Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Egyptian inflation's December stability may embolden the central bank to continue rate cuts into 2026.

Egypt’s inflation rate held steady in December, a development that could give the central bank the confidence to continue cutting interest rates in 2026.

The state statistics agency, CAPMAS, reported Saturday that urban consumer price growth was 12.3% year-over-year, matching the previous month's figure. On a month-over-month basis, inflation slowed slightly to 0.2% from 0.3% in November.

This stability is a key metric for the Middle East's most populous nation, which has been working to control price pressures that peaked at a record 38% in September 2023. The subsequent economic turmoil led to a $57 billion global bailout package the following year.

While the headline inflation number has been cut by more than half over the last 12 months, several factors have prevented it from falling into the single digits. These include recent cuts to subsidies on items like fuel, backed by the International Monetary Fund, and a legal amendment that raised rents for millions of properties.

Despite these pressures, the central bank of Egypt anticipates a general easing of consumer price growth throughout 2026. This outlook holds even with ongoing challenges from non-food inflation and global geopolitical tensions. Authorities have also signaled that local fuel prices will not be increased again before October.

Food Prices and Seasonal Pressures

Food and beverage prices, the largest component of the inflation basket, climbed 1.5% annually in December. However, they registered a 0.7% decline on a monthly basis.

Grocery prices could face temporary upward pressure as Ramadan approaches. The Muslim holy month, starting in mid-February, is typically marked by evening feasts and family gatherings that lead to a surge in household spending.

The slowdown in inflation over the past year has already allowed Egypt’s central bank to pivot from its aggressive tightening cycle. It has delivered a combined 725 basis points in interest rate cuts across five meetings, moving away from a record high.

These rate reductions are considered essential for two main goals:

• Encouraging investment from the private sector.

• Reducing the government's interest payments, which consume a large portion of state spending.

The central bank’s benchmark deposit rate currently stands at 20%. The next monetary policy decision is scheduled for February 12. Looking further ahead, Goldman Sachs Group Inc. forecasts an additional 700 basis points of rate cuts in 2026.

Venezuela and the United States are taking initial steps to restore diplomatic relations following a dramatic US military raid that resulted in the capture of former President Nicolas Maduro and his wife, Cilia Flores.

On Friday, Venezuela confirmed it had started talks with the U.S. about reestablishing ties. The announcement came as a team of American diplomats and a security detail visited the South American nation to conduct an assessment for potentially reopening the U.S. Embassy in Caracas.

The interim government, led by President Delcy Rodriguez, stated it "has decided to initiate an exploratory diplomatic process" with Washington aimed at restoring diplomatic missions in both countries. While Venezuela also plans to send its own delegation to the U.S., further details have not been provided. Such a visit would likely require the U.S. Treasury Department to waive existing sanctions.

Initially, interim President Delcy Rodriguez condemned what she called the United States' "grave, criminal, illegal, and illegitimate aggression" in phone calls with leaders from Brazil, Colombia, and Spain.

However, her tone shifted later on Friday. Rodriguez stated that diplomacy with U.S. President Donald Trump was the most effective strategy to defend Venezuela and "ensure the return of President Nicolas Maduro and First Lady Cilia Flores."

"We will meet face-to-face in diplomacy... to defend the peace of Venezuela, the stability of Venezuela, the future, to defend our independence and to defend our sacred and inalienable sovereignty," Rodriguez announced at a public event in Caracas.

As a gesture of goodwill, Jorge Rodriguez, the head of the Venezuelan National Assembly and the interim president's brother, announced on Thursday that authorities would begin releasing political prisoners.

While the official reason for Maduro's capture was his alleged links to drug trafficking, President Trump has openly cited access to Venezuela's vast oil reserves as a key driver for U.S. intervention.

At a White House meeting on Friday, Trump pressed top oil executives to increase their investments in Venezuela. He told them he wanted U.S. oil companies to commit a minimum of $100 billion to boost the country's oil production. "If you don't want to go in, just let me know, because I've got 25 people that aren't here today that are willing to take your place," Trump said.

The demand was met with caution. ExxonMobil CEO Darren Woods responded that Venezuela's current legal and economic conditions made such investment impossible.

After asking the media to leave the room for negotiations, Trump later claimed a "deal" had been formed. "They're going to be going in with hundreds of billions of dollars in drilling oil, and it's good for Venezuela and it's great for the United States," he said, without offering specifics.

The diplomatic moves follow a U.S. airstrike and military operation in Venezuela on January 3 that led to the seizure of Nicolas Maduro. The government in Caracas has stated the operation left 100 people dead. Maduro and his wife, Cilia Flores, were subsequently flown to New York, where they are facing drug-trafficking and other charges.

Despite the diplomatic talks, tensions remain high on the ground. On Friday, demonstrators rallied in the streets of Caracas, demanding Maduro's release and protesting the U.S. intervention.

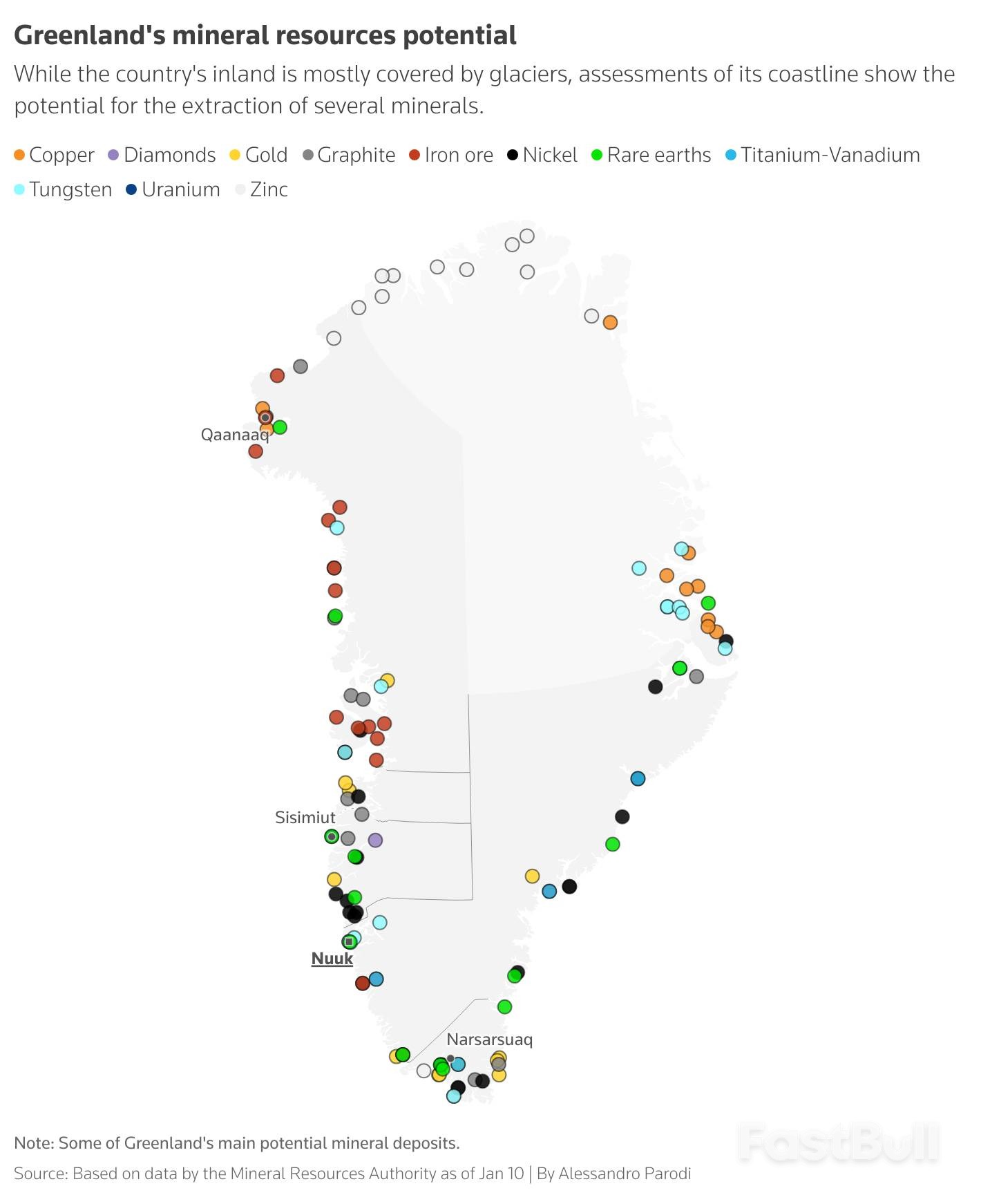

As U.S. Secretary of State Marco Rubio prepares to meet with his Danish and Greenlandic counterparts, Denmark finds itself defending a territory that has been on a steady path toward independence since 1979. The Trump administration's threats to seize Greenland have galvanized European support for Copenhagen, but they have also exposed a deep-seated dilemma: Denmark is spending immense political capital to protect a population that ultimately wants to go its own way.

This high-stakes geopolitical drama highlights several critical issues:

• The Trump administration is keeping all options open for taking control of Greenland.

• Denmark's global relevance is tied to its strategic Arctic territory.

• Greenland has been moving toward full independence for decades.

• Resisting U.S. pressure could come at a significant diplomatic cost.

The crisis has laid bare an uncomfortable reality. With Greenland's largest opposition party now advocating for direct negotiations with Washington, Copenhagen faces a precarious future. "Denmark risks exhausting its foreign policy capital to secure Greenland, only to watch it walk away afterwards," said Mikkel Vedby Rasmussen, a political science professor at the University of Copenhagen.

Denmark's geopolitical standing is intrinsically linked to Greenland. The territory's location between Europe and North America makes it a critical site for the U.S. ballistic missile defense system and a key piece of the Arctic strategic puzzle. Losing it would mean losing relevance on the world stage.

European allies have rallied behind Denmark not just out of solidarity, but because allowing the U.S. to claim Greenland could set a dangerous precedent. Such a move could embolden other major powers to pursue territorial claims against smaller nations, threatening the post-1945 international order.

In a joint statement on December 22, Danish Prime Minister Mette Frederiksen and Greenlandic Prime Minister Jens-Frederik Nielsen affirmed that "national borders and the sovereignty of states are rooted in international law." Frederiksen later added a stark warning: "If the U.S. chooses to attack another NATO country, everything stops, including NATO and the security the alliance has provided since World War Two."

For decades, Denmark’s strategic influence in Washington was bolstered by what became known as "the Greenland Card." As a 2017 report from the University of Copenhagen’s Centre for Military Studies noted, this allowed Denmark to maintain lower defense spending than other NATO allies.

However, Greenland’s own ambitions have been growing. The former colony gained greater autonomy and its own parliament in 1979. A landmark 2009 agreement went further, explicitly recognizing Greenlanders' right to independence should they choose it. Today, all of Greenland's political parties support independence, differing only on the timeline.

The Trump administration's pressure has simply accelerated a process already in motion, forcing Denmark to defend a relationship with an uncertain future. "How much should we fight for someone who doesn't really care about us?" asked Joachim B. Olsen, a political commentator and former Danish lawmaker.

Denmark's financial commitment to Greenland is substantial. Copenhagen provides an annual block grant of roughly 4.3 billion Danish crowns ($610 million) to support Greenland's stagnant economy, which saw just 0.2% GDP growth in 2025. The central bank estimates an additional annual financing gap of 800 million Danish crowns is needed to make its public finances sustainable.

On top of this, Denmark covers the costs of policing, the justice system, and defense, bringing total annual spending to nearly $1 billion. Last year, Copenhagen also announced a 42 billion Danish crown ($6.54 billion) Arctic defense package, largely in response to U.S. criticism that it was not doing enough to protect Greenland.

Some argue the relationship transcends transactional terms. Marc Jacobsen, an associate professor at the Royal Danish Defence College, noted the deep historical and cultural ties. "We're talking about family relations," he said. "It's not just about defence and economy, it's about feelings, it's about culture."

Prime Minister Frederiksen is navigating a difficult diplomatic balancing act. According to Serafima Andreeva, a researcher at the Fridtjof Nansen Institute, Denmark has little choice but to stand firm to maintain its credibility. However, doing so risks alienating the United States at a time when "Russia is an accelerating threat and being on the U.S.'s bad side is no good for anyone in the West."

While Greenland has not been a major theme in this year's election, some in Denmark are questioning the long-term strategy. "I don't understand why we have to cling to this community with Greenland when they so badly want out of it," commented Lone Frank, a Danish science writer. "To be completely honest, Greenland doesn't inspire any sense of belonging in me."

For now, the debate over the cost of holding on to Greenland has been overshadowed by outrage at U.S. threats. As professor Rasmussen noted, "I fear we have gone into patriotic overdrive."

The Indian economy is demonstrating strong resilience and is expected to become the world's fastest-growing, supported by low inflation and sustained financial stability, according to a key adviser to Prime Minister Narendra Modi.

Speaking at a New Delhi event on Friday, Shaktikanta Das, who previously served as Governor of the Reserve Bank of India, affirmed this positive outlook while also acknowledging the significant challenges ahead.

Das noted that India will continue to face external pressures. He highlighted several key global risks impacting the economic environment:

• Slowing Global Trade: A slowdown in the growth of international trade is creating a drag on export-oriented economies.

• Strained Multilateralism: The framework of global cooperation is under severe strain, complicating international policy and trade relations.

• Strategic Sector Rivalry: Critical industries, particularly semiconductors, are increasingly being used as tools of geopolitical influence.

These global issues are compounded by the pressure of US tariffs on India, which are among the highest in the region. In response, many investors are adjusting their portfolios to focus more on domestic-oriented sectors that are less exposed to external headwinds.

A core strength underpinning India's economic forecast is its manageable inflation. While the consumer price index in November rose from the previous month's all-time low, it remained comfortably below the Reserve Bank of India's 4% target.

This low-inflation environment provides the central bank with significant flexibility, leaving open the possibility of further interest rate cuts to stimulate economic activity if needed.

Das concluded by emphasizing India's strategic policy posture. He stated that the country remains a strong advocate for a rules-based global system. At the same time, India is actively embracing a policy of self-reliance to safeguard its strategic interests in an increasingly uncertain world.

President Donald Trump on Friday called for a one-year cap on credit card interest rates at 10%, a proposal announced on social media that offered no details on how it would be implemented or enforced.

The move revives a pledge Trump made during his 2024 election campaign, which analysts at the time dismissed because any such cap would require congressional approval. The White House later confirmed the president's call on social media but did not elaborate on the plan.

In a post on Truth Social, Trump declared his intention to set the rate cap effective January 20, 2026. "Please be informed that we will no longer let the American Public be 'ripped off' by Credit Card Companies," he wrote.

However, the announcement did not specify how his administration would compel companies to comply, nor did it endorse any existing legislation. Major financial institutions, including American Express, Capital One, JPMorgan, Citigroup, and Bank of America, did not immediately respond to requests for comment.

The issue of high credit card interest rates has drawn criticism from lawmakers in both major parties. Republicans currently hold a slim majority in both the Senate and the House of Representatives, where legislative efforts to address the problem have previously been introduced.

Key bipartisan proposals include:

• A bill from Senator Bernie Sanders and Republican Senator Josh Hawley aimed at capping credit card interest rates at 10% for five years.

• A House of Representatives bill introduced by Democratic U.S. Representative Alexandria Ocasio-Cortez and Republican Congresswoman Anna Paulina Luna also seeking to establish a 10% cap.

Despite cross-party interest, these legislative proposals have not yet become law. Opposition lawmakers have criticized Trump for not delivering on his earlier campaign promise to tackle high rates.

The proposal was met with immediate criticism from some in the financial world. Billionaire fund manager Bill Ackman, who endorsed Trump, labeled the call a "mistake" on the social media platform X.

Ackman warned that forcing rates down could have severe unintended consequences. He argued that without the ability to price for risk, "credit card lenders will cancel cards for millions of consumers who will have to turn to loan sharks for credit at rates higher than and on terms inferior to what they previously paid."

This move also follows the Trump administration's recent action to scrap a Biden-era rule that capped credit card late fees at $8. The administration had supported business and banking groups in a legal challenge that claimed the rule was illegal, and a federal judge ultimately threw it out.

The United Kingdom has allocated £200 million ($270 million) to fund preparations for a potential troop deployment to Ukraine. This move follows a pledge made earlier this week for British soldiers to join a multinational force designed to operate in the country should a ceasefire be reached.

The commitment solidifies a "declaration of intent" agreed upon Tuesday by British Prime Minister Keir Starmer, French President Emmanuel Macron, and Ukrainian President Volodymyr Zelenskiy at a summit of Ukraine’s allies.

During a visit to Kyiv on Friday, British Defence Minister John Healey confirmed the new funding. He detailed that the money is earmarked for critical military preparations, including:

• Upgrading vehicles and communication systems

• Enhancing counter-drone protection

• Ensuring troops are fully prepared for deployment

The announcement came just hours after Russia launched a powerful hypersonic missile, an act that Kyiv’s European partners described as an attempt to intimidate them from supporting Ukraine.

The proposed Multinational Force for Ukraine (MNFU) is aimed at reinforcing security guarantees for Kyiv. While France has indicated it could send thousands of troops, Britain has not yet specified the size of its potential contribution. Prime Minister Starmer stated on Wednesday that the UK's plans are still being finalized.

Healey emphasized that the new funding demonstrates the government's commitment to "surging investment" into its Ukraine preparations.

A statement from the Ministry of Defence added that the capital spending "sends a clear signal to allies and adversaries of the UK's intent to lead the MNFU, (and) fulfil our promises to secure the peace in Ukraine."

UK to Supply Advanced "Octopus" Drones

In addition to the funding, Healey informed President Zelenskiy that production of Octopus interceptor drones will begin in January. The drones, which are based on a Ukrainian design but manufactured in Britain, will be sent to Ukraine by the thousands each month. This initiative is intended to help the country bolster its defenses against Russian drone attacks.

A coalition of major investment firms has announced its readiness to negotiate Venezuela's $60 billion in defaulted government bonds, potentially paving the way for one of the largest sovereign debt workouts in decades.

The Venezuela Creditor Committee, which includes heavyweights like Fidelity Management & Research Company LLC, Morgan Stanley Investment Management, and Greylock Capital Management, stated on Friday that they are prepared to begin talks once they receive the necessary authorization. A successful debt restructuring, the group noted, would "accelerate financing across all sectors of the Venezuelan economy."

This development follows a thaw in relations between Caracas and Washington after a US military operation ousted President Nicolas Maduro. Acting leader Delcy Rodriguez has expressed a willingness to collaborate with the Trump administration to boost oil production and stabilize the economy.

The political shift has ignited a rally in Venezuelan bonds, which have been in default since 2017.

• Government notes due in 2027 surged over 10 cents this week, marking their largest weekly gain since 2023.

• Debt from the state-owned oil company, Petroleos de Venezuela SA (PDVSA), also saw upward movement.

This recent bond surge has captured the interest of ETF managers and investors specializing in distressed debt. Bondholders are optimistic that negotiations could begin this year, though the timeline remains highly dependent on political factors.

While the focus is on the $60 billion in bonds, Venezuela's total debt is estimated to be as high as $170 billion when factoring in past-due interest, loans, and other financial obligations. This scale positions the potential workout as one of the most significant in recent history.

However, major obstacles remain. Venezuela is still under US economic sanctions that block its access to capital markets—a critical component for any restructuring plan. Furthermore, the future of the nation's oil industry is uncertain, and oil revenue will be the primary determinant of Venezuela's ability to repay its creditors.

The creditor committee, which formed about eight years ago after Venezuela's initial defaults, met on Monday to discuss the latest developments. According to sources familiar with the matter, some members believe Maduro's removal has accelerated the timeline for a potential restructuring.

One key proposal under consideration is to combine Venezuela's sovereign debt and PDVSA's debt into a single, unified restructuring. This approach would create a single pricing baseline for the country's debt and simplify the negotiation process.

The committee is represented by Thomas Laryea of Orrick, Herrington & Sutcliffe LLP. Its membership also includes Grantham Mayo Van Otterloo & Co, Fidera, HBK Capital Management, Mangart Capital, T. Rowe Price Associates, and VR Advisory Services Ltd.

American involvement in Venezuela's oil sector could create significant opportunities for international banks. JPMorgan Chase, in particular, appears well-positioned due to its historical presence in the country and experience with international trade financing.

While banks like JPMorgan and Citigroup reduced or ceased operations in Venezuela over the past few decades, the current situation may open doors for financing trade or investing in oil infrastructure. Despite the potential, significant challenges to doing business would persist even under an interim government.

JPMorgan could hold a competitive advantage from its 60-year history in Venezuela. The bank maintained a dormant office in Caracas for years after scaling back its operations in 2002, which could be reactivated.

The Department of Energy stated on Wednesday that oil proceeds would be settled in US-controlled accounts at global banks. ConocoPhillips CEO Ryan Lance also noted that US banks, including the Export-Import Bank, might need to be involved in financing Venezuelan oil investments.

Several strategic avenues could open for JPMorgan. One internal idea involved creating a trade bank to finance oil exports, mirroring the Trade Bank of Iraq established in 2003. The bank could also leverage its $1.5 trillion, 10-year Security and Resiliency Initiative to finance investments in critical minerals, which are abundant in Venezuela. Currently, JPMorgan trades non-sanctioned Venezuelan sovereign bonds with offshore counterparties.

A White House official confirmed that the Trump administration is carefully weighing all options, with a focus on the best interests of the American people. The official added that any formal announcements would come directly from the administration, dismissing other reports as speculation.

Although Latin America accounts for a small portion of US banks' revenue—just 2.19% for JPMorgan Chase in 2024—Venezuela's strategic importance transcends its economic size. While its economy represents only 0.1% of global GDP, its vast oil reserves give it immense geopolitical and economic significance, as highlighted in a January 5 note from Deutsche Bank economists.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up