but later you will

but later you will

Signal Accounts for Members

All Signal Accounts

All Contests

[Speaker Of The U.S. House Of Representatives: Confident Of Sufficient Votes To End Partial Government Shutdown By Tuesday] February 1st, According To Nbc News, U.S. House Speaker Johnson Said He Is Confident That There Will Be Enough Votes By At Least Tuesday To End The Partial Government Shutdown

Iranian Official Tells Reuters: Media Reports Of Plans For Revolutionary Guards To Hold Military Exercise In Strait Of Hormuz Are Wrong

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Security Committee's Vice Chairman Medvedev: Behind The So Called 'Chaos' Of Trump, He Is An Effective And Original USA Leader

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

but later you will

but later you will

but later you will

but later you will

Envious of Trump, who can freely control gold prices.

Envious of Trump, who can freely control gold prices.

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Silver retreated after the U.S. deferred import tariffs, yet analysts foresee structural deficits sustaining its value.

Silver's volatile start to the year has taken a sharp turn, with prices falling after President Donald Trump confirmed the U.S. would not impose import tariffs on the precious metal and other critical minerals for now. The decision offers a temporary reprieve to a market that had rallied 30% in the new year amid escalating supply concerns.

In a series of proclamations, the White House announced it will not apply tariffs on processed critical minerals and their derivative products. Instead, the administration plans to pursue new trade agreements to bolster the supply of these materials, based on recommendations from the Secretary of Commerce.

The statement highlighted the nation's dependence on foreign sources, noting that the U.S. lacks sufficient production capacity for processed minerals. As of 2024, the United States was 100% reliant on net imports for 12 critical minerals and at least 50% reliant for another 29.

"The Secretary recommended that I negotiate agreements with foreign nations to ensure the United States has adequate critical mineral supplies and to mitigate the supply chain vulnerabilities as quickly as possible," the White House stated.

However, the administration left the door open for future trade restrictions, adding that it may be "appropriate to impose import restrictions, such as tariffs, if satisfactory agreements are not reached in a timely manner."

The news triggered significant selling in the silver market. After touching a high of $93 an ounce, spot silver last traded at $90.09 an ounce, a decline of more than 3% on the day. Despite the drop, prices showed some resilience by bouncing off lows near $86 an ounce.

Analysts believe the removal of the immediate tariff threat could ease liquidity issues that have plagued the silver market.

"In the near-term, prices may consolidate in a range as tariff risks are reassessed and positioning normalises," said Ewa Manthey, Commodities Strategist at ING. "However, structural deficits, tight physical availability, and ongoing policy uncertainty suggest downside might be limited, with silver likely to remain well-supported on dips."

Market participants had been closely watching for this decision for months. The issue arose in November when silver and Platinum Group Metals (PGMs) were added to the U.S. Geological Survey's (USGS) 2025 List of Critical Minerals. This action prompted a Section 232 tariff investigation, giving the government 90 days to make a ruling.

While gold, silver, and PGMs were exempt from global tariffs imposed last year due to their status as precious metals, fears persisted that silver, platinum, and palladium could face new levies because of their industrial importance.

Although analysts considered tariffs an unlikely outcome, the lingering risk forced market players to maintain high U.S. stockpiles throughout most of 2025. This put immense pressure on the global supply chain, creating liquidity shortages as investment and industrial demand competed for limited supplies in London and China.

While the tariff news has provided some relief to the supply crunch, analysts maintain that the market's underlying structural problems are far from over.

Market analysts at BMO Capital Markets noted that the reactionary sell-off was expected. "As Trump has not categorically ruled out tariffs, we would expect this to be transient," they said.

This view is shared by others who see persistent tightness in the global market. "The immediate heat may be off silver, but we can't expect the tightness to ease dramatically, especially as it's now tight in Asia as well," commented Rhona O'Connell, head of market analysis at StoneX.

While U.S. supply issues have been addressed temporarily, the physical market remains sensitive to other potential disruptions, including China's new export restrictions. However, analysts at Metals Focus suggest these fears may be exaggerated.

"Exporting silver from mainland China has always required a licence, and the list of qualifying companies is reviewed every two years," the firm explained. "This policy should not be interpreted as an export ban or a material shift in China's stance on silver exports. Instead, it represents a move towards stricter management of export licensing."

Metals Focus anticipates that as inventories in London recover and Chinese exports normalize, the market dislocation will gradually ease. This could create some short-term price weakness, but they expect investors will quickly buy the dip, leading to "further upside for the silver price over the foreseeable future."

Looking ahead, the firm expects ongoing supply issues to fuel volatility. A shortage of high-grade refining capacity has slowed the return of scrap silver to the market. This, "combined with an ongoing structural deficit in 2026, [means] above-ground bullion inventories have not been rebuilt as quickly as might have been expected."

Jan 15 (Reuters) - A federal appeals court ruled on Thursday that a judge had no jurisdiction to order the release of Columbia University graduate Mahmoud Khalil from immigration detention, delivering President Donald Trump's administration a victory in its efforts to deport the pro-Palestinian activist.

The 2-1 ruling by a panel of the Philadelphia-based 3rd U.S. Circuit Court of Appeals opens the door to Khalil being rearrested after it ordered, opens new tab the dismissal of a lawsuit he filed challenging his initial detention.

The court said that under the Immigration and Nationality Act, the district court that considered his lawsuit was not the proper forum to address his claims, which should have been heard through an appeal of a removal order from an immigration judge.

Khalil was among the most prominent of a number of foreign students detained last year after engaging in pro-Palestinian activism on their college campuses. While the ruling is likely to be appealed, if it stands it could close off a legal avenue that many have used to challenge deportation orders.

Thursday's ruling came from U.S. Circuit Judges Thomas Hardiman and Stephanos Bibas, both of whom were appointed by Republican presidents.

"The scheme Congress enacted governing immigration proceedings provides Khalil a meaningful forum in which to raise his claims later on in a petition for review of a final order of removal," they wrote in an unsigned opinion.

U.S. Circuit Judge Arianna Freeman dissented, saying Congress did not mean to foreclose meaningful judicial review over Khalil's claims that his detention and potential re-detention violate his free speech rights under the U.S. Constitution's First Amendment.

"Khalil claims that the government violated his fundamental constitutional rights," wrote Freeman, who was appointed by Democratic President Joe Biden. "He has also alleged, and proven, irreparable injuries during his detention."

Khalil in a statement said the ruling is "deeply disappointing, but it does not break our resolve." His lawyers vowed to appeal the ruling, which does not take immediate effect, preventing his re-detention for now.

"The door may have been opened for potential re-detainment down the line, but it has not closed our commitment to Palestine and to justice and accountability," Khalil said.

The U.S. Department of Homeland Security, which oversees Immigration and Customs Enforcement, did not respond to a request for comment.

Khalil, a prominent figure in pro-Palestinian protests against Israel's war in Gaza, was arrested on March 8 by immigration agents in the lobby of his university residence in Manhattan.

Trump had called the protests antisemitic and vowed to deport foreign students who took part. Khalil became the first target of this policy.

Though Khalil was initially detained in New York, by the time his lawyer sued over his detention there, immigration officials had moved him to New Jersey, leading his case to be transferred to a judge there.

He walked out of a Louisiana immigrant detention center in June, after U.S. District Judge Michael Farbiarz of Newark, New Jersey, ordered the U.S. Department of Homeland Security to release him from custody.

The Trump administration appealed, calling Farbiarz's ruling an "unprecedented" intrusion into its efforts to detain and deport a key figure in "violent and antisemitic riots and protests" that occurred at Columbia in 2024 over Israel's war.

In September, an immigration judge ordered Khalil to be deported to Algeria or Syria over claims that he omitted information from his green card application. His lawyers have said they will appeal that order.

Thursday's ruling came hours before a federal judge in Boston was scheduled to consider whether to block the Trump administration from arresting, detaining and deporting foreign students and faculty engaged in pro-Palestinian advocacy, after he concluded last year that the policy was unconstitutional.

Michigan Governor Gretchen Whitmer delivered a sharp rebuke of President Donald Trump's economic strategy at the Detroit Auto Show on Thursday, presenting a starkly different reality than the one Trump portrayed in the same city just two days earlier.

Speaking to the heart of America's automotive industry, Whitmer, a Democrat in her final year as governor, argued that the administration's tariff policies are actively harming U.S. auto manufacturing while inadvertently boosting Chinese competitors.

"This will only get worse without a serious shift in national policy," Whitmer warned, highlighting the economic uncertainty currently gripping the auto sector.

Her comments directly countered President Trump's recent message. During a visit that included a tour of a Ford plant in Dearborn, Trump defended his economic record, stating confidently, "All U.S. automakers are doing great."

The governor painted a contrasting picture, asserting that American manufacturing has been contracting for months, resulting in job losses and cuts to production. Whitmer's opposition to the tariff strategy is long-standing, particularly given Michigan's deep economic ties with Canada.

She emphasized the complex cross-border supply chain where auto parts frequently move between the U.S. and Canada during assembly. Disrupting this relationship, she argued, weakens the entire North American manufacturing base.

"America stands more alone than she has in decades," Whitmer stated. "And perhaps no industry has seen more change and been more impacted than our auto industry."

The White House did not provide an immediate comment on the governor's speech.

A central theme of Whitmer's address was the geopolitical consequence of the administration's trade policy. She revealed that in every meeting with President Trump over the past year, she has argued that damaging the U.S.-Canadian relationship ultimately serves China's interests.

"When we fight our neighbors, however, China wins," she said, framing the issue as a strategic misstep.

This argument extends to the United States-Mexico-Canada Agreement (USMCA), a trade deal negotiated during Trump's first term. While Whitmer defended the agreement, Trump recently suggested it was "irrelevant" during his Detroit-area tour, offering few details on his position ahead of the agreement's scheduled review this year.

Whitmer's public disagreement with Trump is notable for its measured tone, which marks a difference from her relationship with him during his first term. She has made several visits to the White House over the last year, adopting a less combative public stance than other potential 2028 Democratic presidential candidates like California's Gavin Newsom or Illinois's J.B. Pritzker.

President Trump himself has adjusted his approach to auto tariffs. After initially announcing a 25% tariff on automobiles and parts, the administration later relaxed the policy as domestic manufacturers sought relief from the threat of escalating production costs.

Venezuelan opposition leader María Corina Machado is meeting with President Donald Trump at the White House, a high-stakes discussion that comes just after Trump publicly questioned her ability to lead the nation. The meeting occurs in the shadow of a daring U.S. military raid that captured former President Nicolás Maduro, creating a power vacuum in the South American country.

Despite Machado's long-standing role as a face of the Venezuelan resistance, the Trump administration has signaled a surprising willingness to work with acting President Delcy Rodríguez, who served as Maduro's vice president. This move effectively sidelines Machado, who has spent years building relationships with Trump and key figures like Secretary of State Marco Rubio.

President Trump has openly raised doubts about his administration's commitment to installing a new democratic government in Venezuela. By engaging with Rodríguez and other members of Maduro's inner circle who still control daily government operations, Trump is charting an unexpected course.

The White House confirmed that since Maduro's ouster, the Venezuelan government has been fully cooperating. Rodríguez has softened her stance on Trump's "America First" policies and is continuing to release prisoners, including several Americans this week, in a move seen as a concession to the U.S. administration.

On Wednesday, Trump described a "great conversation" with Rodríguez, their first since Maduro's capture. "We had a call, a long call. We discussed a lot of things," Trump said. "And I think we're getting along very well with Venezuela."

This budding relationship stands in stark contrast to his comments on Machado. Hours after Maduro was detained, Trump stated it would be "very tough for her to be the leader," claiming she lacks "the support within or the respect within the country."

The White House stated that Machado requested the meeting with Trump without any set expectations. Her visit to Washington follows her party's widely recognized victory in the 2024 elections, which Maduro had rejected.

Machado has navigated her relationship with Trump carefully. After winning the Nobel Peace Prize last year—an honor Trump has openly desired—she offered to share it with him, though the Nobel Institute rejected the proposal.

Following her lunch with Trump, Machado is scheduled to hold a meeting at the Senate. The president referred to her as "a nice woman" but suggested their talks would not cover major issues.

Her trip also coincides with another U.S. action in the Caribbean, where forces seized a sanctioned oil tanker allegedly tied to Venezuela. This is part of a wider American strategy to control the country's oil sector after U.S. forces captured Maduro and his wife in Caracas, bringing them to New York to face drug trafficking charges.

Machado, an industrial engineer and the daughter of a steel magnate, has been a prominent figure in Venezuelan opposition for two decades.

Her political activism began in 2004 when Súmate, a non-governmental organization she co-founded, promoted a referendum to recall then-President Hugo Chávez. Although the referendum failed, Machado and other Súmate leaders were charged with conspiracy.

In 2005, she again drew the ire of Chávez's government by meeting with President George W. Bush in Washington. A photograph of her shaking hands with Bush in the Oval Office became a lasting image of her alignment with U.S. interests.

Nearly two decades later, she mobilized millions of Venezuelans against Maduro in the 2024 election. Despite credible evidence of her victory, ruling party loyalists declared Maduro the winner, triggering anti-government protests that were met with a brutal crackdown. After being briefly detained in Caracas early last year, Machado went into hiding, only reappearing publicly in Oslo when her daughter accepted the Nobel Peace Prize on her behalf.

Peru's economy expanded just 1.5% in November, a figure that fell far short of the 2.8% median forecast from economists. This unexpected slowdown, driven by a sharp drop in copper production, marks a significant setback for one of Latin America's standout economies.

The 1.5% year-over-year growth was a stark miss, aligning only with the single most pessimistic market forecast.

According to data from Peru's national statistics institute, INEI, the economy contracted on a monthly basis, shrinking by 0.44% compared to October.

The primary driver behind the slowdown was a 12% annual drop in copper production. While Peru's energy and mines ministry has not yet released detailed figures identifying which companies were affected, the impact on the national economy was clear.

Adding to the pressure, the fishing sector also contracted by 17.9% year-over-year, though the institute noted that fishing seasons can vary significantly from one year to the next.

This weak performance contrasts with Peru's recent history as a regional economic leader, which has consistently posted faster growth and lower inflation than many of its peers.

Before the release of the November data, the country's finance ministry had projected that the economy would grow by approximately 3.5% for the full year, a target now under pressure.

Despite the slowdown in growth, other parts of the economy showed strength. In a separate report, INEI announced that the unemployment rate in Lima dropped to a record-low 5% in December, beating the median forecast of 5.9%.

Meanwhile, Peru's central bank has held its key interest rate steady at 4.25%. This decision comes as the nation's currency approaches a six-year high and inflation remains below the central bank's target.

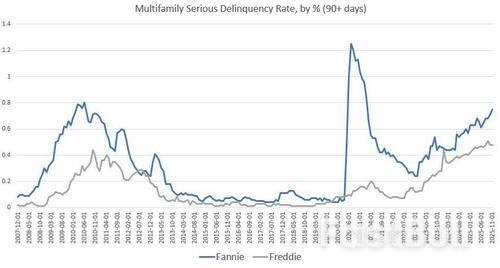

Fannie Mae and Freddie Mac (also known as "GSEs") have released their November reports on their mortgage portfolios and mortgage delinquencies. Both Fannie and Freddie report that serious delinquencies in multifamily are rising to multiyear highs.

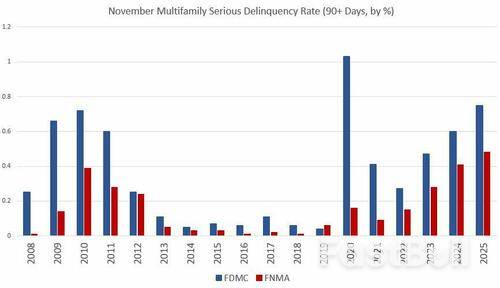

For November, seriously delinquent multifamily mortgages (90+ days delinquent) at Fannie Mae rose to 0.75 percent. That's up from October's total of 0.71 percent, and it was up from November 2024's total of 0.60 percent. Fannie's delinquency rate has risen quickly since December 2022 when the rate was 0.24 percent. Excluding the covid panic, Fannie's delinquency rate is now the highest since 2010, but remains below the Great-Recession high of 0.80 percent.

Freddie Mac's delinquency report, on the other hand, shows delinquencies above the Great-Recession peak. During November, Freddie reported multifamily serious delinquency rate was 0.48 percent. That's unchanged from October 2025, but up from November 2024's level of 0.41 percent.

Comparing for November of each year, November 2025's delinquency rate at Fannie exceeds that of November 2011, the previous peak year for delinquencies (ex covid), when November delinquencies reached 0.72 percent. At Freddie, November 2025's delinquency rate of .48 percent is the highest in decades, and above the previous peak of 0.39 percent.

This trend likely reflects slowing rent growth and waning demand for rentals as employment stagnates and wage growth slows. CNBC reported on Dec 26:

After years of steep increases, renters are finally seeing sustained price relief, a trend that appears to be carrying into early 2026.

In November, the median asking rent across the 50 largest U.S. metro areas was $1,693, down about 1% from a year earlier and marking the 28th consecutive month of year-over-year declines, according to Realtor.com listings data. Nationally, the median rent fell to $1,367, down 1.1% from a year earlier, according to Apartment List's data.

November is typically the slowest month for rentals, but rents fell more from October to November this year than they did over the same period last year, according to Apartment List.

With new apartment supply still hitting the market, rents are expected to remain lower into 2026.

"Barring a major economic shock, 2026 is shaping up to be one of the more renter-friendly periods we've seen in a decade," says Michelle Griffith, a luxury real estate broker at Douglas Elliman.

The phrase "renter friendly" is anything but friendly for owners of multifamily rentals. Moreover, landlords must continue to contend with rising prices in services and materials necessary for regular maintenance of multifamily units. In other words, we must consider inflation, so real, inflation-adjusted rent growth is even worse than the nominal declines now reported in a number of metro areas. In Denver metro, for example, the median asking rent in November was down 4.8 percent, year over year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up