Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Putin and Trump fail to reach an agreement; Powell to speak at Jackson Hole this week, a critical moment for bond market rate cut bets......

It’s unsurprising to see oil trading lower this morning following the Trump-Putin summit in Alaska. While talks failed to secure a ceasefire, the tone and the absence of “severe consequences” for the lack of a truce, reduce, or at least delay, the risks of stricter sanctions. In fact, following the meeting, President Trump said he would hold off on secondary tariffs against China for its purchases of Russian oil, citing progress made over the weekend with Putin.However, the next focus for the market will be talks today between Trump and President Zelensky, along with a number of European leaders. Ultimately, Russia still wants Ukraine to cede territory, something Ukraine will be very hesitant to do, particularly without very strong security guarantees from the US and Europe.

Furthermore, there’s been little progress regarding the secondary tariffs that the US imposed on India for its buying of Russian oil. These tariffs are set to come into effect on 27 August, so there is still time for India to try to negotiate ways to avoid them.Ultimately, the reduced risk of tougher sanctions and secondary tariffs should allow bearish oil fundamentals to become the dominant driver for oil prices moving forward.

Positioning data shows that speculators continued to sell oil over the last reporting week. The managed money net long in ICE Brent fell by 34,430 lots over the week to 206,547 lots as of last Tuesday. This was predominantly driven by fresh shorts entering the market. Meanwhile, NYMEX WTI also saw aggressive speculative selling, with the managed money net long declining by 29,562 lots to 49,264 lots. This is the smallest position that speculators have held in WTI since April 2009. Clearly, speculators are already focusing on the bearish outlook for the market.

Baker Hughes data shows that US producers increased the rig count for a second consecutive week, increasing by 1 to 412. While it’s a very marginal increase, it does at least suggest that drilling activity may be stabilising, after the rig count fell aggressively from March through to early August. But given the expectation that oil prices still have room to move lower, we may still see another leg lower in US drilling activity.

European natural gas prices came under further pressure over the last week ahead of the Trump-Putin summit, with the Title Transfer Facility (TTF) falling by more than 3%. This also left TTF settling at its lowest level since July 2024. Investment funds probably wanted to reduce risk heading into the weekend, given the uncertainty over how the talks could have unfolded. The weakness in TTF has seen the Japan Korea Marker (JKM) premium to European gas widening. This should see LNG cargoes diverted to Asia. However, with EU gas storage almost 74% full and still lagging both last year’s levels and the 5-year average, Europe will need to continue to see strong LNG inflows in order to get close to the 90% storage target.

Focus now turns to the Trump/Zelenskyy meeting in the Oval Office, where scenes from the prior meeting on 28 February – and Zelenskyy's roasting by JD Vance – won't have been forgotten. One suspects there will be some heat on Zelenskyy this time around to take whatever is put on the table. Talk of the US offering Ukraine security guarantees may form the centrepiece of discussions, with Zelenskyy required to cede control of up to five territories to move closer to a lasting peace agreement – a factor he has consistently said is not possible. Hence, market expectations for anything tangible that would constitute a positive surprise remain low. Long EU equity, RUB, and short Brent would be the cleanest expressions.

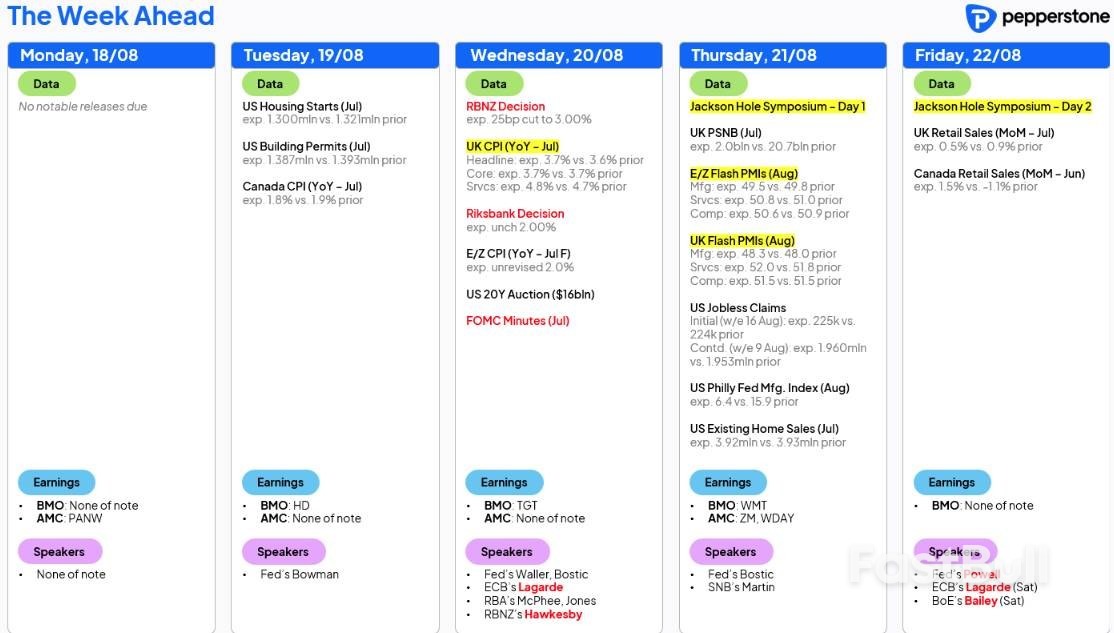

Outside of the geopolitical developments, at a topline level, the main events for traders to navigate will be the Jackson Hole Symposium, inflation readings from the UK, Japan, Mexico and Canada, while the RBNZ looks set to cut rates to 3% on Wednesday.

On the earnings side, in the US we get results from the retailers – Home Depot, Lowe's, TJX and Walmart. In Australia, BHP, Woodside, CSL, Santos and Goodman Group are the big names to report FY numbers, in what is the key week for company earnings. Earnings also ramp up in the HK50/H-share space, with Alibaba, Xiaomi, Baidu, AIA, and retail favourite Pop Mart all set to get attention.

In markets, close focus for many falls on moves in bond markets, and notably on the slope of the yield curves – and not just in US Treasuries, but also in the long end of the German and UK curves, and possibly in Japan too. Notably, German 30-year bond yields have broken out to their highest levels since 2011. UK 30-year yields are pushing YTD highs, with 5.60% having been the level where buyers have previously stepped in – as such, a closing break of 5.60%/5.65% could draw significant attention.

The slope of the US Treasury curve will also be closely watched ahead of the week's most anticipated event, the Jackson Hole Symposium, culminating with Fed Chair Jay Powell's speech on Friday. Powell's guidance on policy will be seen as a key steer for markets, which currently price a 77% probability that the Fed cut in September, with the Fed expected to pull the rates trigger again in December.

The US 2s vs 30s yield curve sits at 116bp, pressing the top of its YTD range of 120bp, while the 5s vs 30s curve is at 108bp, the steepest since October 2015. The message from the US Treasury market is a complex one – within the Fed there are concerns that core PCE inflation, having lost its disinflationary momentum since April 2024, is progressively pulling even further from its 2% target. In fact, the upcoming core PCE print is expected to come in at least 90bp above target, close to its widest divergence from the Fed's goal since January 2024.

The rates/swaps market has priced in over 100bp of cuts from the Fed by Q2 2026. While there are concerns shared by rates traders that inflation may rise in the short term, this is expected to be temporary, with slowing growth and labour market dynamics the primary influence for rates traders that will force the Fed's hand even if inflation stays ahead of target.

The long end of the US Treasury curve (10s and 30s) and the bear steepening underway sees that argument through a different lens and therefore offers a disconnect to rates pricing, and a message the Fed should not be too hasty in cutting rates. Powell's guidance at Jackson Hole will therefore be important in showing how he balances the focus on inflation versus growth and labour markets.

In essence, if the outcome from Powell's speech results in some of the implied rate cuts being priced out, and the curve flattening, then the USD will likely push higher, and equity sold. There is a clear relationship between EURUSD and the US 2s vs 30s curve – the steeper the curve, the more buying support for EURUSD has been observed.

The slope of the curve also hints that implied policy settings may be too loose, raising questions about Fed's credibility through independence. Meanwhile, corporate credit spreads remain extremely tight. The effects are visible in equity and volatility markets, with high short-interest plays outperforming, lower-quality names finding form, and “alt season” gaining traction in crypto.

The disconnect between what rates traders are focused on, and what the long end of bond markets is signalling, is complex – but it suggests frothy markets may soon make a move. The US Labour Day holiday (1 September) looks like a key marker, with September historically a weak period for bond returns and could be stage for an increasingly probable pickup in cross-asset volatility.

In the dynamic world of cryptocurrency, understanding macroeconomic trends is absolutely crucial. While digital assets often carve their own path, external economic events frequently create ripples across all financial markets, including crypto. Staying informed about upcoming financial calendar highlights can give you a significant edge, helping you anticipate potential volatility and make more informed decisions. Let us explore the key happenings this week that could influence your portfolio.

This week brings a series of significant announcements and speeches that could steer market sentiment. From central bank insights to labor market data, each event offers a piece of the puzzle regarding the global economic outlook. For cryptocurrency investors, these moments can present both opportunities and challenges, influencing price action and overall market liquidity.

Tuesday, August 19 (18:10 UTC): U.S. FOMC Member Bowman Speaks

Wednesday, August 20 (01:15 UTC): China PBoC Loan Prime Rate

Wednesday, August 20 (18:00 UTC): U.S. FOMC Meeting Minutes

Thursday, August 21 (12:30 UTC): U.S. Initial Jobless Claims

Friday, August 22 (00:00 UTC): U.S. Jackson Hole Symposium

Friday, August 22 (14:00 UTC): U.S. Fed Chair Powell Speaks

As these critical economic events unfold, smart traders and investors remain vigilant. Here are some actionable tips:

This week promises to be eventful for global financial markets. From central bank pronouncements to crucial economic data releases, these economic events will undoubtedly shape investor sentiment and influence asset prices. By staying informed and understanding the potential market impact of each announcement, you can better navigate the complexities of the financial landscape and make more strategic decisions for your crypto investments.

Frequently Asked Questions (FAQs)

What is the FOMC?

The Federal Open Market Committee (FOMC) is the monetary policymaking body of the Federal Reserve System in the United States. It sets the federal funds rate target, influencing interest rates and the money supply.

Why are FOMC meeting minutes important?

FOMC meeting minutes provide a detailed summary of the discussions and decisions made at the most recent Federal Reserve policy meeting. They offer valuable insights into the Fed’s economic outlook, concerns, and the rationale behind their policy choices, helping investors anticipate future actions.

What is the Jackson Hole Symposium?

The Jackson Hole Economic Policy Symposium is an annual gathering of central bankers, finance ministers, academics, and financial market participants from around the world. It is a significant event where major policy ideas are often discussed and sometimes unveiled, particularly regarding global economic events and monetary policy.

How do these economic events affect cryptocurrency prices?

These economic events can influence cryptocurrency prices indirectly. For example, changes in interest rate expectations (due to Fed policy) can impact the dollar’s strength, investor risk appetite, and the overall liquidity in financial markets, all of which can spill over into crypto valuations.

What is the PBoC Loan Prime Rate?

The PBoC Loan Prime Rate (LPR) is a benchmark lending rate set by the People’s Bank of China. It reflects the interest rates that commercial banks charge their best customers. Changes to the LPR indicate shifts in China’s monetary policy, aiming to stimulate or cool down its economy.

There was no deal when U.S. President Donald Trump met his Russian counterpart Vladimir Putin on Friday.That was not unexpected. The summit, which was initially arranged to discuss a ceasefire to Moscow's war in Ukraine, was on Tuesday reframed by White House Spokesperson Karoline Leavitt as a "listening exercise" that allowed Trump to get a "better understanding of how we can hopefully bring this war to an end."Prior to the summit, analysts were already casting doubt on the talks advancing any real ceasefire in Ukraine.

"Let's be clear, Putin does not take Trump seriously," Tina Fordham, founder of Fordham Global Foresight, told CNBC.And the fact that the summit was scheduled — and Putin invited to Alaska, the first time he stepped on U.S. soil in about a decade — was already a "big win" for the Kremlin leader, according to a comment by Richard Portes, head of the economics faculty at the London Business School, before the meeting took place.While no agreement was reached, Trump on Friday described the meeting as "very productive" — and announced the next day that he would be pursuing a "peace agreement" rather than a ceasefire between Russia and Ukraine.

But peace means very different things to the Ukraine, Russia and America. To one, it could be the complete halt of armed warfare and the retreat of foreign troops from its soil. To another, it might seem like acquiring annexed territory. And for some, it might look like a shiny golden coin engraved with the profile of Alfred Nobel, regardless of the prerequisites.

Trump-Putin summit yields no ceasefire agreement. On Saturday, Trump said he would be pursuing a "peace agreement" between Ukraine and Russia. Putin has agreed that the U.S. and European nations could give Ukraine "Article 5-like" security guarantees, the White House said Sunday.

OpenAI in share sales talk that would value it at $500 billion. The shares would be sold by current and former employees to investors including SoftBank, Dragoneer Investment Group and Thrive Capital, according to a source.

The Dow Jones Industrial Average outperforms. Major stock indexes ended Friday mixed, with the Dow Jones Industrial Average rising a fractional 0.08%. Europe's Stoxx 600 index ticked down marginally and closed near the flatline.

A trip by U.S. trade officials to India has been called off. The visit, which was expected to take place between Aug. 25 and Aug. 29, will likely be rescheduled, according to Indian news broadcaster NDTV Profit.

Fedspeak to parse for the week. Minutes for the U.S. Federal Reserve's August meeting come out Wednesday, while Fed Chair Jerome Powell will speak at Jackson Hole, a symposium of economic policy, on Friday. They may give clues on policy path.

The Bullish IPO last week took on added significance, perhaps because of the company name.When shares of the Peter Thiel-backed cryptocurrency exchange more than doubled out of the gate on Wednesday before finishing the day up 84%, it was the latest sign that the tech IPO bulls are back in business.But Lise Buyer, founder of IPO advisory firm Class V Group, warns that tech markets have a history of overheating.

The dollar dithered on Monday ahead of a key meeting between U.S. President Donald Trump and his Ukrainian counterpart Volodymyr Zelenskiy, while investors also looked ahead to the Federal Reserve's Jackson Hole symposium for more policy clues.

Currency moves were largely subdued in the early Asia session, though the dollar steadied after last week's fall as traders further pared back bets of a jumbo Fed cut next month.

The euro was little changed at $1.1705, while sterling edged up 0.07% to $1.3557.

Against a basket of currencies, the dollar advanced slightly to 97.85, after losing 0.4% last week.

Markets are now pricing in an 84% chance the Fed would ease rates by a quarter point next month, down from 98% last week, after a raft of data including a jump in U.S. wholesale prices last month and a solid increase in July's retail sales figures dimmed the prospect of an oversized 50-basis-point cut.

"While the data don't all point in the same direction, the U.S. economy looks to be in okay shape in the third quarter," said Bill Adams, chief economist at Comerica Bank.

"The Fed is likely to cut interest rates by year-end, either in September, when markets now price in a cut, or a few months later, when Comerica forecasts a cut."

The main event for investors on Monday is a meeting between Trump and Zelenskiy, who will be joined by some European leaders, as Washington presses Ukraine to accept a quick peace deal to end Europe's deadliest war in 80 years.

Trump is leaning on Zelenskiy to strike an agreement after he met Kremlin chief Vladimir Putin in Alaska and emerged more aligned with Moscow on seeking a peace deal instead of a ceasefire first.

Also key for markets this week will be the Kansas City Federal Reserve's August 21-23 Jackson Hole symposium, where Fed Chair Jerome Powell is due to speak on the economic outlook and the central bank's policy framework.

"I think (Powell) will also talk about the current economic conditions in the U.S., and that will be more policy relevant, that will be more interesting to markets," said Joseph Capurso, head of international and sustainable economics at Commonwealth Bank of Australia.

"Given market pricing is very high for a rate cut in September, I think the risk is that Powell is hawkish, or is perceived to be hawkish, if he gives a balanced view of the U.S. economy."

In other currencies, the dollar rose 0.11% against the yen to 147.34, after falling roughly 0.4% last week.

Japan's government on Friday brushed aside rare and explicit comments from U.S. Treasury Secretary Scott Bessent who said the Bank of Japan was "behind the curve" on policy, which appeared to be aimed at pressuring the country's central bank into raising interest rates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up