Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Egypt drives major clean energy expansion, targeting 42% renewables by 2030 and green hydrogen leadership.

Egypt is setting the stage for a major expansion of its energy sector, backed by recent oil discoveries and an ambitious strategy to scale its renewable energy capacity. The country kicked off the year by signing $1.8 billion in renewable energy agreements, signaling a serious commitment to its clean energy goals.

These new deals, which include contracts with Norwegian developer Scatec and China's Sungrow, are a cornerstone of Egypt's plan to have renewable sources account for 42% of its electricity generation by 2030.

The first major project underway is a Scatec solar energy plant in Upper Egypt's Minya Governorate. According to an Egyptian cabinet statement, this facility will not only produce clean electricity but will also feature integrated energy storage stations. The solar plant is designed for a total capacity of 1.7 GW, complemented by 4 GW-hours of battery storage.

In a related move, the Egyptian government has finalized a power purchase agreement (PPA) with Scatec for 1.95 GW of clean power and 3.9 GW-hours of battery storage. Scatec noted in a statement that these agreements highlight a growing market demand for reliable clean power and sophisticated storage solutions.

Alongside generation projects, Egypt is focused on developing local manufacturing capabilities. Sungrow plans to construct a factory in the Suez Canal Economic Zone dedicated to producing energy storage batteries.

A portion of the factory's output will supply the new Scatec solar plant, while the rest will be targeted for regional export and to meet rising domestic demand. This initiative aligns with the government's strategy to bolster supply chain security through local production.

This aggressive push into renewables is a direct response to the severe energy shortages Egypt has faced in recent years. The country's economy was particularly affected by shortfalls in natural gas production from its giant offshore Zohr field.

To counter this, Egypt began courting foreign investment in green energy last year, aiming to secure over $10 billion in private funding for wind and solar projects. By the end of 2024, it had attracted $4 billion. To draw in more capital, the government has been offering a suite of incentives, including tax breaks, free land, and cash rebates. However, experts have noted that improvements to national energy policies are also essential to attract the desired level of investment.

By 2024, Egypt's installed renewable energy capacity, including hydropower, wind, and solar, was nearly 7.8 GW. Solar capacity alone saw a dramatic rise from just 35 MW in 2012 to almost 2.6 GW in 2024. The New and Renewable Energy Authority reported that the country's total renewable installed capacity reached about 8.6 GW last year.

Looking ahead, Egypt is also positioning itself as a key player in the green hydrogen market. Last year, the government announced investment incentive packages designed to capture 8% of the global green hydrogen share, equivalent to 10 million tonnes per year.

Egypt's strategic location, connecting Africa, Europe, and the Middle East, combined with its abundant sunlight, makes it an ideal hub for green hydrogen production and export. The Suez Canal is expected to become a critical artery in the global clean energy supply chain.

A tangible project in this area is the expansion of green ammonia production at the Misr Fertilisers Production Company complex in Damietta. In partnership with Scatec and Yara International, the project will use 480 MW of solar and wind energy to produce 150,000 tonnes of green ammonia annually, with production slated to begin in 2027.

While these new projects are promising, the government acknowledges that more international support is needed to hit its 2030 energy mix target. Investors have previously been hesitant due to a lack of clarity on long-term power pricing. However, the new PPA-based deal with Scatec suggests a shift towards more favorable contracts designed to attract foreign developers.

Azza Ghanem, an Energy and Environmental Economist, noted the significant progress. "Egypt has successfully integrated more than 2,000 MW of wind power and over 2,500 MW of solar power into the national grid—a significant shift compared to the situation a decade ago," she said. Ghanem emphasized that public-private partnerships and long-term PPAs have been crucial for driving investment, helping to reduce fossil fuel reliance and support Egypt's climate objectives.

To realize its full green energy potential, Egypt must continue to refine its policies and successfully attract higher levels of international investment across the entire clean energy spectrum.

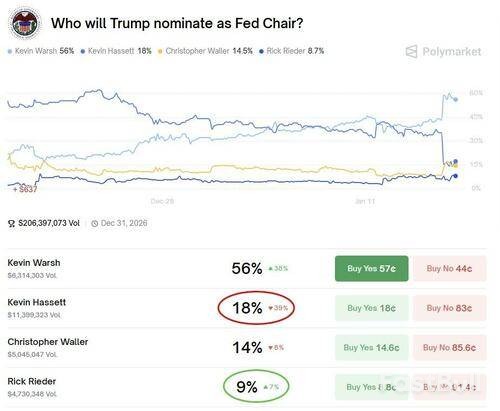

BlackRock executive Rick Rieder’s recent meeting with President Donald Trump has ignited speculation that the bond market heavyweight is a serious contender to become the next chair of the Federal Reserve.

The meeting immediately raises the profile of Rieder, who serves as BlackRock's chief investment officer for global fixed income. Over the last decade, this role has made him one of the most powerful voices in global bond markets. While he lacks direct experience within the Fed or in a government policy position, his opinions on monetary policy are closely monitored by investors and officials.

Rieder has built a reputation on his view that interest rates have been kept higher than necessary for the current economic landscape. He has consistently argued that the Federal Reserve should be prepared to lower rates toward a more neutral level, which he suggests is closer to 3 percent.

His perspective is shaped by decades of navigating credit markets, leading him to worry that overly restrictive monetary policy could unnecessarily strain the financial system and curb economic growth. Rieder believes the Fed has focused too much on historical inflation data and risks overtightening, especially as financial conditions are already helping to cool the economy. He advocates for a broader focus on overall financial health rather than a narrow obsession with inflation metrics.

Adding to his unique profile, Rieder has often downplayed concerns about large government deficits. He contends that structural forces, such as aging demographics, high global savings, and strong demand for U.S. assets, make these deficits more manageable than many critics believe.

At times, Rieder has also questioned the conventional wisdom that inflation must be strictly controlled, suggesting that a rate slightly above the Fed's target may not be harmful if it helps stabilize debt and support employment. These views resonate with Trump's long-standing calls for a central bank leader who favors lower interest rates. Still, nominating a Wall Street asset manager to lead the world's most important central bank would be a highly unconventional move.

As Rieder’s candidacy gains momentum, the field of potential nominees is shrinking. Last week, Trump indicated that economic adviser Kevin Hassett is no longer in the running, stating he prefers to keep Hassett in his current role at the White House. This removes a prominent name from the list of contenders.

With Hassett out, the race now centers on a smaller group. Besides Rieder, the most frequently mentioned candidates are former Fed governor Kevin Warsh and current governor Christopher Waller. Both Warsh and Waller offer deep experience within the central banking system and would represent more traditional choices compared to Rieder's market-oriented background.

Treasury Secretary Scott Bessent has confirmed that a decision is expected soon, noting that Trump aims to announce his pick before or shortly after the Davos forum. Rieder’s meeting at the White House signals that the president is actively considering both conventional and non-traditional candidates to shape the future of U.S. monetary policy.

Newly public transcripts from the Federal Reserve's 2020 meetings offer a detailed look at how Chair Jerome Powell personally championed a policy shift that he would later come to regret.

The records show that during the height of the COVID-19 pandemic, Powell forcefully advocated for strong, specific guidance on keeping interest rates at zero, winning a crucial internal debate despite significant pushback from his colleagues. Critics now see this commitment as a key reason the Fed was slow to act when inflation surged in the following years.

The pivotal discussion took place at the Fed's September 2020 meeting, six months into the pandemic. With interest rates already slashed to zero in March, Powell argued it was time to issue a decisive statement about how long they would remain there to support what he expected to be a long economic recovery.

The central bank releases edited minutes three weeks after each meeting, but full transcripts are withheld for five years. These new documents reveal the extent of the internal disagreement over the policy.

The statement ultimately issued by the Fed promised to hold rates near zero "until labor market conditions have reached levels consistent with the committee's assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time."

While the final decision saw only two official dissents—from Dallas Fed President Rob Kaplan, who wanted a weaker commitment, and Minneapolis Fed President Neel Kashkari, who wanted an even stronger one—the transcripts reveal a broader unease.

Several other policymakers shared Kaplan's concerns, even though they did not formally vote against the measure. This group included:

• Eric Rosengren (then-Boston Fed President)

• Tom Barkin (Richmond Fed President)

• Raphael Bostic (Atlanta Fed President)

Then-Cleveland Fed President Loretta Mester and then-Philadelphia Fed President Patrick Harker, who were both voting members, also expressed reservations but ultimately supported the decision.

Mester described "the changes to the liftoff criteria as being very significant ones." She added that she "would have preferred to wait to make such a change until the committee had had the opportunity to fully discuss the implications of this commitment."

Powell, however, saw no reason for delay. "With the expansion well under way, now is the time to focus our policies and communications on supporting the economy as it travels the long road to a full recovery. I see no need to wait further," he told his colleagues.

His push came just one month after the Fed had announced a historic overhaul of its policy framework, moving away from its long-standing practice of preemptively raising rates to head off inflation.

The transcripts show Powell was concerned that the market and the public were not taking this strategic shift seriously.

"It's so easy to slide back into a place where people say, 'There's no story here.' In fact, it's already happening," the Fed chair said. "A substantially weaker form of guidance going forward, to me, would sound an awful lot like the same reaction function we've been using for the past eight years."

At the time of the September 2020 meeting, the Fed's preferred inflation metric stood at 1.3%, and the median policymaker projection did not see it reaching the 2% target until 2023.

Instead, inflation soared the following year, peaking at 7.2% in mid-2022. For months, Powell and other Fed officials labeled the price spike "transitory," delaying an aggressive policy response. The strong commitment to near-zero rates made in 2020 is now widely seen as a factor that tied the central bank's hands.

By November 2022, after the Fed had begun its aggressive rate-hiking cycle, Powell admitted his misgivings at a Brookings Institution event.

"The one piece of guidance that we gave that I probably wouldn't do again is, we said we wouldn't lift off unless, until we saw both maximum employment and price stability," Powell reflected. "And I don't think I would do that again."

While the transcripts highlight a decision Powell now regrets, they also show his early recognition of the COVID-19 threat. At an unscheduled meeting on March 2, 2020, before the virus had fully hit the U.S., Powell was unequivocal about the risk at a time when some of his colleagues were still downplaying it.

Referring to a late-February gathering of finance officials in Saudi Arabia, he said, "I picked up growing concern at the G-20 meeting in Riyadh that weekend that the coronavirus was likely to now spread widely around the world."

"Markets and the general public need a clear signal that the Federal Reserve and other policymakers around the world understand the significance of what's going on and will move decisively," Powell urged. That day, the Fed cut its benchmark rate by half a percentage point.

Canada is preparing to launch a sweeping new automotive strategy designed to protect its domestic manufacturing sector and counter the Trump administration's efforts to lure factories to the United States. The plan aims to reward companies that build vehicles in Canada while opening the door to investment from Chinese automakers for the first time.

According to a government official familiar with the plan, this new policy will grant preferential market access to manufacturers with a physical presence in the country. This move comes as Canada seeks to reverse a trend of factory closures and job losses that has accelerated since the U.S. imposed tariffs on foreign-made vehicles last April.

The strategy, expected to be officially announced by Industry Minister Melanie Joly in February, is a direct response to recent setbacks. Over the past year, General Motors Co. shut down an Ontario plant, and Stellantis NV scrapped plans for a Toronto-area factory in favor of building Jeep vehicles in Illinois.

Canada's new policy represents a significant shake-up for its auto market, which saw 1.9 million new vehicle sales last year. Currently, the country is the largest importer of U.S.-made automobiles, with major brands like Tesla Inc., Nissan Motor Co., and Kia Corp. serving Canadian consumers entirely from foreign factories.

However, trade data shows that since the U.S. trade war began, American factories have been losing market share in Canada to vehicles produced in Mexico and South Korea.

The new strategy is designed to benefit the five companies that currently assemble vehicles in Canada:

• General Motors Co.

• Stellantis NV

• Ford Motor Co.

• Toyota Motor Corp.

• Honda Motor Co.

A significant portion of their Canadian production is exported to the United States. The policy from Prime Minister Mark Carney's government will also address key issues surrounding electric vehicles, such as sales mandates and consumer incentives, as Canada navigates an upcoming review of the US-Mexico-Canada Agreement.

A central pillar of this new direction is a recent trade truce negotiated between Prime Minister Carney and Chinese President Xi Jinping in Beijing. The agreement eases Canadian tariffs on Chinese-made EVs, allowing approximately 49,000 vehicles to enter the country under a low 6% tariff. In exchange, China is expected to lower tariffs on Canadian agricultural products and grant visa-free travel to Canadians.

During the trip, Minister Joly met with Chinese auto firms BYD Co. and Chery Automobile Co., as well as Canadian auto parts giant Magna International Inc.

A key part of the deal is a commitment from Chinese companies to explore major automotive investments in Canada. The Canadian government will review this arrangement in three years to ensure compliance.

However, any potential Chinese manufacturing operations in Canada would face specific conditions. The government official stated that Canada can require domestically built EVs to use a secure technology platform to mitigate security risks. This could create opportunities for Canadian firms like BlackBerry Ltd., a major player in vehicle software. The plan also leaves open the possibility of mandating joint ventures with domestic companies.

Before 2024, when Canada imposed a 100% surtax on Chinese-made electric vehicles, many of the EVs imported from China were Teslas. The Carney government has now promised to certify vehicles from Chinese brands like BYD, which could fill a larger portion of the import quota over time.

The deal with China also includes a gradually increasing requirement for a certain number of vehicles in the quota to be priced at or below C$35,000 ($25,155), a move that benefits lower-cost Chinese manufacturers.

This diplomatic maneuver with China raises questions about its impact on talks with the United States. The Canadian official confirmed that U.S. Trade Representative Jamieson Greer was notified of the agreement beforehand.

President Trump appeared unconcerned by the deal, telling reporters, "That's OK, that's what he should be doing. If you can get a deal with China you should do that."

Ultimately, Canada's strategy aims to reduce its reliance on the U.S. market and expand its vehicle exports globally. The official highlighted Canada's advantage of having free trade agreements with both Europe and Asia.

The government believes the most effective counter to U.S. protectionism is to create a linked, low-tariff market environment between Canada, Europe, and Asia. The recent agreement with China is seen as a major step toward achieving that long-term vision.

Ukrainian President Volodymyr Zelenskiy has declared that relentless Russian airstrikes are destroying "even the small opportunities for dialogue" between Kyiv and Moscow, casting a shadow over diplomatic efforts to end the nearly four-year-long war.

As his negotiating team prepared for a meeting in Miami with U.S. envoys Steve Witkoff, Jared Kushner, and Daniel Driscoll, Zelenskiy stressed that the primary goal was to communicate the severe impact of Russia’s actions.

"The main task for the Ukrainian delegation is to provide all the real information on what is happening, about the consequences of Russian strikes," he stated on social media. "One of the consequences of this terror is the discrediting of the diplomatic process, people are losing faith in diplomacy." He added that the American side "must understand this."

Zelenskiy’s comments follow recent criticism from U.S. President Donald Trump, who identified the Ukrainian leader as the primary obstacle to a peace agreement. In an interview with Reuters, Trump claimed that Russian President Vladimir Putin was "ready to make a deal" and that Zelenskiy was the main impediment.

This accusation reflects the American president's shifting positions on the conflict, having previously blamed both nations for the failure to reach an accord he claimed during his 2024 campaign could be easily settled.

Meanwhile, Ukraine remains focused on its own terms for peace. Kyrylo Budanov, Zelenskiy's presidential chief of staff, said he anticipated an "important conversation" with the U.S. team regarding the details of a potential agreement. "Ukraine needs a just peace. We are working toward the result," he posted on X.

Zelenskiy had earlier framed the latest talks as an effort to secure post-war security guarantees for Ukraine, with the hope of signing an agreement at the World Economic Forum in Davos, Switzerland, which begins on Monday.

The diplomatic friction comes as Russia continues its targeted attacks on Ukrainian infrastructure. The state gas company Naftogaz reported on Saturday that its production facilities had been struck for the sixth time in the past week.

These near-daily assaults on the energy grid have plunged large parts of the country into widespread blackouts lasting for days, compounding the crisis during the harsh winter months. According to Zelenskiy, the cities currently facing the most severe power shortages are Kyiv, Kharkiv, and Zaporizhzhia, along with their surrounding regions.

While a major U.S. military operation in Venezuela captured global attention, investors in Latin America's largest economy barely blinked. Following the capture of Venezuelan President Nicolás Maduro, Brazil's Bovespa stock index didn't crash—it climbed.

On January 5, the first trading day after the attack, the Bovespa advanced nearly 1%. It has continued to rise, gaining almost 3% through last Friday's close. Similarly, the iShares MSCI Brazil ETF (EWZ), a U.S.-traded fund tracking Brazilian stocks, is up about 3% since the operation.

The apparent disconnect raises a key question: Why are Brazilian markets so resilient to geopolitical turmoil on their doorstep? For investors, the answer lies not in regional politics, but in Brazil's own domestic economic story.

Analysts suggest that investors are far more concerned with Brazil's internal battle against inflation and the future path of interest rates than with events in Venezuela.

"In the case of Brazil, I don't see this being a big issue – I don't see the high risk of aggressive intervention there," Amr Abdel Khalek, an emerging markets strategist at MRB Partners, told CNBC. "Inflation and interest rates, that's really what the market is focused on."

After a period of aggressive monetary tightening, Brazil's central bank has held its benchmark Selic rate at 15%, a near two-decade high. However, recent data has fueled optimism that rate cuts are on the horizon. The Brazilian Institute of Geography and Statistics (IBGE) reported last week that annual inflation slowed more than expected to 4.26%, falling below the National Monetary Council's 4.5% target. This marked the lowest cumulative figure for the year since 2018.

"Unemployment is at a record low and inflation is going down," noted Silvio Cascione, Eurasia Group's director for Brazil. He added that while the average Brazilian might not feel their life is dramatically changing, "you're doing better than you had been a few years ago."

Despite the positive inflation news, lowering interest rates is not a simple decision. Cascione warns that rate cuts could complicate an economy that remains "severely imbalanced with a big fiscal problem."

Currently, high interest rates serve two crucial functions: they attract foreign capital and help keep inflation under control, even as the government injects stimulus into the economy. "Investors, they want to see some stronger action to correct some of those imbalances, to reduce fiscal expansion, to encourage more savings and investments," Cascione explained.

How the Presidential Election Shapes the Outlook

The path of monetary policy is heavily tied to the outcome of Brazil's general elections in October. Pablo Echavarria, a portfolio manager at Thornburg Investment Management, anticipates that rate cuts will likely begin in the first half of 2026. However, the pace of cuts in the latter half of the year will depend on who wins the presidency.

According to Echavarria, a re-election for President Luiz Inacio Lula da Silva would likely lead to fewer rate cuts. Conversely, if his opponent wins and brings "more fiscal prudence," the central bank could cut rates "a little bit more aggressively."

A more aggressive easing cycle could have a "pretty significant" impact on corporate earnings. Furthermore, it could trigger a major shift in domestic investment. With returns from the fixed income market falling, many local investors could move their capital into equities. "To the extent that interest rates do come down, you should see more domestic participation in the equity markets," Echavarria said. "If Lula loses the elections, the market will take that very positively."

While the Venezuela situation hasn't directly pressured stocks, it still has regional implications. President Lula has stated he is working with Mexico and Colombia to improve stability in Venezuela.

Thea Jamison, managing director at Change Global, believes this narrative of fostering investment and opportunity in Venezuela will be "meaningful" in the context of the Brazilian elections. "Latin America has a huge potential for [foreign direct investment] going forward if they square away this political and economic mismanagement," she said.

Brazil is already attracting significant foreign capital. Between January and November of last year, foreign direct investment (FDI) hit $84.1 billion, the highest level since 2014. Still, Jamison argues this is below its potential, noting that Spanish companies in particular have been divesting from the region's oil and banking sectors over the past few decades.

With the world's largest proven crude oil reserves, Venezuela's energy sector is a major focus. President Donald Trump has said U.S. oil companies will spend at least $100 billion to rebuild the industry under American protection.

This has raised concerns that a revitalized Venezuelan oil sector could compete with Brazil's own efforts to attract investment, particularly to its "equatorial margin" off the northern coast.

However, Elizabeth Johnson of TS Lombard believes Brazil is well-positioned to handle any volatility. She argues that while countries like Bolivia, Venezuela, and Argentina have struggled with government mismanagement of natural resources, "Brazil has had the steady opening and very clear rules about its oil and gas sector that really make it an attractive market for international oil companies."

Brazil's Economic Shield: Diversification

Even if Brazil's energy sector faced new competition, the country's broader economy is highly resilient. Unlike many resource-dependent nations, Brazil is a top exporter of a wide range of commodities, including:

• Beef

• Coffee

• Iron ore

• Soybeans

Thanks to this diversified economy and Lula's focus on attracting foreign investment, Johnson views the country as insulated from single-sector shocks. "If the oil price tanks, Brazil's economy is not going to crumble," she said.

A final reason for the market's calm may be that U.S. pressure on the region is not new. MRB Partners' Abdel Khalek pointed out that U.S. intervention in the domestic politics of emerging markets is a key risk for 2026. The Trump administration's imposition of a 50% tariff on Brazilian goods last year is one example of this ongoing pressure.

"The key point here is that this is not new," he said.

So, is the market's muted reaction a sign of complacency? "Perhaps," Abdel Khalek responded. "But I would take the other view and say, 'We don't really know exactly.' It's hard to predict what the U.S. is going to do next."

Corporate leaders are voicing quiet concern over Donald Trump's economic agenda, but analysts say a widespread fear of retaliation is preventing more forceful opposition. While lobby groups call for "fearless" defense of free markets, many executives appear hesitant to publicly challenge policies on trade, immigration, and direct corporate intervention.

This dynamic was on display when U.S. Chamber of Commerce CEO Suzanne Clark urged executives to defend free markets over government control. Speaking to a business audience, she emphasized that the U.S. must remain "open to the global exchange of talent and goods and ideas and innovation"—a message seen as a subtle critique of Trump's policies.

His administration has taken unprecedented steps in business affairs, including directing the U.S. to take stakes in tech companies, asserting control over corporate equity structures, imposing tariffs, and advancing immigration policies that the Chamber opposes.

Despite these interventions, the response from business leaders has been markedly subdued. According to several corporate governance experts, this hesitation stems from a fear that the administration will punish dissent. This marks a significant shift from Trump's first term, when executives more openly broke with him over events like his handling of the 2017 white nationalist rally in Charlottesville.

Richard Painter, a University of Minnesota law professor and former chief ethics lawyer for President George W. Bush, contrasted Trump's authoritarian approach with Bush's free-market principles. "I'd like to see a lot more aggressive stance from the Chamber here," Painter said of Clark's speech. "A lot of executives may have voted for Trump, but they need to speak out against coercion."

Mark Levine, the New York City Comptroller who oversees public pension fund investments, described the CEOs' recent comments as "baby steps," noting they tend to speak up only when Trump's actions directly impact their bottom line. "I don't think capitalism works if we allow a president with autocratic tendencies to dictate the behavior of every company in America," Levine said.

In response, a Chamber spokesman noted that Clark advocates against government intervention regardless of the party and said CEOs are doing "quiet work" behind the scenes rather than "rushing to outrage."

The few CEOs who have spoken out have offered temperate critiques focused on their specific industries.

• Exxon Mobil CEO Darren Woods on January 9 told Trump that Venezuela is "uninvestable," undercutting the White House's messaging on the country's oil industry. Two days later, Trump suggested he might exclude Exxon from future deals there, telling reporters, "I didn't like their response. They're playing too cute."

• JPMorgan CEO Jamie Dimon on January 13 voiced support for the independence of Federal Reserve Chair Jerome Powell after the administration opened a criminal investigation into his conduct. Trump dismissed the comments, telling Reuters, "I don't care what he says."

• Pfizer CEO Albert Bourla expressed frustration with Health Secretary Robert F. Kennedy Jr.'s move to roll back childhood vaccine recommendations, stating, "what is happening has zero scientific merit."

An Exxon representative declined to comment for this story, as did a representative for JPMorgan. Pfizer representatives did not respond to questions.

Despite Trump portraying his economic policies as a success, his approval rating on the economy stands at a lackluster 36%, below his overall 41% rating. "Under our administration, growth is exploding, productivity is soaring, investment is booming, incomes are rising, inflation is defeated, America is respected again," Trump said in Detroit on Tuesday.

However, a recent Conference Board survey revealed that uncertainty is the biggest risk factor for U.S. CEOs in 2026. Dana Peterson, chief economist at the Conference Board, noted that while the survey didn't ask about Trump specifically, "the executives I've spoken with understand that lobbying is different now."

Gary Clyde Hufbauer, a senior fellow at the Peterson Institute for International Economics, warned that CEOs may be calibrating their comments to avoid blowback and potentially benefit from Trump's policies. He cautioned that this silence could backfire.

"My guess is they (CEOs) think the actions are a passing fad," Hufbauer said. "Since state capitalism is catnip both to progressive Democrats and to some MAGA Republicans, executives and investors could be asleep at the switch," he added, suggesting their silence could open the door to heavier regulation after Trump leaves office.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up