Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Dec)

Euro Zone Consumer Inflation Expectations (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Nov)

Euro Zone Unemployment Rate (Nov)A:--

F: --

P: --

Euro Zone PPI MoM (Nov)

Euro Zone PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Dec)

Euro Zone Selling Price Expectations (Dec)A:--

F: --

P: --

Euro Zone PPI YoY (Nov)

Euro Zone PPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Dec)

Euro Zone Industrial Climate Index (Dec)A:--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Dec)

Euro Zone Economic Sentiment Indicator (Dec)A:--

F: --

Euro Zone Services Sentiment Index (Dec)

Euro Zone Services Sentiment Index (Dec)A:--

F: --

Euro Zone Consumer Confidence Index Final (Dec)

Euro Zone Consumer Confidence Index Final (Dec)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Dec)

Mexico 12-Month Inflation (CPI) (Dec)A:--

F: --

P: --

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)A:--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)A:--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)A:--

F: --

P: --

U.S. Exports (Oct)

U.S. Exports (Oct)A:--

F: --

P: --

U.S. Trade Balance (Oct)

U.S. Trade Balance (Oct)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)A:--

F: --

Canada Trade Balance (SA) (Oct)

Canada Trade Balance (SA) (Oct)A:--

F: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Oct)

U.S. Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Consumer Credit (SA) (Nov)

U.S. Consumer Credit (SA) (Nov)A:--

F: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)--

F: --

P: --

China, Mainland CPI YoY (Dec)

China, Mainland CPI YoY (Dec)--

F: --

P: --

China, Mainland PPI YoY (Dec)

China, Mainland PPI YoY (Dec)--

F: --

P: --

China, Mainland CPI MoM (Dec)

China, Mainland CPI MoM (Dec)--

F: --

P: --

Japan Leading Indicators Prelim (Nov)

Japan Leading Indicators Prelim (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Nov)

Germany Industrial Output MoM (SA) (Nov)--

F: --

P: --

Germany Exports MoM (SA) (Nov)

Germany Exports MoM (SA) (Nov)--

F: --

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)--

F: --

P: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Sept)

U.S. Building Permits Revised YoY (SA) (Sept)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Sept)

U.S. Building Permits Revised MoM (SA) (Sept)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)--

F: --

P: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Born from a minerals deal, a new U.S.-Ukraine fund targets $200M for critical sectors, reshaping economic ties amid war.

The U.S. International Development Finance Corporation (DFC) has officially launched an online portal for its new U.S.-Ukraine Reconstruction Investment Fund (URIF), inviting project submissions for what it expects to be a $200 million vehicle by the end of the year.

The fund, which began operations in December, was established as part of a minerals agreement signed by the two countries in April. It aims to fast-track investments into Ukraine’s critical industries, with the first projects expected to be announced in the coming months.

"We look forward to reviewing project proposals and making our first investments in the months ahead," said Conor Coleman, DFC's head of investments and a board member of the fund.

DFC CEO Ben Black stated that the portal's launch highlights President Donald Trump's commitment to securing a lasting peace in Ukraine by enabling investments that advance the shared national interests of both nations.

The DFC has outlined several key areas for investment. The fund is designed to inject capital into projects that are vital for Ukraine's economic resilience and future growth.

Priority sectors for proposals include:

• Critical Minerals: Both upstream and midstream projects.

• Energy: Power generation, transmission, and hydrocarbon extraction.

• Infrastructure: Transport and logistics.

• Technology: Information and communications technology (ICT) and other emerging technologies.

In its initial years, the fund is expected to prioritize equity and equity-like investments to drive long-term value.

The creation of the URIF stems from a minerals deal Kyiv signed after months of pressure from the Trump administration. The agreement grants the U.S. preferential access to new Ukrainian mineral projects in exchange for investment, a move intended to secure ongoing support from Washington.

A senior U.S. official noted that the deal has significantly improved dialogue with Kyiv and revitalized the U.S.-Ukraine relationship.

However, officials acknowledge the complexities of investing in the country, which will mark the fourth anniversary of Russia's invasion on February 24. The U.S. will require that all projects satisfy the interests of both governments and generate commercial returns.

The fund launched with $150 million in seed money and has already received an additional $23 million from hydrocarbon auctions. The senior U.S. official stated the fund is "ballparking around $200 million" by the year's end.

The URIF is structured to expand over time and is designed to encourage co-investment from other international bodies, including the World Bank and the European Bank for Reconstruction and Development.

Unlike typical private equity projects, the fund's investments will focus on strategic sectors and begin immediately, without waiting for a ceasefire. Officials emphasized that a key goal is to mobilize private capital to invest alongside the fund.

A significant advantage, according to the official, is that these projects will "carry both a U.S. and Ukrainian flag." This dual backing is intended to offer a layer of protection and encourage greater private sector participation in Ukraine's reconstruction efforts.

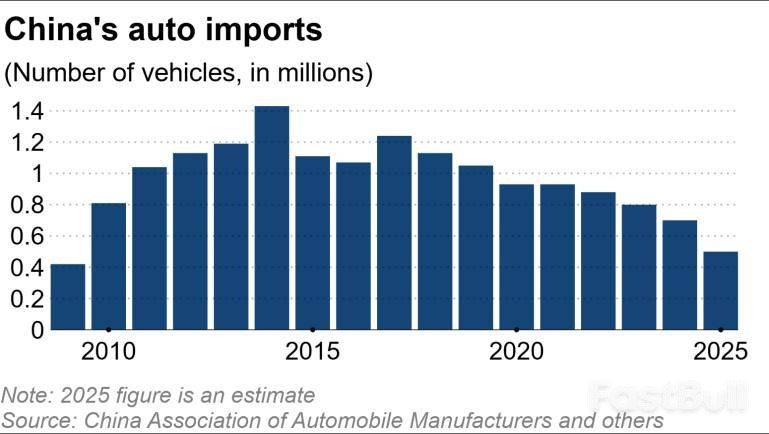

China's demand for imported cars is plummeting, with projections showing a 30% drop last year. For the first time in 16 years, fewer than 600,000 vehicles are expected to have entered the country, a dramatic shift driven by the unstoppable rise of low-priced domestic electric vehicles that are sidelining traditional luxury brands from Europe and the U.S.

According to the China Association of Automobile Manufacturers, sales of imported vehicles from January to November fell by 30% year-on-year to just 447,000 units. The full-year total is forecast to land around 500,000 vehicles, marking a historic turning point for the world's largest auto market.

Imported vehicles, long a status symbol for China's wealthy, are losing their appeal. The primary cause is the market's rapid pivot to so-called new energy vehicles (NEVs), a category where domestic automakers have a commanding lead.

Last year, NEVs accounted for over half of all passenger vehicle sales in China. In stark contrast, 80% of imported passenger vehicles were gasoline-powered. Foreign automakers are far behind their Chinese counterparts in product variety, with EVs and plug-in hybrids making up a mere 2% of total vehicle imports.

The impact has been uneven across major auto-exporting nations, with German and American brands hit especially hard.

• German Imports: Plummeted 46% to approximately 90,000 vehicles, with BMW and Mercedes-Benz Group experiencing significant drops.

• U.S. Imports: Fell a staggering 53% to about 40,000 vehicles. Automakers like General Motors and Ford reportedly halted exports to China in April and May after President Donald Trump's high tariffs triggered retaliation from Beijing.

• Japanese Imports: Bucked the trend, with shipments of Japan-made vehicles down only 4% year-on-year from January to October.

While the trade war has cooled, imported vehicles still face a 15% tariff in China, with an additional 10% levied on those from the United States.

The flood of low-priced EVs from Chinese automakers is creating intense downward pressure on vehicle prices across the board, affecting gasoline-powered cars as well.

Sales of vehicles priced under 300,000 yuan ($43,000) grew last year. Meanwhile, the 300,000-to-400,000 yuan segment—once a premium sweet spot dominated by imports—saw sales decline. This shift is partly attributed to weakening consumer purchasing power stemming from China's prolonged real estate slump.

The fierce price competition has been called "abnormal" by a senior executive at Porsche's China operations. In response, Porsche established its first research and development facility outside of Germany in Shanghai last November to accelerate vehicle development tailored specifically for the Chinese market.

While imports dwindle, China's auto production and exports are expanding rapidly. From January to November, production rose 10% year-on-year to 31 million units, with 20% of that volume heading for export.

For the full year, China's vehicle exports are projected to climb 20% to 7 million units, making it the world's top auto exporter. For comparison, Japan, the world's second-ranked exporter, shipped 3.8 million vehicles in the first eleven months of the year.

This export surge has been met with resistance. The U.S. imports virtually no Chinese-made EVs, and the European Union has imposed tariffs of up to 45.3% since October 2024, a sharp increase from the previous 10%.

To navigate these barriers, Chinese companies are building production facilities in tariff-free zones, including Thailand, Hungary, and Turkey. Zhang Yongwei, secretary-general of the think tank China EV100, predicted last month that 8 million Chinese vehicles will be sold abroad this year, with 1 million of them produced in overseas factories.

The entire industry is focused on the global market, with component suppliers like battery giant CATL also establishing factories in Europe and Southeast Asia to support this expansion.

Former U.S. President Donald Trump has affirmed Washington's commitment to the North Atlantic Treaty Organization (NATO), even as he questions whether that loyalty would be returned. His comments follow growing concerns among European allies over his reported interest in acquiring Greenland.

The statement, made via social media, came just a day after the leaders of France, Britain, Germany, Italy, Poland, Spain, and Denmark issued a joint declaration. They emphasized that Greenland, a Danish territory, belongs to its people and that any decisions regarding its future rest with Denmark and Greenland alone.

These transatlantic tensions are mounting as the White House is reportedly exploring multiple options for acquiring the territory, including potential military action. This comes at a critical time when the alliance is grappling with the Russia-Ukraine war and other pressing security challenges.

In a post on Truth Social, Trump presented a vision of the alliance centered on American strength. "We will always be there for NATO, even if they won't be there for us," he wrote. "The only Nation that China and Russia fear and respect is the DJT REBUILT U.S.A."

He further claimed that without the United States, Russia and China have "zero fear" of NATO.

Trump also expressed deep skepticism about the alliance's reliability, stating, "AND I DOUBT NATO WOULD BE THERE FOR US IF WE REALLY NEEDED THEM." He credited his administration for strengthening the American armed forces, adding, "EVERYONE IS LUCKY THAT I REBUILT OUR MILITARY IN MY FIRST TERM, AND CONTINUE TO DO SO."

A key part of Trump's argument revolves around member contributions. He pointed to a commitment made by NATO members last year to increase defense spending to 5% of their gross domestic product (GDP) by 2035, a significant jump from the previous 2% guideline.

"Remember, for all of those big NATO fans, they were at 2% GDP, and most weren't paying their bills, UNTIL I CAME ALONG," he said. "The USA was, foolishly, paying for them!"

Trump took personal credit for the change, stating, "I, respectfully, got them to 5% GDP, AND THEY PAY, immediately. Everyone said that couldn't be done, but it could, because, beyond all else, they are all my friends."

Trump extended his claims to other areas of international affairs, asserting that Russia "would have all of Ukraine right now" without his intervention.

"Remember, also, I single-handedly ENDED 8 WARS, and Norway, a NATO Member, foolishly chose not to give me the Nobel Peace Prize," he wrote. "But that doesn't matter! What does matter is that I saved Millions of Lives."

Meanwhile, recent events have intensified scrutiny of Trump's intentions. A military operation this month aimed at capturing Venezuelan leader Nicolas Maduro has reignited fears that the former president could escalate efforts to acquire Greenland, which he has previously described as a national security imperative.

Jan 7 (Reuters) - Wall Street's main indexes were mixed on Wednesday, with the S&P 500 and the Dow coming off their intraday record highs after rallying in the previous two sessions, while investors assessed numerous economic datasets.

At 10:09 a.m. ET, the Dow Jones Industrial Average (.DJI), opens new tab fell 145.00 points, or 0.30%, to 49,317.08, the S&P 500 (.SPX), opens new tab gained 0.78 points, or 0.01%, to 6,945.60, and the Nasdaq Composite (.IXIC), opens new tab gained 53.51 points, or 0.23%, to 23,600.68.

The Dow slipped from its record high and remained about 1.5% below the historic 50,000 level, while modest moves in the S&P 500 kept it at a record high, leaving the benchmark 0.7% shy of the 7,000-point peak.

Wall Street surged on Tuesday amid renewed enthusiasm for artificial-intelligence-linked stocks.

U.S. job openings fell more than expected in November after rising marginally in October, while a separate ADP report showed that private payrolls increased less than expected in December.

Kim Forrest, chief investment officer at Bokeh Capital Partners, said that investors could stay cautious over the next couple of days, avoiding any outsized bets until the key nonfarm payrolls report is released on Friday.

Healthcare (.SPXHC), opens new tab extended its gains on Wednesday, up 1.1% to hit a record high, boosted by a 4% rise in heavyweight drugmaker Eli Lilly (LLY.N), opens new tab. The Wall Street Journal reported on Tuesday that Eli Lilly was in advanced talks to buy Ventyx Biosciences (VTYX.O), opens new tab for more than $1 billion.

Memory chipmakers that had surged in the previous session on the prospect of chip shortages leading to price increases eased. SanDisk (SNDK.O), opens new tab and Western Digital (WDC.O), opens new tab fell 2.6% and 10.2% after climbing 27.5% and 10%, respectively, on Tuesday.

Materials (.SPLRCM), opens new tab also pulled back, down 1.6%, after climbing over 2% in the previous session.

Wall Street's three main indexes appear to have started 2026 on a positive note, after marking their third consecutive year of double-digit gains in 2025.

Markets will also keep an eye on geopolitical developments, including developments in Venezuela and the use of the country's oil resources, following the capture of Venezuelan President Nicolas Maduro over the weekend.

U.S. President Donald Trump said the U.S. would refine and sell up to 50 million barrels of crude stuck in the Latin American nation.

The U.S. said it has seized a Russian-flagged, Venezuela-linked tanker on Wednesday, marking Washington's efforts to dictate oil flows in America's backyard and force Caracas' socialist government to become its ally.

The White House said on Tuesday that Trump is discussing options for acquiring Greenland, including potential use of the U.S. military.

Among other stocks, Strategy (MSTR.O), opens new tab rose 1.5% before the bell after MSCI dropped a plan to exclude the bitcoin hoarder and other crypto treasury firms from its indexes.

First Solar (FSLR.O), opens new tab fell 8.2% after Jefferies downgraded the solar panel maker's rating to "hold" from "buy", citing recent project cancellations and margin pressures.

Declining issues outnumbered advancers by a 1.56-to-1 ratio on the NYSE, and by a 1.19-to-1 ratio on the Nasdaq.

The S&P 500 posted 24 new 52-week highs and 8 new lows, while the Nasdaq Composite recorded 62 new highs and 33 new lows.

The United States is in direct talks with Caracas to indefinitely manage all oil sales from Venezuela's state-owned energy company, PdV. U.S. Energy Secretary Chris Wright confirmed the discussions on Wednesday, outlining a plan that would also involve supplying Venezuela with the necessary equipment to boost its flagging oil output.

The announcement follows President Donald Trump's statement on Tuesday that the U.S. will receive between 30 and 50 million barrels of high-quality sanctioned oil from Venezuela's interim government. This volume represents nearly all of Venezuela's current onshore and floating crude storage.

Speaking at the Goldman Sachs Energy, CleanTech and Utilities Conference in Miami, Wright elaborated on the strategy. The U.S. intends to first market Venezuela's stored barrels and then "indefinitely, going forward, we will sell the production that comes out of Venezuela into the marketplace."

To achieve this, the U.S. would provide the critical diluents required to extract and move the heavy crude oil that dominates Venezuela's reserves.

"As we make progress with the government, we'll enable the importing of parts and equipment and services to kind of prevent the industry from collapsing, stabilize the production, and then as quickly as possible, start to see it growing again," Wright explained.

He added that these steps are designed to eventually facilitate the return of more U.S. companies to the Venezuelan oil sector.

This plan was rapidly developed following the U.S. special forces operation on January 3 that resulted in the capture of President Nicolas Maduro, who was subsequently transported to the U.S. on drug trafficking charges.

The Trump administration is now working with interim president Delcy Rodriguez to execute its objectives. While Rodriguez has maintained a publicly defiant stance, her actions have largely complied with Washington's demands, prompting both PdV and its key foreign partner, Chevron, to adapt quickly.

Despite the high-level talks, PdV is not positioned to increase deliveries beyond its current stored volumes due to severe, long-term operational failures and recent equipment outages. The political uncertainty following Maduro's seizure has also led many PdV employees to stay home from work.

"PdV is working at minimal capacity," a source within the company told Argus. "Operational areas [E&P and upgrading] are half working. Storage is full."

The situation is worsened by the fact that three of the four major upgrading facilities needed to process Venezuela's extra-heavy crude are offline. According to the source, these shutdowns followed unexplained explosions and fires in recent weeks, which occurred as U.S. military forces were building up near the country.

To move the plan forward, Secretary Wright is scheduled to meet with American oil executives on the sidelines of the Goldman Sachs conference to finalize details of the U.S. involvement.

President Trump is also set to discuss Venezuela with U.S. oil executives at the White House on January 9.

Russian forces are systematically testing European defenses with drones, aircraft, and warships, signaling a strategy that extends far beyond the war in Ukraine. These are not random incursions but calculated probes designed to normalize intrusion and desensitize the West. Backing this strategy is a revitalized military-industrial machine working around the clock, with shipyards launching ice-capable submarines and factories stockpiling long-range missiles.

A deep dive into Moscow's procurement priorities reveals three alarming trends in its naval and missile sectors: a rapid expansion of production facilities, a clear focus on strategic platforms targeting Europe, and investments geared for long-term operational endurance.

Unless NATO abandons its reactive posture for credible deterrence—enforced red lines, offensive capabilities, and sustained support for Ukraine's drone innovation—Moscow will continue to set the terms of confrontation long after the current war ends.

While Ukraine's maritime drones have battered Russia's Black Sea fleet, Moscow has doubled down on shipbuilding. With Turkey's closure of the Bosphorus Strait preventing naval reinforcements, a singular focus on the Ukrainian theater would suggest deprioritizing naval assets. Instead, the opposite is happening.

Russian shipyards are now concentrating on platforms that directly threaten Europe's maritime corridors. The order books are filled with ice-capable fleets, nuclear service vessels, and advanced diesel-electric submarines. These are not assets designed to challenge the U.S. Navy in the open ocean; they are built for the constrained waters around Northern Europe, where they can carry cruise missiles and electronic warfare systems into NATO's most vulnerable areas.

The industrial metrics confirm this pivot:

• Financial Turnaround: St. Petersburg's Baltic Shipyard swung from a $264 million loss to a $41 million profit in just one year after securing a wave of state contracts, including for nuclear maintenance vessels intended for the Arctic.

• Resource Surge: Steel consumption at Baltic Shipyard jumped 98% in a year, while Vyborg Shipyard saw a 93% increase since 2022, highlighting the scale of state subsidies.

• Industrial Consolidation: A $2.6 billion plan is underway to merge five St. Petersburg shipyards into a single, modernized cluster, making Russia's naval industry more resilient and capable of rapid mobilization.

This industrial effort is already yielding results. Admiralty Shipyards continues to produce non-nuclear submarines like the Project 636.3 Yakutsk and the Lada-class Kronstadt. While less formidable than nuclear subs in open oceans, these vessels are highly effective in the North Sea, Baltic, and Mediterranean. By arming these smaller ships and submarines with long-range cruise missiles, Russia can threaten European cities and infrastructure from multiple, unpredictable angles, exploiting existing air defense gaps.

Russia's missile production has surged since 2023, pointing to a strategy of stockpiling for future conflicts rather than simply replenishing its forces in Ukraine. According to Ukrainian intelligence, Russia is producing 115-130 long-range systems per month—a pace that far exceeds its typical usage against Ukraine, where it often favors cheaper Shahed-type drones.

This output includes Kalibr cruise missiles, Kh-101/102 air-launched weapons, and Iskander ballistic missiles, all capable of striking European capitals and NATO bases. The industrial expansion supporting this surge is undeniable:

• Votinks Machine-Building Plant: This facility, which produces Iskander missiles, has installed thousands of new machines and hired thousands of additional workers since 2022.

• Biysk Oleum Plant: A new facility is being built here to produce up to 6,000 metric tons of high explosives annually.

• Sverdlova Plant: This munitions manufacturer received billions in state investment to boost TNT production for missile warheads.

• MKB Novator: The producer of Kalibr and Iskander missiles shifted to 24/7 operations early in the war.

• Krasnoyarsk Machine-Building Plant: This plant is accelerating the serial production of the RS-28 Sarmat heavy intercontinental ballistic missile.

Together, these naval and missile assets provide Moscow with a flexible toolkit for coercion. Russian Navy ships armed with Kalibr missiles already operate within striking distance of European capitals from the Baltic and Mediterranean. Meanwhile, strategic bombers conduct regular flights over the Barents and Norwegian Seas, normalizing a military presence on NATO's northern flank and using the region as a training ground for deep strikes into Europe.

Moscow's industrial strategy is designed to make sustained pressure on Europe cheap and operationally feasible. Its current approach of testing NATO's limits with limited responses—airspace closures, diplomatic statements, and fighter scrambles—only encourages further escalation.

To regain the initiative, NATO and the EU must shift their strategy.

Enforce Clear Red Lines

Deterrence must move from press statements to operational rules. NATO should publicly define automatic consequences for intrusions. Drones should be intercepted by default, warships denied access to specific zones, and sanctions targeting enablers should be triggered within 48 hours. Violations must incur predictable and immediate costs.

Develop Offensive Strike Capabilities

A defensive "drone wall" of sensors and electronic warfare systems is necessary but not sufficient. Effective deterrence requires the ability to strike back. European leaders must openly develop and discuss long-range strike options—cruise missiles, armed drones, and cyber capabilities—that raise the cost of Russian aggression and sabotage. A credible offense is essential to changing Moscow's risk calculus.

Fund Ukraine's Drone Innovation

Europe must treat Ukraine's drone ecosystem as its forward defense laboratory. The rapid innovation, mass production, and battlefield testing happening in Ukraine are developing the exact capabilities Europe will need. Funding this ecosystem is not charity; it is a direct investment in Europe's future security, ensuring the right tools and tactics are ready when the pressure shifts fully to NATO territory.

Russia's military buildup is already reshaping Europe's security environment. Its investments are creating a coercive arsenal aimed squarely at the continent. If Europe fails to articulate and enforce its own red lines, Moscow will continue to write the script.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up