Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin surges past $97K amid Fed policy debates, with deregulation emerging as a potential inflation-buster.

Bitcoin's price has soared past $97,000, hitting a high not seen since last November as U.S. markets opened for trading. The surge comes as traders navigate a complex economic landscape, with a postponed Supreme Court decision on tariffs and an anticipated January announcement from the White House adding to the uncertainty.

Amid these developments, the central question for investors is what to expect from the Federal Reserve's upcoming financial declarations.

Federal Reserve official Miran, who also serves as a representative for Trump, has been a vocal advocate for reducing interest rates. He has repeatedly stressed the need for rate cuts to support the economy.

However, strong employment data from last week has tempered expectations for an immediate policy shift. The robust jobs report makes it highly unlikely that the Federal Reserve will lower rates during its January session.

A key argument for a more accommodative monetary policy centers on the potential impact of deregulation. Proponents believe that reducing regulatory burdens could stabilize prices and enhance economic productivity by expanding supply capabilities.

According to Miran, failing to align monetary policy with deregulation would lead to an "overly restrictive" environment that unnecessarily hinders growth. His long-term vision includes a goal to lift approximately 30% of regulations by 2030, a move he estimates could slice inflation by half a percentage point each year.

He explained his reasoning:

"Deregulation should exert downward pressure on prices, offering another reason for us. The central bank is expected to reduce interest rates. Deregulation introduces a positive supply and productivity shock, enhancing the economy's capacity while alleviating price pressures. If central banks do not counteract the effects of deregulation, policy becomes overly restrictive, unnecessarily inhibiting growth."

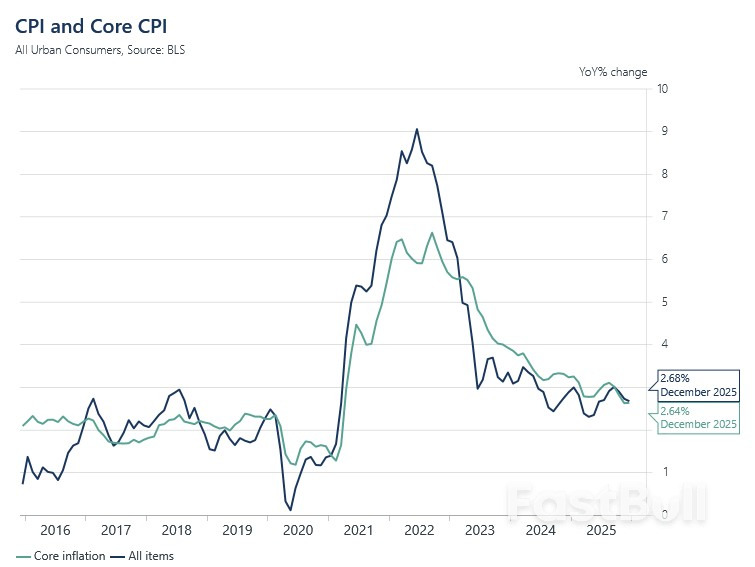

While today's Producer Price Index figures were conflicting, any clear sign that inflation is falling below 3% would make it easier for the Fed to consider a shift toward a neutral interest rate. President Trump has also argued that a combination of tariffs, deregulation, and immigration policies would contribute to lower inflation.

The current scenario presents several key takeaways for investors and market watchers:

• No Imminent Rate Cut: The Federal Reserve is widely expected to hold interest rates steady in its upcoming January meeting, primarily due to strong employment figures.

• Deregulation's Potential: Proposed deregulation stands out as a potential catalyst for significant economic benefits, including reduced inflation and enhanced productivity.

• Persistent Uncertainty: The deferral of the Supreme Court's decision on tariffs adds another layer of uncertainty to market expectations.

Although Miran's perspective on interest rate cuts may not yet represent the consensus view within the Federal Reserve, the broader economic and regulatory environment continues to fuel speculation and drive volatility in markets like Bitcoin.

A revealing shift in language from a U.S. congressman signals a profound change in American foreign policy. Last December, Rep. Andy Ogles described the United States as "the dominant predator across all landscapes," a phrase reflecting decades of global power projection. Today, that vision has shrunk.

The United States has long operated as the world's preeminent superpower. Its influence is built on a global network of allies, unparalleled military might, and the ability to deploy force to any corner of the globe. This power wasn't just for show; it was designed to protect concrete American interests, including:

• The stability of the dollar-based financial system.

• Freedom of navigation on the open seas.

• Access to strategic resources worldwide.

• The ability to project power from allied territories like Europe.

This global posture was a complex mix of hard power, diplomatic persuasion, and carefully maintained international institutions.

However, recent actions under President Donald Trump, including those related to Venezuela and outlined in the National Security Strategy, suggest this era is over. This is not a classic exercise in power projection but a deliberate retreat from America's role as a global superpower.

The evidence for this pullback is clear. When questioned recently about a raid in Venezuela, Rep. Ogles updated his description of American dominance. The U.S., he declared, is "the dominant predator force in the Western Hemisphere."

The vague, all-encompassing term "landscapes" is gone, replaced by a single, geographically limited hemisphere. This isn't a strategic realignment; it's an unforced retreat. In effect, the Trump administration is adopting the "spheres of influence" worldview long advocated by rivals like Russia and China.

Many observers worry that Trump's actions weaken international law, setting precedents that authoritarian leaders will exploit. They suggest that President Xi Jinping of China and President Vladimir Putin of Russia might get "ideas" from the White House.

This misses the point. Neither leader has been waiting for permission from Washington. Xi already has his own timeline for a potential move on Taiwan, and Putin's history of war crimes in Ukraine shows he acts without seeking approval.

Instead, these leaders will interpret Trump's new hemispheric focus as an American surrender to their long-pushed narrative of "multipolarity"—a world with multiple centers of power, each dominating its own region. They will see it as a validation of their goal to break U.S. hegemony.

This effectively gives them a green light to pursue their imperial ambitions more openly. Russia and China won't lament the loss of U.S. influence in the Caribbean if it legitimizes their own expansionist goals closer to home. This dynamic was already visible in 2019, when Moscow reportedly offered Washington a free hand in Venezuela in exchange for Russia having its way in Ukraine.

History offers a cautionary tale. From 1945 to 2025, the U.S. played a global role similar to that of 19th-century Britain. To maintain its empire, Britain had to manage emerging competitors, cultivate a global network of allies, and, most importantly, never show weakness. In a predatory international system, perceived weakness is blood in the water.

It would have been unthinkable for Britain at the height of its power to abandon its global empire in exchange for securing Normandy. Yet, that is analogous to the strategic trade-off Trump appears to be making.

This strategic retreat is likely to generate damaging geopolitical ripple effects.

First, it will further alienate U.S. allies. If Trump takes aggressive action to acquire Greenland, for instance, these former partners will be even less likely to support American interests.

Second, the pullback signals to adversaries that the dominant global power may be weak, wounded, and incapable of sustaining its global commitments. This perception will only embolden them.

Trump's hemisphere-centric plan does not secure U.S. interests or consolidate its strength. It creates severe strategic dilemmas by pushing away allies while encouraging enemies. The price of rebuilding the alliances and global posture being discarded will be immeasurably higher than the cost of preserving Washington's current influence.

The concept of a "rules-based international order" is being openly challenged by a return to raw power politics. Recent state news broadcasts in Russia champion a new reality where strength dictates outcomes, a doctrine vividly demonstrated by recent military actions from both Washington and Moscow.

From a lightning raid in the Caribbean to a hypersonic missile strike in Eastern Europe, both superpowers are signaling a strategic pivot toward pravo sil'nogo—the "right of the strong."

On January 3, the Trump administration executed a dramatic show of force with "Operation Absolute Resolve." In a 30-minute strike, U.S. Delta Force commandos captured Venezuelan President Nicolás Maduro and his wife in Caracas.

The operation, supported by over 150 aircraft, represents an aggressive reassertion of the Monroe Doctrine. By using overwhelming force to decapitate a hostile regime, Washington sent a clear message. President Trump later reinforced this, stating, "American dominance in the Western Hemisphere will never be questioned again."

Just days later, on January 9, the Kremlin responded with its own form of "kinetic diplomacy." Russia launched its Oreshnik hypersonic missile, targeting the Ukrainian city of Lviv near the Polish border.

This was a calculated signal to NATO. The missile, carrying six warheads traveling at Mach 10, was designed to demonstrate a capability that Western air defenses cannot intercept. While the warheads were reportedly inert "dummies," the launch served as a blunt reminder of Moscow's capacity for escalation and its ability to hold Western targets at risk.

These escalatory moves unfold against the backdrop of a brutal war of attrition in Ukraine. Russia's full-scale invasion has now lasted longer than the Soviet Union's war against Nazi Germany in World War II.

Despite the deployment of advanced drones and hypersonic technology, the frontlines have remained largely static. The conflict has devolved into a "meat grinder" that has also diminished the battlefield effectiveness of advanced Western weapons systems like the Abrams tank and HIMARS.

The trend of assertive power plays extends to other strategic regions. The U.S. has continued to signal territorial ambitions in the Arctic, with President Trump vowing to acquire Greenland from Denmark. "I would like to make a deal, you know, the easy way. But if we don't do it the easy way, we're going to do it the hard way," Trump stated at a recent press conference.

These events raise critical questions about the new global landscape. Was the raid in Venezuela the opening move in a larger geopolitical bargain between Washington and Moscow? And is Russia's Oreshnik strike a genuine threat or a desperate signal aimed at an unpredictable U.S. administration? As global norms erode, the world is left to decipher the intentions behind these powerful displays of force.

Sales of previously owned homes in December rose to a seasonally-adjusted, annualized rate of 4.35 million units, a 5.1% increase from November, according to the National Association of Realtors. That was higher than analysts' expectations for a gain of 2%. Sales were 1.4% higher than a year earlier.

For the full year, there were 4.06 million existing home sales, unchanged from 2024.

After adjusting for seasonal factors, December sales were the strongest in nearly three years. Sales increased in all regions month-over-month and were higher annually in the Northeast and Midwest, but lower in the South and West.

This count is based on closings, so sales contracts likely signed in October and November, when mortgage rates weren't moving much. The average rate on the 30-year fixed loan hovered between 6.2% and 6.3% during that time. That rate, however, was lower than it was last spring and summer, when it was closer to 7%.

"2025 was another tough year for homebuyers, marked by record-high home prices and historically low home sales," said Lawrence Yun, chief economist for The Realtors, in a release. "However, in the fourth quarter, conditions began improving, with lower mortgage rates and slower home price growth."

Inventory was the big headline of the monthly report. There were 1.18 million units available for sale at the end of December, down 18% from November, although 3.5% higher year-over-year.

With stronger sales, that dropped the supply to just 3.3 months, which is considered quite lean. Low supply kept prices in positive territory, although just barely.

The median price of a home sold in December was $405,400, up 0.4% annually and the 30th straight month of annual gains. The increase, however, was smaller than the 1.2% gain in November.

"With fewer sellers feeling eager to move, homeowners are taking their time deciding when to list or delist their homes. Similar to past years, more inventory is expected to come to market beginning in February," Yun added.

WASHINGTON, Jan 14 (Reuters) - U.S. existing home sales accelerated in December, boosted by lower mortgage rates and slow growth in house prices.

Home sales jumped 5.1% last month to a seasonally-adjusted annual rate of 4.35 million units, the National Association of Realtors said on Wednesday. Economists polled by Reuters had forecast home resales would rise to a rate of 4.21 million units. Home sales increased 1.4% on a year-over-year basis.

"In the fourth quarter, conditions began improving, with lower mortgage rates and slower home price growth," Lawrence Yun, the NAR's chief economist, said in a statement. "Inventory levels remain tight, with fewer sellers feeling eager to move, homeowners are taking their time deciding when to list or delist their homes."

Mortgage rates dropped in 2025 though they remain considerably higher than they were three years ago. President Donald Trump last week ordered the Federal Housing Finance Agency, which oversees mortgage finance giants Fannie Mae and Freddie Mac, to purchase $200 billion of bonds issued by the two companies in a bid to bring down mortgage rates.

Analysts expect the mortgage purchases to have a modest impact. Mortgage rates, which track the benchmark 10-year Treasury yield, remain elevated.

The inventory of existing homes rose 3.5% from a year ago to 1.18 million units in December. At December's sales pace, it would take 3.3 months to exhaust the current inventory of existing homes, up from 3.2 months a year ago.

The median existing home price last month increased 0.4% from a year ago to $405,400. Trump also has proposed banning institutional investors from buying single-family homes to improve affordability.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up