Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Nov)

France Trade Balance (SA) (Nov)A:--

F: --

France Current Account (Not SA) (Nov)

France Current Account (Not SA) (Nov)A:--

F: --

P: --

South Africa Manufacturing PMI (Dec)

South Africa Manufacturing PMI (Dec)A:--

F: --

P: --

Italy Unemployment Rate (SA) (Nov)

Italy Unemployment Rate (SA) (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Dec)

Euro Zone Consumer Inflation Expectations (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Nov)

Euro Zone Unemployment Rate (Nov)A:--

F: --

P: --

Euro Zone PPI MoM (Nov)

Euro Zone PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Dec)

Euro Zone Selling Price Expectations (Dec)A:--

F: --

P: --

Euro Zone PPI YoY (Nov)

Euro Zone PPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Dec)

Euro Zone Industrial Climate Index (Dec)A:--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Dec)

Euro Zone Economic Sentiment Indicator (Dec)A:--

F: --

Euro Zone Services Sentiment Index (Dec)

Euro Zone Services Sentiment Index (Dec)A:--

F: --

Euro Zone Consumer Confidence Index Final (Dec)

Euro Zone Consumer Confidence Index Final (Dec)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Dec)

Mexico 12-Month Inflation (CPI) (Dec)A:--

F: --

P: --

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)A:--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)A:--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)A:--

F: --

P: --

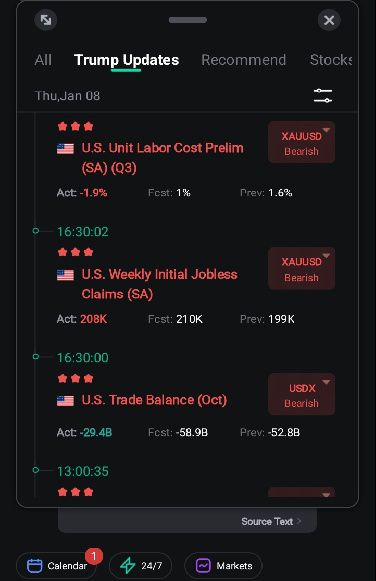

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)A:--

F: --

P: --

U.S. Exports (Oct)

U.S. Exports (Oct)A:--

F: --

P: --

U.S. Trade Balance (Oct)

U.S. Trade Balance (Oct)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)A:--

F: --

Canada Trade Balance (SA) (Oct)

Canada Trade Balance (SA) (Oct)A:--

F: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Oct)

U.S. Wholesale Sales MoM (SA) (Oct)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Consumer Credit (SA) (Nov)

U.S. Consumer Credit (SA) (Nov)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland CPI YoY (Dec)

China, Mainland CPI YoY (Dec)--

F: --

P: --

China, Mainland PPI YoY (Dec)

China, Mainland PPI YoY (Dec)--

F: --

P: --

China, Mainland CPI MoM (Dec)

China, Mainland CPI MoM (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Japan Leading Indicators Prelim (Nov)

Japan Leading Indicators Prelim (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Nov)

Germany Industrial Output MoM (SA) (Nov)--

F: --

P: --

Germany Exports MoM (SA) (Nov)

Germany Exports MoM (SA) (Nov)--

F: --

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)--

F: --

P: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Sept)

U.S. Building Permits Revised MoM (SA) (Sept)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Sept)

U.S. Building Permits Revised YoY (SA) (Sept)--

F: --

P: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)--

F: --

P: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

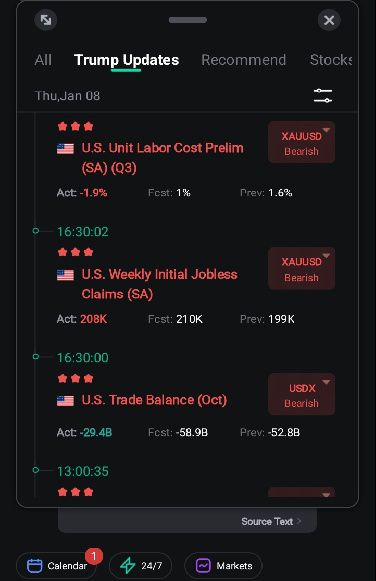

Seoul seeks Beijing's help with North Korea's nuclear program, signaling a strategic diplomatic shift to improve ties.

South Korean President Lee Jae Myung has formally requested China's assistance in containing North Korea's nuclear program, signaling a push to improve relations with Beijing and open a "new phase" of diplomatic ties.

The request was made during a meeting with Chinese President Xi Jinping in Beijing on Monday, with Lee later providing details to journalists in Shanghai on Wednesday. This marks the first visit to Beijing by a South Korean president in six years.

President Lee stated that he asked President Xi for China to assume a "mediating role" on the Korean Peninsula, particularly concerning North Korea's advancing nuclear capabilities.

"I would like China to play a mediating role on issues related to the Korean Peninsula, including North Korea's nuclear program. All our channels are completely blocked," Lee explained. "We hope China can serve as a mediator — a mediator for peace."

According to Lee, Xi advised him to show "patience" toward North Korea amid the current high tensions. Lee also acknowledged that past military actions by Seoul could have been perceived as threatening by Pyongyang.

While affirming that a "nuclear-free Korean Peninsula" remains Seoul's long-term goal, Lee outlined a more immediate objective aimed at freezing Pyongyang's progress.

"Just stopping at the current level — no additional production of nuclear weapons, no transfer of nuclear materials abroad, and no further development of [intercontinental ballistic missiles (ICBMS)] — would already be a gain," he said.

Lee reported that Seoul and Beijing had reached a "consensus" on these issues during his visit.

The diplomatic outreach comes as North Korea continues to conduct a series of ballistic missile tests and enhance its nuclear arsenal, which its leader, Kim Jong-un, has framed as a necessary deterrent against the United States.

Lee, who took office in June 2025, represents the left-leaning Democratic Party of Korea (DPK), which traditionally advocates for stronger engagement with China and a less confrontational stance toward North Korea than its rival, the People Power Party (PPP).

This diplomatic initiative highlights South Korea's complex strategic position. China stands as its top trading partner, yet Seoul maintains a robust defense alliance with the United States, requiring a delicate balance in its foreign policy.

Forecasting a central bank's next move is a difficult game, but the Bank of England (BoE) is currently presenting a unique challenge for UK economists. The economic data is sending a clear signal that the Bank's work on taming inflation is nearly finished, yet the institution itself appears deeply divided and far from convinced.

This disconnect between the data on the ground and the BoE's official stance is creating significant uncertainty over the timing of future rate cuts.

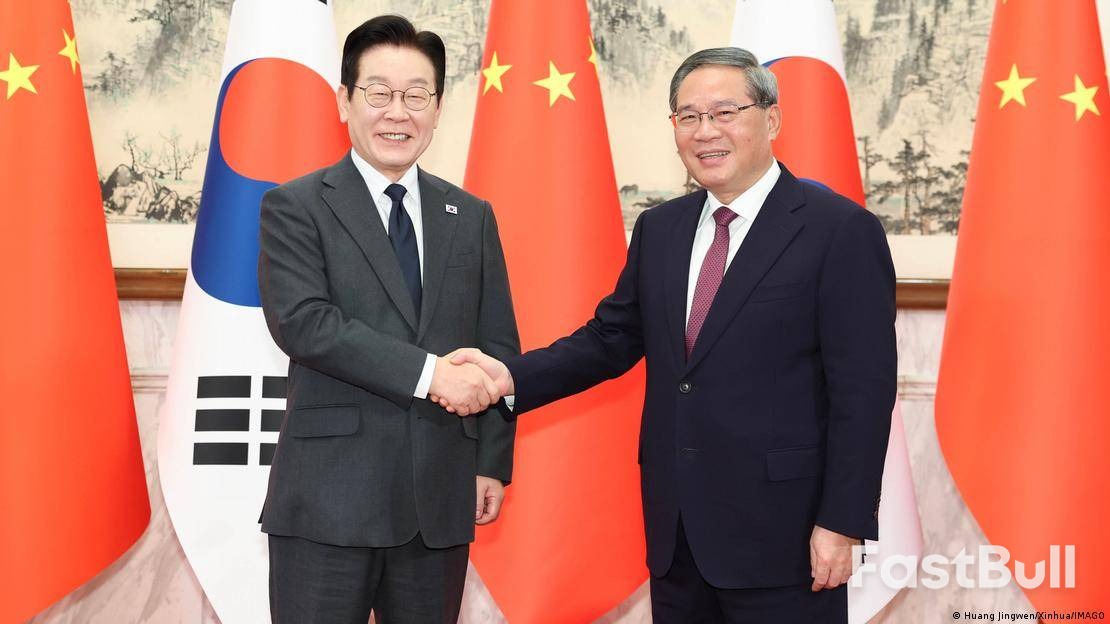

The state of the UK jobs market is central to the puzzle. In 2022, the market was incredibly tight, with one job vacancy for every unemployed person. Two-thirds of businesses reported they couldn't find enough staff.

That picture has changed entirely, driven by an unprecedented wave of economic migration. From late 2019 to late 2024, the number of non-EU nationals working in Britain nearly doubled. During the same period, the number of EU workers fell, and only 24,000 additional UK nationals entered the workforce. The share of non-EU workers in low-paid sectors like hospitality and health care surged from 10% to 20%.

This influx has dramatically eased labor shortages. The number of unfilled job openings has fallen sharply, now sitting below pre-COVID levels with only four vacancies for every 10 unemployed workers. Redundancies are beginning to rise, and an unusual number of companies are closing down.

This cooling labor market has two critical implications:

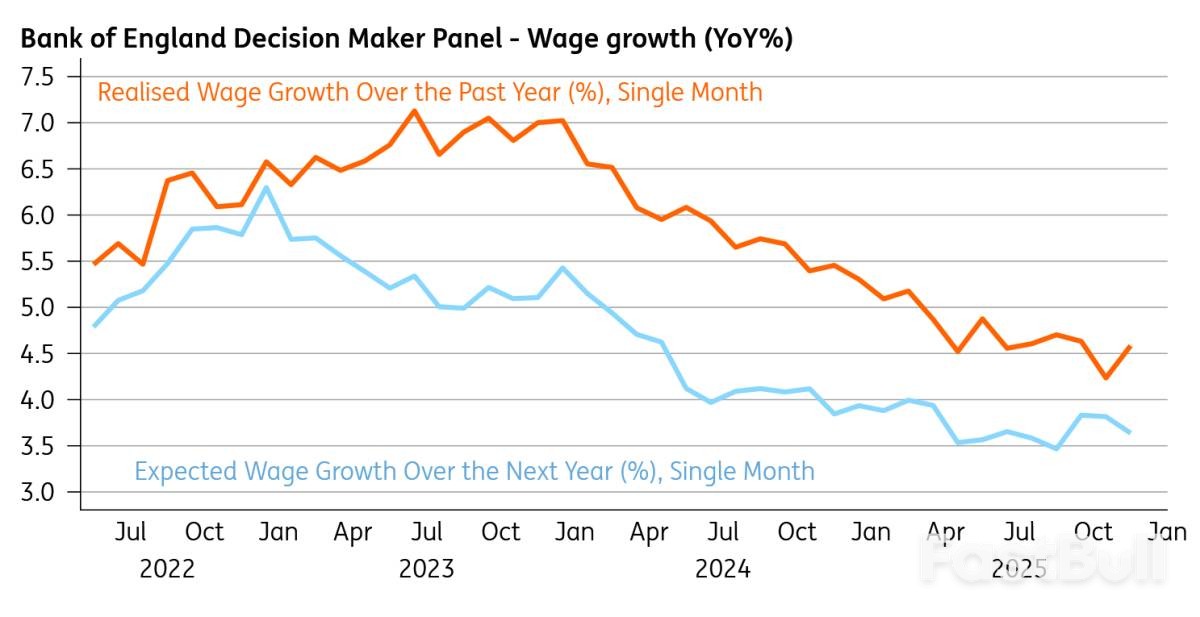

1. Wage growth is falling fast. Private sector pay growth, which stood at 6% last January, dropped to 3.9% in October and could plausibly hit 3% in the coming months—a rate lower than before the pandemic. As a result, real disposable incomes are expected to be flat this year.

2. Fears of another inflation wave are overblown. In 2022, the energy price shock hit an economy where conditions were perfect for inflation to become entrenched. That is no longer the case. Neither workers nor companies have the same power to demand higher wages or pass on rising costs.

While inflation expectations have risen due to food price spikes, the underlying economic conditions don't support a sustained inflationary surge like the one seen a few years ago.

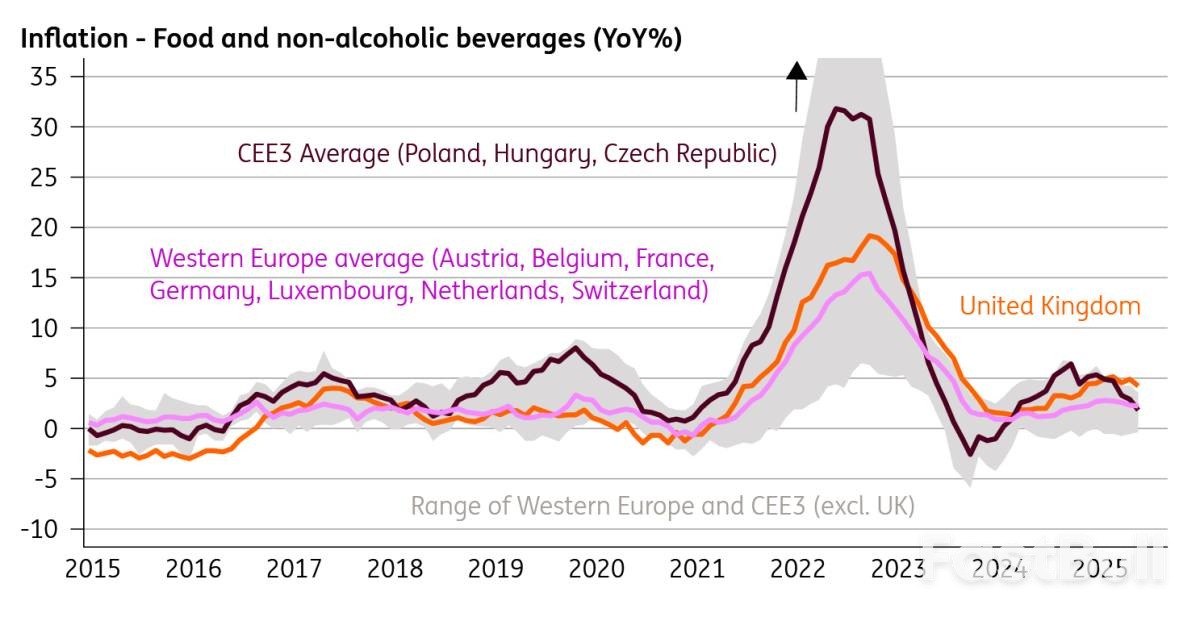

Food inflation has already started to decline, and evidence from Western and Central and Eastern Europe—which often leads the UK—suggests it has much further to fall. The UN's index of food input prices is also trending downward.

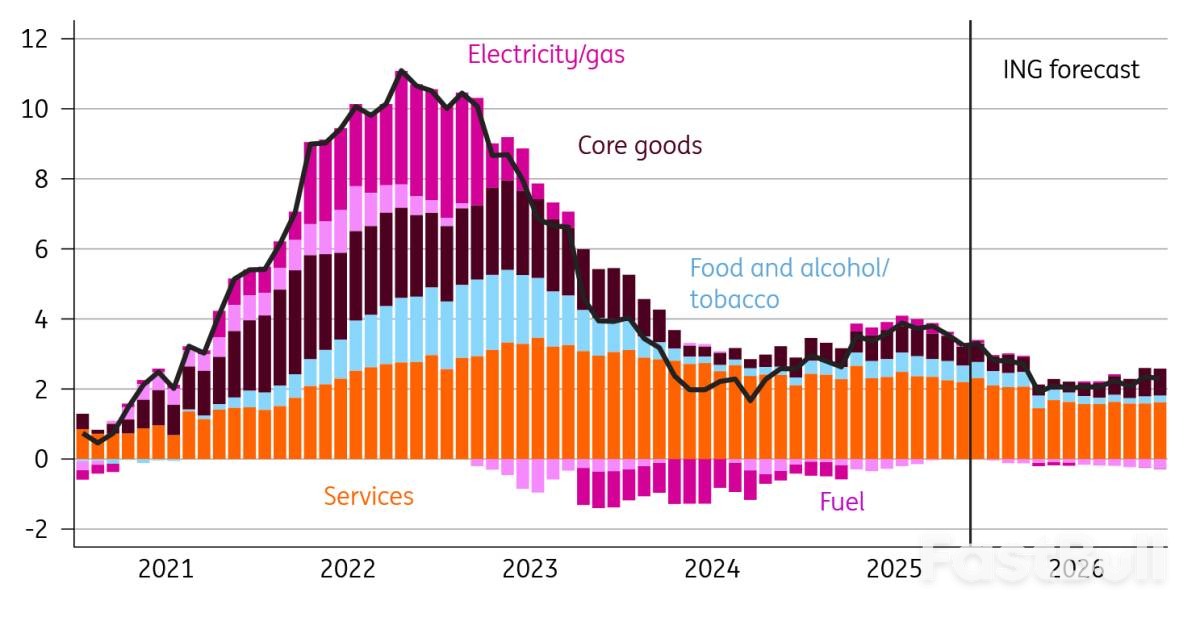

Services inflation is also on a downward trajectory. It is expected to fall from 4.4% in November to between 3.2% and 3.3% by the summer. Several factors are contributing to this trend:

• Rental inflation is continuing its decline.

• Pressure from food prices is easing.

• The increase in the Living Wage is less aggressive this year.

• There is no repeat of last year's payroll tax increase.

Furthermore, a significant drop in the annual inflation comparison is expected in April when last year's large increases in sewerage and vehicle taxes are no longer factored in. Combined with falling energy prices, headline inflation is projected to drop from its current 3.2% to the 2% target in April, where it is expected to remain for the rest of the year.

Given the weak economic data, including GDP growth of just 0.1% in the third quarter and a likely flat fourth quarter, one might assume the BoE would be ready to cut rates in February. However, a surprisingly hawkish stance at its last meeting makes this unlikely.

Although the BoE did cut rates last month and signaled more could follow, the message was clear: further cuts might be a long way off. Governor Bailey suggested the Bank could "slow the cadence" of cuts, a notable comment given the already slow pace.

Markets have adjusted their expectations, now almost fully pricing in a cut for April, with March seen as a 50/50 chance.

A key factor influencing both doves and hawks on the committee is the BoE's monthly corporate survey. This survey has shown that expected wage growth has leveled out in the 3.5-3.8% range, a sign of persistent underlying pressure that makes the Bank hesitant. The next release of this data will be crucial.

Ultimately, there isn't enough new data between now and the early February meeting to convince the committee to act. In fact, services inflation—a key metric for the BoE—is likely to rise temporarily in December due to the timing of airfare measurements.

By the March meeting, however, policymakers will have three more months of wage growth data. If this data continues to show a cooling trend, it should provide the reassurance needed for another cut. It would not be surprising if the unemployment rate also ticks higher by then.

For these reasons, the most probable scenario is that the Bank of England will cut rates again in March, followed by another cut in June. With the committee experiencing near-unprecedented levels of division, it only takes a shift in stance from one or two officials to significantly alter the pace of monetary policy.

Recent geopolitical events, from a U.S. military operation in Venezuela to tensions over Greenland, are fueling a significant rally in European defense stocks. As the global security landscape becomes less predictable, investors are increasingly viewing military spending not as a cyclical trend but as a long-term structural theme.

A Bloomberg index tracking European defense companies has already climbed 10% this year. The momentum accelerated following the U.S. military's capture of Venezuelan President Nicolás Maduro and continues as U.S. President Donald Trump has not dismissed using military force to acquire Greenland, creating friction with NATO ally Denmark.

Analysts argue that these events reinforce a new reality for Europe: the need for greater military self-reliance. The perception is that U.S. security policy is becoming more unilateral and transactional, even toward its traditional allies.

"That means that Europe has understood it needs to be able to act with or without US support," said Saima Hussain, an analyst at Alphavalue, in an interview with Bloomberg Television.

This sentiment is a key driver behind the sector's performance. The same defense index surged 73% in 2025, and last year, the sector was responsible for about 12% of the total returns for the Stoxx Europe 600 index, second only to banks.

The "less predictable world" is hardening the political will across Europe to boost military investment, according to Aneeka Gupta, macroeconomic research director at WisdomTree. She notes that events like the one in Venezuela encourage nations to meet or exceed NATO's spending target of 2% of GDP.

This directly benefits European defense contractors specializing in key areas:

• Munitions replenishment

• Air and naval power

• Surveillance and cyber capabilities

Germany has already committed to a spending increase of around €50 billion ($58.4 billion) on armored vehicles, air-defense missiles, and satellites. The country aims to meet its NATO spending commitment in 2029, six years ahead of schedule. This follows a pledge from most NATO members to adopt a new spending goal of 3.5% of GDP, spurred by Trump's reluctance to continue underwriting Europe's defense costs.

Strategists at Goldman Sachs Group Inc., including Sharon Bell, remain bullish on the sector, expecting government spending commitments to continue driving profit growth. Furthermore, analysis shows that the European aerospace and defense sector trades at a discount compared to its U.S. counterpart based on forward price-to-earnings ratios.

However, there are risks. Renewed investor interest has pushed valuations to expensive levels relative to the broader European market. High earnings expectations could lead to disappointment, a factor that slowed the rally in the second half of last year. A potential ceasefire in Ukraine could also temporarily cool market sentiment.

Fiscal pressures may also pose a challenge. Ana Andrade of Bloomberg Economics noted that the region’s five largest economies are likely to fall short of spending targets. Germany, with its lower debt levels, is in the best position to lead the military buildup.

Despite these concerns, the sector has started the new year strong.

• Saab AB became the first major European defense company to hit a record stock price in 2026.

• Rheinmetall AG remains a top pick among analysts.

Analysts at Bernstein, led by Adrien Rabier, advise a selective approach, focusing on national champions poised to benefit from their respective government's spending plans. They do not anticipate a Russia-Ukraine ceasefire soon but caution that stock prices may react to peace-related headlines.

"Ceasefire or not, the spending needs to happen," the Bernstein team wrote. They project that topline growth for large-cap defense firms in 2026 will remain as strong as in 2025, forecasting revenue gains of 9% for the group. They see the most potential for upgrades in Rheinmetall, Thales, and Leonardo, with Rheinmetall’s sales growth forecast to accelerate by 40%.

Cyprus began its rotating presidency of the European Union on Wednesday, launching its six-month term with a high-profile meeting attended by Ukrainian President Volodymyr Zelenskyy, European Commission chief Ursula von der Leyen, and European Council President Antonio Costa.

Zelenskyy's presence in Nicosia sends a strong political signal of the EU's continued backing for Kyiv as its war with Russia moves into its fifth year.

Upon his arrival at the presidential palace, Zelenskyy was welcomed by Cypriot President Nikos Christodoulides. During a brief exchange, the Ukrainian leader expressed his goals for the new presidency.

"We hope that during your presidency a lot of steps can be taken forward, closer to membership in the EU," Zelenskyy told Christodoulides.

He added that the meeting was also an opportunity to follow up on discussions from a Paris summit on Tuesday. At that gathering, the United States and a broad coalition of allies pledged to provide security guarantees to support Ukraine in the event of a ceasefire if Russia were to attack again.

The island nation, which is assuming the EU helm for the second time, aims to serve as a strategic bridge between Europe and the Middle East. A formal ceremony in Nicosia will include regional leaders such as Lebanese President Joseph Aoun, highlighting this ambition.

While Cyprus traditionally maintained close cultural and political ties with Russia, it has fully supported sanctions against Moscow. Many on the island draw parallels between Russia's invasion of Ukraine and Turkey's 1974 invasion of northern Cyprus, which followed a coup engineered by the military junta then ruling Greece.

For his part, President Christodoulides stated that Cyprus's presidency will focus on boosting the EU's autonomy and deepening its integration to better address global challenges.

Euro-area inflation has aligned with the European Central Bank's target, reinforcing the view among policymakers that interest rates can remain on hold barring any major shifts in the economic outlook.

Consumer prices in December rose 2% from the previous year, a slight decrease from the 2.1% recorded in the prior month. The figure matched economists' expectations.

A closer look at the data reveals a broader trend of moderating price pressures. Core inflation, which excludes volatile items like food and energy, slowed to 2.3%. Similarly, services inflation, a metric closely watched by the ECB, also showed signs of easing.

Price growth has now been hovering near the central bank's 2% objective for over six months. This stability has allowed the ECB to maintain its current borrowing costs since June, with both economists and investors anticipating no further policy moves in the foreseeable future.

While most ECB officials agree that inflation is largely under control, they have been circumspect about future steps, pointing to persistent uncertainty in the global economy.

At their final meeting of 2025, policymakers revised their forecasts, now expecting inflation to fall only slightly below its target this year. This upward adjustment reflects a slower-than-anticipated easing in the cost of services.

Divergent Inflation Rates Across the Bloc

Recent reports from member states show that while consumer price growth is easing across the Eurozone, the pace differs significantly from country to country.

• Spain: Inflation dropped to 3%.

• France: Inflation eased to 0.7%.

• Germany: Inflation registered at 2%.

Services inflation remains a primary point of concern for the ECB, driven partly by robust wage growth. The most comprehensive measure of pay increases held steady at 4% in the third quarter, a level considered above what is consistent with long-term price stability.

ECB President Christine Lagarde acknowledged last month that this is "a trend that we look at carefully." However, she also expressed confidence that wage pressures should moderate this year as salaries catch up to the post-pandemic price surge.

Several other factors could potentially push inflation away from the 2% target, including the ongoing effects of US tariffs, the strength of the euro, and fiscal expansion in Germany.

Under its baseline scenario, the central bank projects that inflation will average 1.9% in 2026. Following a further decline, it is then expected to accelerate back toward the 2% target by 2028.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up