Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

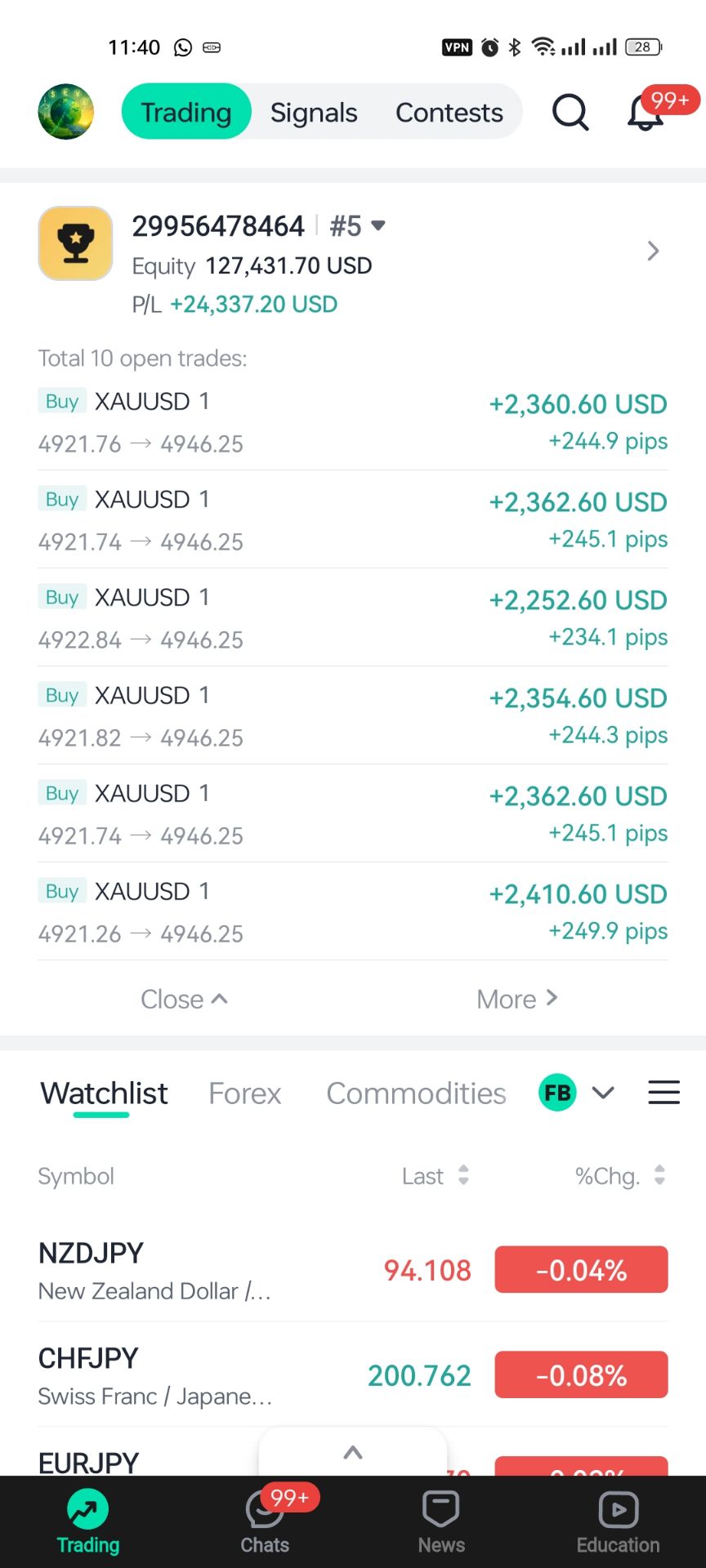

Signal Accounts for Members

All Signal Accounts

All Contests

New Zealand-Run Global Dairy Trade Price Index Rises 6.7%, With An Average Selling Price Of $ 3830/Tonne - Auction

The US AI Software Pioneer Index Closed Down 5.22% At 101.34 Points. US Stocks Fell Sharply In Early Trading And Continued To Fluctuate At Low Levels After 23:00 Beijing Time

USA Treasury Issues License Authorizing Supply Of USA Diluents To Venezuela, Administration Official Tells Reuters

Rubio Discussed Formalizing Bilateral Cooperation On Critical Minerals Exploration, Mining, And Processing With Indian External Affairs Minister - State Department

US President Trump: Millions Of Barrels Of Venezuelan Oil Seized Are Being Shipped To Houston, Texas

(US Stocks) The Philadelphia Gold And Silver Index Closed Up 4.63% At 398.43 Points. (Global Session) The NYSE Arca Gold Miners Index Rose 4.29% To 2815.40 Points. (US Stocks) The Materials Index Closed Up 4.04%, And The Metals & Mining Index Closed Up 5.35%

On Tuesday (February 3), In Late New York Trading, Spot Silver Rose 7.36% To $85.0929 Per Ounce, Reaching A Daily High Of $89.1655 At 21:46 Beijing Time. Comex Silver Futures Rose 11.05% To $85.505 Per Ounce, Reaching A Daily High Of $89.100 At 21:46. Comex Copper Futures Rose 4.47% To $6.0960 Per Pound, Experiencing A Significant Upward Surge At 14:00 – After A Period Of Low-level Consolidation, They Subsequently Traded In A High-level Range. Spot Platinum Rose 4.08%, And Spot Palladium Rose 1.82%

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

No matching data

View All

No data

Trump's election federalization push draws bipartisan criticism, fueling midterm interference fears.

President Donald Trump’s call for Republicans to “nationalize” U.S. elections has sparked sharp criticism from lawmakers, including some in his own party. Democrats, meanwhile, are voicing renewed alarm that the move signals an intent to interfere with the upcoming November midterm elections, which will decide control of Congress.

In a podcast interview released Monday, Trump repeated his false claims of a stolen 2020 election and declared that his party should “take over” and “nationalize” voting in at least 15 locations, though he did not specify what that would entail.

Under the U.S. Constitution, state and local governments are responsible for administering elections, not the federal government. Democratic officials and voting rights advocates argue Trump's comments are part of a plan to undermine or manipulate this year's results.

"This is not about the 2020 election," Democratic Senator Mark Warner of Virginia stated at a press conference. "This is frankly about what comes next."

While Trump’s base has embraced his calls to overhaul the nation's voting systems, key Republican leaders pushed back on the idea of federalizing elections.

Senate Majority Leader John Thune told reporters he was "not in favor of federalizing elections." He defended the current system, noting, "I'm a big believer in decentralized and distributed power. It's harder to hack 50 election systems than it is to hack one."

House Speaker Mike Johnson argued that a federal takeover was unnecessary but maintained that Trump's concerns about election integrity were justified. The White House later clarified that Trump wants Congress to pass the SAVE Act, a Republican bill that would impose new voter ID and citizenship verification requirements.

"The president believes in the United States Constitution," said press secretary Karoline Leavitt. "However, he believes there has obviously been a lot of fraud and irregularities that have taken place in American elections."

The controversy comes just months before the critical midterm elections. Historically, the president's party tends to lose seats, and Democrats need to flip just three Republican-held districts to win control of the House of Representatives.

Election experts warned against dismissing the president's rhetoric. "The last time he started talking like this, his allies minimized the risks and we ended up with Jan 6," wrote Brendan Nyhan, a political science professor at Dartmouth College, referencing the 2021 attack on the U.S. Capitol.

Some of Trump’s allies have suggested he could use federal funding as leverage. The government provides states with hundreds of millions of dollars annually for election administration, including cybersecurity and voting equipment. Allies believe Trump might threaten to withhold these funds from states that resist new voting measures like ID requirements or restrictions on mail-in ballots.

Concerns were amplified by recent events in Fulton County, Georgia, a key battleground in Trump’s 2020 efforts to overturn the election. Last week, the FBI executed a search warrant for 2020 ballots in the county's election office.

Alarmingly for Democrats, Tulsi Gabbard, the director of national intelligence, was present during the search. The involvement of the DNI in a domestic election operation without a clear foreign threat is highly unusual and raised immediate red flags.

Senator Warner, who co-chairs the Senate Intelligence Committee, said Gabbard’s office had not notified Congress of any foreign threats to election infrastructure. He criticized her appearance in Georgia as an act that "politicizes an institution that must remain neutral and apolitical."

In a letter to Warner and Congressman Jim Himes, Gabbard stated that Trump had requested her presence at the FBI operation. She also asserted her legal authority to coordinate and analyze election security matters. This follows her comments at an April cabinet meeting where she announced her office was investigating election integrity issues, claiming electronic voting systems are "vulnerable to exploitation."

NATO confirmed on Tuesday that it is planning a new mission in the Arctic, a move that comes just weeks after U.S. President Donald Trump created friction within the alliance by insisting the U.S. needed to control Greenland. Trump cited unverified security threats from Russia and China as justification for his stance.

Martin O'Donnell, a spokesperson for NATO's Supreme Headquarters Allied Powers Europe, announced that a "NATO enhanced vigilance activity" is being developed to "further strengthen NATO's posture in the Arctic and High North." As planning has just begun, he did not provide additional details.

The location for the exercises remains unclear. This initiative is separate from the ongoing NATO exercise in Greenland, "Operation Arctic Endurance," which is currently led by Denmark.

Germany's Spiegel newsmagazine first reported on the plans, revealing that NATO's commander, U.S. General Alexus G. Grynkewich, had ordered the development of a mission titled "Arctic Sentry." According to the report, NATO defense ministers may convene in Brussels in the coming weeks to discuss the preliminary operation plans.

The push for a stronger NATO presence follows a period of diplomatic strain. In the lead-up to the World Economic Forum in Davos last month, President Trump suggested he might use force to acquire Greenland, a strategically valuable Arctic island.

The White House did not retract these claims, with the president later repeating his assertion that the U.S. would "have" Greenland "one way or the other."

The statements put Washington's European allies in a difficult position, forcing them to balance their support for Denmark's sovereignty over Greenland with the need to avoid further antagonizing Trump and risking the integrity of the defense alliance.

Tensions appeared to ease after Trump met with NATO Secretary General Mark Rutte at Davos. Following the meeting, Trump announced he had secured a "framework" deal to protect U.S. interests and seemed to back away from his threats of force.

Rutte confirmed he had discussed with Trump how NATO allies could work together to ensure Arctic security. However, the specific details of the deal mentioned by Trump have not been made public.

Despite the apparent de-escalation, Greenland remains cautious. On Monday, Prime Minister Jens-Frederik Nielsen warned that the U.S. is still pursuing "paths to ownership and control over Greenland."

Last week, senior officials from the U.S., Denmark, and Greenland initiated diplomatic talks. According to Denmark's foreign ministry, the discussions aim to "address American concerns about security in the Arctic while respecting the Kingdom's red lines."

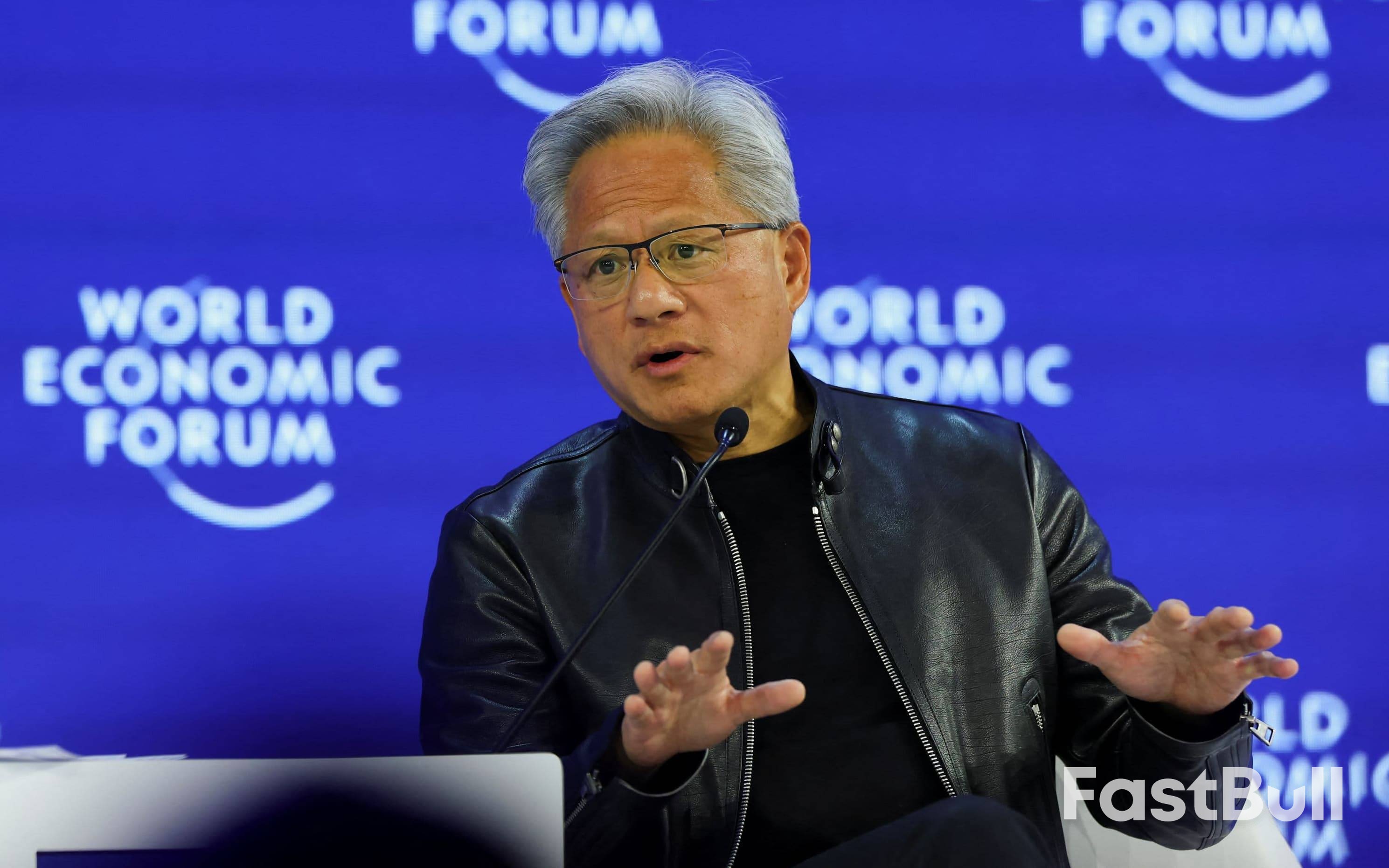

Nvidia CEO Jensen Huang has reaffirmed the company's plan to invest in OpenAI, directly pushing back on recent reports suggesting the landmark deal was in jeopardy.

"There's no drama involved. Everything's on track," Huang stated in a Tuesday interview with CNBC's Jim Cramer. His comments came as Nvidia's stock fell over 3.4% amid a wider tech sell-off, with shares now trading 13% below their October peak.

The partnership first made headlines in September when Huang and OpenAI CEO Sam Altman announced a letter of intent. The plan outlined a staggering investment of up to $100 billion from Nvidia into the AI research lab, which would use the funds to build out AI infrastructure powered by Nvidia technology and requiring up to 10 gigawatts of power.

However, doubts began to surface. An SEC filing in November revealed the deal had not been finalized. The speculation intensified over the past weekend after a Wall Street Journal report claimed the agreement was "on ice."

In his latest remarks, Huang sought to end the uncertainty by confirming Nvidia's participation in OpenAI's next fundraising round, which he described as potentially the "largest private round ever raised in history."

Last month, reports indicated that OpenAI was in discussions for a new funding round that could raise as much as $100 billion.

"We will invest in the next round," Huang said unequivocally. "There is no question about that." He also noted that Nvidia would be open to investing in subsequent rounds and would want to participate if OpenAI pursues an eventual IPO.

The relationship between the two tech giants is foundational, as OpenAI has historically relied on Nvidia's graphics processing units (GPUs) to train and run its powerful AI models like ChatGPT.

Yet, recent commentary from Sam Altman has highlighted a critical bottleneck: a shortage of AI chips. Altman has stated that OpenAI could generate significantly more revenue if it had greater access to computing power. In response, OpenAI has started to diversify its supply chain, striking deals with Nvidia's competitors, including Advanced Micro Devices, Broadcom, and Cerebras.

Despite these moves, Altman publicly dismissed any notion of a rift. In a post on X on Monday, he clarified his company's position.

"We love working with NVIDIA and they make the best AI chips in the world," Altman wrote. "We hope to be a gigantic customer for a very long time. I don't get where all this insanity is coming from."

Investors are positioning for a major shift in the bond market, betting on higher long-term Treasury yields and a steeper yield curve. The catalyst is the expected appointment of Kevin Warsh as the next Chair of the Federal Reserve, who is anticipated to pursue rate cuts while simultaneously shrinking the central bank's massive balance sheet.

This unique policy combination is forcing a market repricing, as the two actions pull financial conditions in opposite directions.

Warsh’s expected strategy hinges on two key pillars. First is his preference for a significantly smaller Fed balance sheet, which currently stands at roughly $6.59 trillion. Reducing it means the Fed would buy fewer Treasuries, effectively withdrawing a major source of demand from the market.

When the Fed steps back, more government debt supply must be absorbed by private investors. This typically pushes long-term yields higher to attract buyers, leading to a steeper yield curve.

"The main outcome of shrinking the balance sheet would be to have a yield curve that is more normally positively sloped as it was historically before all the intervention following the financial crisis," said Eric Kuby, chief investment officer at North Star Investment Management Corp.

At the same time, Warsh is expected to keep short-term rates low. Despite a reputation as a hawk during his time as a Fed governor from 2006 to 2011, he has recently adopted a more dovish stance, aligning with President Donald Trump's calls for rate cuts. This mix of low short-term rates and high long-term rates is the classic recipe for a steepening yield curve.

The bond market was already moving in this direction even before Warsh's nomination. A steepening yield curve—where the gap between long- and short-term rates widens—was being driven by concerns over inflation and rising fiscal deficits, which signal more government debt issuance ahead.

The spread between 2-year and 10-year Treasury yields recently hit 72.70 basis points, its widest level since April 9. This reflects growing investor concern about the long-term economic outlook. Higher long-term yields have a direct impact on the economy, making everything from mortgages to corporate bonds more expensive.

Warsh has argued that productivity gains from artificial intelligence are disinflationary, giving the Fed room to ease monetary policy. U.S. rate futures markets seem to agree, pricing in expectations for about two quarter-point rate cuts this year, with the first potentially coming at the June 16-17 meeting.

While the market is pricing in this outcome, analysts point to a fundamental tension in Warsh's potential approach. Cutting interest rates is a tool to ease financial conditions, while shrinking the balance sheet is a form of tightening. Executing both at once is a complex balancing act.

"It's a tough policy to administer," said Jim Barnes, director of fixed income at Bryn Mawr Trust. "You have one policy that you're using in a dovish fashion like cutting rates, and then you have another policy that you're using that leads to higher rates, like shrinking the balance sheet."

The core challenge is that if the balance sheet shrinks and long-term rates rise, the term premium—the extra yield investors demand for holding longer-term bonds—could also increase. This would counteract the Fed's efforts to ease financial conditions through rate cuts.

"They're going in opposite directions," Barnes added. "You want to cut rates and shrink the balance sheet at the same time. But how do you put that into action? And that's where it becomes problematic."

The road ahead is filled with uncertainty. Lou Crandall, chief economist at Wrightson-ICAP, noted that any plan to reduce the Fed's assets involves complex technical issues, particularly around bank liquidity regulations.

Market participants also anticipate a rise in interest rate volatility. Oscar Munoz, chief U.S. macro strategist at TD Securities, described Warsh as a potentially contentious Fed chief due to his past criticism of the central bank. Munoz highlighted Warsh's "notable 180-degree shift in policy priorities" from his previously hawkish stance during the Global Financial Crisis.

Many bond market veterans suspect Warsh may eventually revert to his hawkish instincts, which would further fuel rate volatility. The MOVE index, a key measure of bond market volatility, has been declining for months and has yet to price in the potential disruption from a new Fed chair.

Ultimately, the market is left to wonder about Warsh's true intentions. "He's changed his tune recently, and a cynic may say only to secure the nomination," said Benjamin Connard, portfolio manager at Carnegie Investment Counsel. "Rates are set by the majority, so Warsh alone cannot cut them."

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up