Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Beneath a surging stock market, Trump's economy hides jobless growth and uneven prosperity, experts warn.

Over the last year, President Donald Trump’s administration has rolled out a series of disruptive policies affecting businesses, supply chains, and employment. Yet, on the surface, the U.S. economy appears to be performing well, with healthy growth and a stable unemployment rate.

However, experts caution that a surging stock market may be masking significant underlying issues.

When Trump began imposing a wide range of tariffs, even on key trading partners, many analysts predicted skyrocketing inflation, a manufacturing collapse, and soaring unemployment. None of these dire forecasts materialized.

The data paints a surprisingly resilient picture. Inflation, though above the Federal Reserve's target, stood at a modest 2.7 percent in December. Last month's unemployment rate was a relatively low 4.4 percent. Most impressively, Gross Domestic Product (GDP) expanded at a 4.3 percent clip in the third quarter of 2025, its fastest pace in two years.

"The shock and awe we anticipated just didn't materialise," Bernard Yaros, lead U.S. economist at Oxford Economics, told Al Jazeera.

Yaros attributes the limited fallout to two main factors: minimal retaliation from other countries and a powerful stock market rally. This rally ignited after Trump scaled back the most aggressive tariffs announced on "liberation day."

Since Trump's announcement on April 2, the stock market—heavily influenced by the "magnificent seven" technology companies—has climbed nearly 30 percent. This has significantly boosted the paper wealth of many Americans, encouraging households to increase their spending.

According to a research briefing from Oxford Economics in October, gains in net wealth have accounted for almost one-third of the increase in consumer spending since the COVID-19 pandemic.

However, these gains have not been shared equally across the population.

Data from Moody's Analytics shows that the top 10 percent of earners now drive roughly half of all consumer spending, the highest share since record-keeping began in 1989.

"The gains are going a lot to people in higher income brackets – they are the ones who have the stock portfolios – and are going to people in sectors and occupations tied to AI," explained Marcus Noland, executive vice president of the Peterson Institute for International Economics. "But, these numbers mask the unevenness in the growth in this economy."

A closer look at the data reveals this unevenness. Despite the strong GDP figures, the growth is not translating into a broad increase in hiring.

While the hospitality and healthcare sectors added workers last year, key industries like retail, manufacturing, and construction—all of which depend heavily on migrant labor—actually shed jobs.

This trend is closely linked to the administration's immigration policies. A combination of mass deportations of undocumented immigrants and stricter legal migration channels caused the U.S. to experience negative net migration last year for the first time in at least five decades, based on a Brookings Institution analysis.

"And through this very public and brutal way of going about deportations, they have discouraged illegal immigration, but also intimidated immigrants in the US," Noland noted. He added that the U.S. workforce is on track for a net decline of two million workers this year.

This economic "bifurcation" is also hitting the business world. Smaller companies, which lack the resources to stockpile inventory or negotiate favorable terms with suppliers, are disproportionately affected by increased tariffs.

"The surge in policy uncertainty this year has had an outsize effect on smaller firms," Oxford Economics stated in a November report.

Furthermore, these smaller firms are largely missing out on the boom in artificial intelligence (AI). The industry's revenue growth has been concentrated in capital-intensive sectors like chip manufacturing and cloud services, benefiting large corporations.

While AI advocates foresee massive productivity gains that could elevate living standards, there is also growing concern about its potential to displace large numbers of workers.

"This could be the new norm – jobless growth. That's one reason people are not feeling so great," said Yaros. "While a lot of hype about AI and productivity benefits from AI are still to come, we think that is a risk to the labour market if it continues to hold back hiring."

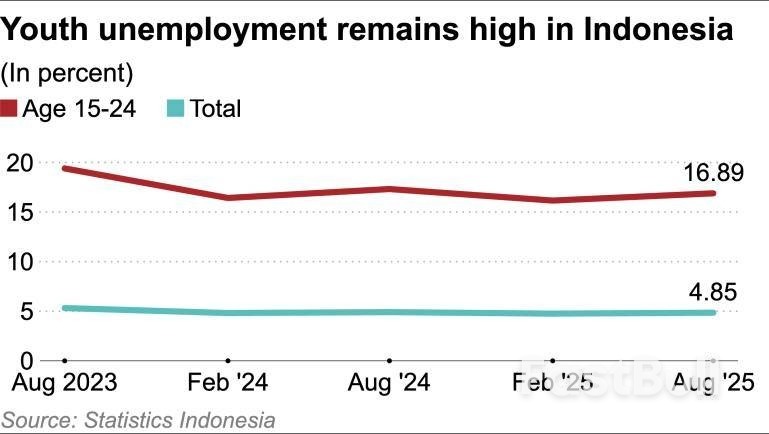

Indonesia has started a program that subsidizes internships for university graduates, aiming to encourage hiring as youth unemployment runs at about three times the national average.

Young people accepted to receive the aid packed a hall in November, eager to learn about their positions. Coordinating Minister for Economic Affairs Airlangga Hartarto told those gathered in central Jakarta that the program would allow recent university graduates to hone their skills before fully joining the workforce.

The subsidies, which have been rolled out in phases since October, are part of an economic stimulus package launched in mid-September, following street protests by young graduates angry at being unable to find work despite strong economic growth.

The program drew 190,000 applicants in the second phase, with roughly 63,000 people accepted.

Muhammad Farhan, 21, an informatics engineering student from Bandung, chose to intern at a maritime industry startup. "I want to learn about the maritime industry, which is related to the information technology industry," he told Nikkei, adding he would like to pursue a maritime career.

Roughly 24,000 people were accepted in December's third phase. To date, over 100,000 interns have been placed. Another phase is planned for this year.

The government provides interns with a salary equivalent to the minimum wage -- 5.7 million rupiah ($340) per month in Jakarta -- for six months. Interns are accepted by state-owned enterprises, private companies and government organizations, for a total of over 6,000 employers as of the third phase.

Indonesia's youth unemployment rate is hovering at around 17%, far above the overall national average of just under 5%.

Nearly 70% of unemployed people are believed to be from Generation Z, aged 15 to 29, and the number of unemployed university graduates exceeds 1 million.

Indonesia continues to see 5% economic growth, but it lags in manufacturing, which has the potential to absorb a large number of workers. The sector accounts for about 19% of gross domestic product, lower than that of other Southeast Asian countries like Thailand and Vietnam, both around 24%, and Malaysia, around 22%.

About 60% of workers are employed in the informal sector, working as street vendors, running small shops or driving for ride-hailing services. An influx of inexpensive Chinese products has contributed to factory closures and layoffs in the textile and footwear industries, pushing more workers into the informal sector in recent years.

Indonesia has the world's fourth-largest population at about 280 million people, and a low average age of 29. University graduates have increased to over 1 million annually, but they face a job market that increasingly favors employers.

Large-scale anti-government demonstrations spread across the country in late August and early September, driven in part by university students and other young people dissatisfied with their dim job prospects.

To what extent the new internship program solves these problems remains to be seen. While some companies may choose to hire talented participants after their internship period ends, most interns will need to find new jobs.

Haikal Rizki, 22, a student from Serang, Banten, has begun an internship as an e-catalog curator at the Policy Institute for Procurement of Goods/Services, a government agency.

Rizki, who graduated in June, realized that the internship program didn't guarantee easy employment after graduation. He has already begun applying to several companies.

"There are a lot of law school graduates, so finding a job that aligns with what I learned during college isn't easy," he said.

Muhammad Baron, vice president of corporate communication at state-owned oil company Pertamina, said that while internship program does not guarantee future employment with Pertamina, "it is considered valuable capital because it increases one's value as a job seeker."

"Pertamina's recruitment process is conducted through a joint recruitment process with state-owned enterprises," he said. "Students have traditionally used internships at Pertamina as an opportunity to learn and enhance their portfolios before applying for jobs at other companies or participating in state-owned enterprise recruitment."

President Prabowo Subianto has set a target of boosting economic growth to 8% and has been working to expand employment opportunities. As a flagship policy, he launched a free school lunch program that benefits 80 million students.

He also plans to channel roughly $8 billion in dividends from state-owned enterprises into a government-affiliated fund to promote investment in higher-value industries in natural resources and other sectors.

But it is unclear whether these policies will speed up economic growth. Worryingly, foreign direct investment in July-September 2025 fell 9%, the second consecutive quarter of decline.

According to an analysis by Goldman Sachs economists, a new tariff threat from President Trump could reduce the real GDP of eight European nations by 0.1% to 0.2%. However, the report stresses significant uncertainty over whether the plan will be implemented.

The proposed measures would place a 10% tariff on imports from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland, effective February 1. The plan reportedly includes an escalation to 25% on June 1, with the tariffs remaining in place until the U.S. secures a deal to purchase Greenland.

Economists at Goldman Sachs noted that it is highly uncertain if these tariffs will materialize. They assume the proposed duties would be applied on top of any existing tariffs.

The targeted European Union member states account for approximately €270 billion in annual exports to the United States, representing about half of the EU's total exports to the country.

The potential economic exposure varies significantly by nation:

• Germany, Netherlands, and Finland: Affected exports could represent 3% to 3.5% of their GDP if applied as a blanket tariff, or 1.5% to 2% if applied more narrowly to goods currently subject to reciprocal tariffs.

• Euro Area: The overall exposure is estimated at 1% to 1.5% of GDP.

• United Kingdom: Affected exports would equal 1% to 2% of GDP.

Goldman's analysis projects Germany would face the largest economic drag. In what the firm considers the most likely scenario—a 10% incremental reciprocal tariff—Germany's GDP would fall by about 0.2%. A blanket tariff could increase that impact to 0.3%.

If the tariff rate climbs to 25%, the GDP drag could widen to between 0.25% and 0.5% across the affected countries. These potential losses would come on top of the 0.4% real GDP hit that Goldman previously estimated from last year's tariff increases. The report adds that the impact could be magnified by negative effects on business confidence or financial markets, but could also be lessened if countries successfully reroute trade through unaffected EU nations.

Goldman expects minimal inflation effects due to lower demand, assuming no retaliation. A simple central bank policy model would suggest modestly lower policy rates in response.

The Goldman Sachs report identifies three potential levels of retaliation from the European Union.

1. Stall the US-EU Trade Deal

The EU could halt the implementation of last year's trade agreement with the U.S. Since the deal requires ratification in the EU Parliament to reduce U.S. tariffs, Goldman sees this as an action with a low hurdle.

2. Impose Counter-Tariffs

The EU could impose its own tariffs on U.S. goods using previously approved lists. One list, valued at €25 billion to match U.S. steel and aluminum tariffs, targets products like soybeans, copper, iron, motorbikes, and orange juice. Another plan targets up to €93 billion of U.S. imports, including aircraft, cars, and agricultural goods. This move would likely create upward pressure on European inflation.

3. Activate the Anti-Coercion Instrument (ACI)

The EU could launch its Anti-Coercion Instrument, a tool designed for situations like this. While activating the ACI does not mean immediate implementation, it signals the EU's intent and opens a window for negotiation. The ACI allows for a broader range of policy responses beyond tariffs, including investment restrictions and taxes on U.S. assets and digital services.

Goldman Sachs believes the United Kingdom would be less likely to retaliate. This view aligns with the UK's approach during trade negotiations last year. "We would expect the UK to focus on engaging diplomatically with Trump," the brokerage stated, a sentiment echoed by Culture Secretary Lisa Nandy in a recent interview.

The global economy is on track to grow faster than expected this year, but a surge in trade barriers and geopolitical friction could easily derail the recovery, the International Monetary Fund warned in a report released Monday.

The IMF's latest quarterly assessment projects the global economy will expand by 3.3% in the current year, an upgrade from its previous 3.1% forecast. The outlook for the United States was also revised upward, with growth now expected to hit 2.4% in 2026, up from 2.1%. However, the IMF trimmed its 2027 U.S. forecast slightly, from 2.1% to 2%.

This improved forecast operates on a critical assumption: that import tariffs and trade restrictions remain at their December levels. This assumption is already being tested. President Trump announced plans on Saturday to levy 10% tariffs on goods from several European countries starting February 1, with the rate set to increase to 25% by June. The move is intended to pressure Denmark into selling Greenland to the United States.

"There are, of course, risks still on the trade side and broadly geopolitical risks," Pierre-Olivier Gourinchas, the IMF's chief economist, told reporters. "The effects of these would build over time."

The report highlights that recent economic resilience has been heavily dependent on a single factor: massive investment in artificial intelligence and its supporting infrastructure. While this spending wave has helped counter the drag from higher import taxes, the IMF cautioned that such a concentrated bet creates significant vulnerabilities.

The Risk of a Tech-Led Downturn

A change in investor sentiment regarding AI's true potential could spark sharp declines in stock prices, beginning with tech companies but likely spreading across the financial system and eroding household wealth, the organization warned.

The IMF’s analysis suggests U.S. stock valuations may be about half as inflated as they were during the 2001 dot-com bubble. But a key difference makes today's market more fragile: equity values now account for 226% of economic output, far higher than the 132% ratio seen in 2001. This means a market correction of a similar percentage today would cause much greater damage to consumer spending and economic growth.

According to the IMF's calculations, even a "moderate" stock market decline could slow global growth to 2.9% this year. The report advised that central banks should be prepared to cut borrowing costs quickly if such a scenario unfolds.

The Upside: AI as a Productivity Driver

However, the technology trend also presents a significant upside. The IMF estimates that the successful rollout of new AI tools could boost global growth to 3.6% this year. Over the long term, AI could add between 0.1 and 0.8 percentage points to annual expansion, depending on the speed of adoption and economic preparedness.

The IMF also noted that the surge in U.S. business investment has likely increased the neutral interest rate—the level at which monetary policy is neither restrictive nor stimulative. If heavy technology spending persists, "it may push real neutral interest rates higher—as occurred during the dot-com era—calling for a monetary policy tightening," the report stated.

The IMF also provided guidance on how the Federal Reserve and other central banks should handle supply-side shocks like new import tariffs. It recommended that they should only lower rates "with robust evidence of inflation expectations remaining anchored and inflation returning toward target."

This advice comes amid rising friction between the Fed and President Trump, who has consistently pushed for significantly lower interest rates. The Justice Department recently launched a criminal investigation into Fed Chair Jerome Powell, which he has characterized as an attempt to intimidate the central bank into cutting rates.

The IMF report strongly emphasized that the Federal Reserve's independence, "both legal and operational," is vital for economic stability.

"It's really important that they remain independent," Gourinchas said. "The expectation that they will do what is needed is absolutely critical in bringing inflation down."

IMF economists warned that political pressure to cut rates to ease government debt service costs could be counterproductive. Gourinchas explained that if markets lose confidence in a central bank's commitment to controlling inflation, it could lead to higher government borrowing costs.

"If you have less credibility in keeping inflation low, there will be potentially a repricing of government securities, and therefore you would have higher financing costs for the government," he stated.

The report also featured upgraded growth forecasts for major emerging economies. China's projected expansion for 2026 was raised to 4.5% from 4.2%, and India's was increased to 6.4% from 6.2%.

This trend shows both countries pulling ahead of other developing nations, mirroring how the U.S. has outpaced other advanced economies. Gourinchas concluded by noting that this growing performance gap between different regions is another emerging danger to sustained global prosperity.

President Donald Trump is set to unveil a series of "aggressive" reforms for the U.S. housing market this week during his speech at the World Economic Forum's annual meeting in Davos, Switzerland. With housing affordability a persistent challenge for the American economy, Trump and his advisors have indicated the new plans could significantly alter the landscape for mortgages and homeownership.

These potential policy shifts have broad implications. Changes to borrowing costs, housing supply, and the rules for using retirement savings can directly impact household budgets, consumer spending, and long-term financial security for millions of Americans, particularly first-time buyers.

Here's a breakdown of the key proposals expected to be announced.

A central component of Trump's plan is a proposal to allow Americans to use their 401(k) retirement funds for housing purchases. National Economic Council Director Kevin Hassett confirmed this on Fox Business, highlighting it as a way to address soaring homeownership costs.

Currently, the government permits penalty-free withdrawals of up to $10,000 from Individual Retirement Accounts (IRAs) for this purpose, but not from 401(k)s, which are a primary workplace retirement vehicle.

"The typical monthly payment about doubled for an ordinary family buying an ordinary home," Hassett noted. "And the down payment they needed to buy a home went from about $15,000, to about $32,000. And so there's a real lot of room to make up."

Trump has already floated a proposal to ban large institutional investors from purchasing single-family homes. The move is aimed at increasing the housing inventory available to individual buyers.

"People live in homes, not corporations," Trump stated on social media in early January. However, industry experts suggest that if the ban is targeted specifically at larger institutional players, most investors currently buying homes would likely not be affected.

Another initiative involves directing government-backed lenders Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds. This strategy is designed to put downward pressure on mortgage rates, making loans more affordable for homebuyers.

The policy may already be working. Analysts at Goldman Sachs observed that mortgage rates fell by 15 basis points following the announcement. "This should improve affordability and improve sentiment in the housing market ahead of the key spring homebuying season," wrote Goldman Sachs analyst Arun Manohar, who projected the move could boost home sales by 5% to 7% in 2026.

Two other concepts may feature in Trump's Davos speech: 50-year mortgages and portable mortgages.

• 50-Year Mortgages: Extending loan terms to 50 years could lower monthly payments for borrowers. The trade-off, however, would be a significant increase in the total interest paid over the life of the loan.

• Portable Mortgages: This idea would allow a borrower to transfer their existing mortgage to a new home. Proponents, including some leading Senate Democrats, argue it could solve the "lock-in" effect, where homeowners with low-rate mortgages are hesitant to sell.

Critics, however, are skeptical. Realtor.com Senior Economist Jake Krimmel argued, "Portability isn't compatible with the architecture of U.S. mortgage finance, and even if it were, it wouldn't fix the broader affordability problems facing the housing market today."

French Premier Sebastien Lecornu is moving to pass the 2026 budget by invoking a special constitutional power, Article 49.3, which allows the government to enact legislation without a parliamentary vote. The decision comes after months of stalled negotiations with opposition parties in the National Assembly.

While Lecornu’s office has not officially commented, French media reports indicate the move is imminent. This strategic maneuver suggests the government is confident it can withstand the no-confidence motions that are certain to follow.

Article 49.3 is a powerful but politically risky tool. Lecornu had previously stated he would avoid using the mechanism, which is deeply unpopular with opposition lawmakers. Its use has led to the ouster of his two predecessors amid intense feuds over the national budget.

Once the article is invoked, opposition parties can trigger no-confidence votes. However, this time, the government appears to have secured the necessary backing to survive such a challenge.

The key to Lecornu's strategy lies in a series of crucial concessions made last week, which appear to have won over the Socialist party. These lawmakers hold the deciding votes in any censure ballot.

The government's revised budget plan includes several measures aimed at securing their support:

• No new tax increases for households.

• A boost to incomes for those earning near the minimum wage.

• The reversal of planned cuts to certain benefits.

• An agreement to extend a temporary tax on large corporations for another year.

Boris Vallaud, who leads the center-left group in the National Assembly, confirmed his party's position. Speaking on RTL radio, he stated that the government had provided sufficient guarantees and that his party now views the use of Article 49.3 as the preferred path forward.

This development offers a clear route for France to adopt a budget and avoid a government shutdown at the start of 2026. The country has been navigating political instability since President Emmanuel Macron’s 2024 snap election resulted in a hung parliament, splitting the lower house into opposing factions.

Over the past 18 months, successive government collapses and setbacks in reining in the euro area's largest deficit have shaken investor confidence. This uncertainty triggered market sell-offs that pushed France's bond yields higher compared to its European peers.

The news of a decisive path for the budget brought immediate relief to the markets. On Monday, the yield spread on French 10-year bonds over their German equivalents narrowed to about 65 basis points, its lowest level since July.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up