Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Britain's PM visits China to mend ties amid US strains, but the economic rationale draws skepticism.

UK Prime Minister Keir Starmer is traveling to China this Tuesday, marking the first visit by a British leader in eight years. The trip aims to repair ties with the world's second-largest economy and hedge against growing unpredictability from the United States.

Starmer joins a list of Western leaders visiting Beijing, but his trip comes at a delicate time. Relations between the UK and its closest ally, the U.S., are strained over President Donald Trump's threats regarding Greenland. Accompanied by two ministers and a delegation of business executives, Starmer is scheduled for a three-day visit to meet with Chinese President Xi Jinping and Premier Li Qiang in Beijing before traveling to Shanghai and concluding with a brief stop in Japan.

Kerry Brown, a professor of Chinese studies at King's College London, noted that the core issue of the visit will be "what both sides make of the current behaviour and posture of the U.S. and Trump." He added, "One of the great anomalies of the current situation is that London is probably closer to Beijing than Washington" on global challenges like AI, public health, and the environment.

Since his election in 2024, Starmer has prioritized resetting the UK's relationship with China. Ties had previously soured over Beijing's actions in Hong Kong, a former British colony, as well as allegations of espionage and cyberattacks.

The visit presents China with an opportunity to strengthen ties with another U.S. ally navigating President Trump's volatile trade policies. This follows Canadian Prime Minister Mark Carney's trip earlier this month, which resulted in a new economic agreement between Canada and China.

Trump responded to that deal by threatening a 100% tariff on all Canadian goods entering the U.S.

Chinese foreign ministry spokesperson Guo Jiakun said Beijing sees the visit as a chance to open a "new chapter in the healthy and stable development of China-UK relations," including deeper practical cooperation. China's commerce ministry also confirmed that trade and investment deals are expected to be signed.

Recent visits by Western leaders have seen mixed results. While Carney secured a deal to cut tariffs on Chinese electric vehicles and Canadian canola oil, French President Emmanuel Macron's visit in December produced few significant economic outcomes.

For Britain, closer trade with China is a key part of Starmer's plan to improve living standards by boosting investment in the economy and public services. In the 12 months leading up to mid-2025, China was the UK's fourth-largest trading partner, with total trade valued at approximately 100 billion pounds ($137 billion).

Despite the government's ambitions, the strategy has drawn sharp criticism from politicians in both the UK and the U.S.

Sam Goodman, a policy director at the China Strategic Risks Institute in London, argued that Britain has seen few economic benefits from its engagement with Beijing and would find it difficult to replace its economic reliance on the United States.

He pointed out that China accounts for only 0.2% of foreign direct investment in Britain, while the U.S. provides about a third. Furthermore, Britain's market share for goods and services in China has declined over the last year.

"We have had a lot of concentrated engagement with this government on China, and the real question from this trip is what was it for?" Goodman asked. "Are there tangible outcomes that really point to meaningful growth in the British economy?"

Starmer's trip follows his government's approval of China's plans to build a large new embassy in London, a decision made despite objections from some politicians who warned it could facilitate spying operations. Last month, Starmer acknowledged that China poses national security threats but maintained that closer business ties were in the national interest.

Central Bank

Remarks of Officials

Commodity

Middle East Situation

Political

Economic

Traders' Opinions

China–U.S. Trade War

Gold prices climbed on Tuesday, holding just below the $5,100 per ounce level first breached in the prior session. The rally is being driven by investors seeking safe-haven assets amid ongoing uncertainty surrounding U.S. President Donald Trump's economic policies.

Spot gold rose 1.6% to $5,092.09 per ounce as of 10:12 GMT, after hitting an all-time high of $5,110.50 on Monday. In the futures market, U.S. gold for February delivery edged up 0.1% to $5,089 per ounce.

Analysts attribute the strong demand for gold to a volatile geopolitical landscape. "The constant back and forth (on tariffs) by President Trump and the U.S. administration, coupled with growing concerns around a military operation in Iran," are key factors unlikely to curb safe-haven demand soon, said Zain Vawda, an analyst at MarketPulse by OANDA.

Recent policy announcements have intensified market jitters. On Monday, President Trump stated he would increase tariffs on automobiles and other goods imported from South Korea. Meanwhile, a U.S. official remarked that the United States is "open for business" if Iran wants to establish contact, following renewed warnings from Trump to Tehran.

So far in 2026, gold has surged 18%, extending last year's gains. The sustained upward momentum is supported by several underlying factors:

• Persistent demand for safe-haven assets amid geopolitical and economic uncertainty.

• Market expectations for potential U.S. interest rate cuts.

• Robust purchasing activity from central banks.

Looking ahead, market participants are focused on the Federal Reserve's policy meeting, which begins Tuesday. While the central bank is widely expected to hold interest rates steady, investors will be watching closely for any news regarding the replacement for Chair Jerome Powell.

Major financial institutions remain bullish on gold's outlook. Both Deutsche Bank and Societe Generale have projected that gold prices could reach $6,000 per ounce in 2026, suggesting significant room for further gains.

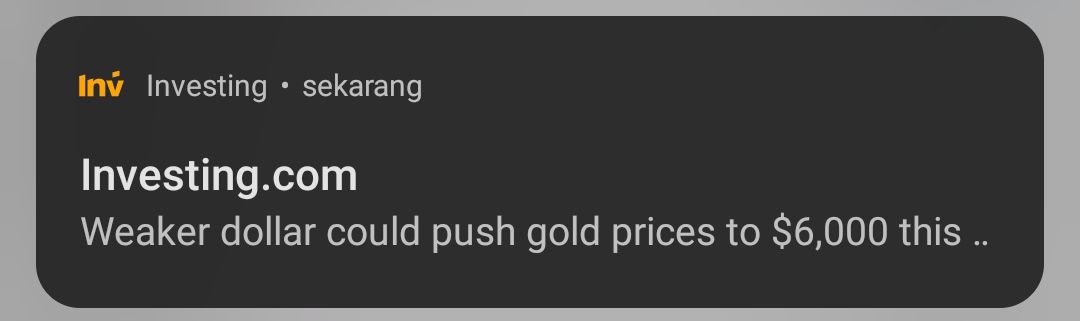

Other precious metals have also seen significant movement. Spot silver jumped 8.4% to $112.57 an ounce, after touching a record high of $117.69 on Monday. The metal has soared more than 50% year-to-date.

However, some analysts anticipate a cooldown. In a note, BMI, a unit of Fitch Solutions, stated, "We expect prices to ease in the coming months as supply tightness eases and industrial demand for silver starts to peak with a slowing Mainland Chinese economy."

Elsewhere in the metals market, spot platinum fell 2.5% to $2,689.12 per ounce after previously hitting a record of $2,918.80. In contrast, palladium added 3.3%, rising to $2,048.28.

Chile's central bank is widely expected to keep its benchmark interest rate unchanged at 4.5%, signaling a pause in monetary easing as the nation's economic outlook brightens.

According to a Bloomberg survey, nearly every economist anticipates the hold decision on Tuesday. This marks a shift from the previous meeting in December, when policymakers delivered a 25-basis-point cut. The move to maintain current borrowing costs, the lowest since early 2022, is fueled by improving growth prospects that reduce the need for further economic stimulus.

The central bank's confidence stems from an upgraded economic forecast. Board members led by Rosanna Costa recently raised their 2026 growth projection and now anticipate gross domestic product (GDP) will expand by as much as 3% this year as investment picks up.

This economic momentum is also supported by elevated prices for copper, Chile's most important export. With activity strengthening, the argument for holding rates steady is compelling, even as inflation continues to cool toward the official target.

A surge in financial market optimism has followed José Antonio Kast's presidential election win in December. His administration is prioritizing a pro-business agenda focused on economic deregulation and lower taxes, with a stated goal of accelerating growth to 4% by the end of its term.

Investor enthusiasm is reflected in the market's performance. The stock exchange is currently trading at a record high, while the Chilean peso has climbed to its strongest level since December 2023.

While the central bank refrains from commenting on politics, analysts will be watching its statement for clues on how it balances inflation against accelerating growth. The current 4.5% policy rate is already within the estimated neutral range of 3.75% to 4.75%, a level that neither stimulates nor restricts the economy.

Fernando Honorato and other Bradesco economists noted they will be "attentive to how the board will balance a benign scenario of inflation with a possible acceleration of economic activity." Consumer prices rose 3.5% last year, and policymakers project inflation will return to the 3% target during the first quarter of 2026.

The recent strength of the peso has also helped by curbing imported inflation. Looking ahead, some analysts believe rate cuts could resume later this year. Andrés Abadia, chief Latin America economist at Pantheon Macroeconomics, projects "two 25 basis-point cuts in the second quarter, taking the policy rate to 4% by year-end."

The central bank will publish its decision on its website at 6 p.m. Santiago time, a day before the U.S. Federal Reserve is expected to halt its own rate-cutting cycle.

Germany is facing a dual economic landscape, marked by a booming underground economy even as officials welcome a landmark trade deal between the European Union and India. A new study reveals that Germany's shadow economy has expanded to its highest level in over a decade, with undeclared work and illegal activities now valued at over €500 billion.

A study by financial scientist Friedrich Schneider from the University of Linz and the Institute for Applied Economic Research in Tübingen estimates the value of Germany’s shadow economy reached €510 billion ($606 billion) in 2025. This figure represents a €30 billion increase from 2024.

The report projects continued expansion, forecasting that the shadow economy will grow by another 5.5% to €538 billion in 2026. This underground activity includes income from undeclared work—known in Germany as Schwarzarbeit—and illegal operations like unregulated gambling and certain forms of sex work.

The study identifies several core drivers behind the growth of the underground economy, linking it to weak performance in the regular economy and rising unemployment. According to the analysis, specific policy changes have also created incentives for undeclared or illegal activities.

These factors include:

• The increase in the minimum wage to €12.82 at the start of 2025, with a further rise to €13.90 scheduled for January 1, 2026.

• An increase in the earnings cap for "mini-jobs."

Schneider suggested that lowering associated costs for employers could be a key strategy to tackle the problem. He argued that current conditions reduce "the income from declared employment," which in turn lowers tax revenue for the state. In contrast, the study noted that a decrease in VAT within the hospitality industry had successfully reduced incentives for shadow work in that sector.

In 2025, Germany's shadow economy was equivalent to 11.5% of its GDP. While significant, this figure remains below the average for 20 major industrialized nations.

However, the rate of growth is notable. Since 2021, Germany's shadow economy has expanded by 2.4 percentage points relative to its GDP. This is substantially faster than the 0.8 percentage point average increase seen across the other industrialized countries during the same period.

In a separate development, German Vice Chancellor and Finance Minister Lars Klingbeil celebrated a new trade agreement signed between the European Union and India.

Klingbeil hailed the deal as a move that "creates new opportunities for growth and good jobs — in Europe and India alike — while deepening the strategic partnership with the world's largest democracy."

Describing the agreement as "a new chapter in European trade policy," the vice chancellor emphasized a strategic focus on transparency and collaboration. "At a time of upheaval, we are consciously focusing on openness, reliability, and strong partnerships," he stated.

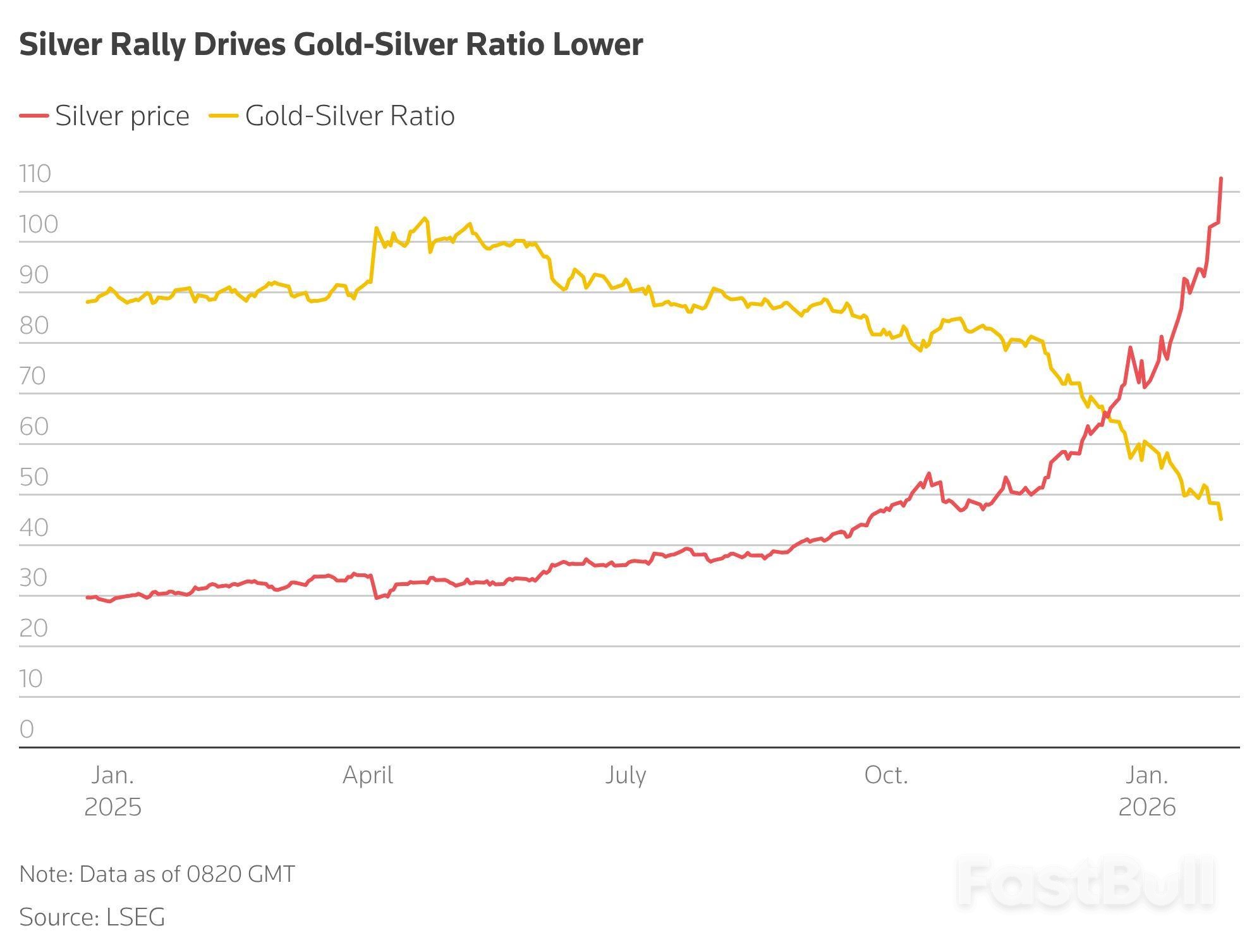

President Trump is once again leveraging tariffs, this time targeting South Korea, a U.S. ally with a bilateral trade relationship exceeding $160 billion. The move comes after Trump claimed the country failed to uphold its end of a recent trade agreement.

In a post on his social media platform, Truth Social, Trump announced his decision, citing delays by South Korea's legislature in approving a deal reached in November. That agreement was designed to lower U.S. tariffs on imported cars and auto parts from 25% to 15%. It also included a commitment of $350 billion in South Korean investment across various U.S. industry sectors.

Trump directly addressed the legislative hold-up, questioning the inaction following the agreement he framed as a major bilateral achievement.

"South Korea's Legislature is not living up to its Deal with the United States," Trump wrote. "President Lee and I reached a Great Deal for both Countries on July 30, 2025, and we reaffirmed these terms while I was in Korea on October 29, 2025. Why hasn't the Korean Legislature approved it?"

He emphasized that the U.S. expects reciprocal action from its trading partners. "Our Trade Deals are very important to America," Trump stated. "In each of these Deals, we have acted swiftly to reduce our TARIFFS in line with the Transaction agreed to. We, of course, expect our Trading Partners to do the same."

As a consequence of the delay, Trump said he would restore tariffs on key South Korean imports to their previous levels. The tariffs on Korean cars, lumber, and pharmaceutical products will now increase from 15% back to 25%.

The market reaction was immediate. Following the announcement, shares of major South Korean automakers, including Hyundai and Kia, dropped significantly.

This action is consistent with Trump's broader strategy of using tariffs and trade threats as diplomatic tools.

Previously, he threatened to impose a 100% tariff on all Canadian products if its government proceeded with a free trade agreement with China. That possibility was later dismissed by Canadian Prime Minister Marc Carney.

In another instance, Trump threatened 10% tariffs on all goods from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. The threat was linked to opposition from these nations regarding the annexation of Greenland. He later withdrew this measure after announcing that the U.S. had secured an agreement with NATO concerning the island's future.

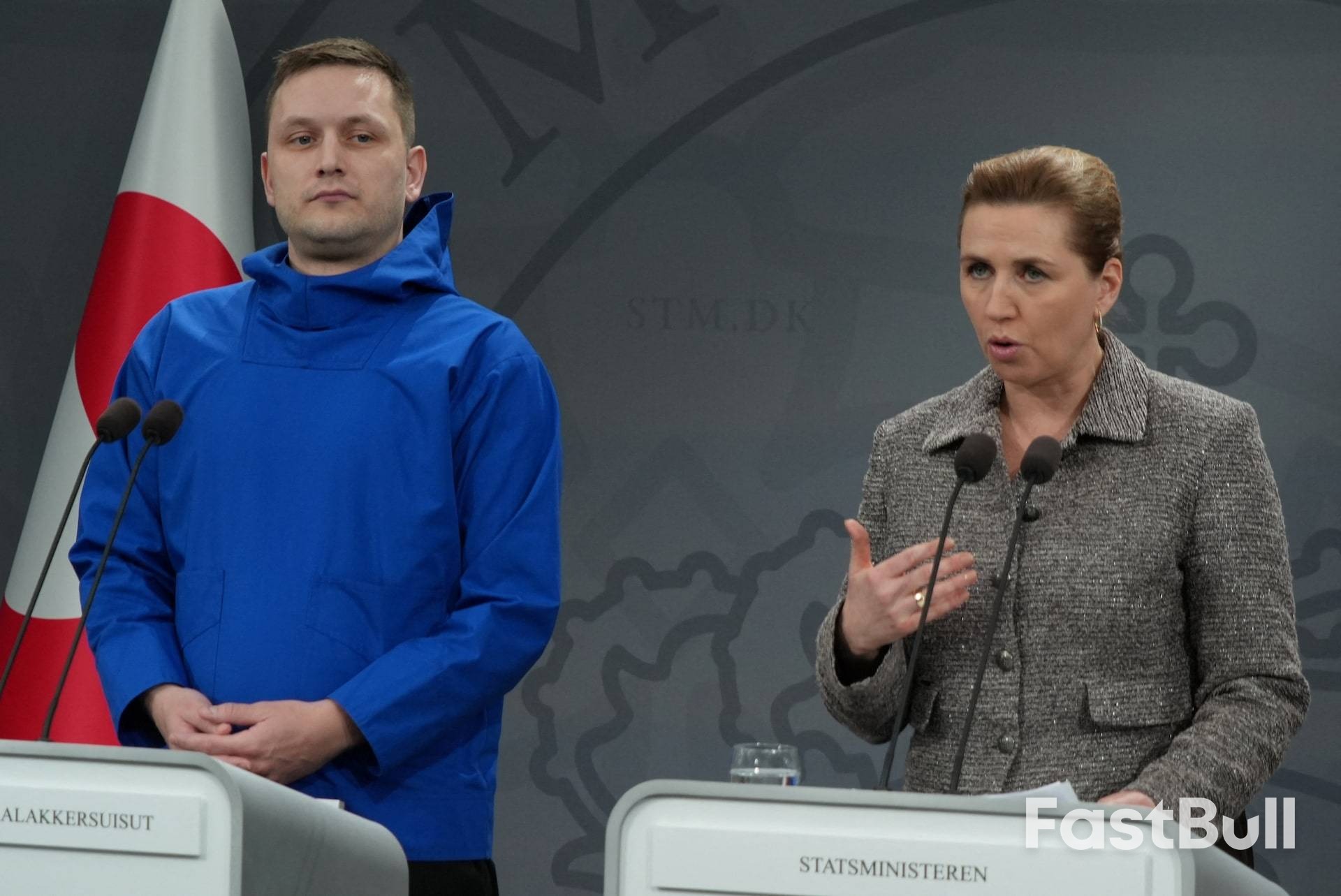

The leaders of Denmark and Greenland are meeting with top European officials in Berlin and Paris to build a united front following recent U.S. pressure to gain control of Greenland. The diplomatic tour aims to reinforce European solidarity as tensions over the Arctic island continue to simmer.

Danish Prime Minister Mette Frederiksen and her Greenlandic counterpart, Jens-Frederik Nielsen, are scheduled to meet with German Chancellor Friedrich Merz on Tuesday and French President Emmanuel Macron on Wednesday. The discussions will focus on "the current foreign policy situation and the need for a strengthened Europe," according to the Danish prime minister's office.

The meetings follow U.S. President Donald Trump's push to acquire Greenland, a Danish territory for centuries. While Trump recently withdrew tariff threats and ruled out a forcible takeover, the initial demand sent shockwaves through transatlantic relations and prompted European nations to reassess their reliance on the United States.

In addition to their political meetings, Frederiksen and Nielsen will also attend the Welt Economic Summit in Germany on Tuesday.

France has signaled strong backing for its European partners. President Macron is expected to reaffirm European solidarity and French support for the sovereignty and territorial integrity of both Denmark and Greenland.

A statement from the Elysee Palace noted that the leaders will address key regional issues, including:

• Security challenges in the Arctic

• The economic and social development of Greenland

The statement confirmed that France and the European Union are prepared to support Greenland's development initiatives. This move highlights a broader European effort to offer a strategic alternative to U.S. influence in the region.

The diplomatic crisis initially strained the NATO alliance, of which both Denmark and the U.S. are founding members. Though the conflict has shifted to a more diplomatic track, underlying tensions remain.

Last week, President Trump claimed he had secured "total and permanent U.S. access to Greenland" through a deal with NATO. The alliance's leadership has emphasized the need for allies to increase their commitment to Arctic security, citing potential threats from Russia and China.

In response, Denmark and Greenland have maintained they are open to discussions with the United States on a range of topics. However, they insist that their "red lines" regarding sovereignty and territorial integrity are non-negotiable.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up