Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Wall Street anticipates aggressive Fed rate cuts in 2026, citing a cooling economy and leadership shift.

Major financial institutions, including Morgan Stanley and Citigroup, are revising their forecasts to predict more aggressive Federal Reserve rate cuts in 2026. This shift reflects a growing consensus on Wall Street that as economic momentum cools, the central bank is preparing to ease monetary policy.

The updated outlook is driven by a combination of weaker economic data and anticipation of new leadership at the Federal Reserve. With President Trump set to nominate a new Fed Chair, analysts are reassessing how quickly policymakers might pivot to support economic growth.

Morgan Stanley now projects a total of 50 basis points in rate reductions for 2026, delivered through two separate 25-basis-point cuts. The bank has pushed back its expected timing for these moves from January and April to June and September.

This adjustment signals a degree of caution regarding near-term inflation, even as signs of an economic slowdown become more apparent. Morgan Stanley’s forecast suggests the Fed will likely wait for clearer economic signals before taking action.

Citigroup has adopted a more dovish stance, now forecasting 75 basis points of cuts in 2026. The bank anticipates three 25-basis-point reductions occurring in March, July, and September.

This outlook places Citigroup at the more aggressive end of the spectrum among major banks. It indicates a heightened concern about growth risks and a strong conviction that inflation will subside enough to justify earlier and more substantial rate cuts.

The move toward expecting more rate cuts is not limited to Morgan Stanley and Citigroup. A broader Wall Street consensus has emerged, with several key players aligning their forecasts.

Major banks now projecting 50 basis points of total cuts in 2026 include:

• Goldman Sachs

• Bank of America

• Wells Fargo

• Barclays

While specific timelines vary between institutions, the general agreement on policy easing marks a significant shift from earlier expectations.

The revised forecasts are shaped by two primary factors. First, recent jobs reports have been weaker than anticipated, fueling concerns about slowing economic activity. However, persistent inflation remains a complicating variable, leading some analysts to believe the Fed may pause in early 2026 before initiating cuts.

Second, political dynamics are playing a key role. Wall Street widely expects that a new Fed Chair appointed by President Trump could be more inclined to favor lower interest rates. This view aligns with comments from Treasury Secretary Scott Bessent, who has emphasized the need to reduce borrowing costs.

Based on these projections, the federal funds rate is expected to settle into a neutral range of approximately 2.75% to 3.25% by the end of 2026. Whether the Fed ultimately delivers two or three cuts, the message from Wall Street is becoming increasingly unified: the next major policy move will be downward.

Russia’s Foreign Ministry has issued a stark warning that any deployment of troops from NATO countries onto Ukrainian soil would be considered an act of foreign intervention, making them legitimate military targets. The statement follows a renewed push by Ukraine and its Western allies to establish a framework for such a deployment as part of a potential peace arrangement.

Russian Foreign Ministry spokeswoman Maria Zakharova delivered the message, clarifying that Moscow's position covers more than just soldiers. "The deployment of military units, military facilities, warehouses, and other infrastructure of Western countries on Ukrainian territory will be classified as foreign intervention," she stated.

Zakharova emphasized that such a move would pose "a direct threat to the security of not only Russia but also other European countries." She concluded with an unambiguous threat: "All such units and facilities will be considered legitimate combat targets of the Russian Armed Forces."

The Kremlin's sharp rhetoric comes in direct response to a "declaration of intent" signed by the United Kingdom and France, which commits both nations to lead a future troop deployment in Ukraine.

British Prime Minister Keir Starmer described the agreement as paving "the way for the legal framework, under which British, French and partner forces could operate on Ukrainian soil." However, the document currently lacks specific details on the composition or mission of such a force.

The declaration was finalized after a meeting in Paris between Starmer, French President Emmanuel Macron, and Ukrainian President Volodymyr Zelensky. The gathering was framed as a meeting of the "coalition of the willing"—a term for countries open to sending troops to Ukraine. US envoy Steve Witkoff and President Trump's son-in-law, Jared Kushner, were also in attendance.

While the United States has not committed to sending its own troops, it has signaled a willingness to provide air support and other forms of assistance to European forces deployed in Ukraine. Zelensky's office confirmed this, stating that Ukraine "values the United States' readiness to support forces tasked with preventing a recurrence of Russian aggression."

Despite some calls within the EU for a greater focus on diplomacy, the path toward a negotiated settlement appears increasingly blocked. The likelihood of a lasting peace deal remains extremely low due to several key factors:

• The continued insistence by Western powers on deploying troops to Ukraine.

• The willingness of the U.S. to provide "NATO-style" security guarantees for the country.

• President Zelensky's steadfast refusal to cede any Ukrainian territory to Russia.

Governments in the US, UK, and Japan have recently fallen over public anger at the rising cost of living. Now, events unfolding in Iran show that authoritarian regimes are not immune to the political fallout from soaring inflation.

Protests ignited in Tehran late last month after the Iranian rial collapsed to a record low, driving up the price of essential goods. The demonstrations, fueled by an economic crisis deepened by global sanctions, have since spread nationwide. In response, Iran's religious and military leadership has threatened to crack down on what they label "rioters."

The Islamic Republic is no stranger to public dissent. In 2022, women led massive demonstrations against their treatment following the death of a young woman in custody. The 2009 "Green Movement" protests over the disputed re-election of President Mahmoud Ahmadinejad were the most severe unrest since the 1979 revolution.

Historically, Supreme Leader Ayatollah Ali Khamenei and the Islamic Revolutionary Guard Corps (IRGC) have suppressed these movements, often violently. This time, however, two crucial factors make the situation different, leading one expert to predict significant change is on the horizon.

Dina Esfandiary, who heads Middle East geoeconomics for Bloomberg Economics, forecasts that the Islamic Republic "is unlikely to survive in its current form" through the end of 2026. While change seems inevitable, its ultimate form remains an open question.

The primary difference in today's protests is the dire state of Iran's economy. After years of sanctions, the financial situation has deteriorated dramatically.

The rial has lost approximately 40% of its value, which has helped push year-on-year food inflation to an estimated 70%, according to Gavekal Research. This crisis is compounded by years of drought and poor water management that have crippled domestic food production.

The economic pressures on ordinary Iranians and businesses include:

• Protracted power cuts

• A weak job market, with one estimate putting labor force participation at just 41%

This challenging environment has caused many small and medium-sized businesses to collapse. Esfandiary notes that enterprises connected to the IRGC are attempting to fill the void, concentrating economic power.

As poverty spreads, so does resentment toward the politically connected elite who remain insulated from the crisis. Tom Holland, deputy global research director at Gavekal, observed that "broad swathes of the population" have now united to demand political change. In a telling sign of eroding support, even Tehran's Grand Bazaar—a traditional bastion of conservative government backing—has been on strike for nearly two weeks.

The second key factor is Iran's diminished geopolitical standing. The regime's influence in the region has been significantly weakened by several recent events. Last year, the ouster of Syrian President Bashar al Assad ended a crucial alliance for Tehran. Furthermore, Iran's allies Hezbollah in Lebanon and Hamas in Gaza have been bombed and degraded.

More directly, a two-year exchange of fire between Israel and Iran culminated in a surprise American attack on Iran's key nuclear facilities last June. President Donald Trump has continued to threaten more action, including offering support to the protestors. Esfandiary argues that regardless of the credibility of Trump's threats, the Iranian government now faces a real possibility of external conflict.

If the current system is indeed unsustainable, what might replace it? Esfandiary outlined four potential outcomes.

She assigns a low probability to either an outright collapse of the government or a genuine reform program that addresses public grievances. This leaves two more likely scenarios: the system remains in place but with different leaders at the helm, or a military coup led by the IRGC.

Another major variable is the health of the 86-year-old Supreme Leader, Ayatollah Ali Khamenei. His death would trigger only the second succession process since the Shah was overthrown in 1979.

"The difference this time compared with last time is the IRGC is much more prevalent," Esfandiary said. "There is no scenario in which the next supreme leader doesn't work very closely with the IRGC."

While these outcomes may not be promising for advocates of democracy, they could still lead to a form of rapprochement with Washington, marking a significant evolution in the complex history of US-Iran relations.

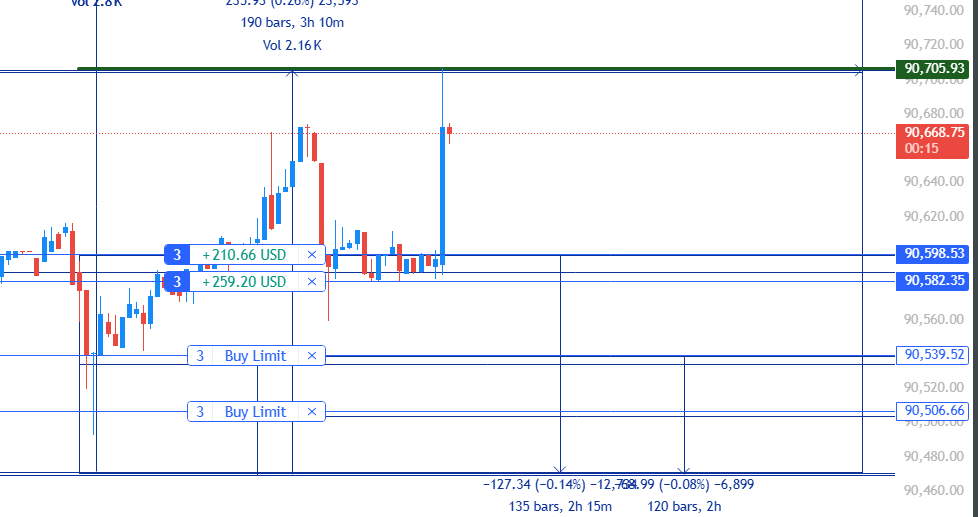

Gold has surged back to record territory, erasing its late October losses and closing December at an all-time high. The precious metal capped its best year since 1979, fueled by a 64% rally in 2025 and an astonishing gain of nearly 140% since the beginning of 2023.

According to strategists at UBS led by Giovanni Staunovo, the new records were driven by a confluence of factors, including "demand for real assets amid USD weakness, geopolitical tensions, institutional uncertainties, and low seasonal liquidity."

Despite the powerful rally, UBS analysts believe the underlying fundamentals support further gains for gold in 2026. They point to a significant drop in U.S. real interest rates, which represent the opportunity cost of holding non-yielding assets like gold. These rates are now at their lowest point since mid-2023, making gold a more attractive investment.

With this backdrop, the bank remains bullish on gold and recently increased its March 2026 price target to $5,000 an ounce.

"We think gold's role as a diversifier and hedge is undiminished," the strategists noted. "For investors with an affinity for the asset class, we think a mid-single-digit allocation to gold can fit in a diversified portfolio."

Recent world events have underscored gold's defensive appeal. UBS highlighted the market reaction following the unexpected U.S. military capture of Venezuelan President Nicolas Maduro. On the day of the news, gold and silver prices climbed 2.2% and 4.3% respectively, while Brent crude oil fell 1.3%.

Beyond short-term shocks, long-term demand trends provide a solid foundation for prices.

• Central Bank Buying: UBS expects central banks to purchase between 900 and 950 metric tons of gold in 2025, just shy of the previous year's record.

• Global Demand: Total global gold demand is forecast to hit approximately 4,850 metric tons, which would be the highest level recorded since 2011.

Adding to the bullish outlook is the sharp rise in government debt across advanced economies. According to the International Monetary Fund, this debt is projected to reach about 110% of GDP this year, a steep increase from roughly 75% two decades ago. The IMF forecasts this figure will climb further to 118% by the end of the decade.

This trend continues to reinforce interest in gold as a reliable store of value in an environment of increasing fiscal pressure.

Egypt’s inflation rate held steady in December, a development that could give the central bank the confidence to continue cutting interest rates in 2026.

The state statistics agency, CAPMAS, reported Saturday that urban consumer price growth was 12.3% year-over-year, matching the previous month's figure. On a month-over-month basis, inflation slowed slightly to 0.2% from 0.3% in November.

This stability is a key metric for the Middle East's most populous nation, which has been working to control price pressures that peaked at a record 38% in September 2023. The subsequent economic turmoil led to a $57 billion global bailout package the following year.

While the headline inflation number has been cut by more than half over the last 12 months, several factors have prevented it from falling into the single digits. These include recent cuts to subsidies on items like fuel, backed by the International Monetary Fund, and a legal amendment that raised rents for millions of properties.

Despite these pressures, the central bank of Egypt anticipates a general easing of consumer price growth throughout 2026. This outlook holds even with ongoing challenges from non-food inflation and global geopolitical tensions. Authorities have also signaled that local fuel prices will not be increased again before October.

Food Prices and Seasonal Pressures

Food and beverage prices, the largest component of the inflation basket, climbed 1.5% annually in December. However, they registered a 0.7% decline on a monthly basis.

Grocery prices could face temporary upward pressure as Ramadan approaches. The Muslim holy month, starting in mid-February, is typically marked by evening feasts and family gatherings that lead to a surge in household spending.

The slowdown in inflation over the past year has already allowed Egypt’s central bank to pivot from its aggressive tightening cycle. It has delivered a combined 725 basis points in interest rate cuts across five meetings, moving away from a record high.

These rate reductions are considered essential for two main goals:

• Encouraging investment from the private sector.

• Reducing the government's interest payments, which consume a large portion of state spending.

The central bank’s benchmark deposit rate currently stands at 20%. The next monetary policy decision is scheduled for February 12. Looking further ahead, Goldman Sachs Group Inc. forecasts an additional 700 basis points of rate cuts in 2026.

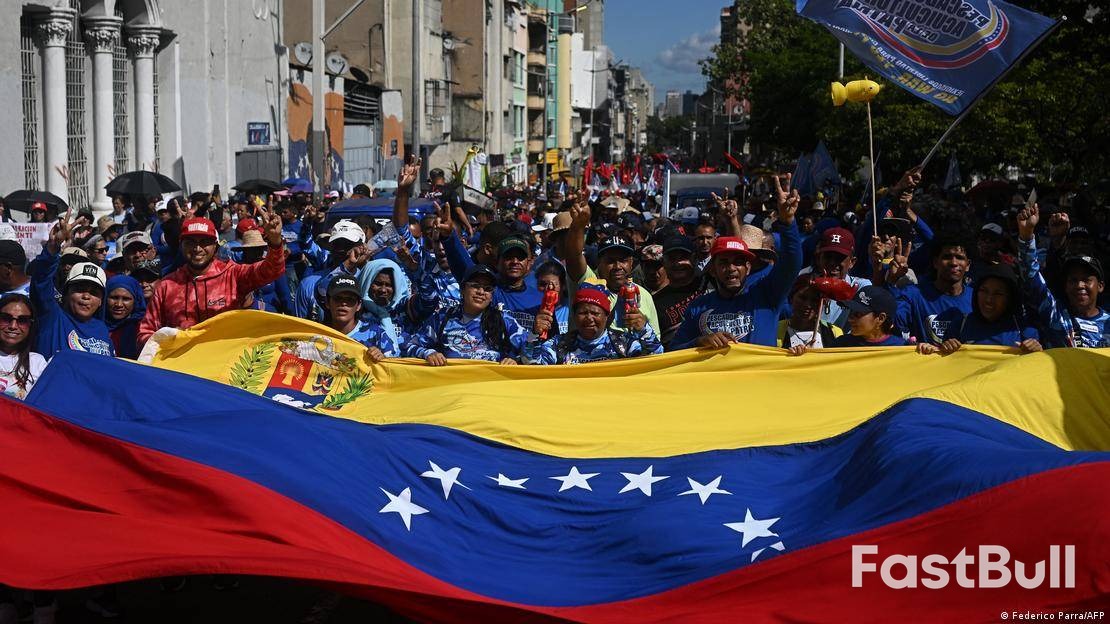

Venezuela and the United States are taking initial steps to restore diplomatic relations following a dramatic US military raid that resulted in the capture of former President Nicolas Maduro and his wife, Cilia Flores.

On Friday, Venezuela confirmed it had started talks with the U.S. about reestablishing ties. The announcement came as a team of American diplomats and a security detail visited the South American nation to conduct an assessment for potentially reopening the U.S. Embassy in Caracas.

The interim government, led by President Delcy Rodriguez, stated it "has decided to initiate an exploratory diplomatic process" with Washington aimed at restoring diplomatic missions in both countries. While Venezuela also plans to send its own delegation to the U.S., further details have not been provided. Such a visit would likely require the U.S. Treasury Department to waive existing sanctions.

Initially, interim President Delcy Rodriguez condemned what she called the United States' "grave, criminal, illegal, and illegitimate aggression" in phone calls with leaders from Brazil, Colombia, and Spain.

However, her tone shifted later on Friday. Rodriguez stated that diplomacy with U.S. President Donald Trump was the most effective strategy to defend Venezuela and "ensure the return of President Nicolas Maduro and First Lady Cilia Flores."

"We will meet face-to-face in diplomacy... to defend the peace of Venezuela, the stability of Venezuela, the future, to defend our independence and to defend our sacred and inalienable sovereignty," Rodriguez announced at a public event in Caracas.

As a gesture of goodwill, Jorge Rodriguez, the head of the Venezuelan National Assembly and the interim president's brother, announced on Thursday that authorities would begin releasing political prisoners.

While the official reason for Maduro's capture was his alleged links to drug trafficking, President Trump has openly cited access to Venezuela's vast oil reserves as a key driver for U.S. intervention.

At a White House meeting on Friday, Trump pressed top oil executives to increase their investments in Venezuela. He told them he wanted U.S. oil companies to commit a minimum of $100 billion to boost the country's oil production. "If you don't want to go in, just let me know, because I've got 25 people that aren't here today that are willing to take your place," Trump said.

The demand was met with caution. ExxonMobil CEO Darren Woods responded that Venezuela's current legal and economic conditions made such investment impossible.

After asking the media to leave the room for negotiations, Trump later claimed a "deal" had been formed. "They're going to be going in with hundreds of billions of dollars in drilling oil, and it's good for Venezuela and it's great for the United States," he said, without offering specifics.

The diplomatic moves follow a U.S. airstrike and military operation in Venezuela on January 3 that led to the seizure of Nicolas Maduro. The government in Caracas has stated the operation left 100 people dead. Maduro and his wife, Cilia Flores, were subsequently flown to New York, where they are facing drug-trafficking and other charges.

Despite the diplomatic talks, tensions remain high on the ground. On Friday, demonstrators rallied in the streets of Caracas, demanding Maduro's release and protesting the U.S. intervention.

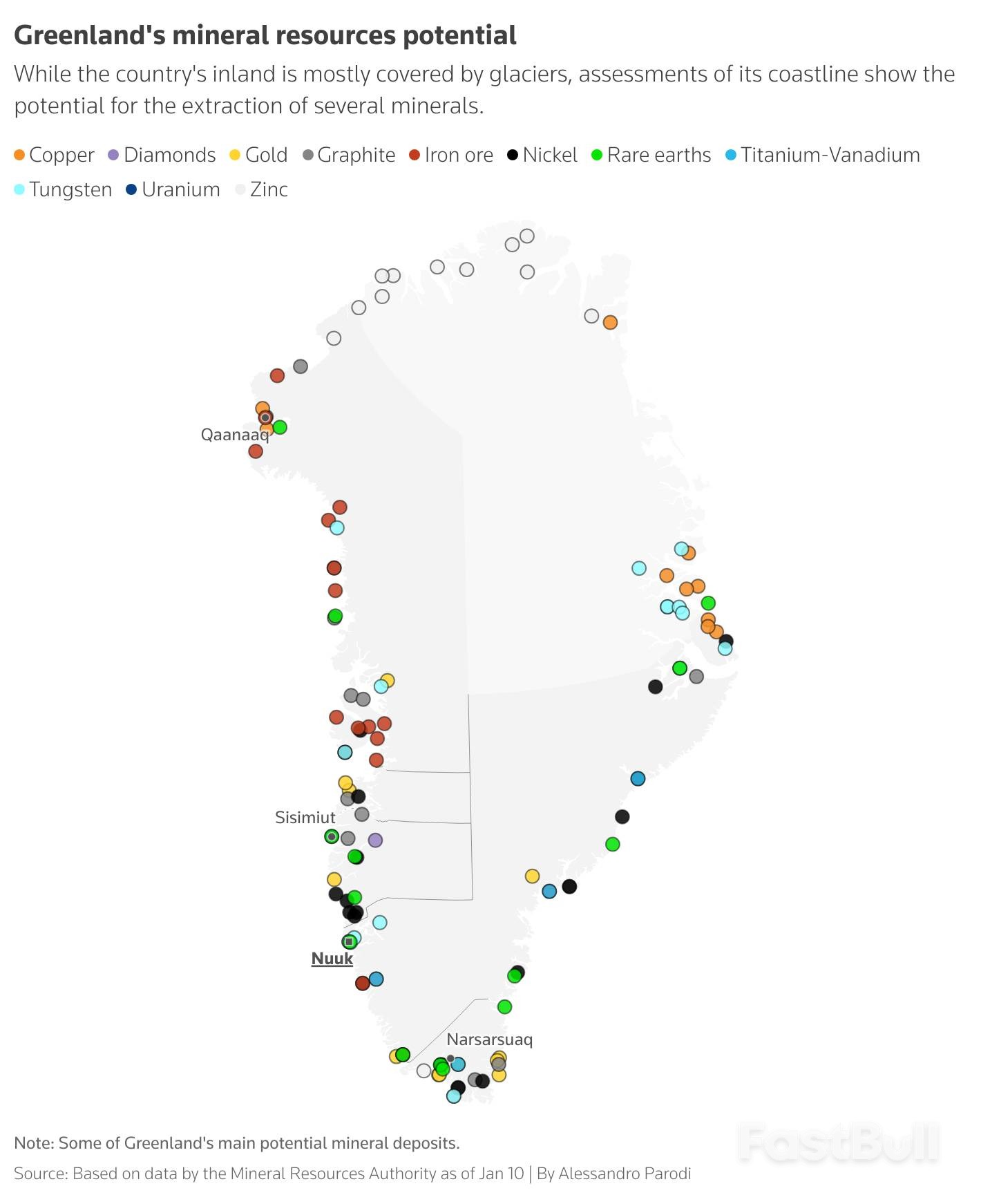

As U.S. Secretary of State Marco Rubio prepares to meet with his Danish and Greenlandic counterparts, Denmark finds itself defending a territory that has been on a steady path toward independence since 1979. The Trump administration's threats to seize Greenland have galvanized European support for Copenhagen, but they have also exposed a deep-seated dilemma: Denmark is spending immense political capital to protect a population that ultimately wants to go its own way.

This high-stakes geopolitical drama highlights several critical issues:

• The Trump administration is keeping all options open for taking control of Greenland.

• Denmark's global relevance is tied to its strategic Arctic territory.

• Greenland has been moving toward full independence for decades.

• Resisting U.S. pressure could come at a significant diplomatic cost.

The crisis has laid bare an uncomfortable reality. With Greenland's largest opposition party now advocating for direct negotiations with Washington, Copenhagen faces a precarious future. "Denmark risks exhausting its foreign policy capital to secure Greenland, only to watch it walk away afterwards," said Mikkel Vedby Rasmussen, a political science professor at the University of Copenhagen.

Denmark's geopolitical standing is intrinsically linked to Greenland. The territory's location between Europe and North America makes it a critical site for the U.S. ballistic missile defense system and a key piece of the Arctic strategic puzzle. Losing it would mean losing relevance on the world stage.

European allies have rallied behind Denmark not just out of solidarity, but because allowing the U.S. to claim Greenland could set a dangerous precedent. Such a move could embolden other major powers to pursue territorial claims against smaller nations, threatening the post-1945 international order.

In a joint statement on December 22, Danish Prime Minister Mette Frederiksen and Greenlandic Prime Minister Jens-Frederik Nielsen affirmed that "national borders and the sovereignty of states are rooted in international law." Frederiksen later added a stark warning: "If the U.S. chooses to attack another NATO country, everything stops, including NATO and the security the alliance has provided since World War Two."

For decades, Denmark’s strategic influence in Washington was bolstered by what became known as "the Greenland Card." As a 2017 report from the University of Copenhagen’s Centre for Military Studies noted, this allowed Denmark to maintain lower defense spending than other NATO allies.

However, Greenland’s own ambitions have been growing. The former colony gained greater autonomy and its own parliament in 1979. A landmark 2009 agreement went further, explicitly recognizing Greenlanders' right to independence should they choose it. Today, all of Greenland's political parties support independence, differing only on the timeline.

The Trump administration's pressure has simply accelerated a process already in motion, forcing Denmark to defend a relationship with an uncertain future. "How much should we fight for someone who doesn't really care about us?" asked Joachim B. Olsen, a political commentator and former Danish lawmaker.

Denmark's financial commitment to Greenland is substantial. Copenhagen provides an annual block grant of roughly 4.3 billion Danish crowns ($610 million) to support Greenland's stagnant economy, which saw just 0.2% GDP growth in 2025. The central bank estimates an additional annual financing gap of 800 million Danish crowns is needed to make its public finances sustainable.

On top of this, Denmark covers the costs of policing, the justice system, and defense, bringing total annual spending to nearly $1 billion. Last year, Copenhagen also announced a 42 billion Danish crown ($6.54 billion) Arctic defense package, largely in response to U.S. criticism that it was not doing enough to protect Greenland.

Some argue the relationship transcends transactional terms. Marc Jacobsen, an associate professor at the Royal Danish Defence College, noted the deep historical and cultural ties. "We're talking about family relations," he said. "It's not just about defence and economy, it's about feelings, it's about culture."

Prime Minister Frederiksen is navigating a difficult diplomatic balancing act. According to Serafima Andreeva, a researcher at the Fridtjof Nansen Institute, Denmark has little choice but to stand firm to maintain its credibility. However, doing so risks alienating the United States at a time when "Russia is an accelerating threat and being on the U.S.'s bad side is no good for anyone in the West."

While Greenland has not been a major theme in this year's election, some in Denmark are questioning the long-term strategy. "I don't understand why we have to cling to this community with Greenland when they so badly want out of it," commented Lone Frank, a Danish science writer. "To be completely honest, Greenland doesn't inspire any sense of belonging in me."

For now, the debate over the cost of holding on to Greenland has been overshadowed by outrage at U.S. threats. As professor Rasmussen noted, "I fear we have gone into patriotic overdrive."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up