Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

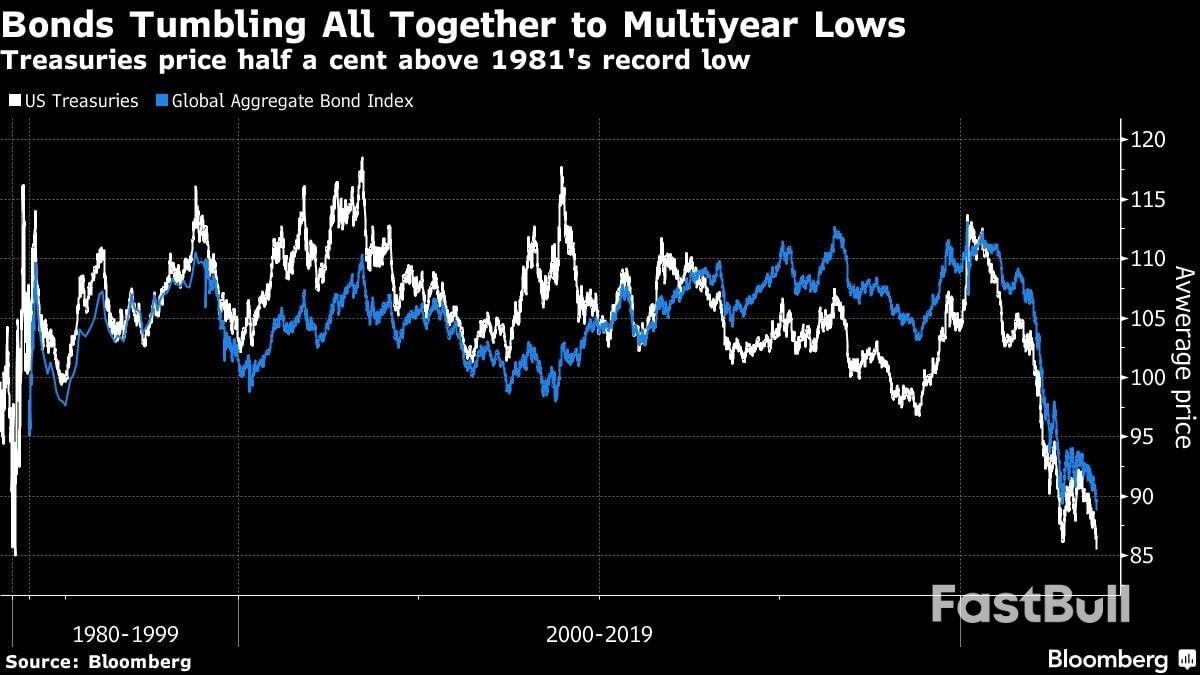

The world's biggest bond markets are in the throes of another rout as a new era of higher for longer interest rates takes hold.

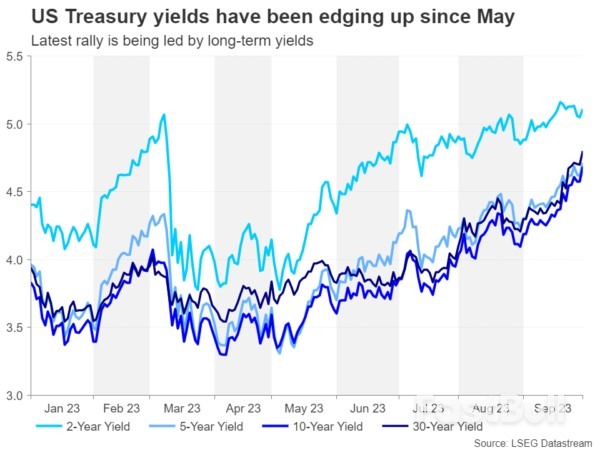

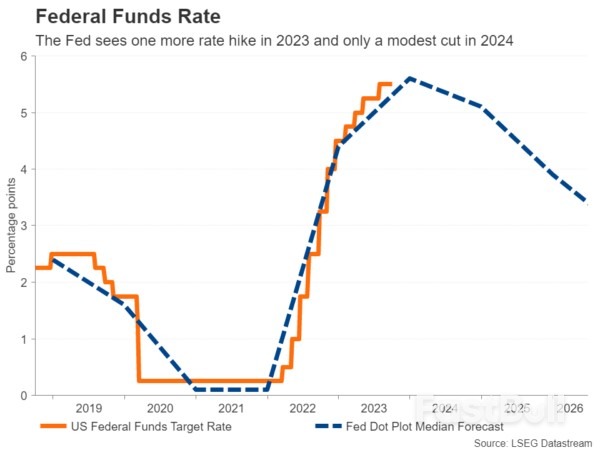

With rates potentially yet to peak in the United States and elsewhere, government bond yields have been rallying since May when the U.S. banking turmoil began to dissipate. However, this latest leg of the rally isn't so much driven by expectations of where interest rates will peak but more about how long they will stay at elevated levels.

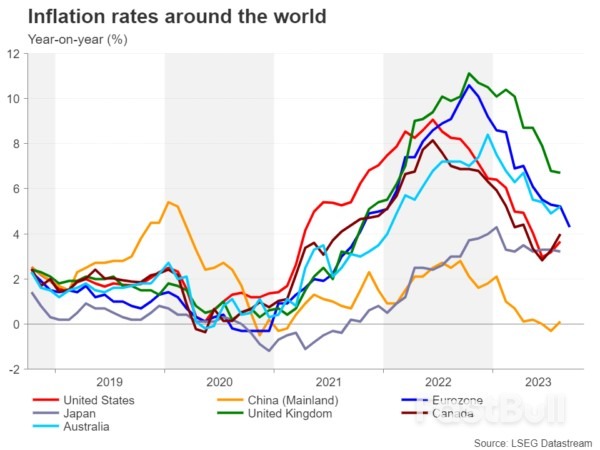

With rates potentially yet to peak in the United States and elsewhere, government bond yields have been rallying since May when the U.S. banking turmoil began to dissipate. However, this latest leg of the rally isn't so much driven by expectations of where interest rates will peak but more about how long they will stay at elevated levels. Inflation may have come down sharply over the past year as the energy crisis subsided, but the next phase may take a lot longer. There are several factors that could prevent inflation from dropping all the way down to 2% in a quick manner and they vary in each country. In America, it is the tight labour market and robust consumer spending.

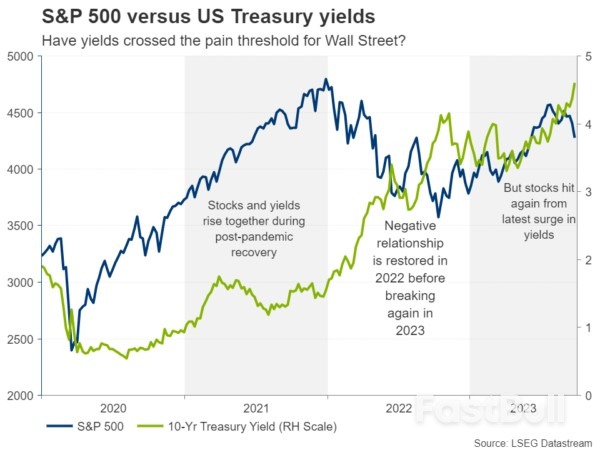

Inflation may have come down sharply over the past year as the energy crisis subsided, but the next phase may take a lot longer. There are several factors that could prevent inflation from dropping all the way down to 2% in a quick manner and they vary in each country. In America, it is the tight labour market and robust consumer spending. Assuming that the outlook in Europe and elsewhere doesn't improve, the U.S. dollar would be in a position to appreciate further, while there could be more pain in store for U.S. equities. So far though, the upside surprises in the economic data, the artificial intelligence (AI) mania as well as the defensive nature of many tech stocks have all contributed to driving Wall Street indices higher even as financial conditions have tightened.

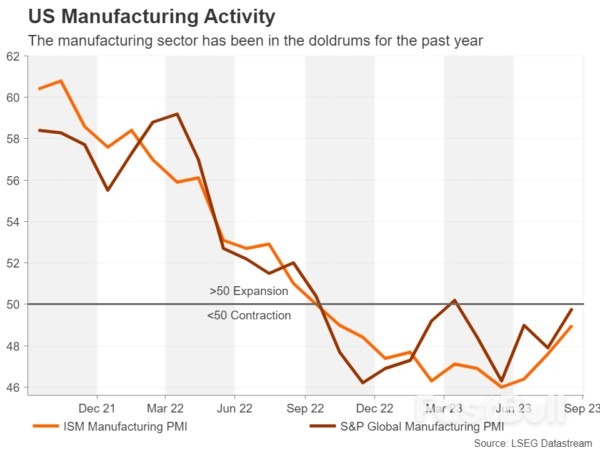

Assuming that the outlook in Europe and elsewhere doesn't improve, the U.S. dollar would be in a position to appreciate further, while there could be more pain in store for U.S. equities. So far though, the upside surprises in the economic data, the artificial intelligence (AI) mania as well as the defensive nature of many tech stocks have all contributed to driving Wall Street indices higher even as financial conditions have tightened. Resurgent oil prices are another worry as they threaten to push up costs again just as the pain was easing. Not to forget the slowdown in Europe and China that's bound to affect the earnings for U.S. multinationals, all this could yet kill any momentum in the economy, if not tip it into recession.

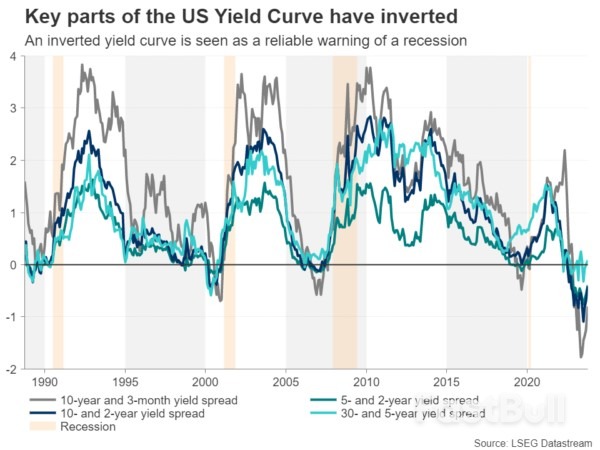

Resurgent oil prices are another worry as they threaten to push up costs again just as the pain was easing. Not to forget the slowdown in Europe and China that's bound to affect the earnings for U.S. multinationals, all this could yet kill any momentum in the economy, if not tip it into recession. The danger is that the risk of a recession may not be as low as policymakers and investors would like to believe. The inverted yield curve continues to flash red even though the gap between long- and short-term yields has narrowed over the last few months. The other cause of concern is that in the past, calls for a soft landing have often tended to precede recessions and what may be happening now is simply the timing of one being pushed further and further back.

The danger is that the risk of a recession may not be as low as policymakers and investors would like to believe. The inverted yield curve continues to flash red even though the gap between long- and short-term yields has narrowed over the last few months. The other cause of concern is that in the past, calls for a soft landing have often tended to precede recessions and what may be happening now is simply the timing of one being pushed further and further back.

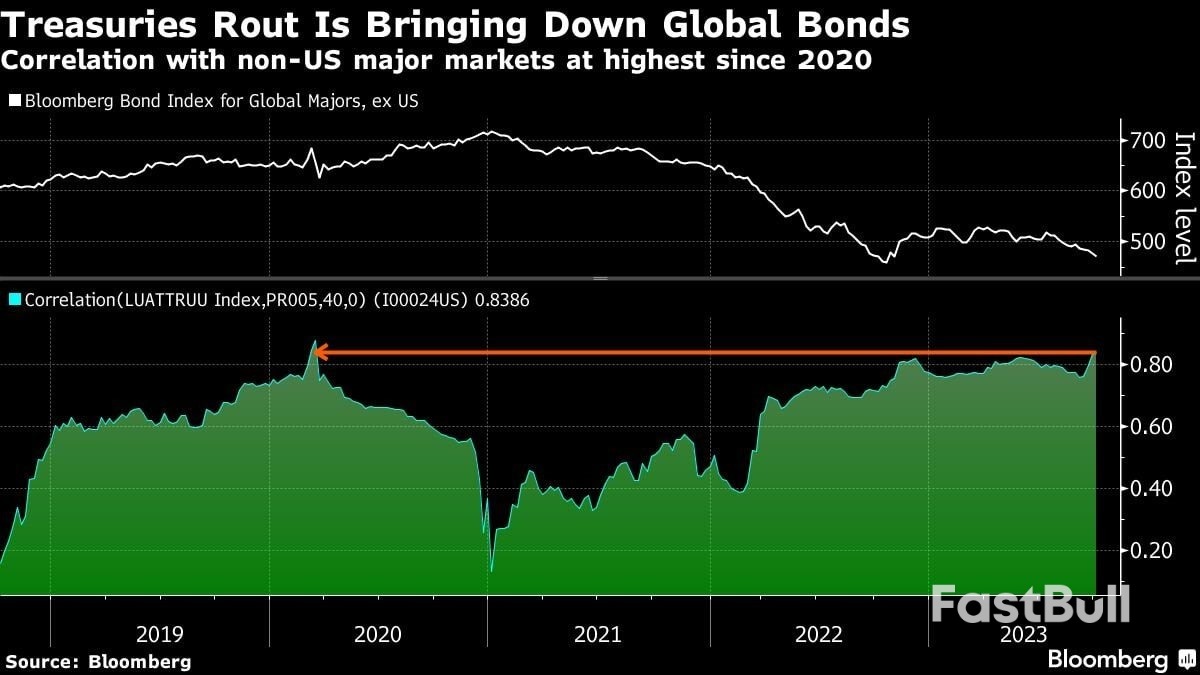

European yields followed their U.S. counterparts higher, with the correlation between Bloomberg's gauge of global securities and an index of Treasuries reaching the highest since March 2020.

European yields followed their U.S. counterparts higher, with the correlation between Bloomberg's gauge of global securities and an index of Treasuries reaching the highest since March 2020.  But the very shortest end of the Treasury market still looks attractive to some. An enlarged 52-week bill sale on Tuesday attracted record demand from non-dealers, as investors locked in a yield above 5% for the next year.

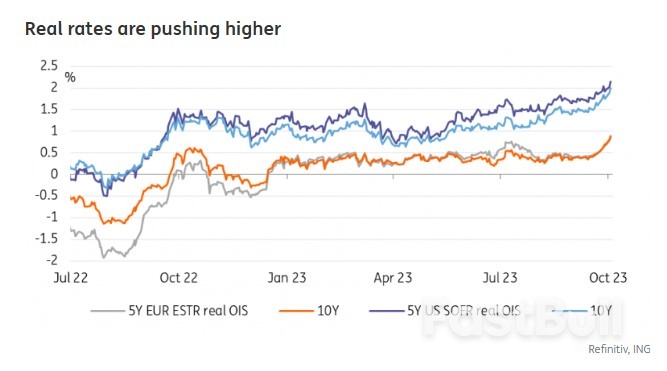

But the very shortest end of the Treasury market still looks attractive to some. An enlarged 52-week bill sale on Tuesday attracted record demand from non-dealers, as investors locked in a yield above 5% for the next year. The rout has also sent so-called real yields to multi-year highs, with the 10-year U.S. inflation-adjusted rate climbing above 2.4% to the sort of levels reached in 2007 just before U.S. equities topped out.

The rout has also sent so-called real yields to multi-year highs, with the 10-year U.S. inflation-adjusted rate climbing above 2.4% to the sort of levels reached in 2007 just before U.S. equities topped out.

Longer EUR real yields also at highs, Italian spreads resume widening

Longer EUR real yields also at highs, Italian spreads resume widening

The narrowing gap between the 2-year and 10-year Treasury yields, contracting to a mere 35 basis points from over 100 basis points a few months earlier, is especially concerning. This normalization, or "de-inverting", of a vital part of the yield curve is often viewed as a precursor to economic downturns, igniting debates on the imminence of a recession.

The narrowing gap between the 2-year and 10-year Treasury yields, contracting to a mere 35 basis points from over 100 basis points a few months earlier, is especially concerning. This normalization, or "de-inverting", of a vital part of the yield curve is often viewed as a precursor to economic downturns, igniting debates on the imminence of a recession. Back to DOW, it's now pressing and important near fibonacci support at 38.2% retracement of 28660.94 to 35679.13 at 32998.17. Sustained break of this level will strengthen the case that fall from 35679.13 is reversing whole rise from 28660.94. This decline could be viewed as the third leg of the long term pattern from 36952.65 high. Deeper fall would be seen to 31.429.82 support, which is close to 61.8% retracement at 31341.88.

Back to DOW, it's now pressing and important near fibonacci support at 38.2% retracement of 28660.94 to 35679.13 at 32998.17. Sustained break of this level will strengthen the case that fall from 35679.13 is reversing whole rise from 28660.94. This decline could be viewed as the third leg of the long term pattern from 36952.65 high. Deeper fall would be seen to 31.429.82 support, which is close to 61.8% retracement at 31341.88. Looking ahead

Looking ahead

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up