Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Dec)

Euro Zone Consumer Inflation Expectations (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Nov)

Euro Zone Unemployment Rate (Nov)A:--

F: --

P: --

Euro Zone PPI MoM (Nov)

Euro Zone PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Dec)

Euro Zone Selling Price Expectations (Dec)A:--

F: --

P: --

Euro Zone PPI YoY (Nov)

Euro Zone PPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Dec)

Euro Zone Industrial Climate Index (Dec)A:--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Dec)

Euro Zone Economic Sentiment Indicator (Dec)A:--

F: --

Euro Zone Services Sentiment Index (Dec)

Euro Zone Services Sentiment Index (Dec)A:--

F: --

Euro Zone Consumer Confidence Index Final (Dec)

Euro Zone Consumer Confidence Index Final (Dec)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Dec)

Mexico 12-Month Inflation (CPI) (Dec)A:--

F: --

P: --

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)A:--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)A:--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)A:--

F: --

P: --

U.S. Exports (Oct)

U.S. Exports (Oct)A:--

F: --

P: --

U.S. Trade Balance (Oct)

U.S. Trade Balance (Oct)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)A:--

F: --

Canada Trade Balance (SA) (Oct)

Canada Trade Balance (SA) (Oct)A:--

F: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Oct)

U.S. Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Consumer Credit (SA) (Nov)

U.S. Consumer Credit (SA) (Nov)A:--

F: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)--

F: --

P: --

China, Mainland CPI YoY (Dec)

China, Mainland CPI YoY (Dec)--

F: --

P: --

China, Mainland PPI YoY (Dec)

China, Mainland PPI YoY (Dec)--

F: --

P: --

China, Mainland CPI MoM (Dec)

China, Mainland CPI MoM (Dec)--

F: --

P: --

Japan Leading Indicators Prelim (Nov)

Japan Leading Indicators Prelim (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Nov)

Germany Industrial Output MoM (SA) (Nov)--

F: --

P: --

Germany Exports MoM (SA) (Nov)

Germany Exports MoM (SA) (Nov)--

F: --

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)--

F: --

P: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Sept)

U.S. Building Permits Revised YoY (SA) (Sept)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Sept)

U.S. Building Permits Revised MoM (SA) (Sept)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)--

F: --

P: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Indexes: Dow down 0.3%, S&P 500 flat, Nasdaq up 0.2%.Strategy gains as MSCI keeps crypto treasury firms in indexes.Private payrolls rebound less than expected in December.

Jan 7 (Reuters) - Wall Street's main indexes were mixed on Wednesday, with the S&P 500 and the Dow coming off their intraday record highs after rallying in the previous two sessions, while investors assessed numerous economic datasets.

At 10:09 a.m. ET, the Dow Jones Industrial Average (.DJI), opens new tab fell 145.00 points, or 0.30%, to 49,317.08, the S&P 500 (.SPX), opens new tab gained 0.78 points, or 0.01%, to 6,945.60, and the Nasdaq Composite (.IXIC), opens new tab gained 53.51 points, or 0.23%, to 23,600.68.

The Dow slipped from its record high and remained about 1.5% below the historic 50,000 level, while modest moves in the S&P 500 kept it at a record high, leaving the benchmark 0.7% shy of the 7,000-point peak.

Wall Street surged on Tuesday amid renewed enthusiasm for artificial-intelligence-linked stocks.

U.S. job openings fell more than expected in November after rising marginally in October, while a separate ADP report showed that private payrolls increased less than expected in December.

Kim Forrest, chief investment officer at Bokeh Capital Partners, said that investors could stay cautious over the next couple of days, avoiding any outsized bets until the key nonfarm payrolls report is released on Friday.

Healthcare (.SPXHC), opens new tab extended its gains on Wednesday, up 1.1% to hit a record high, boosted by a 4% rise in heavyweight drugmaker Eli Lilly (LLY.N), opens new tab. The Wall Street Journal reported on Tuesday that Eli Lilly was in advanced talks to buy Ventyx Biosciences (VTYX.O), opens new tab for more than $1 billion.

Memory chipmakers that had surged in the previous session on the prospect of chip shortages leading to price increases eased. SanDisk (SNDK.O), opens new tab and Western Digital (WDC.O), opens new tab fell 2.6% and 10.2% after climbing 27.5% and 10%, respectively, on Tuesday.

Materials (.SPLRCM), opens new tab also pulled back, down 1.6%, after climbing over 2% in the previous session.

Wall Street's three main indexes appear to have started 2026 on a positive note, after marking their third consecutive year of double-digit gains in 2025.

Markets will also keep an eye on geopolitical developments, including developments in Venezuela and the use of the country's oil resources, following the capture of Venezuelan President Nicolas Maduro over the weekend.

U.S. President Donald Trump said the U.S. would refine and sell up to 50 million barrels of crude stuck in the Latin American nation.

The U.S. said it has seized a Russian-flagged, Venezuela-linked tanker on Wednesday, marking Washington's efforts to dictate oil flows in America's backyard and force Caracas' socialist government to become its ally.

The White House said on Tuesday that Trump is discussing options for acquiring Greenland, including potential use of the U.S. military.

Among other stocks, Strategy (MSTR.O), opens new tab rose 1.5% before the bell after MSCI dropped a plan to exclude the bitcoin hoarder and other crypto treasury firms from its indexes.

First Solar (FSLR.O), opens new tab fell 8.2% after Jefferies downgraded the solar panel maker's rating to "hold" from "buy", citing recent project cancellations and margin pressures.

Declining issues outnumbered advancers by a 1.56-to-1 ratio on the NYSE, and by a 1.19-to-1 ratio on the Nasdaq.

The S&P 500 posted 24 new 52-week highs and 8 new lows, while the Nasdaq Composite recorded 62 new highs and 33 new lows.

The United States is in direct talks with Caracas to indefinitely manage all oil sales from Venezuela's state-owned energy company, PdV. U.S. Energy Secretary Chris Wright confirmed the discussions on Wednesday, outlining a plan that would also involve supplying Venezuela with the necessary equipment to boost its flagging oil output.

The announcement follows President Donald Trump's statement on Tuesday that the U.S. will receive between 30 and 50 million barrels of high-quality sanctioned oil from Venezuela's interim government. This volume represents nearly all of Venezuela's current onshore and floating crude storage.

Speaking at the Goldman Sachs Energy, CleanTech and Utilities Conference in Miami, Wright elaborated on the strategy. The U.S. intends to first market Venezuela's stored barrels and then "indefinitely, going forward, we will sell the production that comes out of Venezuela into the marketplace."

To achieve this, the U.S. would provide the critical diluents required to extract and move the heavy crude oil that dominates Venezuela's reserves.

"As we make progress with the government, we'll enable the importing of parts and equipment and services to kind of prevent the industry from collapsing, stabilize the production, and then as quickly as possible, start to see it growing again," Wright explained.

He added that these steps are designed to eventually facilitate the return of more U.S. companies to the Venezuelan oil sector.

This plan was rapidly developed following the U.S. special forces operation on January 3 that resulted in the capture of President Nicolas Maduro, who was subsequently transported to the U.S. on drug trafficking charges.

The Trump administration is now working with interim president Delcy Rodriguez to execute its objectives. While Rodriguez has maintained a publicly defiant stance, her actions have largely complied with Washington's demands, prompting both PdV and its key foreign partner, Chevron, to adapt quickly.

Despite the high-level talks, PdV is not positioned to increase deliveries beyond its current stored volumes due to severe, long-term operational failures and recent equipment outages. The political uncertainty following Maduro's seizure has also led many PdV employees to stay home from work.

"PdV is working at minimal capacity," a source within the company told Argus. "Operational areas [E&P and upgrading] are half working. Storage is full."

The situation is worsened by the fact that three of the four major upgrading facilities needed to process Venezuela's extra-heavy crude are offline. According to the source, these shutdowns followed unexplained explosions and fires in recent weeks, which occurred as U.S. military forces were building up near the country.

To move the plan forward, Secretary Wright is scheduled to meet with American oil executives on the sidelines of the Goldman Sachs conference to finalize details of the U.S. involvement.

President Trump is also set to discuss Venezuela with U.S. oil executives at the White House on January 9.

Russian forces are systematically testing European defenses with drones, aircraft, and warships, signaling a strategy that extends far beyond the war in Ukraine. These are not random incursions but calculated probes designed to normalize intrusion and desensitize the West. Backing this strategy is a revitalized military-industrial machine working around the clock, with shipyards launching ice-capable submarines and factories stockpiling long-range missiles.

A deep dive into Moscow's procurement priorities reveals three alarming trends in its naval and missile sectors: a rapid expansion of production facilities, a clear focus on strategic platforms targeting Europe, and investments geared for long-term operational endurance.

Unless NATO abandons its reactive posture for credible deterrence—enforced red lines, offensive capabilities, and sustained support for Ukraine's drone innovation—Moscow will continue to set the terms of confrontation long after the current war ends.

While Ukraine's maritime drones have battered Russia's Black Sea fleet, Moscow has doubled down on shipbuilding. With Turkey's closure of the Bosphorus Strait preventing naval reinforcements, a singular focus on the Ukrainian theater would suggest deprioritizing naval assets. Instead, the opposite is happening.

Russian shipyards are now concentrating on platforms that directly threaten Europe's maritime corridors. The order books are filled with ice-capable fleets, nuclear service vessels, and advanced diesel-electric submarines. These are not assets designed to challenge the U.S. Navy in the open ocean; they are built for the constrained waters around Northern Europe, where they can carry cruise missiles and electronic warfare systems into NATO's most vulnerable areas.

The industrial metrics confirm this pivot:

• Financial Turnaround: St. Petersburg's Baltic Shipyard swung from a $264 million loss to a $41 million profit in just one year after securing a wave of state contracts, including for nuclear maintenance vessels intended for the Arctic.

• Resource Surge: Steel consumption at Baltic Shipyard jumped 98% in a year, while Vyborg Shipyard saw a 93% increase since 2022, highlighting the scale of state subsidies.

• Industrial Consolidation: A $2.6 billion plan is underway to merge five St. Petersburg shipyards into a single, modernized cluster, making Russia's naval industry more resilient and capable of rapid mobilization.

This industrial effort is already yielding results. Admiralty Shipyards continues to produce non-nuclear submarines like the Project 636.3 Yakutsk and the Lada-class Kronstadt. While less formidable than nuclear subs in open oceans, these vessels are highly effective in the North Sea, Baltic, and Mediterranean. By arming these smaller ships and submarines with long-range cruise missiles, Russia can threaten European cities and infrastructure from multiple, unpredictable angles, exploiting existing air defense gaps.

Russia's missile production has surged since 2023, pointing to a strategy of stockpiling for future conflicts rather than simply replenishing its forces in Ukraine. According to Ukrainian intelligence, Russia is producing 115-130 long-range systems per month—a pace that far exceeds its typical usage against Ukraine, where it often favors cheaper Shahed-type drones.

This output includes Kalibr cruise missiles, Kh-101/102 air-launched weapons, and Iskander ballistic missiles, all capable of striking European capitals and NATO bases. The industrial expansion supporting this surge is undeniable:

• Votinks Machine-Building Plant: This facility, which produces Iskander missiles, has installed thousands of new machines and hired thousands of additional workers since 2022.

• Biysk Oleum Plant: A new facility is being built here to produce up to 6,000 metric tons of high explosives annually.

• Sverdlova Plant: This munitions manufacturer received billions in state investment to boost TNT production for missile warheads.

• MKB Novator: The producer of Kalibr and Iskander missiles shifted to 24/7 operations early in the war.

• Krasnoyarsk Machine-Building Plant: This plant is accelerating the serial production of the RS-28 Sarmat heavy intercontinental ballistic missile.

Together, these naval and missile assets provide Moscow with a flexible toolkit for coercion. Russian Navy ships armed with Kalibr missiles already operate within striking distance of European capitals from the Baltic and Mediterranean. Meanwhile, strategic bombers conduct regular flights over the Barents and Norwegian Seas, normalizing a military presence on NATO's northern flank and using the region as a training ground for deep strikes into Europe.

Moscow's industrial strategy is designed to make sustained pressure on Europe cheap and operationally feasible. Its current approach of testing NATO's limits with limited responses—airspace closures, diplomatic statements, and fighter scrambles—only encourages further escalation.

To regain the initiative, NATO and the EU must shift their strategy.

Enforce Clear Red Lines

Deterrence must move from press statements to operational rules. NATO should publicly define automatic consequences for intrusions. Drones should be intercepted by default, warships denied access to specific zones, and sanctions targeting enablers should be triggered within 48 hours. Violations must incur predictable and immediate costs.

Develop Offensive Strike Capabilities

A defensive "drone wall" of sensors and electronic warfare systems is necessary but not sufficient. Effective deterrence requires the ability to strike back. European leaders must openly develop and discuss long-range strike options—cruise missiles, armed drones, and cyber capabilities—that raise the cost of Russian aggression and sabotage. A credible offense is essential to changing Moscow's risk calculus.

Fund Ukraine's Drone Innovation

Europe must treat Ukraine's drone ecosystem as its forward defense laboratory. The rapid innovation, mass production, and battlefield testing happening in Ukraine are developing the exact capabilities Europe will need. Funding this ecosystem is not charity; it is a direct investment in Europe's future security, ensuring the right tools and tactics are ready when the pressure shifts fully to NATO territory.

Russia's military buildup is already reshaping Europe's security environment. Its investments are creating a coercive arsenal aimed squarely at the continent. If Europe fails to articulate and enforce its own red lines, Moscow will continue to write the script.

With Nicolás Maduro captured, Venezuela's future is a question mark. But one thing is clear: U.S. President Donald Trump is not eager for a ground war. While a special forces raid is one thing, a full-scale invasion to force regime change is a costly proposition that Trump seems to know American voters will not support.

The administration's stated goal is for the new acting leader, Vice President Delcy Rodríguez, to comply with U.S. demands. However, extreme demands—such as handing over ownership of Venezuela's nationalized oil industry to the U.S.—are illegal under Venezuelan law. What happens if Rodríguez refuses is unknown. But the more critical question is whether any Venezuelan leader can concede to Trump's terms without being overthrown from within.

This high-stakes standoff is not without precedent. It closely mirrors the dilemma that pushed U.S. President James K. Polk into the Mexican-American War of 1846-1848.

Like Trump, Polk didn't initially want a full-scale conflict. He wanted Mexican territory and hoped to acquire it through a combination of coercive diplomacy and cash. The plan was to use the threat of war to compel Mexico to recognize the U.S. annexation of Texas and sell California and New Mexico.

To this end, Polk dispatched envoys like Rep. John Slidell to negotiate, even as he ordered Gen. Zachary Taylor's troops into disputed territory north of the Rio Grande. The U.S. operated under the assumption that its superior military and industrial power would be enough to dictate terms to its weaker neighbor.

Mexican leaders understood they could not win a war against the United States. The problem was that they couldn't afford to make a deal, either.

Any time a Mexican leader attempted to negotiate, they risked being overthrown by rivals who would accuse them of treason. This was precisely the fate of President José Joaquín de Herrera, a moderate who was ousted in 1845 by conservative Gen. Mariano Paredes for allegedly conspiring to sell Mexican territory.

Once in power, Paredes also tried to avoid war. But with U.S. naval forces deploying off Veracruz and Mazatlán, backing down became politically impossible. Mexico cited the deployments as proof of bad faith and refused to meet with Polk's envoy.

Soon, clashes erupted between U.S. and Mexican troops in the disputed region. Claiming that "U.S. blood had been shed on U.S. soil"—a falsehood challenged by a young Abraham Lincoln—Polk secured a declaration of war from Congress.

The Mexican-American War proved far longer and bloodier than Polk anticipated. Even mid-conflict, the U.S. tried to engineer a deal through regime change. Polk helped the exiled general Antonio López de Santa Anna return to Mexico, believing Santa Anna would seize power and sell the territory. Instead, Santa Anna took command of Mexican forces and inflicted heavy casualties on U.S. troops.

In the end, Polk achieved most of his territorial goals, securing a Pacific coast that became foundational to America's global power. But the cost was steep, with nearly 20,000 U.S. casualties. The final Treaty of Guadalupe Hidalgo was rushed through the Senate partly to appease growing anti-war sentiment at home and to escape a brewing Mexican insurgency that threatened to bog down U.S. occupation forces.

Just two decades later, a similar Mexican insurgency would doom a French military occupation, culminating in the execution of the French-backed Emperor Maximilian.

The lesson for the Trump administration is that national leaders sometimes find it less risky to fight a war they know they will lose than to cave to foreign demands. Venezuela's new leadership is likely navigating this same treacherous political landscape.

Of course, the situations are not identical.

The Military Gap: Then and Now

The military mismatch between the U.S. and Mexico in the 19th century was significant, but the gap between the U.S. and Venezuelan militaries today is even wider.

The Political Will for War

Not every difference favors the U.S. In the 1840s, the idea of Manifest Destiny and the promise of free land in the West made high casualties politically tolerable for many Americans. The sons of elites, like Henry Clay's son, died in the conflict, and members of Congress even resigned to lead state militias.

Today, the American public is far less tolerant of military casualties. The potential profits of private oil companies hold little appeal for the average voter compared to the 19th-century dream of western expansion. Should Trump face anything close to the 20,000 casualties Polk endured, the political fallout would be severe—and he knows it.

For now, it appears the Trump administration can accept a post-Maduro government in Venezuela, and the remaining officials seem more interested in accommodation than confrontation.

Then again, so did Maduro at times. Every political system has a breaking point where the internal risk of submitting to foreign pressure outweighs the external threat itself. Mexico fought a war it couldn't win for this very reason, forcing the United States to pay a price in blood far higher than it ever offered in treasure.

The history of the Mexican-American War serves as a cautionary tale. It shows how coercive diplomacy, when miscalculated, can provoke the very conflict it is designed to avoid.

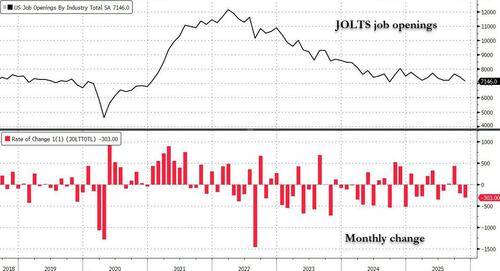

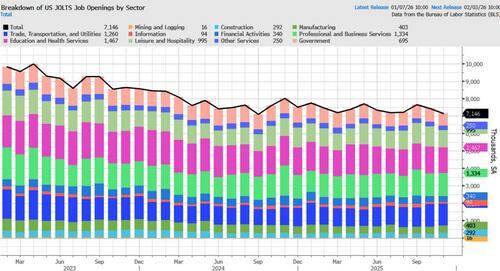

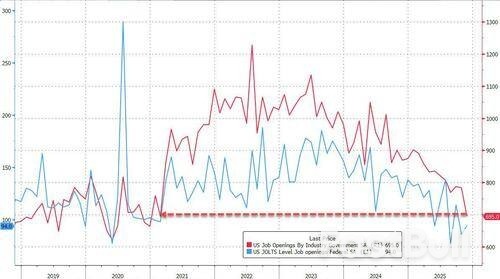

While today's ADP report was a solid rebound from the worst monthly report in years (even if it missed expectations due to a sudden plunge in California payrolls), the same could not be said for the JOLTS job opening report that followed less than two hours later, and which was another epic disaster: for the month of November (recall JOLTS lags the payrolls report by a month), the US had only 7.146 million job openings, a huge drop from the 7.670 million in October (which was conveniently revised lower to 7.449 million) and the lowest since September 2024.

The November print was also a 3+ sigma miss to expectations and came in below the lowest estimate (that of TD Securities).

According to the BLS, the number of job openings decreased in accommodation and food services (-148,000); transportation, warehousing, and utilities (-108,000); and wholesale trade (-63,000). Job openings increased in construction (+90,000).

But the most notable drop by far, was that in government, where the number of workers collapsed to the lowest level since early 2021.

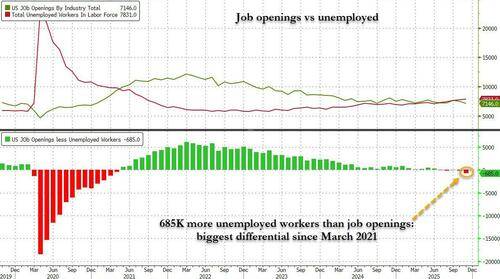

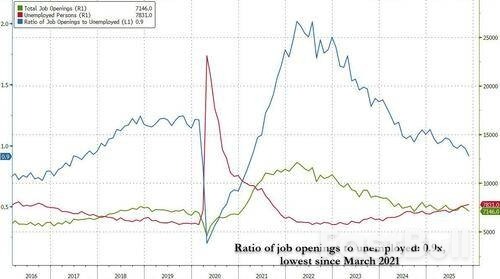

Meanwhile, after four years of the US labor market dodging the bullet, its luck has finally run out because while until just a few months ago, the labor market was supply-constrained, with more job openings than unemployed workers in the US, in November we are finally back to sharply demand constrained, with 685k fewer job openings than unemployed workers, the most since March 2021...

... and translating into a 0.9 ratio of job openings to unemployed workers, the first sub-1.0x print in 4 years.

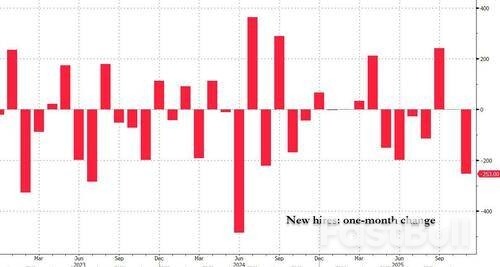

While the job openings data was ugly and potentially another harbinger of the coming jobs recession - things were even uglier below the surface, as the number of new hires tumbled by 253K - the biggest one month drrop since June 2024 - to 5.1156MM the lowest since June 2024.

The only silver lining is that the number of people quitting their jobs - also known as the take this job and shove it indicator - rebounded by almost 200K, to 3.161MM, from 2.994MM.

Putting it all together, despite a rather solid ADP print earlier, today's JOLTS report was quite terrible and certainly enough to ensure that Fed rate cuts continue (assuming no dramatic improvement in Friday's job report). The flip side, of course, is that this report took place when the government was still mostly shut down, so our advice would be to just ignore everything since it is not indicative of the current state of the US economy after it reopened shortly after Democrats captiulated without achieving anything.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up