Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

ECB Monetary Policy Statement

ECB Monetary Policy Statement Canada Average Weekly Earnings YoY (Oct)

Canada Average Weekly Earnings YoY (Oct)A:--

F: --

U.S. Core CPI YoY (Not SA) (Nov)

U.S. Core CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. CPI YoY (Not SA) (Nov)

U.S. CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. Core CPI (SA) (Nov)

U.S. Core CPI (SA) (Nov)A:--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Dec)

U.S. Kansas Fed Manufacturing Production Index (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Nov)

U.S. Cleveland Fed CPI MoM (Nov)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoY--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)--

F: --

P: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)--

F: --

P: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)--

F: --

P: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The U.S. crypto industry celebrated major 2025 regulatory wins under Trump, but key legislation may stall before 2026 elections, leaving firms exposed to shifting rules and uncertain long-term stability.

WASHINGTON, Dec 18 (Reuters) - U.S. consumer prices increased less than expected in the year to November, but the moderation was likely technical after the 43-day government shutdown delayed data collection late into the month, when retailers offered holiday season discounts.

The shutdown also prevented the Labor Department's Bureau of Labor Statistics from publishing month-to-month changes for November's Consumer Price Index report on Thursday, as most of the price data for October was not collected. The October CPI release was canceled because the data could not be collected retroactively. It was the first time that the BLS did not publish monthly CPI rates.

The shutdown also prevented the statistics agency this week from publishing an unemployment rate for October for the first time since the government started tracking the series in 1948. Policymakers, investors, businesses and households will have to wait for December data for clarity on inflation and the health of the labor market.

"The lack of detail and the absence of data collection during the shutdown introduce a degree of skepticism that's hard to ignore," said Olu Sonola, head of U.S. economic research at Fitch Ratings. "We will need to wait until next month for a clearer read on inflation."

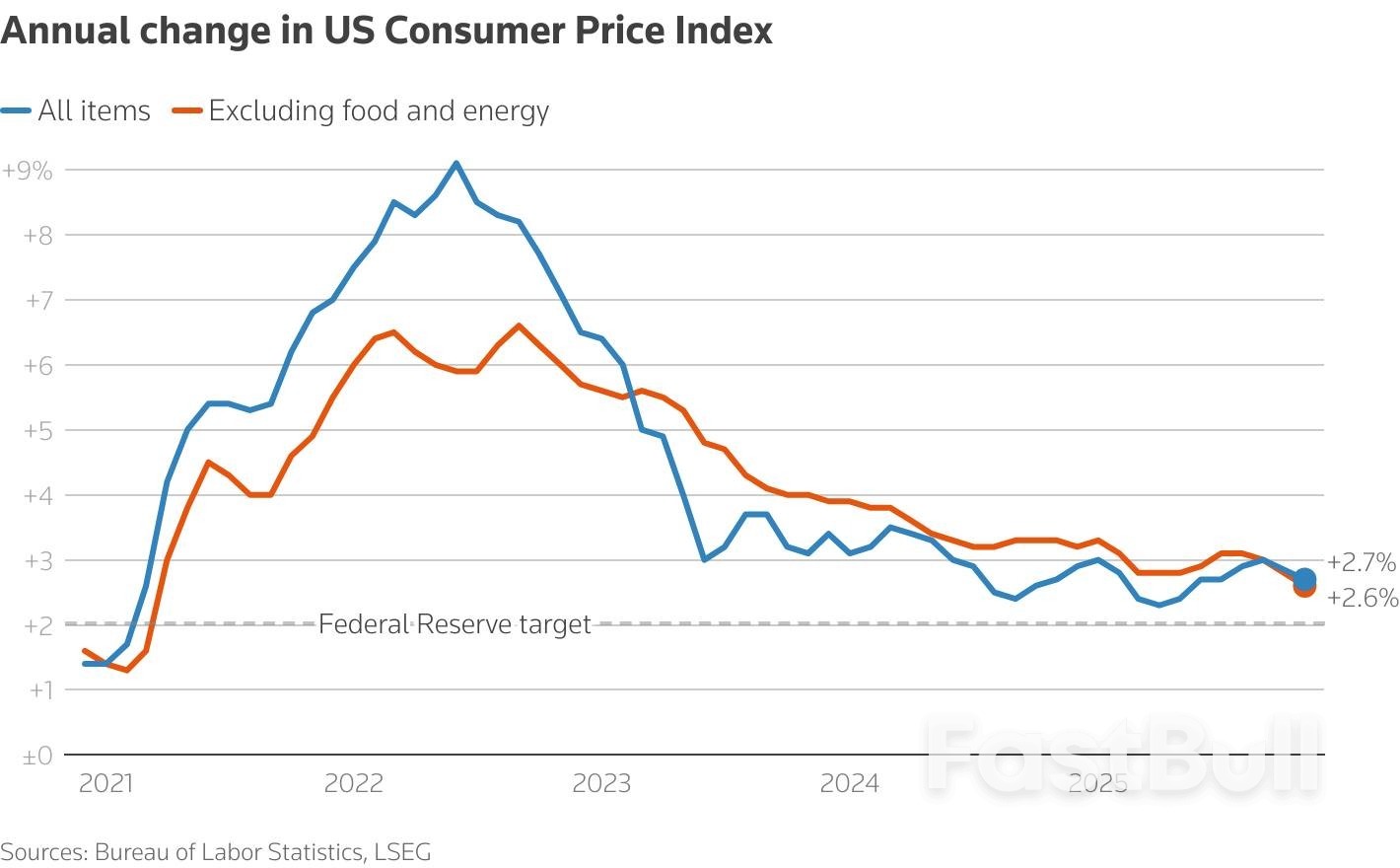

The CPI rose 2.7% on a year-over-year basis in November after increasing 3.0% in the 12 months through September. Economists polled by Reuters had forecast the CPI would advance 3.1%. The CPI gained 0.2% over the two months ending in November. The BLS said it "cannot provide specific guidance to data users for navigating the missing October observations."

The smaller-than-expected increase in the CPI was likely the result of data collection being delayed late into November, when retailers offered holiday season discounts. Economists expect an acceleration in December, which would increase pressure on households facing affordability challenges that have been partly blamed on import tariffs.

Beef prices increased 15.8% on a year-over-year basis in November, while the cost of coffee surged 18.8%. Electricity prices rose 6.9%.

Egg prices, however, decreased 13.2% and gasoline prices rose only 0.9%. New motor vehicle prices increased 0.6% on a year-over-year basis. It could take some time for consumers to see lower prices from the White House's rollback of duties on some goods including beef, bananas and coffee, economists said.

President Donald Trump's sweeping import duties have raised prices for many goods, though the tariff pass-through has been gradual as businesses worked through inventory accumulated prior to the trade policy tightening and also absorbed some of the taxes, evident in the small rise in new motor vehicle prices.

Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics, calculated that retailers had passed on about 40% of tariffs by September, adding that "we expect that proportion to climb gradually to 70% by March and then stabilize."

U.S. stocks were trading higher and Treasury yields were lower. The dollar slipped against a basket of currencies.

A line chart with the title 'Annual change in US Consumer Price Index'

A line chart with the title 'Annual change in US Consumer Price Index'Economists say the tariff burden is falling disproportionately on lower-income households, who have little or no savings buffer and have also experienced slower wage growth relative to other workers.

Trump, who won the 2024 presidential election on promises to tame inflation, has in recent weeks alternated between dismissing affordability problems as a hoax, blaming former President Joe Biden, and promising that Americans will benefit from his economic policies next year.

Excluding the volatile food and energy components, the CPI increased 2.6% on a year-over-year basis in November. The so-called core CPI rose 3.0% in September. Core CPI inflation increased 0.2% over the two months ending in November.

The Federal Reserve tracks the Personal Consumption Expenditures Price indexes for its 2% inflation target.

The PCE price measures are calculated from some components of the CPI and PPI baskets. The PPI report for October was canceled. The producer inflation report will now be released in mid-January. The government has yet to set a new release date for November's PCE price data. Both PCE price measures were well above target in September.

The Fed last week cut its benchmark overnight interest rate by another 25 basis points to the 3.50%-3.75% range, but signaled borrowing costs were unlikely to fall further in the near term as the U.S. central bank awaits clarity on the direction of the labor market and inflation.

Fed Chair Jerome Powell told reporters in a post-meeting press conference that "it's really tariffs that are causing most of the inflation overshoot."

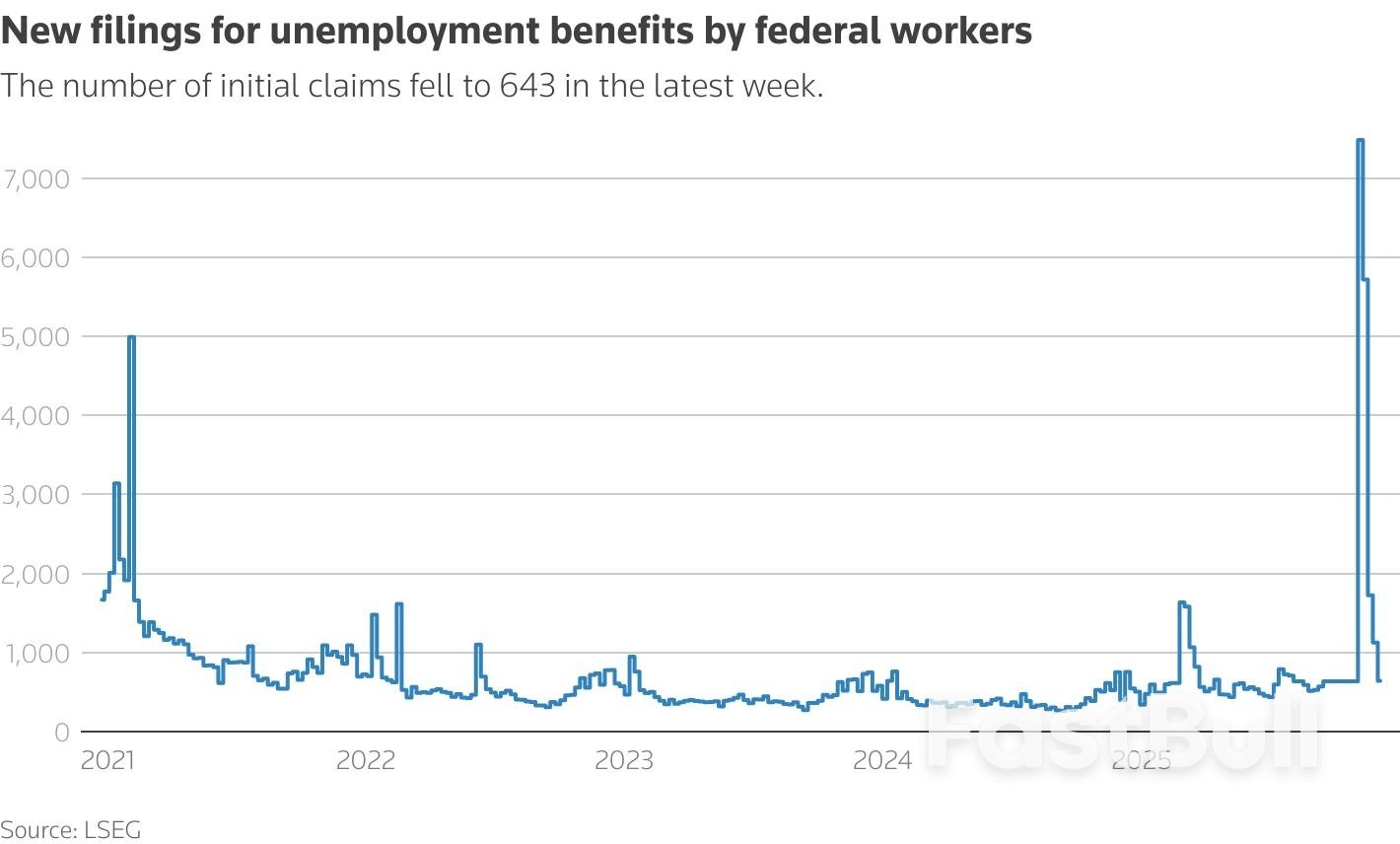

In a separate report, the Labor Department said initial claims for state unemployment benefits dropped 13,000 to a seasonally adjusted 224,000 for the week ended December 13, reversing the prior week's surge and suggesting labor market conditions remained stable in December.

A line chart with the title 'New filings for unemployment benefits by federal workers'

A line chart with the title 'New filings for unemployment benefits by federal workers'Claims have see-sawed in recent weeks, reflecting challenges adjusting the data around the Thanksgiving holiday. The tone of the labor market has not changed much, with employers reluctant to hire more workers, but not embarking on mass layoffs either.

Economists say Trump's tariffs have caused an unexpected shock for businesses, which have responded by pulling back on increasing head count.

A survey of 548 chief financial officers at firms with one to more than 1,000 employees showed on Wednesday that they continued to cite tariffs as a top concern. The survey was conducted by the Richmond and Atlanta Federal Reserve banks in conjunction with Duke University's Fuqua School of Business.

The claims data covered the period during which the government surveyed businesses for the nonfarm payrolls component of December's employment report. Nonfarm payrolls increased by 64,000 jobs in November, the BLS said on Tuesday.

The employment report for December will be released on schedule in January. Though the unemployment rate was at 4.6% in November, the highest level since September 2021, it was distorted by technical factors related to the shutdown.

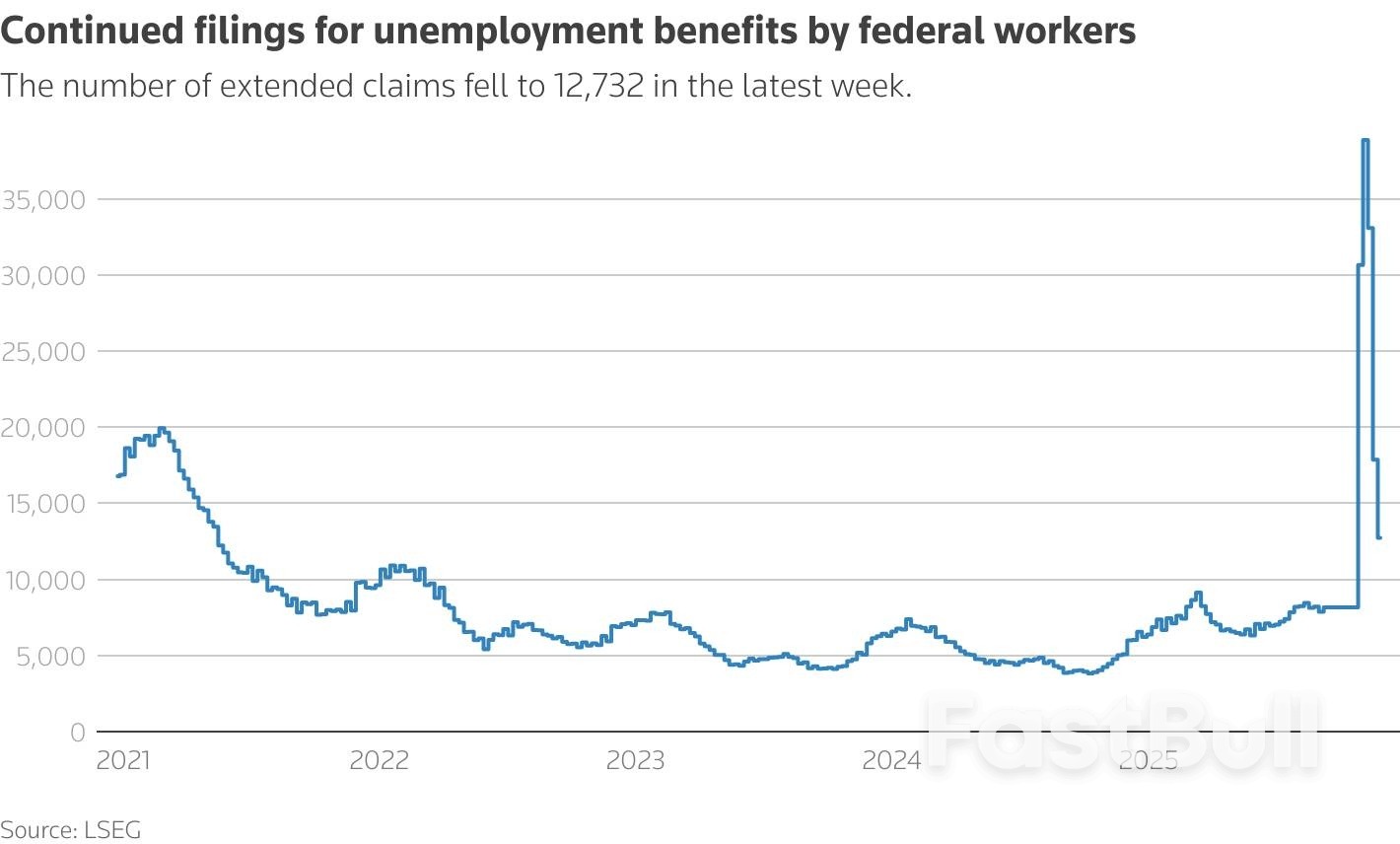

Tepid hiring is causing long bouts of unemployment for some workers who have lost their jobs. The number of people receiving unemployment benefits after an initial week of aid, a proxy for hiring, increased 67,000 to a seasonally adjusted 1.897 million during the week ending December 6, the claims report showed.

A line chart with the title 'Continued filings for unemployment benefits by federal workers'

A line chart with the title 'Continued filings for unemployment benefits by federal workers'Brazil's Senate approved legislation to reduce the sentence former leader Jair Bolsonaro must serve for plotting a coup after his narrow 2022 election loss, setting up a potential clash between Congress, President Luiz Inacio Lula da Silva and the country's Supreme Court.

On Wednesday, 48 senators voted in favor of the bill and 25 against, granting final approval to a proposal the lower house of Congress passed earlier this month. It now goes to Lula, as the president is known. He was the target of the overthrow effort Bolsonaro plotted, and who will now decide whether to veto it.

The leftist leader has suggested that he will strike down the bill that would reduce the 27-year jail sentence Bolsonaro received in September to 20 years and nine months, according to lower house calculations. The legislation also caps the time the right-wing former president would spend behind bars in a so-called "closed regime" at two years and four months, down from six-to-eight years he's currently facing.

"I will do what I understand must be done, because he has to pay for the attempted coup, for the attempt to destroy the democracy of this country," Lula said in an interview with a local TV station last week.

A veto would almost certainly exacerbate tensions between Lula and Congress at a time when the two sides have already battled over a Supreme Court nomination and other issues.

Last Sunday, Lula supporters staged large demonstrations against the legislation that seeks to reduce sentences for Brazilians convicted of crimes related to the Jan. 8, 2023 insurrection attempt that followed Lula's election, including for Bolsonaro.

It also remains unclear whether passage would pacify Bolsonaro allies, including his son Flavio, who have pushed for broad, unconditional amnesty for the former president and others involved in the insurrection attempt.

Flavio, a senator, earlier this month said he had his father's backing to run for president next year, a decision that dented investor desires to see Sao Paulo Governor Tarcisio de Freitas challenge Lula instead.

Flavio later said he was open to negotiating with centrist lawmakers over his candidacy, but that the price for dropping his presidential bid would be securing his father's freedom and eligibility to run in 2026.

The bill's passage could provide a boost to sagging investor hopes that Freitas will still run, although key Bolsonaro supporters, including the leader of his party in the lower house, have said they intend to keep pushing for total amnesty.

Regardless of Lula's decision, the case could wind up in front of the Supreme Court, which has convicted more than 800 people of crimes related to the Jan. 8 riots. If an appeal reaches the court, the justices could rule the congressional measure unconstitutional.

Justice Alexandre de Moraes, who oversees cases related to the attempted coup, criticized the idea of reducing sentences during a trial Tuesday.

"That would send a message to society that Brazil tolerates, or will tolerate, new flirtations with authoritarianism," he said. "The state's response must be firm, and punish those who attempted to destroy Brazil's democracy."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up