Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

It was an interesting trading week for financial markets last week, with the major update coming in the final session as Fed Chair Jerome Powell all but confirmed a September rate cut in his speech from Jackson Hole.

It was an interesting trading week for financial markets last week, with the major update coming in the final session as Fed Chair Jerome Powell all but confirmed a September rate cut in his speech from Jackson Hole.Markets closed the week in a positive fashion on Friday, and most investors are expecting that momentum to carry into the early sessions of this week.It is a relatively quiet week on the macroeconomic calendar; however, there are a few key updates that should see some volatility around them, culminating in the Fed’s favoured inflation indicator on Friday.

Here is our usual day-by-day breakdown of the major risk events this week:

It could be an interesting start to the week for financial markets as key central bank heavy hitters are still in Jackson Hole for the symposium over the weekend, and we could see some sharp moves on the open in Asia, especially in currency markets. Kiwi markets will then be in focus early in the day with the latest Retail Sales numbers due out. Liquidity will be lower than usual in the European session with the UK on holiday, and we could see some moves in the euro with the German IFO Business Climate data due out. The New York session is relatively light on data updates, with just the New Home Sales data due out.

The first two sessions of the day on Tuesday are light in terms of calendar events; however, things should heat up once New York opens. US Durable Goods data is due out early in the day, and this is followed a couple of hours later by the CB Consumer Confidence numbers and the Richmond Manufacturing Index data. The focus will move to Canadian markets later in the session with Bank of Canada Governor Tiff Macklem due to speak.

Australian markets will be in focus for traders in the Asian session with key CPI data due out early in the day. There is very little on the calendar in the latter two sessions; however, the weekly US Crude Oil Inventory numbers are due out in the New York session, and we do hear from the Fed’s Thomas Barkin later in the day.

There is nothing of note on the calendar in the Asian session on Thursday, but the focus will be on Swiss markets early in the London session with the quarterly GDP numbers due out. The New York session again looks likely to be the busiest, with US quarterly Prelim GDP data due out alongside the weekly Unemployment Claims numbers early in the day. Pending Home Sales data is due out later, and we also hear from the FOMC’s Christopher Waller just after the close.

Inflation numbers are in focus across the sessions on Friday. The focus in the Asian day will be on Japanese markets with the key Tokyo CPI numbers due out. The London session sees Prelim CPI data out from Germany, France, Italy, and Spain. However, the main event of the day—and probably the week—is once again scheduled for the final session. The US Core PCE Price Index data is due out early in the session, and traders will be looking for this to confirm a September rate cut. Canadian GDP numbers are out at the same time, and we have revised University of Michigan data later in the session, but expect the PCE numbers to dominate sentiment into the weekend.

Oil prices managed to finish last week higher, settling up almost 2.9% higher as enthusiasm over a potential Russia-Ukraine ceasefire wanes. Uncertainty prevails as US President Trump once again threatens to impose tougher sanctions on Russia unless there’s a deal to end the war. Trump said there needs to be more clarity within roughly two weeks. However, the market may be reluctant to read too much into this latest threat, given the lack of action taken by the US administration against Russia following the Trump-Putin summit.

In the near term, we may see the oil market benefit following Fed Chair Jerome Powell’s Jackson Hole speech, which was largely dovish and provided a boost to most risk assets. The market is pricing in more than an 85% probability that the Fed cuts interest rates by 25bp in September, up from around 72% ahead of Powell’s speech.

It's looking increasingly likely that secondary tariffs against India for their purchases of Russian oil will go ahead on 27 August. There appears to be little progress in trade talks between India and the US, since the US announced the tariff earlier in the month. Furthermore, Indian refiners have been showing increased interest in Russian oil, after state refiners initially paused purchases until there is clarity from the government. If India continues to buy Russian oil despite the 25% secondary tariff, it does little to change the market outlook. Instead, it only confirms the bearish outlook for oil prices.

Speculators continue to reduce their net long in ICE Brent amid a bearish outlook. Speculators sold 23,852 lots over the last reporting week to leave them with a net long of 182,695 lots as of last Tuesday. The move was driven predominantly by longs liquidating. Meanwhile, speculators also sold 19,578 lots in NYMEX WTI, leaving them with a net long of 29,686 lots. This is the smallest position held in WTI since October 2008.

Fading optimism over a Russia-Ukraine peace is providing support for European gas prices. At the same time, concerns over flows to Europe amid upcoming Norwegian maintenance will also provide support to the market. Front-month Title Transfer Facility (TTF) futures managed to settle more than 8% higher over the week. EU gas storage is close to 76% full, below the 91% seen at the same stage last year and lower than the 83% 5-year average.

US natural gas has been more bearish, with Henry Hub down 7.5% over the last week and settling at its lowest level since October 2024. This is despite last week’s storage build coming in below average. However, overall storage remains 5.8% above the 5-year average, while we are moving towards a period where we expect to see reduced cooling demand. This is allowing for larger storage builds ahead of the 2025/2026 winter.

Gold jumped last Friday as the dollar and bond yields fell after Federal Reserve Chair Jerome Powell suggested an interest rate cut in September, pointing to increasing labour market risks despite persistent inflation concerns. Traders added to bets the Fed will cut rates next month. With US rate cut bets intensifying after Powell’s speech, gold could be poised for another fresh record high.

World Steel Association data shows that global steel production fell 1.3% year on year to 150.1mt in July, as lower output in China, Japan, Russia, and Germany offset higher output from India and the US. Cumulative global steel output fell 1.9% YoY to 1,086.2mt over the first seven months of the year. Chinese steel production fell 4% YoY for a second straight month to 79.7mt last month amid government efforts to gain control over supply. Over the first seven months of the year, output fell 3.1% YoY to 594.5mt. In the EU, crude steel production dropped 7% YoY to 10.2mt with Germany (-13.7% YoY) dominating the declines.

Markets were quiet for most of last week as traders waited for Fed Chair Jerome Powell’s speech at Jackson Hole. Until Friday, the U.S. dollar traded sideways and stocks moved lower as investors wanted to hear if the Fed would confirm a rate cut in September. Economic data before the speech was mostly better than expected, with stronger PMI figures in the U.S., U.K., and Eurozone, higher U.K. CPI, and U.S. home sales beating forecasts. Japan’s core inflation slipped to 3.1% in July, just above expectations, while Canada’s removal of retaliatory tariffs was seen as positive for global trade.

On Friday, Powell hinted the Fed may cut rates next month, saying both labor demand and supply are slowing. He stressed that while tariffs are lifting prices, these effects are likely temporary. His tone was more dovish, and markets reacted strongly—equities surged with the Dow hitting a record high, and the U.S. dollar weakened as the chance of a September rate cut rose to about 90%.

Powell also emphasized that the Fed remains data-driven and independent despite political pressures. With job growth slowing and unemployment risks rising, markets are now waiting for this week’s labor and inflation data to confirm whether the Fed will move at the September meeting.

Markets This Week

The Dow hit new record highs last week after Fed Chair Powell’s Jackson Hole speech, with a September rate cut now seen as highly likely. With the negative impact of U.S. tariffs proving less severe than expected, U.S. stocks remain in a strong upward trend. However, the Dow is currently looking overbought, so a pullback or sideways move is likely at the start of the week, which could provide a buying opportunity for both short- and long-term traders. Key resistance levels are at 46,000 and 47,000, while support is seen at 45,000, 44,000, and 43,000.

After hitting a record high early last week, the Nikkei faced profit-taking ahead of Powell’s speech but later found support at previous highs and closed strongly, following the surge in U.S. equities. The index has risen sharply over the past month and has now moved back below the 10-day moving average, suggesting sideways trading in the short term as investors look ahead to when the Bank of Japan may raise interest rates. Key resistance levels are at 44,000円 and 45,000円, while support is seen at 42,250円, 42,000円, 41,500円, and 41,000円.

The USD/JPY traded sideways for most of last week ahead of the Jackson Hole meetings, before falling sharply after Powell’s speech, as a September U.S. rate cut now looks highly likely. The pair remains in a range, with the 10-day moving average also pointing sideways, making range trading the preferred strategy. However, risks lean to the downside if the Bank of Japan signals it is close to raising interest rates or if upcoming U.S. data disappoints. Resistance is at 148, 149, and 150, while support is at 146 and 145.

Gold initially tested lower last week but recovered strongly as expectations of a U.S. interest rate cut in September supported demand. The market has moved back above the 10-day moving average, breaking the recent downtrend. Overall, gold remains range-bound, but with support holding, the market could continue to test higher levels, making buying on weakness the preferred strategy. Resistance is at $3,400 and $3,450, while support is at $3,300, $3,250, and $3,200.

Crude Oil

Crude oil rebounded in a quiet week, breaking the recent downtrend after closing above the 10-day moving average. Buyers returned as talks to end the Russia–Ukraine war showed little progress, while Powell’s comments on future rate cuts were seen as supportive for demand. With the downtrend now broken, prices are expected to trade sideways in the short term as traders wait for further news from the negotiations. Resistance is seen at $65, $70, and $75, while support is at $60 and $55.

Further selling continued through most of last week after the negative key reversal signal on the daily chart, but the market found strong support at $112,000, the August lows and previous record highs. Powell’s speech was positive for Bitcoin, as lower interest rates make the asset more attractive, though Bitcoin remains in a short-term downtrend. For now, the market is likely to trade sideways, offering range-trading opportunities between $112,000 and $120,000 this week. Resistance is at $120,000, $125,000, and $150,000, while support is at $112,000, $110,000, and $105,000.

This Week’s Focus

This week, traders are still reacting to Fed Chair Powell’s speech at Jackson Hole. His dovish comments raised hopes for a September rate cut, but the question now is whether the dollar will keep falling or if the cut is already fully priced in, leading to a rebound. Powell stressed that the Fed is data-driven, so important U.S. reports on durable goods, GDP, inflation, and consumer confidence will be key. These numbers could quickly change market expectations and create new trading opportunities.

Geopolitics may also play a role. A possible breakthrough in Russia–Ukraine peace talks, though unlikely, would likely lift equities but push oil lower. At the same time, traders are watching the Bank of England for signs of another rate cut, and Japan for a possible rate hike after strong GDP. With central bank signals and global risks in focus, volatility is likely to stay high across currencies, stocks, and commodities.

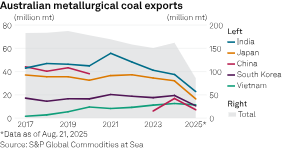

Australian metallurgical coal producers expect higher exports to India but are facing increasing competition from the US and Russia, according to S&P Global Commodities at Sea data.BHP Group Ltd., Whitehaven Coal Ltd. and Yancoal Australia Ltd. outlined increased met coal production in fiscal 2025 while talking up India's demand growth, which could help arrest declining average realized prices. Platts assessed the premium hard coking coal Australia export FOB East Coast price at $187.50/mt on Aug. 22, down from $200.50/mt a year prior.

While Japan accounts for about half of Whitehaven's total volume, "India has actually emerged with 11% now, which is good because that footprint we know will expand considerably as we go forward," Paul Flynn, managing director and CEO, said Aug. 21 during a fiscal 2025 call with analysts.In fiscal 2025, India shot up to become Whitehaven's second-largest export destination with A$795 million in revenue — all of it met coal — behind Japan's A$2.73 billion, according to the miner's annual report.

"Structurally, India is very dependent on the seaborne market for met coal. It has next to nothing in terms of its own resource ... and Australia is already the largest supplier to India of its metallurgical coal demand," Flynn said during a same-day media call."With the growth in blast furnace construction capacity in [India], we can see an outlook for growth in metallurgical coal demand that's very strong; and we see limited opportunities in the pipeline for new supply to come on, hence our view that prices will continue to tighten and you'll see better pricing emerge as a result," Flynn added.

While Australia's total met coal exports rose annually in 2024, the downtrend in exports to India that started in 2021 persisted, according to CAS data. In 2024, exports to India comprised 37.5 million mt of Australia's total of 161.9 million mt.China's return to procuring Australian coal, after banning coal from Down Under in 2020, is partly responsible for Australia's falling exports to India in recent years, said Pranay Shukla, head of dry bulk freight and commodities research at Commodity Insights, in an interview. India diversifying met coal supplies, including from the US, is also a factor, Shukla added.

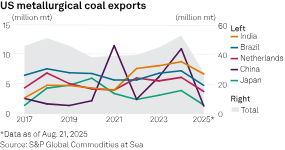

India's met coal imports from the US steadily increased after 2021, hitting a record 8.8 million mt in 2024, second only to China's 11 million mt. India is already the lead destination for US met coal this year with 6.7 million mt as of Aug. 21, ahead of Brazil's 4.8 million mt and the Netherlands' 3.7 million mt. China stood at 1.4 million mt amid trade tensions with the US.The US, whose coal industry is now aided by an accommodative president, was India's third-highest met coal source behind Australia and Russia in 2024. Russia's exports to the subcontinent have also risen since 2021.

A slowdown in China's property sector lowered demand and cut met coal prices across product categories in fiscal 2025, and "India's demand has also been tempered by the early onset of the monsoon season along with higher levels of domestic production," Yancoal said Aug. 19 in its half-year report.However, "the Indian growth opportunity is real," Mark Salem, Yancoal's executive general manager of marketing, said on an analyst call Aug. 20.

"The advantage of the Indian market is that India does not produce its own metallurgical coal, unlike China. Therefore, based on their GDP growth assumptions and this demand profile based on their infrastructure plans, they will need the coking coal to meet that growth requirement," Salem said.BHP CEO Mike Henry also highlighted India as "a bright spot for commodity demand" during an Aug. 19 fiscal 2025 results call.

"Indian pig iron production growth remained strong" during fiscal 2025, and "robust hard coking coal imports from developing countries such as India will lead to growing and resilient demand for decades to come," BHP said in its results."India will likely remain the fastest-growing major economy, driven by sustained public investment, improving monetary conditions and resilient service sector activity," BHP said.

However, Henry noted on the call that BHP had underestimated the resilience of steel demand in China, whose production is believed to have peaked in 2020.BHP has seen "robust commodity demand in China from the continued strong growth there, including from the infrastructure and electrification sectors, even as demand from the property sector remains subdued," Henry added.

Flynn also pointed to Chinese policy being "focused on constraint of surplus production of coal and of course, surplus steel production."Whitehaven's coal exports to China surged by over 957% to A$571 million in fiscal 2025 — all metallurgical — to become the miner's third-highest export destination after not even making its top 10 in fiscal 2024.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up