Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump officials champion rolling back emissions rules to lower vehicle costs, but critics warn of higher fuel bills.

Top officials from the Trump administration are promoting their strategy to lower vehicle costs by rolling back emissions regulations, arguing that affordability is a primary concern for American buyers.

Transportation Secretary Sean Duffy, EPA Administrator Lee Zeldin, and U.S. Trade Representative Jamieson Greer made the case during a tour of the Detroit Auto Show. Their visit was the final stop on a two-day trip through the Midwest that also included visits to a Ford truck factory and a Stellantis Jeep plant in Ohio.

The administration has been systematically reversing electric vehicle policies established under former President Joe Biden.

"These rules will bring car prices down and allow car companies to offer products that Americans want to buy," Duffy stated. "This is not a war on EVs at all... We shouldn't use government policy to encourage EV purchases all the while penalizing combustion engines."

The policy push comes as President Donald Trump confronts economic challenges one year into his term and with midterm elections approaching in November. A key campaign promise was to quickly address rising prices for consumers.

Recent data highlights the affordability challenge. According to research firm Cox Automotive, the average transaction price for a new car reached a record $50,326 in December, driven by strong sales of more expensive trucks and SUVs and a decline in available entry-level models.

Last year, President Trump signed legislation that made several key changes to auto industry regulations:

• It eliminated the $7,500 federal tax credit for electric vehicles.

• It rescinded California's authority to set its own EV rules.

• It canceled penalties for automakers that fail to meet fuel efficiency requirements.

Zeldin argued that the government "should not be forcing, requiring, mandating that the market go in a direction other than what the American consumer is demanding."

Despite these policy shifts and steep tariffs imposed by Trump on imported vehicles and parts, new U.S. vehicle sales increased by 2.4% in 2025, reaching 16.2 million units.

Democrats and environmental advocates argue that the administration's policies, including auto tariffs and the removal of EV incentives, will ultimately hurt consumers.

"The oil industry will rake in billions more from cash-strapped Americans who can't afford to spend more to fuel up their car or truck," said Kathy Harris, director of clean vehicles at the environmental group NRDC.

However, Greer countered that car prices are already trending downward and claimed that tariffs are not being passed on to buyers. "Whatever effects those tariffs may have on various parts of the supply chain, they're not really getting down to the consumer," he said.

The administration's own data illustrates the central trade-off of its policy. In December, the U.S. Department of Transportation (USDOT) proposed reversing Biden-era fuel efficiency standards that had pushed automakers toward EVs.

The USDOT estimates its proposal would reduce the average upfront cost of a new vehicle by $930. However, the department also projects that the change would increase national fuel consumption by as much as 100 billion gallons through 2050, potentially costing Americans an additional $185 billion at the pump over that period.

The EPA is also expected to finalize a rule in the coming weeks that will eliminate vehicle tailpipe emissions requirements.

China and Russia are cementing their control over the global nuclear power market, initiating 90% of all new atomic plant construction last year. Through state-led development, Beijing and Moscow are not only building out their domestic power grids but also expanding their international influence by exporting nuclear technology to emerging nations.

Analysis of data from the World Nuclear Association and the International Atomic Energy Agency reveals a stark trend. Of the nine large-scale nuclear power plants that broke ground in the last year, seven are in China, one is in Russia, and just one is in South Korea.

Over the past decade, China and Russia have systematically cornered the nuclear construction industry. Since 2016, more than 90% of the 63 nuclear power plants started worldwide were of Chinese or Russian design. The only exceptions were five projects in South Korea and the United Kingdom.

This two-nation dominance signals a major shift in the global energy and geopolitical landscape, with long-term implications for technology standards and international alliances.

China is aggressively scaling its domestic nuclear capacity, with 27 reactors currently under construction, according to its Ministry of Ecology and Environment. A government-affiliated industry group projects that China's nuclear generation capacity will hit 110 gigawatts by 2030, a move that would see it overtake the United States as the world's top nuclear power producer.

The Chinese government is accelerating this expansion, having approved plans for 10 new reactors across five locations in April of last year. Nuclear power is forecast to supply 10% of the nation's energy mix by 2040, a significant jump from just under 5% in 2024.

With approximately 60 operational reactors and a generating capacity of around 64 gigawatts, China's nuclear fleet is already on par with that of France, the world's second-largest producer. The country's technological self-sufficiency is also growing, with many new reactors being the Hualong One type—a design China claims as its own. Six are already online in China, with two more operating in Pakistan.

Innovating with Small Modular Reactors

Beyond large-scale plants, China is developing small modular reactors (SMRs), which require less initial investment. State-owned China National Nuclear Corporation successfully conducted a cooling test in October for its Linglong One SMR in Hainan province. This 125-megawatt reactor is scheduled to become operational this year.

While building at home, Russia is primarily focused on exporting its nuclear technology to emerging economies. Over the last ten years, state-owned nuclear giant Rosatom has begun constructing 19 Russian-designed plants overseas in countries like Turkey, Bangladesh, and Egypt.

These projects are highly strategic, locking in relationships that can last for nearly a century—spanning design, construction, fuel supply, maintenance, and eventual decommissioning.

However, Moscow's ambitions face headwinds. Economic sanctions imposed following the invasion of Ukraine have caused delays and financial difficulties for projects abroad. A high-profile plant in Turkey, for example, has missed its original 2023 start date due to funding issues.

Like China, Russia is also pursuing SMR technology. President Vladimir Putin stated at a conference in November that small reactors would "move into mass production," emphasizing Russia's independent technological capabilities.

The United States has been largely dormant in the sector, having built no new commercial nuclear plants since 2013. The Trump administration, however, has signaled a renewed push. In May, President Donald Trump signed an executive order aiming to begin construction on 10 large reactors by 2030, with manufacturers like Westinghouse Electric under consideration.

"Thanks to President Trump, America's nuclear renaissance is here," Energy Secretary Chris Wright posted on social media this month.

AI Boom Fuels Demand for Nuclear Energy

A key driver for this renewed US interest is the recent surge in electricity demand, largely fueled by the artificial intelligence boom. Data centers require a constant, 24/7 power supply that cannot be met by intermittent renewable sources alone.

The US is also heavily invested in SMR development. In early December, the Trump administration announced $400 million in funding for the Tennessee Valley Authority (TVA) and other organizations to advance this technology.

TVA, a government-affiliated utility, plans to adopt an SMR developed by a joint venture between GE Vernova and Hitachi, targeting operation as early as 2032. The utility is also exploring a partnership with US-based NuScale Power to potentially deploy around 70 SMR units with a total capacity of 6 gigawatts. NuScale, which has received investment from Japanese firms like IHI, may use Japanese-made parts in its reactors.

The global energy landscape is pointing toward a "second nuclear renaissance." The first wave in the 2000s and 2010s, driven by decarbonization goals, was largely halted by the 2011 Fukushima Daiichi nuclear accident, which eroded public confidence in nuclear safety.

Today, the combination of geopolitical competition and the massive energy demands of artificial intelligence is once again making a compelling case for nuclear power, setting the stage for a new era of atomic energy development.

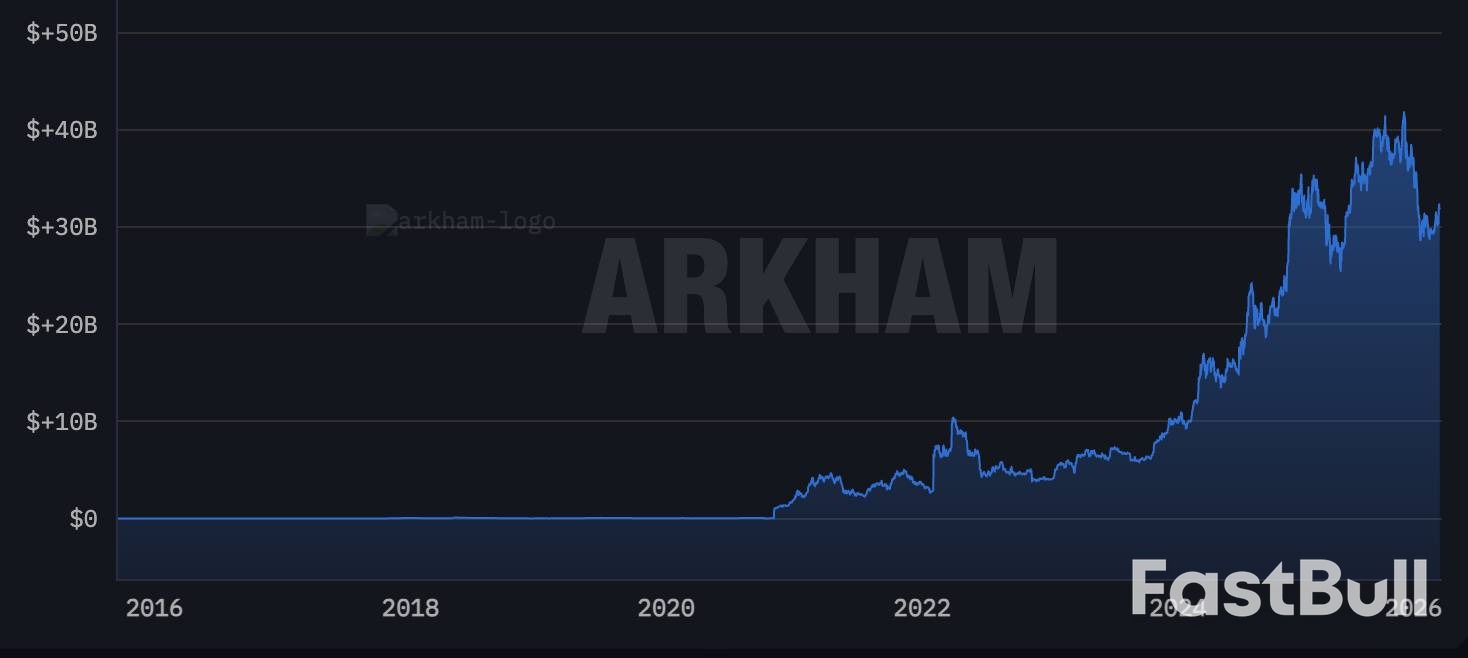

The United States is facing "obscure" legal hurdles in its plan to establish a strategic Bitcoin reserve, according to Patrick Witt, director of the White House Crypto Council. The initiative, designed to create a national stockpile of digital assets, is currently navigating a complex regulatory landscape.

Speaking on the Crypto in America podcast, Witt confirmed that multiple government agencies, including the Department of Justice (DOJ) and the Office of Legal Counsel (OLC), are actively discussing the legal framework for the reserve.

"It seems straightforward, but then you get into some obscure legal provisions, and why this agency can't do it, but actually, this other agency could," Witt explained. "We're continuing to push on that. It is certainly still on the priority list right now."

The push for a national crypto reserve gained momentum in March 2025 when President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve and a broader "Digital Asset Stockpile" that includes various altcoins.

While the move was seen as a landmark moment, its practical limitations quickly drew criticism. The order stipulated that the U.S. government would not sell its existing Bitcoin holdings. Crucially, it only allows the reserve to grow through BTC seized in asset forfeiture cases, prohibiting the government from purchasing Bitcoin or other digital assets on the open market.

The restrictions outlined in the executive order led many in the Bitcoin community to feel that the Trump administration had underdelivered on its promises. The inability to actively acquire BTC was seen as a major flaw.

Bitcoin maximalist Justin Bechler dismissed the effort, stating, "The belief that the federal government will one day build a Strategic Bitcoin Reserve requires a complete detachment from reality."

He added, "There is no movement toward a Bitcoin reserve. There is no intention to acquire a fixed-supply asset in good faith. There are only empty speeches, vague references and opportunistic pandering from Washington politicians."

Further backlash followed in July 2025 when the Trump administration released a long-awaited report on digital asset policy that failed to provide any new details about the strategic BTC reserve.

Despite the setbacks and criticism, discussions about growing the reserve continue. In August 2025, U.S. Treasury Secretary Scott Bessent renewed hope by suggesting the government could acquire BTC through "budget-neutral strategies" that would not increase the annual budget deficit.

This proposal opened the door to the possibility of the U.S. government actively buying Bitcoin on the open market. Potential strategies include converting portions of other reserve assets into BTC or using gains from revaluing the nation's precious metals holdings to fund Bitcoin acquisitions.

Former U.S. President Donald Trump has threatened to impose escalating tariffs on several key European allies unless Denmark agrees to sell Greenland to the United States. The ultimatum sharply intensifies a dispute over the Arctic territory and has already sparked protests in both Denmark and Greenland, with demonstrators demanding the island retain its right to self-determination.

In a post on Truth Social, Trump detailed his plan to levy an additional 10% import tariff starting February 1 on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and Great Britain. These nations are already subject to tariffs previously imposed by his administration.

He added that the new tariffs would increase to 25% on June 1 and would not be lifted until the U.S. is able to purchase Greenland.

Trump has consistently framed the acquisition of Greenland as a matter of U.S. national security, pointing to its strategic Arctic location and significant mineral resources. He has not ruled out using force to achieve this goal.

Tensions have been rising, underscored by the recent deployment of European military personnel to the island at Denmark's request.

"These Countries, who are playing this very dangerous game, have put a level of risk in play that is not tenable or sustainable," Trump wrote. He stated that the U.S. was "immediately open to negotiation," citing America's decades-long role in providing security for Europe.

Analysts at Bernstein offered another perspective in a recent note. "Greenland was probably never really about just buying land or oil," they wrote. "We think it is about control of the Western Hemisphere."

In separate statements, Trump addressed reports concerning JPMorgan CEO Jamie Dimon. He forcefully denied a Wall Street Journal story claiming he had offered Dimon the position of Federal Reserve chair.

Trump also announced his intention to sue JPMorgan within the next two weeks. He accused the bank of "debanking" him after the January 6, 2021, attack on the U.S. Capitol.

Donald Trump has threatened to sue JPMorgan Chase & Co., accusing the banking giant and its CEO Jamie Dimon of "debanking" him following the Capitol riot on January 6, 2021.

The former president’s statement, made in a social media post on Saturday, was a direct response to a Wall Street Journal story. The report claimed Trump had offered Dimon the position of Federal Reserve chief several months ago, an offer Dimon reportedly interpreted as a joke.

"There was never such an offer," Trump wrote. "In fact, I'll be suing JPMorgan Chase over the next two weeks for incorrectly and inappropriately DEBANKING me after the January 6th Protest."

Trump did not provide further details on the planned lawsuit. JPMorgan did not immediately issue a comment on the matter.

This isn't the first time Trump has leveled these accusations against the bank. In August, he claimed JPMorgan "discriminated against me very badly," alleging the firm asked him to close accounts he had maintained for decades. Trump asserted that this action was linked to his supporters storming the Capitol to prevent the certification of Joe Biden’s 2021 election victory.

JPMorgan has previously acknowledged it is facing reviews, investigations, and legal proceedings connected to the broader political fight over "debanking."

In the past, Dimon has directly pushed back against claims that the bank's decisions are politically biased. "We do not debank people's religious or political affiliations," he told Fox Business in December.

Jamie Dimon has made his own position on a potential government role clear. When asked about leading the central bank at a U.S. Chamber of Commerce event on Thursday, Dimon was unequivocal.

"Chairman of the Fed, I'd put in the absolutely, positively no chance, no way, no how, for any reason," he stated.

However, he expressed openness to a different cabinet position, noting that if offered the job of running the Treasury, "I would take the call."

The public exchange highlights ongoing friction over the Federal Reserve's independence. Dimon recently criticized attacks on the institution, warning that "chipping away at Fed independence is not a great idea" and could ultimately result in higher inflation and interest rates. His comments followed actions by the Justice Department, including criminal subpoenas related to the renovation of the Fed's headquarters.

Meanwhile, the question of who would lead the central bank under a new Trump administration remains open. Fed Chair Jerome Powell's term ends in May. On Friday, Trump confirmed he has a successor in mind but declined to name the individual.

Canada is launching a bold new auto strategy designed to counter the impact of Donald Trump's protectionist trade policies, which have threatened to pull car manufacturing back to the United States. The plan, spearheaded by Prime Minister Mark Carney, aims to make Canada a more attractive place for automakers to build vehicles by offering better access to the domestic market.

The full strategy is expected to be unveiled in February by Industry Minister Melanie Joly. However, details emerging from government officials reveal a clear objective: to reverse the trend of plant closures and job losses that have hit the sector since the U.S. imposed tariffs on foreign cars.

Recent high-profile losses include the closure of a General Motors facility in Ontario and Stellantis's decision to build a new Jeep plant in Illinois instead of near Toronto. The new policy is Canada's direct response to these pressures.

In a significant policy shift, Canada will permit Chinese auto companies to assemble vehicles within its borders for the first time. This access, however, comes with strict conditions aimed at integrating these new players into the Canadian economy and managing security risks.

According to a government source, Chinese firms will be required to partner with local companies and utilize Canadian-made software. This requirement highlights a potential role for companies like BlackBerry in providing secure platforms for in-car technology. National security remains a core consideration, with officials emphasizing the need to prevent technology-related vulnerabilities.

The strategy extends beyond attracting traditional manufacturing. It includes a major push into the electric vehicle (EV) market through sales mandates and new buyer incentives. The ultimate goal is to diversify Canada's trade relationships and reduce its heavy reliance on the U.S. market, leveraging existing free trade agreements with Europe and Asia.

Currently, five major manufacturers—GM, Stellantis, Ford, Toyota, and Honda—operate assembly plants in Canada. Most of their output is exported to the United States. Meanwhile, major brands like Tesla, Nissan, and Kia serve the Canadian market, which saw 1.9 million new car sales last year, entirely through imports.

A recent trip to Beijing by Prime Minister Carney has already produced a concrete agreement with President Xi Jinping. This trade truce sets the stage for the new auto policy and includes several key provisions:

• EV Quotas: Canada will allow approximately 49,000 Chinese-made EVs to enter the country annually under a low 6% tariff. This is a dramatic reduction from the 100% surtax imposed in 2024.

• Reciprocal Benefits: In return, China has agreed to lower tariffs on Canadian agricultural exports and grant visa-free travel to Canadian citizens.

• Investment Commitment: During the same visit, Minister Joly secured a tentative agreement with automakers BYD and Chery, along with Canadian parts manufacturer Magna. Chinese firms gain immediate market access but must explore significant investment in Canadian production facilities within three years. Failure to do so could void the deal.

A crucial part of the agreement is a price cap, which mandates that a portion of the EV import quota must consist of vehicles priced at C$35,000 or less. This condition largely favors Chinese brands, which are already leaders in producing affordable EVs.

While the deal caught some in Washington by surprise, President Trump appeared unconcerned. When asked about the Carney-Xi agreement, he told reporters, "That's OK, that's what he should be doing. If you can get a deal with China you should do that."

Despite this reaction, the strategy carries risks. The agreement with China could introduce friction as Canada, the U.S., and Mexico prepare to review their trilateral trade pact. To mitigate potential surprises, the Canadian government stated it had briefed U.S. Trade Representative Jamieson Greer before the deal was finalized. Ultimately, the move underscores a broader ambition for Canada: to forge a more independent economic path, less reliant on its southern neighbor.

Political

Latest news on the Israeli-Palestinian conflict

Remarks of Officials

Palestinian-Israeli conflict

Middle East Situation

The White House has formally invited leaders from several countries to join a U.S.-led "Board of Peace" initiative, a plan designed to first manage the post-conflict governance of Gaza before expanding to address global conflicts. The move follows a fragile ceasefire in Gaza that has been in place since October.

According to a plan unveiled by the Trump administration, this international board will supervise a Palestinian technocratic administration during a transitional period. Both Israel and the Palestinian militant group Hamas have reportedly signed off on the framework.

The White House announced several members of the board, which is intended to outlive its initial role in Gaza. President Donald Trump will serve as the board's chair.

Key members named to the "Board of Peace" include:

• Marco Rubio, U.S. Secretary of State

• Steve Witkoff, Trump's special envoy

• Tony Blair, former British prime minister

• Jared Kushner, Trump's son-in-law

• Marc Rowan, private equity executive

• Ajay Banga, World Bank President

• Robert Gabriel, Trump adviser

Nikolay Mladenov, a former U.N. Middle East envoy, was named high representative for Gaza. Additionally, Army Major General Jasper Jeffers, a U.S. special operations commander, was appointed to lead the International Stabilization Force. This force was authorized by a U.N. Security Council resolution in mid-November.

The White House confirmed more members will be announced in the coming weeks but did not detail the specific responsibilities of each appointee. Notably, the current list does not include any Palestinian members.

In a related move, the White House also announced an 11-member "Gaza Executive Board" to support the technocratic body. This group includes Turkish Foreign Minister Hakan Fidan, U.N. Middle East peace coordinator Sigrid Kaag, UAE International Cooperation Minister Reem Al-Hashimy, and Israeli-Cypriot billionaire Yakir Gabay.

However, the office of Israeli Prime Minister Benjamin Netanyahu stated that the composition of this executive board was not coordinated with Israel and contradicts its policy. The objection may be related to the inclusion of Turkey's Hakan Fidan, as Israel has opposed Turkish involvement.

President Trump has indicated that the board's mandate will extend far beyond the Middle East. "It's going to, in my opinion, start with Gaza and then do conflicts as they arise," Trump told Reuters, adding that its objective would be to address "other countries that are going to war with each other."

Invitations to join the Board of Peace have been sent to the leaders of France, Germany, Australia, and Canada, according to four sources. The offices of the Egyptian and Turkish presidents confirmed receiving invitations, and an EU official stated that European Commission President Ursula von der Leyen was invited to represent the European Union.

The initiative has drawn criticism from rights experts, who have described the structure as resembling a colonial framework. The involvement of Tony Blair has also been criticized due to his role in the Iraq war. One diplomat familiar with the invitation letter called the board a "bold new approach to resolving Global Conflict" and described it as a "'Trump United Nations' that ignores the fundamentals of the U.N. charter."

The fragile ceasefire has been marked by accusations of violations from both Israel and Hamas. During the truce, over 450 Palestinians, including more than 100 children, and three Israeli soldiers have been reported killed.

Israel's military assault on Gaza, which began in October 2023, has killed tens of thousands, triggered a hunger crisis, and internally displaced the entire population. Numerous rights experts, scholars, and a U.N. inquiry have concluded that the actions amount to genocide. Israel maintains it acted in self-defense following an attack by Hamas-led militants in late 2023 that killed 1,200 people and resulted in over 250 hostages being taken.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up