Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

With interest rates in freefall in recent days, but reversing modestly this morning, traders were wondering if today's auction of $58BN in 3 year paper would accentuate the modest reversal or extend on the positive momentum observed over the past week. The answer was resoundingly the latter, and here's why.

With interest rates in freefall in recent days, but reversing modestly this morning, traders were wondering if today's auction of $58BN in 3 year paper would accentuate the modest reversal or extend on the positive momentum observed over the past week. The answer was resoundingly the latter, and here's why.

First, the auction stopped at high yield of 3.485%, down sharply from 3.669% last month, and the lowest since Sept 2024 when the Fed was about to cut rates by a jumbo 50bps on another huge downward jobs revision print. The auction stopped through the When Issued 3.492% by 0.7bps, and following 3 straight tailing auctions, was the biggest through since Feb 2025.

The bid to cover was an impressive 2.726%, up 20bps from August and the highest since February.

The internals were even more impressive, with Indirects taking down a near record 74.24%, up from 53.99% in August and the 2nd highest on record!

And with Directs awarded 17.39%, Dealers were left with just 8.37%, the lowest on record.

Overall this was a blowout 3Y auction, easily one of the top 3 on record, and the bond market certainly liked it: with yields moving higher after today's record negative revision (on expecations of steepening that will follow the inflation that rate cuts usher in) we have seen renewed buying across the curve.

The European Union is working with the U.S. as it prepares to announce its latest round of sanctions on Russia, sources told CNBC.

Despite diplomatic efforts over the summer, Russia's more than three-year-long war in Ukraine is not showing any signs of coming to an end. In fact, Moscow has recently stepped up its offensive and on Sunday launched its biggest air attack on Ukraine, hitting a key government building.

European officials are now working on their 19th package of sanctions against Moscow, with one EU official, who did not want to be named as the measures are not yet finalized, telling CNBC these will be presented at the "end of the week [or] early next week." The package will then have to be formally approved by the 27 members of the EU.

The European Commission and member states started informal discussions about the measures over the weekend, and a delegation of EU officials also traveled to Washington D.C. to coordinate energy-related measures with the Trump administration.

"It is clear that energy dependency on Russia will be targeted more vehemently," a second EU official, who did not want to be named due to the sensitivity of the topic, told CNBC. "The Commission will work with the U.S. on this, especially on the Druzhba pipeline," they said, referring to the transit pipeline that delivers Russian oil to Hungary and Slovakia, two EU member states with close links to the Kremlin.

One key consideration for Europe is potential sanctions on countries that buy Russian energy, including China.

"This is the big question," the first EU official said, adding that for the moment it is unclear whether the bloc will move in this direction.

The European Union has previously sanctioned some Chinese banks for enabling the circumvention of measures imposed on Russia.

The FT reported Monday that European officials are considering secondary sanctions against China, a major buyer of Russian oil and gas.

The U.S., meanwhile, recently imposed tariffs on India for buying energy from Moscow.

The first EU official said the U.S. is, for now, "focused on pushing us to phase out Russian oil and gas faster than the current deadline." The bloc is currently aiming to end its purchases of Russian oil by 2028.

As part of a recent trade agreement between the EU and the United States, the 27-member state bloc agreed to purchase $750 billion of American energy.

The EU's latest package of sanctions against Moscow is also expected to see more Russian vessels listed as part of its "shadow fleet," and to limit the movement of Russian diplomats and tourists.

Now that French Prime Minister Francois Bayrou has officially resigned after losing a no-confidence vote a day earlier, all eyes are on the person who could succeed him. Macron said he would tap a new premier in the coming days.

We have a list of the leading contenders, which includes the 39-year old current defense minister Sebastien Lecornu. Socialist party leader Olivier Faure, former prime minister Bernard Cazeneuve and even central bank governor Francois Villeroy de Galhau are also among the potential successors.

The problem will be finding someone who can find common ground in the polarized National Assembly — and who has the wherewithal to undertake deeply unpopular budget cuts to avert a debt crisis. Investors are unnerved, with France’s borrowing costs converging with Italy’s for the first time in the euro zone’s history.

Marine Le Pen’s far-right National Rally has been among opposition parties calling for a new legislative ballot, something that Macron appears to have ruled out. “For us, it’s a snap election or nothing,” as National Rally President Jordan Bardella summed it up on RTL radio.

Some have also called for Macron’s resignation, but he has steadfastly rejected quitting before the end of his term in 2027. After the downfall of the fourth prime minister in two years though, it’s hard not to see this as the swan song for the Macron era.

Israel conducted a military strike against senior Hamas leaders in the Qatari capital of Doha, escalating an already tense standoff between the country and Arab nations over the war in Gaza. Several blasts were heard in the Qatari city. Qatar is a key mediator between Israel and the Palestinian group that’s designated as a terrorist organization by the US and European Union.

Israel also ordered Gaza City’s one million residents to leave in advance of a major military offensive, with top officials vowing devastation unless Iran-backed Hamas surrenders. Global outrage has grown since Israel announced last month that it would take over the city, home to half the enclave’s population, with longtime European allies threatening to cut trade ties and planning to back Palestinian statehood at the United Nations in two weeks.

France and Germany are urging the European Union to target major Russian oil companies such as Lukoil or Litasco as part of the bloc’s next package of sanctions, according to a document seen by Bloomberg. The EU is currently discussing the content of its 19th package of sanctions, which includes proposed measures to target Russian banks and the country’s energy trade.

Norwegian Prime Minister Jonas Gahr Store is starting talks to form a new Labor government after his center-left bloc won a slim majority in the national legislature. Store — who stemmed 16 years of consecutive decline in Labor support — said he would seek agreements with left-leaning parties, but also broader cooperation across the political spectrum on topics like support for Ukraine and defense.

Egypt is lifting a decades-old rental cap that had allowed millions to pay below-market prices. Rents on affected properties stand to soar as much as 20 times in upscale areas while for lower-income areas the increase would be 10-fold. Contracts on previously rent-controlled housing will be nullified after a seven-year grace period. The government has vowed to build low-income housing to help with the transition.

Banca Monte dei Paschi di Siena has secured a majority stake in Mediobanca, cementing a once-unthinkable €16 billion takeover that’s set to reshape Italian finance. The deal is set to create Italy’s third-largest lender by assets, in line with Italian Prime Minister Giorgia Meloni’s push to establish a new large bank that can rival Intesa Sanpaolo and UniCredit.

Ethiopia inaugurated Africa’s biggest hydroelectric dam, which will power homes and industries across East Africa while deepening a years-long dispute with Egypt and Sudan over the Nile’s flow. Africa’s second-most populous nation expects the dam to address chronic energy shortages and to sustain its manufacturing sector.

As of September 8, 2025, Bitcoin (BTC) trades near $110K after weaker U.S. jobs data dragged Treasury yields and the dollar lower factors that usually support crypto markets. Yet analyst Plan C warns that a Q4 halving isn’t automatic; historical trends show mixed outcomes, so seasonality alone is not a reliable signal.

In this bitcoin price prediction, confirmation remains the focus: defend $110K–$112K and then reclaim $117K–$118K with volume, and the door to higher moves opens; lose that floor and the setup leans toward chop or deeper retracement. In that case, many traders look to rotate into altcoins offering better upside, with fresh breakout patterns and cleaner risk–reward.

The big question is: will the next big leg come from BTC dominance, or is rotation into alternatives the smarter play right now?

The macro environment for bitcoin just brightened: the latest U.S. jobs report showed slower hiring, a rising unemployment rate, and negative revisions. This sent Treasury yields lower, pushed the dollar index down about 0.70%, and lifted expectations for a September Federal Reserve rate cut.

Easier policy usually helps BTC by weakening the dollar and reducing funding costs, which cuts downside risk even if Q4 enthusiasm fades. As one strategist noted, “labor-market weakness gives the Fed room to cut.” A dovish Fed can stabilize Bitcoin, but traders still want confirmation on the chart before leaning bullish.

Sources: U.S. BLS Employment Situation, Aug 2025, Reuters Instant View, Reuters Dollar Reaction, Reuters Fed Cut Expectations.

Sources: BLS Employment Situation — Aug 2025, Reuters: Instant View, Reuters: Dollar falls sharply after jobs data, Reuters: Investors look for more aggressive US rate cuts.

BTC is currently consolidating inside a $110K–$112K support band after its sharp retrace, with repeated wicks suggesting dip-buying even while momentum stays muted.

If buyers protect this range and a strong daily close holds inside or above the zone, or if BTC clears $117K–$118K on convincing volume, then $117K–$118K becomes the first upside target with scope for higher gains if momentum builds further.

But if the range fails on a decisive close, the door opens to $108K–$106K, with potential liquidity grabs into $103K–$101K. In short, this zone remains critical: it offers a tactical entry for medium-term bulls, but confirmation beats trying to catch a falling knife.

With the bitcoin price still stuck near $110K and no clear breakout yet, an altcoin rotation strategy can improve risk–reward. The idea: move part of a position from sideways BTC into coins showing stronger setups, visible catalysts (launches, protocol upgrades, adoption), and breakout potential, while still anchoring with Bitcoin. One candidate drawing attention right now is Pepeto, does it fit the criteria?

Pepeto (PEPETO) is positioned as a promising rotation choice. Its token powers PepetoSwap, a zero-fee exchange with no listing charges, designed to make token launches and trading cheaper while routing incentives through PEPETO. Alongside, it supports a cross-chain bridge enabling users to move assets and liquidity across networks within the app, broadening reach and deepening order flow.

Staking currently offers around 231% APY, attracting early adopters and helping to lock liquidity so markets remain stable post-listing. Momentum is strong: the presale has raised more than $6.6M already, with only a small allocation left, priced at $0.000000152 at the current stage and set to climb as each round fills.

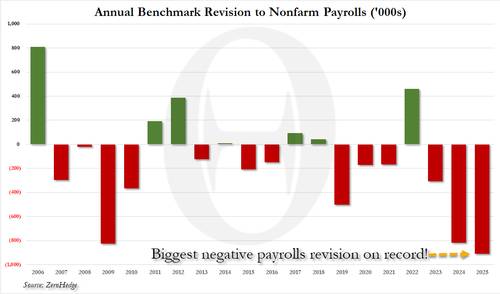

Two weeks ago, before both Bloomberg and Reuters, we told our subscribers to "brace for another huge negative payrolls revision"...

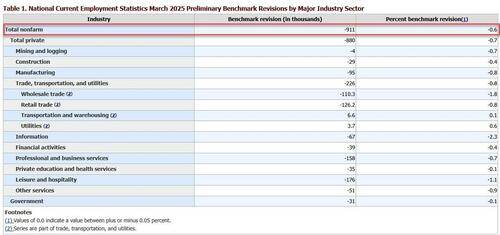

... and just like one year ago when we did exactly the same, we were spot on: moments ago the BLS reported that as part of its preliminary annual benchmark revisions, a record 911K payrolls for the period April 2024-March 2025 would be revised away.

Some more from the full press release:

The preliminary estimate of the Current Employment Statistics (CES) national benchmark revision to total nonfarm employment for March 2025 is -911,000 (-0.6 percent), the U.S. Bureau of Labor Statistics reported today. The annual benchmark revisions over the last 10 years have an absolute average of 0.2 percent of total nonfarm employment. In accordance with usual practice, the final benchmark revision will be issued in February 2026 with the publication of the January 2026 Employment Situation news release.

Each year, CES employment estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW). These counts are derived primarily from state unemployment insurance (UI) tax records that nearly all employers are required to file with state workforce agencies.

What is more remarkable about today's print is that after last year's stunning 818K negative revision, which was the second biggest since the global financial crisis (and which we also warned ahead of time was coming), virtually nobody expected this year's number to be higher. It was not only higher, but it was the biggest negative revision on record!

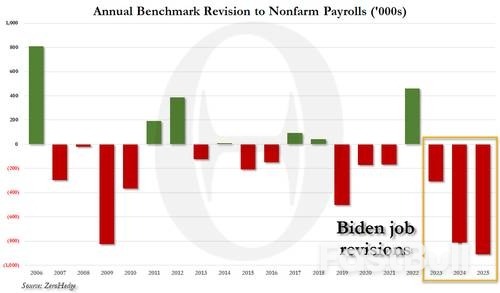

No wonder the WSJ now reports that "White House Prepares Report Critical of Statistics Agency" in what is a clear effort at kitchen-sinking all the ugly, fake jobs numbers that were "created" by the Biden admin, and saddled Trump with relentless negative revisions. Expect 1-2 more months of painful job prints, and then another powerful rally higher into the 2026 midterms under a new BLS commissioner as all of Biden's fake baggage is expunged.

So what does it all mean? Couple things and we will follow up with a more extended analysis but here is the punchline:

Just as remarkable: 2 million jobs from the last 3 years of the Biden admin have now been revised away.

One thing that will never be revised away, however, is the trillions in debt accumulated over his period, and which we now learn encumbered future generations of Americans with massive amounts of debt only to create far fewer jobs than initially reported.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up