Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Economist: Fed Could Further Shrink Balance Sheet If It Uses Term Open Market Operations (Tomos)] Bill Nelson, Chief Economist And Head Of Research At The Bank Policy Institute (Bpi), Believes The Federal Reserve's Reluctance To Restart Term Open Market Operations (Tomos) Is Hindering Further Reduction In Its Balance Sheet, And This Resistance Is Based On Misunderstanding. Nelson Writes, "Without Term Open Market Operations, The Fed Simply Cannot Achieve Meaningful Balance Sheet Reduction. To Reduce Its Balance Sheet, The Fed Must Raise Money Market Rates To A Level Slightly Above The Interest Rate On Reserves (IOR) So That Banks Have An Incentive To Shift Funds From Reserves To Other Liquid Assets."

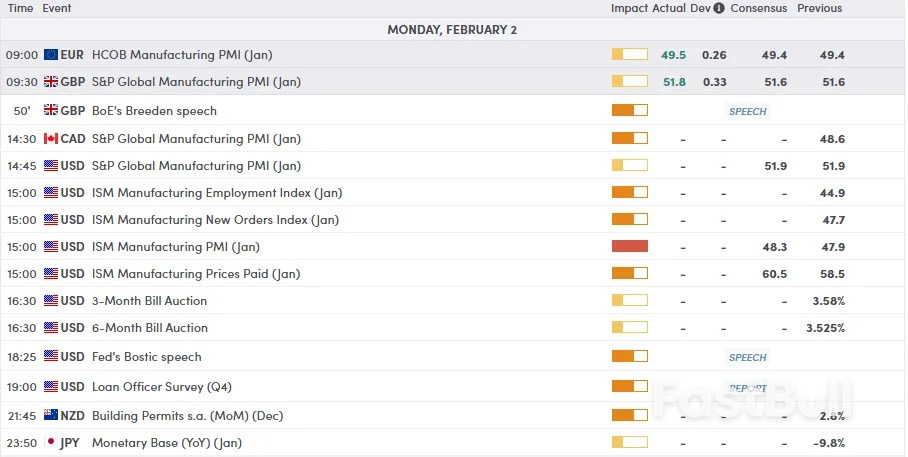

U.S. Treasury Yields Rose Further As Data Showed That The U.S. ISM Manufacturing Sector Expanded At Its Fastest Pace Since February 2022 In January

The US ISM Manufacturing New Orders Index For January Was 57.1, Compared To 47.7 In The Previous Month

Ism USA Manufacturing Prices Paid Index 59.0 In January (Consensus 59.0) Versus 58.5 In December

Gold Volatility Hits Highest Level Since 2008, Dwarfing Even Bitcoin's Rollercoaster Ride. Gold's Volatility Has Surpassed That Of Bitcoin, Highlighting The Metal's Dramatic Price Swings, Comparable To The Most Volatile Periods Of The Past Two Decades, Following A Rapid Price Surge. Bloomberg Data Shows That Gold's 30-day Volatility Has Climbed To Over 44%, The Highest Since The 2008 Financial Crisis. This Level Exceeds Bitcoin's Volatility Of Approximately 39%—the Original Cryptocurrency Often Referred To As "digital Gold."

The Final Reading Of The S&P Global Manufacturing PMI Output Sub-index For January Rose To 55.2, A New High Since August, Marking The Eighth Consecutive Month Of Expansion. The Final Reading Of The Employment Sub-index Fell, Reaching A New Low Since October

A White House Official Said U.S. Middle East Envoy Witkov Will Travel To Abu Dhabi On Wednesday And Thursday For Talks With Russia And Ukraine

A White House Official Said U.S. Middle East Envoy Witkov Will Arrive In Israel On Tuesday And Meet With Israeli Prime Minister Netanyahu

The Final Reading Of The S&P Global Manufacturing PMI For January In The United States Was 52.4, In Line With Expectations Of 52 And The Preliminary Reading Of 51.9

Spokesman: US Treasury Has Not Pledged Funds To African Development Bank's Adf 2025 Financing Round

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold and silver extend historic losses following Trump's nomination of Kevin Warsh as new Fed chair, deepening the precious metals rout.

India's 10-year bond yield surged to its highest level in over a year on Monday, as the government's larger-than-expected borrowing plan unsettled the market ahead of a key central bank policy meeting.

The benchmark 10-year 6.48% 2035 bond yield closed at 6.7662%, a notable increase from Friday's 6.6963% and its highest point since January 17, 2025. This year alone, the 10-year yield has climbed approximately 18 basis points, reflecting mounting concerns over debt supply that have now been amplified by the new budget.

The primary driver behind the market's reaction was the federal budget's announcement of a record gross borrowing of 17.2 trillion rupees ($187.99 billion) for the 2026–27 fiscal year. This figure significantly overshot the 16.3 trillion rupees that analysts had forecasted in a Reuters poll.

According to rating agencies, the budget signals a slower, more gradual approach to fiscal consolidation. The government has set the following targets for the next fiscal year:

• Debt-to-GDP Ratio: 55.6%

• Fiscal Deficit: 4.3% of GDP

This increased borrowing plan has intensified pressure on the bond market, adding to existing worries about high levels of state debt.

In response to the budget, traders began adjusting their portfolios by trimming positions in longer-duration bonds.

Simultaneously, there has been a clear pivot towards shorter-term debt, specifically 1-to-3-year notes. This move is based on the expectation that the Reserve Bank of India (RBI) will continue its liquidity operations, which are anticipated to keep a cap on short-end yields.

Market participants are closely watching for further liquidity measures from the RBI. The central bank has already been active, purchasing 126.55 billion rupees of bonds from the secondary market in the week ending January 23. Furthermore, the RBI has included liquid papers and the former benchmark 6.33% 2035 bond in this week’s 500 billion-rupee bond-buying plan.

The consensus among traders is that the RBI will hold interest rates steady at its policy decision this Friday.

"The budget is positive for growth and neutral for inflation, so we do not expect this to materially influence the RBI at its next MPC meeting on 6 February, where we expect repo rate to be left unchanged," stated analysts at Nomura in a research note.

The Overnight Indexed Swap (OIS) curve steepened on Monday, reflecting the broader trends in the government bond market.

Longer-end swap rates climbed, while short-term swaps saw increased receiving interest due to the RBI's ongoing liquidity support. The one-year OIS rate fell by 1 basis point to 5.5450%. In contrast, the two-year rate rose 1.25 bps to 5.72%, and the five-year OIS rate climbed 3.25 bps to 6.1950%.

Dmitry Medvedev, a top Russian security official, has sounded the alarm over the imminent expiration of the last major nuclear arms control treaty between Russia and the United States. He warned that letting the New START treaty lapse without a clear path forward could accelerate the symbolic "Doomsday Clock."

The treaty, which Medvedev himself signed in 2010 as Russia's president, is set to expire on Thursday. Without a last-minute agreement, the constraints on strategic nuclear arsenals will be removed.

In an interview with Reuters, TASS, and Russian war blogger WarGonzo, Medvedev cautioned against complacency. "I don't want to say that this immediately means a catastrophe and a nuclear war will begin, but it should still alarm everyone," he stated.

Referring to the symbolic gauge of global existential risk, he added, "The clocks are ticking and they obviously have to speed up."

U.S. President Donald Trump has signaled he is prepared to let the treaty expire. Moscow had offered to voluntarily extend the treaty's caps on strategic nuclear weapon deployments, but Trump appears to be holding out for a different deal. "If it expires, it expires... We'll just do a better agreement," Trump told the New York Times last month.

The U.S. has also pushed for China, the world's third-largest nuclear power, to be included in arms control negotiations. However, Beijing has shown no interest in participating.

Medvedev, 60, is a close ally of President Vladimir Putin and currently serves as the deputy chairman of Russia's Security Council. His comments are often viewed by foreign diplomats as a reflection of hardline thinking within the Russian elite.

Although relations with the U.S. were severely strained by the conflict in Ukraine, they have seen some improvement since Trump returned to the White House last year, with American envoys working to mediate an end to the fighting.

When asked about Trump, Medvedev stated that Moscow respects the American people's choice of president and noted that increased contact with Washington was encouraging.

Despite this, he described the world as a dangerous place but clarified Russia's intentions. "We are not interested in a global conflict," Medvedev said. "We're not crazy." In contrast, he was fiercely critical of European leaders, labeling them a "gang of dimwits" who he claimed had damaged their own economies in a failed attempt to defeat Russia.

Addressing Russia's military capabilities, Medvedev said that while specific production figures for artillery and drones are classified, output has surged "many times" since the war in Ukraine began. He asserted that Russia has adapted effectively to the demands of modern drone warfare.

"I believe that our defence industry is working like clockwork today," he said. "We have increased production volumes very quickly."

Looking beyond military hardware, Medvedev, who positioned himself as a modernizer during his 2008-2012 presidency, stressed that Russia cannot afford to lag in critical technologies. He identified generative Artificial Intelligence, synthetic biology, and quantum computing as key areas of focus.

"We are in this race with the others," he said. "The main thing here is not to fall far behind. There was a period in our country when, due to the collapse of the (Soviet) Union, we didn't do much research - we just tried to survive."

Senior U.S. envoy Steve Witkoff is scheduled to travel to Israel for high-level meetings with Prime Minister Benjamin Netanyahu and the country's top military chief, according to two senior Israeli officials. The visit is expected to begin on Tuesday.

Witkoff's trip comes at a critical time, with regional tensions escalating over Iran and the Trump administration actively pursuing its plan to resolve the Gaza war.

The diplomatic push occurs as both Washington and Tehran signal a willingness to restart negotiations. The focus is on reviving talks to address the long-standing nuclear dispute and reduce the risk of a wider regional conflict.

According to a third Israeli official, Witkoff's discussions are designed as preparatory sessions before any potential resumption of talks with Iran.

The meetings will also build on recent military coordination, following a weekend meeting in Washington between Israeli military chief Eyal Zamir and his American counterpart, General Dan Caine.

The geopolitical situation remains tense, underscored by a recent U.S. military buildup in the region. This follows a violent crackdown on anti-government protests in Iran last month, which marked the most severe domestic unrest in the country since its 1979 revolution.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up