Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The Philadelphia Gold And Silver Index Closed Down 0.40% At 380.81 Points. The NYSE Arca Gold Miners Index Fell 1.62% To 2699.52 Points, After A Sharp Rise Followed By A Fall In Early Trading. The Materials Index Closed Up 0.58%, And The Metals & Mining Index Closed Up 1.44%

On Monday (February 2nd) In Late New York Trading, Spot Silver Fell 6.73% To $79.4438 Per Ounce. Comex Silver Futures Rose 1.56% To $79.760 Per Ounce. Comex Copper Futures Fell 1.49% To $5.8345 Per Pound, Having Fallen As Low As $5.5640 At 14:40 Beijing Time. Spot Platinum Fell 2.93%, While Spot Palladium Rose 0.74%

On Monday (February 2nd) In Late New York Trading, Spot Gold Fell 4.54% To $4671.58 Per Ounce, Remaining In A Downward Trend Throughout The Day. At 14:38 Beijing Time, It Had Fallen To $4402.95. On The Daily Chart, Gold Prices Have Fallen For Three Consecutive Trading Days, Approaching The December 31st Low Of $4319.37, And Briefly Breaking Below The 50-day Moving Average And Approaching The 100-day Moving Average (currently At $4483.43 And $4228.16 Respectively). Comex Gold Futures Fell 0.90% To $4702.60 Per Ounce, Also Briefly Falling To $4423.20 At 14:38

US President Trump, Speaking About The Justice Department's Investigation Into The Federal Reserve, Declared: "We'll See How It Goes."

U.S. Treasury Secretary Bessant: Federal Reserve Chairman Nominee Warsh Will Have A Great Start

[Airline ETFs Rise 3.5%, Leading US Sector ETFs; S&P Energy Sector Falls About 2%] On Monday (February 2), The Global Airline ETF Rose 3.51%, Regional Bank ETFs And Banking ETFs Rose Up To 1.79%, Semiconductor ETFs Rose 1.12%, Technology ETFs Rose 0.96%, And Energy ETFs Fell 1.96%. Among The 11 Sectors Of The S&P 500, Consumer Staples Rose 1.58%, Industrials Rose 1.26%, Financials Rose 1.02%, Information Technology/technology Rose 0.46%, And Energy Fell 1.98%

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin's value falls below $75,000, challenged by stalled crypto legislation and a hawkish Fed nominee, despite President Trump's close ties to the sector.

Bitcoin's price fell below the $75,000 mark on Monday, retreating to levels last seen before the re-election of U.S. President Donald Trump. The drop comes as investors pivot away from riskier assets and crucial U.S. cryptocurrency legislation faces delays in Congress.

Digital asset markets had experienced a significant surge following Trump's election victory in November 2024, driven by the perception that his administration would be highly supportive of the crypto sector. Just one month after the election, Bitcoin crossed the $100,000 threshold for the first time—a milestone publicly celebrated by the president.

However, the asset’s trajectory has been volatile. After a sharp decline in April below $75,000, triggered by the announcement of wide-ranging U.S. tariffs that unsettled global markets, Bitcoin resumed its climb. It eventually reached a record high of $126,251.31 in October before beginning its latest pullback.

A primary driver behind the recent downturn is persistent regulatory uncertainty in the United States. While Congress successfully passed a law in July to regulate stablecoins, a more comprehensive crypto bill known as the Clarity Act has stalled in the Senate.

This legislative delay is creating a significant challenge for the market. "Expectations for progress on the Clarity Act have not been met," explained James Butterfill, a researcher at digital asset manager CoinShares. He described the ongoing uncertainty as a major "headwind" on cryptocurrency prices.

Bitcoin's decline accelerated after President Trump announced on Friday his nomination of former U.S. Federal Reserve governor Kevin Warsh to lead the central bank.

Market observers view Warsh as a strong defender of the Fed's independence. His nomination helped reassure traditional financial markets, leading investors to sell safe-haven assets like gold and silver, which saw their prices plunge. At the same time, many investors also liquidated their cryptocurrency holdings and other risky assets to raise cash.

President Trump's close connections to the cryptocurrency industry have drawn accusations of potential conflicts of interest since his return to the White House. He has actively promoted his own crypto-related ventures while in office.

According to recent estimates from Bloomberg, the Trump family's fortune increased by $1.4 billion in the last year from their digital asset holdings alone.

Further intertwining his presidency with the sector, the 79-year-old billionaire launched his own cryptocurrency, $TRUMP, just hours before his inauguration in January 2025. After an initial surge, the coin has since lost approximately 90% of its value from its peak.

Precious metals prices extended their steep decline on Monday, with both gold and silver tumbling as new margin requirements from the CME Group amplified a selloff that began last week following the nomination of Kevin Warsh as the next Federal Reserve chair.

The rout in the precious metals market deepened during Monday's session. By 1:32 p.m. ET, spot gold was down 4.8% to $4,630.59 an ounce after having fallen nearly 10% earlier in the day. U.S. gold futures for April delivery closed 1.9% lower at $4,652.60 an ounce.

This continues a dramatic downturn for bullion, which fell 9.8% on Friday. The metal has now lost approximately $900 from its January 29 record high of $5,594.82, wiping out most of its gains for the year.

Silver faced even greater pressure. Spot silver dropped 9.2% to $76.81 an ounce, following an earlier slide of as much as 15%. Since hitting a record high of $121.64 last week, silver has fallen by about 37%.

Analysts pointed to a combination of technical and fundamental factors fueling the price collapse.

"Gold and silver are on a rollercoaster ride and when you get to the top of the 'lift hill', gravity takes over and you are heading down," said SP Angel analyst John Meyer.

Key drivers include:

• CME Margin Hikes: On Friday, CME Group announced it would raise margin requirements on precious metal futures. The changes, set to take effect after Monday's close, increased the cost of holding futures positions and prompted traders to liquidate.

• Federal Reserve Speculation: Markets are reacting to President Donald Trump's nomination of former Fed official Kevin Warsh to succeed Jerome Powell as Chair in May. Investors are widely anticipating a policy shift toward rate cuts combined with a tighter balance-sheet policy.

• Strengthening Dollar: The dollar index continued its ascent, reaching a high for more than a week. A stronger dollar makes bullion more expensive for buyers holding other currencies, dampening demand.

Despite the sharp price drops, some analysts advised against interpreting the selloff as the beginning of a sustained bear market.

"The conditions do not appear primed for a sustained reversal in gold prices," wrote Michael Hsueh, a precious metals analyst at Deutsche Bank. In a note, he added that investors "remain highly bid for upside," suggesting that the market is bracing for continued volatility rather than a fundamental collapse in sentiment.

The recent price action has also likely forced out many speculative traders who entered the market during its recent rally. This washout could help cool excess speculation and stabilize the market.

"We saw some money coming out of ETFs and we suspect some brave hedge funds took it from there," Meyer commented.

The negative sentiment spread to other precious metals. Spot platinum fell by 3.3% to $2,091.38 per ounce, while palladium dropped 1.4% to $1,673.70.

President Donald Trump's push to install a new Federal Reserve chief and secure interest rate cuts has hit a major snag—a roadblock erected by a key Republican senator. The confirmation of his nominee, Kevin Warsh, is now contingent on the Trump administration dropping its criminal investigation into the current Fed Chair, Jerome Powell.

This unprecedented standoff pits the White House against a member of its own party, delaying a critical appointment and highlighting deep divisions over the independence of the U.S. central bank.

At the center of the stalemate is Senator Thom Tillis, a pivotal swing voter on the Senate Banking Committee, which must approve all Fed nominations. Tillis has vowed to block every nominee until the Department of Justice (DOJ) resolves its probe into building renovations at the Fed.

He has publicly condemned the investigation as a "bogus" attack on the central bank's autonomy. "This process of prosecution has to end before I'm willing to vote to confirm anybody—even somebody as good as Warsh," Tillis told reporters.

This sentiment is shared by other GOP lawmakers who, while accustomed to Trump's verbal criticism of Powell, draw the line at the threat of criminal charges. With Democratic opposition and support from senators like Lisa Murkowski, Tillis has enough backing to halt Warsh's nomination in committee. Democratic leader Chuck Schumer has also stated the nomination should be held until Trump abandons his "vendetta."

Despite the political gridlock, President Trump is not backing down. He recently repeated his attacks on Powell, calling him a "crook" and suggesting the building renovations involved either "gross incompetence, or it's theft."

The president even suggested he is prepared to wait until Senator Tillis's planned retirement in January 2027 to see Warsh confirmed.

Such a delay could have significant consequences, especially with congressional elections looming in November. With polls showing voter dissatisfaction with the economy, the administration wants a Fed chair who will loosen monetary policy to stimulate growth—a goal that remains out of reach as long as the nomination is stalled.

If Warsh is not confirmed by the time Powell's term ends on May 15, the Federal Reserve could face a leadership crisis. The legal question of whether the White House or the Fed's Board of Governors would appoint an interim chair is unresolved. While the board appointed Powell "pro tempore" in 2022, his eventual confirmation was considered a certainty, making the situation fundamentally different.

Trump's aides and allies are eager to avoid this scenario.

• Kevin Hassett, National Economic Council Director, said the impasse "is an issue that should get resolved quickly."

• Kush Desai, a White House spokesman, stated the administration hopes to confirm Warsh "quickly."

• John Thune, Senate Majority Leader, emphasized the need to "get closure on the Powell thing quickly."

Despite the urgency, there is no clear off-ramp from the DOJ probe. A White House official, speaking anonymously, said the president is not directing the DOJ to stop. Deputy Attorney General Todd Blanche confirmed this, stating, "I don't think the timing of President Trump's decision to nominate somebody is a controlling factor in any investigation."

The DOJ and the Fed have declined to comment on whether the central bank has complied with subpoenas issued last month. While Treasury Secretary Scott Bessent initially suggested a satisfactory response could end the matter, he has since defended the investigation.

Even if the administration signals a retreat, legal experts note it may not be enough to satisfy Senator Tillis. Paul Tuchmann, a former federal prosecutor, explained, "Unless you explicitly tell me that the criminal investigation is closed, it's very hard to get that comfort that the prosecutor isn't going to change their mind."

The conflict has escalated long-standing concerns among investors about political pressure on U.S. monetary policy. The legal action is widely viewed as a tactic to intimidate the Fed into cutting interest rates.

After largely ignoring Trump's verbal attacks, Powell responded forcefully on January 11, revealing the DOJ had served grand jury subpoenas and threatened a criminal indictment over his testimony on the renovations. In a video statement, Powell pledged to protect the Fed's independence, a move that galvanized bipartisan support in Congress and prompted Tillis to announce his blockade.

As the standoff continues, the confirmation of the next Fed chair—and the future of U.S. monetary policy—hangs in the balance.

The timing could hardly be more difficult for Bishkek. Just as Kyrgyzstan prepares to host a major trade forum with the United States and other Central Asian nations, reports have emerged that the European Union is considering sanctions against the country.

According to a report first published by Bloomberg, Brussels may be readying trade restrictions on Kyrgyzstan for its alleged role in helping Russia evade sanctions imposed after its attack on Ukraine. The proposed measures would specifically target machine tools and radio equipment.

If implemented, these sanctions would mark a significant escalation, making Kyrgyzstan the first Central Asian nation to face such penalties from the EU. Previously, the US and EU have only sanctioned specific individuals and companies within the region.

For some time, Kyrgyzstan has been suspected of acting as a key channel for Russia to acquire not only goods with potential military uses but also purely civilian products, including automobiles.

Western experts also point to the introduction of a Russian ruble-denominated stablecoin, A7A5, in 2025 as a tool designed to help facilitate transactions that bypass international sanctions.

In response to earlier sanctions targeting Kyrgyz banks, Deputy Prime Minister Emil Baisalov attributed the penalties to a "misunderstanding." He affirmed that Kyrgyz officials "are committed to working with" the EU.

However, Baisalov also emphasized that Bishkek would continue to pursue its "own pragmatic interests of national development and we are focused on our own internal affairs."

The potential action against Kyrgyzstan comes as the EU considers additional sanctions on Russia itself, covering sectors like banking and crypto services. A ban on all ocean-going tanker traffic carrying Russian oil is also reportedly under consideration.

This news from Brussels casts a shadow over the upcoming B5+1 forum, a US-backed event scheduled for February 4-5 in Bishkek. The forum is designed to bring together government and business leaders from the United States and across Central Asia.

Its primary goals are to build stronger business-to-business connections and accelerate trade flows within Central Asia and between the region and the West—objectives now complicated by the threat of EU sanctions.

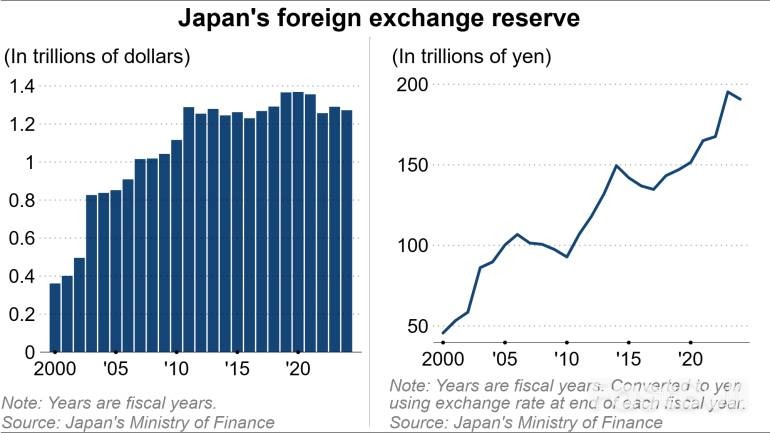

A hot-button topic has emerged in Japan's lower house election campaign: using the nation's massive foreign currency reserves to pay for new policies. Prime Minister Sanae Takaichi brought the issue to the forefront, but analysts warn that tapping into this fund is more complicated than it seems.

During a campaign speech, Takaichi, who leads the ruling Liberal Democratic Party, pointed to a potential source of cash. "There's something called the Foreign Exchange Fund Special Account (FEFSA), and its coffers are brimming now," she said.

Both ruling and opposition parties are now eyeing this account as a way to finance their agendas.

The FEFSA is the government's tool for managing foreign currency reserves and intervening in currency markets. Its operation is straightforward:

• To weaken the yen: The government issues bills to raise yen, sells that yen to buy dollars, and then invests those dollars in assets like U.S. Treasurys.

• To strengthen the yen: It sells its dollar-denominated assets to buy back yen.

The account generates profit primarily because Japan's interest rates have been lower than those of other countries. It earns higher interest on its foreign assets than it pays on the bills it issues. A weaker yen also boosts profits by increasing the yen-denominated value of interest income earned overseas.

Japan's foreign exchange reserves stood at $1.37 trillion at the end of 2025, according to the Finance Ministry. This figure has been hovering around the $1.3 trillion mark since 2012, swelled by past interventions to buy up dollars.

The FEFSA logged a record gain of 5.36 trillion yen ($34.5 billion) in fiscal 2024, the highest since financial disclosures began in fiscal 2008.

These profits already contribute to the government's general budget. Current rules permit 70% of the gains to be transferred. For fiscal 2025, 3.2 trillion yen was moved to the general account, with about 1 trillion yen allocated to defense spending. Under the existing framework, it would be difficult to extract more funds.

While politicians talk about using unrealized gains from foreign assets, significant obstacles stand in the way.

"By the special forex account's very nature, converting its foreign currency assets to yen would be currency intervention, which imposes some limits on its use as a funding source," said Takahiro Hattori, a project associate professor at the University of Tokyo.

International norms permit currency market intervention only on a limited basis, typically to counter speculative swings. If Japan were to sell its dollar assets for domestic funding when no such crisis exists, it would likely face opposition from the U.S. and could reduce its capacity for necessary interventions in the future.

The idea of using the FEFSA is not limited to the ruling party. Opposition parties also see it as a potential funding source.

The Democratic Party for the People has proposed using investment profits and asset sales from the account, along with pension reserves and Bank of Japan-held ETFs, to fund proactive fiscal policy. Similarly, in last summer's upper house election, the Constitutional Democratic Party suggested using forex account gains to help finance a temporary suspension of the consumption tax on food.

Prime Minister Takaichi later elaborated on her comments in a post on X, stating her goal was not to praise a weak or strong yen but to "build a strong economy that is resilient to exchange rate fluctuations." She pushed back on the interpretation that she "stress[ed] the benefits of yen depreciation" but did not address her remarks about the special account.

As Takaichi noted, a weak yen has both pros and cons. It boosts the profits of Japanese exporters and can lift stock prices. However, it also drives up the cost of imported energy, food, and raw materials, fueling inflation. In recent years, Japan's export volume has stagnated even as the yen has weakened.

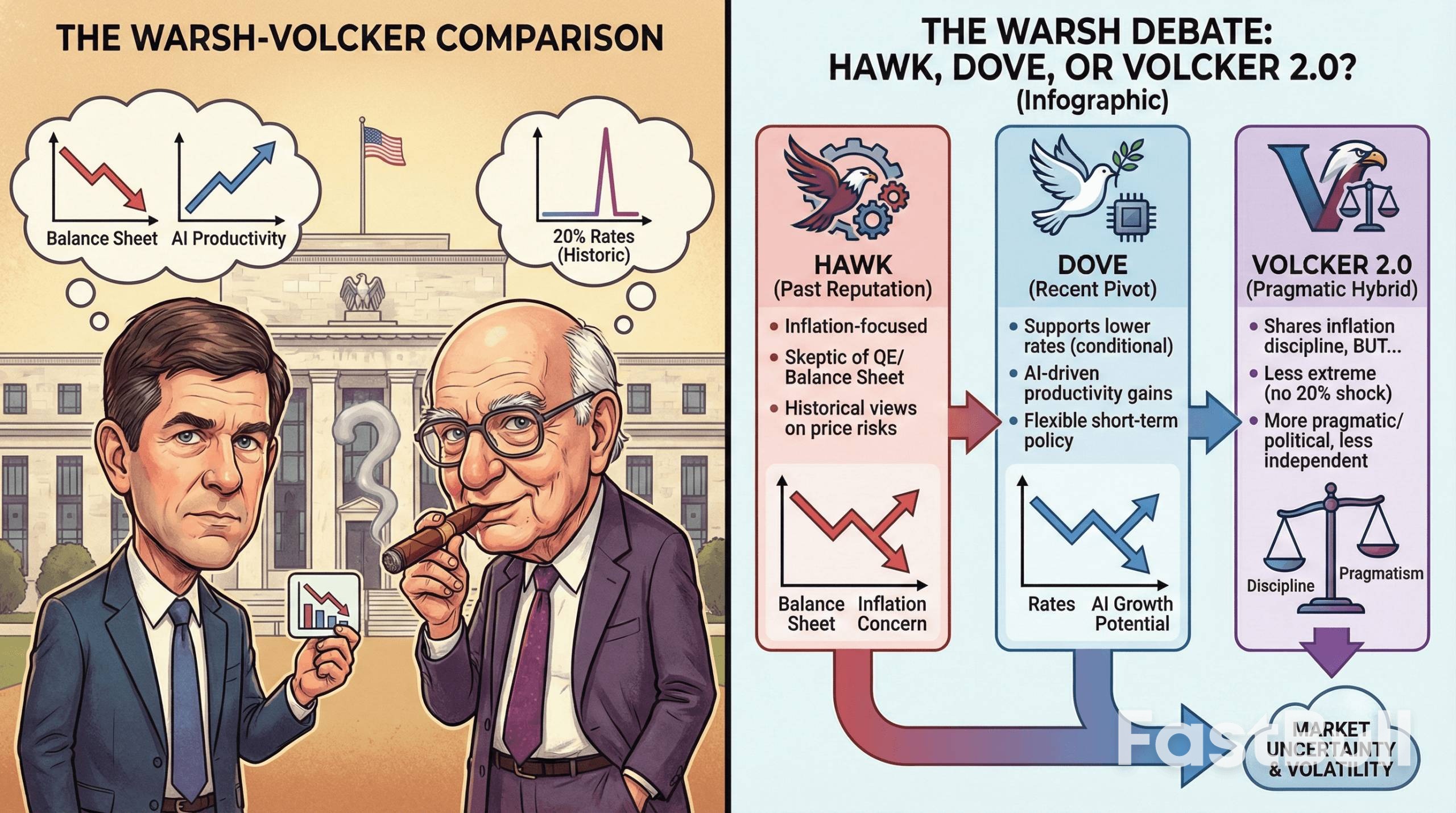

Investors are trading the nomination of Kevin Warsh for Federal Reserve Chair as if Paul Volcker himself just walked back into the Eccles Building. But is Warsh truly the inflation hawk his reputation suggests? The answer is far more complicated.

President Trump announced the nomination on January 30, 2026, positioning Warsh as a figure who can restore discipline at the central bank as Jerome Powell's term ends in May. The move comes after Trump's repeated criticism of the Fed's rate policy and independence, placing Warsh’s monetary philosophy squarely in the spotlight.

Warsh’s record provides ample fuel for the hard-money narrative. As a Fed governor from 2006 to 2011, he built a reputation as one of the board's most consistent voices on inflation. Even as the 2008 financial crisis unfolded, pushing unemployment up and sparking fears of deflation, Warsh persistently warned that inflation expectations could become unanchored.

"Inflation risks, in my view, continue to predominate as the greater risk to the economy," he stated at the time.

After leaving the Fed, this view solidified. Warsh became a prominent critic of quantitative easing (QE), arguing that the central bank's expanding balance sheet distorted capital allocation and dangerously blurred the lines between monetary and fiscal policy. He has maintained that inflation isn't a random event but the direct result of excessive spending and money creation.

"My overriding concern about continued QE, then and now, involves the misallocations of capital in the economy and the misallocation of responsibility in our government," Warsh said in 2018.

This history triggered a classic hawkish reaction in markets upon his nomination. Gold and silver sold off, the dollar strengthened, and traders immediately began making comparisons to Volcker.

However, the full picture is more complex. In recent years, Warsh has also criticized Powell’s policy for being too restrictive and hindering economic growth. He has argued for both lower interest rates and a smaller Fed balance sheet, signaling a willingness to cut rates if accompanied by structural reforms.

This dual position has divided analysts.

• One camp sees intellectual consistency: They believe Warsh's goal is to shrink the Fed's overall footprint, which in turn creates the flexibility to ease short-term rates.

• Another camp sees political pragmatism: They suggest Warsh is adapting his views to align with Trump's well-known preference for lower interest rates.

The tension in Warsh's platform fuels comparisons to Paul Volcker, but the analogy has clear limits. Volcker, the Fed's 12th chairman, inherited runaway inflation in the late 1970s and broke its back by raising the federal funds rate above 20%, knowingly inducing a recession to restore the Fed's credibility. Warsh has neither faced such an extreme scenario nor indicated he would deploy similar economic shock therapy.

Furthermore, Volcker was defined by his staunch independence from political pressure. Warsh is widely seen as more pragmatic and attuned to political realities, making it less likely he would wage a public war against the administration that appointed him.

This doesn't make him a dove; it makes him conditional. While Warsh views inflation control as non-negotiable, he also believes productivity gains, particularly from artificial intelligence, could enable lower rates without stoking price pressures. If the economy delivers on that productivity promise, he may appear accommodative. If inflation surges, the hawk would likely reemerge.

Markets are still trying to solve the puzzle. Fed funds futures are pricing in more rate cuts for 2026, even as traders prepare for a potentially faster reduction of the Fed's balance sheet. This suggests the market is bracing for a hybrid Fed—one that is structurally tighter but potentially looser in its rate signaling.

If confirmed, Warsh could also bring back an old-school communication style. This would mean less forward guidance and more emphasis on actions over promises. Such a shift away from verbal interventions could increase market volatility as traders adjust to a central bank that speaks less but acts more decisively.

Ultimately, Warsh is not a simple Volcker successor. He shares a skepticism of easy money but not an appetite for inflicting economic pain. For investors, the message is clear: ignore the simple labels. Warsh is neither a committed hawk nor a predictable dove. He is a pragmatist who believes in credibility and will likely respond to data, not dogma, making his tenure anything but certain.

Key Points on a Warsh-Led Fed

• Hawkish Credentials: Warsh has a long-standing record of prioritizing inflation control and opposing prolonged quantitative easing.

• Dovish Flexibility: He has recently supported lower interest rates, provided they are paired with balance-sheet reduction and productivity gains.

• The Volcker Parallel: He shares Volcker's focus on monetary discipline but likely lacks his predecessor's tolerance for extreme rate hikes and political confrontation.

• Potential Policy Mix: A Warsh-led Fed might combine faster balance-sheet runoff with targeted rate cuts and a less predictable communication strategy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up