Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Shanghai Futures Exchange: Adjusts Price Limits, Margin Ratios For Some Silver Futures Contracts

Turkish Foreign Minister: We Hope Solution Can Be Found To Avoid Conflict And Isolation Of Iran

Turkish Foreign Minister: Spoke With USA Envoy Witkoff On Thursday, Will Continue Speaking To USA Officials On Iran

Iran's Araqchi Says Tehran Welcomes Talks With Regional Countries That Aims At Bringing Stability And Peace

Istanbul - Iran's Foreign Minister Araqchi Says Tehran 'Is Prepared For Resumption Of Talks With The US'

Istanbul - Iran's Foreign Minister Araqchi: Talks With His Turkish Counterpart Fidan Was Very 'Good And Useful'

Turkish Foreign Minister: Turkey Closely Following Integration Agreement Between Damascus-Sdf In Syria

Turkish Foreign Minister: Turkey Calling On US, Iran To Come To Negotiating Table To Resolve Issues

Turkish Foreign Minister: Turkey Opposes Foreign Intervention On Iran, We Tell Our Counterparts This

Turkish Foreign Minister: Iran's Peace And Stability Important For US, Turkey Saddened By Deaths During Protests

Chevron: Continue To Engage With The USA And Venezuelan Governments To Advance Shared Energy Goals

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)A:--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)A:--

F: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)A:--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Eurozone surprises with domestic-led growth, defying global trade headwinds; Spain and Germany spearhead a resilient bloc.

The Eurozone’s largest economies demonstrated remarkable resilience last quarter, posting modest but steady growth driven by a powerful shift toward domestic consumption and investment. This internal strength successfully counteracted struggling exports and the persistent uncertainty from unpredictable U.S. trade policies.

Despite predictions that the bloc of 350 million people would falter under the pressure of a trade war, fierce competition from China, and regional military conflict, the Eurozone delivered respectable growth each quarter last year. The expansion came even as its traditional engines, industry and exports, lost momentum.

Spain continues to be a primary driver of the bloc's expansion, with its economy growing by 0.8% in the last quarter, easily surpassing expectations of 0.6%. Germany, the Eurozone's economic powerhouse, also beat forecasts, expanding by 0.3% against predictions of 0.2%.

Other key economies also contributed to the steady performance:

• France: Grew by 0.2%, in line with predictions, showing that political instability did not derail sentiment.

• Italy: Expanded by 0.3%, just edging out forecasts.

• Netherlands: Posted a solid 0.5% growth rate.

These national figures suggest that the broader Eurozone growth numbers will align with economists' expectations of a 0.2% quarterly expansion and a 1.2% year-over-year increase.

Data indicates the bloc began 2026 on relatively strong footing. A key sentiment reading released Thursday showed an unexpected jump, fueled by optimism in France and Germany, with gains seen across all major sectors.

Further signs of stability are becoming apparent. The industrial sector is showing signs of stabilizing, while households are finally beginning to reduce their historically high savings rates. At the same time, unemployment remains near record lows, and inflation is holding firm around the European Central Bank's 2% target.

The economic outlook is further brightened by Germany's major spending initiatives in infrastructure and defense. While these projects may take time to fully launch, they are expected to have a measurable impact on growth starting from the second quarter.

This spending is poised to end three years of German stagnation and will likely create a positive ripple effect across Europe, as German industry relies on a vast network of suppliers spread throughout the continent.

A full recovery in exports is unlikely anytime soon. U.S. tariffs, intensifying Chinese competition, and the dollar's decline over the past year all point to a permanent shift in global trade patterns.

This reality places the burden squarely on the domestic economy to find new sources of expansion. However, economists argue that both consumer spending and intra-EU trade have significant untapped potential, keeping the overall outlook upbeat. Most projections now see the Eurozone growing in the 1.2% to 1.5% range for years to come, which is considered around the bloc's potential.

This stable economic environment puts the European Central Bank in a uniquely comfortable position. With inflation at its target, interest rates in a neutral setting, and growth meeting its potential, some policymakers have described the situation as the "nirvana of central banking." Consequently, investors widely expect interest rates to remain steady throughout the year, barring any unforeseen shocks to the system.

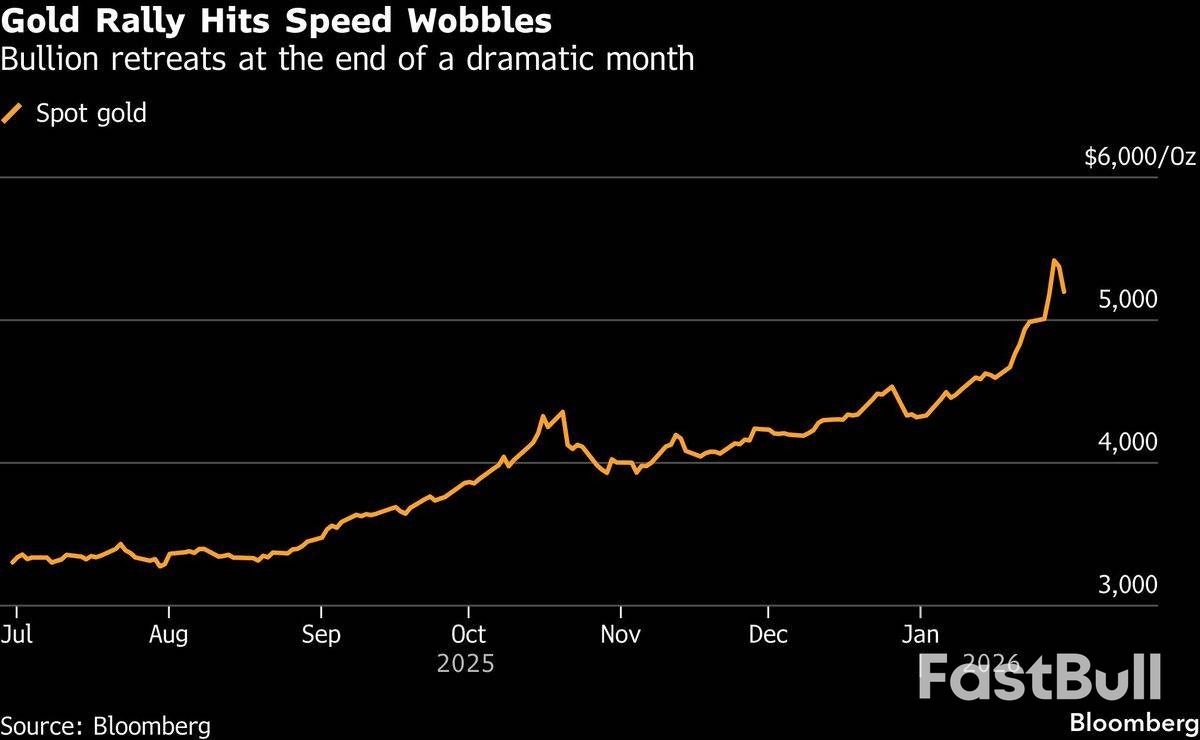

Gold prices dropped sharply on Friday, pulling back from a historic monthly gain after a report suggested the Trump administration is preparing to nominate Kevin Warsh as the next Federal Reserve chair. The news sent the U.S. dollar higher, putting immediate pressure on precious metals.

Silver experienced an even steeper decline, tumbling as much as 9.4%. Gold, which had been positive earlier in the day, reversed course and fell by as much as 4.8%, highlighting the market's volatility after a record-breaking run.

The catalyst for the reversal was a Bloomberg News report that President Donald Trump is expected to name Warsh, a former Fed governor, to lead the central bank. The president confirmed he would announce his nominee on Friday morning U.S. time.

Warsh is widely known as an inflation hawk but has recently aligned himself with the president by publicly arguing for lower interest rates. The prospect of his leadership boosted the U.S. dollar index by as much as 0.5%, making dollar-denominated commodities like gold more expensive for international buyers.

According to Christopher Wong, a strategist at Oversea-Chinese Banking Corp., the sell-off "validates the cautionary tale of fast-up, fast-down." He suggested that while the Warsh nomination news acted as the trigger, a market correction was inevitable after such a rapid ascent.

"It's like one of those excuses markets are waiting for to unwind those parabolic moves," Wong noted.

Even with Friday's pullback, gold remains on track for a roughly 19% gain in January, which would mark its strongest monthly performance since 1982. Silver's rise has been even more dramatic, with the metal up an astounding 48% so far this year.

The recent rally in precious metals has been largely fueled by significant geopolitical uncertainty stemming from the Trump administration's policies. Key drivers for safe-haven demand included:

• The seizure of Venezuela's leader.

• Threats to annex Greenland.

• Tariff threats against allies.

• Warnings of a possible strike on Iran.

• The prospect of levies on countries providing oil to Cuba.

Concerns about the Federal Reserve's independence have also played a crucial role. Renewed attacks on the central bank fueled dollar weakness and a "debasement trade," prompting investors to move away from currencies and sovereign bonds over fiscal fears.

A meltdown in Japan's debt market amplified these concerns, helping to accelerate the dizzying gains in precious metals. The rally was further magnified by a lack of market liquidity.

As of 4:13 p.m. in Singapore, market prices reflected the broad sell-off:

• Gold fell 4.3% to $5,146.58 an ounce.

• Silver tumbled 8.5% to $105.8566 an ounce.

• Platinum and palladium also slumped.

The Bloomberg Dollar Spot Index rose 0.2% on the day but remained down 1% for the week.

In other news, a potential U.S. government shutdown was averted after President Trump and Senate Democrats reached a tentative deal. The White House continues to negotiate with Democrats over new limits on immigration raids that have caused a national outcry.

Diplomatic tensions between Hungary and Ukraine have surged, leading both nations to summon each other's ambassadors amid accusations of election interference. Hungarian Prime Minister Viktor Orbán and Foreign Minister Péter Szijjártó have publicly accused Kyiv of attempting to influence Hungary's upcoming parliamentary elections, a charge Ukraine vehemently denies as cynical and false.

Prime Minister Orbán took to social media to claim Hungary has been facing "daily threats from Ukraine," specifically naming President Volodymyr Zelensky, Foreign Minister Andrii Sybiha, and Ukrainian security services as sources. He asserted that these actions would continue until the election, alleging that Kyiv is actively working to install "a pro-Ukrainian government in Hungary" by targeting him and his administration.

"We did not seek conflict, yet Hungary has been the target for days," Orbán stated, emphasizing that his government would not be swayed from its national interests. He outlined several key policy positions:

• No financial aid: "We will not send money to Ukraine, because it is in a better place with Hungarian families than in the bathroom of a Ukrainian oligarch."

• No energy sanctions: He reiterated his opposition to banning Russian oil and gas imports.

• No fast-tracked EU membership: Orbán argued that Ukraine's accession would "import war" into the European Union.

"As long as Hungary has a national government, these issues will not be decided in Kyiv or Brussels," Orbán declared.

Foreign Minister Reinforces Accusations

Foreign Minister Péter Szijjártó confirmed that Ukraine had summoned Hungary’s ambassador in Kyiv, noting that Budapest was "not surprised." He said Ukrainian officials objected to Hungary’s national petition regarding plans by Brussels and Kyiv to use Hungarian taxpayer funds to arm Ukraine.

Szijjártó added that Kyiv offered no explanation for what he termed President Zelensky’s "vulgar insults" of Orbán or for Sybiha's comparison of the Hungarian prime minister to "one of Hitler's henchmen."

He further warned that Kyiv was escalating its interference in Hungary’s April election to support opposition leader Péter Magyar's Tisza Party. "We understand that Ukraine wants the Tisza Party to win, but only the Hungarian people can decide Hungary's future," he said.

In response, Hungary summoned Ukraine's ambassador in Budapest. Szijjártó described the situation as an "open, shameless and aggressive interference campaign" and vowed to "defend our sovereignty by every possible means."

While not directly addressing Szijjártó's most recent comments, Ukrainian Foreign Minister Andrii Sybiha had previously responded to Orbán's accusations. In a social media post, he told Hungarian officials "not to be afraid of Ukraine," but of the Hungarian people.

Sybiha accused Orbán of cynicism and historical manipulation. "When Viktor Orbán says that he will not allow Ukraine to join the EU for the next 100 years, he is not really talking to the Ukrainian state," Sybiha wrote. "First and foremost, he is telling this to ethnic Hungarians in Transcarpathia."

He further charged that Orbán was using ethnic Hungarians in Ukraine as "hostages to his geopolitical adventures" and claimed that blocking Ukraine's EU path was "yet another crime against the Hungarian people and Hungary itself."

This diplomatic firestorm unfolds against the backdrop of Hungary's long-standing opposition to further arming Ukraine in its conflict with Russia. Budapest has criticized Brussels for what it sees as a reckless and costly strategy to achieve an unrealistic military victory for Ukraine.

The upcoming election on April 12 is considered a significant challenge for Orbán and his governing Fidesz party, with many in Budapest viewing it as their toughest political test to date.

The U.S. government has decided to keep South Korea on its foreign exchange monitoring list, a move that market analysts believe will have a limited immediate impact on the currency market. However, the decision sends a strong signal, with both Washington and Seoul now indicating that the Korean won's recent slide against the dollar is "excessive," fueling expectations of future appreciation.

The U.S. Treasury Department announced the decision in its semiannual "Report to Congress on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States." South Korea was removed from the list in November 2023 after more than seven years but was reinstated in November 2024, preceding the inauguration of the Donald Trump administration.

Treasury Secretary Scott Bessent linked the move to a broader policy shift. "In support of President Trump's America First trade policy, starting with this report, Treasury is strengthening its analysis of trading partners' currency policies and practices," he stated.

Officials in Seoul described the designation as a procedural matter. A senior presidential official noted the decision was made in a "mechanical manner" based on the U.S. Treasury's evaluation framework. "The Treasury reiterated in its report that the recent depreciation of the won does not correspond to Korea's economic fundamentals," the official said, adding that close communication between the two governments will continue.

This view was echoed by Korea's Ministry of Economy and Finance, which said the report reflects Washington's concern over the won's prolonged, one-sided weakening trend since the latter half of last year.

The U.S. Treasury report went beyond monitoring, identifying key drivers behind the won's weakness. It stated that the currency's decline in the latter half of 2025 was inconsistent with South Korea's strong economic fundamentals.

The primary source of downward pressure, according to the report, was capital outflows from the private sector. This trend was largely driven by a significant increase in overseas equity investments by individual Korean investors.

The report also pointed to several structural factors contributing to this capital flight:

• The dominance of large corporations in the domestic economy.

• Conservative corporate dividend policies.

• Limited return prospects in the domestic capital market.

These conditions have prompted both households and institutional investors to move capital abroad, adding to the depreciation pressure on the won.

Market experts agree that Korea's inclusion on the monitoring list is unlikely to cause significant short-term volatility.

"The impact of being placed on the list should be minimal," said Park Sang-hyun, an analyst at iM Securities. "What matters more is the U.S. Treasury's judgment that the won is undervalued relative to fundamentals, a view that has also been echoed by the presidential office. That assessment suggests upward pressure on the currency."

Lee Min-hyuk, chief economist at KB Kookmin Bank, also downplayed the immediate effect, calling the designation a "familiar issue" for markets. However, he emphasized the importance of the underlying message.

"With U.S. Treasury officials, including Secretary Bessent, having openly described the won's weakness as excessive... markets may interpret this as unease in Washington over current exchange-rate levels, potentially capping further increases in the rate," Lee explained.

In the Seoul foreign exchange market on Friday, the won-dollar exchange rate closed at 1,439.5 won, a rise of 13.2 won for the dollar.

France's economic growth slowed to 0.2% in the fourth quarter of 2025, a significant cooldown after a strong summer rebound, according to preliminary data from the INSEE statistics office.

The figure, which matched economists' expectations, marks a deceleration from the 0.5% growth recorded in the third quarter. The slowdown was primarily driven by softer domestic demand and a reduction in business inventories.

Despite the late-year slowdown, the French economy expanded by 0.9% over the full course of 2025. This performance outpaced the 0.7% growth assumption used by the government in its budget planning.

The stronger-than-anticipated annual result increases the likelihood that France's fiscal deficit will be slightly below the currently projected 5.4% of gross domestic product.

The economy demonstrated notable resilience, holding up better than many forecasters had predicted amid months of political turbulence in a deeply divided parliament that weighed on consumer and business sentiment.

"We're off to a good start in 2026," Finance Minister Roland Lescure said on TF1 television. "I hope we'll get at least the 1% (growth) we're expecting."

Some political uncertainty is expected to ease as Prime Minister Sebastien Lecornu prepares to push the 2026 budget through parliament, ending a protracted standoff over fiscal policy. No-confidence motions from opposition parties are expected but are considered unlikely to pass.

Analysts, however, caution that the prospects for a strong economic rebound remain limited. ING economist Charlotte de Montpellier described the outlook as "modestly positive," pointing to several potential drags on growth.

In a note, she stated the budget "remains unfavourable to businesses" and warned that higher taxes could curb investment and job creation. While early signs of improving business confidence are encouraging, a strong euro could also hinder French exports.

The fourth-quarter growth figure was shaped by several competing economic forces:

• Domestic Demand: Strong household spending and investment collectively added 0.3 percentage points to GDP growth.

• Foreign Trade: An increase in exports paired with a decline in imports provided a significant boost, contributing 0.9 percentage points.

• Inventories: A substantial drawdown in corporate stockpiles acted as the primary drag, subtracting 1.0 percentage point from the final growth rate.

Daily News

Economic

Middle East Situation

Political

Commodity

Data Interpretation

Remarks of Officials

Energy

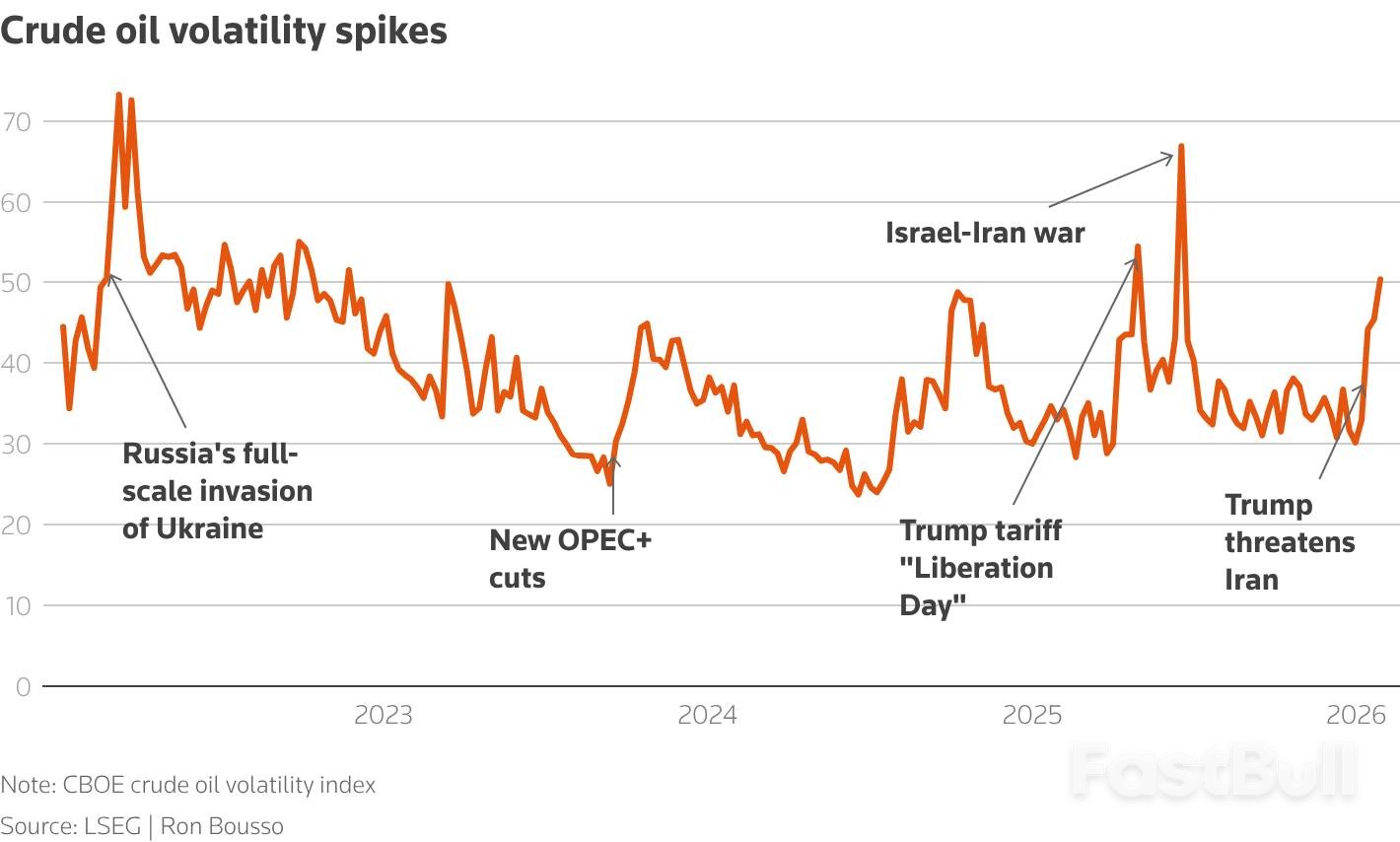

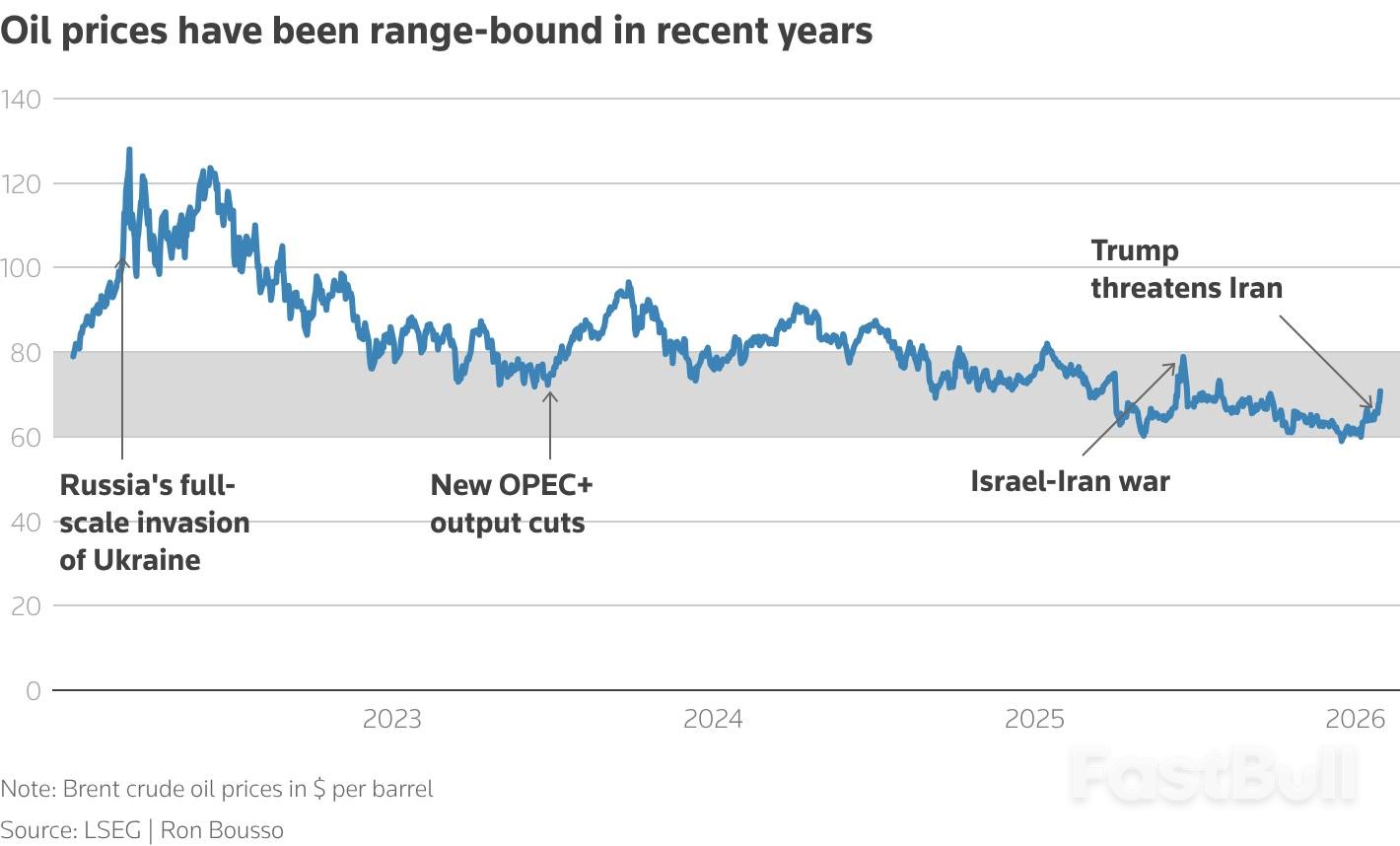

Oil prices have surged 15% in January, fueled by a series of supply disruptions and rising fears of a U.S. strike on Iran. Despite this, crude remains stuck in a familiar trading range. Tough rhetoric from Washington and Tehran is adding a risk premium, but with the global market still well-supplied, it will take a major, sustained supply shock to push prices significantly higher.

In January, Brent crude futures climbed above $70 a barrel for the first time since last July, putting the benchmark on course for its largest monthly gain since January 2022. This rally is the result of several supply setbacks coinciding with escalating geopolitical tension in the Middle East.

January saw a substantial hit to global crude supply from multiple, unrelated incidents, with some outages expected to last for weeks or months.

• Venezuela: Exports dropped to an average of just 605,000 barrels per day (bpd) following the U.S. arrest of Nicolas Maduro. This is well below the 2025 average of 780,000 bpd as the country's oil industry struggles.

• Kazakhstan: A power outage on January 18 halted production at the massive Tengiz field. While operations have resumed, output is not expected to return to its pre-outage level of over 900,000 bpd before mid-February.

• United States: A severe winter storm knocked out up to 2 million bpd of production, representing roughly 15% of the national supply, and the recovery is still underway.

While these disruptions have supported prices, the gains have been capped. The primary reason is the persistent reality of a global supply glut, driven by rising output from other regions, including key OPEC producers. This surplus has been putting downward pressure on prices for months.

Underscoring this trend, the International Energy Agency (IEA) forecasts a massive oversupply of 3.7 million bpd in 2026. This projection is supported by evidence of growing onshore and offshore inventories, which provide a significant buffer against short-term disruptions.

Adding to the bullish case, recent threats from President Donald Trump to strike Iran, coupled with a large U.S. military buildup in the region, have injected fresh anxiety into the market. The situation remains highly uncertain, with key questions about if, how, and when Washington might act—and how Tehran would retaliate.

The stakes for the oil market are extremely high. Iran, OPEC’s fourth-largest producer, pumped 3.3 million bpd in 2025, accounting for about 3% of global crude. Tehran has vowed to respond to any U.S. strike, potentially by attacking neighboring states. This raises the risk of a wider conflict that could disrupt energy exports from a region that supplies nearly 20% of the world's oil.

Market nervousness is clear. The CBOE crude oil volatility index (.OVX), a measure of expected price swings, shot up from 30 at the start of the year to over 50, its highest level since the Israel-Iran war last June.

With physical outages and Middle East tensions creating a bullish backdrop, why hasn't Brent crude broken out of the $60 to $80 per barrel band it has occupied for nearly two years?

The answer is that investors are only pricing in a modest geopolitical risk premium. The market's focus remains fixed on the prevailing global supply glut. Prices stayed within this same narrow range last year despite the Israel-Iran war, Ukrainian attacks on Russian oil facilities, and Trump's "Liberation Day" tariff announcement.

Ultimately, today's oil market is less responsive to political tensions than in the past. For prices to break into triple-digit territory, a doomsday scenario—such as a regional war that severely disrupts oil flows—would likely be required. For now, traders need to see actual supply losses large enough to erode the global overhang, and that remains a very high bar to clear.

Taiwan's economy expanded by 8.63% in 2025, marking its fastest pace of growth in 15 years, driven by relentless global demand for technology essential for artificial intelligence systems.

According to a statement from Taipei's statistics bureau, the full-year growth figure significantly outpaced the 7.5% median estimate from a Bloomberg survey of economists. This surge underscores the critical role of Taiwan's tech sector in the ongoing global AI buildout.

The economic acceleration was particularly pronounced in the final months of the year. Gross domestic product in the fourth quarter surged by 12.68% compared to the previous year, crushing the consensus estimate of 8.75%. This represents the most rapid quarterly expansion the economy has seen since 1987.

Confidence in Taiwan's economic momentum is expected to carry into this year. The sustained demand for AI-related hardware has prompted several financial institutions to revise their 2026 growth forecasts upward, with many now exceeding the central bank's projection of 3.67%. Goldman Sachs Group Inc. recently lifted its prediction for the year to 5.1%, a notable increase from its previous forecast of 4.4%.

This optimism is reinforced by major industry players. Taiwan Semiconductor Manufacturing Co. (TSMC), Asia's most valuable company, signaled its confidence in the longevity of the AI boom by earmarking up to $56 billion in capital spending for 2026—a projection that exceeded market expectations. The chipmaker also anticipates its revenue will grow by nearly 30% this year.

Beyond the AI boom, strengthening trade ties have provided another powerful tailwind. A trade agreement reached between the U.S. and Taiwan this month lowered tariffs on Taiwanese goods from 20% to 15%. The deal also includes provisions for Taiwanese companies to increase investment and financing for their American operations by as much as $500 billion.

These favorable conditions helped propel Taiwan's exports to record levels in 2025. A significant portion of these shipments—over 60%, including specialized advanced chips—were exempt from U.S. duties while the Trump administration conducted a probe into various key imports.

As a result, Taiwan's trade surplus with the United States climbed to a record $150.1 billion last year, more than doubling the $64.7 billion figure recorded in the prior year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up