Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Zelensky Says Security Service Planning New Actions Against Russia] Ukrainian President Volodymyr Zelenskyy Stated On January 28 That The Security Service Of Ukraine (SBU) Is Continuously Planning New Actions Against Russia That Would Alter The Course Of The Russia-Ukraine Conflict. On The Same Day, Zelenskyy Received A Briefing From The SBU On Operational Plans, Including Frontline Combat, Particularly The Operations Of The SBU's Alpha Group Special Forces, And Actions Taken By The SBU Within Russian Territory In Response To Russian Attacks

Kathy Jones, Chief Fixed-income Strategist At Charles Schwab: The Fed's Policy Statement Is Expected To Make A Judgment On U.S. Inflation

USA Natural Gas Inventories Seen Down 232 Billion Cubic Feet Last Week In Thursday's EIA Report, Reuters Poll Shows

Torsten Slok, Chief Economist At Apollo: The Fed Is Expected To Say They Are Staying On The Sidelines

[Market Update] Spot Gold Fell More Than $20 In The Short Term, Currently Trading At $5280.94 Per Ounce

U.S. Senate Majority Leader John Thune: Democrats Must Work With President Trump’s White House To Address The Budget Issues (related To The Department Of Homeland Security/Dhs)

[Market Update] Ahead Of The Fed's Decision, Spot Gold Rose Above $5,320 Per Ounce, Hitting A New High, Up 2.71% On The Day

New York Fed Accepts $1.103 Billion Of $1.103 Billion Submitted To Reverse Repo Facility On Jan 28

Petrobras Says Sales Potential Up To 60 Million Barrels, With A Total Value That May Exceed $ 3.1 Billion

Canada, South Korea Sign Memorandum Of Understanding Intending To Bring South Korean Auto Manufacturing And Investment To Canada -The Globe And Mail, Citing Document

European Central Bank Executive Board Member Schnabel: European Central Bank Rates In A Good Place And Expected To Remain At Current Levels For Extended Period

USTR: Talks On Stronger Rules Of Origin For Key Industrial Goods, Enhanced Collaboration On Critical Minerals, And Increased External Trade Policy Alignment

LME Copper Rose $80 To $13,086 Per Tonne. LME Aluminum Rose $50 To $3,257 Per Tonne. LME Zinc Rose $13 To $3,364 Per Tonne. LME Lead Fell $3 To $2,017 Per Tonne. LME Nickel Rose $101 To $18,270 Per Tonne. LME Tin Rose $1,075 To $55,953 Per Tonne. LME Cobalt Was Unchanged At $56,290 Per Tonne

Iran's Araqchi: Tehran Has Always Welcomed A Fair Nuclear Deal Which Ensures Iran's Rights And Guarantees No Nuclear Weapons

Rubio: There Might Be A USA Presence In The Ukraine Talks In Abu Dhabi This Weekend But It Won't Be Witkoff And Kushner

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Fed pauses rate cuts, but focus shifts to Powell's press conference to address a DOJ probe challenging central bank independence.

The Federal Reserve is widely expected to keep its key policy rate steady on Wednesday, bringing a halt to three consecutive rate cuts of 25 basis points each. This decision comes as the central bank navigates a murky economic landscape, with persistent inflation and mixed signals from the labor market complicating its dual mandate.

After reducing the federal funds rate by 75 basis points late last year, Fed Chair Jerome Powell signaled in December that a pause was likely. He noted the policy rate was "now within a broad range of estimates of its neutral value," suggesting the central bank was "well positioned to wait to see how the economy evolves."

According to Glen Smith, chief investment officer at GDS Wealth Management, further rate cuts are not justified at this time. "It's prudent to now take a wait and see approach," Smith said, pointing to improving labor market data, stable inflation, and the simple fact that the Fed just completed a series of cuts.

Looking further ahead, Smith anticipates a cautious path. "We expect just one rate cut for 2026," he noted, adding that "the timing of this next rate cut is debatable, it will likely come towards the second half of the year, which will also be under the rein of a new Fed Chair."

While the interest rate decision is largely a foregone conclusion, investors are laser-focused on another issue: the central bank's independence. All eyes will be on whether Powell addresses the Trump administration's investigation into the Fed.

Earlier this month, the U.S. Department of Justice served the central bank with grand jury subpoenas concerning the renovation of a Fed office building. In a highly unusual public response, Powell suggested the investigation was a form of punishment. He stated the Fed was being targeted for "setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President."

This development is the latest chapter in a long-running dispute between President Donald Trump and the Fed Chair. Trump has repeatedly and publicly ridiculed Powell for not lowering interest rates and has even threatened to fire him.

For Wall Street, the interest rate announcement itself is already priced in. The main event will be Powell's press conference that follows the decision.

Analysts and traders will be listening for any commentary on the political pressures facing the institution. "This is the first Fed press conference since news came to light about a DOJ investigation into Powell," said GDS Wealth's Smith. "We expect Powell to address this during the press conference and broader questions about the Fed's independence."

Investors tracking the market's reaction can monitor several popular exchange-traded funds (ETFs) that follow the benchmark S&P 500 index, including:

• SPDR S&P 500 ETF Trust (SPY)

• Vanguard S&P 500 ETF (VOO)

• iShares Core S&P 500 ETF (IVV)

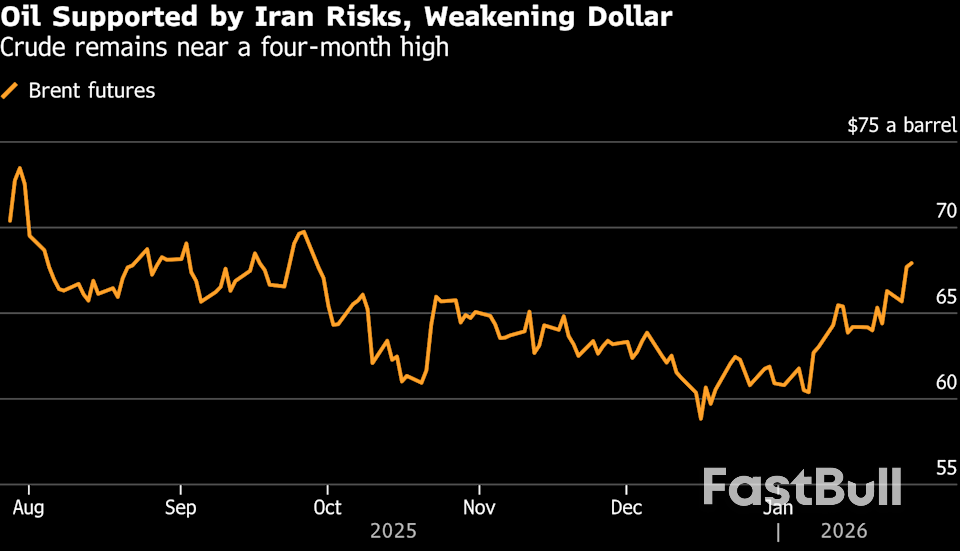

A U.S. aircraft carrier group arrived in the Middle East on January 27, dramatically raising tensions as speculation over a potential strike against Iran intensifies. The military deployment comes as Tehran carries out a brutal crackdown on nationwide protests that rights organizations report have killed thousands.

This external pressure coincides with severe internal turmoil. Iran’s currency, the rial, plunged to a historic low against the U.S. dollar, trading at 1.5 million on the same day.

U.S. President Donald Trump has publicly stated he "hopes" military action against Tehran will not be necessary. However, he has also dispatched what he termed an "armada" to the region, confirming that air strikes remain an option in response to the violent suppression of largely peaceful demonstrators.

In a January 26 interview with Axios, Trump described the situation with Iran as being "in flux." He confirmed that a strike group led by the USS Abraham Lincoln is now in Middle Eastern waters, according to U.S. Central Command.

Despite the military posturing, Trump suggested that Tehran is eager to negotiate. "They want to make a deal. I know so. They called on numerous occasions. They want to talk," he was quoted as saying.

The current wave of unrest began on December 28 among shopkeepers in Tehran's markets, who were initially angered by dire economic conditions. The protests quickly spread across the country, evolving into broader demonstrations against falling living standards and the suppression of freedoms.

The response from authorities has been violent. According to the U.S.-based rights organization HRANA, the confirmed death toll has reached 6,126, a figure that includes security forces. An additional 17,091 fatalities are still under investigation. Some unofficial estimates from media outlets, citing off-the-record officials, suggest the actual number could be several times higher.

Eyewitness accounts and verified reports indicate the crackdown reached its peak on January 8 and January 9, when security forces used live ammunition against demonstrators.

The rial's dramatic fall is symptomatic of a broader economic crisis. The annual inflation rate stands at 44.6 percent, with food prices having surged by nearly 90 percent year-on-year. For years, Iran's economy has been strained by international sanctions and the consequences of the 12-day war with Israel last June.

To control the flow of information, the Iranian government has imposed a weeks-long internet blackout. The watchdog group NetBlocks confirmed in a January 26 report that the shutdown continues, with only limited access reported intermittently. NetBlocks noted that authorities are tightening controls to prevent circumvention while using whitelisted accounts to promote the government's narrative.

An Iranian government spokesman claimed on January 27 that the internet was cut "to preserve human lives," without offering further explanation.

Despite the blackout, new evidence of the suppression continues to surface online. The Vahid Online channel published images reportedly from the city of Amol on the evening of January 9. The visuals appear to show uniformed government forces armed with Kalashnikov rifles firing directly at protesters, contradicting official claims that "terrorists," not state security agents, were responsible for the killings.

The S&P 500 crossed the 7,000 mark for the first time on Wednesday and the Nasdaq inched towards a fresh record, helped by gains in chip stocks, with investors gearing up for a Federal Reserve rate decision and quarterly earnings results of Big Tech companies.

The move through the psychological level underscored risk appetite tied to AI optimism and expectations for strong corporate results, which outweighed lingering geopolitical concerns.

"These big round numbers can be difficult psychological tests for the market. So certainly from a technical analysis perspective, we think it's a very positive sign," said Jeff Buchbinder, chief equity strategist for LPL Financial.

Tech stocks led gains as Nvidia climbed 1.8%, Intel jumped 9%, and Micron and Microchip Technology each gained over 4%. SK Hynix, a key Nvidia supplier, reported a record quarterly profit and ASML booked its highest ever fourth-quarter orders, igniting a tech rally from Europe to Asia.

The Philadelphia SE Semiconductor index rose 2.3%.

The Fed convenes later in the day for its rate decision, with policymakers widely expected to keep it unchanged at 3.5%–3.75%. Traders will watch out for the Fed's statement and Chair Jerome Powell's remarks, for clues on the future rate trajectory.

"We would expect any (Fed rate) cuts that come in 2026 to be accompanied by economic growth, that is certainly a key piece of our positive stock market outlook for 2026. We would argue that the earnings and AI investment is a bigger deal and should be the focus of investors more so than the Fed," Buchbinder added.

Wall Street has rebounded to trade higher, with attention shifting to the earnings story after U.S. President Donald Trump's threats to acquire Greenland had led to bouts of sell-offs earlier this month, sending safe-haven gold soaring.

At 09:32 a.m. ET, the Dow Jones Industrial Average rose 118.82 points, or 0.24%, to 49,122.23, the S&P 500 gained 22.45 points, or 0.32%, to 7,001.05 and the Nasdaq Composite gained 150.01 points, or 0.63%, to 23,967.11.

The U.S. central bank, which recently started receiving real-time data on the economy's health after a partial government shutdown last year, is navigating policy while peering through an increasingly politicized fog.

This meeting arrives in the backdrop of a Justice Department inquiry launched earlier this month involving Powell as well as Trump's hints that a successor will be named "soon".

The markets currently expect the first rate cut to come in June, according to CME's FedWatch tool.

Meta , Microsoft and Tesla report after market close, kicking off the so-called "Magnificent Seven" earnings that have driven the AI trade, powering markets to record levels.

With lofty valuations driving rotation into undervalued areas of the market, the group's capital plans will be closely watched as investors question whether AI spending will drive returns.

Texas Instruments surged 6% after the analog chipmaker forecast first-quarter revenue and profit above Wall Street estimates. Starbucks jumped 6.7% after posting a bigger-than-expected increase in first-quarter comparable sales. AT&T climbed 4% after the U.S. carrier projected annual profit above market expectations.

In industrials, GE Vernova raised its annual revenue forecast, shares rose 2%. Textron fell 6.2% after guiding fiscal profit below estimates, while Otis dropped 5% after fourth-quarter revenue missed expectations.

Meta and Microsoft were flat, while Tesla gained 0.5%. Bellwether IBM , also due to report after the market closes, was flat.

Seagate Technology jumped 14.5% after it forecast third-quarter revenue and profit above Wall Street expectations. Rival Western Digital rose 7.7%.

The Bank of Canada (BoC) is holding its policy rate steady at 2.25%, a widely anticipated move that marks its second consecutive pause on rate changes. Governor Tiff Macklem highlighted that significant uncertainty in the economic landscape makes it challenging to predict when or how the central bank might adjust rates next.

In its quarterly monetary policy report, the bank maintained its forecast for modest economic growth through 2026 and 2027, with inflation expected to remain near its 2% target.

The decision to hold the rate reflects an environment where Canadian businesses are still adjusting to the impact of U.S. tariffs and hiring intentions remain soft.

"While Council judges the current policy rate is appropriate based on our outlook, the consensus was that elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate," Macklem stated in his opening remarks.

This cautious stance leaves economists and financial markets divided on the future of Canada's monetary policy for the rest of the year.

Despite the external pressures, the BoC noted that Canada's economy has proven relatively resilient. The central bank updated its growth projections with a few key adjustments:

• 2025 Growth: Revised up to 1.7% from an earlier projection of 1.2%.

• 2026 Growth: Forecast remains unchanged at 1.1%.

• 2027 Growth: Trimmed slightly to 1.5% from a previous forecast of 1.6%.

The bank expects household spending to continue its modest growth, supported by previous rate cuts and rising disposable incomes. A modest strengthening in business investment is also anticipated.

Governor Macklem identified several key risks to Canada's economic outlook, with trade being a primary concern.

"Geopolitical risks are elevated and the upcoming review of the Canada-United States-Mexico Agreement is an important risk to the outlook," he said.

The BoC also reiterated its view on inflation dynamics. While tariffs could push prices higher, this effect is expected to be offset by downward pressure from excess supply in the economy. The central bank expressed hope that economic restructuring prompted by tariffs will eventually support recovery in productive capacity, but Macklem cautioned, "it will all take time."

Following the announcement, the Canadian dollar firmed 0.28% to C$1.3535 against the U.S. dollar, or 73.88 U.S. cents. Money market bets showed little change.

The financial community remains split on what comes next. Many economists believe another rate cut could be necessary to support an economy dealing with tariffs. In contrast, money markets are not pricing in any cuts through 2026 and are instead tilting toward a potential rate hike in the final quarter of the year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up