Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

At least six U.S. soybean cargoes are scheduled to load for China by mid-December, signaling a revival in agricultural trade following months of stagnation due to tariffs...

Thailand's annual headline inflation rate was negative for an eighth month in November, data showed on Wednesday, and the Commerce Ministry said it was due to falling energy prices and government measures to alleviate the cost of living.

The headline consumer price index fell 0.49% in November from a year earlier, following an annual drop of 0.76% in the previous month. It was also the ninth consecutive month that inflation was below the central bank's target range of 1% to 3%.

Severe flooding in parts of the country's south had little impact on inflation, Nantapong Chiralerspong, head of the Trade Policy and Strategy Office, told a news conference.

The core CPI reading rose 0.66% from a year earlier, the ministry said.

Over the first 11 months of 2025, headline inflation was down 0.12% from the same period a year earlier.

Inflation next year was expected to be in a range of 0.0% to 1.0%, Nantapong said.

Economists expect the central bank to cut interest rates at a policy review on December 17, after the Bank of Thailand held its key rate steady at 1.50% in October.

On Monday, Bank of Thailand Governor Vitai Ratanakorn said he saw room to lower rates, but added such a move had only a limited impact on an economy facing structural problems.

A senior Japanese national security official confirmed with a French foreign policy adviser that both nations would cooperate toward realizing a free and open Indo-Pacific, ahead of Emmanuel Macron's visit to China, according to Japanese media reports.

Keiichi Ichikawa, Japan's secretary general of national security, held a telephone conversation with Macron's diplomatic adviser Emmanuel Bonne on Tuesday, Kyodo News and the Sankei newspaper reported Wednesday. The two officials also agreed to strengthen bilateral security cooperation, the reports said.

Japanese government officials didn't clarify whether the Taiwan issue was discussed during the call, according to the reports.

The call took place after Chinese Foreign Minister Wang Yi said to Bonne during a Nov. 27 telephone call that the two sides needed to support each other, condemning Japanese Prime Minister Sanae Takaichi's "provocative remarks" on Taiwan.

Macron is set to start his three-day visit to China on Wednesday as Beijing tries to seek support from France, one of five permanent members of the United Nations Security Council, in its ongoing dispute with Tokyo.

San Francisco is suing the makers of ultraprocessed foods, including Kraft Heinz, Coca-Cola, Nestle, Kellogg and Mondelez.

"These companies created a public health crisis with the engineering and marketing of ultraprocessed foods," San Francisco City Attorney David Chiu said.

"They took food and made it unrecognizable and harmful to the human body."

What we know about San Francisco's lawsuit

The lawsuit, lodged in San Francisco Superior Court on Tuesday, accuses 10 corporations of violating California laws on public nuisance and deceptive marketing.

It alleges the manufacturers pushed products they know are harmful with marketing that ignored or obscured the risks — similarly to how tobacco companies operate.

"Just like Big Tobacco, the ultraprocessed food industry targeted children to increase their profits," a statement said.

As ultraprocessed foods have proliferated, rates of obesity, cancer and diabetes have increased, the lawsuit claims.

The city is seeking restitution and civil penalties to offset its healthcare costs.

It also wants a court order prohibiting the companies from engaging in deceptive marketing and requiring them to alter their practices.

It's the first time a US municipality has sued over claims food companies have knowingly marketed addictive and harmful ultraprocessed foods.

There isn't a commonly agreed-upon definition of ultraprocessed food.

But researchers generally apply the term to mass-produced foods made using industrial processing techniques and chemically modified substances that normally can't be produced in a normal kitchen at home.

Typical ultraprocessed foods include commercially produced breads, frozen pizza, hot dogs, candy, soft drinks, chips, sweetened breakfast cereals and instant soups.

They frequently contain many added ingredients such as fats, sugars or sweeteners, salts and artificial colors or preservatives.

They most likely also contain other industrially produced substances such as thickeners, foaming agents and emulsifiers.

Ultraprocessed foods now make up more than two-thirds of products in US supermarketsImage: Apu Gomes/AFP/Getty Images

Ultraprocessed foods now make up more than two-thirds of products in US supermarketsImage: Apu Gomes/AFP/Getty ImagesAround 70% of the products sold in US supermarkets are ultraprocessed, and children in the United States get about 60% of their calories from such foods.

"Americans want to avoid ultraprocessed foods, but we are inundated by them. These companies engineered a public health crisis, they profited handsomely, and now they need to take responsibility for the harm they have caused," Chiu said.

A three-part series published in the prestigious medical journal The Lancet in November blamed ultraprocessed foods for an increase in multiple diseases from obesity to cancer.

Other studies tie the consumption of more ultraprocessed foods with early death or higher risks of cardiovascular disease, coronary heart disease and cerebrovascular disease.

According to the US Centers for Disease Control, 40% of Americans are obese.

Almost 16% have diabetes, a condition that can result from being excessively overweight.

Sarah Gallo of the Consumer Brands Association, a trade group representing many of the companies targeted in the suit, said "there is currently no agreed upon scientific definition of ultraprocessed foods."

"Attempting to classify foods as unhealthy simply because they are processed, or demonizing food by ignoring its full nutrient content, misleads consumers and exacerbates health disparities," she said in a statement.

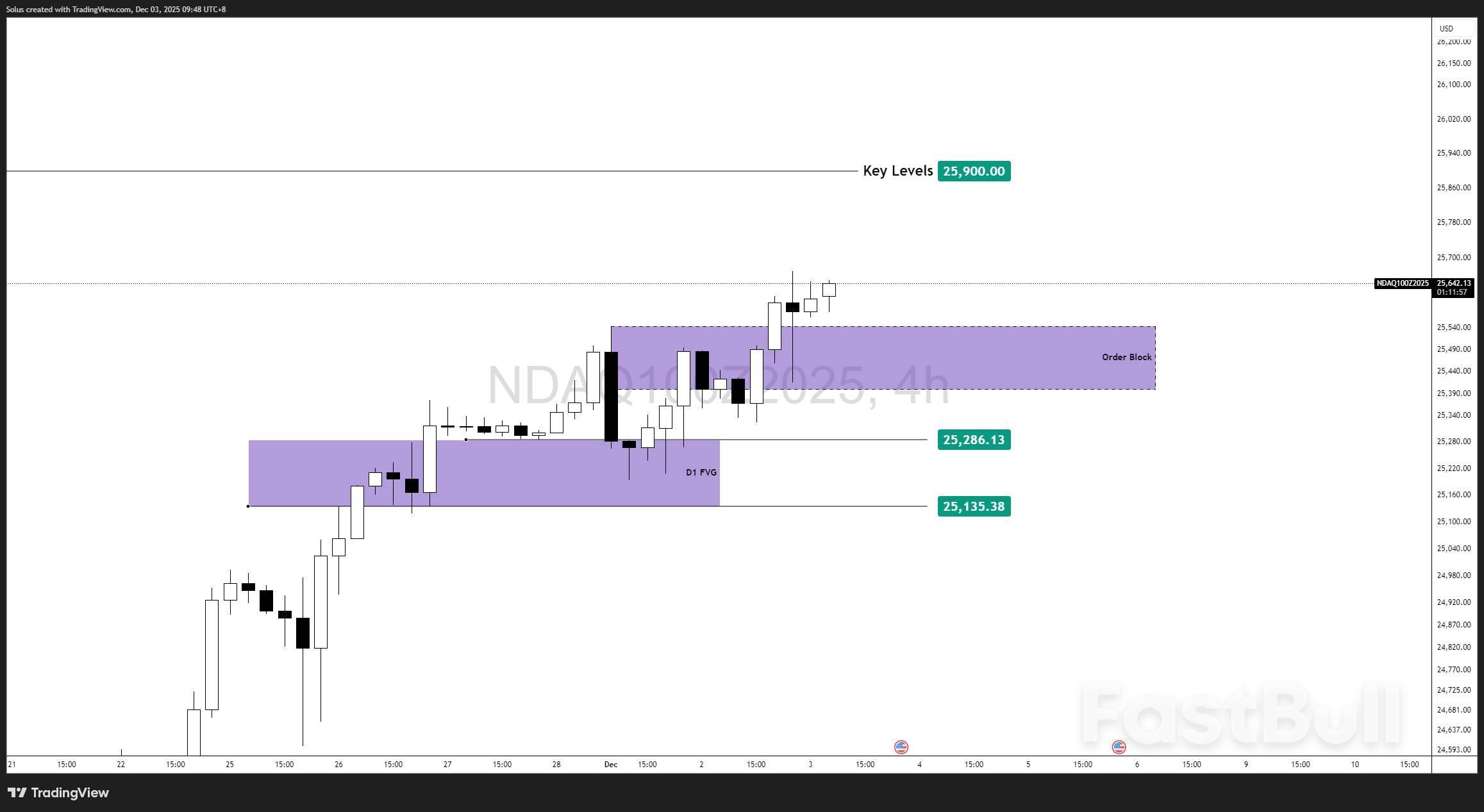

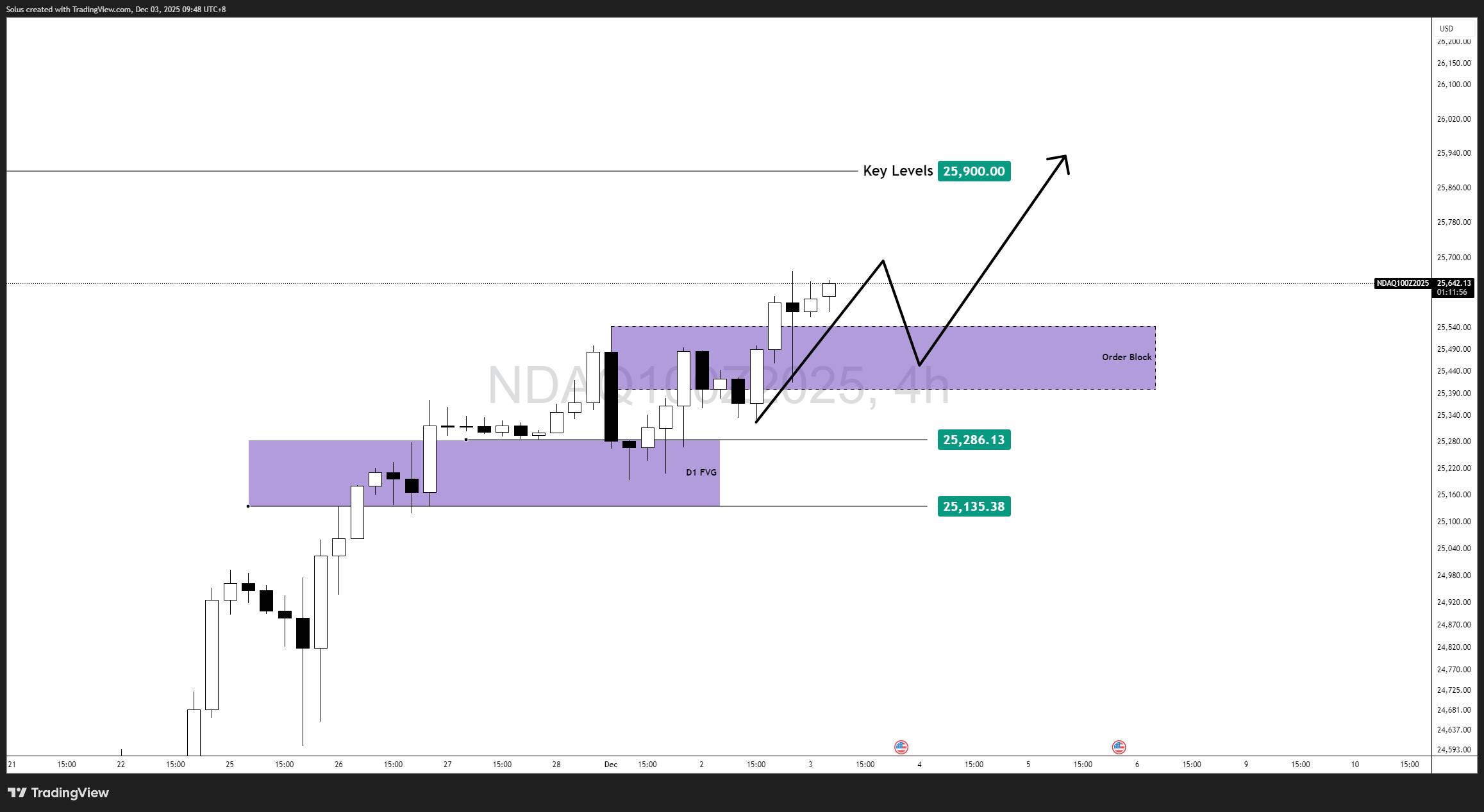

The Nasdaq's recent upswing started precisely where high-timeframe buyers were expected to defend: the Daily Fair Value Gap. This demand pocket served as a springboard, kicking off a fresh bullish impulse that sent the index sharply higher.

Rather than breaking down, Nasdaq respected the inefficiency beautifully - a sign that institutions are still accumulating rather than distributing. The rebound was not a weak drift upward but a clear, impulsive reaction signaling renewed bullish control.

This type of HTF confirmation often precedes deeper continuation moves, especially when macro conditions and sector flows align.

Even outside technicals, Nasdaq's strength is rooted in a broader narrative: large-cap tech is heating up again.

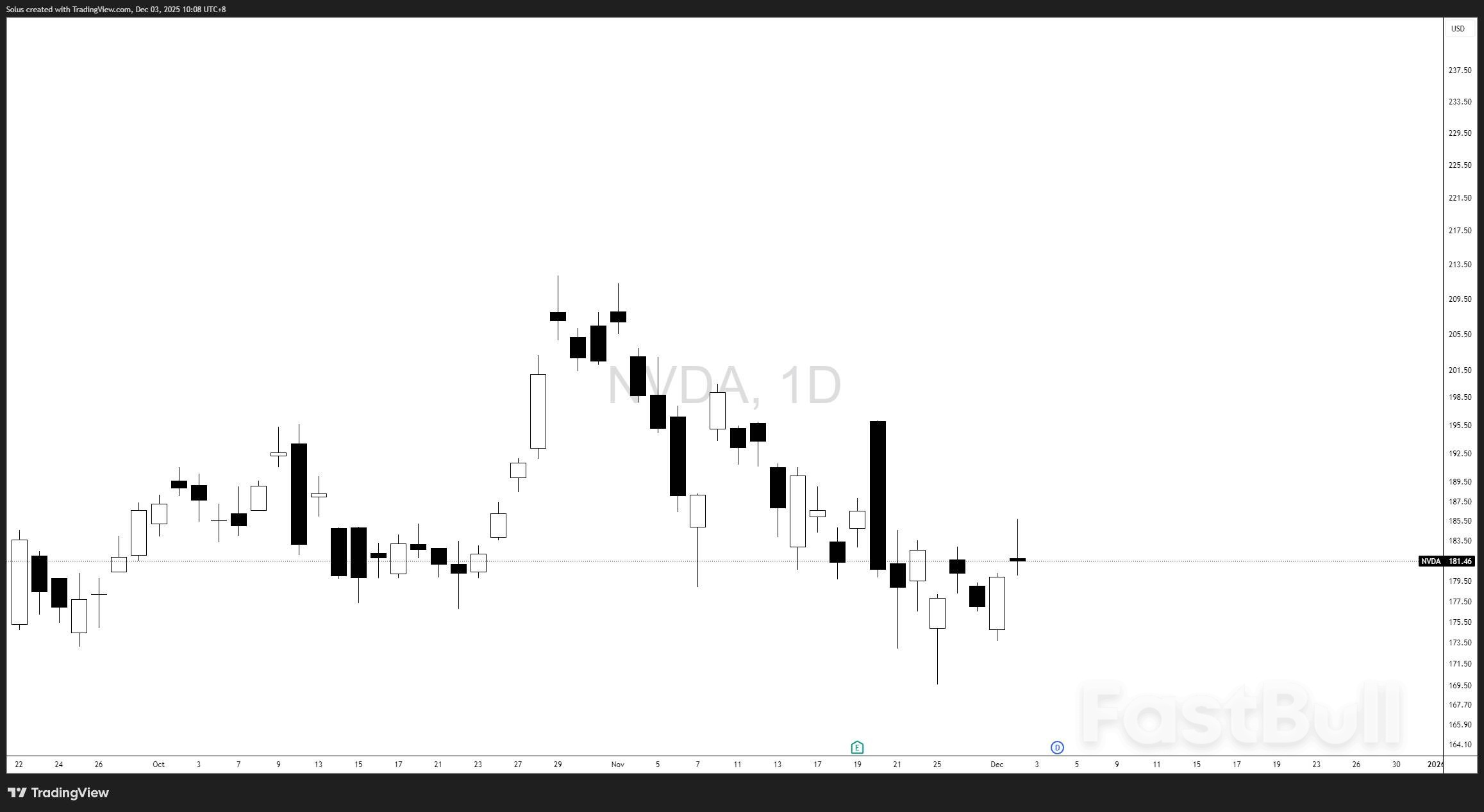

Among the giants, NVIDIA has been the clear standout. Its recent resurgence - driven by AI demand, stronger-than-expected data center revenue, and bullish forward guidance - has re-ignited the entire technology sector.

NVIDIA's aggressive rebound has:

When a major sector leader fires up, money follows - and indices like the Nasdaq benefit almost immediately. This leadership rotation is one of the strongest signals that the rally isn't built on weak footing.

The broader macro landscape is shifting toward "risk-on," anchored by four fundamental drivers:

Together, these create a supportive environment where pullbacks are absorbed quickly - exactly what we've seen this week.

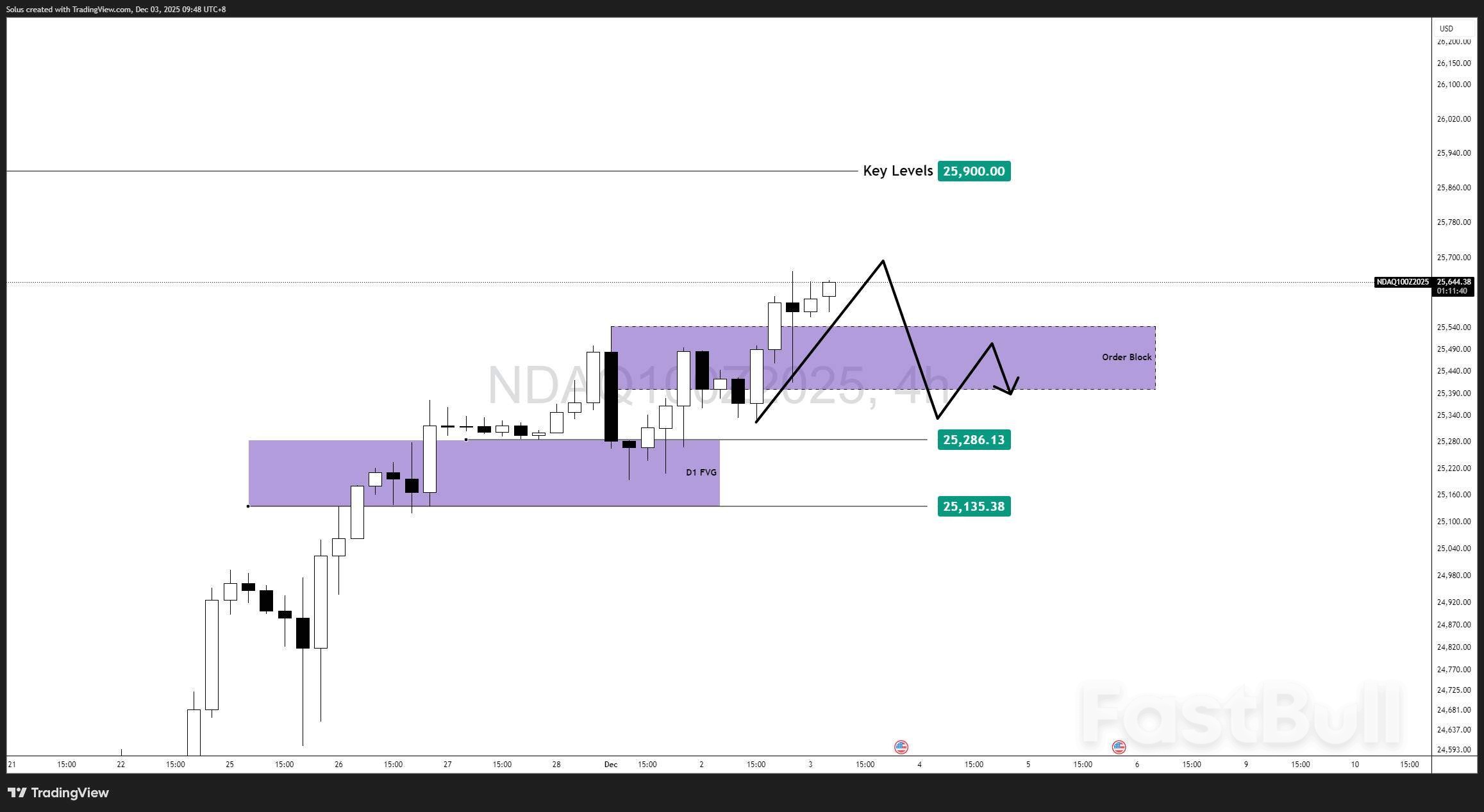

With the index pushing closer to the 25,900 key level, the market is now staring at a familiar ceiling. A decisive break above this structure turns the spotlight directly onto the all-time high at 26,400.

Momentum, fundamentals, and sector rotation all suggest the probability is rising - but not confirmed until 25,900 is cleared.

Until then, we treat 25,900 as the final resistance before a true breakout attempt.

The 4H structure remains classically bullish:

Price action is still in expansion mode, with the 4H OB acting as the most important short-term support.

The bullish outlook remains intact if:

A breakout above 25,900 opens the next phase of upside targets:

This aligns with your 4H projection: a corrective dip into demand followed by a clean continuation.

A shift to a bearish tone would require:

Downside targets:

A rejection from 25,900 combined with OB failure could signal a short-term top.

The Nasdaq's recovery from the Daily FVG is not a random bounce - it's a confluence of institutional demand, improving macro sentiment, and powerful leadership from major tech players like NVIDIA.

All eyes now turn to 25,900.

Mitsubishi Electric plans to triple production capacity for optical semiconductor devices used in data centers and communications base stations, stepping up investment as AI-driven demand continues to grow.

The Japanese electronics maker will direct a portion of its planned investment away from power devices used in EVs amid sluggish growth in that market, instead lifting optical device production capacity for fiscal 2028 to three times the fiscal 2024 level.

The company will be increasing production of optical devices, which convert optical signals to electrical signals and vice versa. The plan is to boost capacity for high-frequency optical devices at its high-frequency and optical device works in Hyogo prefecture. Before the change, Mitsubishi Electric had intended to raise fiscal 2026 capacity by half from the fiscal 2024 level.

Optical devices are used in many applications, including home internet connections and 5G high-speed wireless base stations. Demand is also rising in data centers for artificial intelligence. Data centers use large numbers of optical devices to link graphics processing units used for AI.

The global AI data center market totaled roughly $15 billion in 2024 and is expected to reach about $94 billion in 2032, according to Indian research company Fortune Business Insights. Mitsubishi Electric has decided to upgrade its planned capacity increase based on the expectation of long-term global demand for optical devices.

April-September consolidated revenue in Mitsubishi Electric's semiconductor and device segment, which includes optical and power devices, fell about 4% on the year to 140.6 billion yen ($902 million). Operating profit rose 6% to 24.7 billion yen. Highly profitable optical devices saw strong sales, while power devices struggled.

Mitsubishi Electric revealed in May that it would reassess its previous plan of investing 260 billion yen in raising production capacity for power devices over the five years ending March 2026, shifting a portion to optical devices.

The company claims a roughly 50% global market share in optical devices for data centers. Higher profit margins on optical devices will help offset the overall decline in its semiconductor and device segment.

The Tokyo-based Fuji Chimera Research Institute estimates that the market for equipment that includes optical devices will grow to 10.73 trillion yen in 2030 -- about 3.5 times its 2024 size -- as growing numbers of data centers continue to be built.

Mitsubishi Electric's competition is also preparing to increase production capacity for optical devices in light of these forecasts.

Sumitomo Electric Industries will double capacity for optical devices in fiscal 2026 compared with the fiscal 2024 level, aiming to tap the rapidly growing demand.

Lumentum Japan, an affiliate of U.S.-based Lumentum Holdings with roots in Hitachi, intends to raise its production volume of optical devices to six times the 2024 level in 2027.

The company plans to boost production efficiency by using larger-diameter semiconductor wafers for optical devices, mainly at its plant in Sagamihara, west of Tokyo.

Lumentum Japan will also add more personnel. It expects to hire 80 or so new people, especially engineers, by the end of June 2026, amounting to a quintupling from the previous year.

The Sagamihara facility has a 144-meter-long clean room filled with production equipment. The lines run 24 hours a day in two shifts. The production system operates without stopping, even for holidays.

According to Lumentum Japan, optical devices are one of the strongest fields for Japanese manufacturers, with the top three producers in the country controlling roughly 70% of the global market. Japanese companies are also taking the lead in terms of research into higher-performance devices.

Optical device data transmission speeds are measured in terms of how many times per second they can switch on and off to represent zeros and ones. Many used in data centers now have speeds between 100 gigabits per second and 200 Gbps. As chip performance improves and data volumes grow, the commercialization of optical devices capable of 400 Gbps to 800 Gbps second is not far off.

The three Japanese companies will likely continue to lead in meeting AI data center demand and increasing performance.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up