 Islamic Revolution. The unrest, which began two weeks ago as demonstrations protesting dire economic conditions, has escalated rapidly in recent days. The Islamic Revolution established a theocratic regime in Iran.

An Iranian official said the death toll had exceeded 2,000, while a human rights organization said it had surpassed 2,600.

Iranian Armed Forces Chief of Staff Abdulrahim Mousavi said on Wednesday that Iran "has never faced such massive destruction," blaming it on foreign enemies. French Foreign Minister Jean-Noël Barrow called it "the most brutal repression in contemporary Iranian history."

An Israeli official said that, according to Israeli assessments, Trump has decided to intervene, but the scope and timing of the intervention remain unclear.

The three diplomats told Reuters that some personnel had been told to leave the U.S. Al Udeid Air Base in Qatar by Wednesday night.

One diplomat described the move as a “posture change” rather than an “ordered withdrawal.” There was no indication that troops were being moved to nearby football fields and shopping malls as they had last June, hours before Iran launched missiles at the base in retaliation for a U.S. airstrike.

The U.S. Embassy in Doha has not yet commented on the matter, and the Qatari Ministry of Foreign Affairs did not immediately respond to requests for comment.

Iranian authorities accused the United States and Israel of instigating the unrest, claiming it was carried out by what Iran calls terrorists.

Map of US military facilities in the Middle East.

Map of US military facilities in the Middle East.Trump has been publicly threatening to intervene in Iran for days, but has yet to provide any specific details.

On Tuesday, in an interview with CBS News, Trump vowed that the United States would take "very strong action" if Iran executed protesters. He also urged the Iranian people to continue their protests and take over government institutions, declaring that "aid is coming."

A senior Iranian official, speaking on condition of anonymity, said that Tehran has asked U.S. allies in the region to stop Washington from attacking Iran.

The official stated, "Tehran has told regional countries, including Saudi Arabia, the UAE, and Turkey, that if the United States launches an attack on Iran, U.S. bases in those countries will be attacked."

The official added that direct contact between Iranian Foreign Minister Abbas Araghchi and U.S. envoy Steve Witkov has been suspended.

The United States has deployed multiple forces in the region, including the forward headquarters of the Central Command in Al Udeid, Qatar, and the headquarters of the U.S. Fifth Fleet in Bahrain.

The flow of information within Iran has been hampered due to the internet outage.

HRANA, a U.S.-based human rights organization, says it has confirmed 2,403 deaths of protesters and 147 government-affiliated individuals to date, a number far exceeding the death tolls in previous waves of protests in 2022 and 2009 when authorities cracked down on them.

In June, Israel and the United States launched a 12-day airstrike against Iran, severely damaging the Iranian government's prestige. This followed setbacks for Iran's regional allies in Lebanon and Syria. European countries then initiated the process of restoring UN sanctions on Iran's nuclear program, exacerbating Iran's economic crisis.

A Western official said the massive unrest caught the authorities off guard during a vulnerable period, but the government does not appear to be facing imminent collapse, and its security agencies remain in control.

The authorities attempted to demonstrate that they still enjoyed public support. Iranian state television broadcast footage of massive funeral processions in Tehran, Isfahan, Bushehr, and other cities to mourn those who died in the riots. People waved flags and images of Supreme Leader Ayatollah Ali Khamenei and held up signs with anti-riot slogans.

President Masoud Pezeshkian is an elected figure whose power is subordinate to Khamenei. In a cabinet meeting, he stated that as long as the government has the support of the people, "all the enemies' attempts against the country will be futile."

Iranian state media reported that Ali Larijani, head of Iran's top security agency, spoke by phone with the Qatari foreign minister, while Araghchi spoke separately with his counterparts in the UAE and Turkey.

Aragh told UAE Foreign Minister Sheikh Abdullah bin Zayed that "the situation has calmed down" and that the Iranian people are determined to defend their national sovereignty and security from foreign interference.

During a visit to a Tehran prison holding arrested protesters, Iran's chief justice stated that swift trials and punishments of those who "behead or burn others" are crucial to ensuring such incidents do not recur.

According to the Human Rights Activists Association (HRANA), 18,137 people have been arrested so far.

The Iranian Kurdish human rights organization Hengaw reported that a 26-year-old man, Erfan Soltani, was arrested for participating in protests in Karaj and was scheduled to be executed on Wednesday. The organization stated on Wednesday that it could not yet confirm whether the sentence had been carried out.

In 2025, India's economy presented a picture of remarkable calm in a turbulent world. While other nations grappled with crisis management, India posted strong growth, kept inflation in check, and maintained robust foreign exchange reserves.

But this stability, achieved while avoiding a contraction, masks deeper structural issues. As the nation awaits the Union Budget for 2026-27, the focus is shifting from past performance to future direction. The key question now is whether the current economic model can deliver shared prosperity for all.

A closer look at the data reveals a complex reality. While real GDP growth hit 8.2% in the July-September quarter and consumer price inflation averaged a low 1.8% in July-August, this macroeconomic stability may have reached its limits.

India's economic recovery in 2025 was real, but it was also lopsided. Unlike previous growth cycles powered by broad-based investment, this one leaned heavily on two pillars: consumption and services.

• Private Consumption: Private Final Consumption Expenditure grew by about 7.0% in the first quarter of the fiscal year.

• Services Exports: Net receipts from services exports continued to climb, surpassing $50 billion.

This consumption-led model can produce impressive headline figures, but it fails to expand the economy's productive capacity at the same rate. Without a sustained private capital expenditure cycle, India risks operating below its long-term potential.

The Missing Piece: Private Investment Stays Sidelined

The most significant gap in India's growth story is the hesitation of private investment. Despite corporate profits reaching a 15-year high, a corresponding surge in capital expenditure has not materialized. While total investment announcements rose 39% to $355.45 billion in the first nine months of FY25, this has not been enough to shift the economy's reliance on consumption.

This persistent investment gap, occurring under nearly ideal macroeconomic conditions, points to a structural problem, not just a cyclical pause. When capital flows primarily into consumer credit instead of industrial capacity, the economy generates more debt than durable wages.

The Reserve Bank of India (RBI) has deployed its full arsenal to stimulate the economy. Retail inflation eased to a five-month low of 4.31% in January 2025, down from 5.22% in December 2024, largely due to moderating food prices.

In response, the RBI initiated decisive easing measures, injecting $33.3 trillion of liquidity through open market operations and forex swaps. Yet, the impact on the real economy has been muted.

Credit growth hovered around 11-12%, but the bulk of this lending flowed into retail loans rather than long-term productive investments. This disconnect reveals a critical insight: the primary constraint on India's growth is no longer monetary.

On the surface, India's external accounts appear stable. The current account deficit for FY25 was contained at approximately 0.6% of GDP, with the January-March quarter even recording a surplus of over 1%. Strong services exports and remittances, which brought in over $80 billion quarterly, consistently offset the country's large merchandise trade deficit.

However, the capital account tells a different story. In 2025, foreign institutional investors (FIIs) withdrew between $1.9 billion and $2.1 billion from Indian equities—the largest annual outflow on record. Consequently, the rupee depreciated by over 5% against the dollar, breaching the 90-to-1 mark and becoming Asia's weakest major currency.

The RBI chose not to defend a specific exchange rate level, instead intervening only to smooth volatility. This strategy reflects an acceptance of the open-economy trilemma: with capital mobility and monetary easing, the exchange rate must absorb the pressure. The result was a managed depreciation that supported exports without causing market panic.

India's banking sector looks healthier than it has in a decade. Gross non-performing assets have fallen to around 2.6%, public sector banks posted quarterly profits exceeding $5.4 million, and capital adequacy ratios are well above regulatory minimums.

This apparent strength, however, is built on a foundation of risk aversion. Bank balance sheets are clean not because of efficient risk management but because they have avoided risk altogether. Public sector banks now hold government securities far exceeding statutory requirements, often close to 30% of their assets.

This creates a "sovereign-bank nexus," where the stability of the banking system is tied directly to the government's fiscal health. It also suppresses private credit creation and weakens monetary policy. Even after 125 basis points of policy rate cuts, lending rates adjusted slowly because banks, facing deposit shortages and credit-deposit ratios exceeding 80%, were forced to keep deposit rates high.

The upcoming budget must confront this macroeconomic tension. Government capital expenditure is nearing its fiscal limits, with the deficit targeted at 4.4%. Private investment has failed to step up as the primary engine of growth. The financial system is stable, but its stability is a function of avoiding risk rather than pricing it.

Transitioning from a $4 trillion to a $5 trillion economy will depend not on how well risks are contained, but on how effectively capital is deployed into productive sectors. The real test for the budget is whether it can unlock this shift. If it fails, 2025 will be remembered as the year India perfected macroeconomic management while postponing its development.

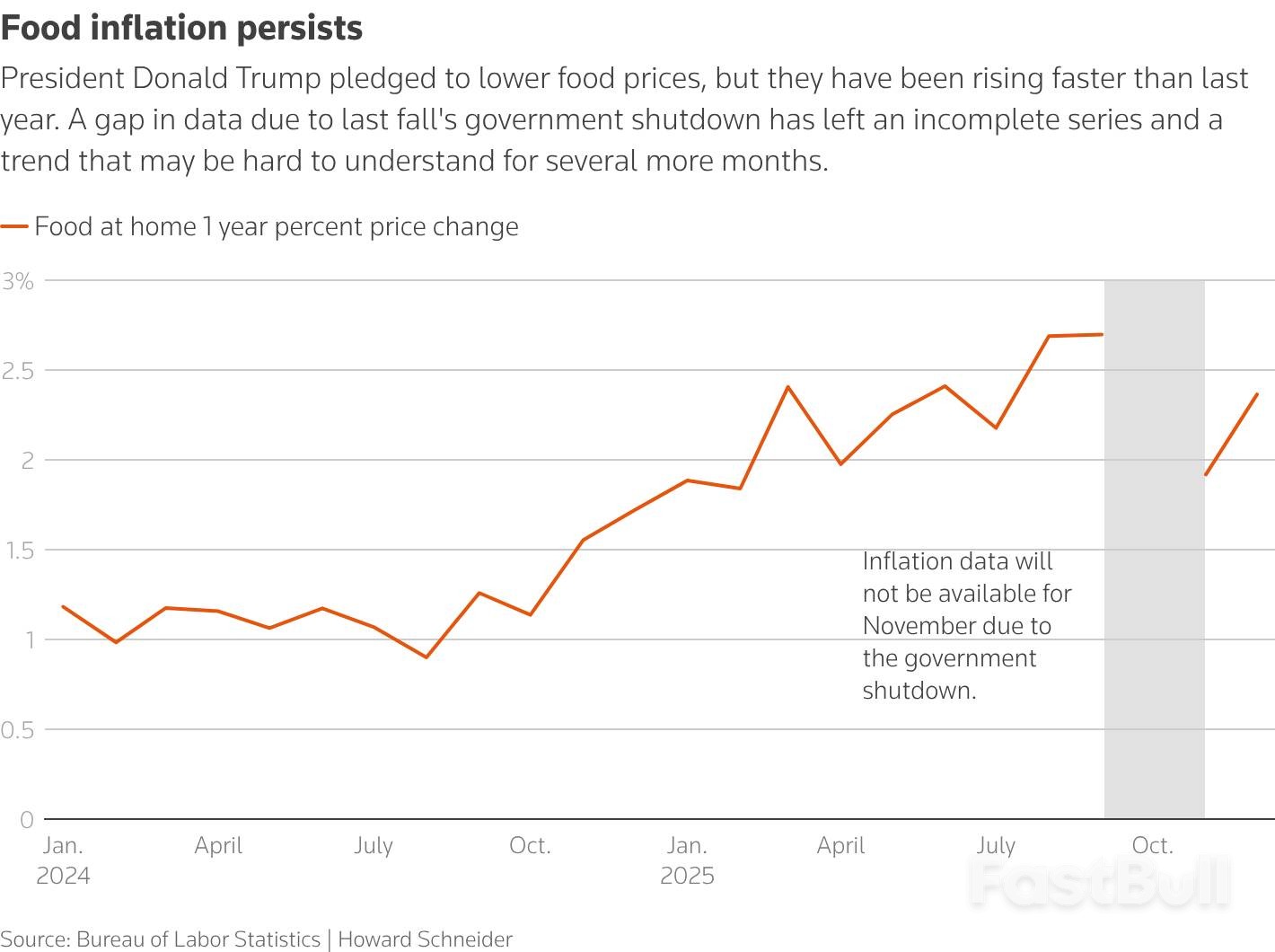

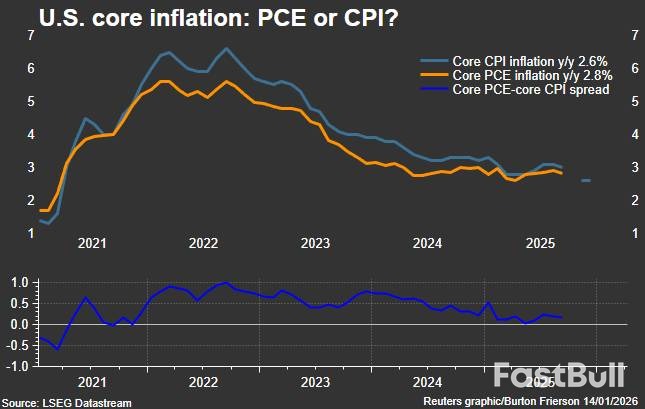

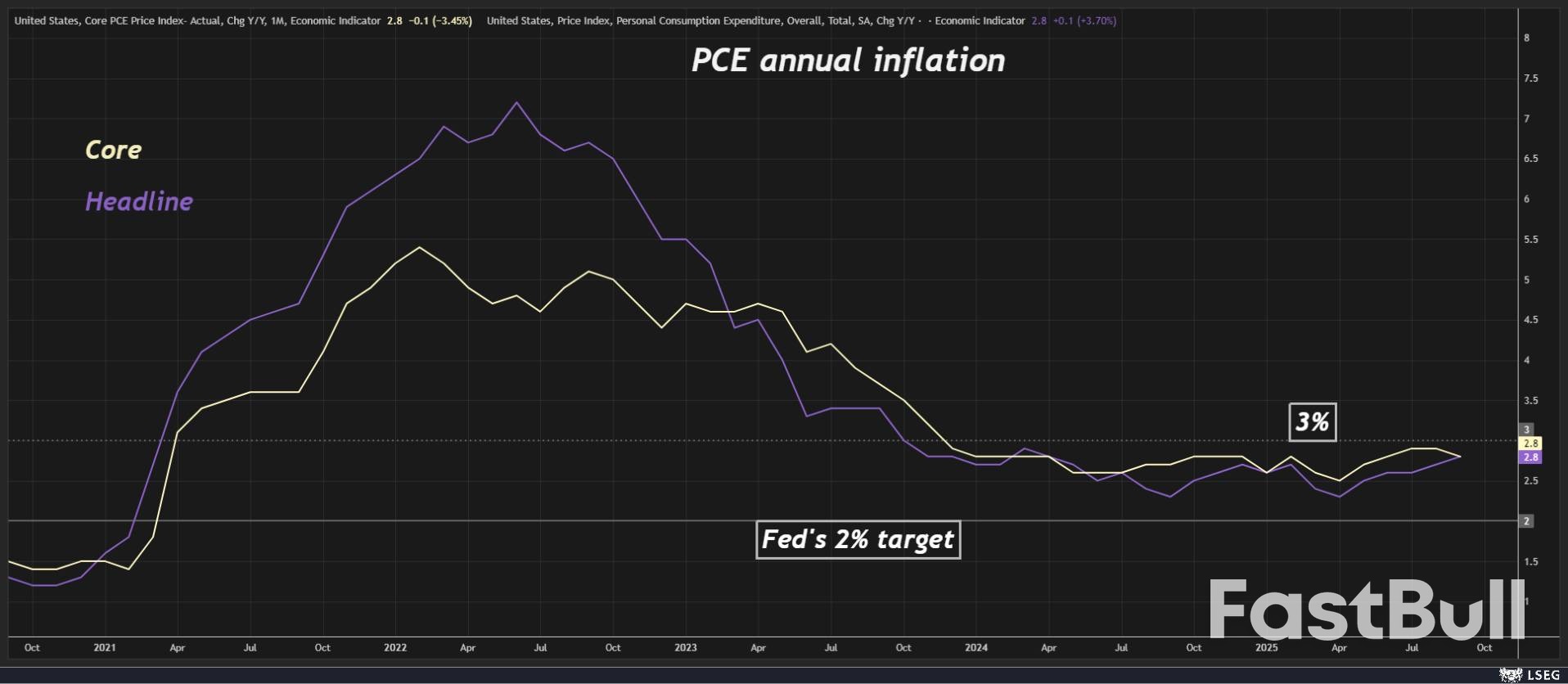

While the latest U.S. Consumer Price Index (CPI) report showed a slightly softer annual increase in core prices, it offers little relief for either consumers or Federal Reserve policymakers.

For everyday households, a sharp spike in food prices is a stark reminder of the ongoing affordability crisis. At the same time, underlying data points to upside risks for the Personal Consumption Expenditures (PCE) price index—the Fed's preferred inflation metric—creating an uncomfortable outlook for the central bank.

The December report showed the headline CPI rising at an annual rate of 2.7%, meeting expectations. Core prices, which exclude food and energy, increased by 2.6%, just a tenth of a percentage point below forecasts.

Despite the seemingly stable core reading, the details are more troubling. Food prices jumped 0.7% in December alone, marking the largest monthly increase since October 2022. This pushed the annual rate of food inflation up to 3.1%.

This surge in grocery bills comes as oil prices begin to climb again, fueled by geopolitical tensions related to President Donald Trump's foreign policy. While a potential oversupply could cap energy prices, the recent uptick is another source of anxiety for U.S. households.

Federal Reserve officials tend to focus on core inflation, which strips out volatile food and energy costs. Consumers, however, do not have this luxury, especially those with lower incomes.

Economists are now highlighting a growing "wedge" between the monthly CPI and PCE inflation measures. This divergence suggests that the December PCE data, delayed until February 20 due to a government shutdown, could come in hotter than expected.

Skanda Amarnath, co-founder of Employ America, notes that the fixed-weight basket of the CPI can underrepresent areas where consumers spend significantly, such as software. In contrast, the PCE index better reflects actual spending habits. "When you look at the goods where people actually allocate their dollars... we're seeing some meaningful upside right now," he explains.

This view is shared by major financial institutions. Economists at Barclays and Morgan Stanley have raised their forecasts for monthly December PCE inflation to just under 0.5%, which would push the annual rate to 2.8% or 2.9%. Similarly, BNP Paribas analyst Andy Schneider stated that December's PCE inflation will be "significantly" higher than the CPI reading.

The Federal Reserve is well aware of these dynamics. New York Fed President John Williams said this week that he expects inflation to peak near 3% in the first half of this year before easing and returning to the 2% target next year.

While this outlook aligns with the Fed's December economic projections, the lack of urgency is notable. It has been nearly five years since any major inflation measure—whether CPI or PCE, headline or core—has been below the central bank's 2% goal. If Williams' forecast is accurate, it will be nearly six years before the target is met again.

Though officials will not state it publicly, the Fed appears to have tacitly accepted that 3% is the new 2%, at least for now.

Several factors could keep inflation hovering closer to the 3% mark in the coming months, including:

• Companies passing on tariff costs.

• A tight housing supply.

• Potential energy price shocks.

• Demand fueled by expected tax relief and fiscal stimulus.

While some of these risks may not materialize, the current landscape suggests that both consumers and policymakers will have to contend with above-target inflation for the foreseeable future.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up