Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The 2025 Trump Xi meeting in Busan will focus on tariffs, rare earths, and trade talks. Learn what’s discussed and how it may impact global markets.

The 2025 trump xi meeting in Busan, South Korea, marks a critical moment for global trade and diplomacy. As the two leaders meet amid renewed tariff tensions and rare earth supply concerns, investors worldwide are watching closely to see whether this summit can reshape markets and ease U.S.–China economic friction.

The much-anticipated trump xi meeting is taking place today, October 30, 2025, in Busan, South Korea, during the APEC Summit. It marks the first face-to-face trump and xi meeting since Donald Trump’s return to the White House. Scheduled for 11:00 a.m. local time, the xi trump meeting is drawing global attention as markets and policymakers await signs of progress on trade and geopolitical issues.

The venue, located at Busan Exhibition and Convention Center, serves as a symbolic choice—bridging economic dialogue across the Asia-Pacific region. Both leaders are expected to hold a brief photo session before entering a closed-door discussion, followed by official statements from each side later in the afternoon.

This trump meeting with xi comes at a sensitive time, as global markets weigh the effects of trade tensions, supply chain realignment, and renewed discussions over technology restrictions. Analysts view the xi and trump meeting as an opportunity to reset economic relations while maintaining strategic competition.

The trump and xi jinping meeting is expected to cover several high-stakes topics influencing global trade and market stability. While both leaders aim to signal cooperation, deep structural differences remain across economics, technology, and security. Below is a summary of the major discussion areas shaping the Busan talks:

| Agenda | Key Focus | Market Relevance |

|---|---|---|

| Tariff and Trade Relief | Exploring a potential truce to reduce mutual tariffs and revive global trade confidence. | Positive sentiment for equities, especially manufacturing and export sectors. |

| Rare Earth and Critical Minerals | Ensuring stable supply chains for semiconductors and EV production. | Likely to impact energy, defense, and technology markets. |

| Technology and Data Security | Addressing U.S. restrictions on chip exports and Chinese regulation of tech firms. | High sensitivity for semiconductor and AI-related stocks. |

| Fentanyl and Cross-Border Cooperation | U.S. pressure for stronger enforcement on chemical exports tied to drug production. | Limited direct market impact but signals wider policy cooperation. |

| Geopolitical Stability | Discussions around Taiwan and Asia-Pacific security frameworks. | Can influence risk sentiment, safe-haven assets, and regional currencies. |

Overall, the trump xi meet represents a pivotal test of whether the world’s two largest economies can manage rivalry while preventing another escalation in tariffs and technological decoupling. For investors, even small signs of compromise emerging from the Busan dialogue could signal renewed confidence in global markets.

While the trump xi meeting is presented as a diplomatic engagement, both sides approach the Busan Summit with carefully defined objectives. The trump and xi meeting is not just about photo opportunities — it is a high-stakes negotiation shaped by domestic pressure, global markets, and strategic competition.

In this context, the xi and trump meeting functions as both a tactical pause and a test of strategic patience. While neither side expects a sweeping deal, analysts believe even a limited understanding on tariffs or minerals could reset short-term market expectations.

Global investors are watching the trump meeting with xi closely for policy signals that could shift sentiment across major asset classes. The Busan talks, framed as an attempt to stabilize trade relations, could trigger significant volatility depending on the outcomes announced.

| Scenario | Market Reaction | Investor Implication |

|---|---|---|

| Positive Outcome (Partial Trade Truce) | Equities rally globally; Asian and emerging market currencies strengthen. | Boost for export-driven sectors, rare earth and semiconductor industries. |

| Neutral Outcome (No Clear Agreement) | Markets stay cautious; investors focus on central bank guidance and data. | Volatility persists, but downside remains limited if dialogue continues. |

| Negative Outcome (Renewed Tariff Threats) | Stocks decline, gold and Treasuries gain as safe-haven demand spikes. | Pressure on manufacturing, shipping, and commodity-linked equities. |

For investors, this xi trump meeting serves as a critical barometer for global risk appetite. A cooperative tone could lift confidence in trade-sensitive markets, while hardline rhetoric may revive fears of decoupling. The trump and xi jinping meeting thus stands as a pivotal event shaping currency trends, commodity prices, and investor positioning into late 2025.

In the aftermath of the trump xi meeting, financial markets are expected to react sharply to the tone and substance of the final statements. Investors should focus on how both governments describe trade progress, technology restrictions, and commitments related to rare earth supply. The trump and xi jinping meeting may set short-term sentiment across global equities and commodities.

For long-term investors, the trump meeting with xi may serve as a guidepost for positioning through 2026, especially in export-driven sectors and technology equities.

According to recent polling referenced in international coverage of the xi trump meeting, Xi Jinping’s approval within China remains high, typically reported above 80% by domestic institutions. However, Western sources note limited transparency in such surveys, emphasizing that official approval metrics are more reflective of policy confidence than electoral support.

Donald Trump’s last official visit to China occurred in November 2017, when he met with President Xi in Beijing. That visit set the stage for years of tariff negotiations leading up to the current trump and xi meeting in Busan. It was during that earlier trip that both leaders pledged cooperation on trade and North Korea before relations later deteriorated.

The reference often circulating online concerns former U.S. President George H. W. Bush, who fainted during a state dinner in Tokyo in 1992 and was assisted out of the room. While unrelated to the trump xi meeting, this event is occasionally cited in media discussions comparing presidential visits to Asia and their historical context.

The trump xi meeting in Busan represents a defining moment for global trade and investor sentiment. While deep divisions on tariffs and technology remain, even partial progress could ease market tension and restore confidence. For now, the world waits to see if this summit can turn rivalry into renewed economic cooperation.

The oil market had a choppy session yesterday, still trying to digest the impact of Russian sanctions amid an increasingly comfortable balance as we head into 2026. However, a set of bullish numbers from the US Energy Information Administration's (EIA) weekly inventory report ensured crude oil prices closed higher, with Brent settling 0.81% higher on the day.

The EIA reported that US crude oil inventories fell by 6.86m barrels over the last week. It was driven by the Gulf Coast, where crude inventories declined by just shy of 10m barrels. Lower imports were behind the inventory draw, with total crude imports falling 867k b/d week-on-week to the lowest level since February 2021, while Gulf Coast imports hit a record low. Refined product numbers were also bullish. Gasoline and distillate stocks fell by 5.94m barrels and 3.36m barrels, respectively. The decline in gasoline inventories occurred despite exports falling 363k b/d. Stronger domestic demand provided support, with implied gasoline demand increasing 470k b/d WoW, while refiners also reduced their utilisation rates by 2 percentage points to 86.6%.

Looking ahead, plenty of attention will be on today's talks between President Trump and President Xi. The market will also be watching this weekend's OPEC+ meeting, where the group will likely announce another 137k b/d supply hike for December.

Away from oil, the latest positioning data shows that investment funds cut their net long in Title Transfer Facility (TTF) natural gas by 14.3TWh over the last reporting week to 46.2TWh – a move driven largely by fresh shorts entering the market. European natural gas prices continue to trade in a largely range-bound manner as we head further into the heating season, despite EU storage standing at just under 83% full. This is below the 5-year average of 92% and is slowly drawing. Meanwhile, investment funds marginally cut their net long in EU allowances by 821 contracts to 93,894, a marginal decline, but it's the first week of fund selling this month.

Copper hit a record on the LME yesterday, topping its previous high of $11,104.50/t set in May 2024. A supportive macro backdrop, falling US dollar, rate cuts and low inventories have lifted industrial metals prices recently.

Copper is the standout performer in the base metals complex, with prices up more than 25% year-to-date, and on track for its best year since 2017. Copper is rallying due to mounting supply disruptions, most recently Freeport's declaration of force majeure at its giant Grasberg mine in Indonesia, and the wider risk-on mood ahead of the Trump-Xi meeting. The outlook for copper is starting to look brighter with balances tightening for both 2025 and 2026 amid supply challenges and rising trade optimism.

However, the risk of demand destruction shouldn't be ignored, as Chinese buyers show signs of price sensitivity, which could put a ceiling on copper's upside. The Yangshan premium, paid by traders for imported metal and a key indicator of physical demand in China, remains in focus. For now, it hovers around $35/t after slumping more than 20% since late September, down from year-to-date highs above $100/t in May.

Sugar prices have continued to come under pressure, with No.11 trading down to its lowest level since December 2020 at one stage yesterday. The Indian Sugar and Bio-energy Manufacturers Association (ISMA) revised higher its estimates of gross sugar output (excluding sugar diverted for ethanol production) to around 31.5mt for the 2025/26 season compared to its previous forecast of 30mt. Favourable weather conditions in key growing regions boosted plant growth and were primarily responsible for the higher output estimates. Sugar allocation for ethanol production could fall to 3.4mt, compared with an earlier estimate of 5mt, as oil refiners scale back purchases of biofuel. The association requests that the government allow the export of 2mt of sugar for the 2025/26 season. In addition, the global market is expected to be in large surplus through the 2025/26 season. Clearly, prices need to remain under pressure to push mills in Brazil to allocate more cane to ethanol production to help resolve the large surplus expected for the 2026/27 CS Brazil crop.

Market reports indicate that China has purchased three US soybean cargoes this week, totaling approximately 180kt of soybeans to be delivered in December and January. China's return to the US soybean market ahead of the Trump-Xi meeting indicates positive market sentiment. Yet the scale of purchases remains relatively modest for now. This could keep traders cautious until the deal details are known. The market is also in the dark about official data. The usual weekly export sales data from the USDA has been delayed by the US government shutdown.

Chinese President Xi Jinping and U.S. President Donald Trump on Thursday arrived in Busan, South Korea, ahead of a much-anticipated meeting to address trade and tariff concerns.The meeting, expected to start at 11 a.m. local time (10 p.m. ET, Wednesday), would be the first time the two leaders see each other in person since Trump began his second term in January.The high-stakes meeting comes as tensions between the world's two largest economies have been on the boil this year. The latest escalation in tensions came this month, with Beijing export controls and Washington threatening to ban software-powered exports to China.

The U.S. in recent days has shared details about deals they hope to achieve with China – from restricting the flow of fentanyl to the U.S. to TikTok's divestiture from its Beijing-based parent ByteDance. Tariffs, tech curbs and rare earths are also on the table for discussion.Beijing had been more circumspect about the prospects of an agreement, but in a possible sign of thawing relationship, China bought its first cargoes of U.S. soybeans in several months, Reuters reported Wednesday.Xi is in South Korea – his first state visit in 11 years – from Thursday to Saturday to attend the APEC Economic Leaders' Meeting in Gyeongju.

Investors are cautiously watching for headlines from Busan as the trade war between the U.S. and China has kept investors on edge. Global markets soared at the start of the week on growing optimism that the U.S. and China could near an agreement on trade.

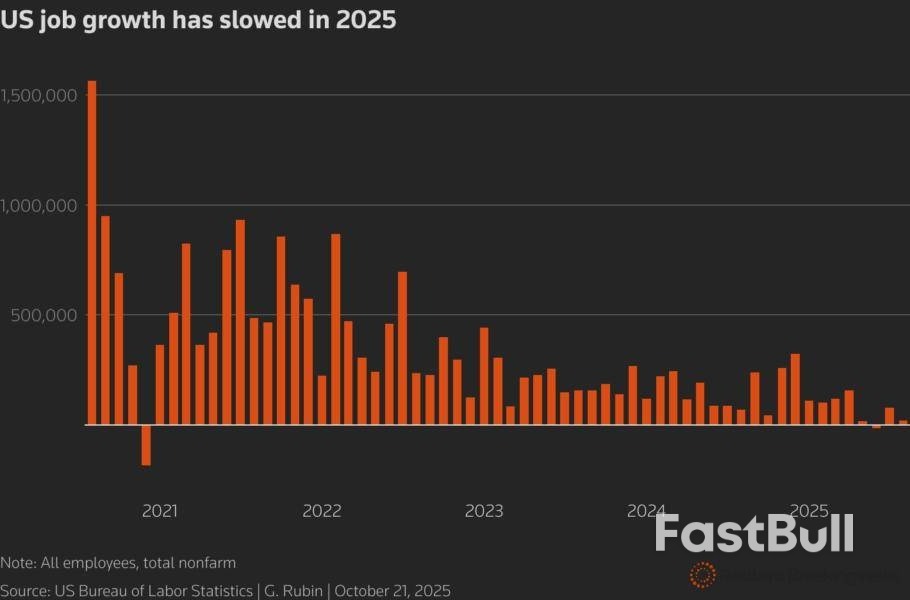

The U.S. labor market has been characterized as a 'no hire, no fire' landscape for much of the past year. But 'no hire, more fire' increasingly looks more accurate, providing further ammunition for the Federal Reserve to cut interest rates.

Retail giant Amazon on Tuesday announced 14,000 layoffs, with more to come next year, while delivery service UPS revealed that it has cut a whopping 48,000 employees over the past year. The reasons cited include protecting margins, employing more artificial intelligence, and reversing pandemic-era over-hiring.

These aren't the only eye-opening announcements recently: around 25,000 workers are being let go at Intel, 15,000 at Microsoft, and 11,000 at Accenture. The Trump administration is also firing swathes of government workers.

In total, U.S. employers announced almost 950,000 job cuts in the January-September period, according to global placement firm Challenger, Gray & Christmas, with the top affected sectors being government, tech and retail.

While most of that was earlier in the year, these figures suggest the labor market is truly cracking, lending credence to Fed Chair Jerome Powell's view that downside risks to employment outweigh upside risks to inflation.

The Fed resumed its interest rate-cutting cycle in September after a nine-month hiatus and is expected to continue easing into next year due to concerns about labor market weakness.

While the unemployment rate hasn't risen much, that is mainly because cooling demand for workers has been offset by shrinking labor supply, as the Trump administration has cracked down on immigration and increased deportations.

In normal times, job cuts at individual firms might not be on policymakers' radar. But these are not normal times. We're in the midst of the second-longest government shutdown in U.S. history. This has prevented the release of almost all labor market data – including monthly payrolls, the unemployment rate, job openings and labor turnover (JOLTS) and weekly jobless claims – for four weeks. Fed officials are flying blind.

With no official incoming data for guidance, specific corporate announcements could take on extra significance.

Troy Ludtka, senior U.S. economist at SMBC Nikko Securities Americas, says the Amazon and UPS announcements may not move the policy dial just yet, but they should confirm Fed officials' "anxieties" over the labor market. "The question now is, just how aggressive will other companies be in reducing headcount?"

As the Fed waits for the answer to that question, the few official economic indicators available are already ringing warning bells.

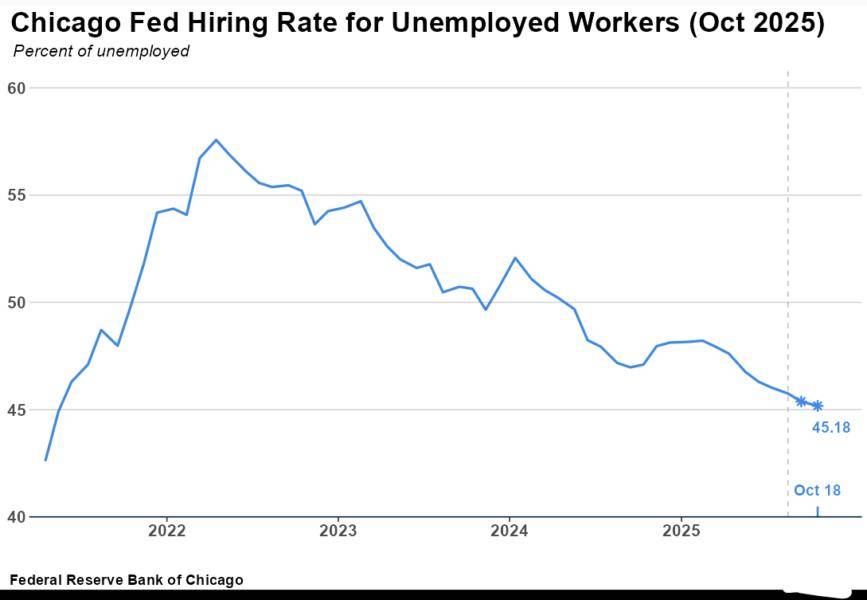

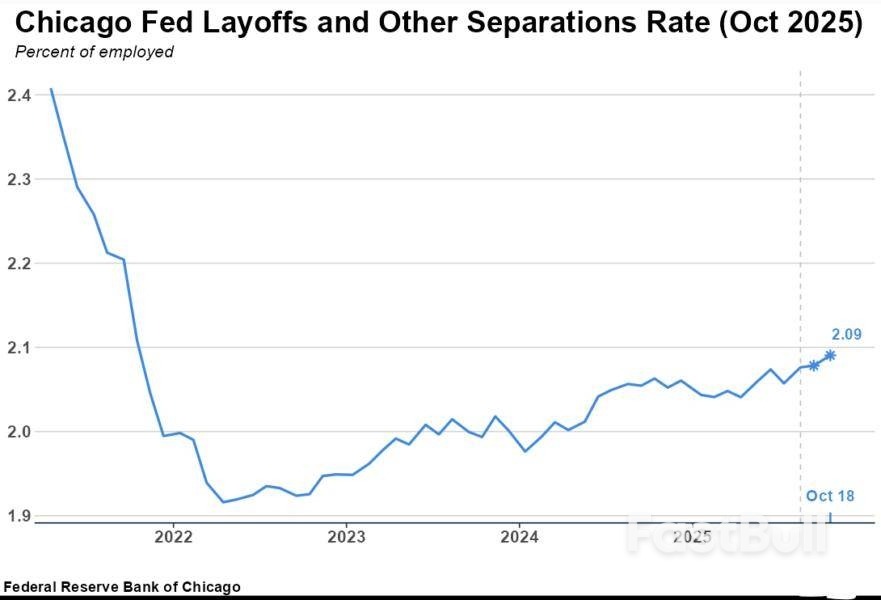

The Chicago Fed's economic model – which uses private data when official government statistics are unavailable – showed that 'Layoffs and Other Separations' as a share of employed workers are grinding higher and that the 'Hiring for Unemployed Workers' as a share of total unemployed is falling. Both of these are levels not seen for four years.

Meanwhile, U.S. private payrolls increased by an average of just 14,250 jobs in the four weeks ending October 11, the ADP National Employment Report's weekly preliminary estimate showed on Tuesday. ADP, which usually publishes monthly reports, said it will now publish weekly preliminary estimates every Tuesday, based on its high-frequency data.

That's a paltry increase, effectively signaling no job growth at all – although it is better than the 32,000 decline in ADP's last monthly report for September.

All told, the labor market picture appears to justify lower interest rates. But easier policy is not without risks. Wall Street, led by tech and AI stocks, is booming, with financial conditions the loosest in years. And inflation is still a full percentage point above the Fed's target.

Rate cuts may be well-intentioned, with the goal of protecting potentially millions of workers at risk of losing their jobs, but easing will pour fuel on the ongoing 'melt up' rally. So while it remains unclear how much these cuts will actually support the labor market, they are almost certain to boost wealthy asset holders' portfolios.

What we also know for sure is that the more companies announce sweeping layoffs, the more likely the Fed is to act.

Oil prices held on to most gains from the previous session in early trading on Thursday as investors awaited U.S.-China trade talks later in the day, hoping for signs that tensions clouding the economic growth outlook will ease.

Brent crude futures fell 3 cents, or 0.05%, to $64.89 a barrel by 0032 GMT, while U.S. West Texas Intermediate crude futures fell 11 cents, or 0.18%, to $60.37.

U.S. President Donald Trump and Chinese President Xi Jinping will meet on Thursday in Busan, South Korea, on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit. Markets hope they will agree to dial down trade tensions that have hurt the outlook for global growth and fuel demand.

Trump said on Wednesday he expects to reduce U.S. tariffs on Chinese goods in exchange for Beijing's commitment to curb the flow of precursor chemicals to make the drug fentanyl.

Also boosting the economic outlook, the U.S. Federal Reserve lowered interest rates on Wednesday, in line with market expectations. However, it signaled that might be the last cut of the year as the ongoing government shutdown threatens data availability.

"The Fed's decision underscores a broader turn in its policy cycle – one that favours gradual reflation and support over restraint, providing a tailwind to commodities sensitive to economic activity," Rystad Energy's chief economist Claudio Galimberti said in a note.

Brent and WTI rose 52 cents and 33 cents, respectively, in the previous session on optimism about the trade talks and a larger than expected drawdown in U.S. crude and fuel inventories.

Crude inventories dropped by 6.86 million barrels to 416 million barrels in the week ended October 24, the EIA said, compared with analysts' expectations in a Reuters poll for a 211,000-barrel fall.

Toyota Motor does not face an immediate chip shortage from recent Chinese export restrictions related to chipmaker Nexperia, even as the Japanese automaker is carefully watching risks to production, Chief Executive Koji Sato said."I do think there's some risk, but it's not like we're facing shortages tomorrow," Sato told reporters at the Japan Mobility Show in Tokyo on Wednesday afternoon.While the issue could impact Toyota's output, the world's top-selling automaker would not be suddenly exposed to a major supply crunch, he said.

Automakers worldwide are scrambling to secure chips and review inventories as concerns mount over a deepening supply squeeze linked to Dutch chipmaker Nexperia.China banned exports of Nexperia's products after the Dutch government seized control of the firm last month, citing fears of technology transfers to its Chinese parent Wingtech, which the United States has flagged as a potential security risk.As an overall industry, Japanese automakers are working to standardise legacy chips to avoid the kind of severe shortages seen during the pandemic, when customised semiconductors left automakers vulnerable, he said.

His comments came after smaller rival Nissan said it had enough chips at the moment to last until the first week of November without disruption - just days away.Separately, Sato said that the world's biggest automaker has no plans to revise the tender offer price for Toyota Industries as part of a planned buyout, despite criticism from some shareholders.The Toyota group said in June it would take Toyota Industries private through a holding company backed by Toyota Motor, Toyota Fudosan and Toyota Chairman Akio Toyoda.

The offer of 16,300 yen ($108.10) per share represents a premium over historical averages before reports of the deal but is below the price on the day before the announcement, drawing complaints from investors who say the bid undervalues the company.The transaction, aimed at taking the forklift maker and key Toyota supplier private, is part of a broader restructuring of Toyota's group and has faced calls for greater disclosure from global asset managers.

Sato said the group will proceed with high transparency and, as a basic principle, ensure minority shareholders' interests are carefully considered. He added that the goal is to advance the plan in a way that secures broad stakeholder understanding rather than rushing it.

Mexico's banking lobby is recommending its members go beyond current regulations to fight illicit financing after the US cracked down on some banks in the country for allegedly aiding drug traffickers.Mexican lenders should commit to an 11-point plan aimed at "closing the gap" between US and Mexican regulations while also implementing stricter controls on international transfers, remittances and big cash withdrawals, Emilio Romano, the head of the Asociacion de Bancos de Mexico, or ABM, said at a press conference on Wednesday.

The initiative also sets a deadline for the end of 2025 to enroll an initial group of banks in a real-time information exchange platform to prevent money laundering and illicit financial activities that would be operational by the end of July next year."This puts us at the forefront, not only in Mexico, but internationally," Romano said.Mexican banks went on high alert after the US Treasury's Financial Crimes Enforcement Network said in June that it would cut off three local firms from the US financial system for allegedly helping fentanyl traffickers launder funds. The unprecedented orders, based on a new power granted under last year's Fend Off Fentanyl Act, crippled the designated firms before even taking effect this month. The move has led other Mexican lenders to purge clients and increase controls in an effort to avoid becoming the next US target.

The move against the Mexican banks was part of a broader US administration strategy for the "total elimination of cartels" that has included deadly military strikes on alleged drug-trafficking boats. The Trump administration launched its largest strikes yet this week, destroying four boats in the eastern Pacific and killing 14 people in an attack that has risked raising tensions with Mexico, a key trading partner.The ABM will propose to Mexican authorities that they put the lobby's recommendations into law and apply them to other financial entities, such as non-bank financial institutions, in order to create a level playing field, Romano said.

The recommendations include limiting international transfers by legal entities to account holders, with the same limitation applied to individuals by June 2027.

"This is very important because a bank account has to go through a selection process," Romano said. "This is what we call 'know your customer,' and the registration process is very regulated. And this regulation allows us to ensure that those who send or receive international transfers are perfectly identified, each and every one."For transfers paid in cash to individuals, the lobbying group recommended that users must show identification, including one biometric data point, while payments should be limited to $350 per remittance and no more than $900 per month per recipient. Cash deposits and withdrawals above 140,000 Mexican pesos (around $7,600) should also face tighter controls by July next year, the ABM said.

The organization will begin to distribute reports to banks on specific money laundering "typologies" they should be watching out for in order to alert authorities of suspicious transactions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up