Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Polymarket Predicts 78% Probability Of "Bitcoin Falling To $65K By 2026"] February 4Th, The Probability Of "Bitcoin Falling To $65,000 In 2026" On Polymarket Has Risen To 78%. Furthermore, The Probability Of It Falling To $55,000 Is Currently At 55%, The Probability Of Rising To $100,000 Is Currently At 56%, And The Probability Of Rising To $110,000 Is Currently At 42%

Marubeni CEO: Coking Coal Prices Are Rebounding, But Iron Ore Market Is Expected To Remain Largely Flat In Next Fiscal Year

Goldman Sachs Says Timing Indicates Western Flows Rather Than Chinese Speculation Drove Much Of The Price Volatility In January

Goldman Sachs: Continues To See Significant Upside Risk To Its Gold Forecast Of $5400/Oz For December 2026

The Statement From Vietnam Indicates That Vietnam Is Willing To Purchase More American Goods, Especially Machinery And High-tech Products

AXIOS Reports That Nuclear Talks Between The United States And Iran Are Expected To Begin In Oman On Friday. The Trump Administration Has Agreed To Iran's Request To Move The Talks From Turkey

China Central Bank Injects 75 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

US Official - US Has Returned Remaining $200 Million From Initial $500 Million Oil Sale To Venezuela

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

No matching data

View All

No data

Volvo Car AB is looking for partnerships for its new central software stack that'll run on all of its future electric models, a sign the carmaker has overcome earlier coding glitches that delayed vehicle launches and sparked recalls.

Volvo Car AB is looking for partnerships for its new central software stack that'll run on all of its future electric models, a sign the carmaker has overcome earlier coding glitches that delayed vehicle launches and sparked recalls.

The manufacturer is open for pacts including licensing of the "superset" system that operates via a handful of high-performance computers, according to Volvo's Chief Engineering & Technology Officer Anders Bell. While a number of carmakers including Volkswagen AG have struggled to move to their own centralized software, those that have managed in-house can potentially tap new revenue streams.

"I am very open to collaborations in this area. The phones are on and the mailboxes are active," Bell said in an interview.

Carmakers, with a history of deep rivalries and spotty success on partnerships, have started to cooperate more on costly new technologies. This follows misses on developing in-house software systems, prompting model delays at the likes of VW and Stellantis NV.

VW last year turned to Rivian Automotive Inc. for a $5.8 billion technology tie-up for Western markets, after mounting setbacks in its Cariad software unit. It set up a similar venture for China with Xpeng Inc. Others, like Ford Motor Co., have scaled back projects that targeted architectures with centralized software functions.

While Volvo, based in Sweden and owned by China's Geely, is shopping its new code, geopolitics means pacts will be limited to partners outside of China, said Bell, who rejoined Volvo in 2022 after six years at Tesla Inc. In the US, regulators are also examining how Volvo's Chinese ownership intersects with data and cybersecurity rules.

Volvo suffered its own pitfalls in the shift from hardware maker into software with bruising delays of the EX90, the brand's flagship SUV: integrating a fully centralized software brain proved far more complex than anticipated, and customers reported a litany of errors. Bell said he's confident that Volvo's next EV, the mid-size EX60 to debut in January, won't have the EX90's problems.

"It has been an extremely big journey to become a software company, and unfortunately we had a spillover effect on customers in the early days of the EX90," Bell said.

The executive compared Volvo's transition to how Apple has built iOS or macOS, and how a central system is configured for successive iPhone or MacBook generations. "Which means: the bugs we solved once for the EX90 are already solved for the EX60."

Bell said he expected the broader industry to mirror moves by VW and Rivian, which are developing an EV and software platform they may sell to other carmakers in the future.

"It's a very interesting example of collaboration that may be unconventional, but it's completely in line with where I believe the development will go," Bell said about the initiative. "You can see carmakers that made big software bets, then went back and adjusted or found a collaboration."

Volvo is also open to sharing its new EV underpinnings, the SPA3 platform.

We're "completely open for business when it comes to collaboration," he said, citing the example of Ford licensing VW's EV platform for Europe. "You can absolutely create a unique customer experience on a technology platform that has been developed more generically."

Volvo's first vehicle made on the new architecture is the EX60, billed as the manufacturer's most important launch in decades. Sister brand Polestar will also produce cars on the platform and other brands owned by Volvo parent Zhejiang Geely Holding Group "may follow," Bell said.

While Volvo has resolved internal issues on software, it still needs to clear broader geopolitical hurdles that in a worst-case scenario could upset sales in the US.

The manufacturer is talking with the Commerce Department a proposed US ban on sales of vehicles that include software developed by Chinese-backed companies. The rules are set to take effect for the 2027 model year, and in a worst-case scenario could mean several Chinese-owned carmakers — including Geely-owned brands such as Polestar and Lotus — could face a sales ban.

Volvo Chief Executive Officer Hakan Samuelsson has repeatedly said he expects the issue to be resolved, though the US government shutdown that ended last month likely delayed the process, according to Bell.

"There is a distinct line between East and West that we have to relate to," Bell said. "Technically, we could open up our entire stack to the whole world. But legally, we cannot."

Oil prices edged down on Tuesday, extending losses from the 2% drop in the previous session, with markets keeping a close eye on peace talks to end Russia's war in Ukraine and a looming decision on US interest rates.

Brent crude futures were down eight cents, or 0.1%, to US$62.41 (RM257.03) a barrel at 0409 GMT. US West Texas Intermediate crude was at US$58.75, down 13 cents or 0.2%.

Both contracts fell by more than US$1 a barrel on Monday after Iraq restored production at Lukoil's West Qurna 2 oilfield, one of the world's largest.

"Brent's slip back towards the US$62 (is) aligning seamlessly with the broader December narrative," said Phillip Nova's senior market analyst Priyanka Sachdeva. "The noise around potential Iraqi disruptions faded overnight, and the market quickly reverted to its core theme of ample supply and cautious demand expectations."

Ukraine will share a revised peace plan with the US after talks in London between its President Volodymyr Zelenskiy and the leaders of France, Germany and Britain.

"Oil is keeping to a tight trading range until we get a better idea of which way the peace talks will go," KCM Trade chief market analyst Tim Waterer said.

"If the talks break down, we expect oil to move higher, or if progress is made, and there is a likelihood of Russian supply to the global energy market resuming, prices would be expected to drop," he added.

According to sources familiar with the matter, the Group of Seven countries and the European Union are in talks to replace a price cap on Russian oil exports with a full maritime services ban, in a bid to reduce Russia's oil revenue.

Also on the radar is the Federal Reserve's policy decision due on Wednesday, with markets pricing in an 87% probability of a quarter-point rate reduction.

Lower interest rates typically are a positive driver for oil demand given the decrease in borrowing costs, though some analysts were cautious about how much impact this could have on oil prices for now.

"Although markets are largely invested in upcoming FED policy decision on Wednesday for a possible 25bp cut, something that could lend short-term support at the lower end of the US$60–US$65 band, the broader price structure remains anchored by expectations of an oversupplied 2026 (oil market)," said Phillip Nova's Sachdeva.

Thai and Cambodian troops exchanged artillery fire overnight, with Bangkok accusing its neighbor of firing rockets into civilian areas as the long-simmering border dispute flared into its most serious violence in months.

Clashes raged for a third day along the roughly 800-kilometer (500-mile) border, with the Cambodian Defense Ministry claiming that Thai shells killed two civilians overnight, raising the death toll to six. The Thai army said rockets fired by Cambodian troops struck two houses near the border, after previously stating that a soldier was killed and nearly 30 others were injured in the latest fighting.

Overnight clashes followed Thailand's use of airstrikes on Monday — its first since July — raising fears that the conflict is expanding just as the two sides struggle to uphold a US-led peace framework. The escalation also poses a challenge for Thai Prime Minister Anutin Charnvirakul, whose political calculus, trade negotiations and domestic standing are at stake.

Thai army spokesman Winthai Suvaree condemned Cambodia for firing rockets across the border, calling it a "violation of sovereignty and a serious threat to public safety." He said Thailand's military actions comply with international law.

Thailand said its air force and navy will continue to support the army in countering Cambodian attacks. Anutin has vowed to press on with the offensive to protect Thailand's sovereignty and has ruled out talks until Cambodia fully halts its attacks.

The latest bout of violence followed five days of military clashes in July, the deadliest in recent history that left nearly four dozen people dead and displacing more than 300,000. A ceasefire agreement was reached days later during talks in Malaysia and a peace accord was signed in October in a ceremony presided over by US President Donald Trump.

The agreement included deploying observers from the Association of Southeast Asian Nations to help maintain peace.

Following is the text of the Reserve Bank of Australia's statement on Tuesday after its monthly monetary policy meeting. At its meeting today, the Board decided to leave the cash rate unchanged at 3.60 per cent. While inflation has fallen substantially since its peak in 2022, it has picked up more recently. The Board's judgement is that some of the recent increase in underlying inflation was due to temporary factors and there is uncertainty about how much signal to take from the monthly CPI data given it is a new data series.

Nevertheless, the data do suggest some signs of a more broadly based pick-up in inflation, part of which may be persistent and will bear close monitoring. Economic activity continues to recover. Growth in private demand has strengthened, driven by both consumption and investment. Activity and prices in the housing market are also continuing to pick up.

Financial conditions have eased since the beginning of the year, credit is readily available to both households and businesses and the effects of earlier interest rate reductions are yet to flow through fully to demand, prices and wages. On the other hand, money market interest rates and government bond yields have risen more recently. Various indicators suggest that labour market conditions remain a little tight. The unemployment rate has risen gradually over the past year and employment growth has slowed. However, measures of labour underutilisation remain at low rates, surveyed measures of capacity utilisation are above their long-run average and business surveys and liaison continue to suggest that a significant share of firms are experiencing difficulty sourcing labour.

Wages growth, as measured by the Wage Price Index, has eased from its peak but broader measures of wages continue to show strong growth and growth in unit labour costs remains high. There are uncertainties about the outlook for domestic economic activity and inflation and the extent to which monetary policy remains restrictive. On the domestic side, the pick-up in momentum has been stronger than anticipated, particularly in the private sector. If this continues, it is likely to add to capacity pressures.

Uncertainty in the global economy remains significant but so far there has been minimal impact on overall growth and trade in Australia's major trading partners. Decision The recent data suggest the risks to inflation have tilted to the upside, but it will take a little longer to assess the persistence of inflationary pressures. Private demand is recovering. Labour market conditions still appear a little tight but further modest easing is expected. The Board therefore judged that it was appropriate to remain cautious, updating its view of the outlook as the data evolve. The Board will be attentive to the data and the evolving assessment of the outlook and risks to guide its decisions.

In doing so, it will pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market. The Board is focused on its mandate to deliver price stability and full employment and will do what it considers necessary to achieve that outcome. Today's policy decision was unanimous.

European Union (EU) members and Parliament reached a deal on Tuesday to cut corporate sustainability laws, after months of pressure from companies and governments, including the United States and Qatar.

The changes, which would weaken such rules for a large majority of businesses now covered, come in response to criticism from some industries that EU red tape and strict regulation hindered competitiveness with foreign rivals.

"This is an important step towards our common goal to create a more favourable business environment to help our companies grow and innovate," Denmark's European Affairs Minister Marie Bjerre said in a statement.

The agreement was a very good compromise, added Jorgen Warborn, a Swedish centre-right lawmaker.

The push to weaken the laws had dismayed environmental campaigners, some investors and governments, including that of Spain, which had urged Brussels to keep the rules intact to support European priorities on sustainability and human rights.

The EU's corporate sustainability reporting directive (CSRD) requires companies to disclose details of their environmental and social impact, so as to be more transparent to investors and consumers.

EU negotiators agreed that such reporting will cover only companies with more than 1,000 employees and annual net turnover exceeding 450 million euros (US$524 million, or RM2.16 billion), down from about 50,000 companies with more than 250 employees now.

For non-EU firms, the threshold was set at 450 million euros in turnover generated within the bloc.

The deal limits the EU's corporate sustainability due diligence directive (CSDDD) to only the largest EU corporations, which have more than 5,000 employees and annual turnover exceeding 1.5 billion euros.

The same rules will cover non-EU companies with turnover in the EU above that level.

The European Union has also dropped a clause for companies to adopt climate transition plans under the directive.

The United States and Qatar have pressured Brussels to scale back the due diligence law, warning that the rules risked disrupting liquefied natural gas trade with Europe.

EU co-legislators also agreed to cap penalties for non-compliance at 3% of companies' global turnover, with guidelines to follow from the Commission, and compliance required by July 2029.

Companies such as Exxon Mobil, as well as the leaders of Germany and France, had sought deeper cuts, including scrapping the due diligence law entirely, saying it hurt the competitiveness of European businesses.

The EU Parliament and EU countries must each give formal approval for the changes to become law, usually a formality that waves through pre-agreed deals.

China's Premier Li Qiang said on Tuesday the "mutually destructive consequences of tariffs have become increasingly evident" over 2025, in remarks at a "1+10 Dialogue" including the heads of the IMF, World Trade Organization and World Bank.

Without naming U.S. President Donald Trump, China's second-highest ranking official told the meeting in Beijing that greater effort was needed to reform global economic governance due to the trade barriers.

China's trade surplus topped $1 trillion for the first time in November, trade data showed on Monday, which economists say is linked to Trump's tariffs diverting shipments from the world's second-largest economy to other markets, putting pressure on manufacturing sectors in those economies.

"Since the beginning of the year, the threat of tariffs has loomed over the global economy," Li told the meeting, which also includes senior officials from the OECD and International Labour Organization.

Li also said artificial intelligence is becoming central to trade, highlighting models such as China's DeepSeek as drivers of the global transformation of traditional industries and as catalysts for growth in new sectors, including smart robots and wearable devices.

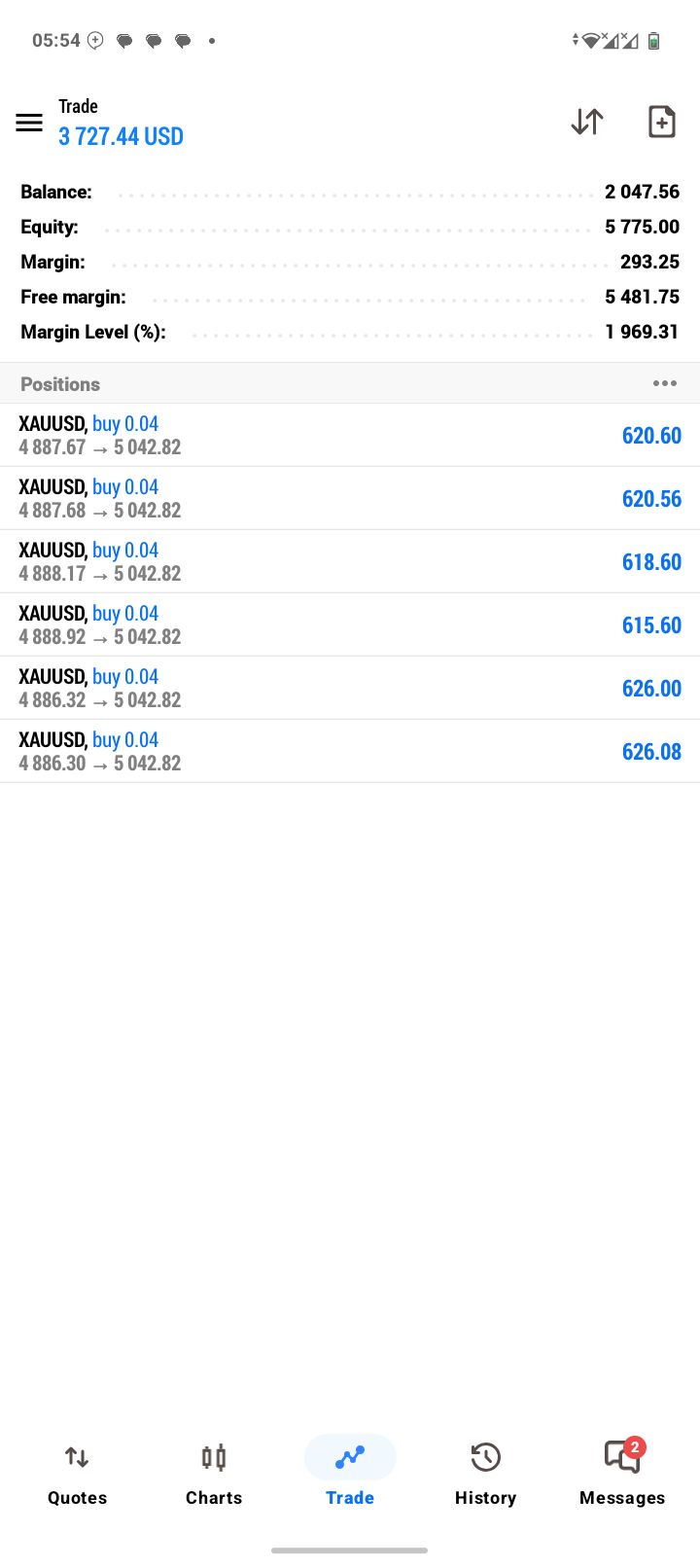

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up