Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

European countries to deploy military personnel to Greenland; Trump: 25% tariff on imported chips not used for U.S. AI......

Aurelius Capital Management and a group of other hedge funds renewed a lawsuit against Argentina seeking payments on securities tied to the performance of the South American nation's economy.

A federal judge in New York threw out their suit in 2024, saying the funds failed to meet pre-conditions for legal action specified in the agreement governing their investments in Argentine gross domestic product-linked warrants.

The funds said in new complaint filed Wednesday that they had now satisfied the requirements, which included getting at least 25% of the bondholders to make a written request to the bond trustee.

Aurelius first sued in 2019, claiming the Argentine government had failed to make nearly $160 million in payments on the fund's $1.4 billion in warrants. Other funds later joined the case with similar claims. The warrants were given to holders of defaulted Argentine sovereign bonds who were willing to accept newly issued bonds at a sharp discount.

The warrants allegedly entitled investors to payments when Argentina's GDP expanded by more than 3% in a year.

Aurelius was one of a group of funds that by 2010 had bought up large chunks of debt on which Argentina defaulted in 2001.

Lawyers for Argetina and representatives of the nation's US embassy didn't immediately respond outside regular business hours to requests for comment.

The case is Aurelius Capital Master, Ltd. et al v. The Republic of Argentina, 26-cv-337, U.S. District Court, Southern District of New York (Foley Square).

Hedge funds are ignoring yen intervention warnings and wagering in the currency option markets that it may fall toward 165 to a dollar before Japanese authorities step in.

Japan's finance minister and top currency official issued fresh warnings on Wednesday after the yen fell to its weakest level against the dollar in 18 months. Prime Minister Sanae Takaichi's plan to call a snap election has added to expectations of further gains in dollar-yen, as investors see a renewed mandate for expansionary policies if the Liberal Democratic Party secures a majority. The pair closed Wednesday down 0.4% at 158.46.

"Hedge fund demand for higher USD/JPY structures continues and we're seeing a steady mix of outright option buying as well as leveraged structures expecting potential central bank intervention in the 160-165 region," said Sagar Sambrani, a senior foreign-exchange options trader at Nomura International Plc in London. He was referring to leveraged structures like reverse knock-out options which are contracts that expire worthless if a specific price barrier is breached and are more cost-effective than standard call options.

Trading volume in options with a notional value of $100 million or greater on Wednesday was more than double for calls that gain in value if the pair rises, than for puts that profit when the pair falls, according to data from Depository Trust and Clearing Corp. The imbalance underscores a bullish bias toward the dollar-yen pair, despite its climb to levels last seen in July 2024, when Japan's Ministry of Finance stepped into the market to support the Japanese currency.

The pair's rapid rise and the threat of intervention have prompted some investors to buy put options, however, for hedging and speculative trades. Japan's last intervention was spread over two days as dollar-yen dropped as much as 2.6% on the first day from a peak of 161.76.

"Some investors are seeking downside protection in the short term amid concerns about potential intervention," said Mukund Daga, global head of FX options at Barclays Bank Plc.

Iron ore's robust start to the year continues to highlight what many observers deem to be a persistent mismatch between market pricing and conditions on the ground.

Benchmark Singapore futures topped $109 a ton this week, a level last reached 15 months ago when the Chinese government was busy with measures to stimulate the economy. The country is the world's biggest buyer of iron ore, the main feedstock for steelmaking.

But the market's resilience is proving hard to reconcile with fundamentals. While China's iron ore imports hit a record last year, its steel output in 2025 is on course for a seven-year low. Port stockpiles have ballooned to near four-year highs, underscoring persistent pressures on demand as the nation's property downturn drags on and policymakers emphasize reforms to reduce overcapacity.

"The strong start for iron ore futures in early 2026 looks increasingly disconnected from underlying fundamentals," said Ewa Manthey, a commodities strategist at ING Groep NV in London. The rally is being driven by improved risk appetite among hedge funds and expectations of policy support, rather than a sustained tightening in the physical market, she said.

"That divergence leaves prices more vulnerable if macro sentiment or positioning were to turn," Manthey said.

Short-term pricing is likely benefiting from the expectation that Beijing will front-load fiscal spending early in 2026, when its latest five-year plan begins. "A stronger boost from infrastructure investment and related activities should help to support commodities demand," HSBC Holdings Plc said in a note.

But the view further out is less constructive. Chinese steel demand has settled into long-term decline, even as more iron ore becomes available, chiefly from the Simandou mega-project that recently came online in Guinea. A Bloomberg survey of analysts forecasts a steady drop in spot prices, from a median of $100 a ton in first-quarter 2026 to $90 in second-quarter 2027.

"Looking into 2026, the iron ore market is expected to remain oversupplied, raising questions over how excess volumes will be digested," BRS Shipbrokers said in a note.

Simandou is casting a long shadow over prices. The first commercial shipment is set to land in China this month, and the $23 billion mine will eventually account for about 5% of global production.

"The decline will occur gradually, rather than a sharp one, as most of the supply surplus — Simandou — will require time to ramp up production and benefit from economies of scale," said Jack Teah, an analyst at Shanghai Metals Market.

A resolution to BHP Group Ltd.'s pricing dispute with China's state-run iron ore buyer would also unlock more supply and pressure prices.

"Once those talks make progress, a huge amount of previously restricted ores will definitely impact market price," he said. "But no one can really predict when that will happen."

BHP Group and Rio Tinto Group, the world's two biggest mining companies, will join forces to extract 200 million tons of iron ore in the Pilbara region of Western Australia.

China's exports ended last year with a growth spurt and sent its trade surplus to a record $1.2 trillion in 2025, extending a boom that's seen factories escape Donald Trump's tariffs by making deeper inroads into markets beyond the US.

President Xi Jinping is welcoming a procession of leaders looking to mend fences with the world's other major economy. Prime Minister Mark Carney landed in Beijing on Wednesday for the first state visit from a Canadian leader in eight years.

Investing in Chinese stocks is the most expensive versus buying bonds in over four years, adding to signs that the country's equities market is getting overheated after a torrid rally.

Chinese private refiners are set to replace discounted Iranian crude with pricier alternatives following new US tariffs, pushing them to boost exports to higher-margin markets to offset rising costs, said Bloomberg Intelligence.

Amazon.com Inc. is challenging Saks Global Enterprises' foray into Chapter 11, saying the luxury retailer breached a deal related to the sale of Saks products on its website and that its equity investment in the now bankrupt business is "presumptively worthless."

Amazon challenged Saks' bid to fund its bankruptcy with financing that would provide the retailer with as much $1.75 billion in fresh cash, according to court documents filed late Wednesday. The financing would saddle the retailer with billions of dollars of new obligations and includes other terms that would harm Amazon and other unsecured creditors of Saks, the filing said.

In 2024, Amazon took a minority stake in the retailer as part of an agreement that helped facilitate Saks' $2.65 billion acquisition of Neiman Marcus. Amazon said it invested $475 million of preferred equity in the luxury retailer as part of the deal.

The investment was also contingent upon an agreement for Saks to sell products on the e-commerce giant's platform, which included launching "Saks on Amazon," according to Amazon's filing on Wednesday. In return, Saks agreed to pay a referral fee and guaranteed at least $900 million in payments to Amazon over eight years, the web giant said.

"Saks continuously failed to meet its budgets, burned through hundreds of millions of dollars in less than a year, and ran up additional hundreds of millions of dollars in unpaid invoices owed to its retail partners," Amazon alleged in its filing.

The company's chief restructuring officer, Mark Weinsten, testified Wednesday that the retailer desperately needed additional financing to keep paying vendors and covering payroll and other expenses.

Without access to that funding, Weinsten said, "we'll be dead in the water." The retailer was seeking court permission to make an initial $400 million draw, with the remaining amounts becoming available later in the Chapter 11 case.

A representative for Amazon declined to comment, while Saks didn't immediately respond to requests for comment. A Texas bankruptcy judge was scheduled to consider approving its request to start tapping the financing during a hearing Wednesday evening.

Days before Saks filed Chapter 11, Amazon said it would oppose the company's bankruptcy financing, according to a Jan. 9 letter made public Wednesday. Amazon claimed the luxury retailer needs the online giant's consent for a key part of the loan, but that Amazon refused to give its consent.

Instead, Saks moved forward with financing from a group of existing lenders, an arrangement the retailer said would strengthen its business. The company said in a Wednesday statement that stores under all its brands were open.

Alibaba Group Holding Ltd. plans to link its flagship online shopping and travel services to its AI app, taking its biggest step yet to build Qwen into its one-stop artificial intelligence platform for consumers.

China's online retail leader aims to connect Taobao, Alipay, travel service Fliggy and Amap to the Qwen app starting Thursday. The idea is to eventually help Qwen's 100 million users to shop, book travel and pay for services via a single platform with the help of AI, the company said in a statement. The newly integrated functions are now available for public testing in China.

The ambitious undertaking underscores how companies from Amazon.com Inc. to Meta Platforms Inc. are exploring agentic AI, where artificial intelligence helps people perform actual tasks. Companies like Alibaba and Tencent Holdings Ltd., which already operate "super apps" with hundreds of different services, are considered to have an initial advantage in that sphere.

Alibaba, which also operates a Netflix-like streaming service and one of China's biggest meal delivery platforms, launched Qwen in November as a major step into consumer-facing AI services. It plans to build Qwen into an all-around personal assistant by gradually integrating individual services under the Alibaba umbrella. The company also launched an invite-only "task assistant" feature designed to conduct more complicated tasks, such as making phone calls to restaurants or building web applications.

In doing so, it's seeking to answer global concerns about the money-making potential of AI. Investors are worried in particular about the hundreds of billions of dollars flowing into Nvidia-powered datacenters around the world, given persistent uncertainty about demand for AI services in future.

Alibaba is emphasizing the extent of its ambition by hooking Qwen up with Taobao: the service that launched the company into e-commerce decades ago and remains its main Chinese shopping showcase.

On Thursday, executives will demonstrate how the new Qwen features work. They plan to walk users through detailed tasks such as ordering bubble tea from a local store, buying and paying for stuff on Taobao and confirming restaurant or hotel reservations.

"AI is evolving from intelligence to agency," said Wu Jia, an Alibaba vice president. "What we are launching today represents a shift from models that understand to systems that act — deeply connected to real-world services."

Alibaba has been among the most aggressive investors in and advocates for AI since DeepSeek fired up the local tech industry. Chief Executive Officer Eddie Wu has pledged more than $53 billion for infrastructure and AI development — an outlay he's said the company could surpass over time.

While US apps like OpenAI's ChatGPT are not available in China, it faces stiff competition from domestic rivals including ByteDance Ltd.'s Doubao, by some measures the most popular with about 172 million monthly active users as of the end of September, according to QuestMobile.

Still, investors have largely endorsed Alibaba's broader endeavors in AI, judging by the stock.

The shares have more than doubled since the start of 2025. Alibaba's ability to control costs around consumer services while investing in cloud operations is something investors will monitor over the longer term.

Technology and bank stocks led Wall Street indexes into a second day of declines on Wednesday, while oil prices snapped back from the day's highs after U.S. President Donald Trump softened warnings about unrest in Iran, although persistent economic and geopolitical uncertainty continued to support precious metals.

Banner earnings releases from three of the largest U.S. banks showed rising profits from lending to credit-hungry consumers and businesses and rising fees from a dealmaking rebound, although Wells Fargo missed profit expectations.

Investors sold bank stocks, sending Bank of America (BAC.N), opens new tab shares down more than 4%, Citigroup (C.N), opens new tab 4.5% lower and Wells Fargo (WFC.N), opens new tab sliding more than 5%.

Bank shares (.SPXBK), opens new tab had jumped 25% in the past 12 months but fell this week in part due to a proposal from Trump to cap credit card interest rates.

"After a nice run, and so-so or mediocre earnings, you're seeing profit-taking and consolidation" in the banks, said Michael O'Rourke, chief market strategist at JonesTrading in Stamford, Connecticut. "Generally speaking, people are still optimistic on the group."

Selling spread to tech and growth stocks as investors looked for bargains, while Broadcom and Fortinet (FTNT.O) fell after a Reuters report about new limits from Chinese authorities on domestic companies using cybersecurity software made by roughly a dozen U.S. and Israeli firms.

The tech-heavy Nasdaq Composite (.IXIC) closed 1% lower at 23,471.75. The Dow Jones Industrial Average (.DJI) declined 0.09% to 49,149.63, and the S&P 500 (.SPX) fell 0.53% to 6,926.60.

Data showed U.S. retail sales increased more than expected and producer prices picked up slightly in November, lending further support to broad expectations that the Federal Reserve will cut interest rates twice later this year.

Traders are grappling this week with questions over Federal Reserve independence, the U.S. desire to control Greenland and its implications for the NATO alliance, and whether the U.S. would attack Iran after a crackdown on historic protests.

Oil prices settled higher but then gave back most of the day's gains after Trump said on Wednesday afternoon he had been told that killings in Iran's crackdown on nationwide protests were subsiding and he believed there was currently no plan for large-scale executions.

"The market now thinks that maybe there is not going to be an attack on Iran so the stock market rallied and oil prices plummeted really quickly," said Phil Flynn, senior analyst with the Price Futures Group.

Trump said the U.S. would "watch what the process is" in Iran.

U.S. crude fell 1.1% to $60.49 a barrel and Brent declined 0.93% to $64.86 per barrel.

Expectations of more supply from Venezuela and news that the country's state energy company has begun reversing oil production cuts made under a U.S. embargo limited price gains.

The dollar, meanwhile, strengthened modestly against the euro, benefiting from the prospect that the Fed will wait several months before restarting rate cuts.

The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.1% to 99.09, with the euro last up 0.01% at $1.1643.

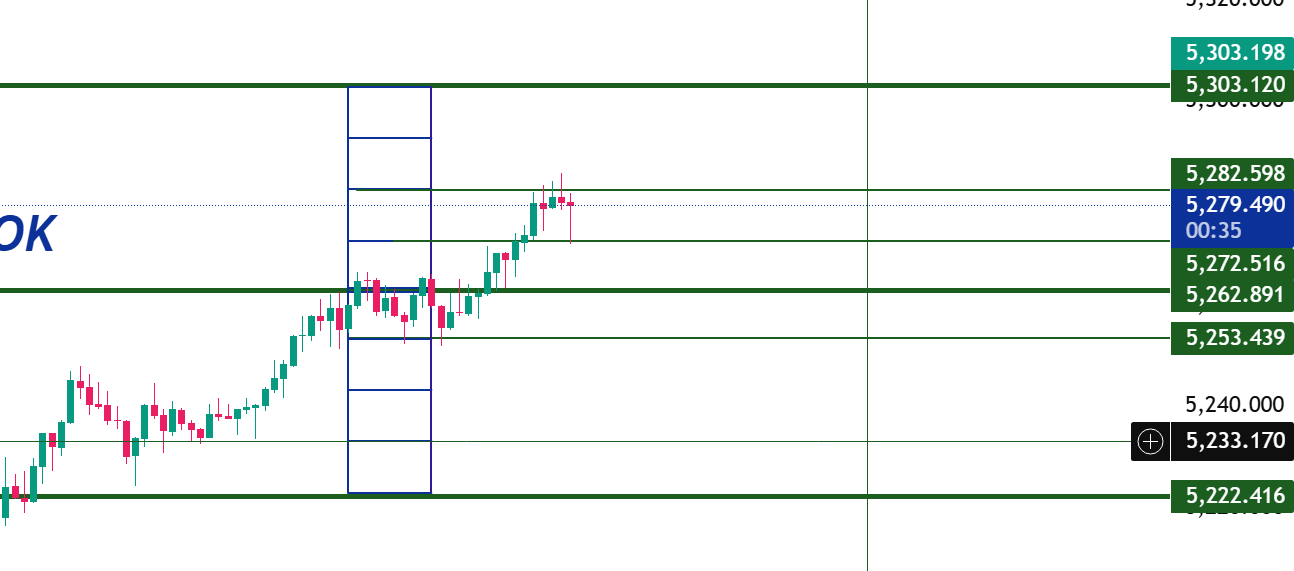

Much market momentum was reserved for precious metals.

Silver rose past $92 per ounce for the first time on Wednesday. It began 2025 under $30 an ounce, and has surged 29% in the first nine trading days of this year.

Gold touched yet another record high of $4,641.40 per ounce and was last seen up 0.73% at $4,620.60 an ounce. Copper is also at unprecedented levels.

"All roads are leading to gold and silver," said Alex Ebkarian, chief operating officer at Allegiance Gold, citing demand from diverse buyers and noting the market is in a structural bull phase.

Gold yields no interest and typically performs well when interest rates are low and uncertainty is high.

The U.S. Supreme Court took one item off the day's agenda when it did not issue a ruling on the legality of Trump's global tariffs. Meanwhile, U.S. high-end department store conglomerate Saks Global filed for bankruptcy protection.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up