Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

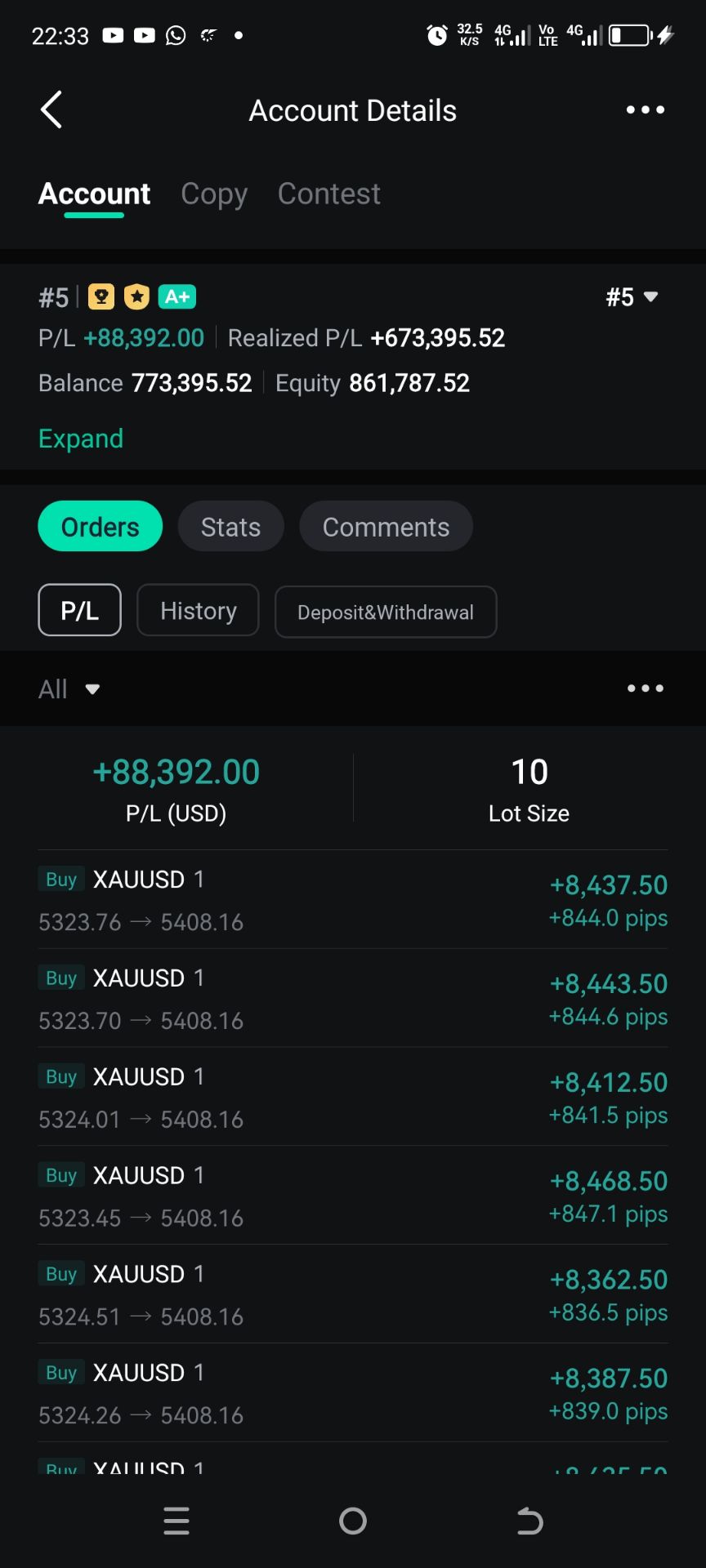

Signal Accounts for Members

All Signal Accounts

All Contests

[Airline ETFs Rise Over 2.6%, Leading US Sector ETFs; S&P Technology Sector Falls Over 1.8%] On Thursday (January 29), The Global Airline ETF Rose 2.64%, Regional Bank ETFs And Banking ETFs Rose Up To 1.84%, The Energy ETF Rose 0.92%, The Semiconductor ETF Rose 0.21%, The Internet Stock Index ETF And Consumer Discretionary ETF Fell Up To 0.48%, The Technology Sector ETF Fell 1.58%, And The Global Technology Stock Index ETF Fell 1.76%. Among The 11 Sectors Of The S&P 500, The Information Technology/technology Sector Fell 1.86%, The Consumer Discretionary Sector Fell 0.64%, The Energy Sector Rose 1.08%, The Real Estate Sector Rose 1.42%, And The Telecommunications Sector Rose 2.92%

On Thursday (January 29), Spot Silver Fell 0.61% To $116.0075 Per Ounce In Late New York Trading, Trading Between $121.6540 And $106.8954. Comex Silver Futures Rose 2.87% To $116.790 Per Ounce. Comex Copper Futures Rose 0.78% To $6.2855 Per Pound, Having Reached $6.5830 At 22:31 Beijing Time. Spot Platinum Fell 2.65%, And Spot Palladium Fell 2.34%

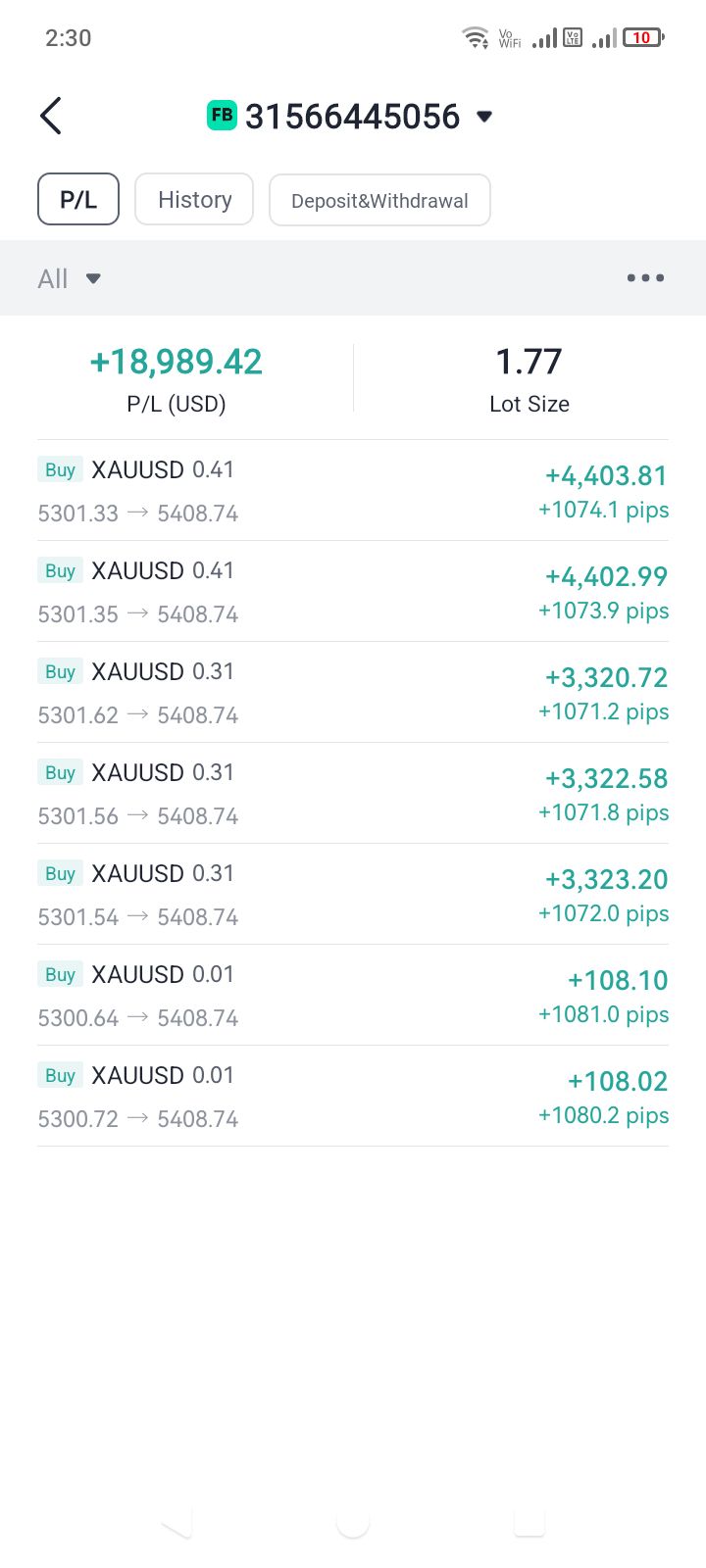

On Thursday (January 29), Spot Gold Rose 0.43% To $5,394.00 Per Ounce In Late New York Trading. At 14:23 Beijing Time, It Reached $5,595.47, Continuing To Set New Historical Highs. A Short-term Plunge Began At 23:00, Hitting A Daily Low Of $5,459.31 At 23:36. Comex Gold Futures Rose 1.97% To $5,408.30 Per Ounce, Having Reached $5,586.20 At 14:22

Stryker: Foreign Exchange Is Expected Slightly Positive Impact On Sales & Adj Net Eps Should Rates Hold Near Year-To-Date Levels For 2026

Bank Of Canada: Canada Government Will Participate In All Fixed-Rate Cmb Syndications Proposed For 2026

Toronto Stock Index .GSPTSE Unofficially Closes Down 159.94 Points, Or 0.48 Percent, At 33016.13

The S&P 500 Initially Closed Down 0.1%, With The Technology Sector Down 2%, Consumer Discretionary Down 0.6%, Energy Up 1.1%, And Telecoms Up 3%. The NASDAQ 100 Initially Closed Down 0.5%, With Atlassian, Microsoft, And Strategy Technology Among The Worst Performers, All Down Approximately 10%. Synopsys Fell 6%, Cadence Fell 5.7%, ASML Rose 2%, And Meta Rose 10.8%. Salesforce Initially Closed Down 6.3%, Boeing Fell 3%, And Microsoft Led The Decline Among Dow Jones Components. JPMorgan Chase Rose 1.6%, Honeywell Rose 4.9%, And IBM Rose Approximately 5%

The Nasdaq Golden Dragon China Index Closed Up 0.3% Initially. Among Popular Chinese Concept Stocks, NIO Closed Up 3.8%, Yum China Rose 1%, Tencent, New Oriental, Li Auto, Xiaomi, And Meituan Rose By More Than 0.9%, Alibaba Fell 0.7%, NetEase Fell 1.3%, WeRide Fell 4.5%, And Pony.ai Fell 7.9%. In The ETF Market, Ashr Rose 0.9%, Kweb Rose 0.5%, And Cqqq Fell 1.5%

ANZ - Roy Morgan New Zealand Consumer Confidence Index 107.2 In January From 101.5 Previous Month

USA Treasury: Thailand Added To Monitoring List Of Trading Partners Whose Currency Practices 'Merit Close Attention' Due To Its Growing Current Account Surplus And Trade Surplus With USA

USA Treasury: No Major Trading Partners Met All Three Criteria For Enhanced Analysis During Review Period

USA Treasury: Now Monitoring More Broadly Whether Countries That Smooth Exchange Rate Movements Do So To Resist Depreciation Pressures

USA Treasury Official Says New Criteria Not Aimed At Any Specific Country On Monitoring List But Will Aid Future Analysis During A Period Of Relative Dollar Depreciation

USA Treasury: Monitoring Trading Partners' Use Of Capital Controls, Macroprudential Measures, Government Investment Vehicles To Influence Foreign Exchange Markets

On Thursday (January 29), The Bloomberg Electric Vehicle Price Return Index Fell 1.76% To 3646.11 Points In Late Trading. The Index Was Down Throughout The Day, Trading Around 3680 Points For More Than Half The Time, And Its Decline Accelerated After 10:00 PM Beijing Time

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)A:--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)A:--

F: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)A:--

F: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)A:--

F: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)A:--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)A:--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)A:--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)A:--

F: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)A:--

F: --

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin plunges as Trump's economic vision and Fed pressure diverge from Bessent's optimism amid market volatility.

Bitcoin experienced a sharp drop during the U.S. trading session, falling below the $84,300 mark. The downturn mirrored a broader sell-off in precious metals, with both silver and gold declining by 8% to 12%. Against this backdrop of market volatility, key statements from President Trump and Treasury Secretary Bessent offered a glimpse into the economic strategies shaping the financial landscape.

President Trump unveiled several significant economic developments, focusing on energy, domestic industry, and monetary policy.

Venezuelan Oil and U.S. Industry

A major announcement involved U.S. oil companies expanding into Venezuela, a move Trump stated would generate wealth for both nations. He also noted that diplomatic dialogues successfully prevented the closure of Venezuelan airspace.

On the domestic front, Trump highlighted the strong performance of American automotive giants Ford and GM. He also celebrated a milestone in industrial output, stating that the U.S. now produces more steel than Japan. While hinting at the possibility of future tariff increases, he emphasized that the U.S. is approaching such measures with caution.

Pressure on the Federal Reserve

Trump voiced a clear desire for lower interest rates, calling for cuts of two or three percentage points. He added that an announcement for a new Federal Reserve chair is expected soon.

This comes as the Fed maintains its pause on rate reductions for the second consecutive time, following a halt in cuts during the final quarter of last year. With no changes anticipated in upcoming meetings, market watchers are also noting that current Fed Chair Powell’s term concludes by June.

Treasury Secretary Bessent provided an optimistic counterpoint, forecasting a positive economic trajectory. He pointed to a downward trend in inflation indicators and projected that 2026 will be a pivotal year.

Bessent argued that the expected rise in Venezuelan oil production will directly benefit American consumers by lowering gasoline prices, providing a boost to the economy. He assured that the revenue from these oil sales would be directed to Venezuelan citizens.

While affirming the Federal Reserve's independence, Bessent stressed the importance of accountability in managing economic strategies. He also confirmed that the IRS has contingency plans ready in the event of any government shutdowns.

As these high-level discussions unfolded, the sharp decline in Bitcoin's price began to slow, suggesting a potential for temporary stability in a turbulent market. The intersection of cryptocurrency volatility and major U.S. economic policy shifts continues to define the key challenges and opportunities facing investors today.

Israeli Prime Minister Benjamin Netanyahu has estimated his country could withstand over 700 missile strikes from Iran. But this confidence belies a critical reality: Iran commands the largest ballistic missile stockpile in the Middle East, an arsenal that far exceeds that number and includes weapons for which there are no proven defenses.

As the United States maintains a significant naval presence off the Iranian coast, the prospect of a direct confrontation looms. While Netanyahu's tough stance may resonate publicly, it overlooks the true scale of the threat facing Israel and U.S. bases across the region.

Iran's missile arsenal is not just large; it is sophisticated and diverse. Many of its ballistic missiles have ranges exceeding 1,000 kilometers, allowing them to strike deep into Israeli territory directly from Iranian soil. This capability is enhanced by a growing inventory of advanced weaponry.

The arsenal includes:

• Hypersonic Weapons: These missiles fly at extreme speeds and on unpredictable trajectories, making them nearly impossible for current defense systems to intercept.

• Maneuverable Ballistic Missiles: Systems like the Kheibar Shekan and Fattah-1 are medium-range ballistic missiles (MRBMs) designed to evade regional air defenses on their way to a target.

This combination of sheer volume and technological sophistication presents a formidable challenge to any defensive network.

Israel protects itself with a multi-layered air defense network developed over decades, incorporating U.S.-supplied systems. This includes the well-known Iron Dome, David's Sling, and the Patriot/Arrow systems.

During the recent 12-Day War, Israeli officials acknowledged an interception rate of 80-90%. However, this success rate comes with critical caveats. First, no system is perfect, meaning a percentage of incoming threats will always get through.

More importantly, Israel’s air defense network is not fully replenished following the last conflict. This vulnerability, combined with Iran's capacity to launch a massive, coordinated attack involving missile salvos, drone swarms, and hypersonic weapons, means Israel's defenses could be overwhelmed. A successful saturation attack could shut down the Israeli economy and inflict lasting damage at a moment of critical national vulnerability.

Following the 12-Day War, Iran's Defense Minister, Brig. Gen. Aziz Nassirzadeh, issued a clear warning. He claimed that the missiles used in that conflict were older models and that Iran had since developed systems with "far greater capabilities."

Nassirzadeh emphasized that if Israel were to launch another attack, Tehran would not hesitate to unleash its newer, more advanced missiles. This rhetoric is backed by action. Reports indicate Iran has ramped up missile production since last June, upgrading guidance and lethality based on lessons learned from the recent conflict.

This is a deliberate strategy. Tehran is signaling to both Jerusalem and Washington that any future military action against Iran will trigger massive retaliation, carrying risks far greater than in previous encounters. The message is that Iran believes its arsenal is now numerous and capable enough to saturate the region's air defenses.

The strategic landscape is further complicated by the stance of neighboring Arab countries. While wary of Tehran, these nations are also concerned about Israeli military actions. They have reportedly informed the U.S. and Israel that they will neither permit their territory to be used for strikes against Iran nor participate in defending Israel from an Iranian counter-attack.

This political reality means an Israeli-American conflict with Iran would not be a short, surgical campaign. Instead, it would become a systemic stress test of Israel's national resilience and America's waning regional power. Tehran is signaling its preparedness to absorb damage while inflicting devastation on an unprecedented scale.

If Washington and Jerusalem continue to believe that precision strikes and layered defenses alone can neutralize a missile superpower, they risk a profound miscalculation. Such an assumption could lead them into a war where the costs far exceed any promised gains.

Commodity

Economic

Central Bank

Daily News

Traders' Opinions

Technical Analysis

Political

Remarks of Officials

Spot gold surged to a new record high near $5,600 an ounce on Thursday before reversing course to trade sharply lower in a volatile session driven by geopolitical news.

The initial spike was fueled by intense safe-haven demand after a report emerged that U.S. President Donald Trump was considering a new military strike on Iran. Spot silver followed a similar trajectory, hitting its own all-time high before plummeting into negative territory.

The price action for gold and silver was dramatic. After hitting a record peak of $5,595.44, spot gold fell 4.6% to trade at $5,166.98 per ounce by 10:34 ET. April gold futures saw a similar reversal, sliding 3.1% to $5,171.14 after touching a high of $5,625.89.

Silver’s moves were even more pronounced. Spot silver crashed 6.5% to $100.02 an ounce after setting a new record of $121.65 earlier in the day.

The recent rally in precious metals has been fueled by a combination of factors, including elevated global geopolitical risk, a weak U.S. dollar, and general policy uncertainty.

The primary catalyst for Thursday's market whiplash was a CNN report stating that President Trump is considering a "major new strike" on Iran following stalled negotiations over the country's nuclear program and missile production.

This development heightened fears of a broader conflict in the Middle East. The report follows the recent deployment of several U.S. ships to the region and earlier threats of military action from Trump, which he framed as potential support for protests within Iran.

The president had previously urged Iran via social media to secure a "fair and equitable" deal with Washington and cease its nuclear activities. He also warned that any future U.S. attack would be far more severe than the one on Iran's nuclear sites in mid-2025. According to CNN, Trump is now weighing airstrikes against Iranian leaders and security officials, as well as additional attacks on nuclear facilities.

Any further U.S. military action is expected to be met with retaliation from Iran, escalating regional instability. This backdrop of geopolitical tension, which includes a recent U.S. incursion in Venezuela and Trump's demands concerning Greenland, has been a significant driver for safe-haven assets like gold.

Despite the bullish geopolitical narrative, some analysts see signs of exhaustion. Keith Lerner of Truist downgraded gold to neutral, citing a less favorable near-term risk-to-reward profile following the metal's exceptional performance.

"Gold now sits more than 40% above the 200-day moving average – a historic extreme," Lerner noted. He acknowledged that momentum could push prices higher but warned that the sharp rally "leaves gold increasingly vulnerable."

Adding to the complex economic picture, the U.S. Federal Reserve decided to leave interest rates unchanged, as widely expected, while presenting an upbeat outlook on the economy. However, Fed Chair Jerome Powell declined to answer questions regarding the central bank's independence in light of an ongoing Department of Justice investigation.

The sharp downturn in gold prices had a spillover effect on other metals. Spot platinum, for instance, fell 3.7% to $2,521.80 per ounce.

Copper, however, proved to be a notable exception. The industrial metal held onto its gains, with benchmark copper futures on the London Metal Exchange rallying over 9% to a record high of $14,356 a tonne.

Copper's strength was attributed to reports of additional policy support for China's beleaguered property market. As the world's largest importer of copper, China's real estate sector is a critical component of global demand.

WASHINGTON, Jan 29 (Reuters) - President Trump said he intends to announce his pick to replace Federal Reserve Chair Jerome Powell next week, ending weeks of speculation over who will lead the U.S. central bank after Powell's term expires in May 2026.

Gold 290126 Daily Chart

Gold 290126 Daily ChartGold suffered a sell-off after testing historic highs as traders rushed to take profits off the table.

In case gold declines below the support at $5100 – $5110, it will head towards the next support level at $4890 – $4900.

Silver 290126 Daily Chart

Silver 290126 Daily ChartSilver made an attempt to settle above the $120.00 level but lost momentum and pulled back.

A move below the $110.00 level will push silver towards the support at $103.00 – $104.00.

Platinum 290126 Daily Chart

Platinum 290126 Daily ChartPlatinum is down by more than 4% amid strong pullback in precious metals markets.

A successful test of the support at $2510 – $2530 will push platinum towards the next support level at $2245 – $2265.

European nations have begun discussing a potential shared nuclear umbrella, signaling a major shift in strategic thinking as reliance on the United States comes under question. German Chancellor Friedrich Merz confirmed these preliminary talks are underway to supplement existing security agreements.

Merz emphasized that while the conversations are happening, they remain in the early stages and no immediate decisions are expected. "We know that we have to reach a number of strategic and military policy decisions, but at the moment, the time is not ripe," he told reporters.

The move comes amid growing transatlantic friction. The Trump administration has repeatedly challenged traditional alliances, prompting European leaders to reassess their defense posture. Europe has long depended on the U.S. and its nuclear arsenal for security but has recently increased military spending in response to pressure from Washington.

President Trump’s actions have unsettled European allies, including his suggestion of purchasing Greenland from Denmark, a NATO partner, and his threats to impose tariffs. He has also previously implied that the U.S. might not defend allies who fail to meet defense spending targets, fueling concerns about the reliability of American security guarantees.

For Germany, any discussion of nuclear armament is particularly sensitive. The country is prohibited from developing its own nuclear weapons under two key treaties: the 1990 "Four Plus Two" agreement that paved the way for German reunification and the 1969 nuclear non-proliferation treaty.

However, Merz noted that these obligations do not prevent Germany from exploring joint defense solutions with its partners. The talks specifically involve Europe’s only two nuclear powers, Britain and France. "These talks are taking place," Merz stated, adding that they "are also not in conflict with nuclear-sharing with the United States of America."

Adding weight to the discussions, Thomas Roewekamp, the head of Germany's parliamentary defense committee, said the country possesses the technical expertise to contribute to a joint European nuclear weapon.

"We do not have missiles or warheads, but we do have a significant technological advantage that we could contribute to a joint European initiative," said Roewekamp, a member of Merz's Christian Democratic Union party. This suggests that while legally constrained from building its own arsenal, Germany could play a crucial role in a collaborative European defense framework.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up