Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Netanyahu pledges support for Druze minority during visit; Israel has expanded military presence in Syria post-Assad; Syria demands return to original buffer zone, Israel refuses; US-brokered talks for Israel-Syria security pact have faltered.

Israel's Prime Minister Benjamin Netanyahu visited Israeli troops deployed in southern Syria, drawing strong condemnation from the government in Damascus, which denounced the trip as a violation of sovereignty.

Israel expanded its military presence in southern Syria after the ousting of Bashar al-Assad last December, seizing positions east of a U.N.-patrolled buffer zone that separates the Israeli-occupied Golan Heights from Syrian territory.

Wearing a flak jacket and helmet, Netanyahu on Wednesday visited troops on Syrian territory, according to photographs published by his office. He reiterated Israel's commitment to protect Syria's Druze minority, whose community straddles the border into northern Israel.

"We attach immense importance to our capability here, both defensive and offensive, safeguarding our Druze allies, and especially safeguarding the State of Israel and its northern border opposite the Golan Heights," Netanyahu told the troops, according to a statement from his office.

"This is a mission that can develop at any moment, but we are counting on you," he said.

The Islamist-led government in Damascus said Netanyahu's visit was "a dangerous violation of Syrian sovereignty and unity," and called it an attempt to "impose a fait accompli."

There was no immediate comment from the Israeli government.

Israel captured the Golan Heights from Syria in a 1967 war and later annexed it, a move not recognised by most countries. Syria has demanded that Israel returns to the original buffer zone, but senior Israeli officials have said they will not relinquish the new posts.

For months, Syria has been in U.S.-brokered talks with Israel to reach a security pact that Damascus hopes will reverse Israel's recent seizures of its land but that would fall far short of a full peace treaty.

The talks have faltered since Israel introduced a new demand, opens new tab to allow the opening of a "humanitarian corridor" to Syria's southern province of Sweida. Syria rejected the request as a breach of its sovereignty.

A Syrian military official said the visit showed Israel was not willing to relinquish any territory.

"Netanyahu's visit sends a message: we won't withdraw from the areas we entered after December 8... Regardless of the security deal, its future or its fate, this is the message they're sending Syria - that Israel is not willing to give up these outposts," the official told Reuters.

The two countries have technically been at war since the creation of Israel in 1948, despite periodic armistices. Syria does not recognise the state of Israel.

Since Assad's ousting, Israel has carried out unprecedented strikes on Syrian military assets including the defence ministry, sent troops into its south and lobbied the U.S. to keep Syria weak and decentralised.

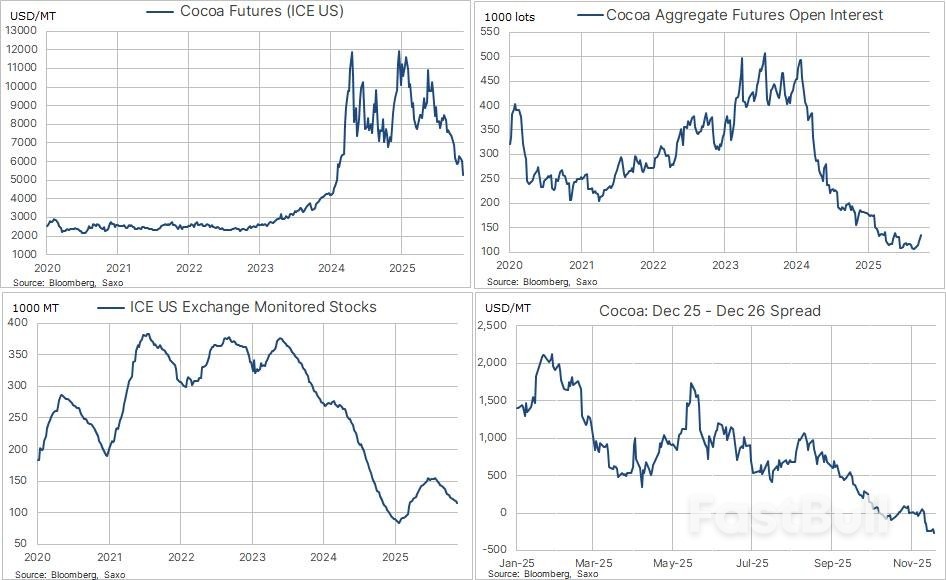

The retreat reflects a classic case of "the best cure for high prices is high prices." After several years of weather disruptions, disease pressure and ageing trees in Ivory Coast and Ghana, the world's two dominant producers, the 2023–24 deficit pushed physical supply to breaking point. Crucially, farmgate prices lagged the futures spike, leaving farmers unable to invest just as climate volatility was intensifying. This mismatch created the conditions for the parabolic rise.

That dynamic is now reversing. Improved rainfall, better fertiliser use and rising producer-country prices have encouraged farmers to rehabilitate plantations, prune more aggressively and replant high-yielding varieties. Beyond West Africa, elevated returns have sparked investment in Latin America and Southeast Asia, gradually broadening the global supply base.

This transition is visible in the forward curve. One year ago, the Dec-24 futures contract traded in New York held a 23% premium over Dec-25, an extreme backwardation that highlighted acute nearby scarcity. Today, Dec-25 trades at a USD 270/t or 5.5% discount to Dec-26, reflecting a return to contango and a market that is no longer scrambling for prompt supply. Producers are again willing to hedge, inventories are starting to recover and traders are no longer paying panic-level premiums to secure beans.

Demand has also played an essential role in normalising the balance. Record-high raw material costs forced chocolate manufacturers into a series of unpopular choices: shrinkflation, price increases and the quiet dilution of cocoa content. The latter has become sufficiently widespread that some UK biscuits and bars can no longer legally be labelled "chocolate," instead qualifying only as "chocolate flavour" coatings dominated by palm and shea oils. This is classic demand destruction — the point at which consumers either trade down or manufacturers reformulate to protect margins.

Lower cocoa prices will not immediately reverse shrinkflation or dilution. Recipe reformulations tend to stick, at least for a while. Reversing them requires either competitive pressure or a sustained period of lower input costs. But the potential is now there. Cocoa at USD 5,000/t is still expensive by past standards but far more manageable for manufacturers than USD 12,000/t.

Seasonality adds a timely twist. The current slump arrives far too late to affect Christmas assortments already produced and priced months ago. The supply shock hit during the production cycle for 2024 holiday products, meaning consumers will still face high prices and—depending on the brand—lighter bars with more palm oil than they might expect. But if the market stabilises around current levels, the impact could show up in 2026's Easter eggs and bunnies. In a market where humour is often in short supply, it is tempting to say that while the cocoa slump won't save Christmas, it may soften the blow for Easter.

From a trading perspective, the picture now looks considerably more balanced than it did a few months ago. The froth that characterised the peak has largely evaporated, evident in the sharp contraction in aggregate open interest as speculative positions were unwound. The recent stabilisation and modest uptick in open interest likely reflect a mix of fresh speculative selling and renewed producer hedging as prices return to more workable levels. With the parabolic phase behind us, price action should increasingly be driven by more conventional fundamentals: West African weather patterns, disease management, the pace of replanting and political risk in key producer nations. On the demand side, global growth trends, consumer sentiment and the extent to which manufacturers restore cocoa content will shape the recovery profile.

The next key question is sustainability. Can the new supply momentum be maintained? West Africa remains vulnerable to climate variability, and gains in new origins may be too small to offset problems if a serious weather event hits the region again. Meanwhile, if manufacturers do not reverse shrinkflation or dilution, demand may not rebound as quickly thereby keeping a ceiling on prices.

Overall, cocoa's downturn marks the start of normalisation after a once-in-a-generation shock. The slump has stabilised the market, given farmers breathing room and eased pressure on buyers. For consumers, the benefits are coming — just not in time to salvage this year's Christmas stockings. But Easter? That might finally bring a bit more real chocolate and a bit less "chocolate-flavoured" improvisation.

Cocoa charts

Cocoa chartsThe dollar strengthened across the board following the publication of the minutes from the latest Federal Reserve meeting. The document confirmed the regulator's readiness to cut rates further, but without clear timing and with an emphasis on future decisions depending on incoming data. For some market participants, this sounded less "dovish" than expected, prompting increased demand for the dollar, while Treasury yields held near local highs.

Another source of uncertainty remains the impact of the prolonged US government shutdown. Due to the suspension of statistical agencies, some key releases on employment and inflation were not published on schedule, meaning that the upcoming batch of labour-market data may bring surprises. Today, investors are focused on private-sector employment reports, jobless-claims data, and related indicators, which will help shape expectations ahead of the Fed's next decisions.

The USD/JPY pair has reached this year's extremes, reacting to the monetary-policy differential. The pair is trading above 157.00, reflecting a combination of a more resilient dollar and the Bank of Japan's persistently dovish stance. The market still does not see the Japanese regulator preparing for tightening, whereas the Fed, despite being in a rate-cutting cycle, maintains a cautious tone and highlights inflation risks.

Technical analysis of USD/JPY suggests a possible test of the key 158.00–158.90 range if the 157.00 level confirms itself as support. Should a downward pullback develop, the pair may decline towards 155.20–156.00.

Events that may influence USD/JPY pricing in the coming trading sessions include:

Sellers of USD/CAD made another attempt yesterday to break support at 1.3980, but were unsuccessful. The price rebounded sharply from this level and held above 1.4000. If the upward momentum continues, the pair may revisit recent highs near 1.4140. A firm move back below 1.4000 could trigger another approach towards 1.3930.

Events that may influence USD/CAD pricing in the coming trading sessions include:

This cardano ada price prediction examines whether the critical $0.51 support zone can act as a launchpad for a long-term move toward $10 between 2025 and 2030. By combining technical analysis, on-chain data, macro drivers and network development trends, this guide provides balanced scenarios to help traders and investors understand potential price paths, key risks and realistic expectations for ADA’s future performance.

The current cardano ada price prediction is highly sensitive to short-term volatility and broader market sentiment. ADA continues to trade within a compressed range, reflecting indecision among market participants and aligning with typical consolidation phases seen before major breakouts.

| Indicator | Current Signal |

|---|---|

| RSI (14) | Neutral to mildly bullish |

| MACD | Early convergence forming |

| 200-Day MA | Acting as dynamic resistance |

The $0.51 level remains the most closely watched zone in any ada cardano price prediction model. Historically, this level has acted as a liquidity magnet and structural base, reinforcing its importance in short and mid-term outlooks.

On-chain data reveals increasing whale wallet accumulation during consolidation phases, a behaviour often preceding larger directional moves. Exchange netflows indicate moderate outflows, suggesting investors are positioning for longer-term holding rather than immediate selling pressure.

This pattern aligns with broader narratives surrounding cardano ada price prediction crypto news, reinforcing the theory that institutional confidence may be rebuilding.

| Quarter | Projected Range (USD) | Market Theme |

|---|---|---|

| Q1 2025 | $0.60 – $0.88 | Accumulation phase |

| Q2 2025 | $0.75 – $1.05 | Speculative momentum |

| Q3 2025 | $0.85 – $1.25 | ETF sentiment anticipation |

| Q4 2025 | $1.10 – $1.60 | Trend confirmation phase |

If regulatory approval occurs, cardano ada price prediction 2025 models suggest accelerated capital inflows into ADA. ETF confirmation may attract institutional demand comparable to historical BTC and ETH behaviour.

Without ETF approval, price action may remain confined within a moderate growth band. This scenario still retains upward momentum but reflects conservative sentiment and delayed institutional commitment.

This outlook also aligns with conservative projections seen in cardano ada price prediction july 2025 discussions, which anticipate gradual progression rather than explosive price action.

Long-term scenarios for ADA between 2026 and 2030 depend on network execution, macro cycles and overall crypto market structure. The table below outlines an illustrative year-by-year range often considered in mid-term cardano ada price prediction models.

| Year | Min (USD) | Average (USD) | Max (USD) |

|---|---|---|---|

| 2026 | $0.90 | $1.60 | $2.40 |

| 2027 | $1.20 | $2.10 | $3.20 |

| 2028 | $1.50 | $2.80 | $4.50 |

| 2029 | $1.80 | $3.50 | $6.50 |

| 2030 | $2.20 | $4.80 | $10.00 |

These values are not guarantees but scenario ranges, providing a structured view for ada cardano price prediction discussions through 2030.

For any multi-year cardano ada price prediction 2030 roadmap, technical milestones are as important as market cycles. Some of the key checkpoints that could influence sentiment and valuation include:

If delivered on schedule, these milestones may support the thesis that ADA can gradually move into a higher valuation band over the 2026-2030 window.

DeFi activity and institutional interest are key pillars behind any ambitious cardano ada price prediction. Capital tends to follow robust ecosystems with real usage and reliable infrastructure.

Balanced analysis, rather than purely speculative cardano ada price prediction crypto news headlines, should weigh these adoption factors when assessing ADA’s potential path toward higher price targets by 2030.

On higher timeframes, ADA has at times formed structures resembling a falling wedge, a pattern that can precede bullish reversals if confirmed by volume and follow-through. Shorter-term charts may show nested wedges or channels inside the broader formation.

In this context, traders often frame cardano ada price prediction scenarios around whether a decisive breakout above wedge resistance can unlock a new trend leg.

Trend-following indicators provide additional confirmation for any falling wedge breakout thesis. Moving averages and momentum oscillators help distinguish between genuine reversals and short-lived rallies.

| Indicator | Typical Bullish Confirmation Signal |

|---|---|

| 50-Day MA | Price reclaiming and holding above after wedge breakout |

| 200-Day MA | Golden cross or sustained trade above long-term trendline |

| RSI | Move from oversold into 50–70 range with higher lows |

When these conditions align, they support more constructive cardano ada price prediction views, especially in multi-year frameworks extending to 2030.

Mapping long-term support and resistance gives structure to both conservative and aggressive targets used in extended forecasts such as cardano ada price prediction atgraphite.com or other research sources. Below is an illustrative level map for the coming years:

| Zone | Approximate Price Band (USD) | Role |

|---|---|---|

| Major Support | $0.50 – $0.70 | Structural base and long-term accumulation region |

| Intermediate Range | $1.00 – $3.00 | Rotation and consolidation area in many models |

| Expansion Zone | $3.00 – $6.50 | Potential mid-cycle rally targets |

| Speculative Upper Band | $6.50 – $10.00 | Aggressive upside target range toward 2030 |

These bands help frame both shorter-term ideas such as cardano ada price prediction 2025 and longer horizons like cardano ada price prediction 2030 within a consistent technical structure, rather than relying solely on isolated price points.

Smart contract expansion remains one of the most influential pillars behind any ada cardano price prediction. The continued evolution of Plutus scripts and developer tooling directly affects network usage, transaction volume and ecosystem maturity.

These metrics often provide a more grounded perspective than short-term cardano ada price prediction crypto news narratives focused solely on speculative momentum.

The Plomin hard fork represents a significant phase in Cardano’s governance and decentralization journey. Its implementation may improve network efficiency, security and participation in on-chain decision-making.

For long-term cardano ada price prediction 2030 models, sustained decentralization and reliable governance frameworks are critical in supporting institutional confidence and long-term valuation.

Cardano’s positioning as a third-generation blockchain places it in direct competition with Ethereum, Solana and other Layer-1 ecosystems. Its appeal lies in scalability, formal verification and academic-driven development.

How effectively Cardano captures market share in high-growth sectors such as DeFi and gaming will significantly shape any mid-to-long term cardano ada price prediction trajectory.

While optimistic projections exist, several risk elements could weaken or invalidate the $10 scenario often mentioned in cardano ada price prediction narratives.

Sustained failure to innovate would significantly challenge aggressive targets projected in some ada cardano price prediction models.

| Year | Projected Average Range (USD) | Key Assumptions |

|---|---|---|

| 2040 | $12.00 – $25.00 | Mass adoption and mature blockchain utility |

| 2050 | $25.00 – $50.00+ | Global integration and sustained institutional use |

These extended forecasts are speculative in nature and are meant to complement long-term perspectives such as cardano ada price prediction atgraphite.com and similar research-based models.

Effective planning is essential when interpreting any cardano ada price prediction 2025 or longer-term outlooks. Investors should balance optimism with realistic portfolio safeguards.

Rather than reacting to short-lived cardano ada price prediction july 2025 speculation spikes, disciplined strategies focused on fundamentals tend to provide more sustainable outcomes over multi-decade horizons.

Reaching $10 is possible under aggressive scenarios where sustained adoption, strong DeFi growth, major network upgrades and favourable macro conditions align. Most cardano ada price prediction models view $10 as a long-term target rather than a near-term expectation.

Estimates vary widely. Conservative projections place ADA between $2 and $4, while optimistic forecasts supported by widespread adoption and ecosystem maturity suggest prices could exceed $8 by 2030.

$100 remains a highly speculative level requiring massive market expansion, enterprise integration and global-scale usage. Most current cardano ada price prediction frameworks do not consider this level realistic within the next few decades.

This cardano ada price prediction highlights how ADA’s future depends on technical strength, ecosystem expansion and broader market conditions. While the $0.51 support zone may provide a base for growth, long-term progress toward higher targets requires sustained innovation and adoption. Investors should balance opportunity with careful risk evaluation and realistic expectations when assessing ADA’s potential through 2030 and beyond.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up