Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The financial regulators stressed that clear rules for DeFi and perpetual contracts could redirect more activity to US platforms.

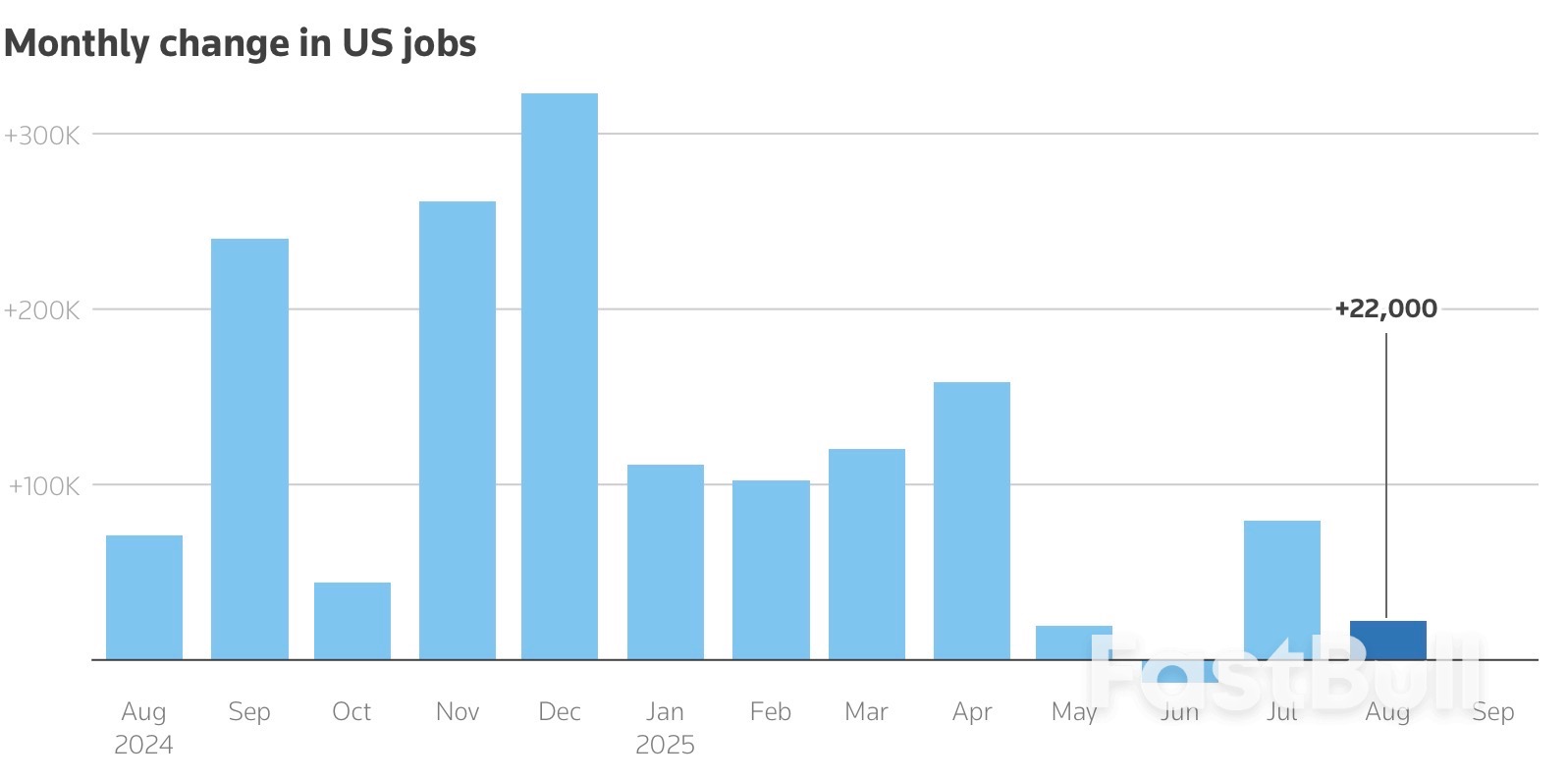

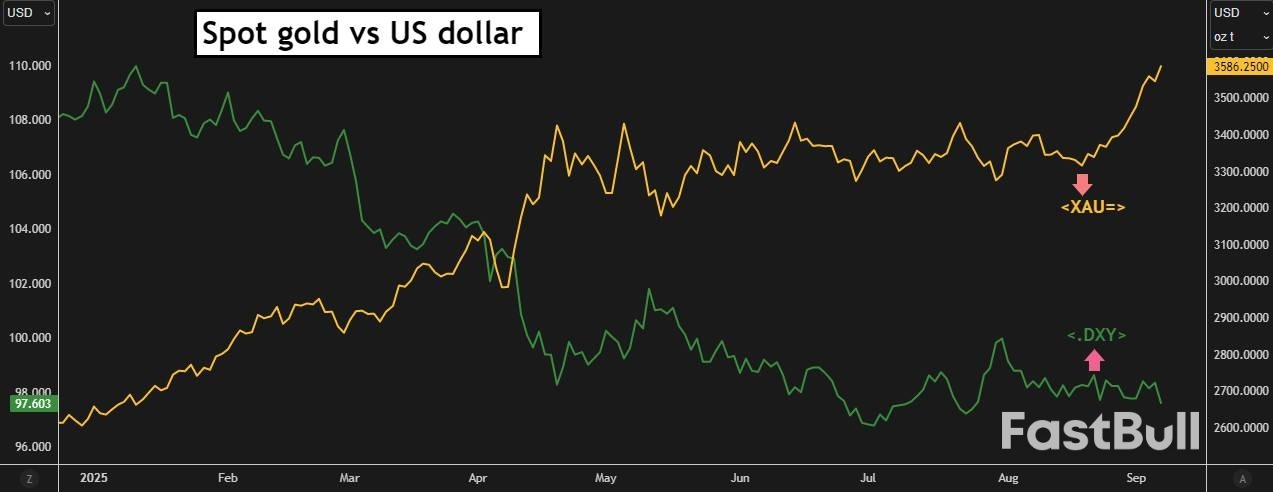

Gold's powerful rally took on fresh legs on Friday, with prices just cents away from $3,600 per ounce, as weak U.S. jobs data further raised expectations for bullion-supportive Federal Reserve rate cuts.

Spot gold was up 1.5% at $3,596.01 per ounce, as of 1636 GMT, having hit a record $3,599.89 earlier. The metal is now on track for its strongest weekly gain in nearly four months. U.S. gold futures for December delivery rose 1.3% to $3,651.90.

Bullion has surged 37% so far this year after a 27% gain in 2024 - driven by U.S. dollar weakness, central bank buying, a softening monetary policy backdrop and wider geopolitical and economic uncertainty.

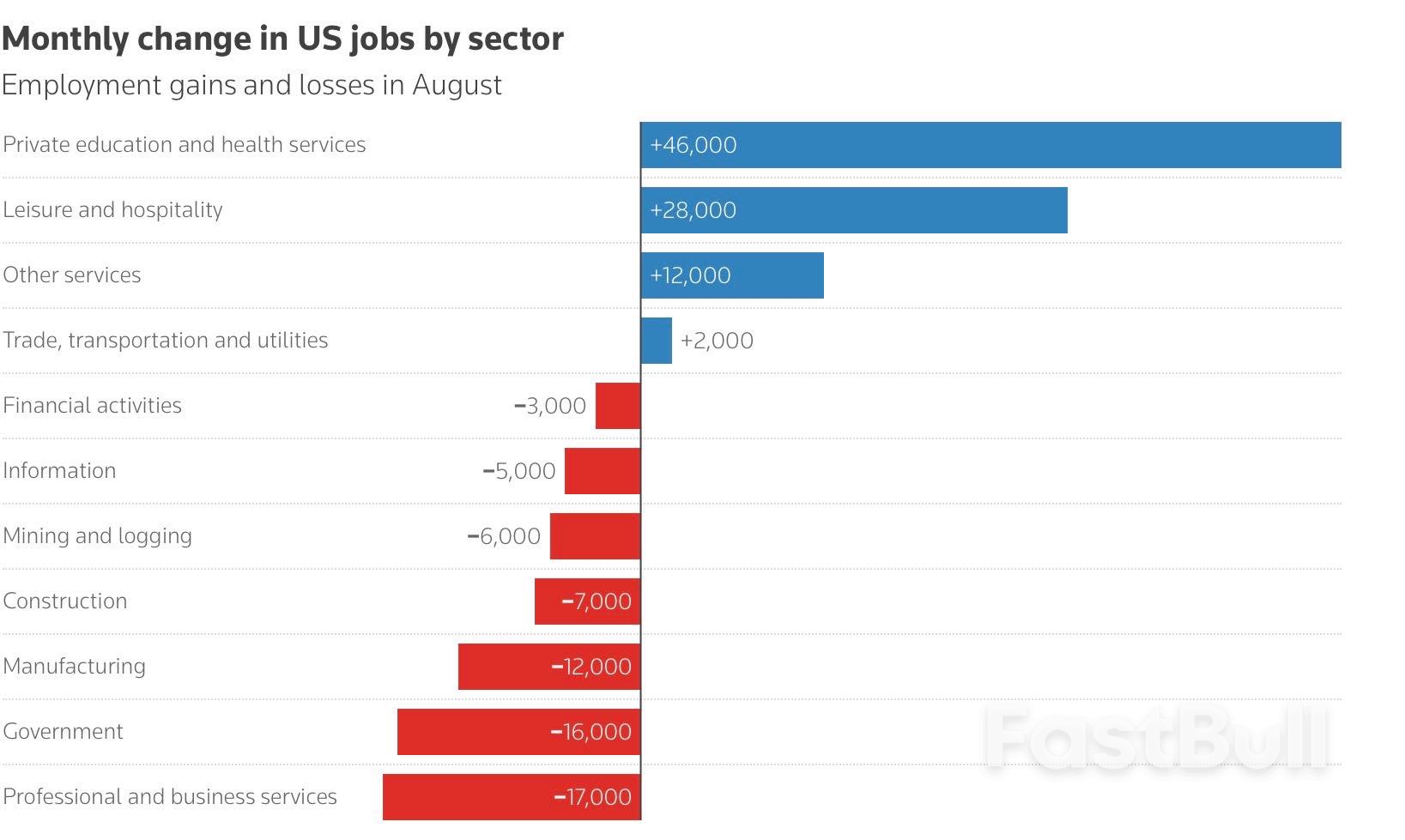

Data showed U.S. job growth weakened sharply in August while the unemployment rate increased to 4.3%, confirming that labour market conditions were softening. Traders are now betting an 86% chance of a 25-basis-point rate cut and a 14% chance of a 50 basis-point cut in September.

"Gold makes new highs; bulls are looking at the clearly weakening trend of employment translating into multiple rate cuts," said Tai Wong, an independent metals trader.

"The outlook is undoubtedly bullish for gold as labour concerns override inflation for the short, probably medium term. However, I think we are still too far away from 4,000 unless there is a massive dislocation," Wong added.

Analysts have also flagged the independence of the Fed as a key factor in shaping gold's trajectory - an issue thrust into the spotlight after U.S. President Donald Trump attempted to fire Fed Governor Lisa Cook and put repeated pressure on the central bank to slash rates.

Bullion, which does not pay interest, tends to shine when rates are low and uncertainty is high, making it a go-to asset for investors seeking safety.

China and India are top gold consumers. Physical demand for gold in these hubs dropped this week due to record high prices.

August gold in reserves data from China's central bank, due on Sunday, will not catch the September record highs, but may still provide more clarity on how demand from central banks was being affected by high bullion prices.

Among other metals, spot silver rose 0.9% to $41.02 per ounce and was heading for its third consecutive weekly gain.

Platinum gained 0.6% to $1,379.45 and palladium fell 1.8% at $1,106.86.

Most crop prices gained Friday, with corn rising to the highest level since July amid robust export demand for the yellow grain.

Exporters sold 1.8 million tons of corn last week, more than analysts expected on average, according to the US Department of Agriculture.

Corn futures rose as much as 1.2%, extending a rally from an almost one-year low in mid-August.

Prices were being supported by expectations that the record corn yield forecast by the USDA in August might be lowered in the agency’s monthly WASDE report, out next week. Advisory service StoneX on Thursday trimmed its estimate for US corn yields, but hiked output.

“Oversold technical indicators are providing some support, but more and more is coming from lower-than-expected corn yields to start the US harvest,” Consus Ag Consulting analyst Karl Setzer said in a note. “While trade wants to see the official updated yield from the USDA in next Friday’s WASDE report, the more reports they hear of lower yields the less willing they are to extend market pressure.”

Canada unexpectedly shed jobs for a second month running in August, extending a soggy summer for a labor market that is showing signs of weakness broadening beyond areas directly hit by tariffs and trade worries.

Employers in the country cut a net 65,500 jobs last month, the steepest decline since the start of 2022 when another Covid-19 variant forced widespread lockdowns, Statistics Canada said Friday. That builds on the 40,800 jobs shed in July to leave the unemployment rate 0.2 percentage point higher, at 7.1%.

The bulk of the jobs lost in August were in part-time roles--unlike in the month before, when losses were concentrated among full-time positions--though much of the decline was among adults even as returning students continued to struggle to find work. August also saw a another slump in employment in services jobs not reliant on trade or in the firing line of higher tariffs.

The data bolsters expectations the Bank of Canada will be pushed to resume cutting interest rates as soon as this month, after the economy contracted more sharply than anticipated in the second quarter and with inflation sitting below the central bank's 2% target four months running. And there are some economists now expecting rate cuts may have to be deeper than previously envisaged.

"Economic weakness is broadening and requires monetary action. We need interest rates in a stimulative stance," said Etienne Bordeleau Labrecque, a portfolio manager at Ninepoint Partners, who now expects the bond market to start pricing in a steep half-percentage-point cut in the Bank of Canada's policy rate at its meeting Sept. 17.

The weakness in Canadian employment echoed the deterioration in the U.S. labor market, where fewer jobs were added to the economy than expected and the unemployment rate ticked up 0.1 point, to 4.3%. That likely seals the case for the Federal Reserve to also lower interest rates at its meeting in two weeks, while potentially raising worries for the Bank of Canada about weakening demand in the U.S., by far Canada's largest export market.

When calculated using U.S. Labor Department methodology, Canada's unemployment rate was 0.2 point higher at 6%.

Canada's jobless rate has now risen half a percentage point since January, when there was a jump in employment, and it now sits at its highest level since May 2016, outside of the peak during the pandemic lockdowns in 2020 and 2021. Economists were expecting an August unemployment rate of 7%, and for employment to have steadied with a modest rise of 10,000.

Business and household sentiment remains subdued, even as trade tensions between Canada and its neighbor have eased. The bigger-than-expected step up in the unemployment rate in August came despite the labor force contracting for a second month in a row and with the participation rate--the proportion of working-age Canadians either employed or looking for work--dipping 0.1 point, to 65.1%.

The data also showed the struggle to find work after being laid off is intensifying, with roughly 15% of those who were jobless in July finding work the next month, compared with just over 23% in the same period of 2017 to 2019 before the onset of the pandemic.

There are few signs conditions will improve in the coming months. The Canadian Federation of Small Business's latest monthly survey found little appetite for new staffing, with plans to hire part-time workers remaining negative and with only slightly more employers looking to add full-time roles than those planning to reduce them. At the same time, the federal government has warned of coming job losses in the public sector as it looks to tighten spending even as it promotes big development projects.

The job picture for manufacturers, who have been hit hardest by the Trump administration's trade policies and tariffs, continues to decline. There were 19,200 fewer manufacturing jobs last month, down 1.0% from the month before, and losses since January now sit at roughly 58,000, or 3.1%.

At the same time, employment in professional, scientific and technical-services roles fell by 26,100, a 1.3% pullback from July. That follows a 3.3% drop in jobs in information, culture and recreation positions in July.

There also were fewer jobs in August in transportation and warehousing and in education, which tends to be volatile in the summer months. Among the few bright spots, there was a rise in employment in construction and in restaurants and hotels.

The labor numbers indicate the Bank of Canada is more likely to be concerned about the economy and less about stickiness in core inflation, which faces less immediate threat of heating up from tariffs after Ottawa sharply scaled back the imports from the U.S. that are hit by its retaliatory levies, economists said.

"An undeniably soft August employment report in our view solidifies a resumption of rate cuts by the Bank of Canada this month," said Citi economist Veronica Clark, who expects the central bank will do more than fine-tune its policy rate and will cut 1 percentage point in all to take the rate to 1.75% by early next year. "The unemployment rate rising above 7% clearly suggests demand further undershooting labor supply even with slowing population growth this year."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up