Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Canada's pivotal data week reveals inflation's tenacity and cautious sentiment, guiding the BoC's stable policy into 2026.

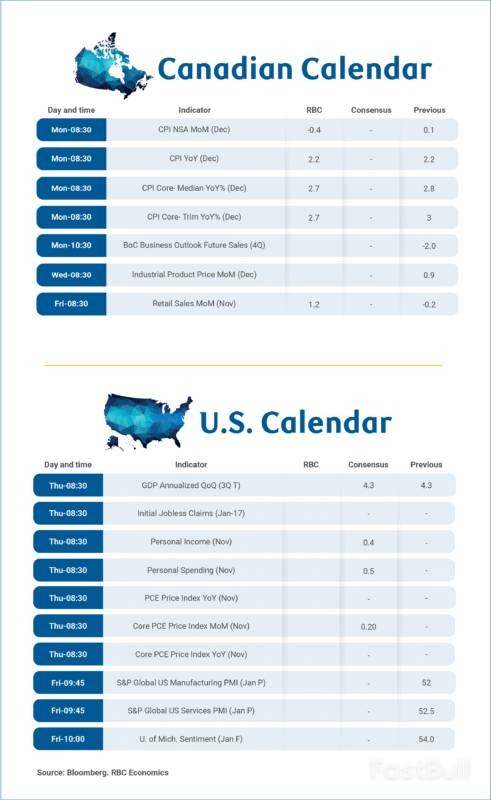

A critical week of Canadian economic data is ahead, featuring the final monthly inflation report for 2025 and the Bank of Canada's (BoC) Q4 Business Outlook Survey on Monday, followed by November's retail sales figures on Friday. These releases will offer crucial insights into the country's economic trajectory heading into the new year.

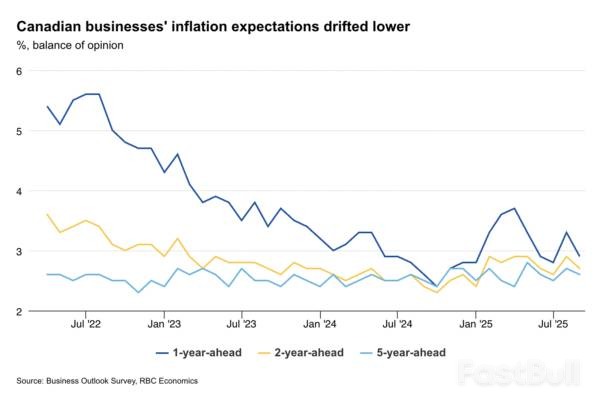

Headline inflation for December is expected to remain largely unchanged, holding steady at the 2.2% year-over-year rate seen in November. Core price growth trends are also anticipated to show little movement, leaving inflation running moderately above the Bank of Canada's 2% target.

Conflicting Price Pressures

Two key components are pulling the headline number in opposite directions:

• Energy Prices: A significant 8% drop in gasoline prices during December should drag overall energy costs further below last year's levels.

• Food Prices: Food inflation has remained high throughout 2025 after a brief easing in late 2024. Price growth is forecast to climb above 5% in December. This is partly due to base effects from a temporary GST/HST tax holiday on restaurant meals a year prior, but high grocery price inflation, which stood at 4.7% in November, continues to be a major driver.

Core Inflation Remains a Concern

When volatile food and energy products are excluded, inflation is projected to edge down to 2.3% from 2.4% in November. While this would be the second consecutive month of improvement, it's not enough to bring inflation back to the central bank's comfort zone.

The BoC's preferred measures—the median and trim CPI—both registered 2.8% year-over-year increases in November, highlighting persistent underlying price pressures that remain well above the 2% target.

How Tax Policies Skew the Numbers

Year-over-year inflation figures continue to be distorted by government policy changes. The removal of the consumer carbon tax in most provinces last April is still suppressing annual energy price growth. Conversely, the temporary GST/HST tax break that ran from mid-December 2024 to mid-February 2025 will artificially inflate the annual price growth figure for December, though this impact may be limited by an offsetting rise in pre-tax prices a year ago.

The Q4 Business Outlook Survey, released just ahead of the BoC's next interest rate decision, is expected to paint a familiar picture. The Q3 survey pointed to an economy stabilizing at a subdued level, and the upcoming report will likely show more of the same: muted demand, cautious pricing behavior, and restrained hiring plans among Canadian firms.

Despite some weaknesses, the Bank of Canada likely remains cautiously optimistic. While heavily trade-exposed sectors have underperformed, the worst-case international trade scenarios feared earlier in the year have not materialized.

Furthermore, domestic consumer demand appears resilient. The upcoming retail sales report for November is expected to reinforce this, with Statistics Canada's advance estimate pointing to a strong 1.2% monthly increase. Data from our cardholder spending tracker also showed domestic purchases firming up through the holiday season.

Given this backdrop, the forecast is for the Bank of Canada to leave its overnight rate unchanged throughout 2026. The next policy move is more likely to be a hike, but that is not expected to occur until 2027.

Global supply chains for rare earths have become a major political battleground. As China tightens its grip with export controls, the United States and its allies are scrambling to build alternative sources and reduce their dependency. But while the world focuses on restrictions, a far more complex strategy is unfolding inside China.

Beijing’s game plan is not just about cutting off supply. It’s a sophisticated, multi-layered approach combining a powerful domestic industrial policy, strategic international cooperation, and a carefully calibrated use of export controls. Focusing only on the threat of a supply cutoff misses the bigger picture of how China is adapting to reinforce its dominance in the face of U.S. pressure.

China's advantage in rare earths was never just about its mineral reserves. Its real power comes from an unmatched ability to integrate extraction, processing, and downstream manufacturing at an enormous scale. This dominance is the direct result of state-level strategic planning that has funneled capital, technology, and regulatory support across the entire value chain.

For years, Beijing has prioritized moving up from a simple raw material extractor to a high-value industrial powerhouse. This technological upgrade has been fueled by a state-led capital allocation model that directs massive credit into the sector. While this sometimes led to oversupply and low prices, it also created steep barriers to entry for foreign competitors. Early environmental regulations also allowed China to scale up its processing capacity rapidly, achieving economies of scale that others find nearly impossible to match.

More recently, China's policy has shifted from quantity to quality. The new focus is on cementing its advantage through:

• Increased government funding for research and development.

• Tighter regulatory and environmental standards.

• Consolidating key producers through state-guided mergers.

• Strengthening midstream and downstream manufacturing for electric vehicles, renewable energy, and other advanced sectors.

These moves aim to anchor China's power not in the volume of earth it digs up, but in its deep industrial capacity, technological superiority, and systemic control over the entire supply chain.

While most policy debates center on the coercive threat of China's rare earth power, economic leverage can be used as both a carrot and a stick. Long before the current geopolitical tensions, China was embedding itself in overseas mineral projects through its "Going Out" strategy and the Belt and Road Initiative.

As U.S.-led decoupling efforts gain momentum, China is now using its rare earth expertise as an inducement for cooperation. Beijing is actively exploring ways to leverage its advanced processing capacity to build closer economic ties with other nations.

A prime example is the reported discussion between China and Malaysia in October 2025 about a potential partnership to build a new refinery. The project would likely involve Chinese technical assistance to process critical materials needed for EV motors, wind turbines, and advanced electronics.

Because outright technology transfer is restricted, Chinese state-owned firms are likely to engage through joint ventures, equipment sales, and engineer training programs. This allows China to support industrial development in partner countries and externalize some production stages while keeping a firm grip on core technologies and downstream markets. By offering targeted assistance, Beijing strengthens its position within global supply networks and counters the push for a broad realignment toward the United States.

While China's export controls can inflict real costs, they also have consequences. The United States and its allies are now actively restructuring their supply chains in direct response to the threat of future Chinese restrictions. In early 2026, a G-7 ministerial meeting in Washington focused squarely on building supply chain resilience, considering measures like price floors and international incentives to break away from Chinese supply.

This push is backed by several U.S.-led initiatives. Washington is increasing state funding and expanding cooperation with allies like Australia and Japan, as well as partners in Southeast Asia such as Malaysia and Thailand, to build alternative capacity. The goal is to institutionalize diversification, treating potential supply disruptions not as one-off shocks but as a permanent risk.

Beijing understands that using its rare earth leverage as a blunt weapon risks accelerating this decoupling. As a result, its export controls have been applied with cautious calibration. The slowdown in exports after the April 2025 curbs, followed by a rebound after talks in London later that year, shows this flexibility. Similarly, restrictions imposed in October 2025 were suspended after a meeting between U.S. President Donald Trump and Chinese President Xi Jinping.

This pattern reveals that China uses export controls as both a retaliatory tool and a powerful bargaining chip. The aim is to manage supply and preserve leverage without triggering a full-scale economic conflict.

To understand China's rare earth strategy, looking only at export controls is a mistake. While these restrictions grab headlines, they are just one tool in a much larger toolkit.

Instead of relying on outright bans, Beijing is executing a multifaceted strategy that combines strengthening its domestic industrial base, offering cooperation as an incentive, and applying restrictions with surgical precision. Together, these efforts allow China to solidify its industrial power, manage the pace of global diversification, and mitigate geopolitical risks in a world where critical minerals have become central to great power competition.

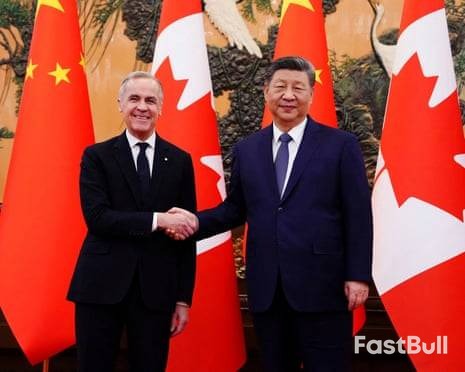

Canadian Prime Minister Mark Carney and Chinese President Xi Jinping have launched a "new strategic partnership," marking the first visit to Beijing by a Canadian leader in eight years and signaling a significant diplomatic reset. The move aims to reshape Canada's trade relationships amid ongoing economic pressure from the United States.

"Together we can build on the best of what this relationship has been in the past to create a new one adapted to new global realities," Carney told Xi during their meeting in the Great Hall of the People.

The state visit highlights Canada's urgent need to diversify its export markets and reduce its economic dependence on the United States. The strategic shift follows President Donald Trump's decision to impose sharp tariffs on key Canadian goods, including steel, aluminum, vehicles, and lumber.

In response, Carney has set a goal to double Canada's non-US exports by 2035. While the U.S. remains its primary economic partner, accounting for about 75% of Canadian goods exports in 2024, the trade friction has forced Ottawa to seek new opportunities. China, currently Canada's second-largest market, received less than 4% of its exports in the same year.

The talks in Beijing produced several preliminary agreements aimed at strengthening economic ties and reopening channels of communication that had been frozen for years.

Key outcomes of the visit include:

• Preliminary Trade Deal: A foundational agreement to reduce tariffs, which includes a commitment for Canada to import 49,000 electric vehicles from China at preferential rates.

• Energy Cooperation: A pact covering both clean energy and fossil fuels. This reopens ministerial-level talks and could lead to Canada importing more Chinese clean-energy technology while increasing its fossil fuel exports to China. In 2024, only 2% of Canada's crude oil was sent to the Chinese market.

• Expanded Sector Pacts: Additional agreements were signed to boost cooperation in forestry, culture, and tourism.

Carney identified agriculture, energy, and finance as the sectors offering the most immediate opportunities for progress under the new strategic partnership.

The renewed cooperation marks a turnaround from years of diplomatic tension. Relations between Ottawa and Beijing deteriorated sharply in 2018 after Canada arrested Huawei's Chief Financial Officer, Meng Wanzhou, on a U.S. warrant. China responded by detaining two Canadians on espionage charges, sparking a series of retaliatory tariffs and accusations of Chinese interference in Canadian elections.

Both sides have now signaled a desire to move forward. Xi told Carney that their previous meeting at the Apec summit in October 2025 "opened a new chapter" for improving relations. He added that the "healthy and stable development of China-Canada relations serves the common interests of our two countries."

During his trip, Carney also met with China's Premier, Li Qiang, and is scheduled to hold talks with business leaders to further discuss trade. While officials continue negotiations to finalize a broader agreement on lowering tariffs, the visit itself represents a calculated strategic pivot for Canada in a changing global economic landscape.

Federal Reserve Vice Chair for Supervision Michelle Bowman stated on Friday that a fragile U.S. job market, which could weaken quickly, means the central bank must be prepared to cut interest rates again if necessary.

In a speech for the New England Economic Forum, Bowman argued that without a "clear and sustained improvement in labor market conditions, we should remain ready to adjust policy to bring it closer to neutral." She emphasized that while monetary policy is not on a predetermined path, the Fed "should also avoid signaling that we will pause" on more rate cuts unless economic conditions change.

Bowman described the current monetary policy stance as "moderately restrictive" and stressed that officials should be forward-looking when setting rates. She advocated for using forecasts informed by a wide range of indicators and direct engagement with businesses and communities.

Bowman’s baseline forecast is for continued solid economic expansion and a labor market stabilizing near full employment as policy becomes less restrictive. However, she noted that the risks to the Fed's dual mandate are uneven.

She believes price pressures are likely to ease as the effects of trade tariffs diminish, bringing underlying inflation closer to the Fed's 2% target. In contrast, she sees the job market as "increasingly more fragile" and warned it "could continue to deteriorate in the coming months." Given that conditions can shift rapidly, Bowman argued for the Fed to remain nimble on policy decisions.

The Federal Reserve enters 2026 with policymakers generally expecting inflation to moderate, the job market to stabilize, and economic growth to remain decent as uncertainty from President Donald Trump's policies subsides.

In the last months of 2025, the Fed cut its benchmark interest rate by three-quarters of a percentage point, bringing it to a range of 3.50%-3.75%. These cuts were intended to support a weakening job market while keeping enough restraint to lower high inflation.

At their December 9-10 meeting, Fed officials projected a single quarter-percentage-point rate cut for 2026. Since the start of the year, they have signaled no immediate urgency to act, preferring to wait for more evidence that inflation, still well above the 2% target, is on a downward path.

This cautious stance comes amid considerable pressure from President Trump to lower rates further. The president is expected to soon announce his choice to succeed Fed Chair Jerome Powell, whose term ends in May. Tensions recently escalated after it was revealed the administration is criminally targeting the Fed over costs related to its headquarters renovation, an action Powell described as a response to the central bank exercising independent judgment on rate policy.

WASHINGTON, Jan 16 (Reuters) - White House adviser Kevin Hassett played down the federal criminal investigation into Federal Reserve Chair Jerome Powell on Friday, saying he expected there would be "nothing to see here".

The Trump administration has opened a criminal investigation into Powell over cost overruns for a $2.5 billion project to renovate two historical buildings at the Fed's headquarters complex. Powell, who disclosed the probe on Sunday, denies wrongdoing, and said the unprecedented actions were a pretext to put pressure on him for not satisfying U.S. President Donald Trump's long-running demands for sharply lower interest rates.

Hassett, the director of the National Economic Council who is a candidate to replace Powell, said in an interview with Fox Business Network that he wished there had been more transparency from the Fed about cost overruns of building renovations.

"The bottom line is, I expect, you know, Jay is a good man - I expect that there's nothing to see here, that the cost overruns are related to things like asbestos, as he says. But I sure wish they had been more transparent," Hassett said.

The probe drew criticism from foreign economic officials, investors and former U.S. government officials from both political parties - as well as lawmakers in Trump's own Republican Party, as politicizing sensitive policymaking.

Powell's term as Fed chair ends in May. Trump has yet to announce a replacement.

Hassett tried to minimize the federal criminal probe as a "simple request for information".

"I'm sure the information will be forthcoming shortly, and then things will move forward," he told "Mornings with Maria."

The Trump administration is pursuing a dual-track strategy in its relationship with Venezuela, marked by high-level diplomatic meetings in both Caracas and Washington following the capture of President Nicolas Maduro earlier this year.

In a significant move, CIA Director John Ratcliffe met with Venezuela's acting president, Delcy Rodriguez, in Caracas. Simultaneously, Venezuelan opposition leader Maria Corina Machado held a meeting with President Donald Trump at the White House.

Maria Corina Machado, a prominent liberal opposition figure, met with President Trump on Thursday. The meeting was highlighted by a significant gesture: Machado presented Trump with the Nobel Peace Prize medal she had received the previous year.

After what she described as an "excellent" meeting, Trump publicly thanked Machado for the medal on social media, calling it "a wonderful gesture of mutual respect." Machado is scheduled to speak with reporters on Friday at the Heritage Foundation, a conservative think tank with strong connections to the Trump administration.

John Ratcliffe’s visit to Caracas makes him the most senior U.S. official known to have met with acting President Delcy Rodriguez since the U.S. attack on January 3 that resulted in the capture of Nicolas Maduro and his wife.

According to a U.S. official, the CIA chief met with Rodriguez at Trump's direction. The key objectives of the meeting were:

• To signal that the United States is seeking an improved working relationship.

• To discuss intelligence cooperation and economic stability.

• To demand assurances that Venezuela will not serve as a "safe haven for America's adversaries, especially narco-traffickers."

The diplomatic overtures are set against a backdrop of deep political friction. During her first State of the Union address on Thursday, acting President Rodriguez appeared to take a swipe at Machado's visit to Washington.

"If I should visit Washington," Rodriguez told the Venezuelan people, "I will do so with my head held high, walking, not on my knees."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up