Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

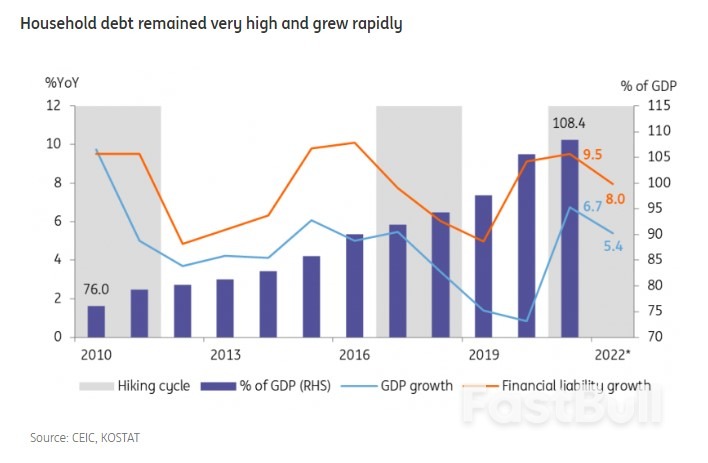

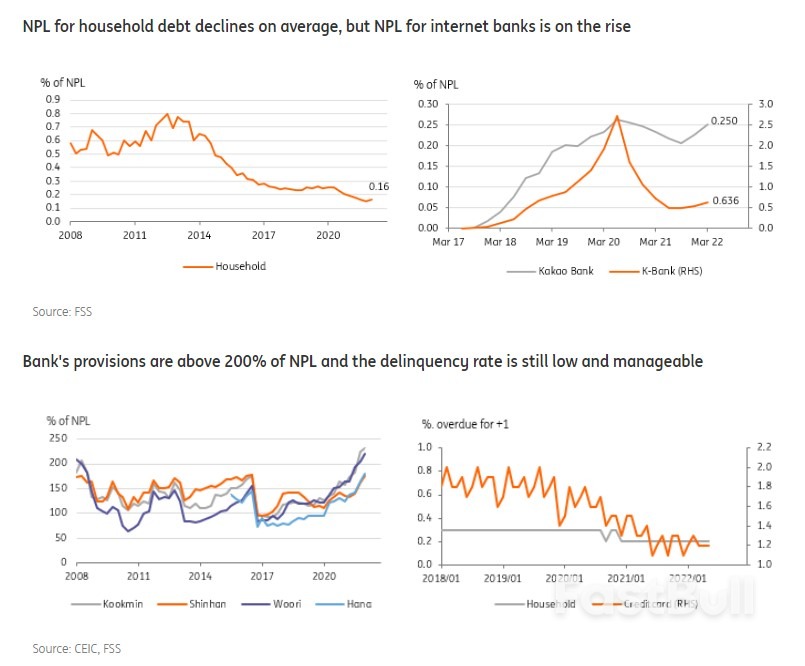

Korea's high level of household debt has been regarded as a major risk factor for the economy for some time.

Historical data shows that debt growth tends to decelerate during policy rate hikes and the latest data confirms that this negative correlation holds in the current hike cycle. We expect the negative correlation to strengthen even more in the coming months due to the faster pace of rate hikes this year compared to past hiking cycles.

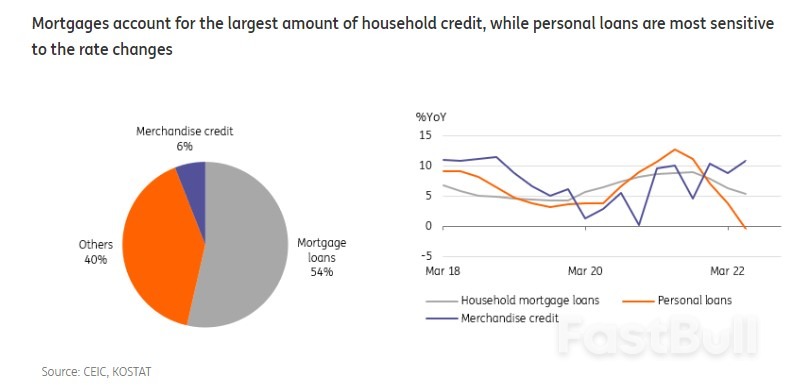

Historical data shows that debt growth tends to decelerate during policy rate hikes and the latest data confirms that this negative correlation holds in the current hike cycle. We expect the negative correlation to strengthen even more in the coming months due to the faster pace of rate hikes this year compared to past hiking cycles. Mortgage loans account for more than half of total household credit

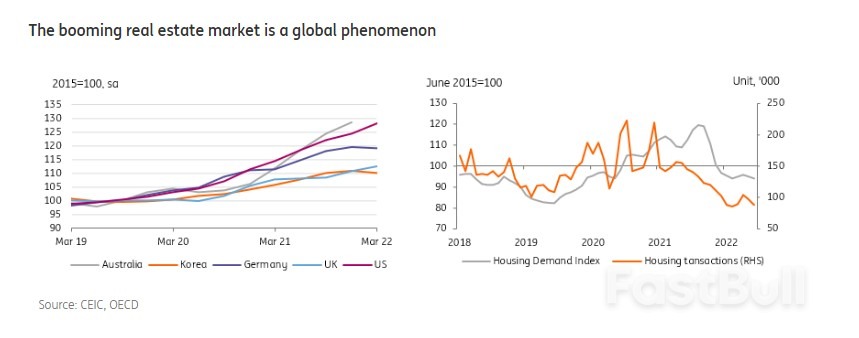

Mortgage loans account for more than half of total household credit To curb sharp rises in house prices, the government has tightened terms for mortgage loans more stringently since 2020. For home purchases, the loan-to-value (LTV) ratio in speculative overheated districts (basically, the entire area of Seoul) was lowered from 80% to 60%, and then again to 20-40%, and loans for a house value of KRW 1.5bn or more were not available at all. Eventually, with these stringent lending conditions at work, the growth of mortgage loans began to decelerate from last year, and this year the slowdown has been accelerating due to rapid rate hikes and growing concerns over valuations. As forward-looking data points to further price corrections, along with the continuing high-interest environment, mortgage loans will grow at a slower pace in our view.

To curb sharp rises in house prices, the government has tightened terms for mortgage loans more stringently since 2020. For home purchases, the loan-to-value (LTV) ratio in speculative overheated districts (basically, the entire area of Seoul) was lowered from 80% to 60%, and then again to 20-40%, and loans for a house value of KRW 1.5bn or more were not available at all. Eventually, with these stringent lending conditions at work, the growth of mortgage loans began to decelerate from last year, and this year the slowdown has been accelerating due to rapid rate hikes and growing concerns over valuations. As forward-looking data points to further price corrections, along with the continuing high-interest environment, mortgage loans will grow at a slower pace in our view. Personal loans: the riskiest segment of household debt

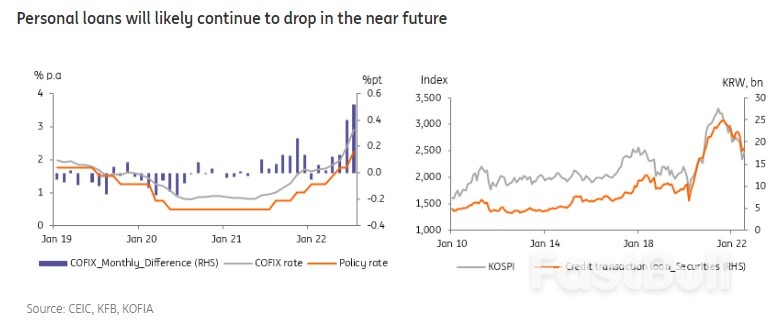

Personal loans: the riskiest segment of household debt The latest data support our view

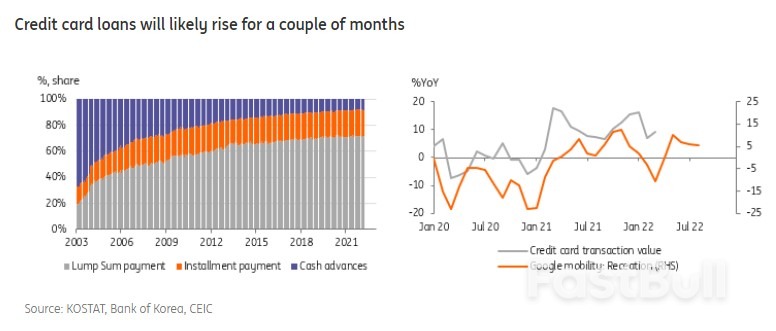

The latest data support our view We expect credit card loans to increase in the near term as key leading indicators of household consumption, such as Google Mobility and Oxford's Stringency Index, continue to improve. Although the high inflation rate, tightening monetary environment, and weak asset market will eventually put a burden on household consumption from the next quarter, we believe private consumption will remain relatively solid in the current quarter thanks to the strong jobs market and various government stimulus packages. In particular, healthy service consumption is expected to continue to benefit from the reopening effect for the time being.

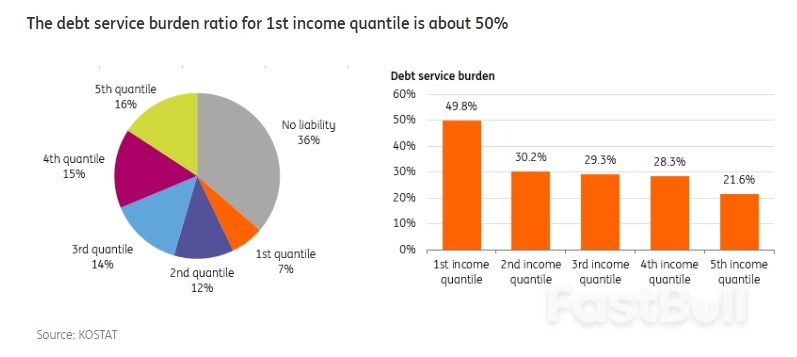

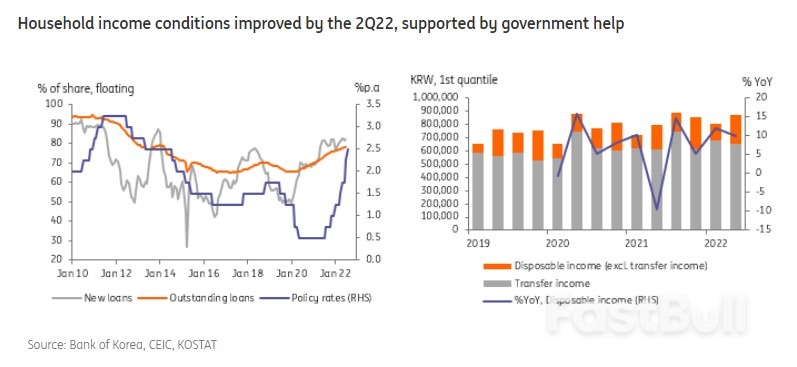

We expect credit card loans to increase in the near term as key leading indicators of household consumption, such as Google Mobility and Oxford's Stringency Index, continue to improve. Although the high inflation rate, tightening monetary environment, and weak asset market will eventually put a burden on household consumption from the next quarter, we believe private consumption will remain relatively solid in the current quarter thanks to the strong jobs market and various government stimulus packages. In particular, healthy service consumption is expected to continue to benefit from the reopening effect for the time being. For personal loans, the poor performance of asset markets could be a major risk factor due to the positive correlation between personal loan demand and asset market performance. New demand for leveraged investments will decrease, but it may be difficult to repay existing loans during a period of falling asset prices. But, we believe the bank's stringent Debt-to-Service Ratio (DSR) standards will likely manage potential risks, to some degree. Unemployment and income conditions are the main two factors of loan delinquency and losses but these two factors remain healthy, thus the possibility of default is quite low. The unemployment rate for August stayed at 2.9% and is expected to remain below 3.5% by the end of this year. Real disposable income rose 8.3% YoY in 2Q22. Wage/salary and property incomes declined but transfer and business incomes increased sharply. We think wage/salary incomes will likely rise in the second half of this year as the majority of companies have not finished their annual wage negotiations with labour unions while the reopening will continue to support business income.

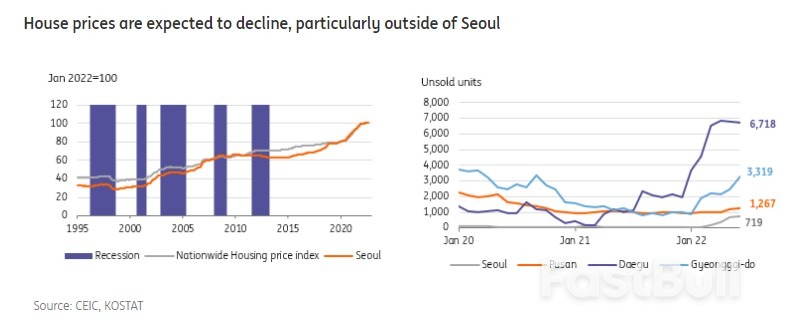

For personal loans, the poor performance of asset markets could be a major risk factor due to the positive correlation between personal loan demand and asset market performance. New demand for leveraged investments will decrease, but it may be difficult to repay existing loans during a period of falling asset prices. But, we believe the bank's stringent Debt-to-Service Ratio (DSR) standards will likely manage potential risks, to some degree. Unemployment and income conditions are the main two factors of loan delinquency and losses but these two factors remain healthy, thus the possibility of default is quite low. The unemployment rate for August stayed at 2.9% and is expected to remain below 3.5% by the end of this year. Real disposable income rose 8.3% YoY in 2Q22. Wage/salary and property incomes declined but transfer and business incomes increased sharply. We think wage/salary incomes will likely rise in the second half of this year as the majority of companies have not finished their annual wage negotiations with labour unions while the reopening will continue to support business income.  For mortgages, in theory, unless house prices plummet by more than 20%, the possibility of bad loans is still low because the financial authorities previously capped the LTV limit to 80% and recently lowered it to 20-40%. Home prices fell about 13% during the 1998 crisis but recovered quickly during the following expansion period. We don't expect a nationwide sharp depreciation of house prices in the near future, but as the number of unsold properties outside the Seoul Metropolitan area is increasing, the price adjustment is expected to be steeper in small and medium-sized cities than in Seoul. Falling real estate prices will reduce the wealth effect, limiting household consumption activity. For the Jeonse deposit, as the Korea Housing Finance Corporation and other credit guarantee funds guarantee up to 80% of the Jeonse loan, the direct risk exposure for commercial banks is limited. But, for those who do not purchase Jeonse guarantee insurance, the sudden drop in the Jeonse price may be a risk factor.

For mortgages, in theory, unless house prices plummet by more than 20%, the possibility of bad loans is still low because the financial authorities previously capped the LTV limit to 80% and recently lowered it to 20-40%. Home prices fell about 13% during the 1998 crisis but recovered quickly during the following expansion period. We don't expect a nationwide sharp depreciation of house prices in the near future, but as the number of unsold properties outside the Seoul Metropolitan area is increasing, the price adjustment is expected to be steeper in small and medium-sized cities than in Seoul. Falling real estate prices will reduce the wealth effect, limiting household consumption activity. For the Jeonse deposit, as the Korea Housing Finance Corporation and other credit guarantee funds guarantee up to 80% of the Jeonse loan, the direct risk exposure for commercial banks is limited. But, for those who do not purchase Jeonse guarantee insurance, the sudden drop in the Jeonse price may be a risk factor. Although the current government has eased some loan terms for first-time buyers and personal loans from the beginning of the third quarter of 2022, it is unlikely that there will be immediate loan demand due to the fairly limited eligible groups and unfavourable market conditions for homebuyers.

Although the current government has eased some loan terms for first-time buyers and personal loans from the beginning of the third quarter of 2022, it is unlikely that there will be immediate loan demand due to the fairly limited eligible groups and unfavourable market conditions for homebuyers.

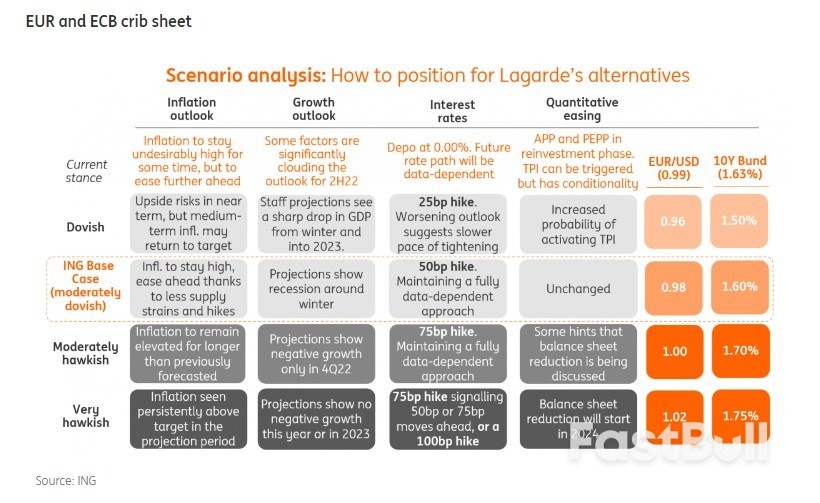

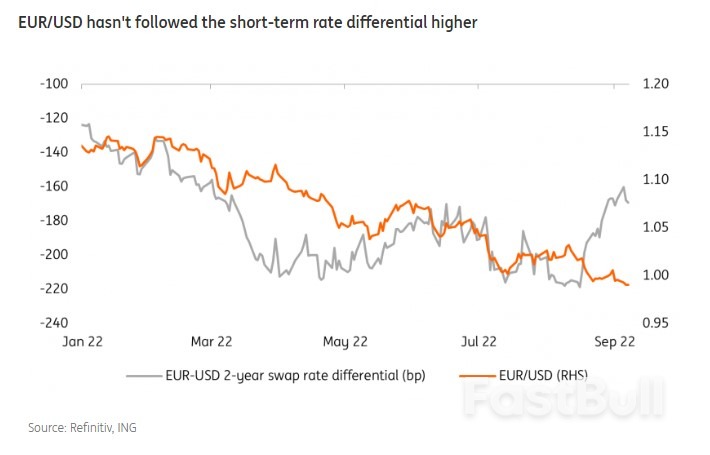

Downside risks for EUR…

Downside risks for EUR… In our EUR/USD short-term fair value model, the short-term rate differential now has a smaller beta than relative equity performance, which is a gauge of diverging growth expectations and is more directly impacted by the energy crisis. This also means that the short-term undervaluation in EUR/USD has shrunk to around 3-4% from the 5-6% peak seen two weeks ago.

In our EUR/USD short-term fair value model, the short-term rate differential now has a smaller beta than relative equity performance, which is a gauge of diverging growth expectations and is more directly impacted by the energy crisis. This also means that the short-term undervaluation in EUR/USD has shrunk to around 3-4% from the 5-6% peak seen two weeks ago.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up