Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

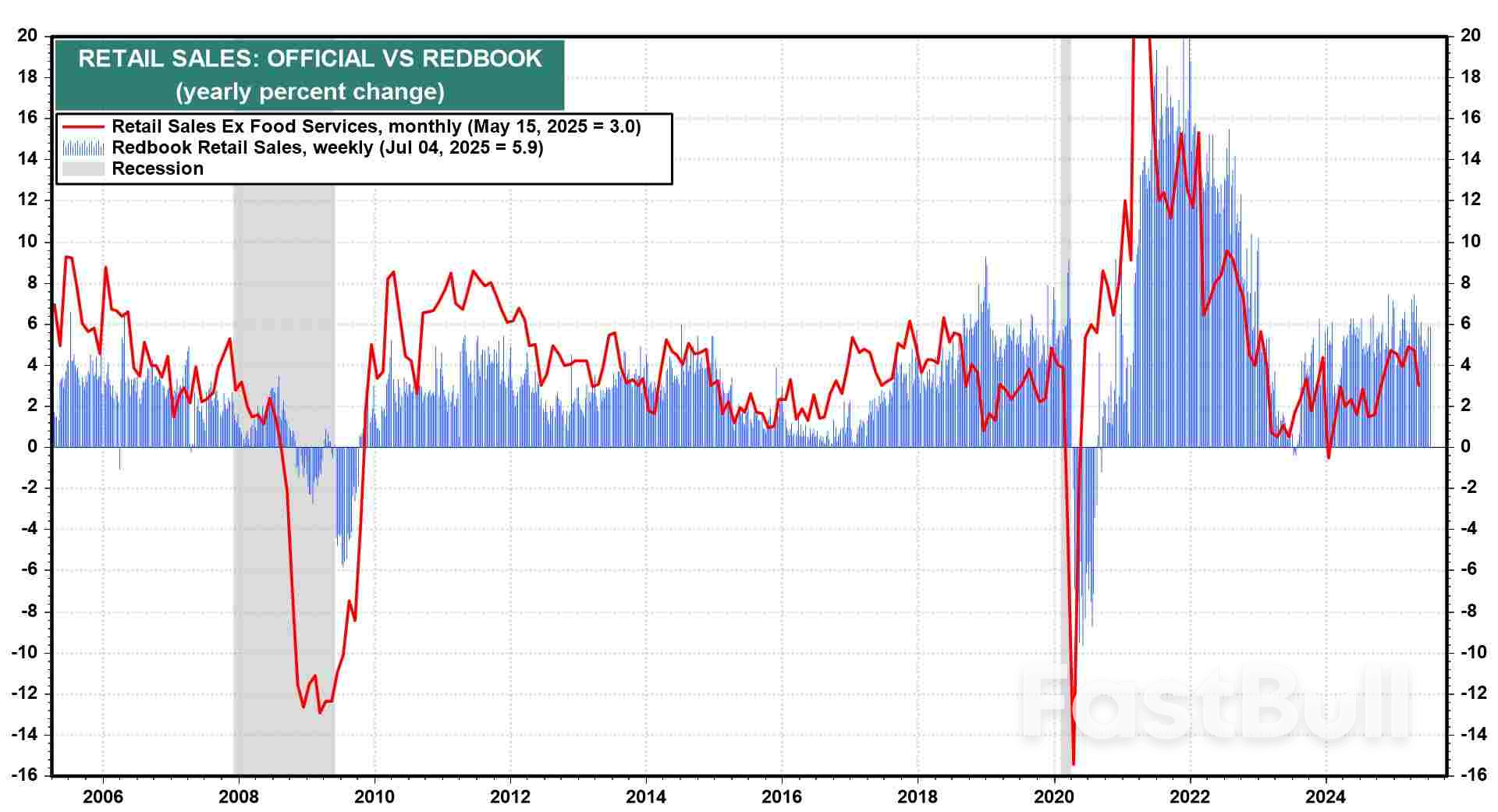

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. President Donald Trump's threatened 30% tariff on European Union imports is complicating the European Central Bank's decision-making but is unlikely to derail plans for a pause in rate cuts next week, five ECB policymakers told Reuters.

U.S. President Donald Trump's threatened 30% tariff on European Union imports is complicating the European Central Bank's decision-making but is unlikely to derail plans for a pause in rate cuts next week, five ECB policymakers told Reuters.

The ECB signalled after its June meeting that it was likely to keep interest rates unchanged on July 23-24.

But the 30% duty floated by Trump is steeper than the ECB had anticipated even under the most negative of three scenarios for the euro zone economy it released last month.

That means the ECB has been forced to come up with new estimates and policymakers to contemplate a more negative outcome than they thought possible in June, said the five sources, all members of the ECB's Governing Council.

They said governors remain reluctant to act on the basis of what is still a threat, however, especially given the sometimes contradictory statements made by Trump's administration since his first announcement of global tariffs in April. Any discussion about rate cuts is therefore likely to be kept for the ECB's September meeting, the sources said.

Trump said on Sunday that his tariffs would kick in on August 1, and the European Commission has also paused its countermeasures until that date.

Market economists have largely said they think it unlikely that Trump will follow through with his tariff threat because of the damage it would cause to the U.S. economy in terms of higher inflation and lower growth.

But should the 30% levy be imposed, they expect the ECB to cut interest rates in response.

Barclays analysts predicted a lowering of the ECB's deposit rate to just 1% by next March from 2% now if the U.S. imposes an average tariff rate on EU goods of 35%, which they estimated would subtract 0.7 percentage points from euro zone growth.

The ECB's latest macroeconomic projections, released in June, pointed to a gradual recovery in the euro zone economy in coming years, with inflation hovering around its 2% target.

Those projections assumed as their baseline a 10% tariff on EU good exports to the U.S., which would put euro zone economic growth at 0.9% this year, 1.1% next year and 1.3% in 2027.

But forecasts under an alternative scenario released at the same time showed that a 20% U.S. tariff would curb growth by 1 percentage point over the same period and also pull down inflation to 1.8% in 2027, from 2.0% in the baseline scenario.

White House economic advisor Kevin Hassett speculated Monday that new tariff policies are not yet sparking widespread price inflation because President Donald Trump has convinced more people to buy American.

"There's, I think, a lot of patriotism in the data," Hassett said on CNBC's "Squawk Box" when he was asked to explain why Trump's protectionist policies have not stoked higher prices, despite warnings by many economists.

The National Economic Council director pointed to a recent White House report, which found prices of imported goods fell between December and May.

"My theory, as an economist, of why that is, is that Americans, because of President Trump's leadership, have recognized that when they buy an American product, they not only get perhaps a better product, certainly a better product most of the time, but they're also making their community stronger," Hassett said.

"The bottom line is, people prefer American products," he said.

"Therefore, the demand for imports has gone way down, so much that even with what tariffs have been there, where people would say, 'Oh, they might increase prices at least a little bit,' we've seen prices going down."

Hassett also argued that countries with which the United States has trade deficits are eating the cost of the tariffs, instead of passing on higher prices to American consumers.

Trump's tariffs are still expected to lead to higher prices this year.

And critics have noted that Trump has at least temporarily pulled back on some of his biggest tariff plans, including many announced during his "liberation day" in early April.

Others note that many importers stockpiled goods in anticipation of incoming tariffs, muting the near-term effects of the duties on prices.

Ernest Tedeschi, director of economics at the Budget Lab at Yale, wrote that the methodology used in the White House's report "will understate tariff effects in their import indices."

Tedeschi, who served as the top economist at the White House Council of Economic Advisers under former President Joe Biden, also cited data from Harvard University's Pricing Lab showing that prices on imported goods have risen since early March, when U.S. tariffs on Canada, Mexico and China took effect.

The big Monday announcement by President Trump... just the threat of more secondary tariffs on Russia? And venting a little more frustration at no peace progress.

If this is "it"... the "major announcement" on Russia that was planned, then we will say it could have been a lot worse in terms of escalation (such as ramping up more offensive weapons deliveries to Kiev), but amid Trump perhaps poorly managing expectations, people will be asking: that was it? Even RT is chiming in with some light mockery...

Given markets were expecting something more 'huge' - oil prices pushed lower on the news of another lengthy timeline of "if no deal in 50 days"...

And yes, there will be some more weapons sent to Ukraine, Trump stated, but they will come via NATO allies, primarily.

As if the Big Beautiful Bill's spending increases, the bombing of Iran, mixed signals on immigration and the suppression of the Epstein files weren't enough to infuriate Trump voters, now comes news that President Trump is going to announce what a top DC warmonger calls an "aggressive" transfer of offensive weapons to Ukraine. Under the novel arrangement, European countries are supposedly going to foot the bill.

Last week, the administration announced that weapons shipments that had just been halted by Defense Secretary Pete Hegseth over concerns about the depletion of America's own arsenal were being given a hasty green light after all. Trump broke the news on Monday after last week's "disappointing" phone call with President Putin, telling reporters he would send “more weapons” to Ukraine. Critically, Trump had emphasized that these would be "defensive weapons primarily."

Now, two sources tell Axios that it's likely a new weapons package will include long-range missiles capable of attacking deep inside Russia to include Moscow. They noted that a final decision hadn't been made. "Trump is really pissed at Putin. His announcement tomorrow is going to be very aggressive," warmongering South Carolina Sen. Lindsey told Axios.

While MAGA nation and libertarian-minded Trump voters will be disgusted, it's like a second Christmas in a month for Graham. First delighted by Trump's decision to engage the US military in Israel's war on Iran, long-time Ukraine-meddler Graham is now enthusing over Trump's new escalation. "The game...is about to change," said Graham in a Sunday appearance on Face the Nation. "I expect in the coming days you will see weapons flowing at a record level...[and] there will be tariffs and sanction available to President Trump he's never had before."

The transaction is expected to be announced Monday when Trump meets with NATO Secretary General Mark Rutte. This time around, European countries are expected to pay for American weapons bound for Ukraine. "Basically, we are going to send them various pieces of very sophisticated military [equipment]. They're going to pay us 100% for them," Trump told reporters on Sunday. "As we send equipment, they're going to reimburse us."

The new arrangement sprang from a suggestion made by Ukrainian President Volodymyr Zelensky at a NATO summit in late June. Striking an exceedingly Trump-like tone, an unnamed US official told Axios, "Zelensky came like a normal human being, not crazy, and was dressed like a somebody that should be at NATO. He had a group of people with him that also seemed not crazy. So they had a good conversation."

Trump was reportedly angered by his July 3 phone call with Putin, in which the Russian president made clear his intention to escalate the war. Sure enough, that very night Russia launched an apparently record-setting overnight drone attack on Ukraine - said to be among the largest since the war began.

According to the new report, Western and Ukrainian officials are hoping an infusion of weapons will alter Putin's calculus about his war aims and terms for a ceasefire if not an end to it.

Russia had been gradually but relentlessly taking over more territory (via Institute for the Study of War)

Russia had been gradually but relentlessly taking over more territory (via Institute for the Study of War) During his 2024 campaign, Trump repeatedly vowed to bring a quick end to the war, variously claiming that he would get it "settled before I even become president" or, at worst, "within 24 hours" of doing so. Now, nearly 6 months into his term, Trump is about to pour more weapons into the 3 1/2-year old war.

In doing so, Trump gives us yet another illustration of Tom Woods' Law #3: "No matter whom you vote for, you always wind up getting John McCain."

President Donald Trump announced Monday that the United States will impose "very severe tariffs" on Russia in 50 days if no deal is reached to end the war in Ukraine.

During a meeting with NATO Secretary General Mark Rutte in the Oval Office, Trump revealed that an agreement had been made to send weapons to Ukraine. "Made deal today to send weapons to Ukraine," Trump stated.

The president added that the U.S. would be "sending the best to NATO" and that the effort "will be coordinated by NATO."

Trump expressed disappointment with Russian President Vladimir Putin during the Oval Office meeting, where he sat side-by-side with Rutte.

The NATO Secretary General emphasized European participation in the initiative, stating, "This is Europeans stepping up" and "European countries want to be part of it." Rutte described the current support as "the first wave," indicating that "there will be more."

Rutte also confirmed that participating countries would "move equipment quickly into Ukraine" as part of this coordinated effort.

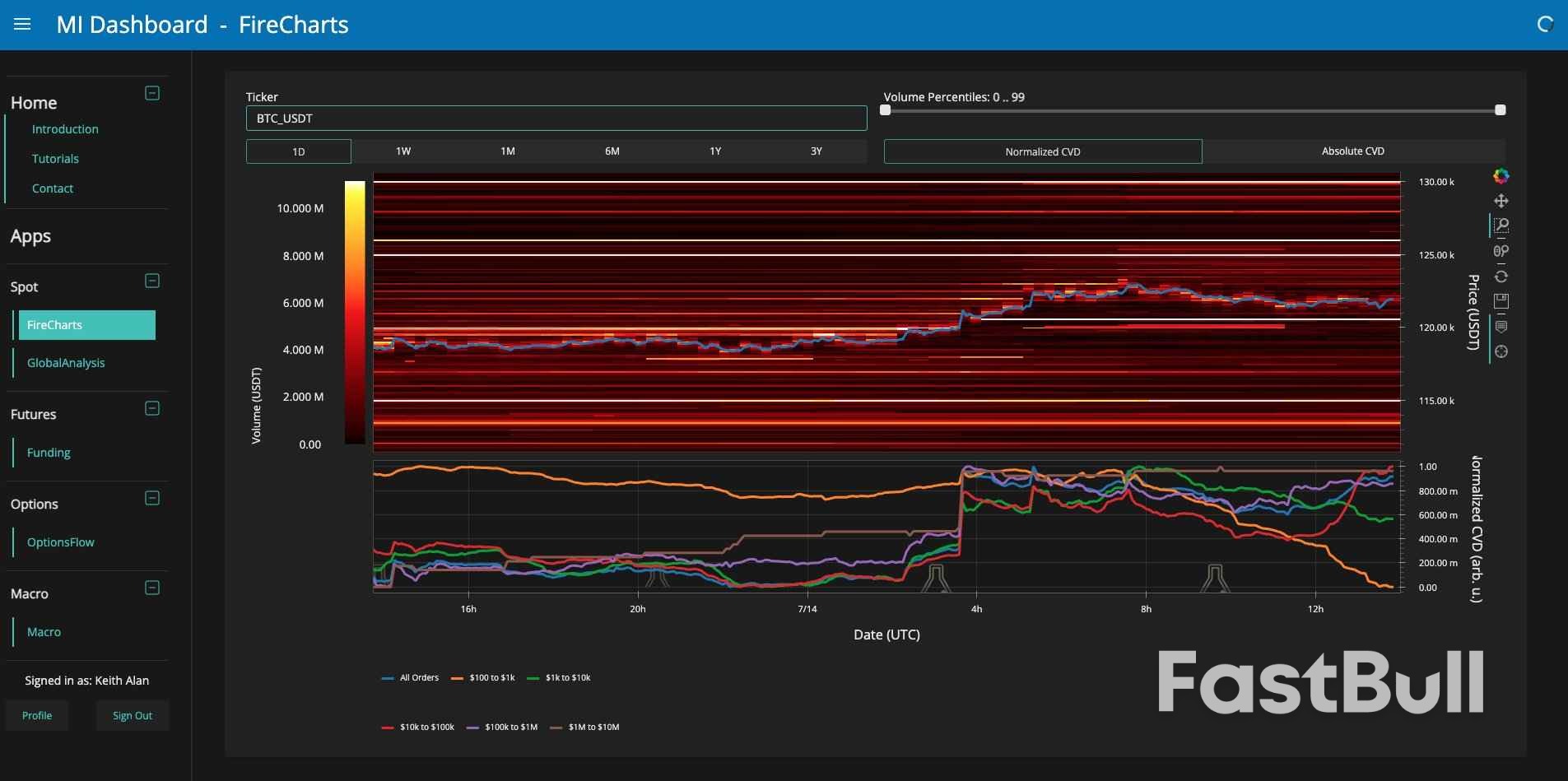

BTC/USDT order-book liquidity data. Source: Material Indicators/X

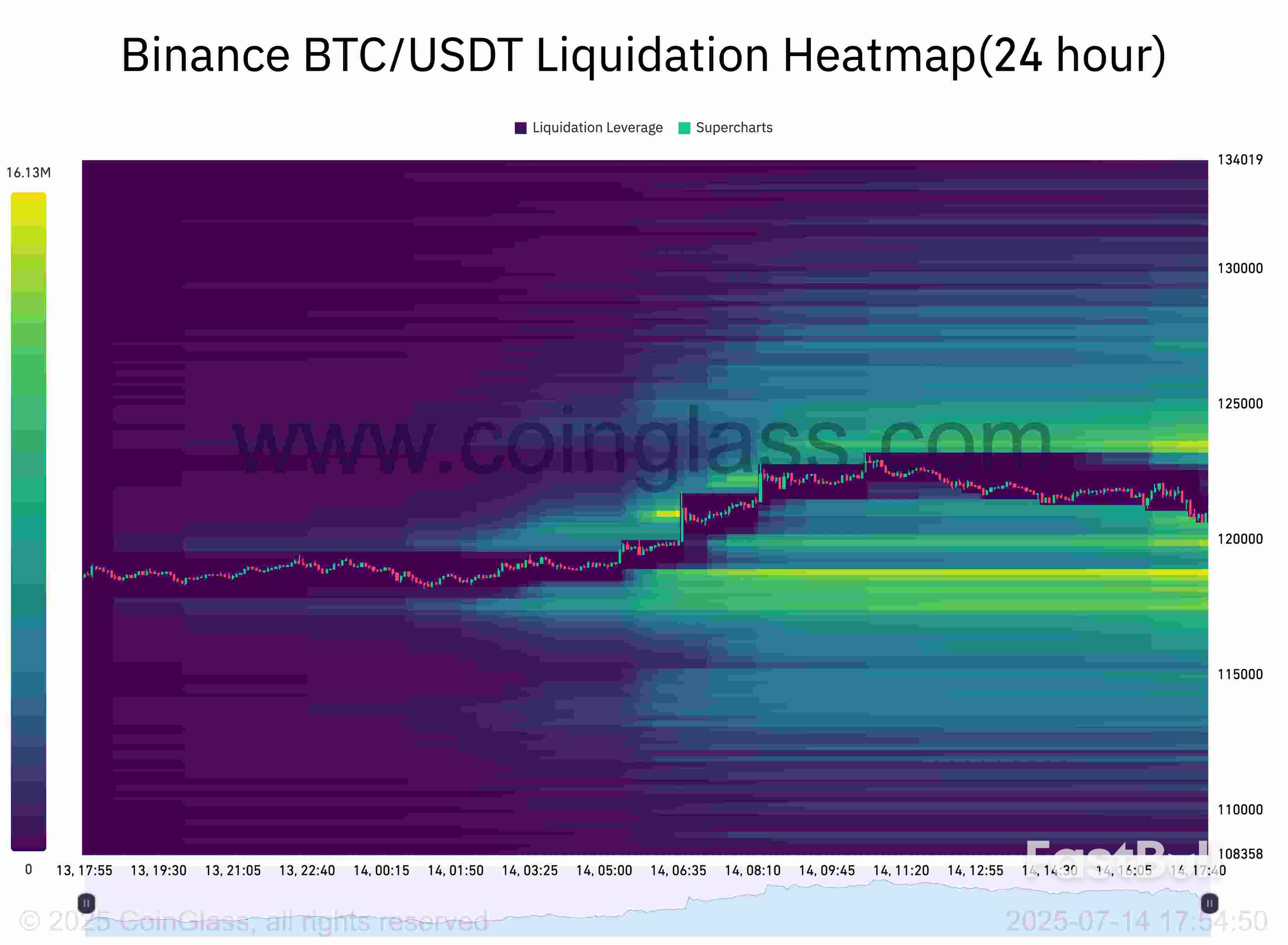

BTC/USDT order-book liquidity data. Source: Material Indicators/X Binance BTC/USDT liquidation heatmap. Source: CoinGlass

Binance BTC/USDT liquidation heatmap. Source: CoinGlass

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up