Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Israeli Military Reportedly Closely Coordinating With US Military On Military Action Against Iran] According To Israeli Sources On The 30th, The Israel Defense Forces (IDF) And The US Military Are Closely Coordinating On Military Action Against Iran. A Senior US Official Stated That After The Relevant Military Deployments Are In Place, US President Trump May "make A Decision On Whether To Launch A Strike" In The Coming Days. Israeli Assessments Suggest That Even A Limited-scale US Strike Could Trigger A Significant Iranian Military Retaliation, In Which Case Israel Will Respond Forcefully. Israel Believes That The US Is More Likely To Focus Potential Strikes On Iranian Nuclear Facilities And Missile-related Infrastructure, Rather Than Seeking To Directly Overthrow The Iranian Regime Through Limited Military Action

Syrian Kurdish Forces Says It Agreed To Deployment Of Syria's Internal Security Forces In Cities Of Hasakeh, Qamishli

China's Ministry Of Finance Announced That A Provisional Import Tax Rate Of 5% Will Be Implemented On Whiskey Starting February 2, 2026

Syrian Kurdish Force Says It Has Agreed To Phased Integration Of Military Forces Into Syrian Government As Part Of Comprehensive Deal

Both WTI And Brent Crude Oil Rose By $0.70 In The Short Term, Currently Trading At $64.46/barrel And $68.41/barrel Respectively

Ukrainian President Zelensky: During The Talks In Abu Dhabi, The United States Proposed That Neither Moscow Nor Kyiv Should Use Long-range Combat Capabilities

Ukrainian President Zelensky: (Regarding Stopping The Attacks On Energy Targets) This Is Our Initiative, And Also President Trump's Personal Initiative. We See It As An Opportunity, Not A Deal

Ukrainian President Zelensky: The Date Or Location Of The Next Meeting Between Ukrainian, Russian, And American Negotiators May Change

Ukrainian President Zelensky: Willing To Attend Any Form Of Leaders' Summit, But Not In Moscow Or Belarus

Ukrainian President Zelensky: There Is No Formal Ceasefire Agreement Between Ukraine And Russia Regarding Energy Targets

Ukrainian President Zelensky: (Regarding Russian President Putin) I Publicly Invited Him (to Kyiv), Of Course, If He Dares To

Ukrainian President Zelensky: Ukraine Will Be Technically Ready To Join The European Union By 2027

Ukrainian President Zelensky: If Russia Stops Attacking Ukraine's Energy Infrastructure, Ukraine Will Not Attack Russia's Energy Infrastructure

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)A:--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)A:--

F: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US outlines a Gaza demilitarization plan centered on a funded Hamas weapons buyback, linking Israeli troop withdrawal to disarmament under international oversight.

The United States has outlined a plan to demilitarize Gaza that centers on an internationally funded program to buy back weapons from Hamas. The proposal, detailed at the U.N. Security Council, directly links further Israeli troop withdrawals to the militant group relinquishing its arms.

This initiative follows an October ceasefire agreement brokered by U.S. President Donald Trump. Under the terms of that deal, Hamas still controls just under half of the Gaza Strip, and the next phase of de-escalation depends entirely on its disarmament.

According to U.S. Ambassador to the United Nations Mike Waltz, the United States and the 26 countries in Trump's "Board of Peace" will pressure Hamas to disarm. The plan, which reflects point 13 of Trump's 20-point Gaza peace plan, aims to completely remove Hamas from any governing role.

"Hamas must not have any role in the governance of Gaza, directly or indirectly, in any form, period," Waltz told the 15-member council.

The core components of the demilitarization process include:

• Infrastructure Removal: All military infrastructure, including tunnels and weapon production facilities, will be destroyed and not rebuilt.

• Independent Oversight: International monitors will supervise the process of placing all weapons "permanently beyond use."

• Funded Decommissioning: The effort will be supported by an "internationally funded buyback and reintegration program."

A U.S. State Department spokesperson confirmed that discussions on implementing this second phase are ongoing.

While Hamas has reportedly agreed to discuss disarmament with other Palestinian factions and mediators, its officials told Reuters they have not yet received a detailed or concrete proposal from Washington or other intermediaries.

Meanwhile, a U.S. official, speaking anonymously, suggested that Washington believes disarmament would likely be paired with some form of amnesty for Hamas militants.

From the Israeli perspective, Hamas remains a significant military threat. Israel's U.N. Ambassador Danny Danon informed the Security Council that the group still possesses a large arsenal. "It still holds thousands of rockets, anti-tank missiles, and tens of thousands of Kalashnikov rifles," Danon stated, estimating a total of roughly 60,000 assault rifles. He added that these weapons are used against both Israel and Gazans who oppose Hamas rule.

A key part of the U.S. plan involves deploying a temporary International Stabilization Force (ISF) in Gaza. This force is authorized by the Board of Peace to establish stability, creating the conditions for the Israeli Defense Forces to withdraw.

"The ISF will begin to establish control and stability, so that the Israeli Defense Forces can withdraw from Gaza based on standards, milestones and time frames linked to demilitarization," Waltz explained.

These withdrawal terms are to be agreed upon by the Israeli military, the ISF, and the guarantors of the ceasefire agreement—the United States, Egypt, and Qatar. While Waltz thanked countries contributing to the ISF, the U.S. has not yet announced which nations have committed forces.

The diplomatic framework for this initiative was established in November when the U.N. Security Council mandated Trump's Board of Peace to operate through 2027 with a focus on Gaza.

The resolution positions the board as a transitional administration responsible for coordinating redevelopment funding until the Palestinian Authority is deemed sufficiently reformed. However, the U.S.-drafted resolution faced some opposition; Russia and China abstained from the vote, citing concerns that it did not provide the United Nations with a clear role in shaping Gaza's future.

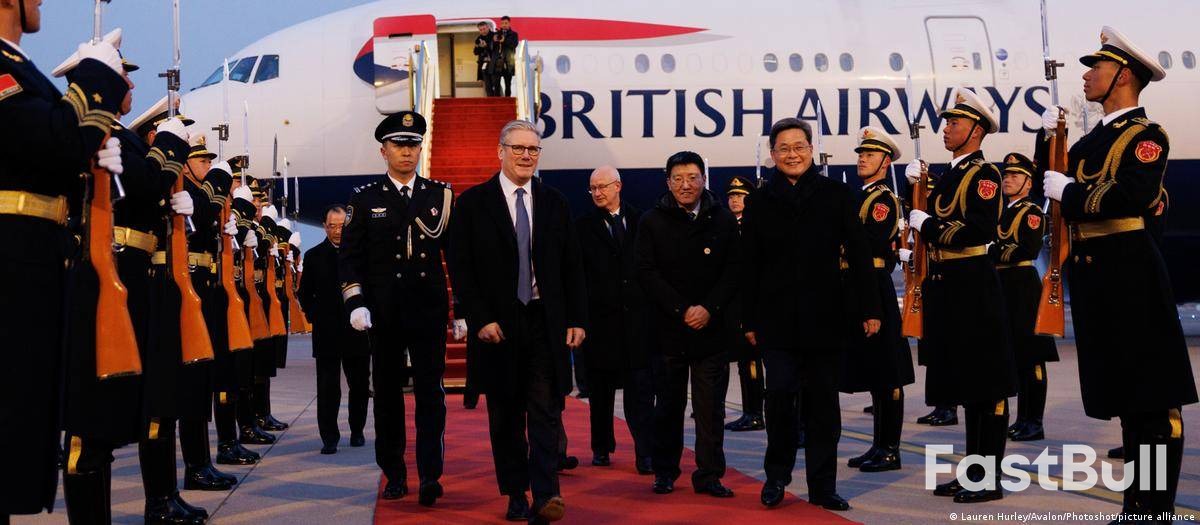

UK Prime Minister Keir Starmer arrived in Beijing on Wednesday, leading a business delegation on a three-day visit aimed at strengthening ties with China. The trip marks the first time a British prime minister has visited the country in over seven years, since Theresa May's visit in 2018.

Starmer's goal is to reinforce both political and commercial links with China, navigating a relationship strained by a tense decade and the shifting dynamics between Western nations and the United States under Donald Trump.

Facing criticism at home for not adopting a tougher stance, Starmer argued that while the UK must be vigilant about security threats, it cannot afford to disengage from the world's second-largest economy.

"It doesn't make sense to stick our head in the ground and bury it in the sand when it comes to China, it's in our interests to engage," Starmer told reporters during the flight. "It's going to be a really important trip for us and we'll make some real progress."

China has recently ramped up its diplomatic outreach, extending invitations to a series of Western leaders following a period of relative isolation during the COVID pandemic. This diplomatic flurry comes as Beijing navigates its own trade disputes with Washington.

In recent months, delegations from France, South Korea, Ireland, and Finland have all traveled to China. Canadian Prime Minister Mark Carney's visit occurred just days before he delivered a speech at the World Economic Forum in Davos that was widely interpreted as a critique of Trump. Following the trip, Trump threatened Canada with tariffs over a bilateral accord reached during Carney's visit.

The diplomatic activity is set to continue, with German Chancellor Friedrich Merz expected in Beijing at the end of February. This series of engagements follows last year's tariff dispute between China and the US and precedes a planned visit by Trump to China in early April.

Prime Minister Starmer's schedule is packed with high-level meetings and economic discussions.

On Thursday, the Labour prime minister is scheduled to hold talks with President Xi Jinping and Prime Minister Li Qiang. Following the political meetings in the capital, Starmer and his delegation of roughly 60 representatives from business, sport, and culture will travel to the financial hub of Shanghai on Friday for discussions with local executives.

The visit is not without its challenges. Starmer's government has faced domestic criticism over the planned construction of a massive new Chinese Embassy in London. Furthermore, the ongoing suppression of freedoms in Hong Kong, a former British colony, remains a significant point of friction.

When asked, Starmer did not confirm whether he would raise specific issues such as the recent conviction of media tycoon Jimmy Lai or other legal and democratic concerns in Hong Kong.

He also sought to dismiss concerns that the visit could jeopardize the UK's relationship with the US. Describing his approach, Starmer said, "I'm a pragmatist, a British pragmatist applying common sense."

Remarks of Officials

Economic

Energy

Forex

Political

Data Interpretation

Middle East Situation

Daily News

Commodity

Oil prices climbed to their highest level since late September on Wednesday, pushed higher by a combination of escalating tensions around Iran, tightening supply, and a weakening U.S. dollar.

By 1:57 p.m. ET, Brent crude futures had advanced 1.12% to $68.33 a barrel, while U.S. West Texas Intermediate (WTI) crude rose 1.22% to $63.15. Both benchmarks are now poised for their largest monthly percentage gains since July 2023, with Brent up approximately 12% and WTI up around 10% for the month.

Growing concerns over Iran are a primary factor supporting the price rally. U.S. President Donald Trump on Wednesday urged Tehran to negotiate a nuclear weapons deal, warning that a future U.S. attack would be "far worse" if they refused. Iran responded by stating it would fight back "as never before."

Adding to the tension, U.S. officials confirmed that an American aircraft carrier and its supporting warships arrived in the Middle East earlier this week.

"The markets were up on concerns about the U.S.' armada," noted Phil Flynn, senior analyst at Price Futures Group. However, he added that prices pulled back slightly on the "possibility of peace" between Russia and Ukraine, with trilateral talks set to resume in Abu Dhabi on February 1.

In a surprise development, the U.S. Energy Information Administration (EIA) reported on Wednesday that domestic crude oil inventories fell by 2.3 million barrels last week. This defied analysts' expectations of a 1.8 million-barrel increase, bringing total stockpiles down to 423.8 million barrels.

Giovanni Staunovo, an analyst at UBS, described the data as a "solid report," pointing to "strong crude exports and lower imports" as key drivers for the draw. "The next report will be more interesting, to see the impact of the cold weather on the data," he added.

The recent winter storm that swept across the United States has also constrained supply. The severe weather strained energy infrastructure, and U.S. crude output was estimated to be down by roughly 600,000 barrels per day—about 4% of the nation's total production—as producers worked to bring wells back online.

The oil rally is also receiving a boost from macroeconomic factors, particularly a weak U.S. dollar. The greenback is currently hovering near four-year lows against a basket of major currencies. A weaker dollar makes oil, which is priced in dollars, more affordable for buyers using other currencies. Market participants are closely watching the Federal Reserve, which is expected to hold interest rates steady in its upcoming decision.

Meanwhile, global supply remains under pressure due to production losses in Kazakhstan. While the OPEC+ member hopes to gradually resume output at its Tengiz field within a week, some sources suggest the recovery could take longer.

In a balancing development, the CPC pipeline operator, which handles about 80% of Kazakhstan's oil exports, has reportedly restored full loading capacity at its Black Sea terminal following maintenance.

Spot gold surged past $5,300 on Wednesday, propelled by a sharp decline in the U.S. dollar. The Dollar Index, which measures the greenback against other major currencies, recently hit a four-year low following comments from President Donald Trump that appeared to welcome a weaker currency.

This dynamic highlights a classic inverse relationship in financial markets: one asset's weakness can directly translate into another's strength. While gold's rally is already supported by factors like geopolitical risk, inflation concerns, and expectations of lower interest rates, the potential for a deliberate weak-dollar policy from the U.S. has added a new layer of complexity for traders.

When asked about the dollar's recent decline during a visit to Iowa, President Trump's response caught the market's attention. "I think it's great, the value of the dollar," he said, adding, "If you look at China and Japan, I used to fight like hell with them, because they always wanted to devalue."

These remarks are now prompting traders to consider whether the dollar's slide is not just a market reaction to uncertainty but an intentional goal of the administration. Matthew Ryan, head of market strategy at Ebury, noted that this could be the "opening act of a more coordinated policy effort from the Trump administration to actively pursue a weaker dollar."

A weaker dollar can make U.S. exports cheaper for foreign buyers, potentially reducing the trade deficit and boosting the overseas profits of American multinational corporations. However, for the average person in the U.S., it means reduced purchasing power.

Nigel Green, founder of deVere Group, commented that "the dollar's supremacy is cracking." He added, "When leaders and policymakers appear unconcerned about sharp declines, traders assume volatility will persist."

With the dollar's direction in question, all eyes are turning to the Federal Reserve. Market participants are closely watching for any comments on the currency from Fed Chair Jerome Powell following the central bank's latest interest-rate decision.

Looking ahead, many strategists anticipate that gold prices will continue their ascent. A weaker dollar, which competes with gold as a safe-haven asset, could provide an additional catalyst. Amy Gower, a metals and mining strategist at Morgan Stanley, described dollar weakness as an "additional tailwind" for gold.

Gower also pointed to other supportive factors, including strong investor appetite for real assets and central bank rate cuts, which benefit non-yielding assets like commodities.

Morgan Stanley recently highlighted that gold remains the dollar's "biggest challenger." As of September, the precious metal's share of central bank reserves surpassed that of U.S. Treasurys for the first time since 1996.

Despite the bullish long-term outlook, the rapid pace of gold's recent rally raises the risk of a short-term correction.

James Steel, chief precious metals analyst at HSBC, warned that the "near parabolic move in gold does invite volatility." He suggested that any positive news could trigger a wave of profit-taking from investors, leading to a temporary pullback in the price of the precious metal.

The Federal Reserve is holding its policy interest rate steady, aligning with market expectations but offering no clear signal on when it might begin cutting rates. According to analysis from Fed observer Nick Timiraos, the central bank is waiting for more definitive economic data before making its next move.

While projections from December showed that 12 of 19 Fed officials anticipated at least one rate cut this year, Timiraos notes that this outcome hinges on one of two scenarios materializing first:

• A significant deterioration in the U.S. labor market.

• Inflation returning convincingly to the Fed's 2% target.

Until one of these conditions is met, the central bank appears content to maintain its current policy stance.

Since the December projections were released, neither of the necessary conditions for a rate cut has been satisfied.

On the employment front, job growth has slowed, but the unemployment rate has remained largely stable, preventing the trigger of a weak labor market.

Meanwhile, inflation data has become difficult to interpret. Timiraos points out that recent figures have been unpredictable, partly due to statistical disruptions caused by a government shutdown, making it harder to confirm a clear downward trend toward the 2% goal.

Given the lack of a clear economic signal, the timeline for a rate cut remains uncertain. Timiraos suggests that if the labor market does not show further signs of weakening, the next rate reduction could be postponed until after Federal Reserve Chairman Jerome Powell's term ends in May.

The Federal Open Market Committee (FOMC) has decided to hold its policy rate steady, maintaining the target range of 3.5%-3.75%. This move marks a significant pause after the committee enacted three consecutive quarter-point cuts in its previous meetings, which were framed as "risk management" measures.

The committee's latest press release indicates a notable shift in its assessment of the U.S. economy, with key language changes suggesting a reduced need for further rate cuts.

An Upgraded View on the Economy and Labor

The FOMC's characterization of economic activity was upgraded from "moderate" to "solid," reflecting a stronger performance.

Critically, the statement no longer includes the prior reference to "the downside risks to employment having increased." This omission suggests the committee believes the immediate dangers have subsided and further "risk management" cuts are not necessary.

The description of the labor market was also updated to reflect recent data:

• Job gains are now described as "remaining low," a change from the previous "having slowed."

• The unemployment rate is noted as "showing some signs of stabilizing," an improvement from the earlier description that it "has moved up since earlier this year."

A Subtler Stance on Inflation

While inflation is still viewed as "somewhat elevated," the FOMC dropped its previous language stating that it "has moved up since earlier in the year." This adjustment acknowledges more recent inflation readings, which have been cooler.

The decision to hold rates was not unanimous. Ten of the twelve committee members voted in favor of the pause. However, Stephen Miran and Christopher Waller dissented, both advocating for another quarter-point rate cut.

Today's widely expected decision signals that the FOMC is entering a wait-and-see phase. With the risk management cuts now complete and the policy rate approaching a more neutral level, the committee intends to observe how last year's monetary easing impacts the broader economy.

The changes in the official statement establish a higher threshold for any future rate cuts. This more hawkish stance is supported by a labor market that is showing signs of stabilization and economic activity that appeared to finish last year on solid footing.

Looking ahead, this momentum could carry into 2026, potentially amplified by fiscal stimulus from the "One Big Beautiful Bill." Barring an unexpected downturn in the labor market, the FOMC is likely to remain on the sidelines. The committee will probably wait for more definitive progress toward its 2% inflation target, a development that is not anticipated until later this year.

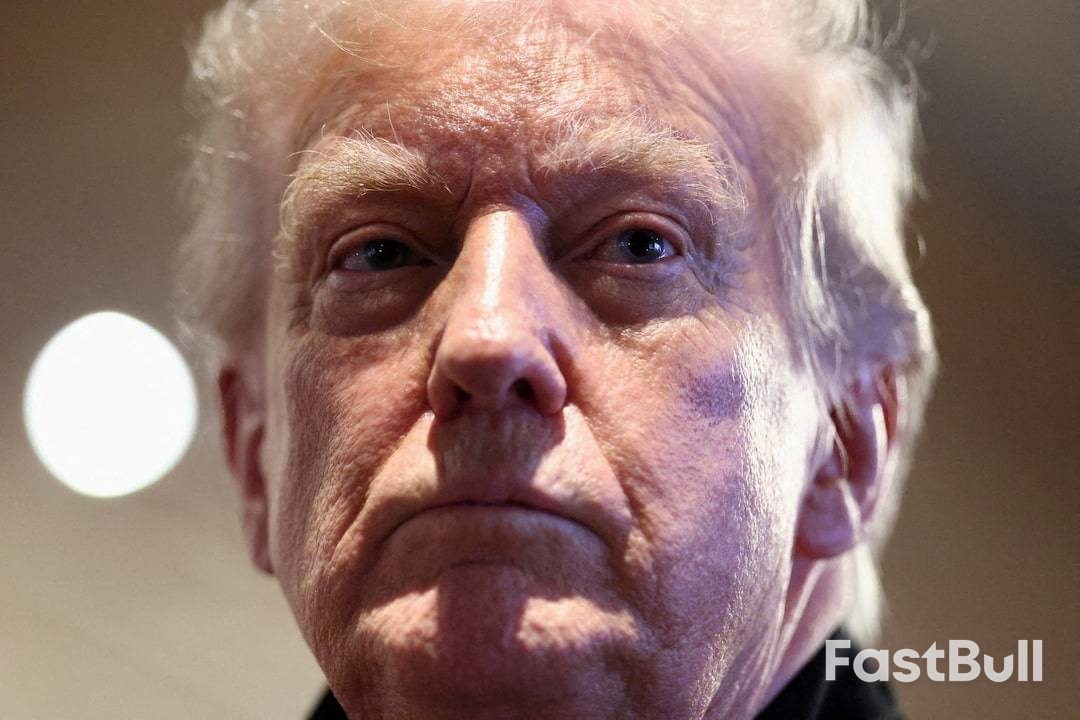

U.S. President Donald Trump has issued a stark ultimatum to Iran: return to the negotiating table to forge a new nuclear agreement or risk a military strike "far worse" than previous encounters. Tehran swiftly rejected the threat, vowing to retaliate against the United States, Israel, and their allies if attacked.

The escalating war of words highlights the deep-seated tensions between the two nations as the U.S. increases its military presence in the Middle East.

In a social media post, President Trump urged Iran to "Come to the Table" and negotiate a "fair and equitable deal" with a clear red line: "NO NUCLEAR WEAPONS." He emphasized the urgency, stating, "Time is running out, it is truly of the essence!"

Trump, who withdrew the U.S. from the 2015 world powers' nuclear deal with Iran, explicitly referenced a previous military strike in June as a precedent. "The next attack will be far worse! Don't make that happen again," he wrote, adding that a U.S. "armada" was heading toward the region.

This naval force, led by the aircraft carrier USS Abraham Lincoln, has already arrived in the Middle East, according to U.S. officials. The warships were redeployed from the Asia-Pacific as tensions spiked following a crackdown on widespread protests within Iran.

Iran's leadership responded with defiance. Ali Shamkhani, an adviser to Supreme Leader Ayatollah Ali Khamenei, declared that any U.S. military action would trigger an Iranian response targeting the U.S., Israel, and their supporters.

Iranian Foreign Minister Abbas Araqchi reinforced this message, stating that the nation's armed forces "are prepared—with their fingers on the trigger—to immediately and powerfully respond to ANY aggression."

While signaling military readiness, Araqchi also outlined Iran's conditions for diplomacy. He said Iran has "always welcomed a mutually beneficial, fair and equitable NUCLEAR DEAL," but one that is negotiated "on equal footing, and free from coercion, threats, and intimidation." Such a deal must also ensure Iran’s rights to peaceful nuclear technology and guarantee no nuclear weapons.

Araqchi also denied recent contact with U.S. special envoy Steve Witkoff or having requested negotiations, according to state media reports.

The military posturing occurs against a backdrop of significant internal challenges for Iran. U.S. Secretary of State Marco Rubio told a congressional committee that the Iranian government is likely weaker than ever and its economy is collapsing. He predicted that recent anti-government protests, sparked by economic hardship and political repression, would re-emerge.

President Trump had previously threatened to intervene if Iran continued its violent crackdown on demonstrators, though the countrywide protests have since subsided.

A spokesperson for Iran's Islamic Revolutionary Guard Corps confirmed that the country has prepared operational plans for all possible scenarios, signaling that Tehran is bracing for a potential conflict.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up