Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

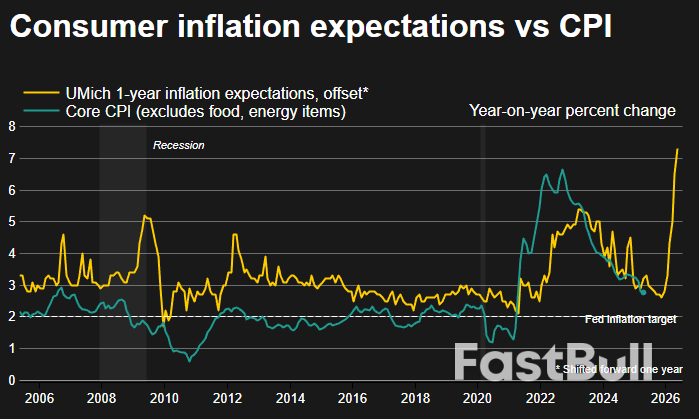

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The S&P 500 has “gone green” for the year to date. A few days ago, the US headline stock market index climbed to a point where it is now higher than it was at the start of January.

The S&P 500 has “gone green” for the year to date. A few days ago, the US headline stock market index climbed to a point where it is now higher than it was at the start of January.

It’s still below its (US dollar terms) all-time high set on 19th February. But it really doesn’t have to climb that much further to set a fresh record.

That’s quite the turn-up for the books really, I think most of us would agree. I mean, what about all that tariff stuff? I know that US president Donald Trump has been rowing back a bit from the most extreme levels of tariffs, but the status quo has not returned by any manner of means.

And what about the whole question of interest rates and what happens next with the bond market? Because, you know, if tariffs aren’t going to be the thing that fills the US deficit now, what will? And how will those promised tax cuts be paid for?

You can see why people might be feeling a bit confused. And the truth is, I think it’s sensible to feel confused, or at least not to place too much conviction in any one view. Uncertainty is, of course, the nature of things, but there are times when conditions are supportive of higher levels of confidence in certain outcomes.

This is most definitely not one of those times. Something that has stood out to me in recent weeks is that the traders and investors whose work I follow most closely — those on my “must read” list — are in “low conviction” mode. They’re taking stock, rather than piling in with big aggressive views on what’s going to happen next.

The “End Of US Exceptionalism” Trade Is Still On

So let’s take a step back ourselves, so as not to lose sight of our current thesis here — which is that “US exceptionalism” is over.

US exceptionalism (in the markets sense at least) refers to the fact that US markets have outperformed “non-US” markets handsomely since just after the global financial crisis in 2008. You can tell a long story about why that’s happened but it’s irrelevant to this particular conversation.

The recent period of outperformance was unusually long, and that has led to a certain sense among investors who’ve been trained by experience to “buy the dip,” that the US will never be a place to “underweight.”

Yet US outperformance is not a natural law or an inevitability. There have been many periods during which the US has underperformed — the period between the tech bust and the lead-up to the financial crisis being just one of those. And it’s certainly my view that we’re returning to one of those periods now — where “the rest” beat the US for a while.

Those who have watched the S&P 500 rocket back to its 2025 starting point might be thinking, “well, so much for that.” But there are a number of ways in which the gap between the US and the rest of the world can close.

The obvious one is that US stocks go down and the rest go up. But the gap would also close if all stocks fall, but US ones fall faster — or, as the case is right now, US stocks go up, but others go up faster still.

And so far, this is exactly what’s been happening. I’ll switch to using sterling as the measuring stick, because the majority of my readers pay their taxes in pounds.

In sterling total return (ie including dividends) terms, since the start of the year, the S&P 500 is still down 6%. The FTSE 100 by contrast, is up 5.5%. That’s a punchy outperformance in anyone’s book. The MSCI World index excluding the US — which is an index of 22 developed markets — is up by 6%. And the MSCI Emerging Markets index is up 3%.

In short, the gap is still closing. And so far I don’t see any reason to expect this theme to end soon. Clearly, I’ve been talking about the UK a lot here as an under-appreciated market to explore as a potential beneficiary of the US losing its “only place to own” status.

But there are many other options to investigate too. As I’m writing this, Michael Hartnett of Bank of America (for my money, one of the best mainstream strategists out there), has put out a note arguing that “nothing will work better than emerging market stocks.”

There’s a big wide world out there. Don’t get panicked into ignoring it by a sense of FOMO because the US has rebounded from its April lows.

Send any feedback to jstepek2@bloomberg.net and I’ll print the best. Or ping any questions to merrynmoney@bloomberg.net.

Looking at wider markets — the FTSE 100 is up 0.5% at around 8,670. The FTSE 250 is up 0.5% at 20,950. The 10-year gilt yield is sitting at 4.61%, lower on the day, as are yields on its German and French peers.

Gold is down 2.5% at $3,160 an ounce, and oil (Brent crude) is up about 0.2% to $64.70 a barrel. Bitcoin is up 0.2% at $103,690 per coin, while Ethereum is up 3.3% at $2,620. The pound is down 0.1% against the US dollar at $1.328, and down 0.2% against the euro at €1.186.

Follow UK Markets Today for up-to-the-minute news and analysis that move markets.

Sign up for Bloomberg UK’s daily morning market newsletter, The London Rush. It’s all you need to get you up to date on the most important UK market-moving stories every morning. Get it delivered every day.

The main stories to watch out for next week include:

If you haven’t yet subscribed to the Merryn Talks Money podcast, I highly recommend you do so. Apple folk can subscribe here ; fellow Android users, you could go with Spotify , or just the podcast app of your choice.

Bitcoin is surging in 2025, igniting speculation about a historic Bitcoin supercycle. After a volatile start to the year, renewed momentum, recovering sentiment, and bullish metrics have analysts asking: Are we on the cusp of a 2017 Bitcoin bull run repeat? This Bitcoin price analysis explores cycle comparisons, investor behavior, and long-term holder trends to assess the likelihood of an explosive phase in this cryptocurrency market cycle.

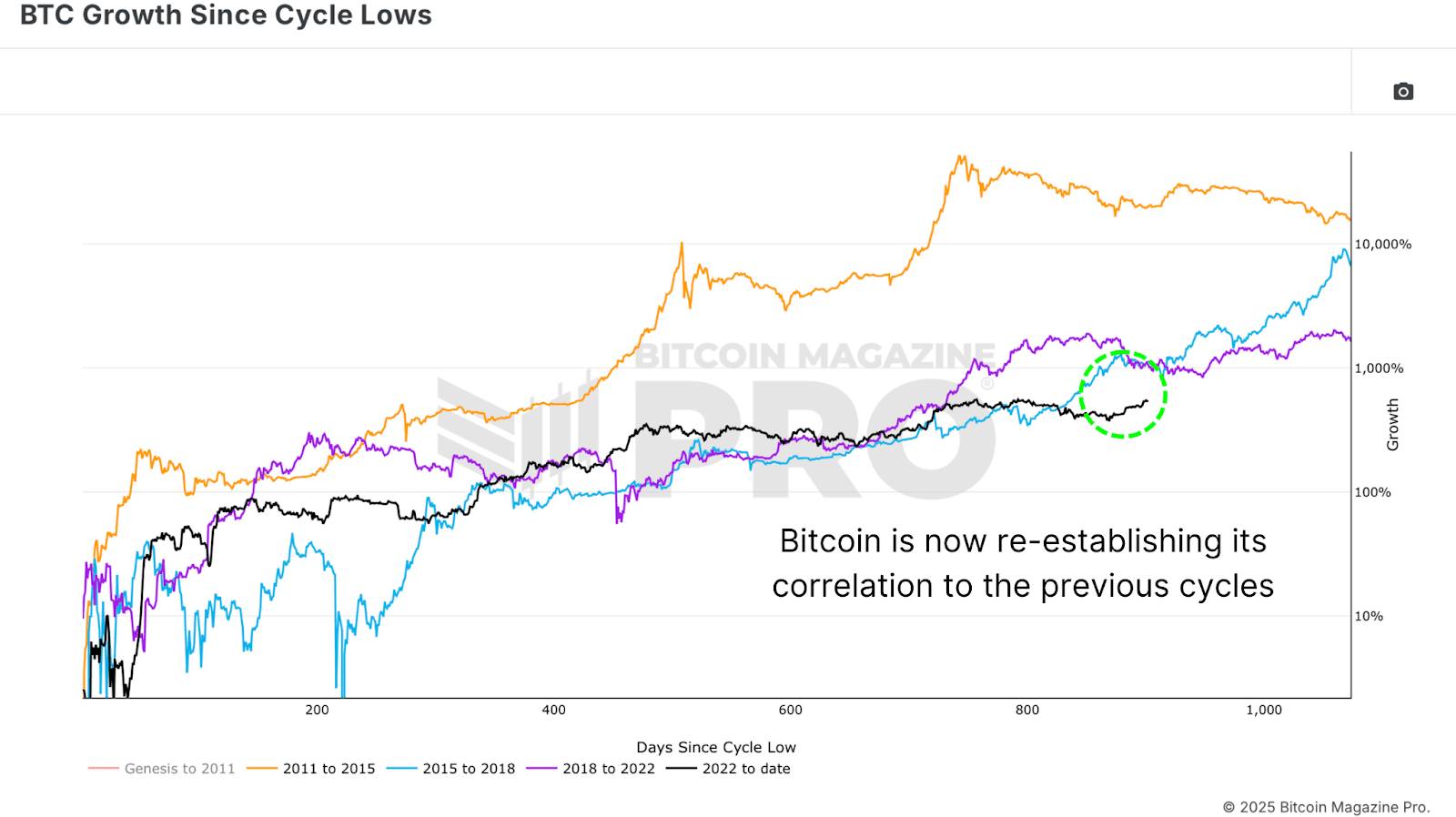

The latest Bitcoin price surge has reset expectations. According to the BTC Growth Since Cycle Low chart, Bitcoin’s trajectory aligns closely with the 2016–2017 and 2020–2021 cycles, despite macro challenges and drawdowns.

Figure 1: Bitcoin’s 2025 bullish price action mirrors previous cycles.

Figure 1: Bitcoin’s 2025 bullish price action mirrors previous cycles.Historically, Bitcoin market cycles peak around 1,100 days from their lows. At approximately 900 days into the current cycle, there may be several hundred days left for potential explosive Bitcoin price growth. But do investor behaviors and market mechanics support a Bitcoin supercycle 2025?

To gauge cryptocurrency investor psychology, the 2-Year Rolling MVRV-Z Score provides critical insights. This advanced metric accounts for lost coins, illiquid supply, growing ETF and institutional holdings, and shifting long-term Bitcoin holder behaviors.

Last year, when Bitcoin price hit ~$73,000, the MVRV-Z Score reached 3.39—a high but not unprecedented level. Retracements followed, mirroring mid-cycle consolidations seen in 2017. Notably, the 2017 cycle featured multiple high-score peaks before its final parabolic Bitcoin rally.

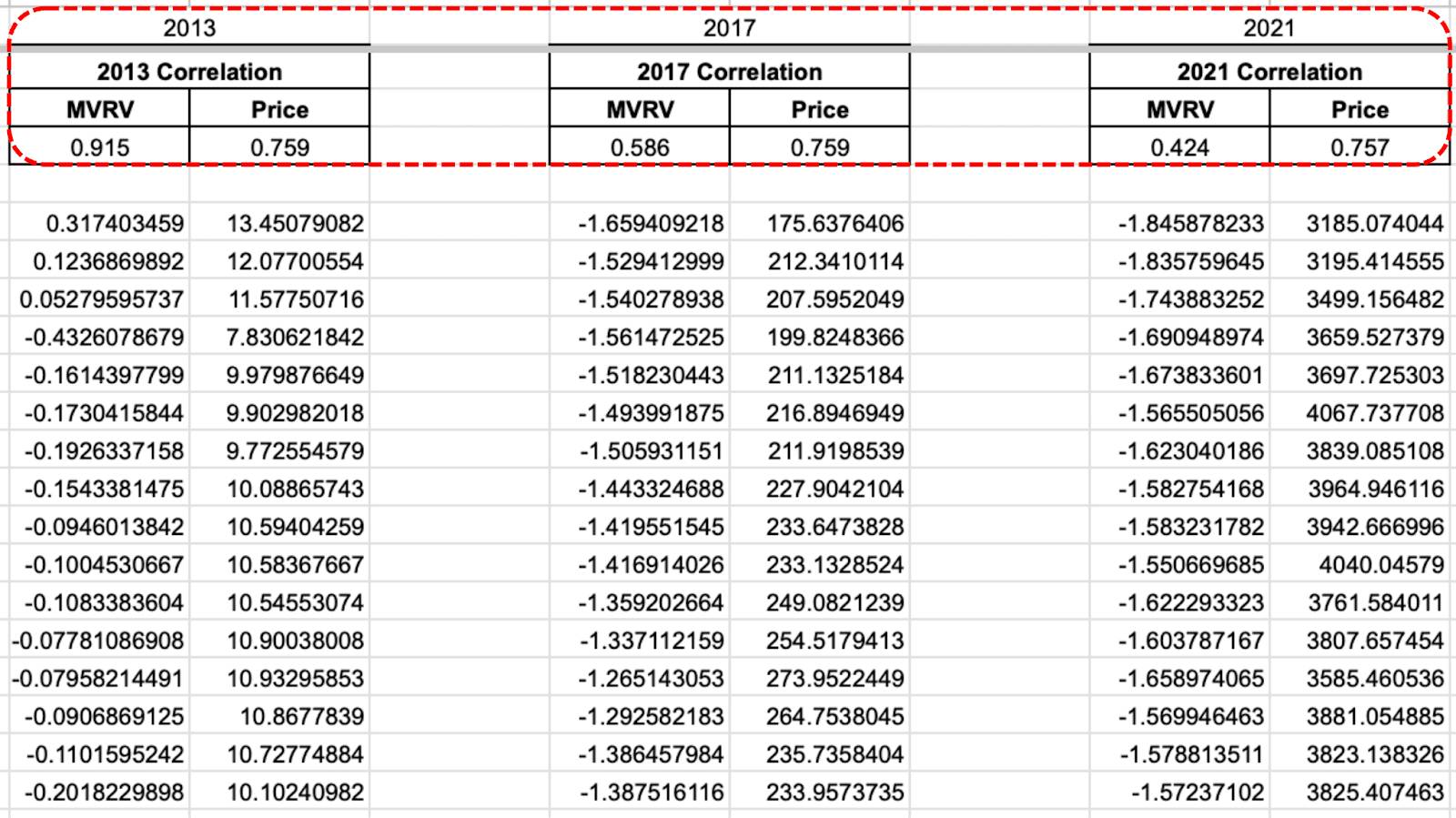

Figure 2: MVRV-Z Score shows behavioral similarities to the 2017 Bitcoin bull run.

Figure 2: MVRV-Z Score shows behavioral similarities to the 2017 Bitcoin bull run. Using the Bitcoin Magazine Pro API, a cross-cycle Bitcoin analysis reveals a striking 91.5% behavioral correlation with the 2013 double-peak cycle. With two major tops already—one pre-halving ($74k) and one post-halving ($100k+)—a third all-time high could mark Bitcoin’s first-ever triple-peak bull cycle, a potential hallmark of a Bitcoin supercycle.

Figure 3: Cross-cycle behavioral correlations using rolling MVRV-Z scores and price action.

Figure 3: Cross-cycle behavioral correlations using rolling MVRV-Z scores and price action.The 2017 cycle shows a 58.6% behavioral correlation, while 2021’s investor behavior is less similar, though its Bitcoin price action correlates at ~75%.

The 1+ Year HODL Wave shows the percentage of BTC unmoved for a year or more continues to rise, even as prices climb—a rare trend in bull markets that reflects strong long-term holder conviction.

Figure 4: The rate of change in the 1+ Year HODL Wave suggests confidence in future Bitcoin prices.

Figure 4: The rate of change in the 1+ Year HODL Wave suggests confidence in future Bitcoin prices. Historically, sharp rises in the HODL wave’s rate of change signal major bottoms, while sharp declines mark tops. Currently, the metric is at a neutral inflection point, far from peak distribution, indicating long-term Bitcoin investors expect significantly higher prices.

Could Bitcoin replicate 2017’s euphoric parabolic rally? It’s possible, but this cycle may carve a unique path, blending historical patterns with modern cryptocurrency market dynamics.

Figure 5: A repeat of 2017’s exponential Bitcoin price growth may be ambitious.

Figure 5: A repeat of 2017’s exponential Bitcoin price growth may be ambitious.We may be approaching a third major peak within this cycle—a first in Bitcoin’s history. Whether this triggers a full Bitcoin supercycle melt-up remains uncertain, but key metrics suggest BTC is far from topping. Supply is tight, long-term holders remain steadfast, and demand is rising, driven by stablecoin growth, institutional Bitcoin investment, and ETF flows.

Drawing direct parallels to 2017 or 2013 is tempting, but Bitcoin is no longer a fringe asset. As a maturing, institutionalized market, its behavior evolves, yet the potential for explosive Bitcoin growth persists.

Historical Bitcoin cycle correlations remain high, investor behavior is healthy, and technical indicators signal room to run. With no major signs of capitulation, profit-taking, or macro exhaustion, the stage is set for sustained Bitcoin price expansion. Whether this delivers a $150k rally or beyond, the 2025 Bitcoin bull run could be one for the history books.

Many fear that America’s withdrawal from the Paris climate agreement will undermine the international consensus to reduce greenhouse-gas emissions. Yet just in the last month, there have been two major steps toward widespread carbon pricing where it is needed most.

To be sure, carbon pricing is not always the best policy, and not all sectors need to be subjected to schemes that require international consistency. If India electrifies its vehicle fleet more slowly than Europe, European industry suffers no competitive disadvantage. But the situation is different in long-distance shipping and aviation, and in heavy industries such as steel and chemicals, which account for around 25% of global emissions. Here, carbon pricing is key to cost-efficient decarbonization, and must be imposed on an internationally consistent basis.

Fortunately, the technologies needed to achieve net-zero emissions by mid-century in each sector already exist. For example, methanol or ammonia can be used instead of fuel oil in ship engines, and hydrogen can replace coking coal in iron production. As matters stand, these technologies would impose a significant “green cost premium” at the intermediate product level, but with only a small impact on consumer prices. For example, even if shipping-freight rates doubled, the price of a pair of jeans made in Bangladesh and bought in London would rise less than 1%. If making zero-carbon steel costs 50% more per ton, that would add around 1% to the price of an automobile made from green steel.

Carbon pricing is essential to overcome the green cost premium, and it could drive cost-efficient decarbonization at a trivial cost to consumers. But in each of these sectors, inherently international products (long-distance shipping) or the international trade in products (steel) make purely domestic approaches untenable. That is why the International Maritime Organization (IMO) agreed on April 11 to impose a carbon levy reaching $380 per metric ton on ship operators whose emissions intensity exceeds a defined threshold.

The IMO agreement is not perfect. The organization aims to cut global shipping emissions by 20% by 2030, but the new pricing scheme would achieve only an 8% reduction. Still, concluding a new multilateral agreement despite a US boycott of the negotiations is a big step forward. China, India, and Brazil were among the 63 countries in favor.

Carbon pricing could also drive decarbonization in heavy industry, but if it is imposed in only some countries, production and emissions will simply move to others. Though the ideal solution would be common carbon prices worldwide for these energy-intensive sectors, there is no international rule-making body like the IMO. The second-best solution, then, is for individual countries to impose domestic carbon prices combined with border carbon tariffs.

The European Union is pursuing this approach. Not only will its emissions-trading scheme likely price carbon around $140 per metric ton by 2030; it is also removing the free allowances that heavy industry previously enjoyed and introducing a border carbon adjustment mechanism (CBAM) to subject imports to the same carbon pricing as domestic production. In principle, this creates strong incentives for decarbonization, while protecting domestic competitiveness.

But the CBAM has been too weak, and heavy-industry decarbonization projects have been delayed. As a result, in March the European Commission committed to strengthening the regime in three respects: by ensuring a level playing field for exports as well as domestic sales; by widening the product coverage; and by improving the measurement of imports’ carbon intensity.

The crucial question now is how developing countries will respond. In the past, several governments – in particular China and India – have criticized CBAMs as protectionist. But their arguments are unconvincing. Combining a domestic carbon price with a CBAM does not give domestic producers a competitive advantage. It simply maintains the competitive balance that existed before both were introduced. Moreover, it is the only way that developed countries can truly decarbonize their heavy industry, rather than hypocritically claiming to reduce emissions that have merely moved to other countries. The objective of the policy is not to raise tariff revenue, but to encourage other countries to impose carbon prices at home.

These arguments are beginning to gain traction in developing countries. China’s own emissions-trading scheme has been extended to heavy-industry sectors, and prices are slowly increasing – though they still hover around $10-15 per metric ton. If carbon prices in China, India, and other developing countries gradually rose to European levels, and if CBAMs were imposed on those outside this low-carbon club, Chinese and Indian companies would also decarbonize. Even better, the impact on local consumer prices would be trivial, and governments would generate revenue.

In this way, the EU’s approach could unleash a global wave of carbon pricing on heavy industry, matching the IMO’s progress in shipping. Ideally, policies would reflect internationally agreed standards for measuring the carbon intensity of production, and some of the revenues from CBAMs – and from the IMO’s carbon levies – would go toward supporting emissions reduction in lower-income countries. These ideas should be debated at COP30 in Brazil this November, regardless of whether an official US delegation attends.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up