Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

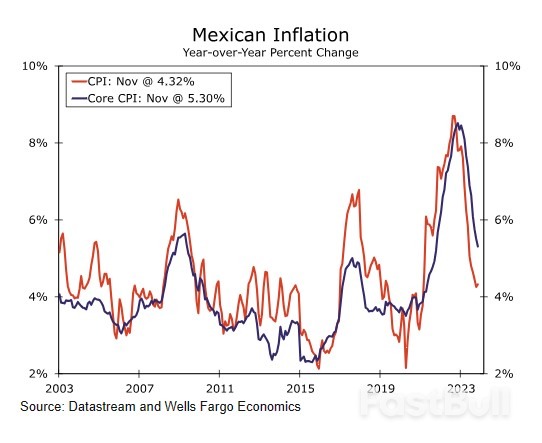

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Attacks by Houthi rebels along the trade route have led to firms pausing shipments, raising the possibility of a shock to the world economy.

Germany's Hapag-Lloyd has also said its container ships would continue to avoid the route, which is a central artery for global trade on the passage from Asia to Europe via the Suez canal and the Mediterranean.

Germany's Hapag-Lloyd has also said its container ships would continue to avoid the route, which is a central artery for global trade on the passage from Asia to Europe via the Suez canal and the Mediterranean.

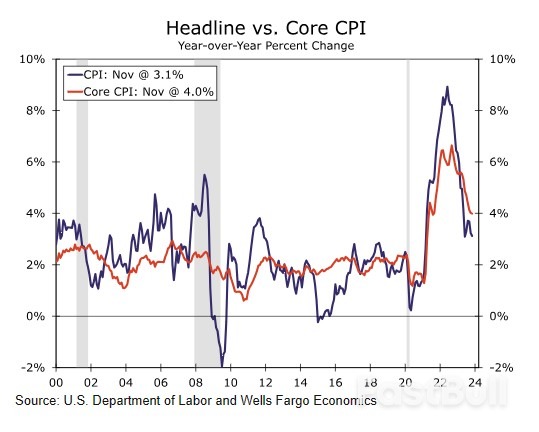

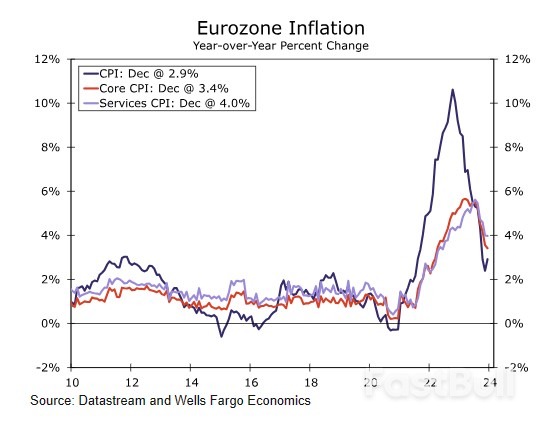

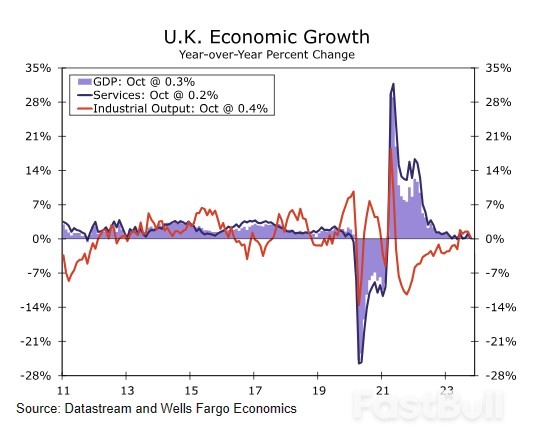

Today, inflation is cooling as the world's leading central banks use higher interest rates to crush demand. With households and businesses under pressure, world trade volumes and economic growth have slowed, raising the prospect of recessions in the US, UK and EU nations.

Today, inflation is cooling as the world's leading central banks use higher interest rates to crush demand. With households and businesses under pressure, world trade volumes and economic growth have slowed, raising the prospect of recessions in the US, UK and EU nations. Open Wallets

Open Wallets

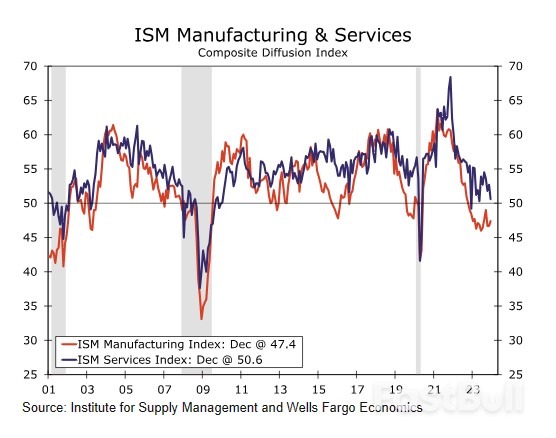

Elsewhere, there remains a stark divergence between the manufacturing and services sectors. December marked the 14th straight month of waning manufacturing activity, according to the ISM Manufacturing Index. Its services sector counterpart continued to expand, albeit at a scant pace. According to survey responses, manufacturers continue to be weighed down by weak demand for new orders, the unfavorable financing environment and grim prospects for manufacturing employment. In contrast, survey responses among service providers were generally positive despite December's dip in activity. Hard data on personal consumption expenditures echo these themes. Economy-wide spending on durable goods has declined in five of the past 10 months, while services spending has only dipped once in the past 40. Sentiment in these sectors will likely converge somewhat as weaker growth takes hold over the coming year. Although we expect manufacturing to remain under pressure, manufacturers surveyed by ISM seem to be growing more optimistic as inflation pressures abate and expectations mount for Federal Reserve rate cuts in 2024. We also look for some moderation in services demand in the coming year, especially if earnings growth continues to come off the boil.

Elsewhere, there remains a stark divergence between the manufacturing and services sectors. December marked the 14th straight month of waning manufacturing activity, according to the ISM Manufacturing Index. Its services sector counterpart continued to expand, albeit at a scant pace. According to survey responses, manufacturers continue to be weighed down by weak demand for new orders, the unfavorable financing environment and grim prospects for manufacturing employment. In contrast, survey responses among service providers were generally positive despite December's dip in activity. Hard data on personal consumption expenditures echo these themes. Economy-wide spending on durable goods has declined in five of the past 10 months, while services spending has only dipped once in the past 40. Sentiment in these sectors will likely converge somewhat as weaker growth takes hold over the coming year. Although we expect manufacturing to remain under pressure, manufacturers surveyed by ISM seem to be growing more optimistic as inflation pressures abate and expectations mount for Federal Reserve rate cuts in 2024. We also look for some moderation in services demand in the coming year, especially if earnings growth continues to come off the boil.

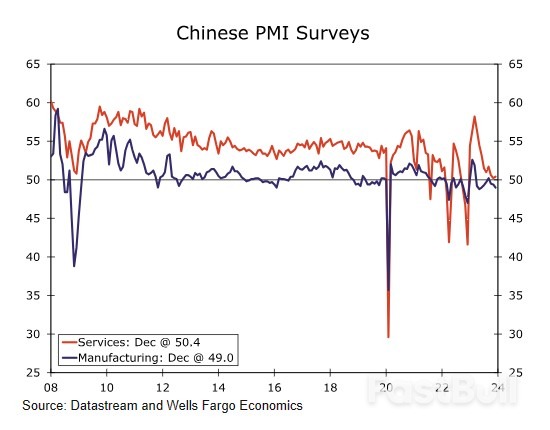

This week's news from emerging economies was mixed. China's official PMI surveys for December saw the manufacturing PMI unexpectedly fall to 49.0 and the services PMI rise less than expected to 50.4. Within the manufacturing survey, the new orders component fell to 48.7, while the employment component also fell slightly. For the official services PMI, the new orders and employment components both rose. Elsewhere, China's December Caixin manufacturing PMI edged up to 50.8, while the Caixin services PMI rose to 52.9.

This week's news from emerging economies was mixed. China's official PMI surveys for December saw the manufacturing PMI unexpectedly fall to 49.0 and the services PMI rise less than expected to 50.4. Within the manufacturing survey, the new orders component fell to 48.7, while the employment component also fell slightly. For the official services PMI, the new orders and employment components both rose. Elsewhere, China's December Caixin manufacturing PMI edged up to 50.8, while the Caixin services PMI rose to 52.9.

But for the time being, wage growth is still too high for the BoE's liking. We also think services inflation will remain sticky around 6% for the next two to three months, before falling more noticeably by the summer.

But for the time being, wage growth is still too high for the BoE's liking. We also think services inflation will remain sticky around 6% for the next two to three months, before falling more noticeably by the summer.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up