Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Denmark and Greenland rally European support, asserting sovereignty amidst U.S. pressure for control of the Arctic island.

The leaders of Denmark and Greenland are meeting with top European officials in Berlin and Paris to build a united front following recent U.S. pressure to gain control of Greenland. The diplomatic tour aims to reinforce European solidarity as tensions over the Arctic island continue to simmer.

Danish Prime Minister Mette Frederiksen and her Greenlandic counterpart, Jens-Frederik Nielsen, are scheduled to meet with German Chancellor Friedrich Merz on Tuesday and French President Emmanuel Macron on Wednesday. The discussions will focus on "the current foreign policy situation and the need for a strengthened Europe," according to the Danish prime minister's office.

The meetings follow U.S. President Donald Trump's push to acquire Greenland, a Danish territory for centuries. While Trump recently withdrew tariff threats and ruled out a forcible takeover, the initial demand sent shockwaves through transatlantic relations and prompted European nations to reassess their reliance on the United States.

In addition to their political meetings, Frederiksen and Nielsen will also attend the Welt Economic Summit in Germany on Tuesday.

France has signaled strong backing for its European partners. President Macron is expected to reaffirm European solidarity and French support for the sovereignty and territorial integrity of both Denmark and Greenland.

A statement from the Elysee Palace noted that the leaders will address key regional issues, including:

• Security challenges in the Arctic

• The economic and social development of Greenland

The statement confirmed that France and the European Union are prepared to support Greenland's development initiatives. This move highlights a broader European effort to offer a strategic alternative to U.S. influence in the region.

The diplomatic crisis initially strained the NATO alliance, of which both Denmark and the U.S. are founding members. Though the conflict has shifted to a more diplomatic track, underlying tensions remain.

Last week, President Trump claimed he had secured "total and permanent U.S. access to Greenland" through a deal with NATO. The alliance's leadership has emphasized the need for allies to increase their commitment to Arctic security, citing potential threats from Russia and China.

In response, Denmark and Greenland have maintained they are open to discussions with the United States on a range of topics. However, they insist that their "red lines" regarding sovereignty and territorial integrity are non-negotiable.

Oil prices edged lower on Tuesday as the market weighed the prospect of returning supply from Kazakhstan against major production disruptions in the United States caused by a severe winter storm.

By 0900 GMT, Brent crude futures had slipped 28 cents, or 0.4%, to trade at $65.31 a barrel. U.S. West Texas Intermediate (WTI) crude saw a similar dip, falling 19 cents, or 0.3%, to $60.44 a barrel.

A key factor weighing on the market is the anticipated resumption of production from Kazakhstan's largest oilfield. The country's energy ministry confirmed on Monday that output is poised to return, although industry sources noted that volumes remained low.

Further signaling a return to normal operations, the Caspian Pipeline Consortium (CPC) announced it was back to full loading capacity at its Russian Black Sea terminal after completing maintenance at a mooring point. The CPC operates the main export pipeline for Kazakh crude.

"Oil production in Kazakhstan resuming in the near future puts downward pressure on the market," explained Tamas Varga, an oil analyst at brokerage PVM. He also suggested that some traders may be taking profits on heating oil, which had risen sharply due to the cold weather in the U.S.

Counterbalancing the bearish news from Kazakhstan, a severe winter storm sweeping across the United States has strained energy infrastructure and curtailed crude production.

Analysts and traders estimate that U.S. oil producers lost up to 2 million barrels per day over the weekend, accounting for roughly 15% of the nation's total production.

The freezing weather has also caused operational issues at several refineries along the U.S. Gulf Coast. According to Daniel Hynes, an analyst at ANZ, this has sparked concerns about potential fuel supply disruptions. In response, analysts are now forecasting significant drawdowns in oil inventories in the upcoming weeks, a factor that could provide a boost to prices.

Beyond the immediate supply disruptions, several other elements are helping to support the oil market.

Middle East Tensions Remain a Factor

On the geopolitical front, two U.S. officials confirmed on Monday that a U.S. aircraft carrier and its supporting warships have arrived in the Middle East. The move expands President Donald Trump's military capabilities in the region, particularly concerning potential actions against Iran.

"Supply risks haven't totally evaporated," noted Hynes. "Tension in the Middle East persists after President Trump dispatched naval assets to the region."

OPEC+ Poised to Maintain Production Discipline

Adding another layer of support, key members of the Organization of the Petroleum Exporting Countries and their allies (OPEC+) are expected to maintain their current pause on oil output increases for March.

According to three OPEC+ delegates, the decision is likely to be confirmed at a meeting scheduled for February 1. The eight members participating in the meeting are Saudi Arabia, Russia, the UAE, Kazakhstan, Kuwait, Iraq, Algeria, and Oman.

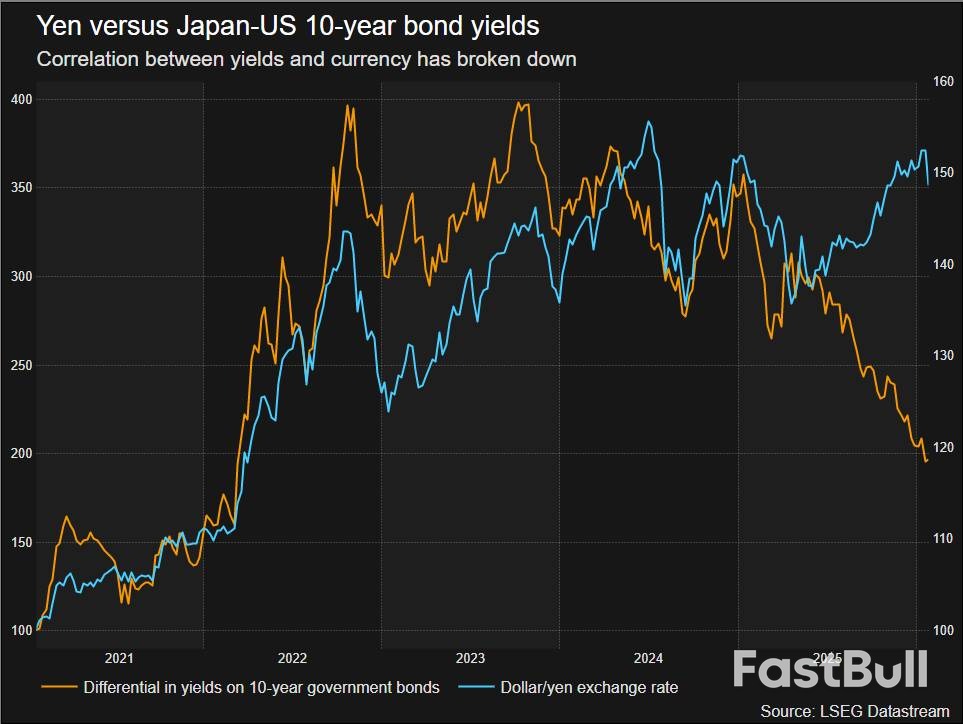

The Japanese yen's steady decline is flashing warning signs about the nation's financial health, prompting talk of government intervention. But with a snap election looming and stimulus promises on the table, history suggests that any official action to prop up the currency may only be a temporary fix.

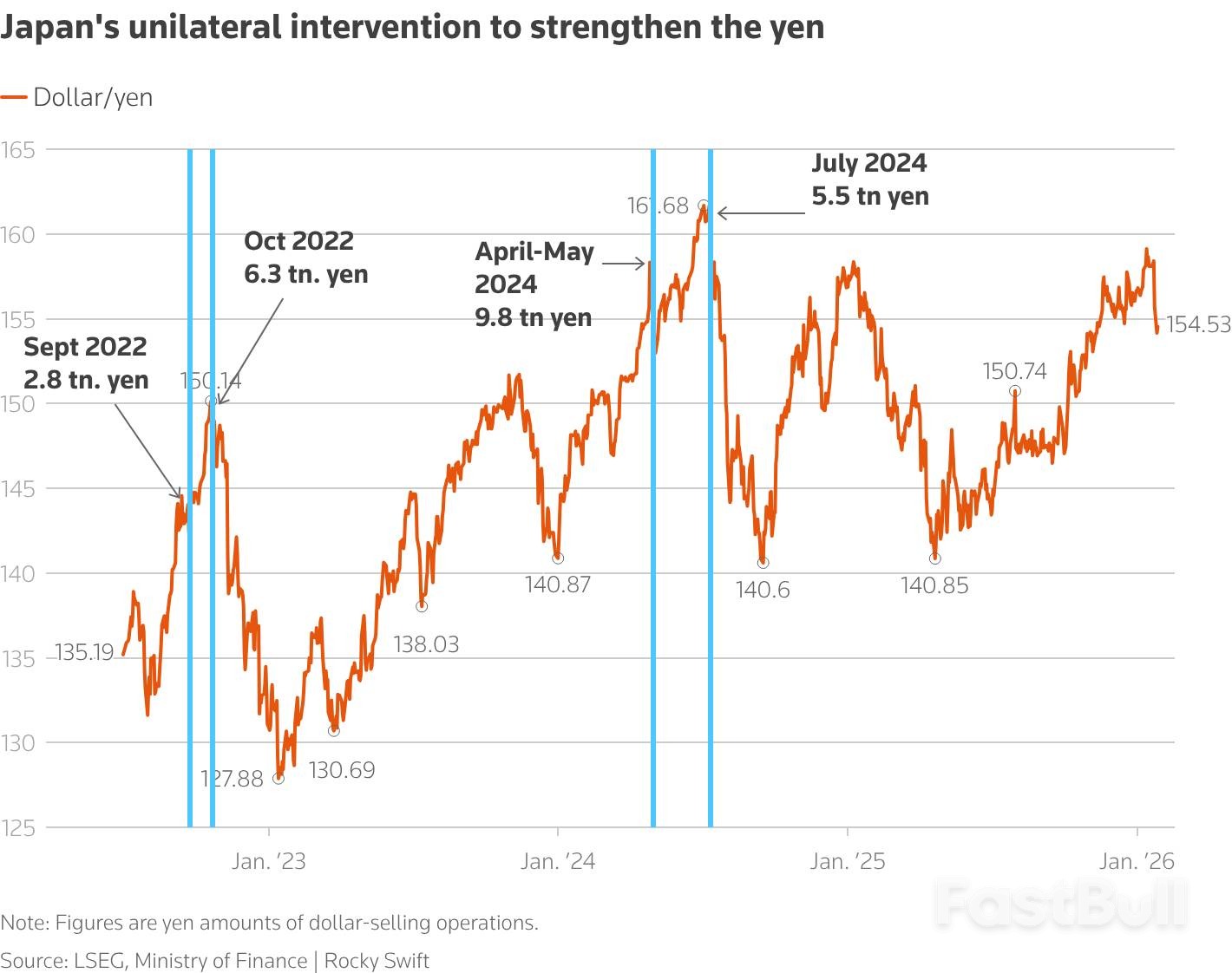

Japanese authorities are hinting at their first market intervention since July 2024. The move comes as Prime Minister Sanae Takaichi bases her election campaign on a platform of expanded stimulus, a strategy that is rattling investors and fueling a sell-off of the yen.

The yen's weakness has become a potent symbol of market anxiety. Typically, rising government bond yields would support a currency. Yet, even as Japanese government bond (JGB) yields have soared to record highs, the yen has continued its relentless slide. This breakdown in a classic market relationship signals deeper concerns.

Toshinobu Chiba, a fund manager at Simplex Asset Management, believes the currency could spiral toward 180 per dollar if Takaichi secures a major election win and expands her stimulus plans. While many expect intervention if the dollar-yen rate moves beyond 160, Chiba is skeptical about its long-term impact.

"Most investors do not trust Japan's fiscal control," he noted. "It's a sovereign credit issue."

At the core of the market's fear is Japan's massive government debt, which stands at roughly 230% of its gross domestic product—the highest in the developed world.

Adding to these concerns, Prime Minister Takaichi has pledged to suspend the consumption tax on food. This policy, also supported by her main political opponents, would remove approximately 5 trillion yen ($32.36 billion) in annual revenue without a clear plan to cover the shortfall.

These fears of a fiscal blowout triggered a sharp market reaction last week. Long-dated JGB yields jumped to record highs, stocks saw their worst selloff in three months, and the yen hit record lows against the euro and Swiss franc.

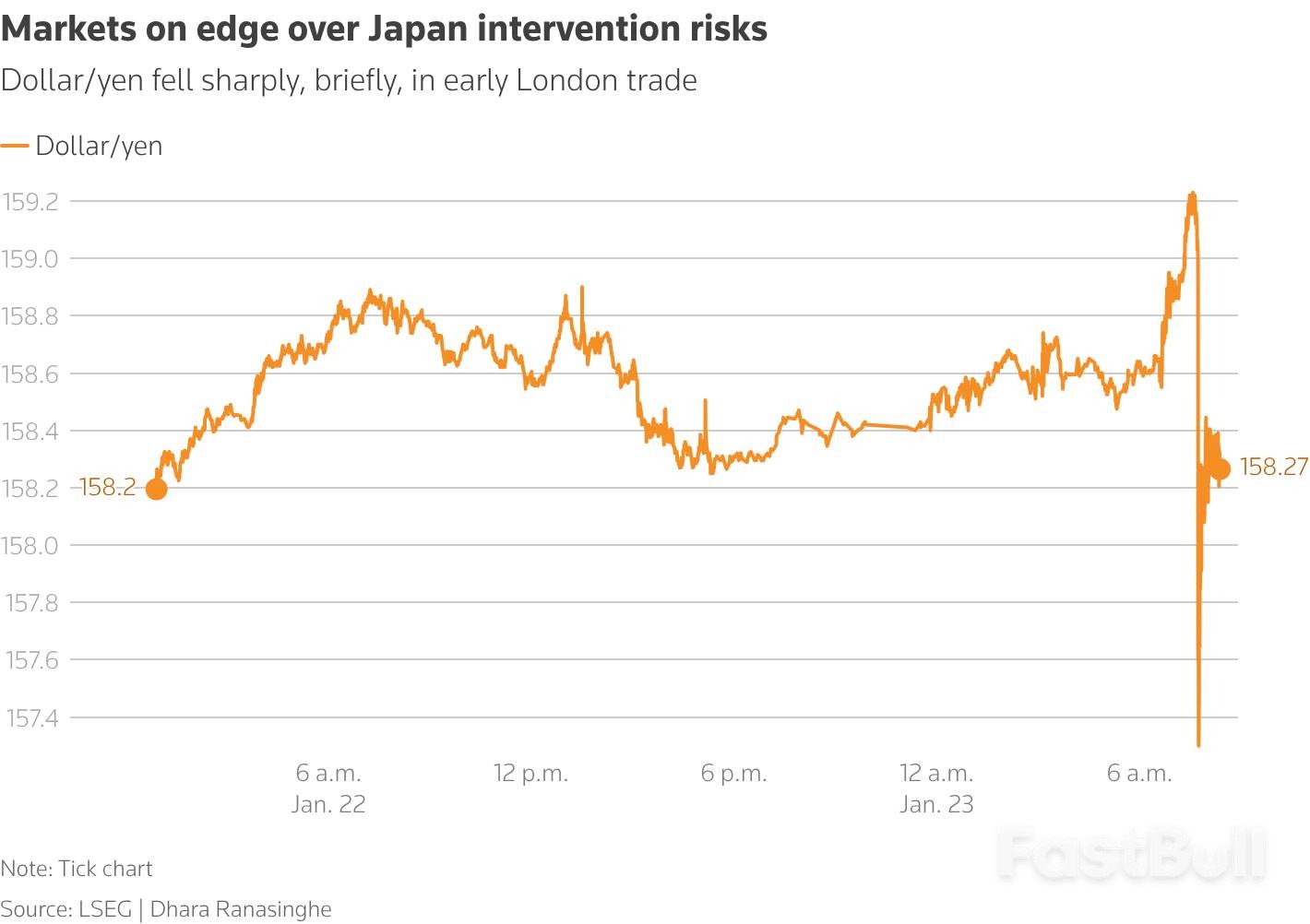

Facing a potential "Sell Japan" market rout ahead of an election, authorities appeared to act. On Friday, the yen suddenly spiked twice despite hawkish signals from the Bank of Japan, in what traders believe were rate checks from both the BOJ and the Federal Reserve Bank of New York.

The yen strengthened dramatically, moving from around 159.20 per dollar to as strong as 153.30 by the close of the day.

While Japan's top currency diplomat, Atsushi Mimura, declined to comment, he affirmed that policymakers would maintain close coordination with their U.S. counterparts. Joint action with Washington, though rare, would align with American support for a stronger yen.

Even with potential U.S. support, currency intervention is generally seen as a tool to slow a currency's move, not reverse its fundamental direction—especially when that direction is driven by fears of fiscal collapse.

Japan's recent history with intervention highlights its limitations:

• Massive Spending, Limited Effect: In 2024, Tokyo spent a record 15.3 trillion yen to stop yen selling, driven by diverging monetary policies between the Fed and the BOJ. After an intervention in late April of that year, the yen was hitting new lows again within two months.

• Timing is Everything: A more successful intervention in July 2024 worked primarily because it was immediately followed by an unexpected dovish pivot from U.S. Federal Reserve Chair Jerome Powell.

Today, policymakers are worried that suspending the food tax will be politically difficult to reverse. Chris Scicluna, head of research at Daiwa Capital Markets Europe, pointed out that consumption tax hikes since 2014, while unpopular, were crucial for improving Japan's fiscal health.

"The snap election is very much crystallising in investors' minds the risks that Japan's public finances just are not going to be put on a sustainable path," Scicluna said. While the country is benefiting from the return of inflation and reasonable growth, he concluded, "Unfortunately, the politics is getting in the way."

As American influence resurges in the West and the global rules-based order shows signs of unraveling, the world's "middle powers" are emerging as a potential check on the growing unilateralism of global superpowers.

This sentiment found a powerful voice last week when Canada's Prime Minister, Mark Carney, addressed the World Economic Forum (WEF). He argued that middle powers must collaborate to defend against the rise of hard power and the erosion of multilateral institutions like the United Nations and the World Trade Organization.

"Great powers can afford, for now, to go it alone," Carney stated. "They have the market size, the military capacity and the leverage to dictate terms. Middle powers do not."

His warning was stark: "The middle powers must act together, because if we're not at the table, we're on the menu."

The term "superpower" has historically been associated with countries holding a permanent seat on the United Nations Security Council, such as China, France, Russia, the U.K., and the U.S. However, in today's geopolitical landscape, the only nations with true superpower status are arguably the United States and China.

The definition of a "middle power" is less precise. It generally refers to states that wield significant economic, diplomatic, or political influence but are considered to be in the second tier of the global hierarchy.

Most members of the G20 fit this description. A WEF whitepaper, "Shaping Cooperation in a Fragmenting World," identifies prominent middle powers in the Global North, including Australia, Canada, and South Korea. In the Global South, countries like Argentina, Brazil, and Indonesia fall into the same category.

While not mentioning him by name, Carney's speech was widely interpreted as a thinly veiled critique of U.S. President Donald Trump. Over the past year, Trump has frequently used the threat of tariffs to pressure partners into trade agreements more favorable to the United States.

Furthermore, Trump's threat to use military force to acquire Greenland and the U.S. capture of Venezuelan leader Nicolas Maduro have raised questions among allies about America's commitment to international law.

The speech resonated with a growing frustration at Davos over Trump's perceived hostility toward long-term allies, positioning Carney as the leader of a "middle powers charge." If this movement gains traction, analysts believe it could lead to more bilateral deals that sideline the U.S., such as the trade agreement announced Tuesday between India and the EU.

Stewart Patrick, a senior fellow at the Carnegie Endowment for Global Peace, praised Carney's address. "The most striking thing... was that it was the first time that the leader of a close U.S. ally had the courage to stand up to President Donald Trump and the guts to say enough is enough," he wrote in a post-Davos analysis.

Patrick added that Carney "signaled that at least one erstwhile ally is prepared not only to hedge against an unpredictable and predatory United States, but if need be to balance against it."

The White House response was sharp. In his own Davos speech, Trump lambasted Carney, stating, "Canada lives because of the United States. Remember that, Mark, the next time you make your statements."

This public friction highlights a deeper shift. "America's closest and longest standing allies are now publicly questioning not only U.S. credibility but its motives," noted Michael Butler, professor at Clark University. He warned that this damage may be lasting, cautioning that it "would be a mistake to assume that Canada and Europe will rush right back into the fold if and when U.S. foreign policy moderates."

While middle powers may be "having their moment," their ability to revive international cooperation faces significant hurdles. Carnegie's Stewart Patrick urged a dose of realism, outlining several key challenges.

First, the global political structure remains largely bipolar, dominated by the U.S. and China. Both superpowers may actively work to thwart or constrain initiatives led by smaller coalitions.

Second, the middle powers themselves are a "heterogeneous bunch." Their varied interests, competing values, and different visions for the world will often limit their ability to unite on joint projects.

Finally, Patrick cautioned against idealizing these nations. "Not all are admirable, much less prepared to contribute to international cooperation," he noted. "And even those that do support multilateralism are motivated not by altruism but by self-interest, albeit enlightened."

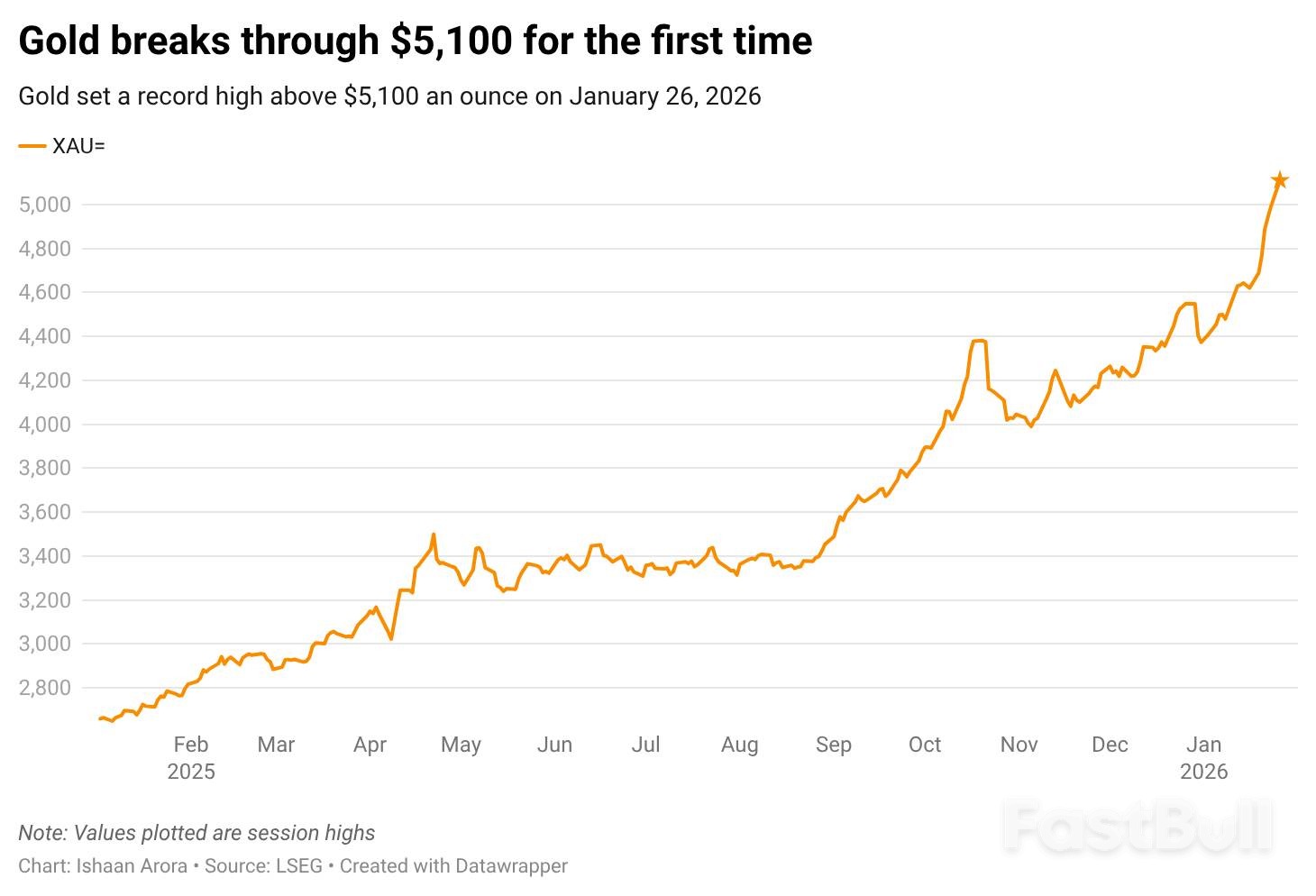

Gold prices climbed on Tuesday, continuing a powerful rally driven by geopolitical uncertainty and renewed trade tensions. The precious metal is holding near record highs as investors seek safe-haven assets.

Spot gold rose 1.6% to $5,092.70 per ounce after hitting an all-time high of $5,110.50 on Monday. This marks the first time the metal has breached the significant $5,100 level. Meanwhile, U.S. gold futures for February delivery saw a modest increase of 0.1%, trading at $5,088.40 per ounce.

Analysts point to President Donald Trump's aggressive trade policy as a key catalyst for gold's recent performance. "Trump's disruptive policy approach this year is playing into the hands of precious metals as a defensive play," said Tim Waterer, chief market analyst at KCM Trade. "The threats of higher tariffs to Canada and South Korea are doing enough to keep gold a safe-haven choice."

On Monday, President Trump announced plans to raise tariffs to 25% on certain South Korean imports, including autos, lumber, and pharmaceuticals, citing Seoul's failure to implement a trade deal. This followed recent tariff threats against Canada, which emerged after Canadian Prime Minister Mark Carney's visit to China.

This policy unpredictability, coupled with the risk of a U.S. government shutdown, has pressured the U.S. dollar. A weaker greenback typically makes gold cheaper for buyers holding other currencies, further boosting its appeal.

Christopher Wong, a strategist at OCBC, noted that gold's rally reflects a "material geopolitical, or uncertainty premium" that is "driven less by cyclical factors and more by the persistent uncertainty around geopolitics, policy unpredictability and (loss of) confidence in the dollar."

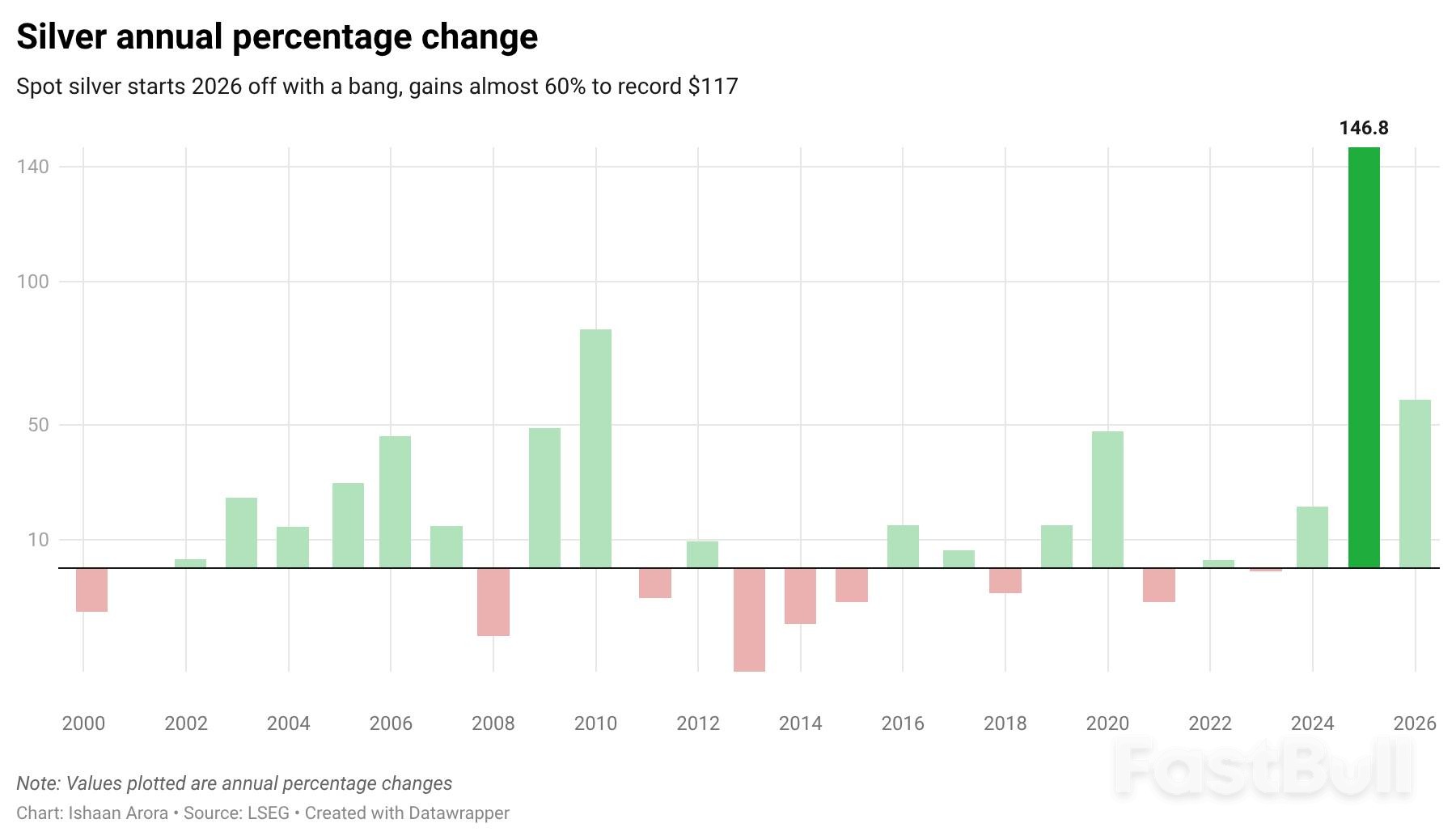

Silver has also experienced a dramatic surge, with spot prices jumping 6.1% to $110.19 an ounce. This follows a record high of $117.69 set on Monday. So far this year, silver is up more than 50%.

However, some analysts are sounding a note of caution. According to a note from BMI, a unit of Fitch Solutions, silver now appears expensive relative to gold. The gold-to-silver ratio has fallen to a 14-year low, suggesting a potential imbalance.

BMI attributed the latest rally to speculative buying and expects prices to ease in the coming months. The firm anticipates that easing supply tightness and peaking industrial demand, partly due to a slowing Chinese economy, could cool the market.

The rally has not extended to all precious metals. Spot platinum fell 2.2% to $2,697.45 per ounce after setting its own record of $2,918.80 in the previous session. In contrast, palladium added 1.1% to reach $2,004.37.

Market participants are also watching the U.S. Federal Reserve, which begins its policy meeting later today. The central bank is widely expected to hold interest rates steady, especially given the challenges posed by the Trump administration's policies to its independence.

Europe's economy could fall further behind its global rivals unless the European Union urgently overhauls banking regulations that are choking off lending, the European Banking Federation (EBF) has warned.

In a letter to European Commission President Ursula von der Leyen and other top officials, the influential industry group described the current situation as "neither satisfactory, nor sustainable."

Slawomir Krupa, President of the EBF and CEO of French bank Societe Generale, argued in the January 19 letter that the regulatory landscape has become "increasingly complex and fragmented."

The core issue, Krupa stated, is that "Banks, already subject to high capital requirements, operate under the spectre of further increases."

To back this claim, the EBF presented data from 2021-2024 showing the concrete impact on 15 major European banks:

• Over €100 billion ($119 billion) in extra capital was required due to discretionary supervisory actions.

• 90% of net capital generated by these banks was absorbed by these measures.

• This resulted in a lost lending capacity of €1.5 trillion.

Europe's sluggish economic growth has long been a point of concern for policymakers, and attempts to create a truly unified banking market have stalled.

A spokesperson for the European Commission acknowledged that simplifying rules is a "central priority" and pointed to existing proposals aimed at reducing complexity. However, the official noted that regulatory simplification is a shared responsibility among the Commission, Europe's parliament, national governments, and supervisors.

The Commission is currently preparing a report on the competitiveness of the region's banking sector, which "will help inform our assessment of where targeted measures could most effectively support banks' ability to compete and finance the European economy," the spokesperson added.

The European Central Bank (ECB) has also taken a cautious stance. In December, it proposed measures to simplify bank regulation but did not ease the overall financial burden. ECB Vice President Luis de Guindos stated this month that current capital demands support bank resilience and are not holding back lending.

This view is echoed privately by some supervisors, who argue that lowering capital requirements would more likely lead to higher shareholder payouts than increased lending to the economy. Adding to this complex picture, European banks are currently enjoying a period of record profits, with stock prices hitting their highest levels since the 2008 financial crisis.

The EBF's warning comes as other major financial centers move in the opposite direction. In the United States, former President Donald Trump has been pushing regulators to cut red tape for Wall Street, while UK regulators are also easing certain rules.

Krupa warned that these reforms abroad highlight a strategic risk for Europe. "Europe is risking further competitive disadvantage in terms of a level playing field that could be irreversible for our economy," he wrote.

To counter this, the EBF urged the EU to take several steps to simplify its regulatory framework, including:

• Eliminating the duplication of capital requirements.

• Removing the systemic risk buffer.

• Aligning rules for banks' trading divisions with those in the U.S.

($1 = 0.8413 euros)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up