Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The US Dollar Index Rose Approximately 0.7% In Late New York Trading On Monday (February 2nd), Reaching 97.641 Points. The Index Traded Between 97.008 And 97.733 Points During The Day, Maintaining A Slight Upward Trend And Hovering Around 97.100 Points Before Extending Its Gains. The Bloomberg US Dollar Index Rose 0.35% To 1192.42 Points, Trading Between 1187.02 And 1193.19 Points During The Day

US Treasury Says To Borrow $574 Billion In Q1, Sees End Cash Balance Of $850 Billion (Removes Extraneous Word "It")

US Treasury Says It Expects To Borrow $109 Billion In Q2, Sees End Cash Balance Of $900 Billion

[The Carlyle Group Joins Europe's Top Ten Oil Refiners] As Major Oil Companies Streamline Their Portfolios, The Carlyle Group Has Joined The Ranks Of Europe's Top Ten Fuel Manufacturers. The Private Equity Giant Holds A Two-thirds Stake In Varo Energy, Which Completed Its Acquisition Of The Lysekil And Gothenburg Refineries In Sweden In January. According To Data Compiled By Bloomberg, This Move, Combined With Its Existing Holdings, Elevates Carlyle To Ninth Place Among European Fuel Manufacturers

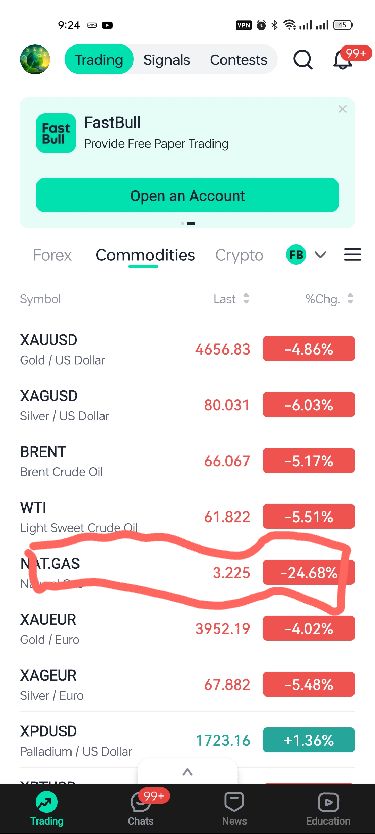

WTI Crude Oil Futures For March Delivery Closed At $62.14 Per Barrel. Nymex Natural Gas Futures For March Delivery Closed At $3.2370 Per Million British Thermal Units (MMBtu). Nymex Gasoline Futures For March Delivery Closed At $1.8514 Per Gallon, And Nymex Heating Oil Futures For March Delivery Closed At $2.3598 Per Gallon

Ukraine Designates Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization" On February 2nd. Ukrainian President Volodymyr Zelenskyy Announced That Ukraine Has Designated Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization." Iran Has Not Yet Responded

Intercontinental Exchange (ICE), The Owner Of Nasdaq (NYSE), Has Received Approval From The U.S. Securities And Exchange Commission (SEC) To Provide U.S. Treasury Clearing Services

Swiss National Bank Chairman: Expects Swiss Inflation To Rise In Coming Months, Sees Monetary Conditions In Switzerland As Appropriate

Rubio: US Looks Forward To Working Closely With Costa Rica's President-Elect Laura Fernández Delgado's Administration After Electoral Victory

German Chancellor Merz: Transatlantic Relationship Has Changed And No One Regrets It More Than Me

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin‘s value has taken a hit after reaching over $86,400, with the European Union voicing its concerns over tariffs. Currently, the cryptocurrency stabilizes around the $85,000 mark. While some market experts warn against expecting further declines, discussions about future predictions for cryptocurrencies persist.

Recently, Ki Young Ju, the CEO of CryptoQuant, indicated that bear markets may have begun, allowing short sellers, especially in altcoins, to capitalize on his insights. Nevertheless, this view is not universally accepted. Historically, significant recoveries often occur after steep downturns, reminiscent of the market behavior noted in mid-2021.

As Mister Crypto analyzed the current situation, he identified unrealized losses in Bitcoin’s circulating supply, cautioning those who predict a continued downturn. Interestingly, only 24% of the circulating Bitcoin is in unrealized loss, a figure suggesting that the market might merely be experiencing a routine dip within a broader bull market cycle.

Despite the prevailing fears linked to tariffs and other adverse news, many expect a rise in cryptocurrency prices. Historical trends indicate that that such recoveries are typical; as markets improve, past suffering often fades from memory. Moustache emphasized this with visual data, predicting an upward trajectory.

Monitoring indicators closely, Jelle noted that Bitcoin has recently surged above a critical moving average for the third time, suggesting a possible end to the downtrend. The significant observation is that this key average is no longer declining.

With Bitcoin holding steady around $85,000, the interest in altcoins remains subdued, but many market watchers are cautiously optimistic about the potential for a rally in the near term.

The project, reportedly led by Bill Zanker—a longtime associate who has previously worked with Donald Trump on NFT collections and the Trump memecoin—is expected to debut by the end of April 2025.

Insiders describe the game as a digital real estate experience where players earn virtual currency by moving pieces around a digital board and building properties in a virtual city, evoking similarities to Monopoly Go!. However, Zanker’s spokesperson has denied that the game is directly modeled on Monopoly Go!, calling such claims “hearsay” while confirming the game is in development.

This new game is part of a broader expansion of Trump-branded crypto ventures, which include NFT collections, a memecoin, a decentralized finance platform called World Liberty Financial, a stablecoin, and a Bitcoin mining company involving Trump’s sons Eric and Donald Jr. The Trump family’s growing involvement in crypto coincides with President Trump’s administration advocating for deregulation and strategic initiatives to strengthen the U.S. position in digital finance, including plans for a national crypto reserve.

Despite the buzz, some in the crypto community remain cautious, raising questions about the game’s economic model and potential intellectual property issues. Hasbro, the owner of Monopoly, has not licensed its intellectual property to any Trump-affiliated group for this crypto project. Attempts to reacquire rights to the 1989 Trump-branded Monopoly game were reportedly unsuccessful.

Bill Zanker, known for his entrepreneurial ventures since the 1980s, reconnected with Trump in recent years to launch various crypto products, including NFTs and the Trump memecoin, which attracted significant attention but also controversy.

This upcoming crypto game marks the latest move by the Trump family into blockchain and digital assets, combining traditional real estate-themed gameplay with emerging crypto technology. More details are expected to be revealed upon the game’s official launch later this month.

"All point to a more gradual copper price decline through 2Q'25 versus the deeper and faster investor sell-off we previously anticipated, with funds still positioned net bullish," Citi added in a note.

The investment bank raised its three-month copper forecast to $8,800 per tonne. On April 7, it reduced its forecast to $8,000 following Trump's tariff announcements.

The bank estimated average copper prices of $9,000 per tonne in the second quarter.

Citi said it remains bearish over the next three to six months as physical copper consumption and manufacturing activity slow down due to U.S. tariffs, especially the 145% levy on manufacturing hub China.

"We are unsure exactly how far copper prices can fall but our view is still to wait to buy until President Trump reverses tariffs, fully redistributes tariff revenue, or Fed or China "policy puts" kick in," Citi said.

Citi also raised its aluminum price forecast to $2,300 per tonne from $2,200 for the second quarter, with an average of $2,400.

The Dow Jones Industrial Average rose 134.79 points, or 0.33%, to 40,659.58; the Nasdaq rose 81.18 points, or 0.48%, to 16,912.66; and the S&P 500 rose 25.67 points, or 0.47%, to 5,431.64.

U.S. stocks closed higher on Monday, with the Dow Jones Industrial Average rising more than 300 points, and all three major indexes closed higher for the second consecutive trading day.

On the evening of April 11, Eastern Time, the U.S. Customs announced that, according to the memorandum signed by President Trump that day, integrated circuits, communication equipment, smartphones, display modules, etc. would be exempted from the so-called "reciprocal tariffs." The U.S. Customs policy boosted U.S. stocks.

But on the 13th local time, U.S. Commerce Secretary Lutnick said that the Trump administration’s tariff exemptions for technology products such as mobile phones and computers are only "temporary" and that these products will soon be included in the so-called "semiconductor tariffs" and are expected to be implemented "within a month or two."

Trump posted on Truth Social on Sunday denying that there were "exceptions" to the tariffs on certain electronics products announced by U.S. Customs last Friday, saying that the exempted products were simply transferred to another tariff category, and that semiconductors and the entire electronics supply chain would be reviewed and tariffs would be imposed on the entire electronics supply chain.

Trump has long threatened to impose tariffs on semiconductors without specifying the scope of the levies. Trump has already imposed industry-specific tariffs on steel, aluminum and autos, while preparing new tariffs on auto parts and copper and promising other tariffs on semiconductor chips, pharmaceuticals, lumber and critical minerals.

Trump said on Monday he was considering changes to tariffs on auto and parts imports from Mexico, Canada and elsewhere.

Dan Boardman-Weston, CEO and CIO of BRI Wealth Management, said: "The market has been hungry for any positive signal. The news about electronics and mobile phones last weekend was very positive for market sentiment, so we have seen the market rebound in recent days."

“The tone is positive as the market is pricing in a temporary relief on auto tariffs and the electronics sector is still responding to the tax cuts, even if they are temporary,” said Georgios Leontaris, chief investment officer for Switzerland and EMEA at HSBC Global Private Bank and Wealth.

"When tariff exemptions start to appear for certain sectors, the market starts to think that these tariffs may not be across the board and there may even be further exemptions," said Illiana Jain, an economist at Westpac.

However, analysts generally remained cautious as Trump's changing stance on tariffs continued to cast a shadow over the market and global economic outlook.

The latest development of Trump’s tariffs is that the U.S. Department of Commerce is advancing new trade investigations into imports of semiconductors and pharmaceutical products, and plans to impose additional tariffs on related products, which may further expand the scope of the trade war.

The U.S. Federal Government Gazette notified that the U.S. Department of Commerce is conducting a national security investigation into imported semiconductor technology and related downstream products.

The official document, which asks the public to comment on the investigation, further confirms that the chip and electronics supply chain has not been excluded from Trump's tariff plan despite his statement on Friday that many products in the supply chain were exempted from "reciprocal tariffs."

The U.S. Commerce Department will investigate the "feasibility of increasing domestic semiconductor production capacity" to reduce dependence on imports and whether additional trade measures, including tariffs, are "necessary to protect national security."

The scope of this investigation is wide, covering chip components such as silicon wafers, chip manufacturing equipment, and "downstream products containing semiconductors".

The European Union and the United States made little progress this week in bridging their trade differences as Trump administration officials said most U.S. tariffs on the bloc would not be rolled back.

According to reports, citing people familiar with the matter, EU trade chief Šefčović left the talks still unclear about the US position and difficult to determine the US intentions. He held talks with US Commerce Secretary Lutnick and Trade Representative Greer in Washington for about two hours on Monday.

U.S. officials have said the 20% “reciprocal tariff” and other duties on industries such as autos and metals will not be completely rolled back, the people said, asking not to be identified discussing private matters.

The U.S. stock earnings season has just begun, and first-quarter results from Bank of America and Johnson & Johnson exceeded analysts' expectations.

The corporate earnings season accelerates this week, with several large companies set to release their earnings reports.

Although Trump's tariff policy has caused sharp fluctuations in U.S. stocks recently, some corporate executives said that current financial reports may not give investors a clear understanding of how Trump's new tariff policy will affect their companies.

“I think when it comes to earnings season, we’re just going to hear some companies say there’s a lot of uncertainty,” said Brenda Vingiello, CEO of Sand Hill Global Advisors. “I think after this earnings season, we’ll probably know that the first quarter was probably pretty good, but there won’t be a lot of answers (otherwise).”

The market is also paying attention to the news that Trump wants to remove Powell from the position of Fed Chairman. The news of the Fed's "change of leadership" has put the global financial market at greater risk of turbulence.

On Monday local time, U.S. Treasury Secretary Scott Bessent said in an interview that he and President Trump "have been considering" the next Federal Reserve chairman and plan to start interviewing potential candidates in the fall.

Public information shows that the term of the current Federal Reserve Chairman Powell will end in May 2026, and Bessant's remarks have ignited market speculation about changes in the Federal Reserve's leadership in advance.

At the same time, the Trump administration is targeting independent institutions and asking the Supreme Court to fire relevant officials. Analysts believe that this move may open up a legal path for Trump to remove Powell, which will challenge the long-standing independence norms of the Federal Reserve.

In fact, Trump's dissatisfaction with Powell's monetary policy (especially interest rate decisions) has long been known.

Under Powell's leadership, U.S. inflation is on a cooling track, but its efforts to fight inflation are now facing new threats from Trump's trade war. The market is focused on whether Powell will choose to maintain a hawkish stance to ensure that inflation does not return, or will succumb to market pressure and start a rate cut cycle ahead of schedule.

In response, the White House continued to put pressure on Powell. According to media reports, Trump has been critical of the interest rate policy of the Federal Reserve under Powell's leadership and has repeatedly pressured Powell to cut interest rates significantly. He once posted on social media to publicly urge Powell to cut interest rates: "He is always 'half a beat' behind the times, but now there is a chance to reverse his image, so he must act quickly."

Despite the recent tariff shock, the Fed has recently resisted pressure to keep interest rates unchanged. Powell also hit back earlier this month, saying that the tariffs were larger than expected and could trigger "persistent" inflation beyond the short-term price shock.

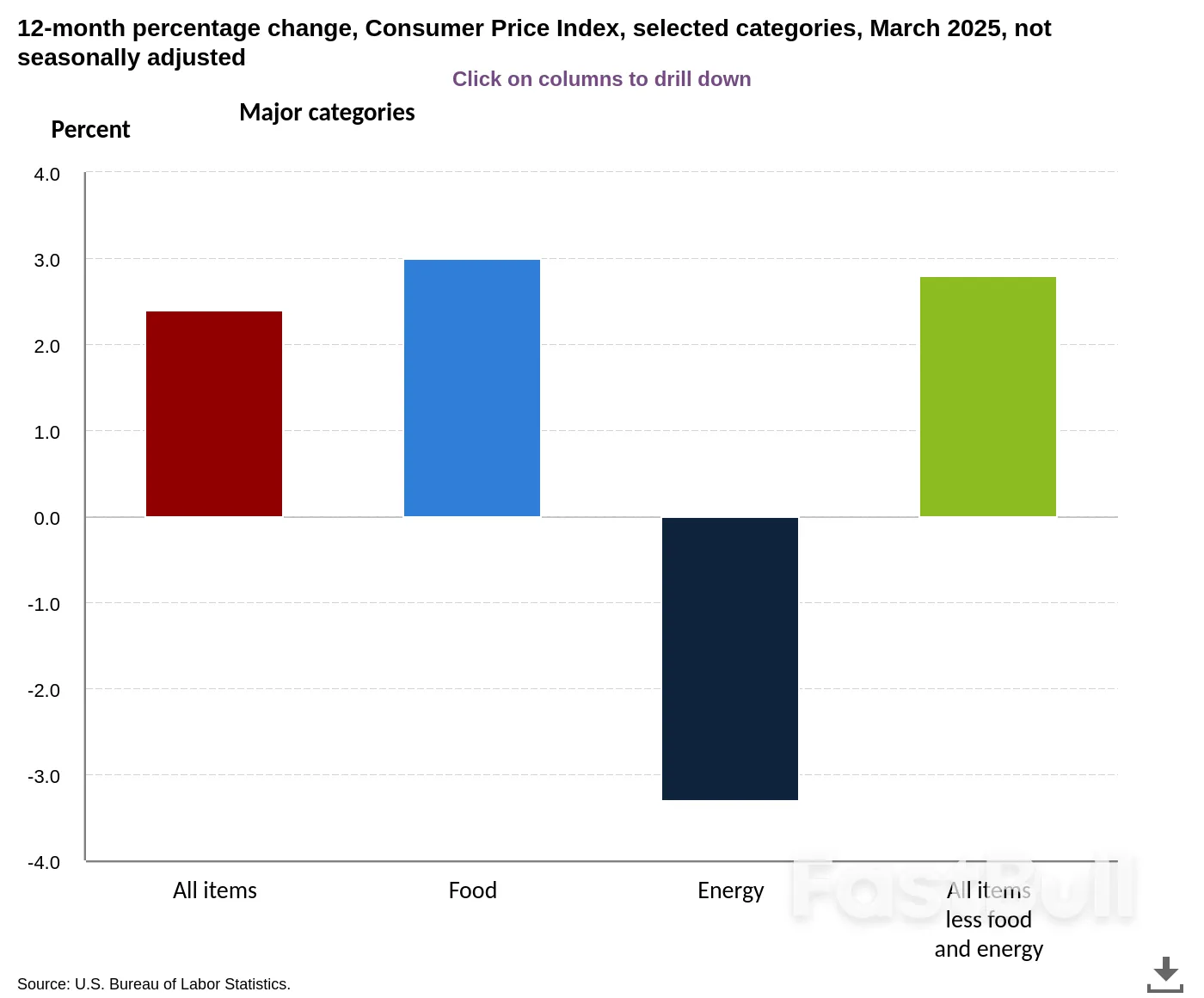

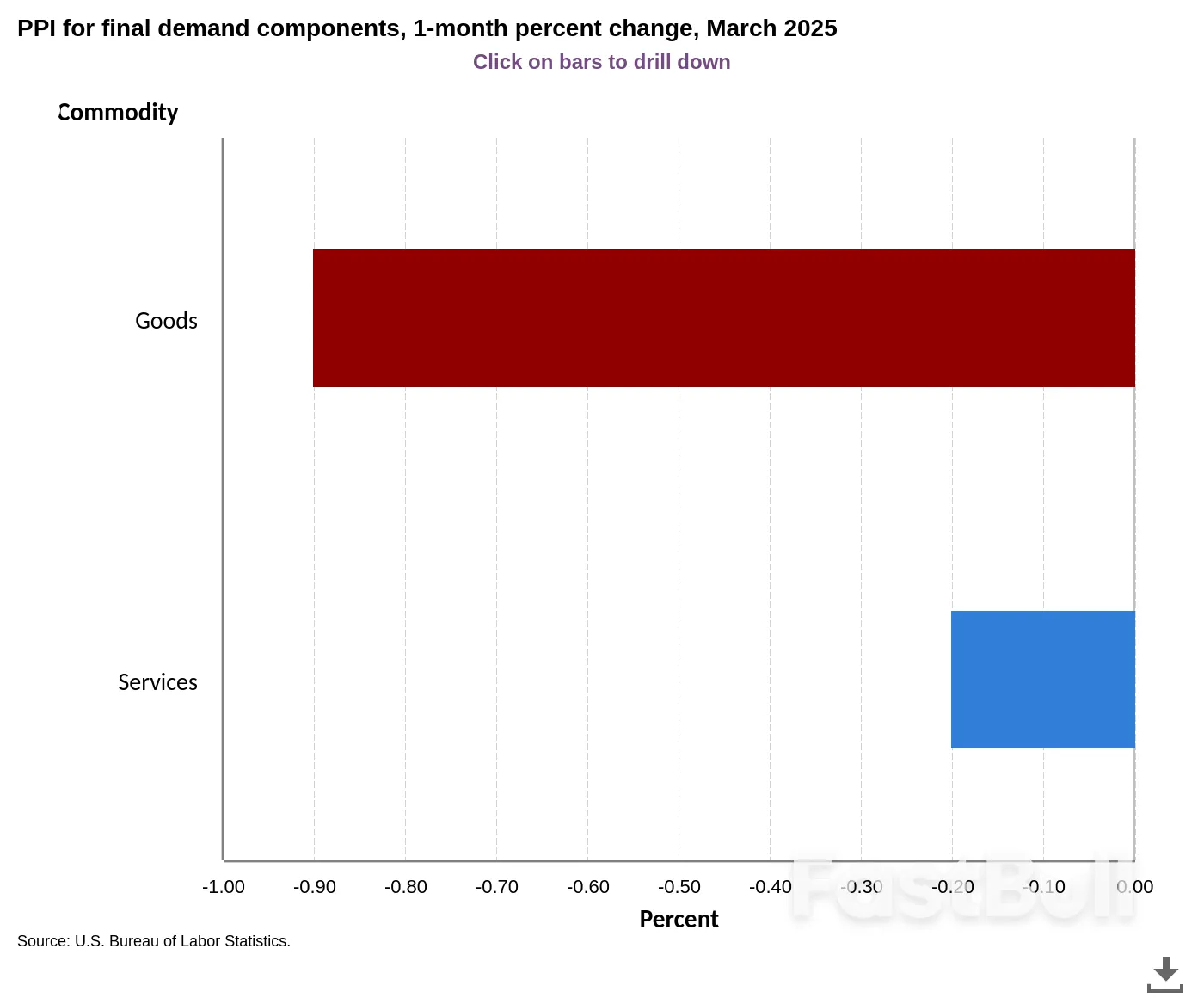

According to the U.S. Bureau of Labor Statistics, U.S. import prices fell 0.1% month-on-month in March, up 0.2% the previous month. The median forecast of 24 economists was flat month-on-month, with a range of 0.2% to 0.7%. Import prices rose 0.9% year-on-year in March. Import prices excluding petroleum were flat month-on-month, up 0.1% in February. Export prices were flat month-on-month, up 2.4% year-on-year; up 0.5% month-on-month in February.

Pete Boockvar, an independent economist and market strategist, said import prices were modest in March, but the data was "very out of date" because of previous tariffs and a weaker dollar.

“To put it bluntly, many manufacturers are now basically groping in the dark, especially those doing business with China, the automotive industry, and any company that needs to use steel and aluminum as raw materials,” Boockvar wrote. “A 90-day pause on other things sounds fine, but we still don’t know what will happen after 90 days, and we are still facing the reality of a 10% tariff on all imports.”

A research report released by the San Francisco Federal Reserve shows that although the U.S. unemployment rate has been rising slowly and relatively moderately in recent years, several less-noticed labor market indicators are sending warning signals of the risk of economic recession.

The authors of the latest issue of the San Francisco Federal Reserve's Economic Newsletter found that before the onset of many past recessions, the unemployed generally showed a continuous extension of the job search cycle and a gradual increase in the time they stayed in the ranks of the unemployed. "Historically, such patterns often appear at the beginning of economic recessions, suggesting that these current changes may be a signal of rising recession risks."

Fund managers are the most pessimistic about the economic outlook in 30 years, a Bank of America survey showed, but that pessimism is not fully reflected in their asset allocations, which could mean more selling in U.S. stocks.

In a monthly survey by Bank of America, 82% of fund managers expect the global economy to weaken. At the same time, the survey showed a record number of fund managers planning to reduce their exposure to U.S. stocks.

“Fund managers are extremely pessimistic on the macro level, but not yet as pessimistic as they could be about the market itself,” said Bank of America strategists led by Michael Hartnett.

U.S. President Trump posted on Truth Social that in view of Nvidia's investment commitment in the United States, "all necessary licenses will be expedited and quickly delivered" to Nvidia. On Monday, Nvidia CEO Huang Renxun said that he would build a $500 billion artificial intelligence infrastructure in the United States within four years.

Tesla CEO Elon Musk posted on the X platform on Tuesday that Tesla is about to achieve a universal, pure AI fully autonomous driving (FSD) solution. The technology will rely entirely on cameras and Tesla's self-developed AI chips, and will be driven by Tesla's AI software, which is highly consistent with Tesla's long-standing vision of achieving autonomous driving based solely on vision.

Musk said excitedly: "For the first time, fully autonomous driving will soon have a general, pure AI solution."

According to media reports, Apple CEO Cook recently explained in an interview why Apple sticks to Made in China. Simply put, it still chooses Made in China not because it is cheap, but because no one can replace it.

Cook said: "Many people think that Apple came to China for low-cost labor. This statement is outdated. China is no longer a 'low-cost factory'. What really attracted Apple is 'skill density'."

Bank of America Global Research cut its price target on Microsoft to $480 from $510.

JPMorgan analyst Samik Chatterjee maintained his buy rating on Apple and cut his price target to $245 from $270.

UBS analyst Karl Keirstead maintained a buy rating on Microsoft and cut his price target to $480 from $510.

Morgan Stanley analyst Brian Nowak maintained his buy rating on Amazon and cut his price target to $245 from $280.

Boeing CEO warns that tariffs may lead to delays in Boeing aircraft deliveries.

Netflix announced its goal: to achieve a market value of $1 trillion by 2030.

Ericsson's adjusted EBIT in the first quarter exceeded expectations.

Total expects refining margins to rise in the first quarter.

TSMC plans to mass-produce panel-level advanced semiconductor packaging in small batches in 2027.

U.S. stock index futures pointed to a lower open on Tuesday, as optimism over the possibility of tariff relief for the auto sector waned on signs of new levies on pharma and semiconductor imports.

Federal Register filings showed the Trump administration was proceeding with probes into imports of pharmaceuticals and semiconductors as part of a bid to impose tariffs on both sectors.

Johnson & Johnson'sshares slipped 1.3% despite the company beating Wall Street estimates for first-quarter revenue and profit. Drugmakers such as Pfizerand Eli Lillyalso edged lower.

Trading was choppy, with index futures reversing early gains over hopes of more tarrif cuts after U.S. President Donald Trump on Monday hinted at potential exemptions for the 25% tariffs imposed on imports of autos and auto parts.

Rapid changes in U.S. policy have sparked steep market selloffs, and left investors, companies and consumers confused over the outlook for policy and economic growth.

"We had a pretty good day yesterday off not a lot of data, and we've moved pretty far since last Wednesday, it's totally natural at this point just to take a breath, maybe pull back a little bit," said Mark Hackett, chief market strategist at Nationwide.

The main indexes gained some ground on Monday after key electronics products were granted exemption from reciprocal tariffs.

Corporate results will be closely monitored over the next weeks for indications on how companies and consumers are coping with changes in trade policy.

"With all the uncertainty and all the moving parts that we have right now, it is not really in corporate management's best interest to do anything other than be cautious or provide no guidance at all, which is probably more likely," Hackett said.

Bank of Americaadvanced 1.4% after reporting a higher profit in the first quarter, while Citigrouprose 1.2% as it also reported higher profit, lifted by revenue from equities trading.

At 08:32 a.m., Dow E-miniswere down 134 points, or 0.33%, S&P 500 E-miniswere down 15.25 points, or 0.28% and Nasdaq 100 E-miniswere down 38.5 points, or 0.2%.

Among other stocks, Boeinglost 3.2% after a report said China has ordered airlines in the country to not take any further deliveries of the company's jets.

Most analysts expect markets to remain volatile, until there's more clarity on Trump's tariffs.

The S&P 500's 50-day moving average (DMA) slipped below the 200-DMA on Monday, producing a "death cross" pattern that suggests a short-term correction could turn into a longer-term downtrend.

Global investors have slashed their U.S. equity holdings over the past two months, and a record number of managers plan to keep cutting their exposure, BofA Global Research said.

The S&P 500is down 8.1% this year, while the tech-heavy Nasdaq Compositehas slumped nearly 13%.

Richmond Fed President Thomas Barkin and Fed Board Governor Lisa Cook are scheduled to speak later in the day.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up