Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. House Oversight Committee Chairman Comer Is Considering Subpoenaing Bill Gates In Connection With The Epstein Case

Offshore Yuan Hit A New High Since May 2023. On Wednesday (February 4th), At The Close Of New York Trading (05:59 Beijing Time On Thursday), The Offshore Yuan (CNH) Was Quoted At 6.9412 Against The US Dollar, Down 61 Points From Tuesday's New York Close, Trading Within A Range Of 6.9290-6.9434 During The Day. On The Daily Chart, The Offshore Yuan Approached The Highs Of 6.9168 On May 10th, 2023, 6.8963 On May 4th Of That Year, And 6.6975 At 09:27

Alphabet Executives: We Expect To See A Foreign Exchange Tailwind To Consolidated Revenues In Q1 2026

The Philadelphia Gold And Silver Index Closed Down 0.23% At 397.53 Points. The NYSE Arca Gold Miners Index Rose 0.55% To 2830.82 Points. The Materials Index Closed Up 0.57%, While The Metals And Mining Index Closed Down 1.61%

Eric Beinstein, A U.S. Credit Strategist At JPMorgan Chase, Has Left The Company After 40 Years Of Service

Gold Tested The Psychological Level Of $5,000 For The Second Consecutive Day. On Wednesday (February 4th), Spot Gold Rose 0.32% To $4,962.73 Per Ounce In Late New York Trading. It Reached A Daily High Of $5,091.60 At 16:01 Beijing Time, Before Giving Back Its Gains And Hitting A Daily Low Of $4,853.67 At 00:48. Comex Gold Futures Rose 0.98% To $4,984.20 Per Ounce

Fed Governor Bowman: Freezing Bank Capital Levels Allows Fed To Correct Any 'Deficiencies' In Stress Test Models

US Federal Reserve Votes To Maintain Large Bank Stress Capital Buffers Until 2027 As It Considers Stress Test Changes

Toronto Stock Index .GSPTSE Unofficially Closes Up 175.53 Points, Or 0.54 Percent, At 32564.13

The Nasdaq Golden Dragon China Index Closed Up 1.9% Initially. Among Popular Chinese Concept Stocks, Yilong Energy Rebounded 64%, Jinko Solar Rose 8%, Yum China Rose 4.6%, Zai Lab Rose 3.7%, Canadian Solar Rose 3.3%, Li Auto Rose 2.2%, NetEase Fell 5.3%, 21Vianet Fell 5.6%, And WeRide Fell 6.3%

On Wednesday (February 4), The Bloomberg Electric Vehicle Price Return Index Rose 0.65% To 3533.63 Points In Late Trading. The Index Rose Throughout The Day, Exhibiting A "V"-shaped Pattern, Fluctuating At High Levels Between 2:00 PM And Midnight Beijing Time, Reaching A High Of 3561.87 Points In Early Trading. Among Its Components, BMW Closed Up 3.88%, Ola Electric Mobility Ltd. Rose 3.6%, STMicroelectronics Closed Up 3.6%, Porsche P911 Rose 3.5%, Li Auto H Shares Closed Up 3.43%, And Zhejiang Leapmotor H Shares Closed Up 2.88%, Ranking Sixth. Chilean Chemical And Mining Company Sqm Fell 5.3%, Mp Materials Fell 6.2%, WeRide Fell 7.2%, And Solid Power Fell 9.5%

The Yen Fell More Than 0.7%, Nearing 157 Yen. In Late New York Trading On Wednesday (February 4), The Dollar Rose 0.74% Against The Yen To 156.91 Yen, Trading Between 155.70 And 156.94 Yen During The Day, Continuing Its Upward Trend. The Euro Rose 0.64% Against The Yen To 185.26 Yen, Fluctuating At High Levels Since 10:00 AM Beijing Time; The Pound Rose 0.42% Against The Yen To 214.229 Yen, Giving Back About Half Of Its Gains Since 10:00 PM

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference

No matching data

View All

No data

No final decisions have been made and details of the IPO could change, the people said. A representative for SpaceX didn’t immediately respond to a request for comment.

The European Union is going back to the drawing board on its climate diplomacy after a difficult United Nations summit left the bloc feeling isolated and unable to secure more aggressive global action on emissions.

An internal EU document reveals that the 27-nation union is considering a new strategy that leans more heavily on its trade and financial power to achieve its climate goals. The move follows the COP30 summit in Brazil, where the EU struggled to build a coalition for its ambitious proposals.

Negotiations at the COP30 event were already hampered by a major geopolitical setback when U.S. President Donald Trump withdrew the world's largest economy from the climate talks earlier that year.

While the summit ultimately produced a deal to triple adaptation finance for developing nations, it failed to deliver new commitments to phase out fossil fuels or accelerate emission cuts. These were core demands from the EU, which even considered walking out of the negotiations in the final hours.

The internal document notes that the EU faced "increasing difficulty in lining up international support" for its high level of ambition. It described a feeling of being "largely isolated in the final phases of negotiations" as geopolitical dynamics shifted.

During the talks, the EU, along with climate-vulnerable island states and some Latin American countries, pushed hard to include language targeting fossil fuels in the final agreement. This effort was ultimately blocked by nations including Saudi Arabia, a top oil exporter.

However, the EU also faced criticism from another direction. Developing countries pointed out that the bloc resisted calls to increase climate funding until late in the negotiation process, undermining its position.

Andre Correa do Lago, Brazil's president of COP30, highlighted the fundamental disconnect in priorities. "The word 'ambition' doesn't belong to a vocabulary that only exists in the EU," he told Reuters. "When you say 'ambition' in the EU, it's mitigation. When you say 'ambition' in India, it's finance. When you say ambition in other countries, it's technology."

In response to these challenges, the EU is now assessing how to better integrate its economic leverage into its climate diplomacy. The paper suggests that a failure to strategically deploy its trade and development tools "limited the EU's ability to reinforce its positions and to shape incentives in the negotiating rooms and beyond."

EU climate ministers are set to discuss these new ideas at a meeting in Cyprus. A spokesperson for Cyprus, which holds the EU's rotating presidency and drafted the document, confirmed the talks are aimed at "strengthening the effectiveness of the COP31 negotiations."

This approach isn't entirely new. Many EU trade deals already feature climate incentives. For example, a recent trade agreement with India included 500 million euros ($590.90 million) to support India's emissions reduction efforts.

"We're in a new era which is more transactional," commented one EU diplomat, adding that some member states also want a clearer policy on when to reject future climate deals that fall short of the EU's standards.

The EU's struggle on the global stage is mirrored by its own internal challenges. The bloc has found it difficult to maintain unified support for ambitious climate action among its member countries.

Just days before the COP30 summit began, the EU finally agreed on a new climate target after prolonged disagreements between governments over how far-reaching it should be. This internal friction complicates the EU's ability to project a strong, unified voice in international negotiations.

The European Union's three largest economies—Germany, France, and Italy—are set to lead a major initiative to build strategic stockpiles of critical minerals, a move designed to reduce the bloc's reliance on China for essential raw materials.

According to sources familiar with the strategy, the plan assigns specific responsibilities to each nation to streamline the effort.

Under the new framework, the division of labor is clear:

• Germany will be responsible for overseeing the sourcing of the critical minerals.

• France will manage efforts to secure financing for the EU's purchases.

• Italy will oversee the storage and logistics for the stockpiled metals and minerals.

This coordinated structure was outlined in a December meeting with EU officials. However, details regarding which producers Germany has approached or which banks might be involved in financing the purchases have not yet been made public.

This stockpiling initiative is a core component of the European Commission's wider RESourceEU Action Plan, which was formally adopted in early December. The plan aims to secure the EU’s supply of materials like rare earth elements, cobalt, and lithium.

The Commission stated the initiative provides concrete tools and financing to achieve several key goals:

• Protect European industry from geopolitical tensions and price volatility.

• Promote critical raw material projects both within Europe and abroad.

• Forge partnerships with allied countries to diversify supply chains.

Work on the coordinated EU approach to stockpiling began late last year, with a pilot scheme anticipated to become operational early this year.

To support these efforts, the Commission is establishing a European Critical Raw Materials Centre. This body will act as a "portfolio manager" for the EU, handling joint purchasing and managing the stockpiles to ensure resilient supply chains.

Looking ahead, the EU is also planning to enhance its internal circular economy. By early 2026, the Commission intends to introduce export restrictions on scrap and waste from permanent magnets to strengthen Europe's domestic recycling capacity. Similar measures are being considered for copper scrap if deemed necessary.

Beyond stockpiling and recycling, the EU is exploring direct investment to secure resources at their source. In November, European Commissioner Maros Sefcovic noted that the bloc is considering buying direct stakes in critical minerals projects in Australia as another way to secure long-term supply.

Oil prices surged on Wednesday, driven by two major catalysts: a report that nuclear talks between the United States and Iran have been canceled and industry data revealing a surprisingly large drop in U.S. crude inventories.

By 12:39 ET, Brent oil futures for April delivery had jumped 3.5% to $69.68 a barrel. West Texas Intermediate crude futures matched the gain, rising 3.5% to trade at $64.42 a barrel.

The primary driver for the market rally was news that planned diplomatic talks between Washington and Tehran had collapsed. According to a report from Axios, the meeting scheduled for Friday was called off after the U.S. declined to change the location and format.

Iranian officials had reportedly insisted on narrowing the negotiations to focus solely on nuclear issues in a two-way format, raising doubts about the viability of the dialogue from the start.

This diplomatic breakdown coincides with rising military tensions in the Middle East. Recent incidents include:

• The U.S. military shooting down an Iranian drone that approached an American aircraft carrier in the Arabian Sea.

• A group of Iranian gunboats approaching a U.S.-flagged tanker in the Strait of Hormuz.

The possibility of escalating military action, with U.S. President Donald Trump threatening further measures and Tehran warning of retaliation, introduces significant risk to regional stability. Any conflict could potentially disrupt crucial oil supplies from the Middle East, a fear that has been supporting crude prices in recent sessions.

Adding to the upward pressure on prices, industry data showed an unexpected and substantial decline in U.S. oil stockpiles.

The American Petroleum Institute (API) reported that U.S. inventories shrank by 11.1 million barrels in the week ending January 30. This figure starkly contrasts with analyst expectations for a 0.7 million barrel build, catching the market by surprise.

The outsized inventory draw is largely attributed to extreme cold weather across the country, which has disrupted oil production and interfered with exports from the Gulf Coast.

The API data often signals a similar trend in the official government inventory figures, which are due later in the day. Ongoing disruptions in U.S. supplies have been a key factor helping to boost oil prices in recent weeks.

A sharp drop in gold prices, driven by institutional investors, has triggered a buying spree among Chinese retail investors looking to capitalize on the dip. This surge in demand from China is amplifying volatility in the global gold market.

The recent gold slump began after the nomination of Kevin Warsh as the next potential U.S. Federal Reserve chair. Markets reacted to Warsh's reputation as an inflation hawk, speculating he would be less inclined to pursue the deep interest rate cuts favored by U.S. President Donald Trump. This outlook caused the dollar to rebound, putting immediate pressure on gold prices in Asian markets.

Adding to the momentum, commodity trading models at Chinese quantitative hedge funds had reportedly already started reducing their gold positions ahead of the Lunar New Year holiday. The sudden price reversal caught many off guard, leading to significant losses for leveraged investors, from large funds to individual households.

Some analysts had previously warned that the gold market was overheated due to a heavy influx of capital from Chinese retail investors and speculators. As prices fell, these speculative players pulled back, stoking fears of a liquidity crisis in the market.

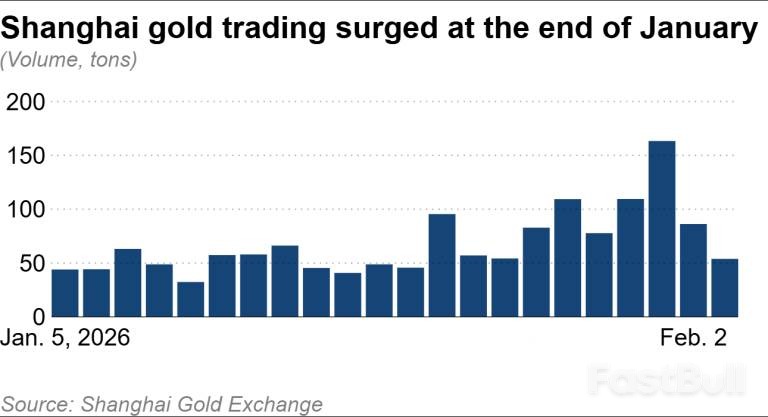

While institutional players sold, many retail investors in China saw the downturn as a long-awaited buying opportunity. Trading volume on the Shanghai Gold Exchange soared as gold prices fell, driven by a fear of missing out on lower prices.

The enthusiasm was visible on the ground. A sales associate at a Shanghai shopping center noted on Tuesday that the store "suddenly became crowded with customers wanting to buy while prices are still low." With the Lunar New Year approaching, many were also purchasing gold for holiday gifts.

In Wuhan, local media reported that customers in bathrobes lined up with folding chairs, waiting overnight for a gold sale to begin. The frenzy has also boosted related stocks, with Laopu, a high-end gold brand, seeing its share price soar to roughly 20 times its IPO price. "Products from Laopu Gold can be resold for more than the gold itself," a resident of Hubei province commented.

For many Chinese retail investors, gold represents one of the few reliable investment options available. Strict restrictions on converting the yuan into foreign currencies and moving capital overseas limit their ability to diversify and protect their assets. Although the Shanghai Composite Index is trending upward, it remains over 30% below its 2007 peak, leaving a lingering sense of caution around equities.

This sentiment is echoed across social media. A well-known blogger’s post stating, "It's a dip, buy the dip," has been widely shared, with the blogger claiming to have purchased gold 12 times during the current downturn. However, not all opinions are unified; some users have questioned the fundamental valuation of gold.

Official data underscores the trend. According to China's National Bureau of Statistics, retail sales of gold, silver, and jewelry hit a record 373.6 billion yuan ($53.8 billion) in 2025, a 13% increase from the previous year. This brought the cumulative total since 2006 to 4.6 trillion yuan.

The intense retail demand has put Chinese authorities on alert. On Monday, the Postal Savings Bank of China issued a notice urging investors to control their investment amounts and avoid chasing high prices.

Other major banks are following suit. China Construction Bank has raised its minimum purchase amount for gold, while the Industrial and Commercial Bank of China plans to implement limits on holiday trading starting Saturday.

This shift marks a notable change in tone. Previously, when the People's Bank of China resumed building its gold reserves, retail investors interpreted it as an official signal to buy. Now, authorities are actively issuing warnings that could dampen demand from one of the metal's most significant markets.

The UK's dominant services sector cut jobs last month as companies increasingly opted for automation over hiring, a closely watched business survey has revealed. Despite a rebound in business activity, employment numbers fell more sharply in January than in December, extending a downward trend that began in October 2024.

According to the monthly Purchasing Managers' Index (PMI), this marks the "longest period of job shedding" for the services sector in 16 years. Firms are not only cutting jobs but also choosing not to replace staff who leave voluntarily.

The UK's services sector is the largest part of its economy, contributing nearly 80% of the country's output and covering industries from hotels and catering to finance and law.

The survey, compiled by S&P Global, found anecdotal evidence that companies are turning to automation to fill staffing gaps and increase productivity. This trend is amplified by squeezed profit margins and fragile market conditions that are dampening hiring decisions.

Tim Moore, economics indices director at S&P Global Market Intelligence, highlighted the pressure on businesses. "There were again gloomy signals for the UK labour market outlook as staff hiring decreased at a steeper pace in January as firms looked to offset rising payroll costs," he said.

The move toward automation has been particularly evident in specific industries. On Tuesday, Anthropic, the company behind the Claude chatbot, announced its tool could automate legal work. The news triggered a sharp sell-off in the shares of publishing and data companies, which began in London and continued across global markets into Wednesday, even as the FTSE 100 reached a record high.

These cost pressures are compounded by several other factors:

• Rises in the national living wage.

• Increases in employers' national insurance contributions since last April.

• Widespread inflation in energy and food prices.

• A recent shake-up of business rates, which has pushed up bills for some companies and drawn criticism of the government.

In a contrasting trend, overall business activity in the services sector had a strong start to 2026. After a weak final quarter, output rebounded to a five-month high.

The PMI survey's activity index rose to a balance of 54 in January, up from 51.4 in December. This marked the fastest pace of expansion since August, with any reading above 50 indicating growth.

When combined with the manufacturing PMI data for January, the overall reading showed that UK business activity hit a 17-month high.

The survey suggests the improvement was partly driven by a lift in sentiment following the budget in late November, which ended months of speculation about potential tax increases. This clarity allowed delayed projects and investment to move forward.

Expectations for a business upturn were also at their strongest since October 2024. That same month, Chancellor Rachel Reeves had imposed unexpectedly large tax rises on companies in her first budget, despite corporate concerns about geopolitical risks and weak consumer demand.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up