Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

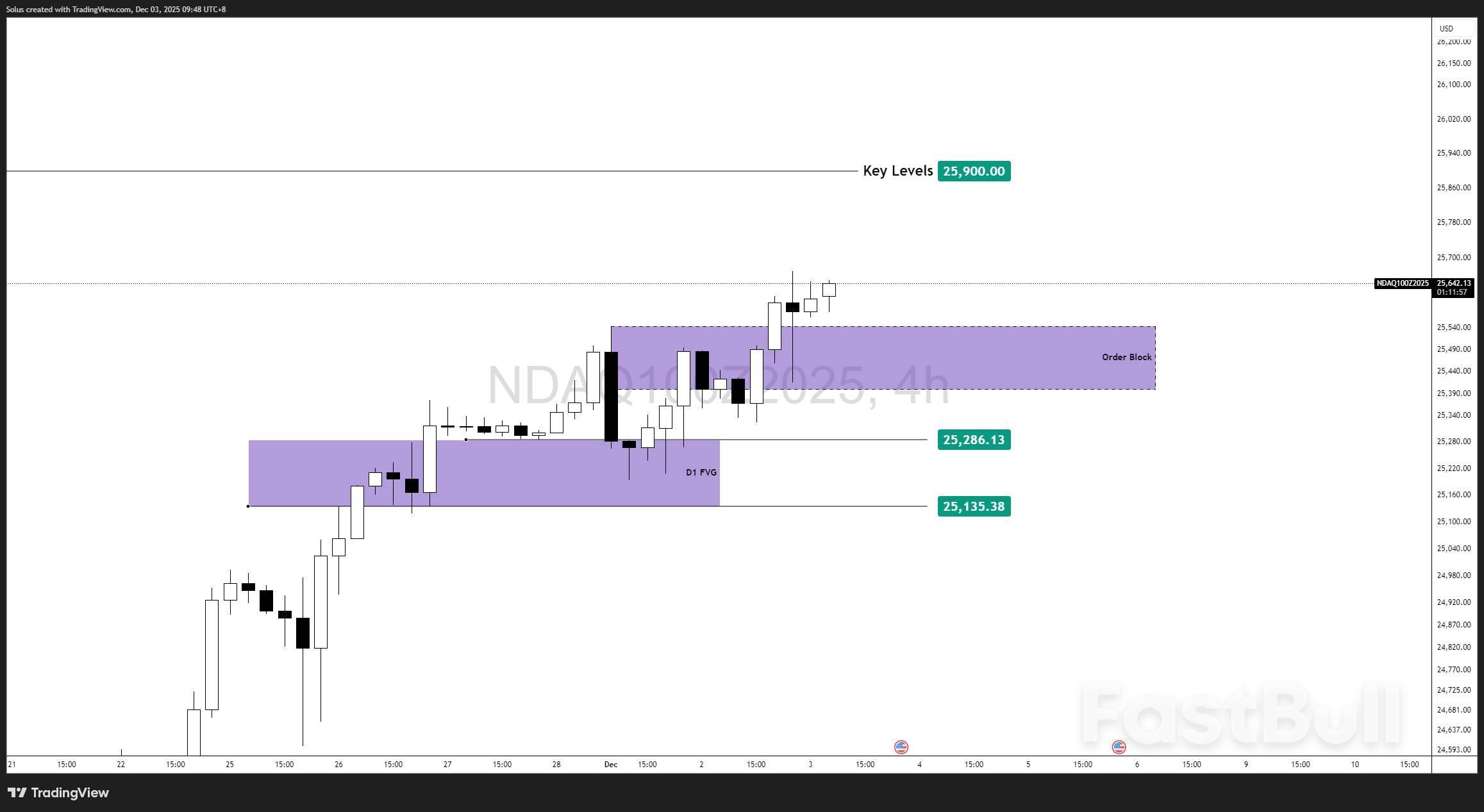

Nasdaq jumps as Big Tech rebounds and risk-on sentiment returns. Learn whether the index can break 25,900 and push toward a new all-time high.

The Nasdaq's recent upswing started precisely where high-timeframe buyers were expected to defend: the Daily Fair Value Gap. This demand pocket served as a springboard, kicking off a fresh bullish impulse that sent the index sharply higher.

Rather than breaking down, Nasdaq respected the inefficiency beautifully - a sign that institutions are still accumulating rather than distributing. The rebound was not a weak drift upward but a clear, impulsive reaction signaling renewed bullish control.

This type of HTF confirmation often precedes deeper continuation moves, especially when macro conditions and sector flows align.

Even outside technicals, Nasdaq's strength is rooted in a broader narrative: large-cap tech is heating up again.

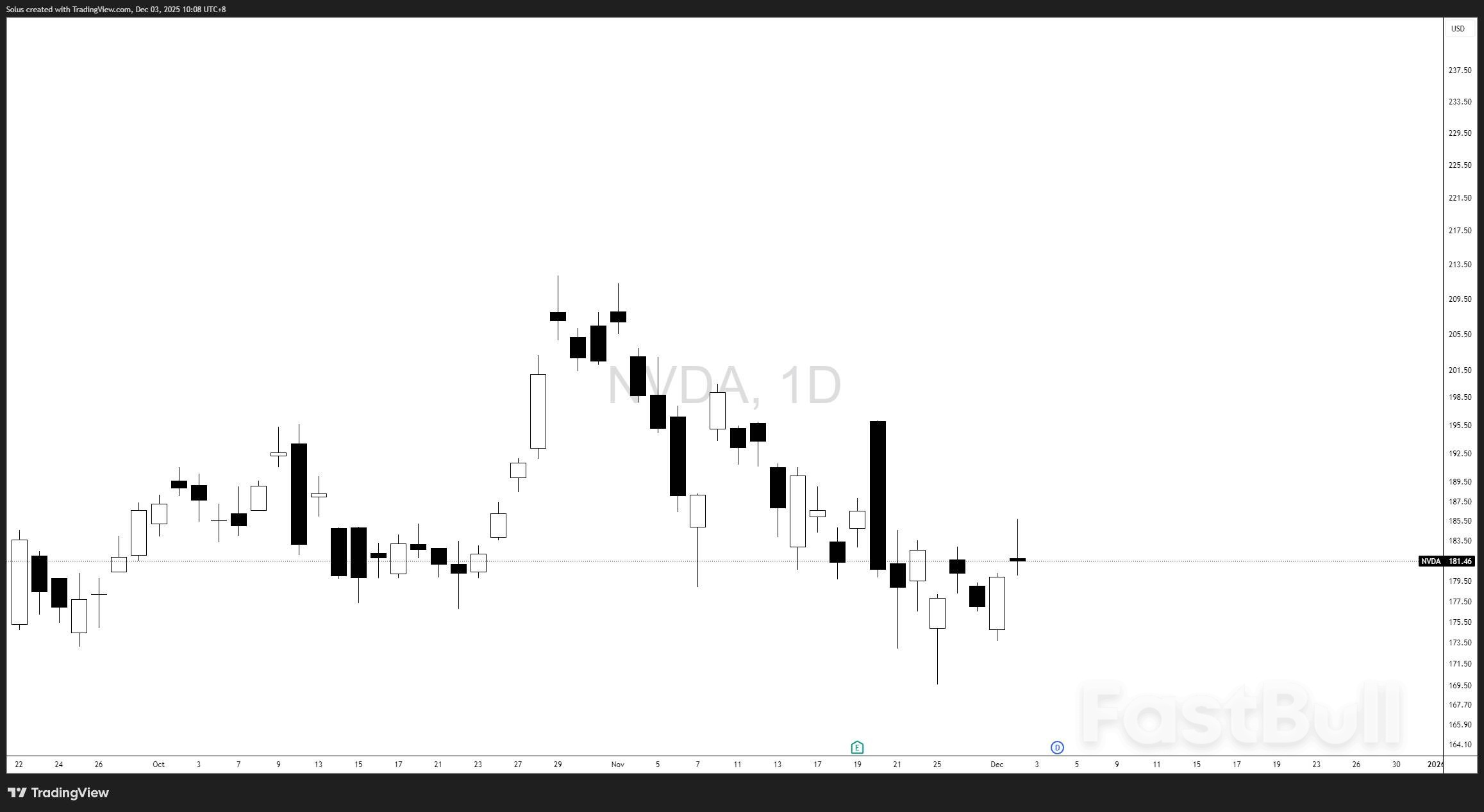

Among the giants, NVIDIA has been the clear standout. Its recent resurgence - driven by AI demand, stronger-than-expected data center revenue, and bullish forward guidance - has re-ignited the entire technology sector.

NVIDIA's aggressive rebound has:

When a major sector leader fires up, money follows - and indices like the Nasdaq benefit almost immediately. This leadership rotation is one of the strongest signals that the rally isn't built on weak footing.

The broader macro landscape is shifting toward "risk-on," anchored by four fundamental drivers:

Together, these create a supportive environment where pullbacks are absorbed quickly - exactly what we've seen this week.

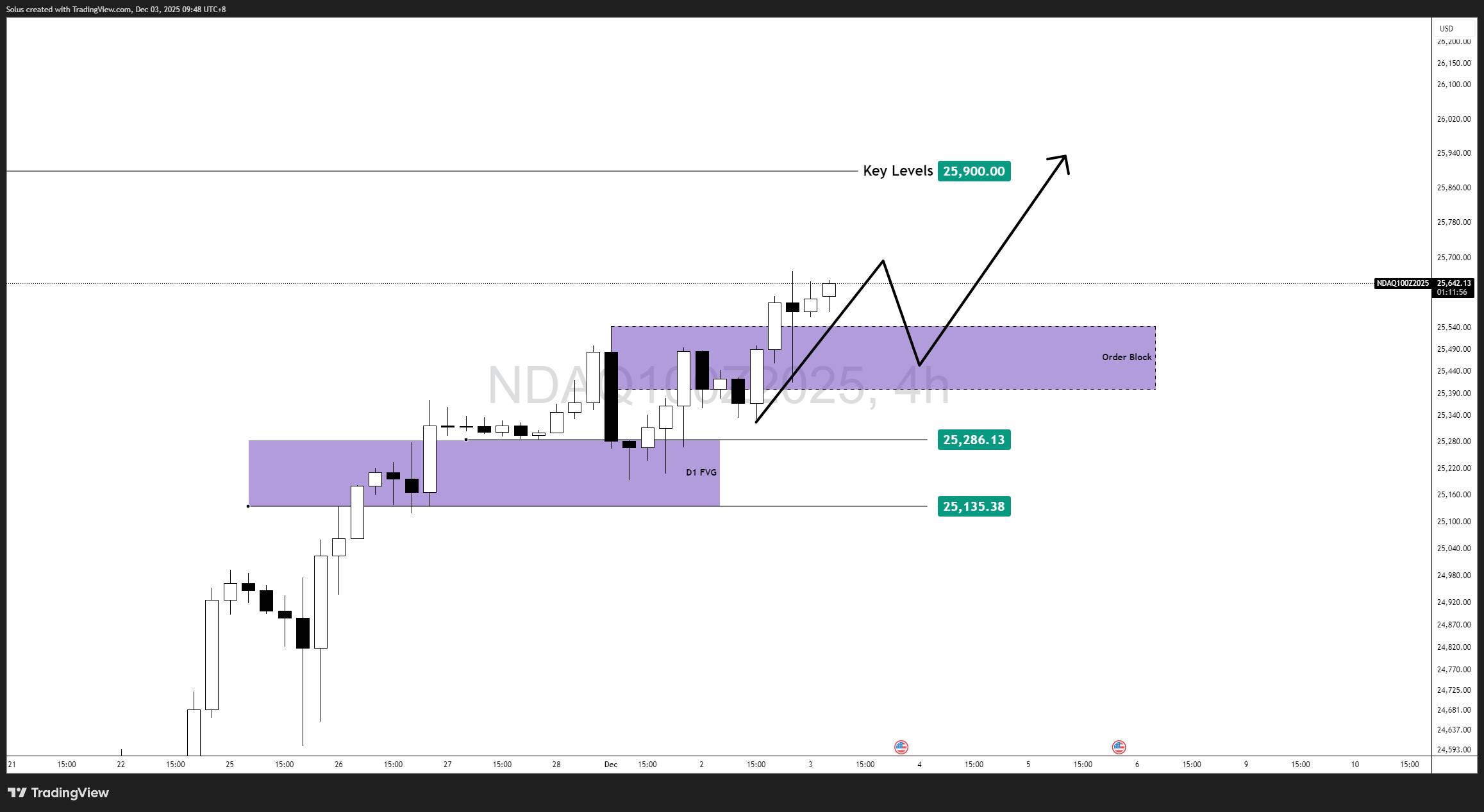

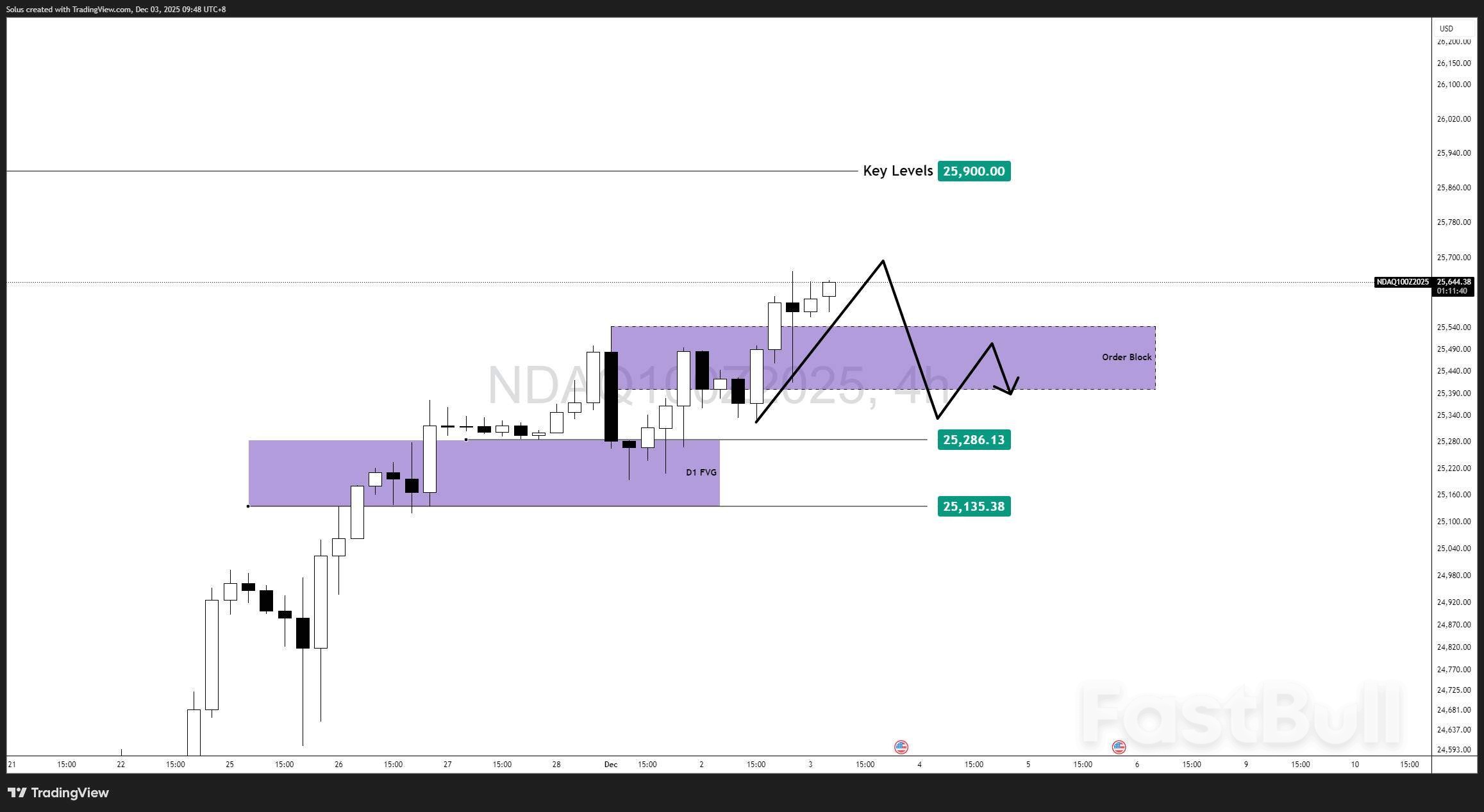

With the index pushing closer to the 25,900 key level, the market is now staring at a familiar ceiling. A decisive break above this structure turns the spotlight directly onto the all-time high at 26,400.

Momentum, fundamentals, and sector rotation all suggest the probability is rising - but not confirmed until 25,900 is cleared.

Until then, we treat 25,900 as the final resistance before a true breakout attempt.

The 4H structure remains classically bullish:

Price action is still in expansion mode, with the 4H OB acting as the most important short-term support.

The bullish outlook remains intact if:

A breakout above 25,900 opens the next phase of upside targets:

This aligns with your 4H projection: a corrective dip into demand followed by a clean continuation.

A shift to a bearish tone would require:

Downside targets:

A rejection from 25,900 combined with OB failure could signal a short-term top.

The Nasdaq's recovery from the Daily FVG is not a random bounce - it's a confluence of institutional demand, improving macro sentiment, and powerful leadership from major tech players like NVIDIA.

All eyes now turn to 25,900.

Mitsubishi Electric plans to triple production capacity for optical semiconductor devices used in data centers and communications base stations, stepping up investment as AI-driven demand continues to grow.

The Japanese electronics maker will direct a portion of its planned investment away from power devices used in EVs amid sluggish growth in that market, instead lifting optical device production capacity for fiscal 2028 to three times the fiscal 2024 level.

The company will be increasing production of optical devices, which convert optical signals to electrical signals and vice versa. The plan is to boost capacity for high-frequency optical devices at its high-frequency and optical device works in Hyogo prefecture. Before the change, Mitsubishi Electric had intended to raise fiscal 2026 capacity by half from the fiscal 2024 level.

Optical devices are used in many applications, including home internet connections and 5G high-speed wireless base stations. Demand is also rising in data centers for artificial intelligence. Data centers use large numbers of optical devices to link graphics processing units used for AI.

The global AI data center market totaled roughly $15 billion in 2024 and is expected to reach about $94 billion in 2032, according to Indian research company Fortune Business Insights. Mitsubishi Electric has decided to upgrade its planned capacity increase based on the expectation of long-term global demand for optical devices.

April-September consolidated revenue in Mitsubishi Electric's semiconductor and device segment, which includes optical and power devices, fell about 4% on the year to 140.6 billion yen ($902 million). Operating profit rose 6% to 24.7 billion yen. Highly profitable optical devices saw strong sales, while power devices struggled.

Mitsubishi Electric revealed in May that it would reassess its previous plan of investing 260 billion yen in raising production capacity for power devices over the five years ending March 2026, shifting a portion to optical devices.

The company claims a roughly 50% global market share in optical devices for data centers. Higher profit margins on optical devices will help offset the overall decline in its semiconductor and device segment.

The Tokyo-based Fuji Chimera Research Institute estimates that the market for equipment that includes optical devices will grow to 10.73 trillion yen in 2030 -- about 3.5 times its 2024 size -- as growing numbers of data centers continue to be built.

Mitsubishi Electric's competition is also preparing to increase production capacity for optical devices in light of these forecasts.

Sumitomo Electric Industries will double capacity for optical devices in fiscal 2026 compared with the fiscal 2024 level, aiming to tap the rapidly growing demand.

Lumentum Japan, an affiliate of U.S.-based Lumentum Holdings with roots in Hitachi, intends to raise its production volume of optical devices to six times the 2024 level in 2027.

The company plans to boost production efficiency by using larger-diameter semiconductor wafers for optical devices, mainly at its plant in Sagamihara, west of Tokyo.

Lumentum Japan will also add more personnel. It expects to hire 80 or so new people, especially engineers, by the end of June 2026, amounting to a quintupling from the previous year.

The Sagamihara facility has a 144-meter-long clean room filled with production equipment. The lines run 24 hours a day in two shifts. The production system operates without stopping, even for holidays.

According to Lumentum Japan, optical devices are one of the strongest fields for Japanese manufacturers, with the top three producers in the country controlling roughly 70% of the global market. Japanese companies are also taking the lead in terms of research into higher-performance devices.

Optical device data transmission speeds are measured in terms of how many times per second they can switch on and off to represent zeros and ones. Many used in data centers now have speeds between 100 gigabits per second and 200 Gbps. As chip performance improves and data volumes grow, the commercialization of optical devices capable of 400 Gbps to 800 Gbps second is not far off.

The three Japanese companies will likely continue to lead in meeting AI data center demand and increasing performance.

South Korean President Lee Jae Myung said on Wednesday there was still work to be done to address the fallout of the failed martial law bid by his predecessor a year ago, and the country needed to ensure the perpetrators were brought to justice.

The attempt to impose martial law by former President Yoon Suk Yeol threatened an irreparable setback to the country, but the people rose up and stopped the military with their bare hands, Lee said in an address marking the first anniversary of the shock announcement.

"The recklessness of those who tried to destroy constitutional order and even plan a war all for their personal ambition must be brought to justice," he said.

"The December 3 coup d'etat was not just a crisis for democracy in one country. If democracy in South Korea collapsed, it would have meant a setback...for world democracy."

Yoon's martial law declaration plunged a country that had been viewed as one of the success stories of democratic resilience into months of political turmoil, just as U.S. President Donald Trump's decision to slap tariffs on global trading partners rattled South Korea, an export-heavy economy.

The conservative leader was later ousted and Lee, a political rival who lost to Yoon in a 2022 presidential poll, won a snap election in June with a mandate to steer the country out of the shock of martial law, as those who were accused of being involved were arrested and tried for subversion.

Since coming to office, Lee has managed to strike a U.S. tariff deal after two summits with Trump, but there remain deep fissures in society and concerns over whether the conservative side feels it is being persecuted.

Lee said the work of reforming the country following the martial law crisis was bound to be painful and time-consuming.

"But just as treating cancer by removing the cancer cells that have taken root deep inside the body, it cannot be completed that easily," he said.

NOBEL PEACE PRIZE?

Yoon justified his short-lived martial law by accusing "anti-state forces", including Lee's Democratic Party, of paralysing government and ruining democracy. He said he had no choice but to impose martial law to restore order in a surprise late-night announcement on December 3 last year.

That declaration was reversed within hours by a majority vote in parliament by Lee's Democrats and some members of Yoon's conservative party.

On trial for insurrection and facing life imprisonment or even potentially the death penalty, Yoon has denied ordering the arrest of opposition lawmakers and political enemies and argued the martial law declaration did not harm the country.

A number of former cabinet members, senior military officers and lawmakers are also on trial or under criminal probe. Yoon's wife, Kim Keon Hee, faces a separate trial on charges of corruption and bribery.

Lee said he will propose designating December 3 as a national holiday to celebrate the role of the people in quelling the martial law bid and added that he believed they deserved to be considered for the Nobel Peace Prize.

Lee plans to take part in a citizens' march later on Wednesday to mark how the country defied the attempt to bring in military rule.

The march will pass parliament, where soldiers and police were deployed on the night of December 3, 2024 to try to block lawmakers, who jumped fences to avoid the security cordons and entered the chamber to vote down the martial law declaration.

Palm oil stockpiles in Malaysia surged to the highest in more than six years as exports dropped in November, according to a survey.

Inventories jumped 10% from a month earlier to 2.71 million tons, the median of 11 estimates in a poll of plantation executives, traders and analysts. That's the highest level since April 2019 and an increase of 47% from a year ago.

Palm oil reserves have been expanding since March and high stockpiles could pressure prices of the tropical oil. Futures briefly dropped below 4,000 ringgit a ton in November as demand from top importer India eased with the end of the festival season.

Exports dropped about 15% to 1.43 million tons, after jumping almost 19% a month earlier. The Malaysian Palm Oil Board will publish its monthly data on Dec. 10.

Crude palm oil production in Malaysia, the world's second-largest grower, eased 2.9% to 1.98 million tons, after jumping 11% in October, according to the survey.

"Peak production months are over and we are entering into the lower production months, but demand has been rather lethargic," said Paramalingam Supramaniam, a director at brokerage Pelindung Bestari Sdn.

Market participants are looking for confirmation on the size of Malaysian stockpiles, and anything above 2.6 million tons would be considered bearish, Paramalingam said.

The US Securities and Exchange Commission has issued a flurry of warning letters to some of the country's most prolific providers of high-octane exchange-traded funds, effectively blocking the introduction of products designed to deliver two or three times the daily returns of stocks, commodities and cryptocurrencies.

In a set of nine almost identical letters posted Tuesday, the SEC told firms including Direxion, ProShares and Tidal that it would not move forward with reviewing proposed launches until key issues are addressed. At the heart of the regulator's concern is that the funds' risk exposures may exceed SEC limits on how much risk a fund can take on relative to its assets. The letters direct the fund managers to either revise their investment strategies or formally withdraw their applications.

"We write to express concern regarding the registration of exchange-traded funds that seek to provide more than 200% (2x) leveraged exposure to underlying indices or securities," the SEC wrote to all nine applicants.

The move marks a rare pause in an otherwise permissive stretch for US fund approvals, which has seen a green light given to crypto-linked ETFs of all stripes, private-asset vehicles and increasingly complex trading strategies. The funds now under scrutiny are on the extreme edge of that trend — combining high leverage, daily trading resets and exposure to some of the most unstable corners of the market, including single-name stocks and digital tokens.

A central concern for the SEC is that the funds appear to be measuring their risk against a benchmark that may not fully reflect the volatility of the assets they aim to amplify.

Leveraged products use options to amplify returns, and they're popular with investors because they can offer big profits quickly. Trading volumes have boomed since the pandemic as traders look for a new edge in fast-moving markets while assets have climbed to $162 billion.

Staff in the SEC's Division of Investment Management publicly posted the letters the same day they were written — an unusual speedy move that suggests the regulator wants to get its concerns out fast. The agency typically posts correspondence with firms 20 business days after wrapping up reviews.

Independent retailers across the UK are facing significant business rates increases next year, with some estimates suggesting rises of up to 15%, despite government assurances of lower tax rates.

Retailers say the latest Budget falls short of promised reforms, leaving many small shops under financial pressure.

The British Independent Retailers Association (Bira) has criticised the government for offering only minimal reductions in business rates multipliers.

While ministers promised the "lowest tax rates since 1991" and a transformed system, most independent retailers will see bills rise, not fall. Typical rateable value increases mean a shop currently paying £8,982 could face a £10,329 bill next year, a 15% rise, even after transitional relief.

Andrew Goodacre, Bira's CEO, described the measures as "tinkering around the edges" rather than meaningful reform.

He highlighted that smaller shops will continue to pay more while some large retail outlets benefit from lower valuations, raising concerns over fairness for high street traders.

The increase in business rates comes alongside other financial challenges. Wage costs are rising, with the National Living Wage set to increase to £12.71 from April 2026.

Independent shops are also affected by a low-value import duty loophole, which allows overseas competitors to undercut prices until its planned closure in 2029.

Bira warns that these factors combine to create a "perfect storm" for small retailers, making it harder for them to compete against larger domestic and international retailers.

The association has called for urgent government action to support independent businesses and level the playing field.

Retailers and Bira are pressing the Treasury and the Valuation Office to provide clarity on how rates are assessed, particularly why high street shops face large increases while some retail parks see reductions.

The organisation urges policymakers to accelerate reform of the business rates system and close loopholes that disadvantage smaller traders.

"Independent retailers need a system that genuinely supports the high street," said Goodacre. "Without further action, many shops will continue to struggle under rising costs and unfair competition."

"UK shops warn business rates could jump 15% despite government pledge" was originally created and published by Retail Insight Network, a GlobalData owned brand.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up