Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

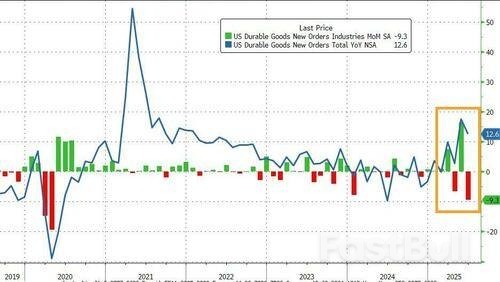

After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders were expected to tumble back to earth in preliminary June data... and they did.

After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders were expected to tumble back to earth in preliminary June data... and they did.

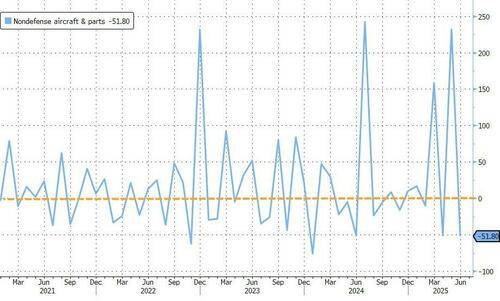

Durable Goods Orders plunged 9.3% MoM (slightly better than the -10.7% MoM expected) - the biggest drop since the COVID lockdowns. But as the chart below shows, it is a wildly noisy time series, almost entirely due to the lumpiness of aircraft orders...

Thanks to a swing from a 230% MoM rise to a 50% MoM decline in non-defense aircraft orders...

Excluding the noise of Boeing orders, the data was actually solid with a 0.25% MoM increase (better than the 0.1% rise expected) in durable goods orders (ex-Transports), pushing YoY orders uo 2.23%

Adding to the confusion, the value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military hardware, decreased 0.7% last month after an upwardly revised 2% gain in May

Capital goods shipments rose 0.4%, excluding defense and commercial aircraft, better than the +0.2% expected, adding to Q2 GDP growth hopes.

So much for the tariff-driven recession that every establishment economist was sure would happen...

Second-quarter earnings for European companies have come in ahead of expectations, with financials and U.S.-exposed sectors leading the surprise, Bank of America (BofA) analysts said.

"European EPS growth surprises to the upside so far on the back of low expectations," BofA wrote, noting that with one-third of companies reporting, Stoxx 600 earnings per share (EPS) are up 8% year-on-year, well above the 2% growth forecast by consensus.

The upside has been “dominated by financials,” which were expected to have a subdued quarter.

Analysts had lowered EPS estimates by more than 6% since April, setting a “relatively low bar” for Q2 performance, BofA said.

While currency headwinds were a concern, given the 3.5% year-on-year gain in the euro trade-weighted index, the bank said “the start of Q2 reporting helps to ease these concerns,” especially for tech and healthcare, which are “so far contributing to the upside surprise.”

Despite the strong headline EPS figure, breadth is said to remain a concern.

“Only 47% of companies have beat EPS estimates so far, the lowest breadth of EPS surprises in six quarters,” BofA noted, citing foreign exchange effects as a key drag.

EPS beats for cyclicals excluding financials fell to 36%, the lowest since at least 2013.

However, U.S.-exposed stocks are said to have bucked the trend with a 57% EPS beat ratio, “a two-year high,” led by healthcare names, where “beats are running at an eight-year high of 73%.”

“Stocks beating EPS estimates have been rewarded with median 1-day outperformance of 1.4%,” BofA said. They stated it is the best post-earnings performance since Q1 2020.

U.S. stock futures pointed to a steady open on Friday following record closes for the S&P 500 and the Nasdaq in the previous session, while investors looked for signs of progress in trade talks as they braced for the August 1 tariff deadline.

At 08:09 a.m. ET, Dow E-minis were up 33 points, or 0.07%, S&P 500 E-minis were up 4.25 points, or 0.07%, and Nasdaq 100 E-minis were down 12.5 points, or 0.05%.

The blue-chip Dow fell 0.7% in Thursday's session, but stayed close to its all-time high, last hit in December.

All three major indexes were poised to cap the week on a high note, as a flurry of tariff agreements between the United States and its trading partners - including Japan, Indonesia, and the Philippines - helped drive markets to new highs.

Expectations were rife the European Union would soon sign an agreement with Washington, while negotiations with South Korea gathered momentum ahead of the August 1 deadline set for most countries, as economies worldwide scrambled to avoid steep U.S. import tariffs.

"Tariff headlines are driving market risk sentiment, fuelling a risk-on mood this week. However, some volatility near the August 1st deadline remains possible," a group of analysts led by Adam Kurpiel at Societe Generale said.

A spate of upbeat second-quarter earnings also supported Wall Street's record run. Of the 152 companies in the S&P 500 that reported earnings as of Thursday, 80.3% reported above analyst expectations, according to data compiled by LSEG.

However, there were a few setbacks during the week. Heavyweights Tesla (TSLA.O), and General Motors (GM.N), stumbled and were on track for their steepest weekly declines in nearly two months.

Tesla CEO Elon Musk warned of tougher quarters ahead amid shrinking U.S. EV subsidies, while General Motors took a hit after absorbing a $1.1 billion blow from President Donald Trump's sweeping tariffs in its second-quarter earnings.

Intel (INTC.O), fell 7.5% in premarket trading on Friday after the chipmaker forecast steeper third-quarter losses than Street expectations and announced plans to slash jobs.

All eyes will be on the U.S. Federal Reserve's monetary policy meeting next week, with bets indicating that policymakers are likely to keep interest rates unchanged as they evaluate the effects of tariffs on inflation.

The central bank is under immense scrutiny from the White House, with President Trump leading a censure campaign against Chair Jerome Powell for not reducing borrowing costs, while often hinting that he would sack the top policymaker.

In a surprise move, Trump escalated the pressure by making a rare visit to the Fed headquarters on Thursday, where he criticized its $2.5-billion renovation project.

Uncertainty over Powell's tenure is prompting investors to assess potential market reactions in the event of a change in leadership at the central bank.

According to CME's FedWatch tool, traders now see a nearly 60.5% chance of a rate cut as soon as September.

Among other stocks, Newmont (NEM.N), added 2.3% after the gold miner surpassed Wall Street expectations for second-quarter profit.

Health insurer Centene (CNC.N), posted a surprise quarterly loss, sending its shares tumbling 15%.Deckers Outdoor

Paramount Global (PARA.O), rose 1.3% after U.S. regulators approved its $8.4 billion merger with Skydance Media.

Oil was steady on optimism over US trade talks ahead of a key deadline next week, and as tightness in diesel markets boosts sentiment.

Brent crude was above $69 a barrel after adding 1% on Thursday, while West Texas Intermediate traded near $66. Indian Commerce Minister Piyush Goyal said he was confident that his country could reach an agreement with the US before the Aug. 1 target date, while Brazil and Mexico looked to broaden trade ties.

Meanwhile, diesel prices have soared, leading to steep premiums for niche crude grades that yield more of the fuel and injecting much-needed strength into a bogged-down oil market. The latest European Union measures restricting Russian energy imports have also added to the tightness, according to TotalEnergies SE.

Crude has remained in a holding pattern this month, but is down for the year as increased supply from OPEC+ adds to concerns over a looming glut. The group will next meet on Aug. 3 to decide on production levels. On Thursday one member, Venezuela, was given a production reprieve by a US decision to let Chevron resume pumping oil in the country.

“The only strength right now is coming from the diesel markets,” said Florence Schmit, an analyst at Rabobank. “The US government’s backpaddling on curtailing Venezuelan oil supplies will only add to a relatively loose supply balance later this year.”

Durable Goods Orders Plunge in June as Transportation Sector Contracts Sharply.

U.S. durable goods orders fell sharply in June, down 9.3% month-over-month to $311.8 billion, reversing much of May’s 16.5% gain. The U.S. Census Bureau reported the drop was largely due to a steep decline in transportation equipment orders, which sank 22.4% to $113.0 billion. Traders are assessing whether this signals a broader cooling in manufacturing or a sector-specific retreat.

The 9.3% drop in total durable goods orders was driven almost entirely by transportation, especially aircraft orders. Transportation equipment orders fell $32.6 billion in June, reflecting ongoing volatility in the sector. Excluding transportation, durable goods orders actually rose by 0.2%, slightly above the 0.1% forecast. This narrow gain offers limited relief, suggesting underlying manufacturing demand remains soft but stable outside transportation.

Core durable goods orders—excluding transportation—posted a modest 0.2% gain, matching a downwardly revised 0.6% rise in May. Although slightly above expectations, the result reinforces a view that core manufacturing growth is tepid. Meanwhile, orders excluding defense spending fell 9.4%, pointing to waning demand from the private sector. These trends highlight cautious capital expenditure from businesses in a climate of elevated interest rates and tighter financial conditions.

The softer headline figure has not significantly altered rate expectations. With inflation readings showing signs of stabilization, the Federal Reserve is expected to maintain its current policy stance. However, continued weakness in durable goods orders—particularly in transportation—could start influencing forward guidance, especially if business investment falters further. Bond yields were little changed following the report, while the dollar held steady, reflecting market consensus that the Fed will stay on hold for now.

The sharp drop in durable goods orders in June, especially in transportation, points to a bearish short-term outlook for the manufacturing sector. While core orders showed modest growth, the broader trend remains fragile. Unless transportation rebounds and private-sector demand strengthens, traders should anticipate further pressure on industrial stocks and manufacturing-related assets in the near term.

It’s been a mediocre week for UK economic data.

House price data at the start of the week pointed to a flat market, with reasonable activity but no great conviction. The public finances turned out to be in worse shape than expected. Yesterday’s snapshots of economic activity from S&P Global pointed to a weaker-than-hoped services sector, with talk of job cuts and falling new orders.

Now, this morning, we’ve seen a tepid reading for consumer confidence, plus retail sales data which — you guessed it — missed expectations.

The most eye-catching point from the consumer confidence survey was that UK households feel like (and do remember, this is about stated “feels” rather than actions) saving more now than at any point since November 2007. As you’ll recall, that was in the run-up to the financial crisis and not long after Northern Rock had tested the British love of queuing to its limit.

That is strikingly downbeat. Saving money is no bad thing. But cautionary saving points to wider problems with the economy — people refrain from spending because they’re worried — and we’re spoiled for choice on those.

Inflation remains pretty high and shows no real sign of retreating. Wages might have gone up on average in “real” (after inflation) terms but not everyone has enjoyed an inflation-matching pay rise this year, with better-paid sectors tending to see the lowest increases in recent months.

So it’s possible that the better off are aware of the pinch and are keen to save more. People might also be worrying about their job security. It’s not at all clear what’s going on with the UK labour market right now, but we can fairly assume that it’s not booming.

Or it might be that they’re worried about taxes going up in autumn, given the state of the public finances, and so they’re saving as a precaution. Whatever the reason, the issue here is that the UK is a consumer economy. As I said, saving is no bad thing, but if spending is weak then that isn’t great for business sentiment — or employment — either.

On the other hand, we don’t want to get too downbeat. As Rob Wood, chief UK economist at Pantheon Macroeconomics points out, the official retail sales figures have been distorted somewhat by the timing of Easter this year. Looking at the figures across the year, retail sales have gone up by about 0.3% a month, “a healthy clip.”

The consumer confidence figure, says Wood, should be taken with a pinch of salt. Savings intentions alone don’t necessarily correlate with actual savings balances — in other words, what people say and what they do are two different things.

Looking at company results also points to people acting in a less cautious manner than they’re necessarily letting on. The hot weather helps of course, but pubs have been reporting very solid results so far this year, with JD Wetherspoon, Marston’s, and this morning, Mitchells & Butler’s, all doing decent business.

At the end of the day, you can’t spend money you don’t have. And so far, it seems that people do have money to spend, even if they don’t feel that cheerful about what’s going on in the wider world.

Will it last? Clearly that depends on what happens with the jobs market. That may in turn depend on how many more political mini-crises we end up having between now and the end of the year.

There is a lot of pressure on the government, and while there are hints that a wealth tax is not the way that UK chancellor Rachel Reeves is inclined to go — as much for practical reasons as anything else — she has also talked up the need to obey the fiscal rules, and that almost certainly means tax increases.

The lack of predictability, as much as anything else, will continue to hang over consumers and businesses until the direction of travel is clearer.

But on the bright side, the mediocre data should make life easy for the Bank of England next month. A quarter-point interest rate cut is widely expected — even if there’s a chance it could be the last we’ll see this year.

And as I pointed out in yesterday’s piece, in relative terms, the UK does still have some advantages. Not least that we’re hardly the only economy suffering from uncomfortable levels of uncertainty. Sometimes muddling through until things get better is all you need to do. Let’s hope we can manage that.

Looking at wider markets — the FTSE 100 is down 0.3% at around 9,110. The FTSE 250 is down 0.4% at 22,060. The 10-year gilt yield is sitting at 4.64%, higher on the day, as are yields on its German (2.73%) and French (3.40%) peers.

Gold is down 0.7% at $3,340 an ounce, and oil (Brent crude) is up about 0.2% to $69.30 a barrel. Bitcoin is down 2.0% at $116,420 per coin, while Ethereum is down 0.5% at $3,720. The pound is down 0.4% against the US dollar at $1.345, and down 0.2% against the euro at €1.147.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up