Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Wall Street rose slightly as investors looked past trade tensions and weak data, focusing on upcoming U.S. jobs figures. The dollar rebounded, gold slipped, and oil prices edged higher.

Dutch far-right leader Geert Wilders triggered a government collapse in the Netherlands on Tuesday by pulling his nationalist PVV party out of the right-wing government coalition, which prompted the cabinet to resign.

Here's a look at what will happen next:

Prime Minister Dick Schoof said he would resign following Wilders' unexpected move, which left the coalition with only 51 seats in the 150-seat Lower House of Parliament.

After Schoof formally presents his resignation to Dutch King Willem-Alexander, the head of state, a new election is expected to be called. It is unlikely that the vote will be held before mid-October, based on previous election cycles.

Wilders' PVV won the last election in November 2023 with a surprisingly wide margin of 23% of the vote. Polls indicate he has lost some support since then, to about 20%, at par with the Labour/Green combination, the second-largest in parliament.

Political preferences in the Netherlands have shifted rapidly in recent years, making it almost impossible to predict the outcome of an election in October.

Wilders did not emerge as a likely winner of the previous election until a few days before that vote, and other right-wing parties that enjoyed sudden success in recent years have seen their gains disappear as quickly as they came.

Schoof has already said that he and the remaining ministers of the other three coalition parties will stay in their positions to form a caretaker government until a new government is formed after an election.

In the fragmented Dutch political landscape it usually takes months for a coalition to form.

"As caretaker government we will do all we can in the interest of the people in this country, within the room granted to us by parliament. We have decisions to take that do not bear any delay," the outgoing prime minister said.

In the coming days parliament is expected to set out which disputed topics the caretaker government cannot deal with and which they can still make decisions about. The Netherlands is expected to continue its political and military assistance to Ukraine as this enjoys wide political support.

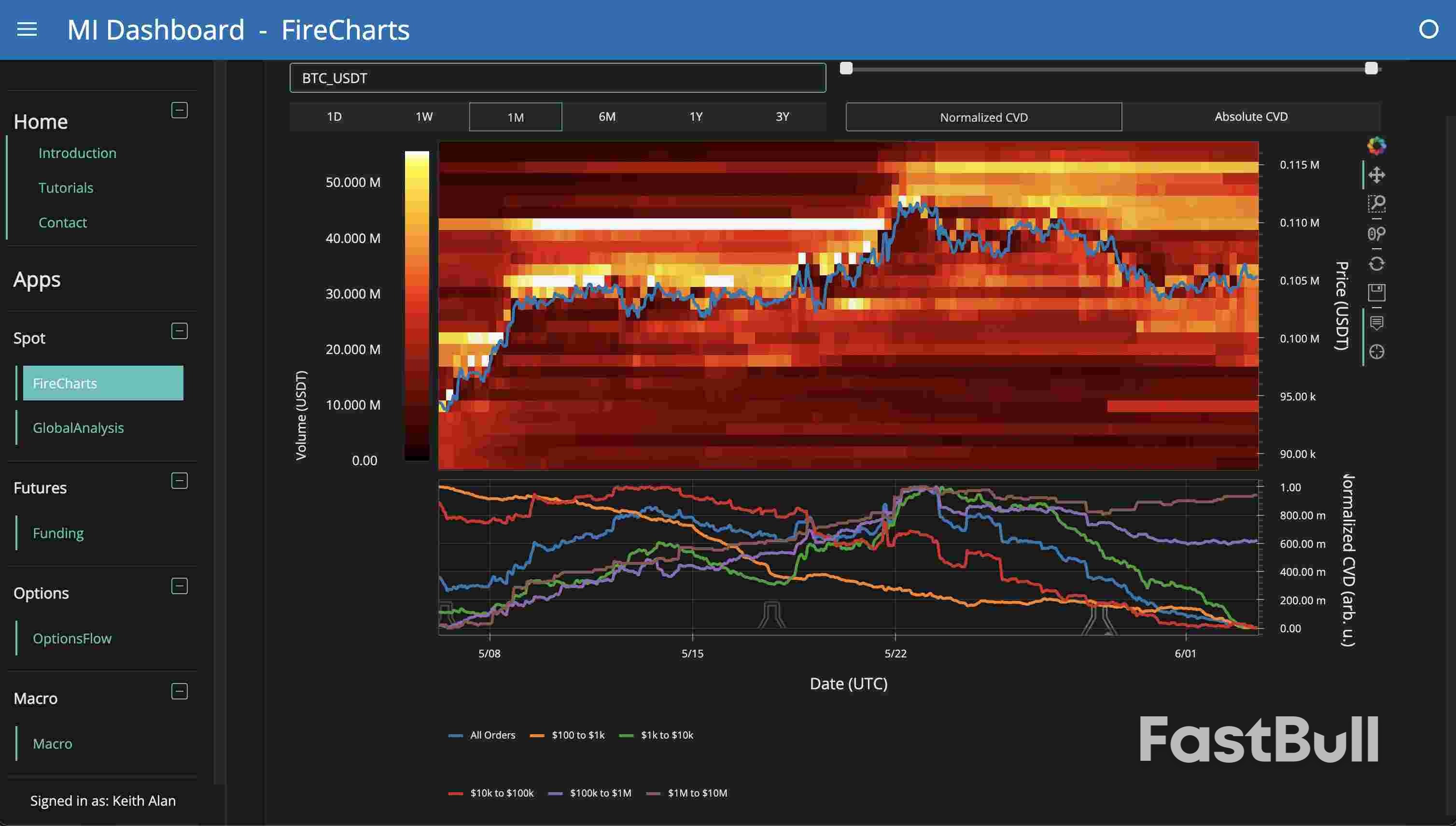

BTC/USDT order book liquidity data. Source: Material Indicators/X

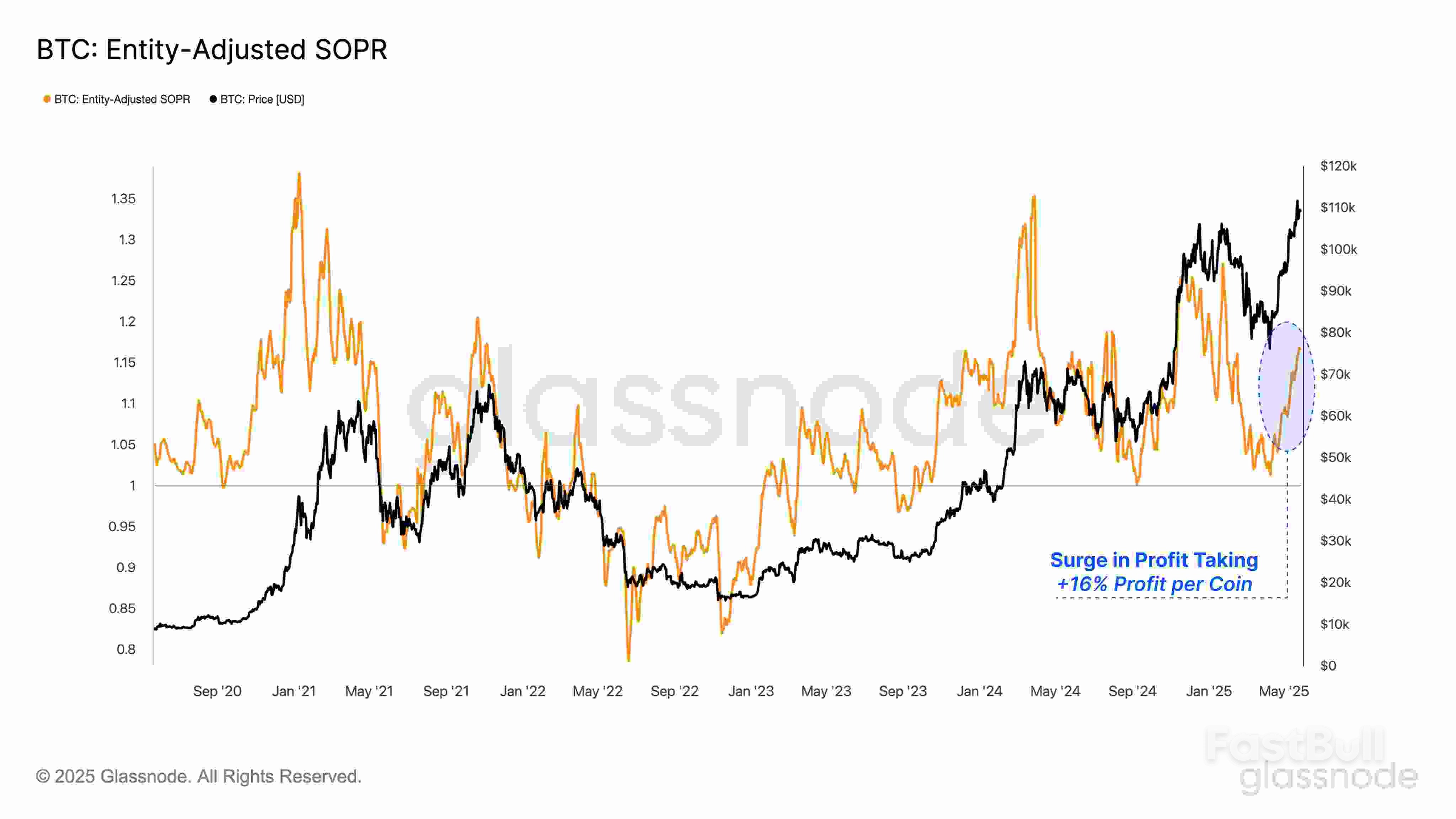

BTC/USDT order book liquidity data. Source: Material Indicators/X Bitcoin entity-adjusted SOPR chart. Source: Glassnode

Bitcoin entity-adjusted SOPR chart. Source: GlassnodeFederal Reserve Bank of Atlanta president Raphael Bostic said he’s in no rush to move interest rates, adding he wants to see “a lot” more progress on inflation despite recent encouraging price data.

“There’s still a ways to go in terms of the progress that we’re going to need to see,” Bostic said in a phone call with reporters on Tuesday. “I’m not declaring victory on inflation yet.”

Bostic on Tuesday also released his latest essay on the economy. In it he reiterated his stance that he sees no need to adjust rates until he knows more about how tariffs and other policies will be implemented and how they’ll ripple across the economy.

“I continue to believe the best approach for monetary policy is patience,” Bostic said in an essay published on Tuesday. “As the economy remains broadly healthy, we have space to wait and see how the heightened uncertainty affects employment and prices. So, I am in no hurry to adjust our policy stance.”

Speaking to reporters, he said he still sees the potential for one quarter-point interest-rate cut in 2025.

Fed officials have signalled they’ll hold interest rates steady until they have a better understanding of how President Donald Trump’s policies on tariffs, immigration and taxes will affect the US economy. Many economists and policymakers have said they expect Trump’s levies will slow growth and boost prices, with the scale of the impact depending on how the tariffs are implemented.

Bostic said research by economists at the Atlanta Fed suggests tariff-related price increases will start appearing in the coming weeks. Those price pressures may subside if agreements with trading partners result in lower tariffs, he said. But if “elevated import levies persist, then the opposite will probably happen”, he said.

Officials may be able to “look past” price increases sparked by tariffs if they appear as a “one-time bump,” Bostic said. But the risks are different if the levies trigger more persistent inflation, he said.

“Then there is a risk that inflation and higher inflation expectations could get entrenched in a more enduring way, which could warrant a policy response,” said Bostic.

In the call with reporters, Bostic was asked if recent inflation readings would merit a rate cut in the absence of elevated uncertainty. The Fed’s preferred price gauge showed inflation was 2.1% in the year through April.

“I actually think this is a tough call,” Bostic said, acknowledging the recent positive data. But, he added, underlying measures “are still flashing red”.

“So you take that as a baseline and then you put the uncertainty on top of it, and many of the economic models would suggest that there’s likely going to be some upward pressure on prices moving forward,” he said. “That makes me very cautious about sort of jumping to cuts at this point.”

Policymakers are widely expected to leave rates unchanged when they meet June 17-18 in Washington, according to pricing in futures contracts. Officials will issue fresh projections for interest rates, growth, inflation and the labor market at that gathering.

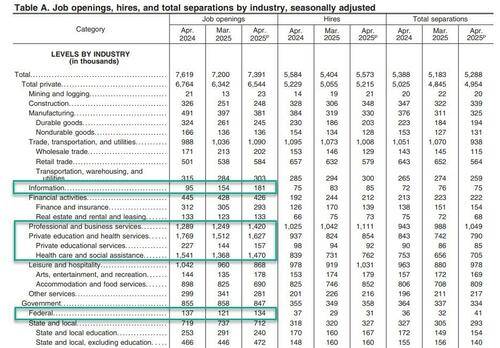

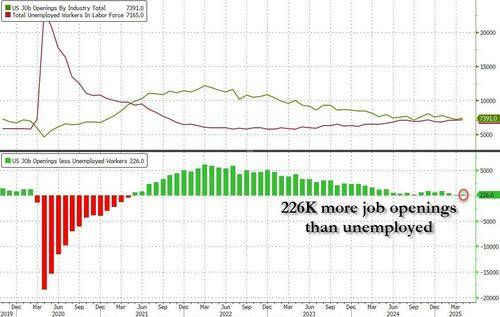

One month after the BLS reported that in March the labor market reverted to its deteriorating trendline, when the US sported some 7.192 million job openings (revised to 7.2 million), a drop from 7.480 million in February, moments ago the latest JOLTS report showed that in April the labor market unexpectedly stabilized with the number of job openings rising sharply by 191K, the biggest increase since January's 254K, and above estimates of a 7.1 million print.

According to the BLS, the number of job openings decreased in accommodation and food services (-135,000) and in state and local government, education (-51,000). The number of job openings increased in arts, entertainment, andrecreation (+43,000) and in mining and logging (+10,000).

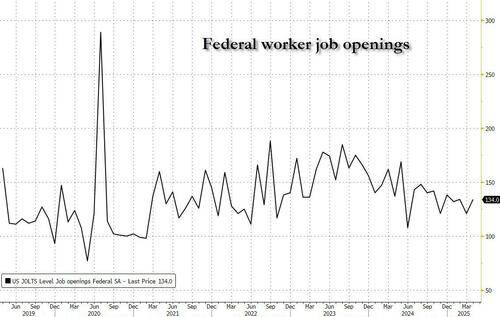

Also notable is that the slide in Federal Government job openings last month was unexpectedly revised higher from 98K (the first sub-100K print since covid) to 121K for March, and then rose again to 134K in April, confirming that Musk - and DOGE - have left the building.

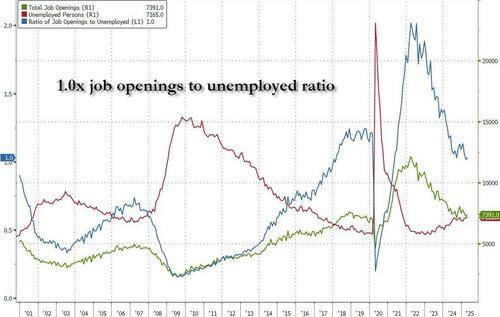

In the context of the broader jobs report, in February the number of job openings was 109 more than the number of unemployed workers (which the BLS reported was 7.083 million), down from 428K the previous month, and the lowest differentials since the covid crash.

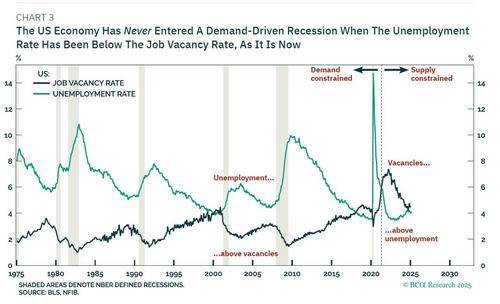

Still, as noted previously, until this number turns negative - which it probably will in a month or two - the US labor market is not demand constrained, and a recession has never started in a period when there were more job openings than unemployed workers.

Said otherwise, in April the number of job openings to unemployed remained unchanged at exactly 1.0.

While the job openings data was a beat and a rebound, there was more good news on the hiring side where the number of new hires also rose to 5.573 million from 5.404 million, the highest since last May, and hardly screaming collapse in the labor market. Meanwhile, the number of workers quitting their jobs - a sign of confidence in finding a better paying job elsewhere - dropped modestly after rising the previous month, and in April it dipped to 3.194 million, down from 3.344 million, perhaps the only blemish in today's JOLTS report.

Well it may have to do with the DOL starting to factor in the collapse in the shadow labor market - the one dominated by illegal aliens - and the replacement of illegals with legal, domestic workers. And since this will surely lead to higher wages, we doubt many Trump supporters will hate the development, even if it means an increase in inflation down the line.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up