Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)A:--

F: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)A:--

F: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)A:--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)A:--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)A:--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Oct)

U.S. Building Permits Revised YoY (SA) (Oct)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Oct)

U.S. Building Permits Revised MoM (SA) (Oct)--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

P: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

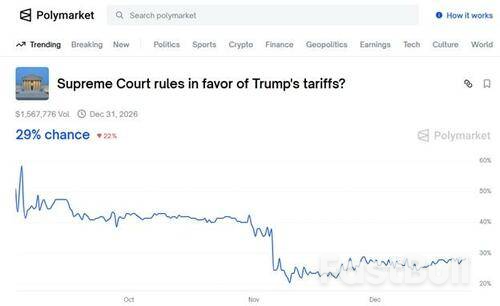

High stakes: Supreme Court weighs Trump's tariffs, testing executive power and fiscal stability.

The U.S. Supreme Court is poised to rule on the legality of President Donald Trump's sweeping tariffs, with a decision possible as soon as January 9. This high-stakes verdict will determine the fate of a cornerstone of Trump's economic agenda after lower courts found the import taxes were imposed illegally.

The tariffs have remained in effect while the Trump administration appealed to the nation's highest court. During a hearing on November 5, justices expressed skepticism about the president's authority to unilaterally impose these levies under a 1977 emergency law. A ruling against the administration would mark Trump’s most significant legal defeat since returning to the presidency and could trigger complex legal battles over billions of dollars in refunds.

The core of the case revolves around the constitutional separation of powers. Article 1 of the U.S. Constitution explicitly grants Congress the authority to levy taxes and regulate foreign commerce. Over the years, lawmakers have delegated limited trade powers to the president through various laws.

In his first term, Trump tested the limits of these powers. This time, he invoked the International Emergency Economic Powers Act (IEEPA) of 1977, claiming it gave him nearly unlimited authority. The administration cited U.S. trade deficits and cross-border drug trafficking as national emergencies, using IEEPA to justify the tariffs through executive orders.

This move was unprecedented. The IEEPA, which is typically used for sanctions, does not mention tariffs. Lower courts, including the U.S. Court of International Trade, ruled that the law does not delegate "an unbounded tariff authority to the President," a decision later affirmed by the U.S. Court of Appeals for the Federal Circuit. The judges clarified that their ruling was not on the wisdom of the policy but on its legality, stating the president's actions were "impermissible... because [the law] does not allow it."

The Supreme Court's decision specifically targets the "Liberation Day" tariffs announced on April 2. These levies are structured in several layers:

• A minimum baseline tariff of 10% on most imports, with some exceptions.

• "Reciprocal tariffs" ranging from 10% to 41% on goods from nations that did not secure trade deals with the U.S.

• Additional levies on certain imports from Mexico, China, and Canada, which Trump justified by citing the fentanyl crisis.

It is important to note that this case does not affect all of Trump's tariffs. Levies on steel, aluminum, automobiles, copper products, and lumber were imposed using a different legal basis—Section 232 of the 1962 Trade Expansion Act—which allows for tariffs if imports are deemed a national security risk by the Commerce Department.

If the Supreme Court strikes down the IEEPA-based tariffs, the administration would not only lose the ability to collect them but would also face demands to refund duties already paid. More than 1,000 companies have already lined up in court seeking reimbursement.

This potential unraveling of a major revenue stream could worsen concerns about U.S. public finances. The administration had previously pointed to increased tariff revenue as a way to offset tax cuts from a bill Trump signed on July 4. A sudden reversal could amplify questions from bond market investors about the country's growing debt load.

In a separate but related case, a federal judge in Washington also declared some of Trump's tariffs unlawful, though the ruling was limited to the two family-owned toy manufacturers that filed the lawsuit.

Even a loss at the Supreme Court wouldn't completely disarm Trump's push to reshape global trade. The administration has other tools at its disposal, though they are generally more limited than the broad powers it sought under IEEPA. These alternatives include:

• Section 232: Continuing to use national security investigations to justify tariffs on specific product categories.

• Trade Act Provisions: Imposing temporary import taxes of up to 15% for 150 days, but only in the event of a "large and serious" balance-of-payments crisis or to prevent a significant depreciation of the dollar.

• Section 301 Investigations: Launching investigations into unfair trade practices by other countries, although this process is slower to implement.

The justices are set to return from a four-week holiday recess on January 9, which is scheduled as their first "opinion day," making it the earliest possible date for a ruling in this landmark case.

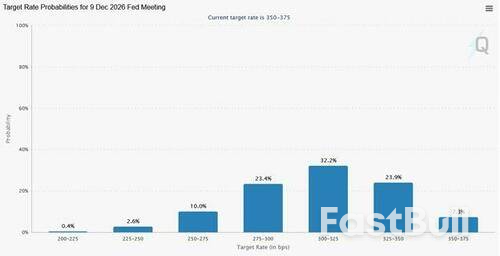

A December survey from the Federal Reserve Bank of New York reveals a growing disconnect in the American economic outlook, with consumers expecting higher inflation while their confidence in the job market has fallen to its lowest point in over a decade.

These conflicting signals highlight the complex challenge facing the Federal Reserve as it weighs its next move on interest rates.

According to the New York Fed’s monthly Survey of Consumer Expectations, Americans see prices rising by 3.4% over the next year, an increase from the 3.2% expectation reported in November.

At the same time, the survey painted a grim picture of the labor market. The perceived probability of finding a new job after a layoff dropped to 43.1%. This marks the lowest level of confidence recorded since the survey began in mid-2013, signaling significant anxiety about job security.

Longer-term inflation expectations, however, remained stable, with both the three-year and five-year outlooks holding steady at 3%.

This data captures the core debate within the central bank. Some Fed officials remain focused on taming inflation, while others see rising unemployment as the more immediate risk. The divergence between rising price expectations and falling job market confidence is likely to keep the Fed on hold, making an interest rate adjustment at its upcoming policy meeting improbable.

The survey's findings were released just ahead of key economic data, including the Bureau of Labor Statistics' monthly employment report and the upcoming consumer price index figures, which will provide a clearer picture of the economy's direction.

The report also uncovered conflicting views on personal financial health.

Consumers reported a higher probability of missing a minimum debt payment over the next three months, which climbed to 15.3%—the highest level since the economic turmoil of April 2020.

Despite this near-term financial pressure, a surprising wave of optimism emerged. The share of respondents who expect their personal financial situations to improve over the next year rose to its highest point since February 2025.

The U.S. Senate is scheduled to vote Thursday on a resolution to curb President Donald Trump's authority to use military force in Venezuela without getting a green light from Congress.

The vote follows a military strike ordered by the president less than a week ago that led to the capture of Venezuelan leader Nicolás Maduro. That operation was launched without prior legislative authorization.

The measure, a War Powers Resolution, is being brought forward by a bipartisan effort from Democratic Senator Tim Kaine and Republican Senator Rand Paul. It needs only a simple majority to pass the Republican-controlled Senate and would force the president to seek congressional approval before committing to further military action in Venezuela.

The resolution cuts to a core constitutional debate over which branch of government has the power to commit the nation to war.

"Make no mistake, bombing another nation's capital and removing their leader is an act of war plain and simple," Senator Paul said in a statement. "No provision in the Constitution provides such power to the presidency."

While the Constitution vests Congress with the power to declare war, the Trump administration and its allies have argued that the strike against Maduro did not require congressional approval. They have characterized the mission as a law enforcement operation, noting that Maduro is now facing drug-related charges in New York.

Securing enough votes for the resolution will be a challenge. Republicans currently hold a 53-47 majority in the Senate, meaning at least four Republican senators must join all Democrats for the measure to pass.

A similar resolution was voted down in November, with only two Republicans—Paul and Senator Lisa Murkowski of Alaska—siding with the Democrats.

If the resolution clears the Senate, it would then move to the House of Representatives for approval, where Republicans also hold a razor-thin majority.

There are signs that more Republicans may be willing to support the measure this time. On Thursday, Senator Susan Collins of Maine announced she would vote for the resolution.

"While I support the operation to seize Nicolas Maduro, which was extraordinary in its precision and complexity, I do not support committing additional U.S. forces or entering into any long-term military involvement in Venezuela or Greenland without specific congressional authorization," Collins stated.

Defense sector stocks led the S&P 500 on Thursday after former President Donald Trump called for a massive increase in U.S. military spending. The proposal, shared on his Truth Social platform, immediately boosted the shares of major defense contractors.

In his post, Trump outlined a vision for a significantly larger military budget. "For the Good of our Country, especially in these very troubled and dangerous times, our Military Budget for the year 2027 should not be $1 Trillion Dollars, but rather $1.5 Trillion Dollars," he stated.

This proposed $1.5 trillion figure represents a dramatic jump from current and projected levels. For fiscal year 2025, the Department of Defense budget stands at $850 billion. The White House had previously proposed an increase to nearly $1 trillion for fiscal 2026. Trump's plan would amount to an approximately 50% increase over that projection.

The market reacted swiftly to the prospect of increased government contracts. Several defense giants saw their stock prices climb, placing them among the top performers in the S&P 500.

• Lockheed Martin (LMT), Huntington Ingalls (HII), and L3 Harris (LHX) each gained more than 7%.

• General Dynamics (GD) and Northrop Grumman (NOC) shares rose by more than 4%.

• RTX Corp. (RTX), the parent company of Raytheon, added 2%.

Thursday's rally marked a sharp reversal from the previous day's trading session. On Wednesday, defense stocks had suffered losses after Trump criticized the companies for spending on stock buybacks and dividends. He argued they should instead focus their resources on accelerating and improving their manufacturing capabilities.

The call for higher spending comes amid heightened military activity under the Trump administration. Recent actions include last weekend's strike that resulted in the capture of Venezuelan President Nicolás Maduro. The White House has also renewed discussion about controlling Greenland for strategic purposes, suggesting the military could be utilized in such an effort.

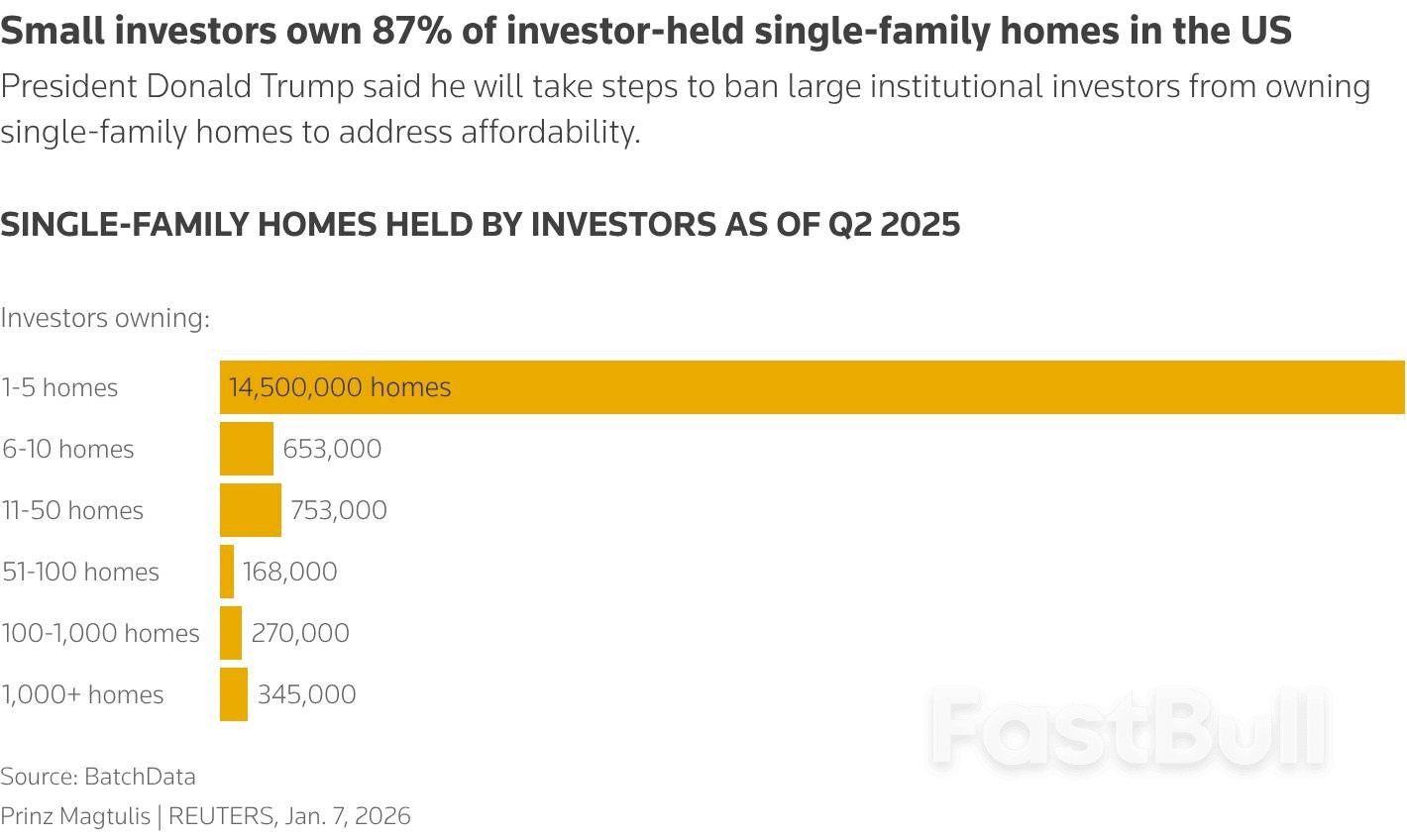

U.S. President Donald Trump on Wednesday said his administration is moving to ban Wall Street firms from buying up single-family homes in a bid to reduce home prices, a potential blow for private-equity landlords that also pressured homebuilder stocks.

In a post on Truth Social, Trump said he was immediately taking steps to implement the ban, which he would also call on Congress to codify in law. It was not clear what steps he would take.

"For a very long time, buying and owning a home was considered the pinnacle of the American Dream," Trump wrote, adding that inflation had put that dream out of reach for many Americans.

"People live in homes, not corporations," said Trump, who is under growing pressure to address voter anxiety over the cost of living ahead of this year's congressional midterm elections.

A Republican move to target Wall Street landlords would, perversely, align the party with Democrats, who for years have criticized corporate homebuying, claiming it has helped stoke housing costs, and have unsuccessfully pushed bills to crack down on the trend.

A bar chart showing the number of single-family homes held by investors, by the number of home units held by each investor as of the second quarter of 2025.

A bar chart showing the number of single-family homes held by investors, by the number of home units held by each investor as of the second quarter of 2025.Wall Street institutions such as Blackstone (BX.N), American Homes 4 Rent (AMH.N) and Progress Residential have bought thousands of single-family homes since the financial crisis of 2008 led to a wave of home foreclosures.

By June 2022, institutional investors owned around 450,000 homes, or about 3%, of all single-family rental homes nationally, according to a 2024 study by the Government Accountability Office.

American Homes 4 Rent (AMH.N) dropped to a near three-year low of $28.84 and was halted for volatility before trading resumed. Its shares closed down 4% at $31.01.

Blackstone shares hit a one-month low of $147.52 and closed down about 5.6% at $153.59. The PHLX housing index (.HGX) fell 2.6%.

A spokesperson for Blackstone said their ownership of such homes represented a small portion of their overall business, and that they had been a net seller of homes for the prior decade.

"That said, we believe our current portfolio is poised to continue to perform quite well and operate at the highest standards for residents," the spokesperson said.

American Homes 4 Rent and Progress Residential did not immediately respond to a request for comment.

Wall Street landlords dispute that their investments have stoked inflation. In a January 2025 research note, Blackstone said institutional home purchases have declined 90% since 2022 and that supply shortage is the reason for house price increases.

The GAO study found that the effect of institutional homebuying on homeownership opportunities was unclear in part due to limited data.

Critics say Wall Street firms are also bad landlords, skimping on upkeepto keep investors happy, and wrongly evicted tenants during the COVID-19 pandemic.

"Resident experience is hurting as a result," said Jeff Holzmann, COO of RREAF Holdings, a Dallas-based real estate investment firm with over $5 billion in assets.

"Instead of you calling your landlord to discuss a problem, you're calling a call center that gives you the runaround."

Trump, who has occasionally dismissed affordability concerns and blamed inflation on his Democratic predecessor, has seen his own public approval mostly sag since his inauguration as Americans worry about the economy.

It was not immediately clear what authority Trump would draw upon to impose a ban, and he did not outline the changes he was seeking from Congress.

The White House did not respond to a request for comment.

Since Trump's first electoral victory, U.S. home prices have risen 75%, more than double the increase in overall consumer prices tracked by CPI. But home sales price increases have eased substantially over the past year.

The Federal Housing Finance Agency last week reported that national home sales prices had risen just 1.7% in October, from a year earlier, the lowest in more than 13 years. That's less than half the rate by which they were climbing when Trump came back into office last January and a fraction of their peak gains of nearly 20% in 2021 and 2022.

A big factor in home price inflation has been a lack of properties for sale, although that has also been slowly improving over the last year or so, according to National Association of Realtors data.

As of November, annual shelter-cost inflation, which had shot to as high as 8.2% in the COVID-19 pandemic aftermath, had also eased to 3.0%, the lowest in more than four years, according to the Labor Department's Consumer Price Index.

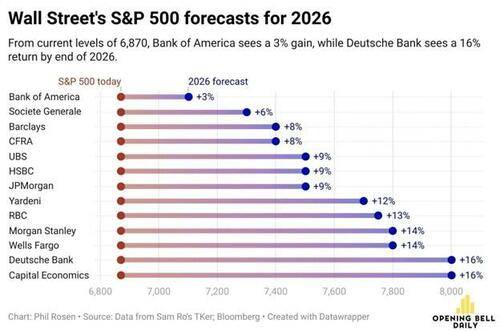

It's that time of year when every Wall Street analyst posts their forecast for where the S&P 500 will close at the end of 2026. This year, as in every other, Wall Street expects the S&P 500 to post positive returns. As shown below, Bank of America is the most cautious, with a 3% gain, while Deutsche Bank and Capital Economics are the most bullish. On average, the analysts shown below forecast a 10.5% return in 2026, below last year's 16% but slightly above the longer-term average.

Like Wall Street, we could spitball a 2026 price forecast for the S&P 500, but why? It's a fruitless endeavor. No one has enough insight into the countless events that will unfold in 2026 and their potential economic, fiscal, and monetary consequences to make a meaningful forecast. Furthermore, even if we had a crystal ball that predicted how the year's events would unfold, gauging their impact on investor sentiment and, ultimately, on markets would be nearly impossible.

Instead of offering a forecast for 2026, let us consider the potential events and factors that could influence investor sentiment and move markets this year. Inevitably, no matter how many events we and others are considering today, there will be market-moving ones that are not on anyone's radar currently.

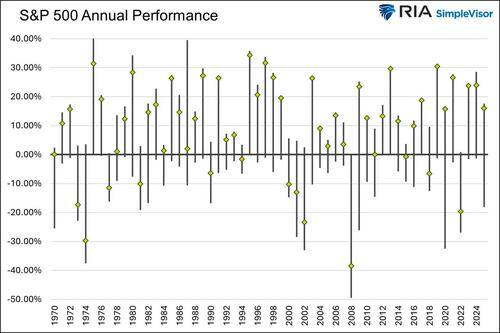

Before we focus on potential events in 2026, let's review historical returns since 1970 to gain perspective.

The graph below shows annual returns (gold diamonds) and the range between the minimum and maximum returns for each respective year. The average annual return since 1970 has been 9.43%, with an average yearly drawdown of 11.12%. Moreover, the average annual maximum gain was 16.35%, approximately 7% higher than the average closing price. Thus, the market, on average, closes at the 65th percentile of its range.

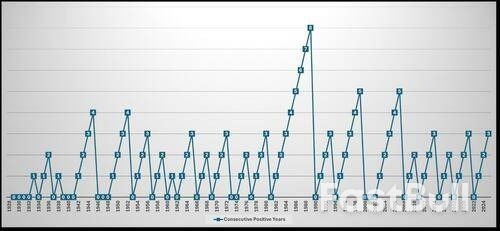

The second graph below is courtesy of one of our clients. His graph helps us assess whether we can expect a fourth consecutive year of positive returns. As shown, eight straight years is the record, with two four- and five-year winning streaks.

The odds are stacked against positive. Since 1928, there have only been five times that a four-year gains streak occurred.

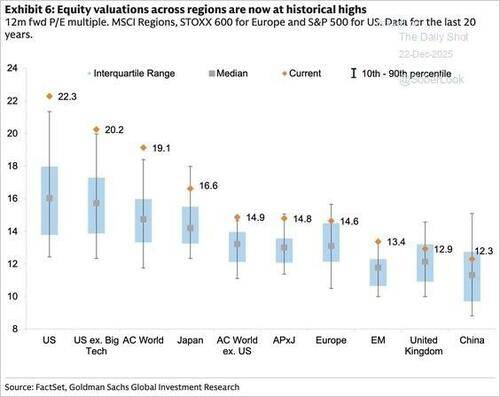

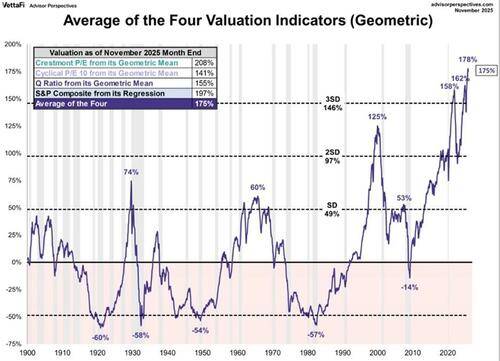

Valuations are stretched! The first graphic below, courtesy of Goldman Sachs, shows that 12-month forward P/E ratios are significantly elevated globally. The second from Crestmont indicates that the average of four widely used valuation techniques is at a record high.

Current valuations should serve as a constant reminder throughout 2026 to avoid complacency. While caution may be rewarded this year, we must also bear in mind that valuations make poor short-term timing tools.

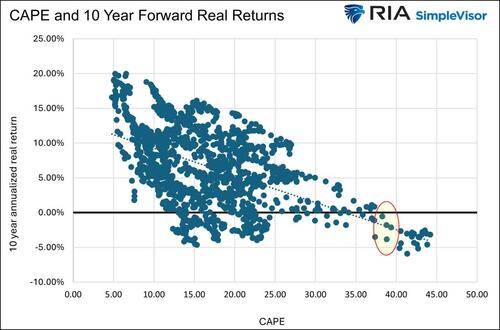

The first graph below shows the extent to which the CAPE10 valuation at 39 is stretched. Based on historical correlations between valuations and returns, we should expect negative real returns over the next 10 years. However, the second graph indicates that returns of +/- 25% are possible in 2026.

2026 may be the year that valuations normalize, thus resulting in a down year. Even if that is the case, we must recognize that market valuations and those of individual stocks and sectors can differ significantly. Some sectors are less expensive than others and may perform better in a down market. For example, the graph below, courtesy of Dimensional, shows that large-cap price-to-book ratios are at record highs, whereas those for small-cap value companies are at the midpoint of their range over the last 25 years.

Might 2026 be the year where value comes back into vogue, or will valuations, especially for the largest of stocks, get even more extreme?

Last December, the Fed reintroduced QE under the guise of Reserve Management Purchases (RMP). The action is intended to supply the market with liquidity. Per the Fed's Statement Regarding RMP:

The Desk plans to release the first schedule on December 11, 2025, with a total amount of RMPs of approximately $40 billion in Treasury bills; purchases will start on December 12, 2025. The Desk anticipates that the pace of RMPs will remain elevated for a few months to offset expected large increases in non-reserve liabilities in April. After that, the pace of total purchases will likely be significantly reduced in line with expected seasonal patterns in Federal Reserve liabilities.

Simply put, liquidity in the banking system was becoming scarce as reserves declined. To avoid worsening liquidity conditions, the Federal Reserve is injecting reserves into the banking system.

The question for investors is whether the $40 billion in monthly reserves, intended to last "a few months," is sufficient to offset the expected decline in liquidity over that period.

If it's not, then the markets may come under pressure as liquidity wanes.

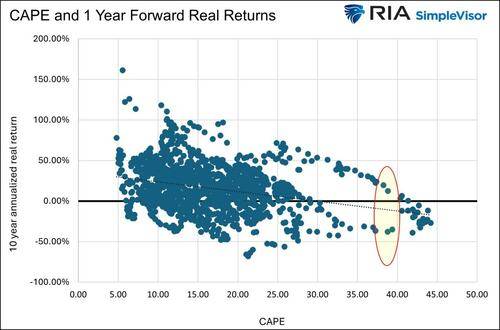

Conversely, if you think the Federal Reserve's actions will boost reserves meaningfully, our article "QE Is Back" may offer a practical trading blueprint for the first few months of 2026. The article identifies which stock market indexes, sectors, and factors are strongly correlated with bank reserves. The table below, from the article, indicates that transportation, materials, consumer-discretionary, financial, and technology stocks could benefit most from a reserve increase. Conversely, the utilities, energy, and staple sectors offer little correlation.

Will QE once again prove to be a driving force for the stock market?

Jerome Powell's term as Fed Chair ends in May 2026, and Trump's appointment of a new Chair is being closely watched. The new Chair's stance on the trade-offs between inflation and labor-market weakness could significantly alter investor sentiment.

The two front-runners for Powell's chair are Kevin Warsh and Kevin Hassett. We compared the two potential nominees in our Daily Commentary on December 17th–

Warsh is viewed as more hawkish than Hassett. He has frequently mentioned the inflation risk associated with dovish monetary policy. Moreover, as we noted above, he has expressed skepticism about aggressive QE. Conversely, Hassett, viewed as dovish, actively advocates deeper rate cuts to stimulate growth.

Kevin Warsh adheres to a Milton Friedman-style logic: inflation is a function of excessive money-supply growth. Based on recent speeches, Hassett is focused on growth-oriented easing and is not overly concerned with inflation.

Hassett likely appeals more to President Trump because of his dovish views. However, Kevin Warsh lends greater credibility to the Federal Reserve's promise to reduce inflation. Additionally, Warsh is more likely to improve sentiment in the bond market, thereby lowering long-term yields.

Initially, the bond market is likely to be more affected than the stock market by President Trump's decision regarding the next Federal Reserve chair. However, said changes in interest rates could readily impact the stock market.

To assess potential market reaction, we should monitor changes in inflation expectations. As noted below, 1-year inflation expectations are falling rapidly, despite the more dovish Kevin Hassett expected to replace Powell. Thus, at the moment, the market is not expressing concerns about a dovish Fed Chair.

Will it be the dovish Kevin Hassett or the hawkish Kevin Warsh running the Federal Reserve in 2026?

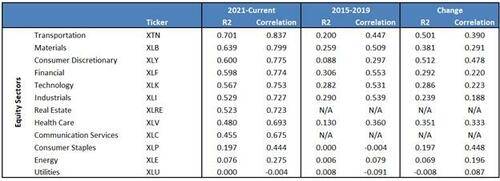

The November midterm elections will determine the balance of power in the U.S. Congress. As shown below, the Polymarket betting site assigns a 79% probability to the Democrats taking control of the House and a 66% chance that the Republicans will maintain Senate leadership.

If one or both houses of Congress change hands, the administration will find it much more challenging to pursue its domestic and foreign policy objectives. From a market perspective, this may limit the President's ability to manage fiscal spending and further change the tax code. Accordingly, changes in Congressional power and budgetary implications could significantly affect growth and inflation, as well as individual stocks and sectors.

As the year progresses, investors will likely pay closer attention to the betting markets and traditional polls for insight into the midterm elections.

While investors wait for the elections, it is worth noting that Americans will get a "gigantic" tax refund next year. The tax provisions in the Big Beautiful Bill should, in practice, result in larger-than-normal refunds this year. Per Treasury Secretary Scott Bessent via FoxBusiness:

I can see that we're gonna have a gigantic refund year in the first quarter because working Americans did not change their withholdings," Bessent told the "All-In Podcast" hosts. "I think households could see, depending on the number of workers, $1,000- $2,000 refunds."

The massive capital expenditure (CapEx) cycle for AI infrastructure, including data centers, the power grid, and supercomputing, is expected to continue into 2026 and beyond. As we saw in 2025, the spending will boost GDP growth and profits for many companies involved. However, toward the end of 2025, investors began to question whether some companies were spending and borrowing more than they would ever recoup.

We pose a few questions to help you consider what 2026 may bring.

Will the AI-led bull market continue to charge ahead like last year on the belief and hope that massive CapEx spending will translate into enormous profits?

Will the rapidly growing debt requirements needed to fund CapEx be a drag on the market?

Given that technological change is occurring rapidly, might there be a new development to shake up the AI industry? Think about Deep Seek roiling the market last January.

Might investors start to question whether the productivity benefits of AI are worth the cost?

Is AI in a bubble like the dotcom bubble? If so, will 2026 be the year it surges, as in 1999, or the year it peaks, as in 2000?

The Supreme Court has heard oral arguments in the tariff legality case and will announce its findings on January 9, 2026. According to Polymarket, the odds of a favorable ruling for Donald Trump are low at 29%.

If the Supreme Court strikes down the tariffs, the economic impact could be substantial. To begin with, the prices of some goods that are no longer subject to tariffs may fall, and trade flows will adjust accordingly.

However, it's not wise to go down that road too far. The President reportedly has a Plan B ready. Tariffs or some other similar measure will most certainly be implemented if the Supreme Court rules against tariffs. But these measures may also be subject to judicial review.

Whatever the final trade policy is, there will be supply chain realignments that could significantly affect import costs, profit margins, and global trade patterns.

The question is not the Supreme Court ruling itself, but the mechanism the administration will ultimately use to implement tariffs, taxes, or trade restrictions. Moreover, we should consider how investors will handle a period of uncertainty.

Geopolitical Hotspots: Ongoing conflicts and tensions in Ukraine, Venezuela, and the Middle East, along with increased provocations between the US, China, Iran, and Russia, pose persistent headline risks. Many of these tensions can cause sudden changes in energy prices and economic activity, and disrupt supply chains and consumer sentiment.

Debt Levels and Sovereign Risk: 2025 began with higher bond yields, driven by the "bond vigilantes" and their grave concerns about the U.S. fiscal situation. With the U.S. government continuing to run massive fiscal deficits, the ability to finance these debts and manage interest costs will remain a concern. Renewed signs of bond market stress or investor concerns about a government's ability to meet its debt obligations could trigger significant volatility, particularly in the U.S. Treasury market. Such volatility would quickly filter through to the stock markets. Will the bond vigilantes regain their voice?

Bear in mind, there is a risk of another government shutdown by the end of the month.

Monetary Policy: The ECB is considering raising interest rates. Might we find that the Fed reaches a similar conclusion later in 2026? Or might rates and inflation be heading much lower? As shown below, the Fed Funds futures market forecasts only one rate cut in 2026. The Fed has enough trouble predicting the next three to six months; what makes anyone think Wall Street is any better?

Yen Carry Trade: A depreciating yen strengthens the carry trade, supporting many US financial assets. At the same time, a depreciating yen heightens affordability issues and the popularity of its political leaders. This is primarily because Japan is heavily dependent on imports of energy and raw materials, whose prices rise when the yen depreciates.

Given domestic economic and political pressures, along with US persuasion, we expect the Japanese government to take steps to strengthen the yen. If any upward adjustment is done gradually, the impact on financial markets should be minimal. However, if it occurs suddenly, such as in August 2024, financial market volatility could spike.

There are 14 questions in this article, and we could easily have doubled or tripled that number. There are far more questions than answers about what the new year may hold. More importantly, there will be additional events that are not known today.

Thus, instead of forecasting where the S&P will close in 2026 with zero confidence, we would rather take the market and news as they come. We suspect that QE will provide initial support to the market through the winter. Valuations should keep us on guard throughout the year. Many of the other items we discuss pose a constant risk and or the potential for better returns throughout the year.

As you consider your forecast for 2026, we leave you with a thought to ponder from Arthur Zeikel:

Most investors tend to cling to the course to which they are currently committed, especially at turning points.

United States President Donald Trump has publicly accused major defense contractors of profiteering, warning them to change their business practices or face consequences. In a series of posts on Truth Social, he outlined specific demands for companies that supply the U.S. military.

Trump’s core message was clear: contractors are not producing equipment fast enough. "MILITARY EQUIPMENT IS NOT BEING MADE FAST ENOENOUGH," he wrote in a 322-word post on Wednesday. He insisted that companies must fund new investments using their profits from dividends and stock buybacks, and by reducing executive compensation, rather than seeking government funds or taking on debt.

The president’s directives targeted several key areas of corporate governance and operations within the defense industry. He called on contractors to:

• Curb what he described as excessive executive pay.

• Invest corporate profits into building new, modern factories.

• Accelerate the production and repair of military equipment.

"This situation will no longer be allowed or tolerated!" Trump declared, arguing that shareholder rewards were being prioritized over national security needs.

Trump specifically identified technology company Raytheon, now known as RTX, as a primary offender. "I have been informed by the Department of War that Defense Contractor, Raytheon, has been the least responsive to the needs of the Department of War, the slowest in increasing their volume, and the most aggressive spending on their Shareholders," he stated in a follow-up post.

He threatened to sever the U.S. government's relationship with RTX, a company that earns billions from federal contracts. This warning comes after the Department of Defence awarded the firm a 20-year contract in August with a maximum value of $50 billion for equipment, services, and repairs.

"Our Country comes FIRST, and they're going to have to learn that, the hard way," Trump added.

The president's sharp criticisms sent stocks for defense contractors falling amid new uncertainty in the sector.

Defense spending is a major component of the American economy, accounting for about 2.7% of U.S. gross domestic product (GDP) in 2024, with the total budget typically near $1 trillion.

In a move that contrasted with his criticism of industry spending, Trump also announced on Wednesday that he would ask congressional Republicans to increase the defense budget to a record $1.5 trillion for fiscal year 2027. He framed the increase as essential for building a "Dream Military" that would ensure national security "regardless of foe."

Since beginning his second term, Trump has adopted a hands-on approach with private companies involved in sectors linked to national security.

• U.S. Steel: In June, the administration secured a "golden share" in U.S. Steel, granting it veto power over major corporate decisions in exchange for approving its merger with Japan's Nippon Steel.

• Intel: In August, technology firm Intel agreed to sell a 10% stake to the U.S. government following pressure from the president.

• Mining: The Trump administration has also been acquiring stakes in private mining companies that produce rare earth minerals and other raw materials critical to the technology sector.

While it remains unclear how Trump would legally enforce his new demands on defense contractors, his track record suggests a willingness to directly intervene in corporate affairs.

Trump detailed his specific complaints against the defense industry. He argued that executive pay packages are "exorbitant and unjustifiable" given the slow delivery of vital equipment. He proposed a cap on executive salaries, stating, "Until they do so, no Executive should be allowed to make in excess of $5 Million Dollars."

He also demanded that contractors build "NEW and MODERN Production Plants" to both deliver current equipment and develop future military technologies. He criticized companies for being "far too slow" in providing repairs for their products.

The president’s main contention is that profits are being misallocated. RTX, for example, is a Virginia-based company with sales over $80 billion in 2024 and designs critical systems like the Patriot Missile. This week, the company was awarded a $438 million contract from the FAA to update its radar system.

However, Trump asserted that too much of this income is channeled into shareholder dividends and stock buybacks instead of being reinvested into production capacity. "Defense Contractors are currently issuing massive Dividends to their Shareholders and massive Stock Buybacks, at the expense and detriment of investing in Plants and Equipment," he wrote.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up