Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)A:--

F: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)A:--

F: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)A:--

F: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)A:--

F: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)A:--

F: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)A:--

F: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)A:--

F: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)A:--

F: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)A:--

F: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)A:--

F: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)A:--

F: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

Japan PPI MoM (Dec)

Japan PPI MoM (Dec)--

F: --

P: --

Australia Consumer Inflation Expectations (Jan)

Australia Consumer Inflation Expectations (Jan)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Dec)

U.K. 3-Month RICS House Price Balance (Dec)--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest Rate--

F: --

P: --

Saudi Arabia CPI YoY (Dec)

Saudi Arabia CPI YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Nov)

U.K. Services Index MoM (SA) (Nov)--

F: --

P: --

U.K. Services Index YoY (Nov)

U.K. Services Index YoY (Nov)--

F: --

P: --

U.K. Manufacturing Output MoM (Nov)

U.K. Manufacturing Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance (Nov)

U.K. Trade Balance (Nov)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Nov)

U.K. Monthly GDP 3M/3M Change (Nov)--

F: --

P: --

U.K. GDP MoM (Nov)

U.K. GDP MoM (Nov)--

F: --

P: --

U.K. Industrial Output MoM (Nov)

U.K. Industrial Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Nov)

U.K. Trade Balance Non-EU (SA) (Nov)--

F: --

P: --

U.K. Trade Balance (SA) (Nov)

U.K. Trade Balance (SA) (Nov)--

F: --

P: --

U.K. Manufacturing Output YoY (Nov)

U.K. Manufacturing Output YoY (Nov)--

F: --

P: --

U.K. Construction Output MoM (SA) (Nov)

U.K. Construction Output MoM (SA) (Nov)--

F: --

P: --

U.K. Industrial Output YoY (Nov)

U.K. Industrial Output YoY (Nov)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output YoY (Nov)

U.K. Construction Output YoY (Nov)--

F: --

P: --

U.K. GDP YoY (SA) (Nov)

U.K. GDP YoY (SA) (Nov)--

F: --

P: --

U.K. Trade Balance EU (SA) (Nov)

U.K. Trade Balance EU (SA) (Nov)--

F: --

P: --

France HICP Final MoM (Dec)

France HICP Final MoM (Dec)--

F: --

P: --

Germany Annual GDP Growth

Germany Annual GDP Growth--

F: --

Italy Industrial Output YoY (SA) (Nov)

Italy Industrial Output YoY (SA) (Nov)--

F: --

P: --

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Nov)

Euro Zone Industrial Output MoM (Nov)--

F: --

P: --

Euro Zone Trade Balance (SA) (Nov)

Euro Zone Trade Balance (SA) (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Nov)

Euro Zone Industrial Output YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump administration approves Nvidia H200 AI chip sales to China, reversing a Biden ban and drawing sharp criticism over national security risks.

The Trump administration is facing sharp criticism after formally approving the sale of Nvidia's powerful H200 artificial intelligence chips to China. The decision, which establishes new rules for the exports, has alarmed lawmakers and former officials who argue it compromises America's technological edge and could empower Beijing's military.

This move reverses the direction of the previous Biden administration, which had barred sales of high-end semiconductors to China over national security fears. Now, despite deep concerns among China hawks in Washington, a pathway for shipping the H200 chips has been cleared.

The policy shift has been met with immediate backlash. Matt Pottinger, who served as a senior White House Asia advisor during Trump's first term, testified at a congressional hearing that the administration is on the "wrong track" with its AI strategy.

He warned that selling H200s to China "will supercharge Beijing's military modernization," improving its capabilities in areas from nuclear weapons and cyber warfare to autonomous drones and intelligence operations. "Congress needs to put guardrails in place so that this mistake can't be repeated," Pottinger added.

Other Republican lawmakers shared these concerns. Michael McCaul stated, "You cannot sell military-grade AI technology to China." He emphasized that while intellectual property theft is already a problem, the U.S. shouldn't be actively selling advanced technology to a rival.

The Trump administration, guided by White House AI czar David Sacks, defends the policy as a strategic move. The official argument is that supplying China with advanced U.S. chips discourages Chinese companies, like the heavily sanctioned Huawei, from accelerating their own efforts to match top-tier chip designs from Nvidia and AMD.

However, Pottinger dismissed this line of reasoning as a "fantasy."

The new regulations come with several conditions intended to mitigate security risks. Before any chips can be exported to China, they must adhere to the following rules:

• Third-Party Vetting: The chips must be reviewed by a testing lab to confirm their technical AI capabilities.

• Supply Cap: China cannot receive more than 50% of the total volume of chips sold to American customers.

• Domestic Priority: Nvidia must certify that there is a sufficient supply of H200s in the U.S. before shipping any to China.

• End-User Checks: Chinese customers are required to demonstrate "sufficient security procedures" and are prohibited from using the chips for military purposes.

These guardrails have received a mixed reception. Republican Congressman Brian Mast, who chairs the House Foreign Affairs Committee, praised the "know your customer" provisions as "significant."

In contrast, Jon Finer, a former deputy U.S. national security advisor under President Joe Biden, expressed skepticism. He pointed out that the rules would create a substantial new workload for the Commerce Department and would depend on Chinese buyers being truthful about their own clients.

Criticism of the policy has come from both sides of the aisle. Democratic Congressman Gabe Amo offered a particularly sharp critique, saying, "It's truly like Trump is handing our opponents our coordinates in the middle of a battle." He questioned the logic of abandoning a clear technological advantage.

The White House, the U.S. Commerce Department, Nvidia, and the Chinese embassy in Washington did not immediately respond to requests for comment on the matter.

The United Arab Emirates has officially joined Pax Silica, a U.S.-led initiative designed to secure critical supply chains for artificial intelligence and semiconductors, signaling a major reinforcement of economic ties with the United States.

This program is a core element of the Trump administration's economic strategy, which aims to reduce dependency on rival nations while fostering deeper cooperation among allied partners.

The UAE joins an exclusive group of nations participating in the initiative. Other members include:

• Australia

• Britain

• Israel

• Japan

• Qatar

• Singapore

• South Korea

U.S. Undersecretary of State for Economic Affairs, Jacob Helberg, explained the program's comprehensive focus to Reuters. "Ultimately we want to focus on the arteries of the supply chain, primarily logistics, the muscle of the supply chain, via industrial capacity, and the fuel of the supply chain, primarily capital and energy," he said.

Helberg emphasized the UAE's unique position within this framework. "We view the UAE as a comprehensive partner that can make meaningful and important contributions in all three of those areas," he added.

Acting on behalf of President Donald Trump and Secretary of State Marco Rubio, Helberg formally invited the UAE to a ministerial-level meeting on critical minerals in Washington next month. He noted that the summit would feature a "large group" of countries.

This partnership aligns perfectly with the UAE's national ambitions. The country has been investing billions to establish itself as a global AI hub and is actively leveraging its strong relationship with Washington to gain access to premier U.S. technology, including the world's most advanced chips. This collaboration is further evidenced by a multibillion-dollar deal to construct one of the world's largest data center hubs in Abu Dhabi using U.S. technology.

When questioned about potential friction from President Trump's threat to impose a 25% tariff on countries trading with Iran—a group that includes the UAE—Helberg expressed confidence. He stated he was "very confident in the strength and depth of America's relationship with the UAE."

Interestingly, while Qatar is part of Pax Silica, regional powerhouse Saudi Arabia is not, despite its own ambitions to become an AI leader. Helberg confirmed that he held initial discussions with Riyadh on Tuesday, but also noted that the U.S. and Saudi Arabia have already negotiated a "very substantial bilateral AI deal" separate from the Pax Silica initiative.

Silver prices recently hit an all-time high of US$92 an ounce, with industry leaders dubbing it the "next generational metal." The rally is fueled by surging demand from the green energy transition, electrification, and data centers, all happening against the backdrop of a persistent supply deficit.

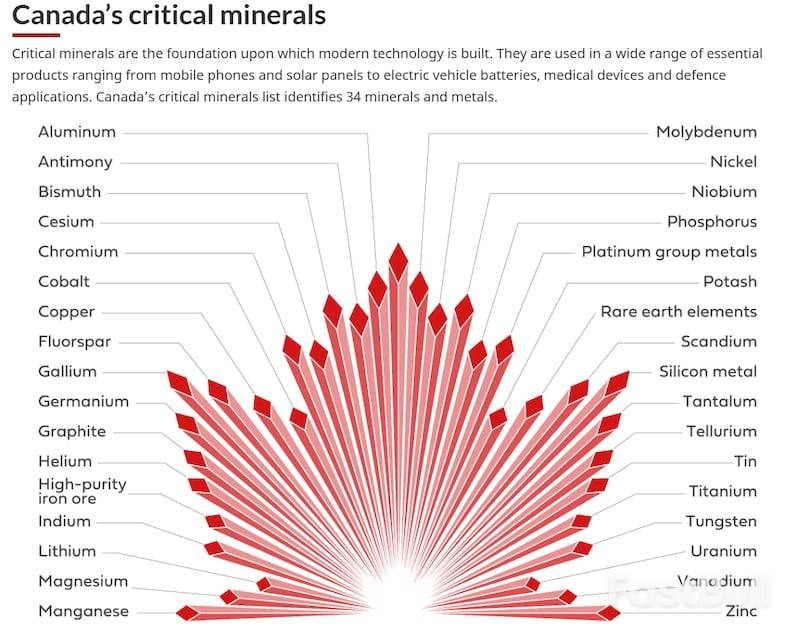

Despite holding some of the world's richest silver deposits, Canada does not consider the metal a strategic priority and has excluded it from its official critical minerals list.

Industry experts are questioning Ottawa's decision. "I think it would be short sighted of them to leave it off," said Michael DiRienzo, president and CEO of the Silver Institute, a global industry organization.

Canada’s Natural Resources Department defends its list of 34 critical minerals as the "foundation" for modern technology and a green economy. The department explicitly stated that silver was left off because it "does not meet Canada's definition of a critical mineral as there is a robust global supply of silver, and its supply chain is not threatened."

DiRienzo directly challenges this assessment, pointing to a projected global market shortfall of 95 million ounces this year. "The amount of silver coming to the market is less than what our demand requirements are," he explained.

Because silver is often produced as a byproduct of mining for other metals like gold, copper, and nickel, its exclusion from Canada's list means it lacks the strategic focus and policy support given to other materials essential for electrification.

The debate is intensifying, especially since the United States added silver to its own critical minerals list in November of last year. DiRienzo argues that Canada should follow this move, which he says "formally recognized silver's transformation from primarily a precious metal into a strategic industrial commodity."

The metal's industrial importance is undeniable. A report from the Silver Institute highlights that global information technology capacity has expanded by over 5,000 percent in the last 25 years. As DiRienzo puts it, "Anything that has an on-and-off switch has silver inside of it."

Canadian mining executives are actively pressing the government for a policy reversal. Last year, First Majestic Silver and around 20 other industry leaders sent an open letter to the Ministry of Energy and Natural Resources urging the reclassification of silver.

The letter pointed out that while Canada was the 13th-largest global silver producer in 2022 and the second-largest supplier to the U.S., its domestic output has fallen over the last decade due to declining ore grades and aging mines.

The group argued that silver meets all three of the government's own criteria for a critical mineral:

• Essential to Canada's economic or national security

• Required for the transition to a low-carbon and digital economy

• Positions Canada as a strategic global partner

The letter also contested the government's supply assumptions, citing a massive 237.7 million-ounce market deficit recorded in 2022. Canada's critical minerals list, last updated in 2024, is reviewed every three years.

However, not everyone believes that adding silver to the list is the solution. Jack M. Mintz, a public policy analyst at the C.D. Howe Institute, suggests the entire focus on designating "critical" minerals may be misguided.

"I really think this whole focus on critical minerals is wrong," Mintz said, noting that mining deposits often contain multiple minerals, making it impractical to apply separate policies to each one. He expressed concern about the risks of governments picking winners and losers in the sector.

"I always get a little bit worried when governments are taking winners and losers," Mintz stated. "We're still doing that, and I think that's one of the political problems that we're going to be creating as a risk."

For investors, silver's profile is rising. According to Brooke Thackray, a research analyst at Global X, silver is emerging as a top metal to watch heading into 2026.

Its appeal is twofold. "Not only is it a critical mineral needed to produce EV cars, solar panels, all that sort of stuff, but at the same time, it's also an investment vehicle," Thackray explained.

He added that because silver production is tied to other metals, its supply cannot ramp up quickly to meet rising prices, even as demand continues to climb. This dynamic creates a unique investment case. "So it's sort of like a little bit of a diversification," said Thackray.

The European Union has given Germany the green light to subsidize a new fleet of gas-fired power plants, a critical step in the country's energy transition strategy. The European Commission's approval also clears the way for a separate €12 billion package designed to lower electricity prices for German industry.

Chancellor Friedrich Merz confirmed the decision, noting that EU approval was necessary because the plan involves significant government subsidies.

As Germany moves to phase out coal and after shutting down its last nuclear reactors nearly three years ago, it faces the challenge of ensuring a stable power supply. The new gas-fired plants are intended to provide flexible power when renewable sources like wind and solar are not available.

The government's plan includes several key components:

• Initial Bids: Germany aims to solicit bids this year to construct 8 gigawatts of new gas-fired power plants.

• Timeline: These plants are scheduled to be operational by 2031.

• Future-Proofing: An additional 4 gigawatts of capacity are planned for lower-carbon energy sources or gas plants designed for a rapid conversion to hydrogen.

Alongside the power plant strategy, the EU has approved a plan to help Germany's struggling industrial sector cope with high energy costs. The government will now move forward with a combined relief package.

The support for businesses will be drawn from two main instruments:

• A €7.5 billion relief measure targeted at small and mid-sized enterprises.

• An existing €4.5 billion program that reimburses companies for the cost of carbon allowances, which will be extended to a wider pool of businesses.

This combined approach is particularly important for large, energy-intensive companies, such as steel producers. Previously, these firms were set to be excluded from the new subsidies because they were already recipients of the carbon allowance reimbursements.

The European Union maintains strict policies to prevent member states from providing excessive subsidies that could distort competition within the bloc. The goal is to create a level playing field for all businesses operating in the EU. Because Germany's plans involve substantial government spending to support specific industries and projects, they required formal approval from the European Commission to proceed.

China's steel exports hit a record high in December as producers rushed to ship metal ahead of a new export licensing system set to begin in 2026. This export boom starkly contrasts with weakening steel demand inside China, which continues to be dragged down by a prolonged property market crisis.

Data released Wednesday by the General Administration of Customs shows the world's largest steel producer shipped 11.3 million metric tons in December, the highest volume ever recorded in a single month.

Beijing's plan to implement a licence system from 2026 is designed to regulate steel exports, which have prompted a growing protectionist backlash from other countries. Analysts note that some exporters accelerated their shipments before January, fearing the new requirements could impact future trade.

For the full year, total steel exports climbed 7.5% from the previous year to an all-time high of 119.02 million tons. This record was achieved even as more countries erected trade barriers, arguing that the influx of Chinese steel was harming their domestic manufacturers.

Despite the strong export performance, China's internal steel consumption is struggling. The country's ongoing property market woes continue to suppress demand for construction materials.

According to a state-backed research agency, China's steel demand is forecast to decline by 1% this year, following a 5.4% drop in 2025.

In a related trend, China's iron ore imports also reached a record high last year. This was driven by steel mills replenishing low inventories and a need for raw materials to support the massive volume of steel exports.

Chinese steelmakers have maintained low inventories since late 2022 as the property crisis strained their cash flow. However, with robust export orders, the demand for iron ore, a key steelmaking ingredient, remained resilient.

December imports rose 8.2% from the prior month to 119.65 million tons, a monthly record. This brought the total for 2025 to a record 1.26 billion tons, an increase of 1.8% from 2024.

Looking ahead, the iron ore market may face headwinds. Bai Xin, an analyst at consultancy Horizon Insights, noted that global iron ore supply is projected to grow by 2.5% in 2026.

Shipments to China are expected to increase by 36 million to 38 million tons, which is likely to put pressure on prices this year.

U.S. retail sales surged more than expected in November, signaling that the economy finished the fourth quarter on solid footing. But behind the strong headline number, analysts are pointing to a growing concern: a "K-shaped" economy where spending is increasingly driven by wealthy households while lower-income consumers fall behind.

The Commerce Department reported on Wednesday that retail sales climbed 0.6% in November, a significant rebound from the previous month's revised 0.1% decline. This performance, which beat the 0.4% rise forecast by economists, suggests robust momentum. On a year-over-year basis, sales were up 3.3%.

The rebound was broad-based, led by a strong recovery in vehicle sales. The data release, which is catching up after a 43-day federal government shutdown, showed notable gains in several categories:

• Motor Vehicles: Receipts at dealerships jumped 1.0%, reversing a decline from October that followed the expiration of electric vehicle tax credits.

• Building & Garden: Sales at building material and garden equipment stores surged 1.3%.

• Recreational Goods: Sporting goods, hobby, and book store sales vaulted 1.9%.

• Clothing & Online: Clothing store sales increased by 0.9%, and online retail grew by 0.4%.

• Food & Drink: Sales at bars and restaurants, the report's only services component, rose 0.6%.

However, not all sectors saw growth. Sales at furniture and home stores slipped, while electronics and appliance store receipts remained unchanged.

Despite the positive overall figures, economists are highlighting an economic divergence. The spending boom appears to be powered by higher-income households, while lower-wage workers and recent graduates grapple with a sluggish labor market and rising costs for essentials.

This "K-shaped" trend became more pronounced in the last quarter. Food prices, for instance, saw their largest increase in over three years in December, disproportionately affecting lower-income budgets. Analysts attribute some of this price pressure to President Donald Trump's import tariffs.

Michael Pearce, chief U.S. economist at Oxford Economics, noted that upcoming tax policies could widen this gap. "Heading into tax refund season, the new tax law will boost refunds the most for higher-income groups," he explained, adding that the combined effect of tax cuts, spending cuts, and tariffs "will be negative for the real incomes of the lowest-income households."

In response to rising living costs, the Trump administration has proposed several measures, including purchasing $200 billion in mortgage bonds and capping credit card interest rates at 10% for one year. However, banks and financial institutions have warned that a rate cap could restrict access to credit for consumers.

Meanwhile, the housing market faces its own affordability challenges. A separate report from the National Association of Realtors showed that sales of previously owned homes jumped 5.1% in December. But as Ben Ayers, senior economist at Nationwide, pointed out, a persistent lack of supply is likely to drive prices higher, counteracting the benefits of lower mortgage rates.

The economy's resilience is strengthening expectations that the Federal Reserve will hold its benchmark interest rate in the 3.50%-3.75% range at its upcoming meeting. This outlook is supported by inflation data that, while showing price pressures, does not indicate a runaway spike.

A report from the Bureau of Labor Statistics revealed that the Producer Price Index (PPI) rose 0.2% in November, following a 0.1% increase in October. Over the 12 months through November, the PPI was up 3.0%.

The increase was largely driven by a 0.9% rebound in producer goods prices, with energy accounting for over 80% of the rise. Wholesale food prices remained unchanged. Excluding volatile food and energy, core producer prices climbed 0.2%.

While the economy grew at a brisk 4.3% annualized pace in the third quarter, largely fueled by consumer spending, potential headwinds are emerging. The Atlanta Federal Reserve is forecasting an even stronger 5.3% growth rate for the fourth quarter, but a weakening labor market could threaten future spending.

Core retail sales—a measure that excludes cars, gasoline, building materials, and food services and aligns closely with the consumer spending component of GDP—rose 0.4% in November. This followed a downwardly revised 0.6% gain in October.

Economists at Wells Fargo noted that "the non-existent hiring environment has many households concerned about steady income prospects, while growing affordability challenges pressure discretionary purchases." As the government works through data backlogs from the shutdown, a clearer picture of inflation and consumer health will emerge, but the underlying split in the U.S. economy remains a central theme for the year ahead.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up