Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Nov)

Euro Zone Industrial Output MoM (Nov)A:--

F: --

Euro Zone Trade Balance (SA) (Nov)

Euro Zone Trade Balance (SA) (Nov)A:--

F: --

Euro Zone Trade Balance (Not SA) (Nov)

Euro Zone Trade Balance (Not SA) (Nov)A:--

F: --

Euro Zone Industrial Output YoY (Nov)

Euro Zone Industrial Output YoY (Nov)A:--

F: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

Brazil Retail Sales MoM (Nov)

Brazil Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Nov)

Canada Wholesale Inventory YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Nov)

Canada Manufacturing Inventory MoM (Nov)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Import Price Index YoY (Nov)

U.S. Import Price Index YoY (Nov)A:--

F: --

U.S. Import Price Index MoM (Nov)

U.S. Import Price Index MoM (Nov)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Wholesale Sales MoM (SA) (Nov)

Canada Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)--

F: --

P: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Australia establishes a A$1.2B critical minerals reserve, a strategic move challenging China's processing dominance to secure global supply chains.

Australia is launching a A$1.2 billion strategic reserve for critical minerals, a direct move to secure supply chains for itself and its key international partners. The government's plan will initially focus on three essential resources: antimony, gallium, and rare earths.

The details were unveiled as Treasurer Jim Chalmers promoted the initiative in Washington. At a meeting with finance ministers from the "G-7 plus" group, hosted by U.S. Treasury Secretary Scott Bessent, Chalmers framed the reserve as a way to "shore up access to critical minerals during periods of market disruption."

This move fleshes out a policy first proposed by the Labor party before the last federal election. The core challenge is clear: while Australia has untapped reserves of these minerals, China dominates their global processing, accounting for 48% of antimony, 98% of gallium, and 69% of rare earths.

The plan raises two key questions: Why have these specific minerals become so vital, and can Australia truly establish itself as the "most reliable" mineral partner for its allies?

Critical minerals are elements essential for modern technology that have no viable substitutes. Their applications are wide-ranging and fundamental to several high-tech industries, including:

• Green Energy: Solar panels and wind turbines.

• Electronics: Lithium-ion batteries, semiconductors, and computing.

• Defense: Advanced systems like radar, fighter jets, submarines, and drones.

• Medicine: High-tech equipment and medical imaging.

Australia faces a significant supply risk despite its abundant reserves. The country exports most of its raw critical minerals to China for processing before they are sold back as finished components in products like solar panels. This dependency makes the market vulnerable to disruptions from global events or trade disputes.

All three minerals targeted by the new reserve are considered "dual-use," meaning they have both civilian and military applications. Antimony is used in flame retardants and night vision goggles; gallium is vital for semiconductors and radar; and rare earths are necessary for the powerful permanent magnets used in fighter jets and lasers.

To build this reserve, Australia will leverage its export finance credit agency to facilitate "offtake agreements." This model allows buyers, including the Australian government itself, to agree to purchase minerals as security, sometimes even before a mine has started production. These secured minerals can then be sold to Australia's international partners.

This strategy is designed to make Western investment more competitive. Currently, Chinese investors are often more willing to provide the equity and long-term offtake agreements needed to get mining projects off the ground. China also holds significant cost and technical advantages over Western firms in the processing stage.

The timing of the announcement, just before the G-7 plus meeting, was a deliberate strategic move. The G-7—comprising the United States, Britain, Canada, France, Germany, Italy, and Japan—has already agreed to a five-point plan for critical minerals security. While not a member, Australia often aligns with the group's positions.

Many G-7 nations are also part of the Minerals Security Partnership, an initiative aimed at building sustainable and diverse critical mineral supply chains. By establishing the reserve, Australia is signaling its willingness to intervene in the market to support the strategic needs of its allies.

Above all, this is an effort to reassure the United States that Australia is a dependable partner. The U.S. is urgently seeking to secure its own mineral supplies, making Australia's "geoeconomic" decision—using economic tools to achieve geopolitical goals—a timely one. The aim is to diversify supply chains and reduce collective dependence on China.

Entering the critical minerals market is inherently risky. The sector requires massive public and private investment, often supported by financial tools like export credits.

The recent boom-and-bust cycle in the lithium market serves as a cautionary tale. High demand for electric vehicles (EVs) drove a surge in lithium mining, but when EV sales slowed, the market collapsed, forcing some Australian mines to scale back or halt production.

While Australia's new reserve may improve Western access to raw materials, a major hurdle remains: China's entrenched dominance in processing is built on years of accumulated knowledge, advanced skills, and superior technology.

Data Interpretation

Political

Commodity

Remarks of Officials

Forex

Economic

Central Bank

Traders' Opinions

Daily News

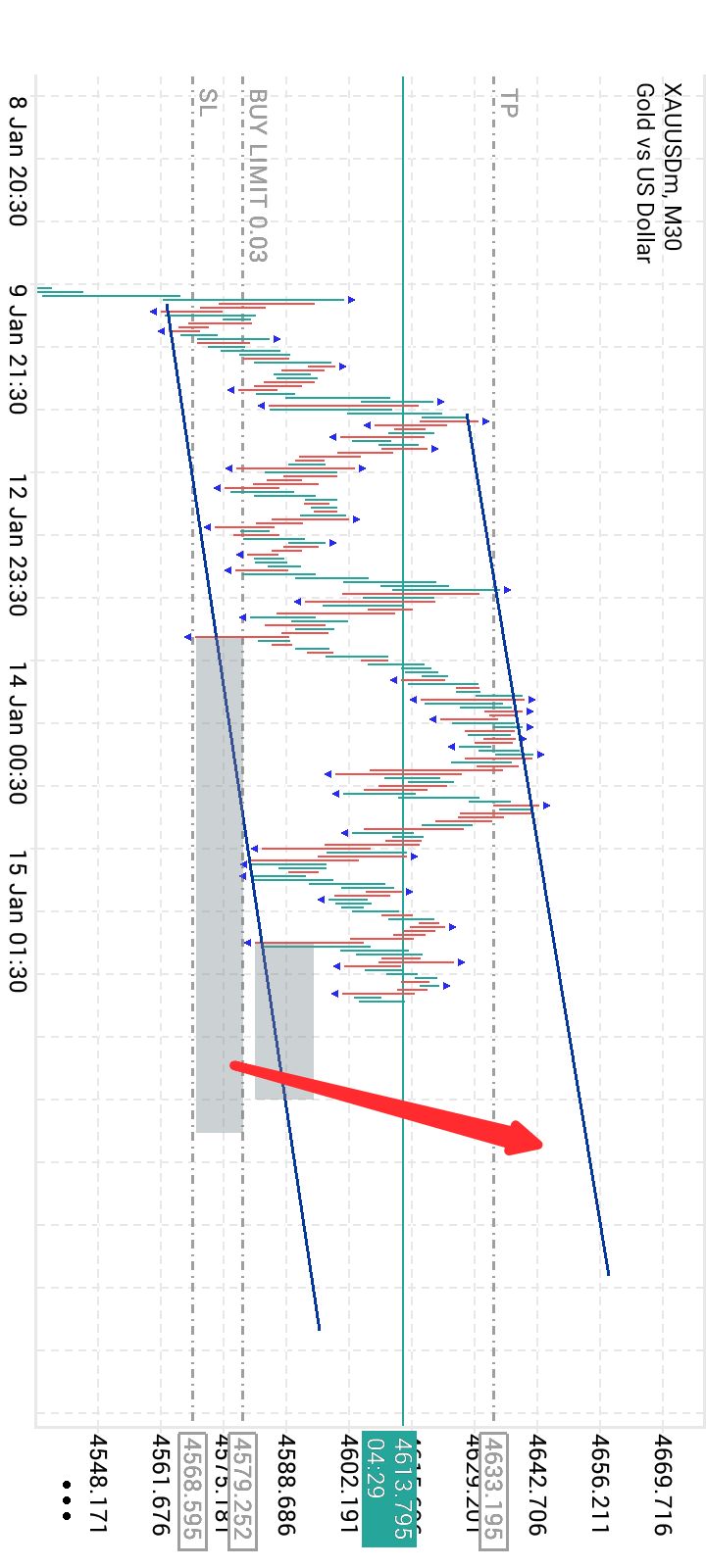

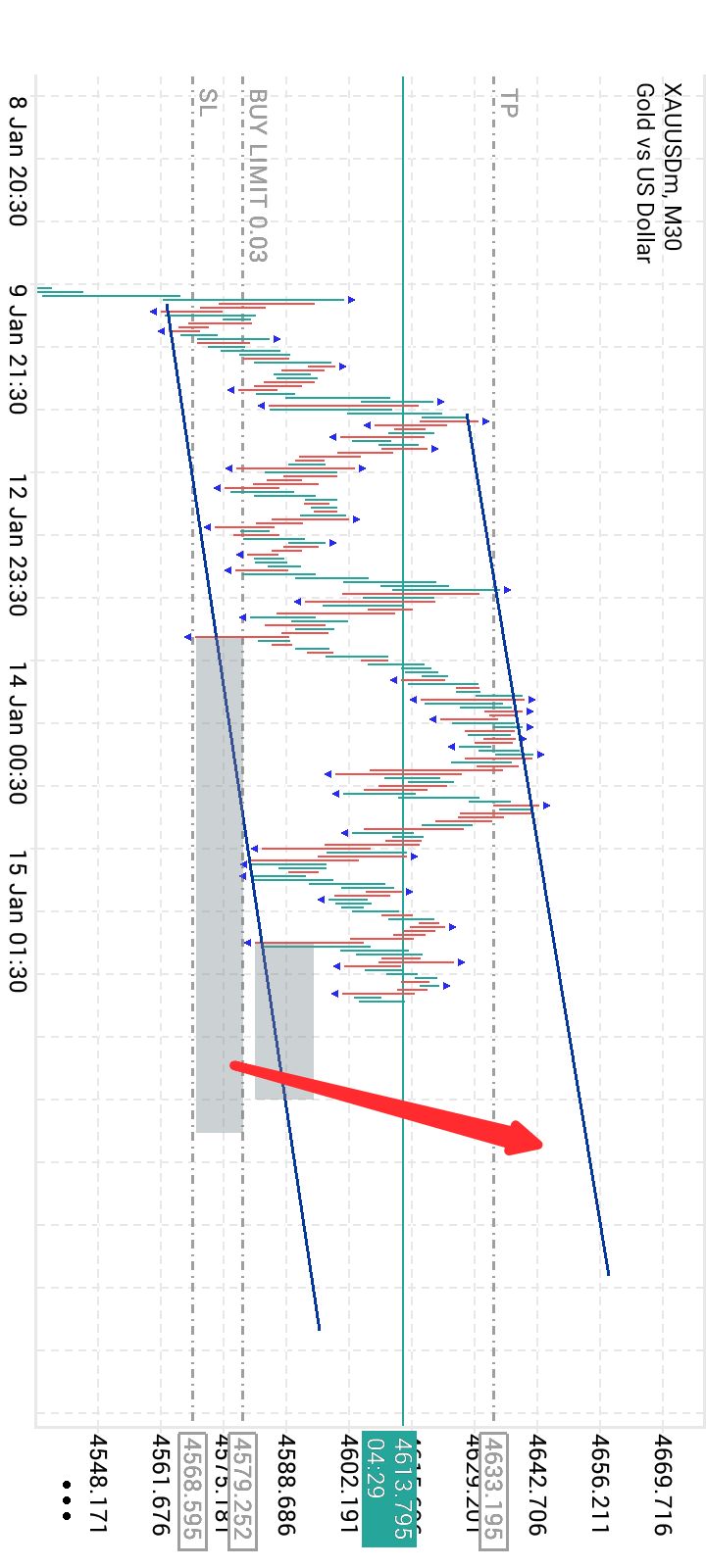

Gold prices retreated on Thursday, pressured by a stronger U.S. dollar following an unexpected drop in weekly jobless claims. An easing of geopolitical tensions surrounding Iran also reduced demand for the metal as a safe-haven asset.

Spot gold fell 0.1% to $4,614.93 per ounce as of 1:30 p.m. ET. The decline came after bullion reached a record high of $4,642.72 on Wednesday. Meanwhile, U.S. gold futures for February delivery settled 0.3% lower at $4,623.70.

The primary driver for gold's dip was fresh economic data from the United States. New applications for unemployment benefits unexpectedly fell last week, a sign of labor market strength that propelled the U.S. dollar index to its highest level since December 2. A stronger dollar typically makes gold more expensive for buyers using other currencies.

"Recent data sort of keeps expectations towards Fed on hold perhaps for the first half of the year, so the dollar index is at a multi-week high and that's providing a bit of a headwind for gold at this point," said Peter Grant, vice president and senior metals strategist at Zaner Metals.

The Federal Reserve is widely expected to keep interest rates unchanged at its upcoming meeting on January 27-28. This comes despite calls from U.S. President Donald Trump for rate cuts. On Wednesday, Trump stated he has no plans to fire Fed Chair Jerome Powell over a Justice Department investigation but noted it was "too early" to determine his final decision. Markets are still pricing in at least two 25-basis-point rate cuts later in the year.

Adding to the pressure on gold was a reduction in geopolitical risk. President Trump signaled a wait-and-see approach toward Iran, stating he was told that killings related to protests were easing and that he saw no immediate plan for large-scale executions.

Grant noted that these easing tensions have weighed on gold prices. However, he described the metal's recent downward move as corrective, suggesting that traders may view the lower prices as a buying opportunity. Gold typically performs well during periods of economic and political uncertainty, especially in low-interest-rate environments.

In a sign of continued institutional interest, Poland's central bank governor, Adam Glapinski, announced on Thursday that the country held 550 tons of gold at the end of 2025 and aims to increase its reserves to 700 tons.

Other precious metals also saw price adjustments:

• Spot silver slid 0.3% to $92.50 per ounce after reaching an all-time high of $93.57 earlier in the session.

• Spot platinum fell 0.8% to $2,404.18 per ounce.

• Palladium held steady at $1,826.32 per ounce.

Philadelphia Federal Reserve President Anna Paulson has voiced strong support for Fed Chair Jerome Powell and signaled she is comfortable holding interest rates steady at the upcoming January meeting.

In her first national interview since taking office last July, Paulson told the Wall Street Journal that Powell is a highly effective leader. Her comments provide a fresh endorsement for the Fed Chair amid rising political scrutiny.

Paulson's remarks come just days after Chair Powell revealed he is facing a criminal investigation concerning the renovation of the Fed's headquarters in Washington—a probe he stated was motivated by President Trump's push for lower interest rates.

"His statement was really strong. I think it really speaks for itself," Paulson said, aligning herself with several Fed colleagues who have publicly defended Powell's integrity this week.

She highlighted Powell's broad appeal, noting that even her 20-year-old son sends her internet memes that celebrate the Fed Chair.

As a new voting member on interest rates this year, Paulson's perspective carries significant weight. She supported the central bank's rate cuts at its last three meetings, including the December decision that brought the target range to between 3.5% and 3.75%.

Looking ahead to the January 27-28 meeting, Paulson indicated she is comfortable maintaining the current policy stance. She views present interest rates as slightly above neutral, a level she believes is appropriate for guiding inflation back down to the Fed's 2% target.

"I want monetary policy restrictiveness to be playing a role to get us all the way back to 2%," she explained.

Conditions for Future Rate Cuts

While favoring a pause for now, Paulson suggested she could be open to modest rate cuts later in 2026 under specific conditions. A policy shift would depend on one of two potential developments:

• Inflation Eases: Data confirms that price pressures are clearly diminishing.

• Labor Market Weakens: Job market conditions deteriorate unexpectedly.

Paulson added that she is paying close attention to January price data, as many businesses typically reset their prices at the start of the year.

A Calmer View on Inflation

Compared to some of her colleagues, Paulson described herself as less concerned about inflation. She cited evidence suggesting that the increases in goods prices seen in 2025 are likely to reverse this year, providing a potential tailwind for disinflation.

The UK government is pushing ahead with its 2030 clean power goals by launching the largest-ever expansion of offshore wind farms, a move that could add up to £1.8 billion annually to household energy bills.

In a recent auction, the government unveiled offshore energy sites with a combined capacity of 8.4 gigawatts—an output far exceeding analyst expectations and sufficient to power approximately 12 million homes.

Ed Miliband, the secretary of state for energy security and net zero, described the initiative as a "monumental step towards clean power by 2030," arguing that the new wind farms will be significantly cheaper to build than new gas plants.

The auction moves the UK closer to its ambitious target of generating 100% of its electricity from renewable sources by 2030. To drive this rapid expansion, however, ministers agreed to pay developers substantially more in this auction compared to last year's, which itself was pricier than the 2024 sale.

The government has positioned its green energy strategy as a flagship policy, framing the 2030 target as one of the most ambitious globally. The official argument is that this investment will ultimately lower bills by freeing the UK from "volatile" international oil and gas markets.

"With these results, Britain is taking back control of our energy sovereignty," Miliband stated. "This is a historic win for those who want Britain to stand on our own two feet, controlling our own energy rather than depending on markets controlled by petrostates and dictators."

Despite the government's optimism, the policy faces significant criticism, particularly as it coincides with multi-year lows in global oil and gas prices. Even with market shocks like Donald Trump's capture of Venezuela's Nicola Maduro and ongoing instability in the Middle East, crude oil is at its lowest nominal price in nearly five years.

Meanwhile, UK energy bills remain high, largely because the costs of the green transition are passed directly to households through a levy system that adds subsidies to customer bills.

An 'Expensive Vanity Project'

Claire Coutinho, the shadow energy secretary, sharply criticized Miliband's decision to grant developers 20-year guaranteed price contracts. She argued that he cared "more about his own clean power vanity project" than about consumers.

"He is cementing our uncompetitive electricity prices for even longer at a time when the world is becoming more unstable and we need cheap, reliable energy to compete," she wrote on X, adding, "Labour promised to cut your bills by £300. This was how Ed Miliband said he was going to do it."

Maurice Cousins, campaign director at Net Zero Watch, echoed these concerns, calling the auction "another hammer blow to the British economy." He dismissed claims that the results are cost-neutral.

"At £95/MWh (2026 prices), this is not a win," Cousins said. "It is a confession that the government's energy plan cannot deliver cheaper power. Moreover, once you factor in the so-called Clean Industry Bonus, prices are closer to £105/MWh."

He compared the deal to locking into a high-cost mortgage for two decades. "By the time network charges, balancing costs and other green levies are added, British businesses and families will still be left paying far more than our international competitors."

The latest auction represents the penultimate realistic opportunity for the government to scale up renewable capacity in time to meet its 2030 target. Next year's auction will need to secure an additional 7 gigawatts of wind farm capacity to stay on track.

Industry experts caution that a singular focus on wind is not enough. Enrique Cornejo, energy policy director at Offshore Energies UK, noted that while the auction is a "positive step," the grid's stability remains a priority.

"The UK will still need continued investment in producing homegrown gas and maintaining our gas generation infrastructure, which remains essential for providing the dispatchable power needed to keep the lights on when the wind doesn't blow and the sun doesn't shine," Cornejo said. "Long-term success for UK energy policy will rely on a balanced approach."

The United States and Taiwan have finalized a major trade agreement that includes a $500 billion investment commitment from Taiwanese semiconductor companies into American operations and a reduction in tariffs on goods from the island.

Under the new terms, tariffs on Taiwanese shipments will drop from 20% to 15%. This brings Taiwan in line with Japan and South Korea, which secured similar agreements last year. The deal resolves a significant point of contention between the US and Taiwan, which Washington supports militarily.

The agreement's financial core is a massive two-part investment from Taiwan's technology sector aimed at bolstering the American semiconductor supply chain.

• Direct Investment: Taiwanese firms will commit to at least $250 billion in direct investments to expand advanced semiconductor, energy, and artificial intelligence facilities in the United States.

• Credit Guarantees: An additional $250 billion will be provided in credit guarantees to support further investment in the US chip industry.

Commerce Department officials confirmed that Taiwan Semiconductor Manufacturing Co. (TSMC) and other companies will spearhead the direct investment portion of the plan. The negotiations, led by Commerce Secretary Howard Lutnick, centered on semiconductors and the framework of the sectoral 232 tariffs.

The agreement also establishes specific tariff caps for other industries. US tariffs on Taiwanese auto parts, timber, lumber, and wood derivative products will be capped at 15%. Furthermore, generic pharmaceuticals manufactured in Taiwan will face no import taxes.

While the White House statement did not single out TSMC, the deal has direct consequences for the world's leading producer of AI chips. Reports earlier in the week suggested the agreement would require TSMC to construct at least four additional chip manufacturing plants in Arizona. This expansion would add to the six factories and two advanced packaging facilities the company has already pledged to build in the state.

To support this expansion, the deal provides tariff relief for companies building new US facilities. They will be permitted to import 2.5 times their current capacity tariff-free during the construction phase. Once the production facilities are operational, that cap will be lowered to 1.5 times their current capacity.

The agreement was announced shortly after a Taiwanese delegation visited Washington to finalize the terms with President Donald Trump's representatives. For months, Taiwanese officials had suggested a pact was imminent.

The deal's framework stems from a Commerce Department investigation that determined chip imports pose a threat to US national security. Instead of imposing broad tariffs, President Trump directed his administration to negotiate arrangements with major exporters. A narrow 25% duty was applied only to certain advanced semiconductors intended for overseas shipment, a move relevant to Nvidia Corp.'s plans to send Taiwan-made H200 AI processors to China.

Taipei was reportedly eager to conclude a deal before a potential meeting between President Trump and Xi Jinping in China, expected in April. The announcement also comes as the Supreme Court prepares to rule on Trump's global tariffs, a decision that could affect his authority to set levies unilaterally.

This agreement provides a boost to Taiwan's economy, which is already thriving on the back of high demand for its tech exports, particularly the accelerators and servers fueling the global AI boom.

Taiwan recently revised its GDP growth forecast for 2025 to 7.3%, which would mark its strongest performance since 2010. The surge in tech exports also helped drive its annual trade surplus with the US to a record $150 billion in 2025.

Taiwanese President Lai Ching-te has expressed support for Trump's goal of reindustrializing the US, though he noted that reforms to American land, electricity, and workforce policies are necessary for projects to succeed. Previously, Taipei had resisted a request to move enough chip production to the US to satisfy half of America's demand.

President Donald Trump is set to select the next chair of the Federal Reserve within weeks, a decision that will profoundly shape U.S. monetary policy and the global economy. The White House confirmed the upcoming announcement, noting the president is considering several qualified individuals for one of the most powerful economic roles in the world.

For investors, businesses, and policymakers, this choice is critical. The next Fed Chair will steer the central bank's strategy on interest rates, inflation, and financial stability at a complex moment for the U.S. economy, which is navigating strong job growth alongside persistent inflation concerns.

The Federal Reserve Chair leads the Federal Open Market Committee (FOMC), the body responsible for setting the federal funds rate. This benchmark rate directly influences the cost of everything from mortgages and car loans to business borrowing and the value of the U.S. dollar. The nominee's philosophy on inflation and employment will set the central bank's course for years to come.

Financial markets are highly sensitive to signals about Fed leadership. The announcement of a decision timeline alone can trigger volatility in stocks and bonds as investors analyze potential nominees for clues on the future path of interest rates.

• A hawkish candidate, who prioritizes fighting inflation with higher rates, could strengthen the dollar but create headwinds for the stock market.

• A dovish candidate, who might favor lower rates to support growth, could boost equities but risk letting inflation run higher.

Beyond Wall Street, the decision directly impacts Main Street. Small business owners seeking capital, families looking to buy a home, and consumers financing purchases all have a stake in the Fed's policy direction. The chair's approach to bank regulation also shapes credit availability across the economy.

While the White House has not released an official list, analysts have identified several leading candidates based on their experience and public statements.

• Jerome Powell (Incumbent): Appointed by President Trump in 2018, Powell has overseen a period of initial rate hikes followed by aggressive stimulus during the pandemic. His current policy is focused on combating inflation through rapid rate increases. A reappointment would signal policy continuity.

• Lael Brainard (Vice Chair): A Fed Governor since 2014, Brainard is known for emphasizing the importance of a strong labor market and robust financial stability. She is often perceived as leaning more dovish than some of her colleagues.

• John Williams (NY Fed President): As the head of the New York Fed, Williams has a permanent vote on the FOMC. He is a respected economist known for a data-driven, technocratic approach to monetary policy.

• Kevin Warsh (Former Fed Governor): A known critic of the Fed's post-2008 policies, Warsh could signal a significant policy shift. He is seen as a hawk who might advocate for a more rules-based monetary framework and a faster reduction of the Fed's balance sheet.

• Glenn Hubbard (Former White House Economist): Hubbard served as Chair of the Council of Economic Advisers under President George W. Bush. An academic with market-oriented views, his appointment would also suggest a change in direction.

Due to the U.S. dollar's status as the world's primary reserve currency, the Federal Reserve effectively acts as the global central bank. Policy decisions made in Washington create ripple effects that are felt in financial markets from Europe to Asia.

Emerging markets are particularly exposed to shifts in U.S. monetary policy. Higher U.S. interest rates can trigger capital outflows from these nations, leading to currency depreciation and increased costs for servicing dollar-denominated debt. International bodies like the IMF will be closely watching the nominee's stance on global economic cooperation and crisis management.

The path to confirming a new Federal Reserve Chair is a multi-step, politically sensitive process:

1. Nomination: The President selects and nominates a candidate.

2. Committee Hearings: The Senate Banking Committee conducts confirmation hearings to vet the nominee.

3. Full Senate Vote: The nominee must be approved by a simple majority vote in the full Senate.

While past chairs like Jerome Powell and Janet Yellen secured bipartisan support, the current political climate could make for a contentious confirmation, especially in a narrowly divided Senate.

Jerome Powell is the current Chair of the Board of Governors of the Federal Reserve System. He was first appointed by President Trump.

The Chair of the Federal Reserve serves a four-year term and can be reappointed by the sitting president, subject to Senate confirmation.

The Chair leads the Federal Open Market Committee (FOMC), which votes to set the target for the federal funds rate. This rate serves as the benchmark for short-term borrowing costs throughout the entire U.S. financial system.

The Federal Reserve is designed to be independent of short-term political pressure. The Chair is expected to make monetary policy decisions based on economic data and the Fed's dual mandate of achieving maximum employment and stable prices, ensuring credibility in financial markets.

If a nominee fails to win Senate confirmation, the President must nominate another candidate. In the interim, the Fed's Vice Chair would typically lead the central bank to ensure operational continuity.

Spain is launching a €10.5 billion ($12.2 billion) sovereign investment fund to sustain economic momentum as the European Union's post-pandemic recovery program concludes.

Prime Minister Pedro Sanchez announced the initiative, designed to ensure Spain's growth trajectory continues after the EU's Next Generation funds expire in 2026.

"We're going to create a major sovereign fund that will take over from the Next Generation funds and extend their momentum, making their legacy endure beyond 2026," Sanchez stated at an investor event in Madrid.

The new fund will be backed by "European funds" and is engineered to attract significant private capital from both domestic and overseas investors. The government's goal is to leverage the initial state investment to generate a total of up to €120 billion.

Key sectors targeted for investment include:

• Energy

• Infrastructure

• Housing

• Security

This strategic focus aims to modernize critical areas of the Spanish economy while building on the foundation laid by previous EU support.

Spain has been one of the primary beneficiaries of the EU's NextGeneration program, a massive effort to help member states recover from the economic impact of the COVID-19 pandemic.

In exchange for implementing key legal reforms, Spain was allocated nearly €80 billion in grants and another €83 billion in loans. The government strategically declined a large portion of the loans, citing its strong access to capital markets.

These funds have been a cornerstone of Sanchez's economic policy, acting as an alternative budget and helping Spain's economy expand at nearly twice the rate of the Eurozone average.

The new fund marks a deliberate pivot. As Sanchez explained, "If the NextGen funds were an exercise in European sovereignty, the Spain Grows Fund will be an exercise in national sovereignty."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up