Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Indonesia Deposit Facility Rate (Dec)

Indonesia Deposit Facility Rate (Dec)A:--

F: --

P: --

Indonesia Lending Facility Rate (Dec)

Indonesia Lending Facility Rate (Dec)A:--

F: --

P: --

Indonesia Loan Growth YoY (Nov)

Indonesia Loan Growth YoY (Nov)A:--

F: --

P: --

South Africa Core CPI YoY (Nov)

South Africa Core CPI YoY (Nov)A:--

F: --

P: --

South Africa CPI YoY (Nov)

South Africa CPI YoY (Nov)A:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Dec)

Germany Ifo Business Expectations Index (SA) (Dec)A:--

F: --

Germany Ifo Current Business Situation Index (SA) (Dec)

Germany Ifo Current Business Situation Index (SA) (Dec)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Dec)

Germany IFO Business Climate Index (SA) (Dec)A:--

F: --

Euro Zone Core CPI Final MoM (Nov)

Euro Zone Core CPI Final MoM (Nov)A:--

F: --

P: --

Euro Zone Labor Cost YoY (Q3)

Euro Zone Labor Cost YoY (Q3)A:--

F: --

Euro Zone Core HICP Final YoY (Nov)

Euro Zone Core HICP Final YoY (Nov)A:--

F: --

P: --

Euro Zone Core HICP Final MoM (Nov)

Euro Zone Core HICP Final MoM (Nov)A:--

F: --

P: --

Euro Zone Core CPI Final YoY (Nov)

Euro Zone Core CPI Final YoY (Nov)A:--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Nov)

Euro Zone CPI YoY (Excl. Tobacco) (Nov)A:--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Euro Zone Gross Wages YoY (Q3)

Euro Zone Gross Wages YoY (Q3)A:--

F: --

P: --

Euro Zone HICP Final YoY (Nov)

Euro Zone HICP Final YoY (Nov)A:--

F: --

P: --

Euro Zone HICP Final MoM (Nov)

Euro Zone HICP Final MoM (Nov)A:--

F: --

P: --

U.K. CBI Industrial Prices Expectations (Dec)

U.K. CBI Industrial Prices Expectations (Dec)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Dec)

U.K. CBI Industrial Trends - Orders (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

Russia PPI YoY (Nov)

Russia PPI YoY (Nov)A:--

F: --

P: --

Russia PPI MoM (Nov)

Russia PPI MoM (Nov)A:--

F: --

P: --

Australia Consumer Inflation Expectations

Australia Consumer Inflation ExpectationsA:--

F: --

P: --

South Africa PPI YoY (Nov)

South Africa PPI YoY (Nov)--

F: --

P: --

Euro Zone Construction Output MoM (SA) (Oct)

Euro Zone Construction Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Construction Output YoY (Oct)

Euro Zone Construction Output YoY (Oct)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Dec)

U.K. BOE MPC Vote Unchanged (Dec)--

F: --

P: --

Mexico Retail Sales MoM (Oct)

Mexico Retail Sales MoM (Oct)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

U.K. BOE MPC Vote Cut (Dec)

U.K. BOE MPC Vote Cut (Dec)--

F: --

P: --

U.K. BOE MPC Vote Hike (Dec)

U.K. BOE MPC Vote Hike (Dec)--

F: --

P: --

MPC Rate Statement

MPC Rate Statement Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement Canada Average Weekly Earnings YoY (Oct)

Canada Average Weekly Earnings YoY (Oct)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Nov)

U.S. Core CPI YoY (Not SA) (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Real Income MoM (SA) (Nov)

U.S. Real Income MoM (SA) (Nov)--

F: --

P: --

U.S. CPI YoY (Not SA) (Nov)

U.S. CPI YoY (Not SA) (Nov)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. CPI MoM (Not SA) (Nov)

U.S. CPI MoM (Not SA) (Nov)--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Nov)

U.S. Core CPI (SA) (Nov)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. Conference Board Employment Trends Index (SA) (Oct)

U.S. Conference Board Employment Trends Index (SA) (Oct)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Dec)

U.S. Kansas Fed Manufacturing Production Index (Dec)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Nov)

U.S. Cleveland Fed CPI MoM (Nov)--

F: --

P: --

Russia PPI MoM (Nov)

Russia PPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Chinese AI chipmaker Biren Technology is poised to raise up to $300 million through a Hong Kong IPO in the coming weeks, as it accelerates domestic production to counter U.S. chip sanctions and meet Beijing’s push for semiconductor self-reliance....

Canada's November inflation report delivered a steady headline print while offering the Bank of Canada (BOC) its first clear signal in months that underlying price pressures are finally cooling.

Statistics Canada reported headline CPI unchanged at 2.2% y/y in November, matching October's rate but coming in slightly below the 2.3% consensus forecast. Monthly CPI rose 0.1%, meeting expectations and down from October's 0.2% increase.

The key development came from the BOC's preferred core measures, which had stubbornly hovered around 3% since April, when U.S. tariffs began affecting Canadian prices.

Both CPI-median and CPI-trim fell to 2.8% from 3.0% in October, marking the first time since March that these measures dropped below the upper end of the central bank's 1-3% control range.

Link to official Statistics Canada Consumer Price Index (November 2025)

The slowdown in core inflation helped calm fears that stubborn inflation and weak growth were happening at the same time, even as food prices stayed high.

With CPI median and CPI trim finally slipping below 3%, economists see underlying inflation moving closer to the 2% target. That supports the idea that the BOC can stay on pause for longer, rather than rushing into more cuts or worrying about rate hikes.

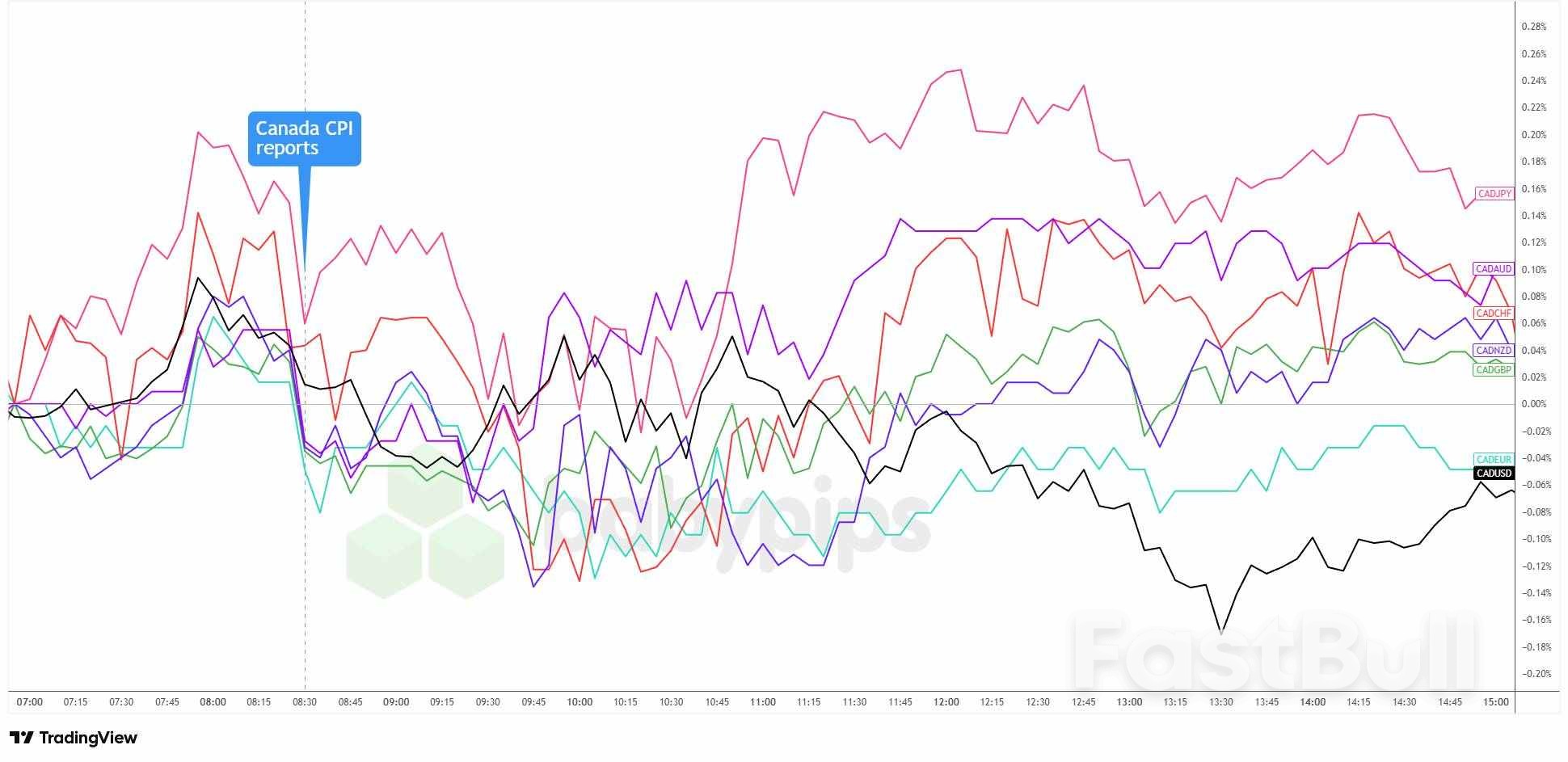

Canadian Dollar vs. Major Currencies: 5-min

But while the easing in core inflation was a positive sign, the central bank had already said at its December 10 meeting that interest rates were "about the right level" after a hefty 275 basis points of cuts. Governor Tiff Macklem also made it clear the bank is comfortable staying on hold for now while it watches how the economy reacts to ongoing trade tensions with the U.S.

This is likely why the Canadian dollar failed to sustain its initial post-event moves during the U.S. session. The Loonie, which initially firmed shortly before Canada's CPI release, briefly dipped at the cooler core CPI prints but soon saw mixed price action against its major counterparts.

The comdoll found an intraday floor a few hours into the U.S. session, and finished the session near its pre-CPI levels. CAD finished the day mixed, trading higher against safe havens USD and CHF and fellow comdolls AUD and NZD, but lower against EUR, JPY, and GBP.

Renewed optimism over a Russia-Ukraine ceasefire weighed on the oil market yesterday. ICE Brent settled a little more than 0.9% lower, leaving it at $60.56/bbl -- the lowest close since May. President Trump has said that an agreement to end the war in Ukraine is closer than ever, after talks in Berlin. Clearly, territory remains a big sticking point.

Oil markets will be watching developments closely, given the significant supply risk from sanctions on Russia. While Russian seaborne oil exports have held up well since the imposition of sanctions on Rosneft and Lukoil, this oil is still struggling to find buyers. The result is a growing volume of Russian oil at sea. India, a key buyer of Russian oil since the Russia/Ukraine war began, will reportedly see imports of Russian crude fall to around 800k b/d this month, down from around 1.9m b/d in November.

The continued weakness in the refined products market may be adding to the broader pressure on oil markets over the last week or so. Refinery margins surged in November amid concerns over the impact of sanctions on refined product flows and persistent Ukrainian drone attacks on Russian refinery assets. These concerns coincide with some refinery outages and the maintenance season. This has been evident in the middle distillate market, with the ICE gasoil crack trading up towards $38/bbl in November on the back of heavy speculative buying. However, speculators have been heavily selling the gasoil market since late November. Ths has seen the crack fall back towards $23/bbl. As of last Tuesday, speculators held a net long of 58,578 lots in ICE gasoil, down from a peak of 102,195 lots as of 25 November.

Cocoa sold off aggressively yesterday. The London market settled a little more than 7% lower, pressured by strong cocoa arrivals at the Ivory Coast ports. Recent data shows that total cocoa arrivals at Ivory Coast ports so far this season have edged up to 895.5kt as of 14 December, compared to 894kt during the same time last year. To date, arrivals have lagged behind last year. Meanwhile, the Ivory Coast government permitted its cocoa regulator to purchase about 200kt of beans from farmers amid falling prices. Last week, the council met with several exporters who are at risk of defaulting on forward purchases. Falling global prices are making it more difficult to fulfil contracts set at higher prices.

CBOT wheat prices extended losses for a second consecutive session, with prices falling around 1.6% amid comfortable supply prospects. Earlier, the Rosario Board of Trade estimated wheat production in Argentina would rise to a record of 27.7mt for the 205/26 season, up from a previous estimate of 25.5mtt. This is due to larger-than-expected planted area and a higher yield forecast.

Recent data from the National Federation of Cooperative Sugar Factories Ltd. shows that sugar production in India rose 28% year-on-year to 7.8mt between 1 October and 15 December, up from 6.1mt for the same period last year. Factories crushed 90.1mt of cane over the period compared to 71.8mt crushed a year ago. Meanwhile, around 479 mills were crushing as of 15 December, slightly up from 473 mills last year.

The Bank of Japan is set to raise interest rates on Friday to a three-decade high and pledge to keep hiking borrowing costs, closing the year with two rate hikes despite headwinds from U.S. tariffs and the inauguration of a dovish prime minister.

While a hike still keeps its policy rate low by global standards, it would be another landmark step in Governor Kazuo Ueda's efforts to normalise monetary policy in a country long accustomed to unconventional easing and near-zero rates.

With stubbornly high food costs keeping inflation above its 2% target for nearly four years, the BOJ is widely expected to raise short-term interest rates to 0.75% from 0.5% at a two-day policy meeting ending on Friday.

The central bank will also stress its resolve to continue raising interest rates, though at a pace dependent on how the economy reacts to each increase, sources have told Reuters.

"There's no gap in the view on the economy" between the government and BOJ, Finance Minister Satsuki Katayama told reporters on Tuesday, signaling the administration's tolerance for a hike to 0.75%.

Any such move would underscore the BOJ's growing conviction that Japan was making progress in sustaining a cycle of rising inflation accompanied by solid wage gains - a prerequisite it set for pushing up borrowing costs.

In a rare, ad hoc poll released on Monday, the BOJ said most of its branch offices expect firms to continue bumper wage hikes next year due to intensifying labour shortages.

With Ueda having essentially pre-committed to a December hike in a speech earlier this month, markets are focusing on what signals the governor will drop on the future rate-hike path at his post-meeting news conference.

BOJ policymakers have signaled their intent to tread cautiously as they push rates closer to levels deemed neutral to the economy, which the central bank estimates as in a range of 1% to 2.5%.

But Ueda also faces pressure to drop hawkish signs to avoid triggering a fresh bout of yen declines that push up import costs and broader inflation, analysts say.

While a weak yen boosts exporters' profits, it could prod retailers to pass on costs and raise prices - adding strains to households already suffering from sliding real wages.

The number of food and beverage items that saw prices rise exceeded 20,000 this year, up 64.6% from 2024, though it is likely to fall to just over 1,000 in 2026, according to a survey by private think-tank Teikoku Databank released last month.

But the number of price hikes could spike if yen declines speed up, heightening inflationary risks and complicating the BOJ's rate-hike decisions next year, analysts say.

Japan stands ready to intervene in the currency market to prevent abrupt, sharp yen falls out of sync with fundamentals, government officials say, a sign the administration and BOJ share their aversion to excessive yen declines.

Kei Fujimoto, senior economist at SuMi TRUST, does not expect the yen to appreciate much with a December rate hike already priced in by markets, and recent yen weakness driven largely by concerns over Japan's fiscal deterioration.

"Both a weak yen and higher interest rates may push up consumer prices, corporate production costs and funding costs, potentially weighing on business sentiment," he said.

President Donald Trump's leading candidate to succeed Federal Reserve Chair Jerome Powell, White House economic adviser Kevin Hassett, is facing mounting resistance from top advisers, lawmakers, and markets just weeks before Trump is expected to announce his choice for the central bank's next leader.

According to a report, individuals close to Trump have privately expressed concerns about Hassett's candidacy, arguing his deep alignment with the president could undermine perceptions of the Fed's independence and unsettle financial markets. . Some advisers reportedly fear that nominating a loyalist could further politicize the central bank. Surprisingly, this connection had earlier made Hassett a top candidate to assume Jerome Powell's current position.

Meanwhile, after this news leaked, reports mentioned that this opposition may clarify why interviews with candidates in early December were called off and later rescheduled for Kevin Warsh last week.

Trump declared that he has already settled on who to serve as the chair of the Federal Reserve. This statement caught many by surprise after the president publicly claimed that Kevin Warsh, the former Fed Governor who is currently serving as the acting economic advisor to the Congressional Budget Office (CBO) and a member of the board of directors at UPS, rose as the leading contender alongside Hassett.

Trump's remarks significantly affected Hassett's odds, causing them to drastically drop on Kalshi prediction markets. Seeing how things turned out, the president argued, "I think the two Kevins are great."

Nonetheless, Monday reports noted that Hassett is still in the lead on Kalshi, with his odds showing a 51% chance. However, this percentage illustrates a decrease from more than 80% odds raised earlier this month. Warsh, on the other hand, experienced a substantial increase in odds, rising to a 44% chance from around 11% at the beginning of December.

Analysts researched the situation and discovered that the current opposition appeared to be concentrated more on backing Warsh instead of criticizing Hassett. It also seems that apart from Trump, Jamie Dimon, the Chairman and CEO of JPMorgan Chase, preferred the former Fed governor. However, he positively talked about both Hassett and Warsh.

In the meantime, a reliable source highlighted that Hassett outperformed his competitors in the race by taking Powell's position at the end of November. Notably, Powell's term is scheduled to conclude in May next year.

Still, several sources emphasized that Hassett encountered some opposition as December progressed. Following this assertion, individuals raised concerns that the bond market might respond negatively if it perceived him as being too closely connected to the US president.

This perception could produce a contrary result from what Trump expects, potentially leading to a surge in long-term yields due to escalating fears that Hassett will not adopt strong measures to address inflation in the event of its increase.

Responding to this criticism, Hassett embraced a stronger stance on the issue of Federal Reserve independence. He made this move during an interview held this past weekend.

In an appearance on "Face the Nation," Hassett shared a transcript stating that, 'Trump has strong and well-reasoned ideas about what we should do. However, the Federal Reserve's role is to remain independent and collaborate with the Board of Governors and the FOMC to reach a consensus on interest rates."

This statement drew the attention of several reports, prompting them to reach out to Hassett for comment on the topic of discussion. When asked whether Trump's opinion held the same essence as that of a central bank member voting, Hassett stated that it did not. He further explained that the president had no influence and his opinion only counted if it was rooted in solid data.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up